10 May 2023 Afternoon Session Analysis

Yen shrank after pessimistic household spending.

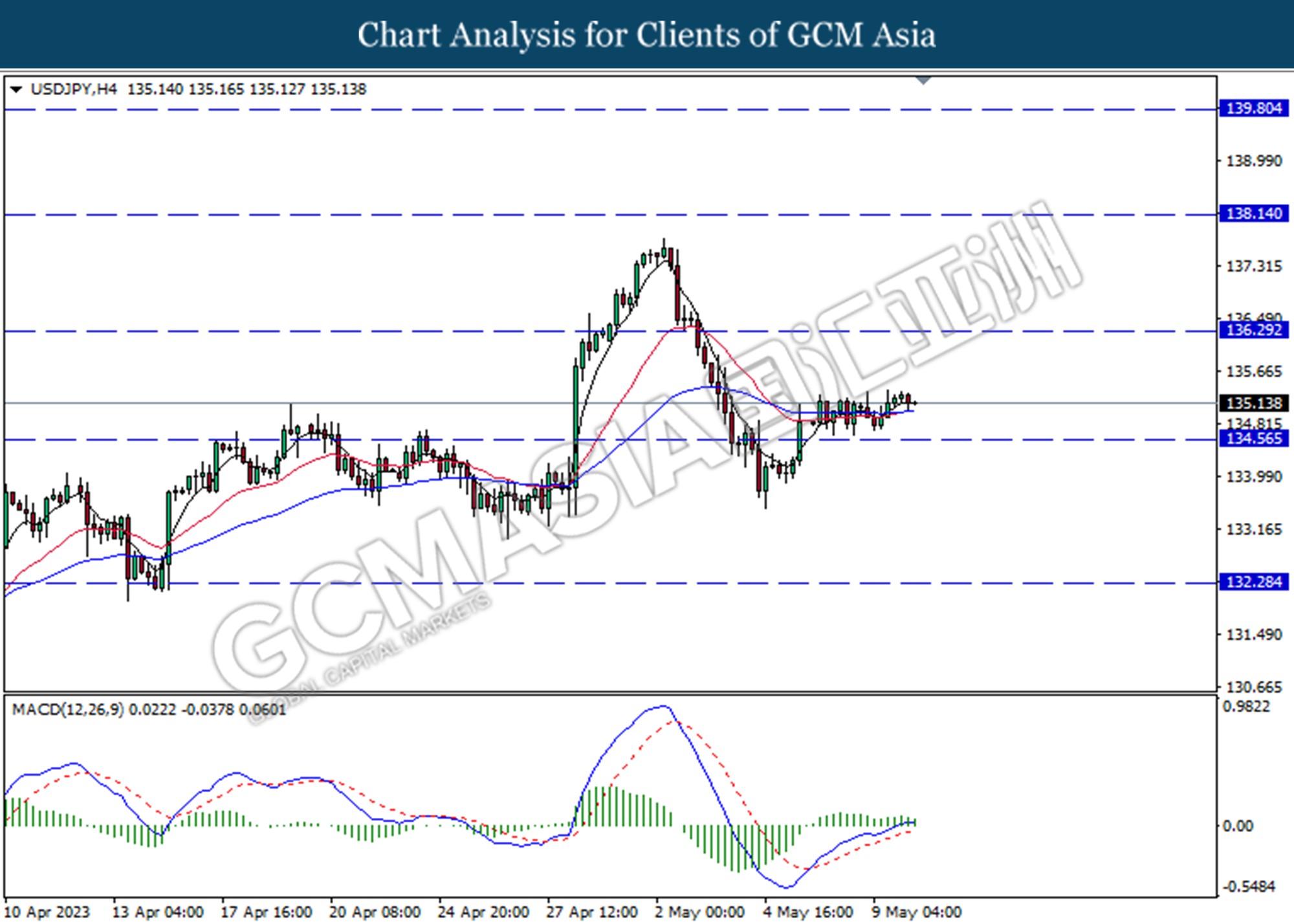

The Japanese Yen, one of the most traded currencies shrank against the greenback after pessimistic housing spending was released. According to the Statistics Bureau of Japan, household spending in March declined to -1.9% from 1.6%, while the market expects on growth by 0.4%. Household spending with two or more people spent an average of 312,758 yen amid high food, energy, and other prices impacted by the Russian War, the Ministry of Internal Affairs and Communications said. Meanwhile, the real wages fell 2.9% in March from a year earlier, showing a twelfth straight month decline, affected by rising inflation. Major Japanese firms offer the biggest pay hikes amid inflation, but the negotiation has not filtered into higher wage growth. The current situation could prompt for new Governor Ueda to normalize its monetary policy. Elsewhere, investors are eyeing the upcoming summary of the Bank of Japan’s (BoJ) opinion for further cues. As of writing, the USDJPY traded down by -0.04% to $135.15.

In the commodities market, crude oil prices are down by -0.72% to $73.16 per barrel after US crude oil stockpiles rise unexpectedly. Besides, gold prices slipped by -0.15% to $2031.55 per troy ounce as investors awaits US inflations data for April.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Apr) | 0.4% | 0.4% | – |

| 20:30 | USD – CPI (YoY) (Apr) | 5.0% | 5.0% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -1.280M | -1.100M | – |

