10 May 2023 Morning Session Analysis

US dollar wobbled as debt ceiling talk had no progress.

The dollar index, which was traded against a basket of six major currencies, failed to extend its rally further amid head-butting between two major political parties on raising the debt ceiling despite default risk loomed. According to Reuters, President Joe Biden and Congressional lawmakers had a meeting early morning today, which aimed to solve the deadlock over raising the $31.4 trillion debt limit to avoid the US government from defaulting any of its existing debt. However, there were no progress in the talk between two parties, as none of them showed softening position. The House of Representatives Speaker Kevin McCarthy mentioned that there no any new movement, while complaining that “Biden didn’t agree to talks until time was running out”. The impasses of raising the debt ceiling are putting the US economy on the brink of collapse, whereby the risk of defaulting debt is heightening as time passes. As such, the dollar index received quite a fair bit of bearish momentum, pressing the value of the currency near the recent low level. Nonetheless, it is noteworthy to highlight that the two parties agreed to meet again on Friday for further talks. As of writing, the dollar index rose 0.27% to 101.65.

In the commodities market, crude oil prices edged up by 1.18% to $73.55 per barrel as the EIA Short Term Energy Outlook report showed a higher seasonal demand and lower-than-expected output going forward. Besides, gold prices ticked up by 0.94% to $2036.40 per troy ounce as the US government failed to raise its debt ceiling following a no-progress talk.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German CPI (MoM) (Apr) | 0.8% | 0.4% | – |

| 20:30 | USD – Core CPI (MoM) (Apr) | 0.4% | 0.4% | – |

| 20:30 | USD – CPI (YoY) (Apr) | 5.0% | 5.0% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.280M | -1.100M | – |