Technical Analysis

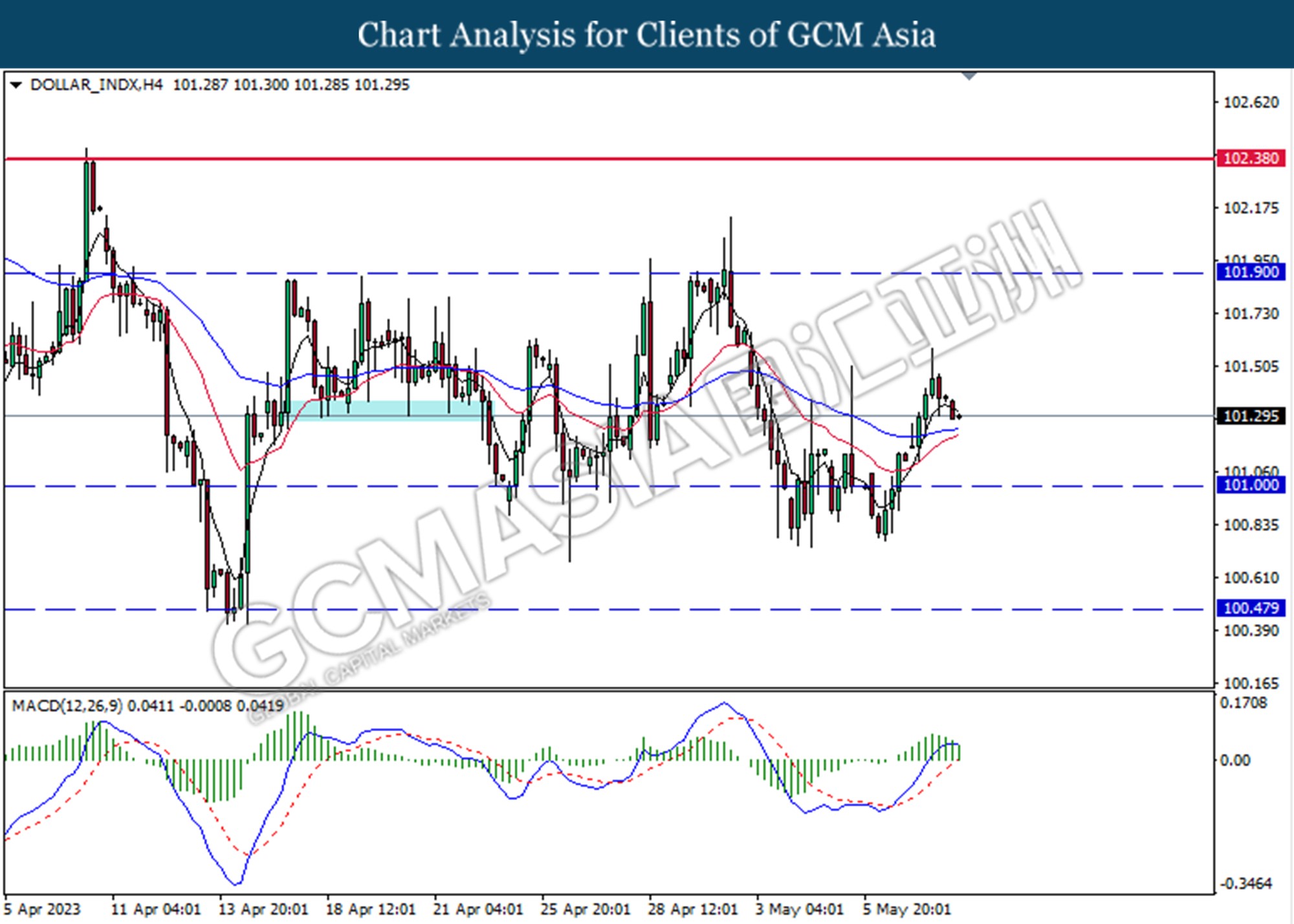

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level.

Resistance level: 101.90, 102.40

Support level: 101.00, 100.50

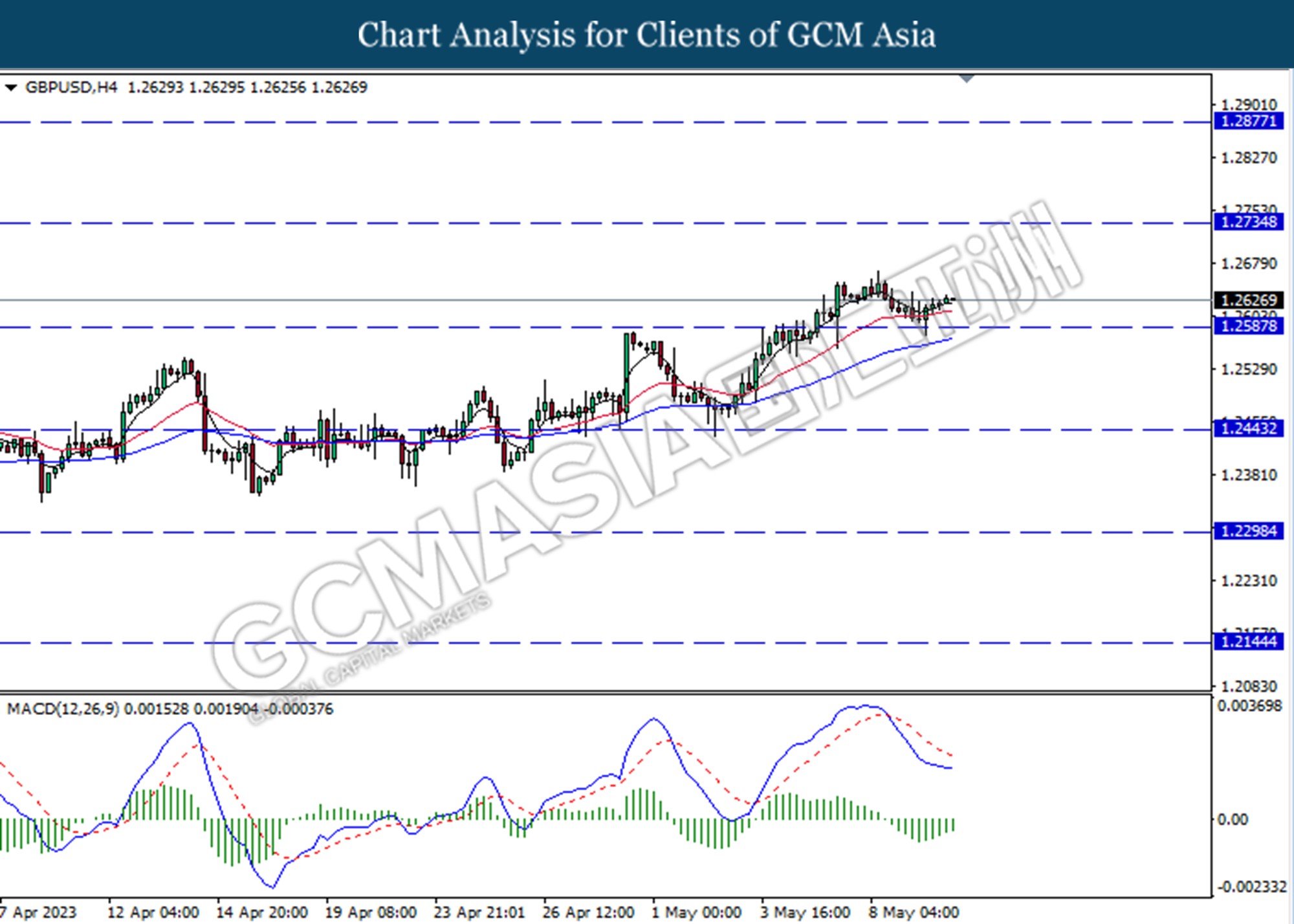

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the support level at 1.2590. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2735, 1.2880