Technical Analysis

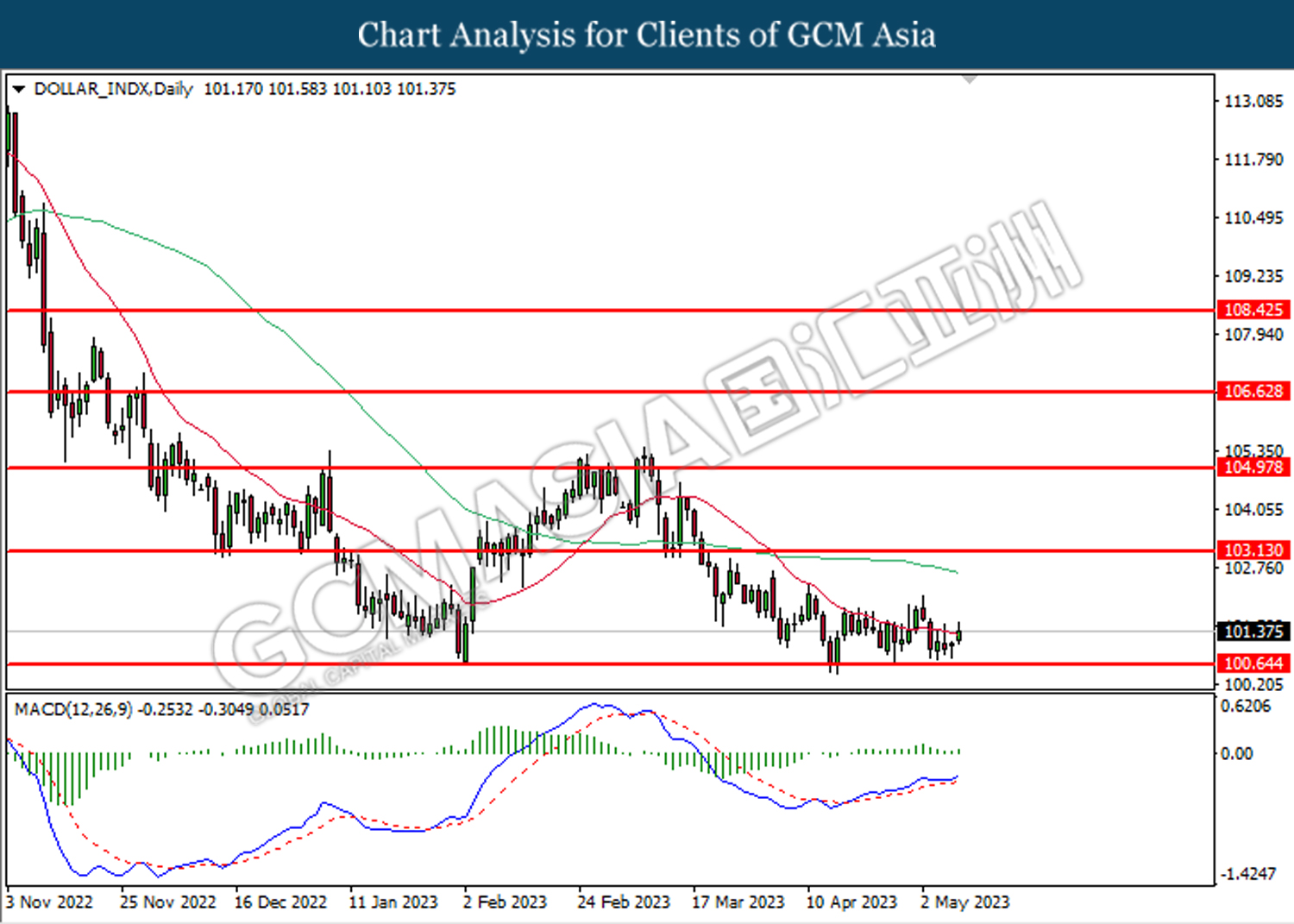

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 100.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 100.65, 99.40

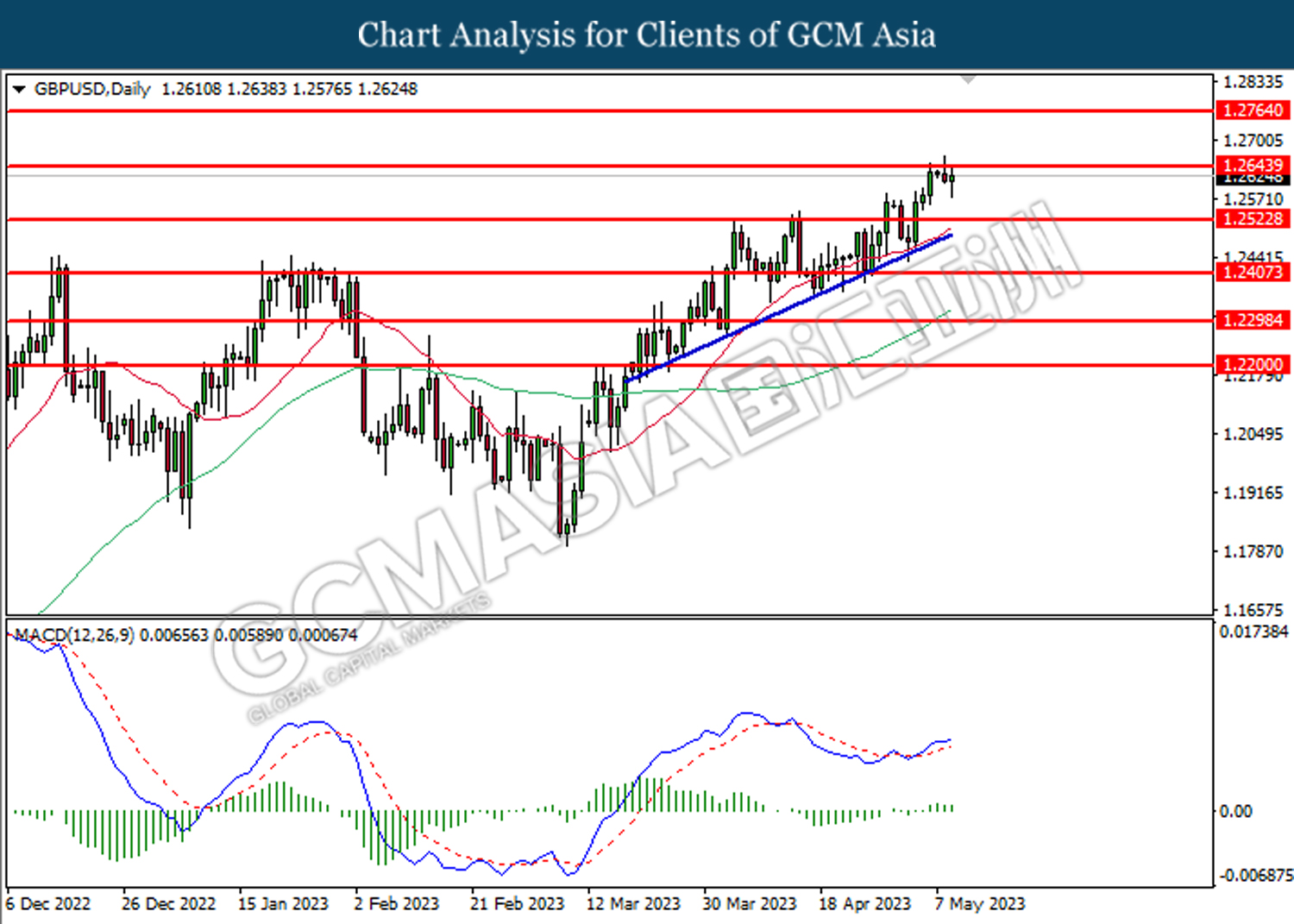

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2645. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

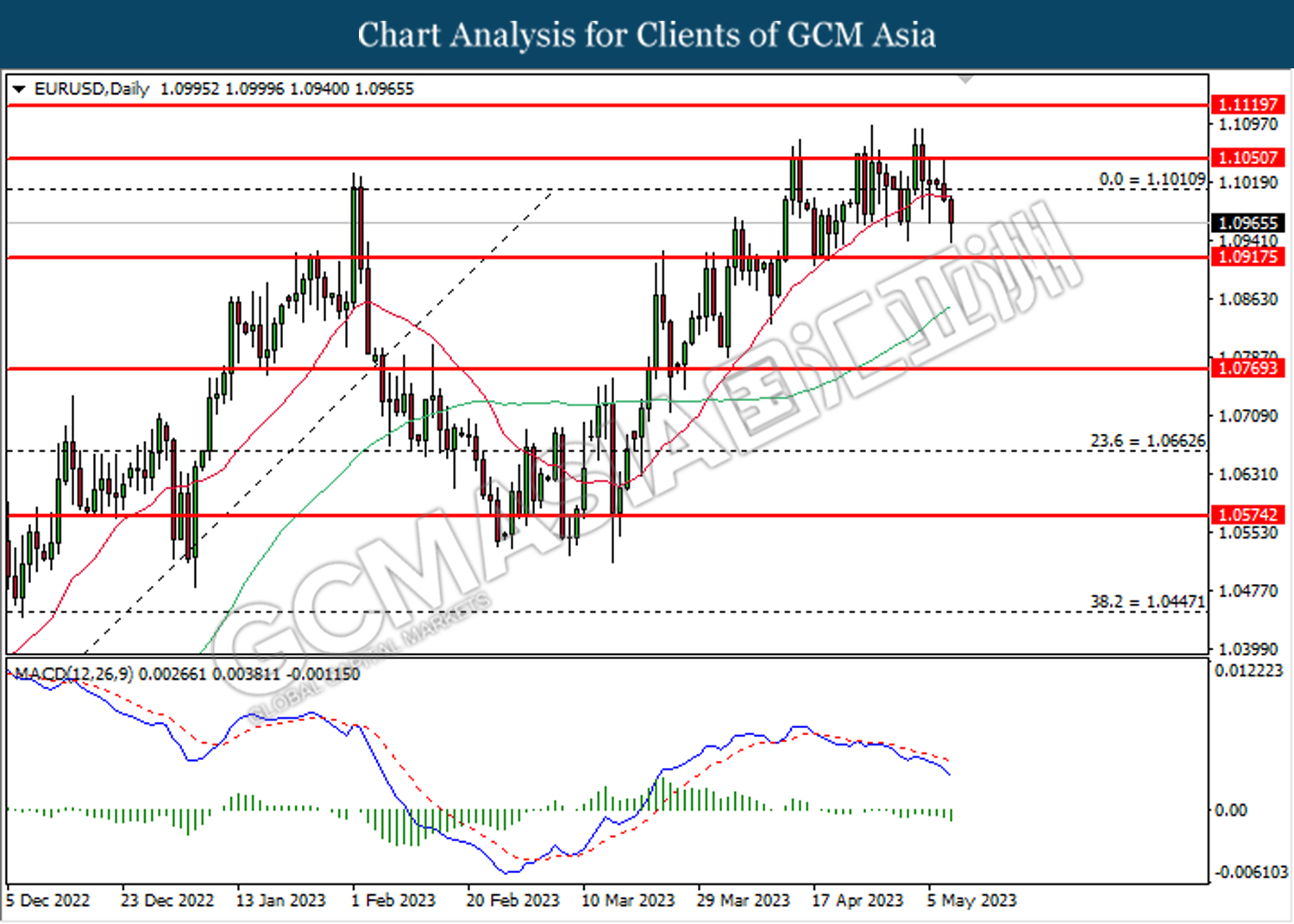

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0915.