Support level: 1.2590, 1.2445

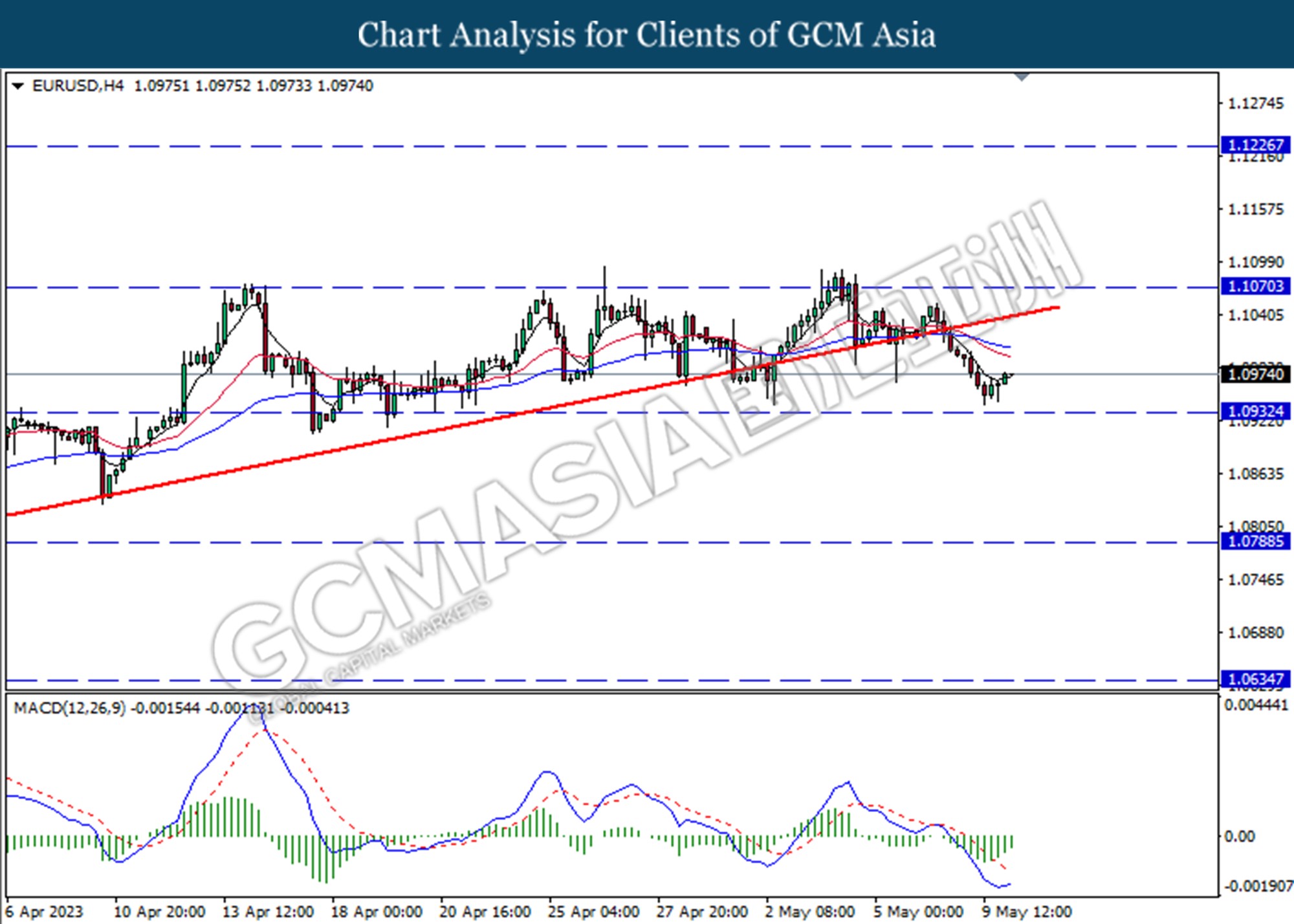

EURUSD, H4: EURUSD was traded higher following a prior rebound from the support level at 1.0930. MACD which illustrated decreasing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

USDJPY, H4: USDJPY was traded lower following a prior retracement from the higher level. MACD which illustrated decreasing bullish momentum suggests the pair extended its losses toward the support level at 134.55.

Resistance level: 136.30, 138.15

Support level: 134.55, 132.30

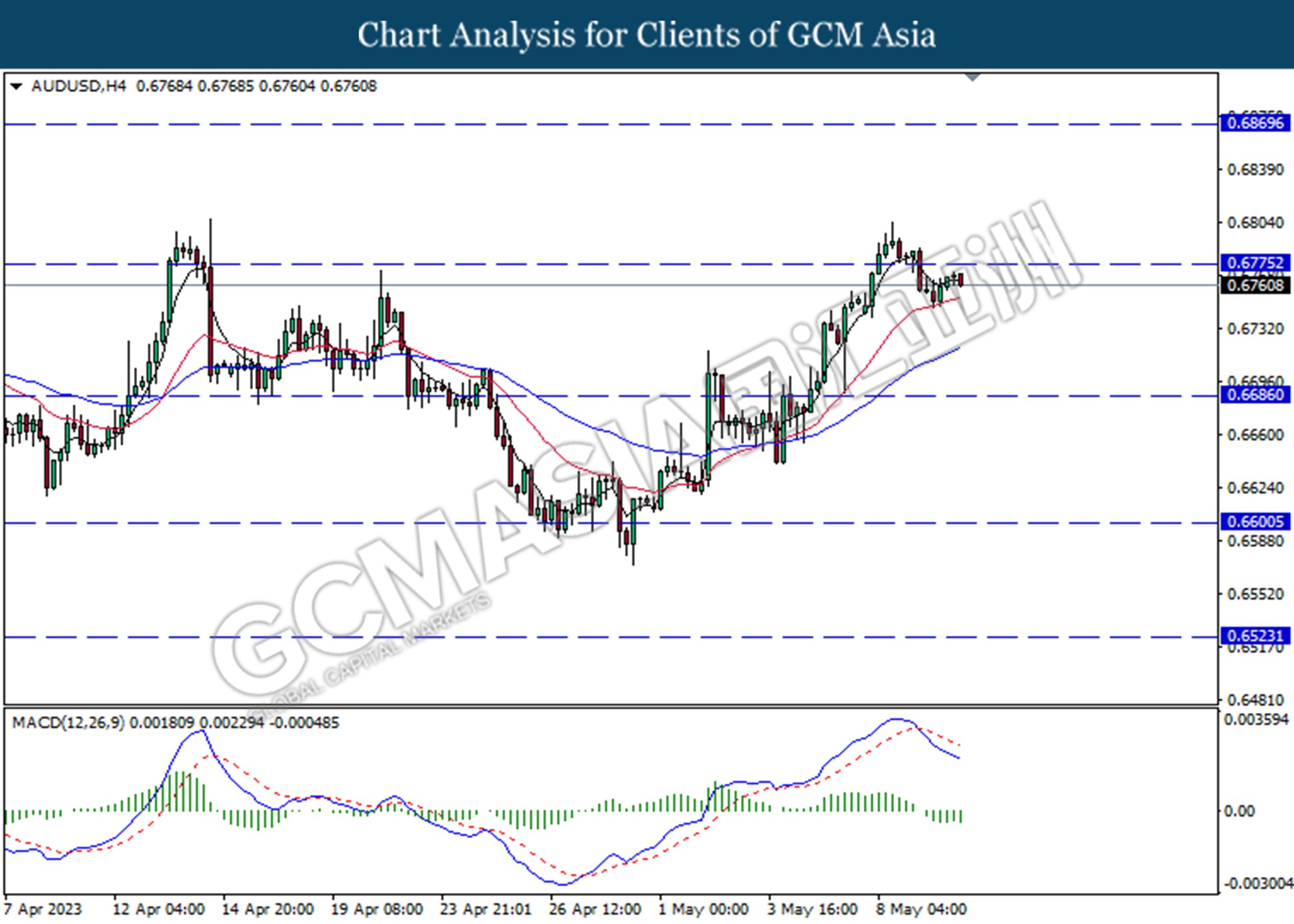

AUDUSD, H4: AUDUSD was traded lower following retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 0.6685.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