Resistance level: 1.1010, 1.1050

Support level: 1.0915, 1.0770

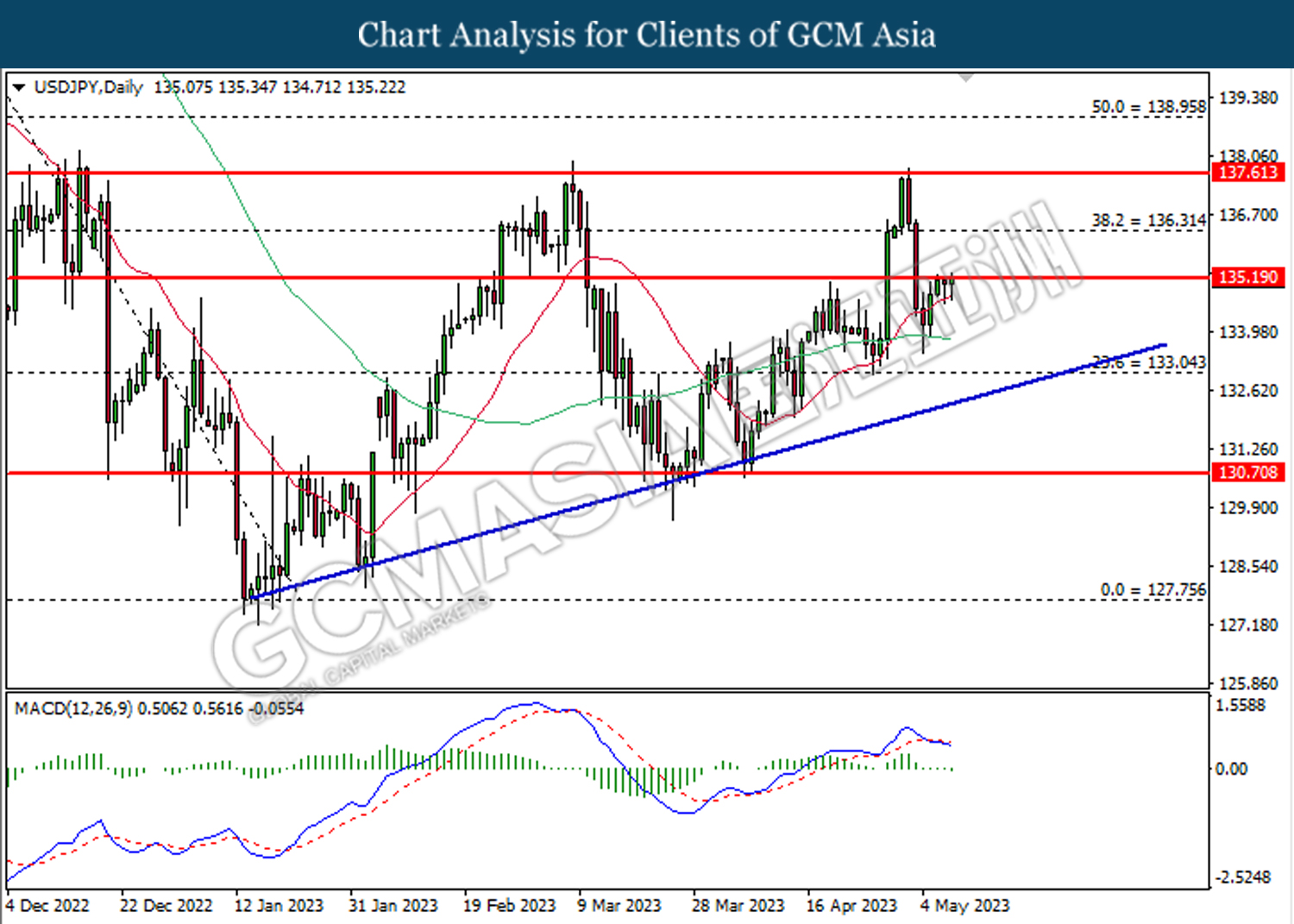

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.20. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.20, 136.30

Support level: 133.05, 130.70

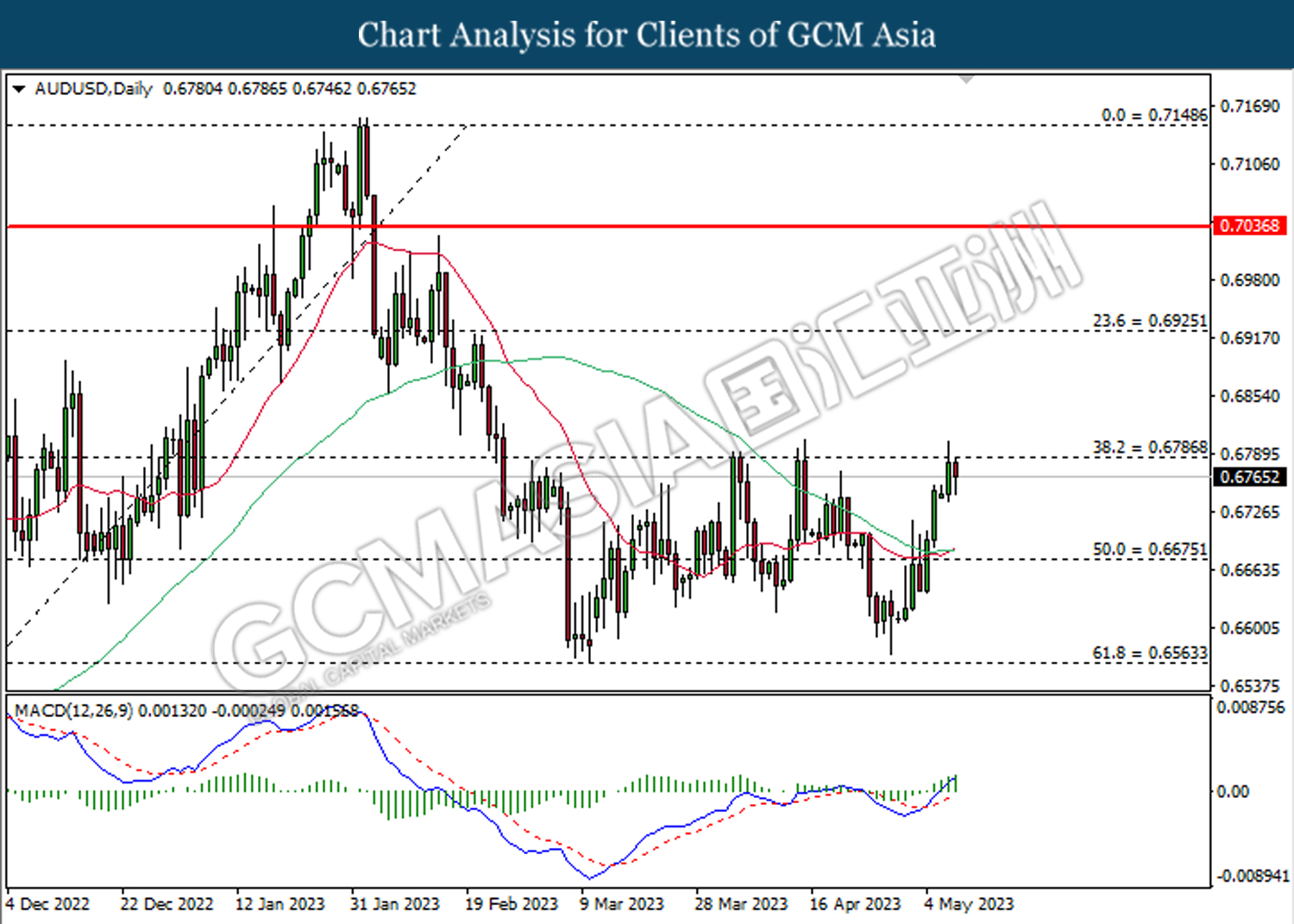

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

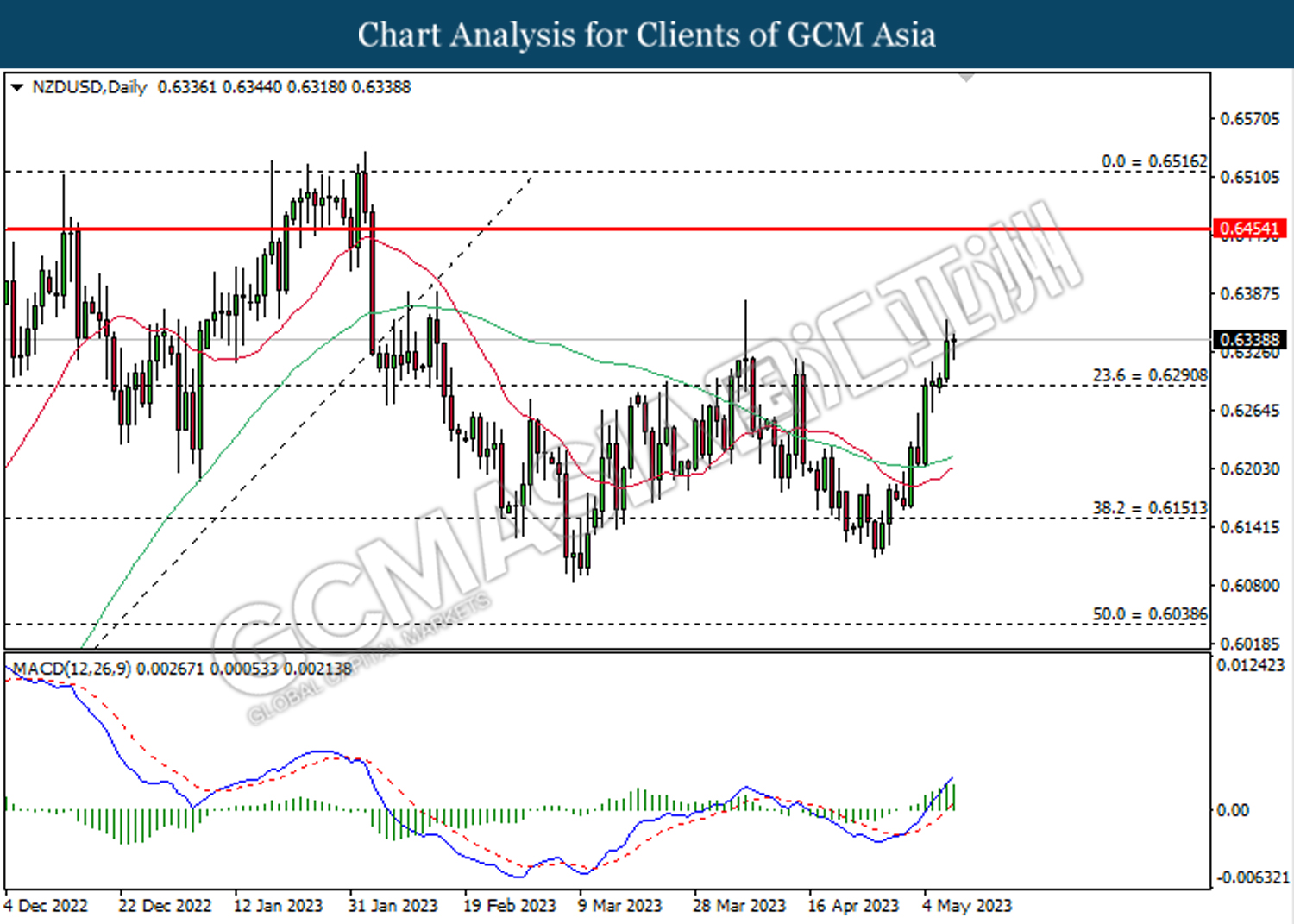

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6290. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6455.