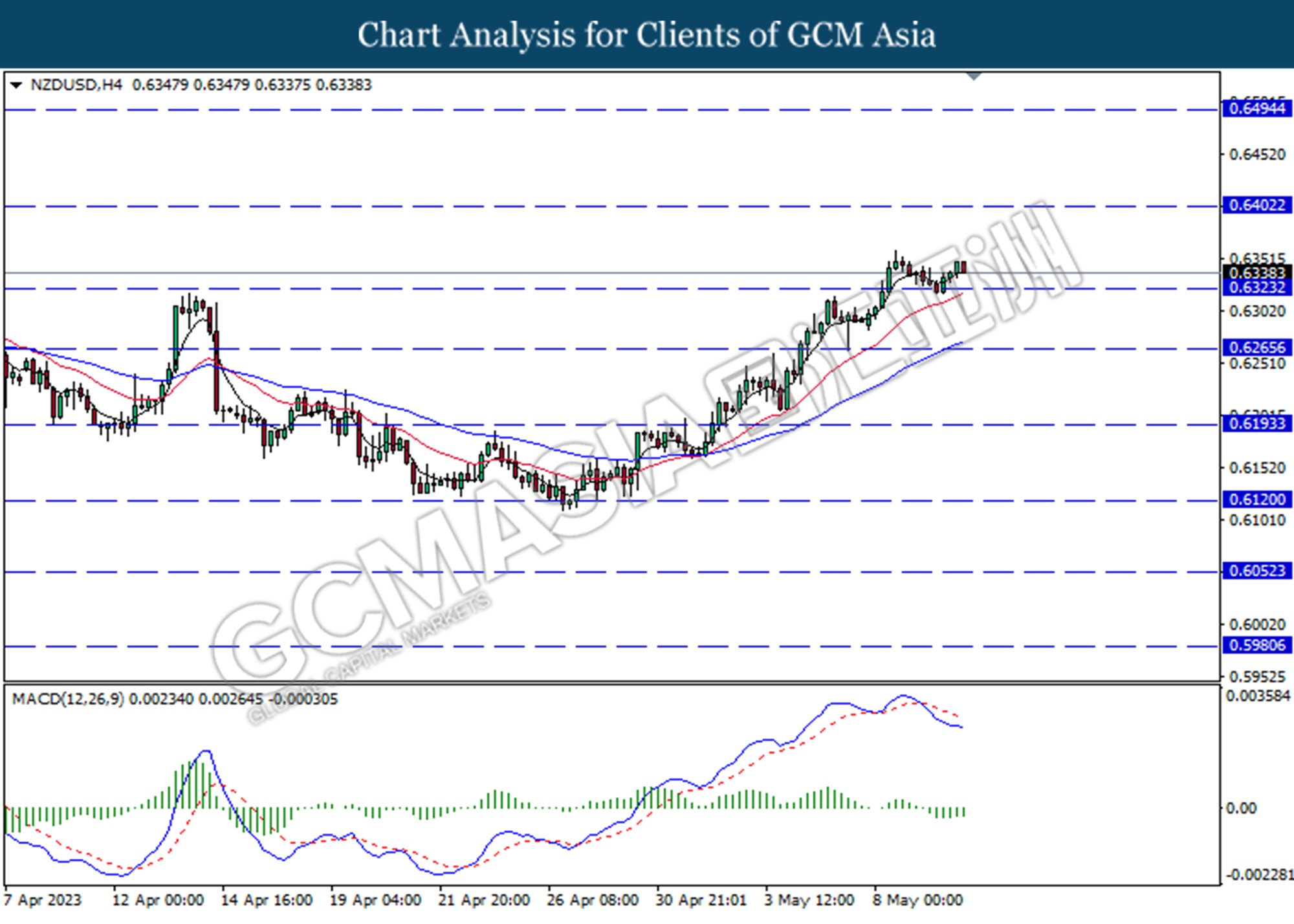

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the pair extended its losses toward the support level at 0.6325.