Resistance level: 0.6455, 0.6515

Support level: 0.6290, 0.6150

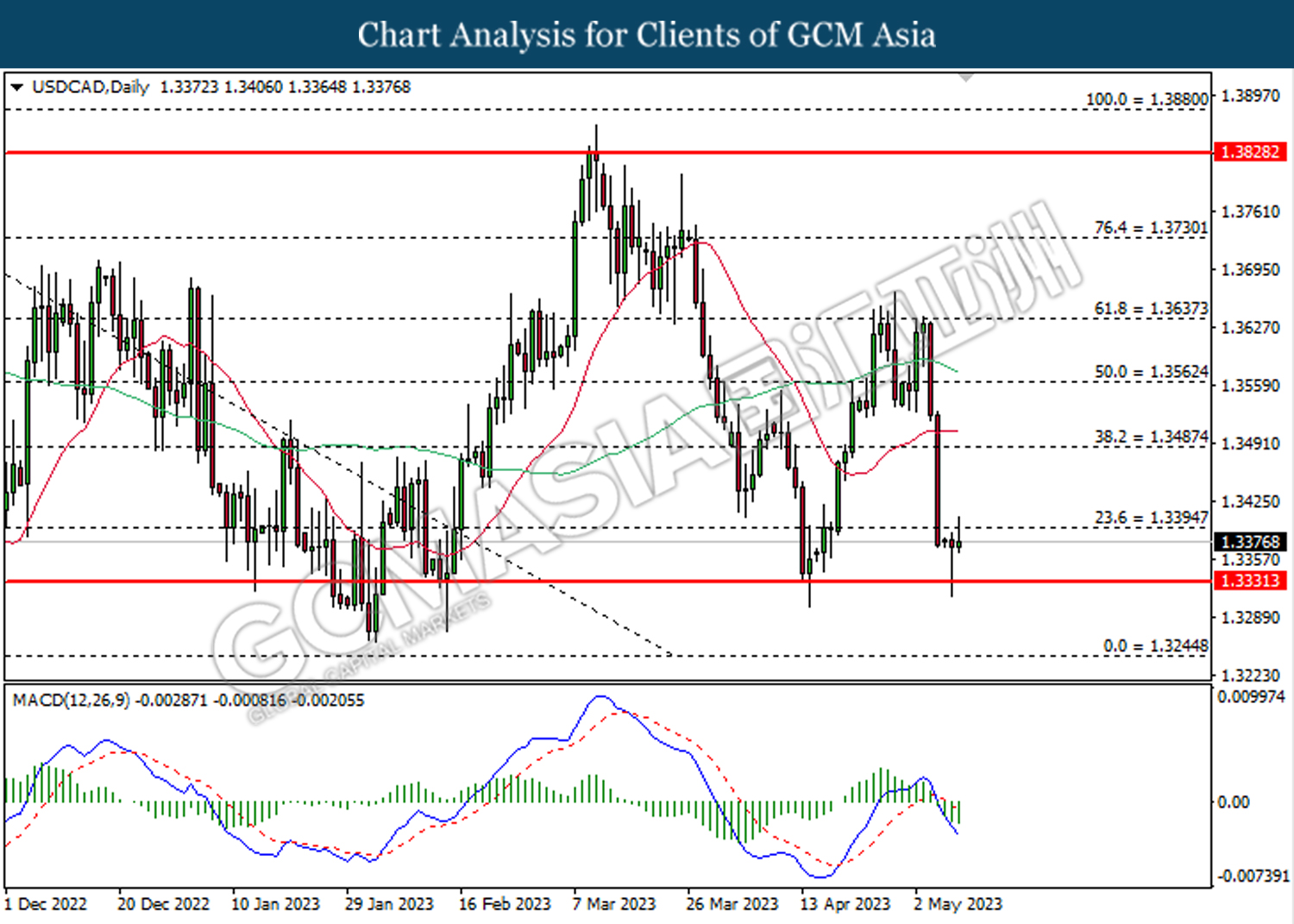

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3395. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3330.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