Resistance level: 0.6400, 0.6495

Support level: 0.6325, 0.6265

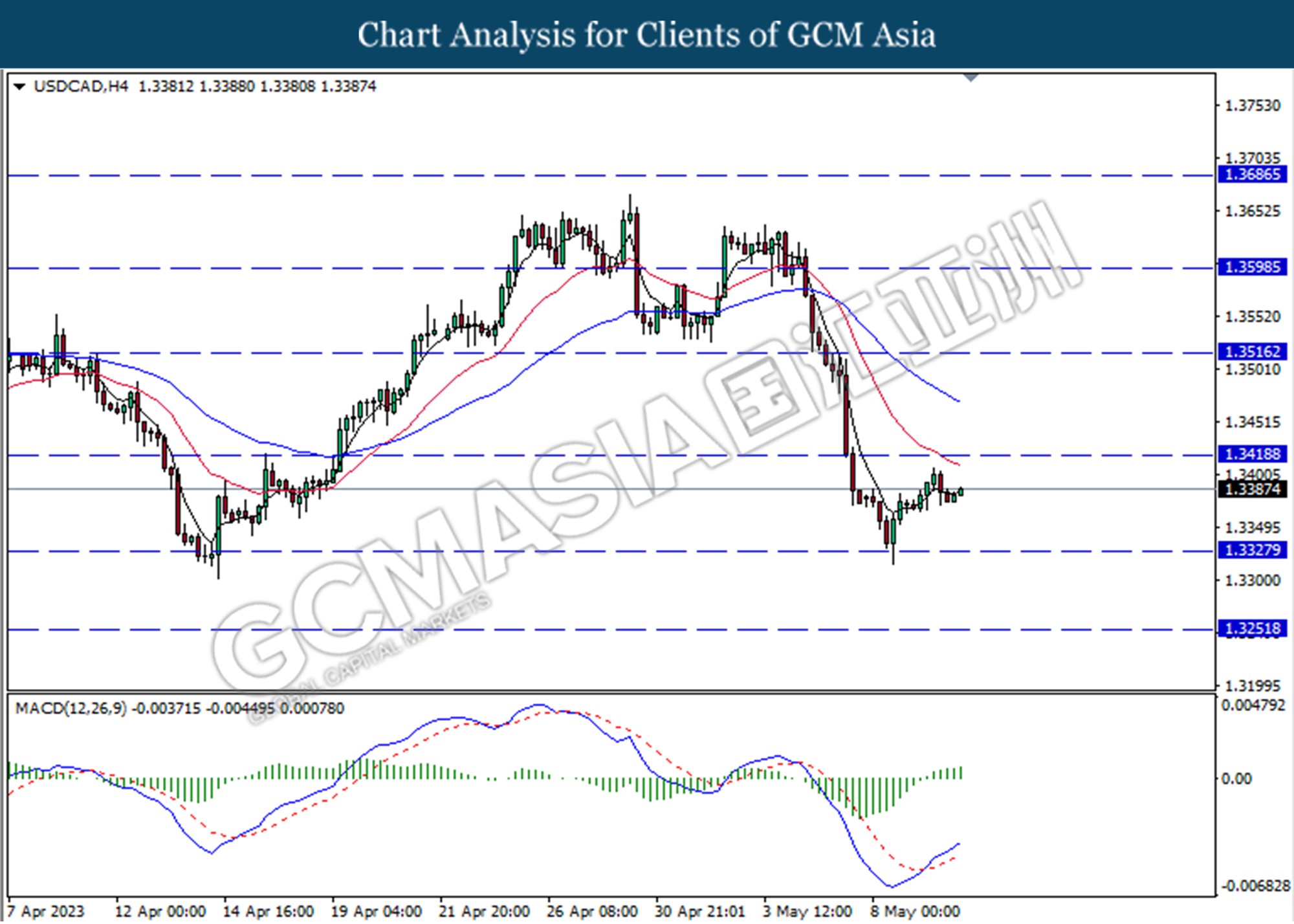

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.3420.