USDCHF, Daily: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

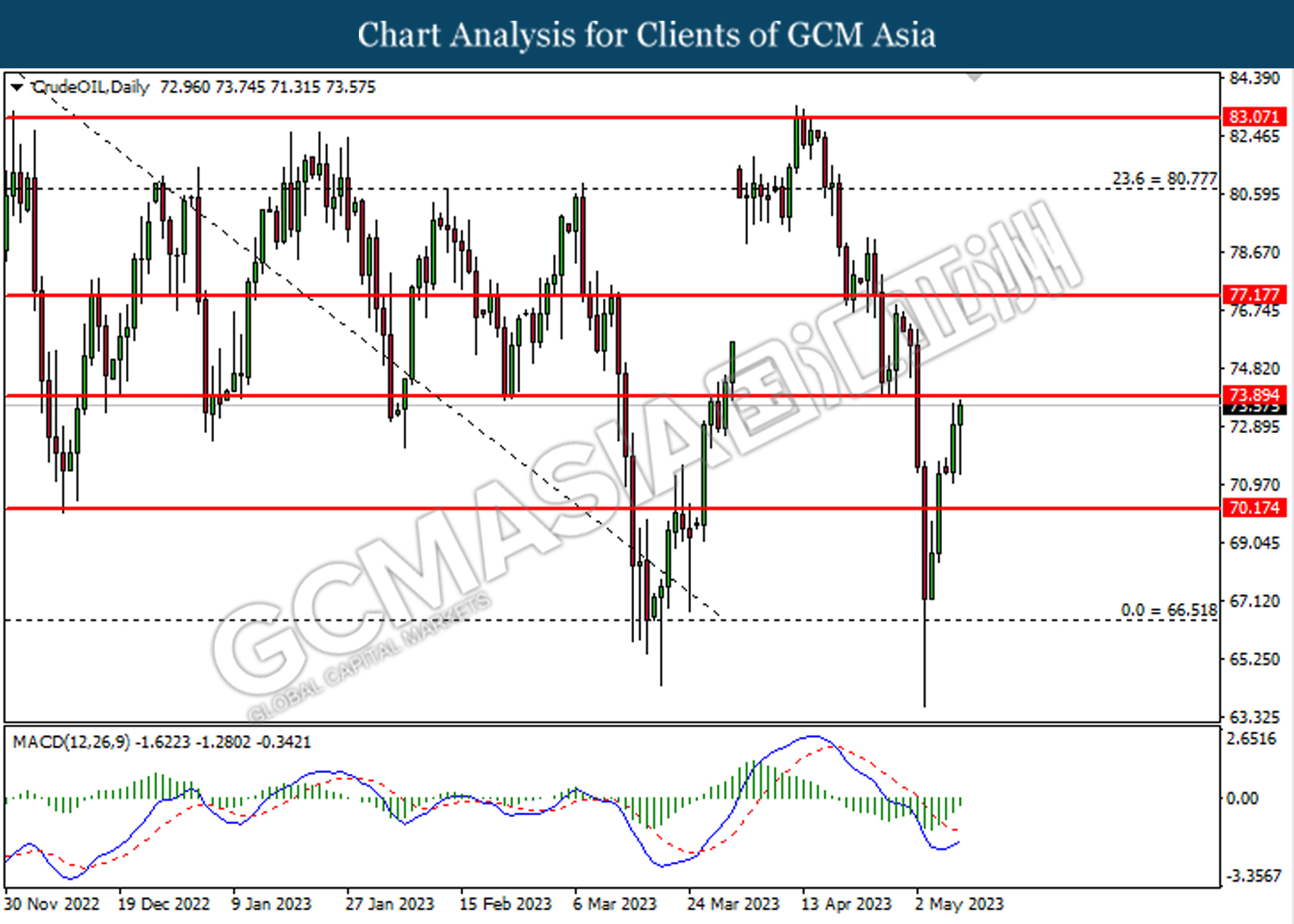

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

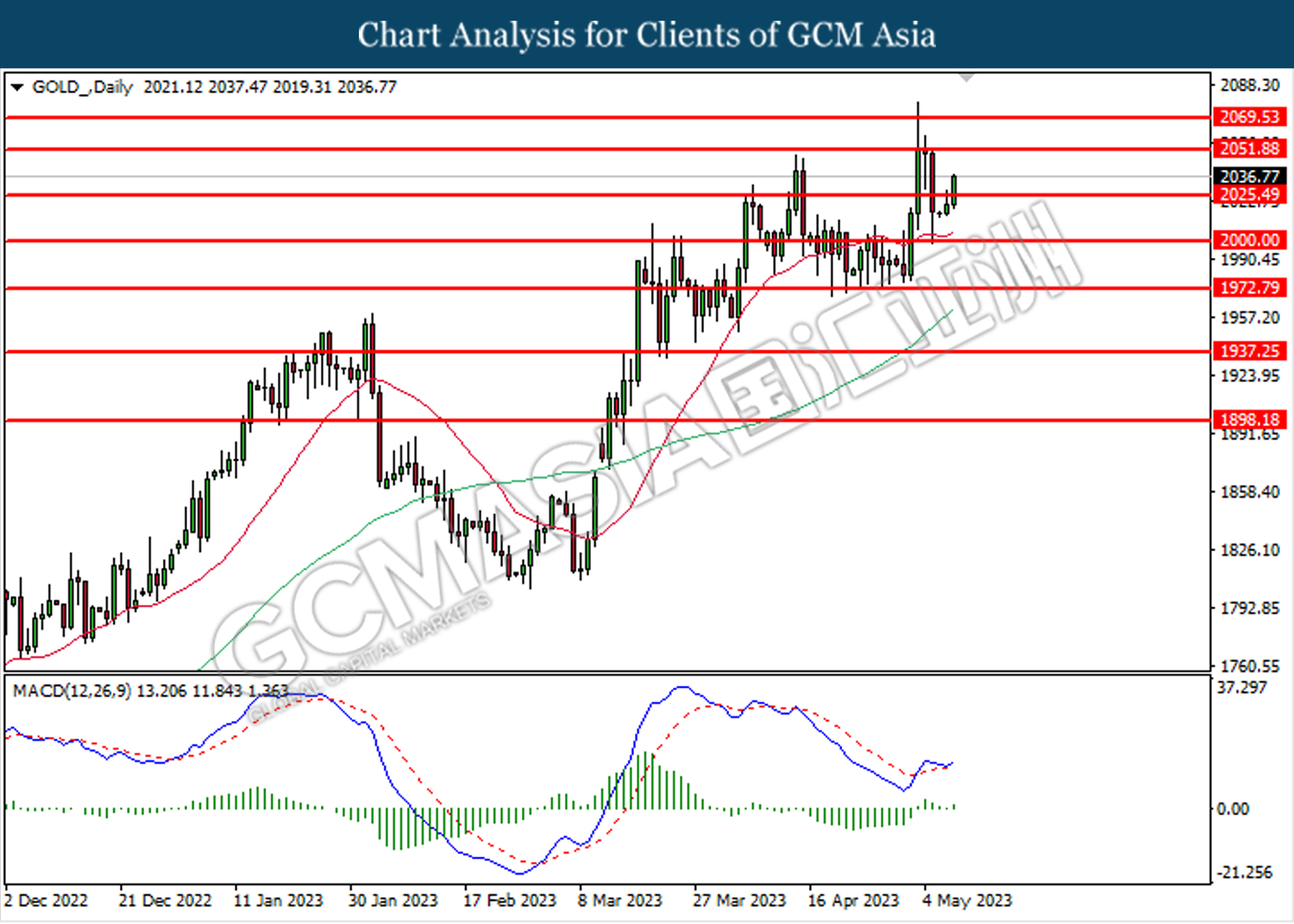

GOLD_, Daily: Gold price was traded higher while currently retesting the resistance level at 2025.50. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 2025.50, 2051.90

Support level: 2000.00, 1972.80