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

USDCHF, H4: USDCHF was traded lower following the prior breakout below the previous support level at 0.8925. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8775

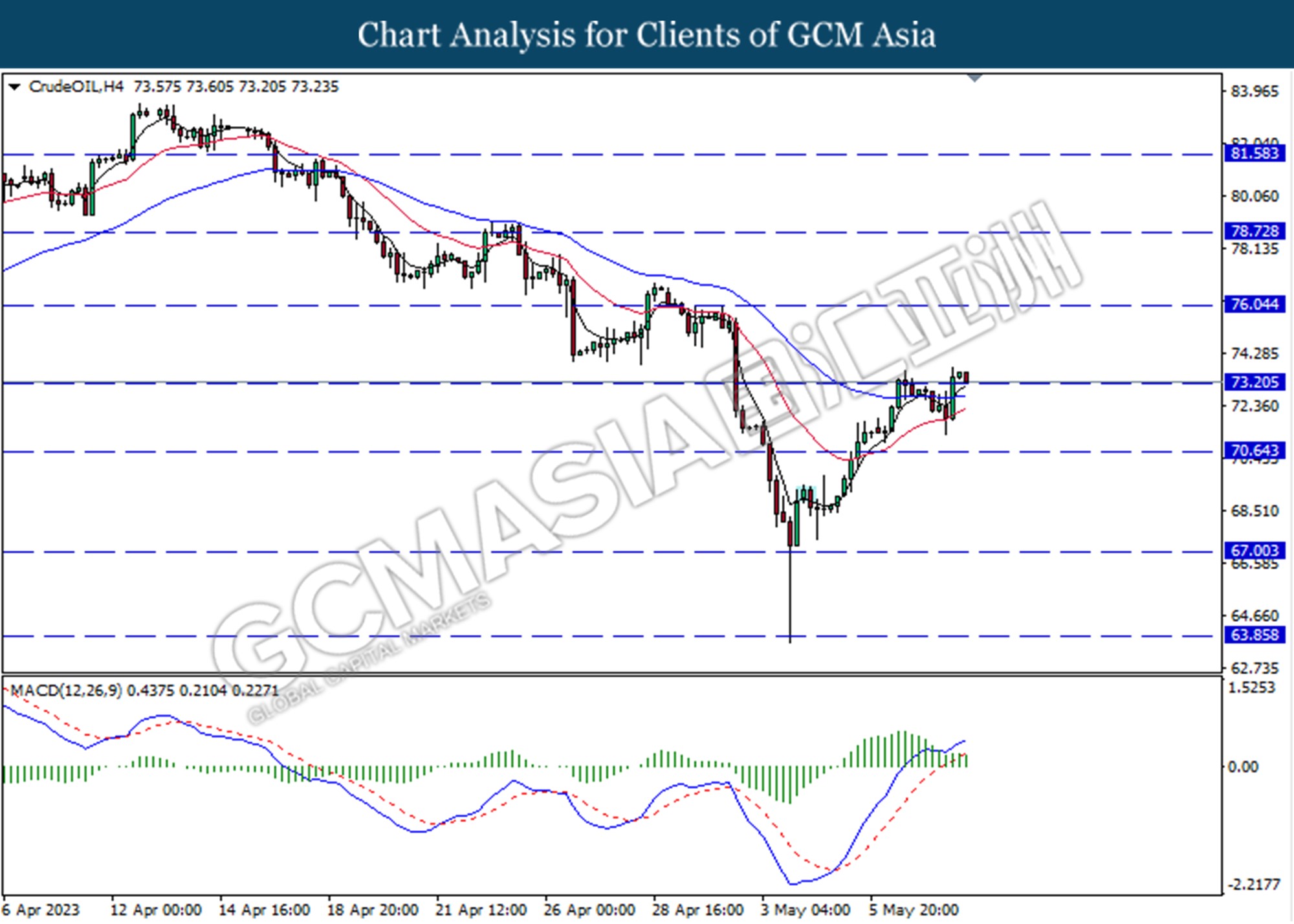

CrudeOIL, H4: Crude oil price was traded lower while currently testing for the support level at 73.20. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses after it successfully break below the support level.

Resistance level: 76.05, 78.70

Support level: 73.20, 70.65

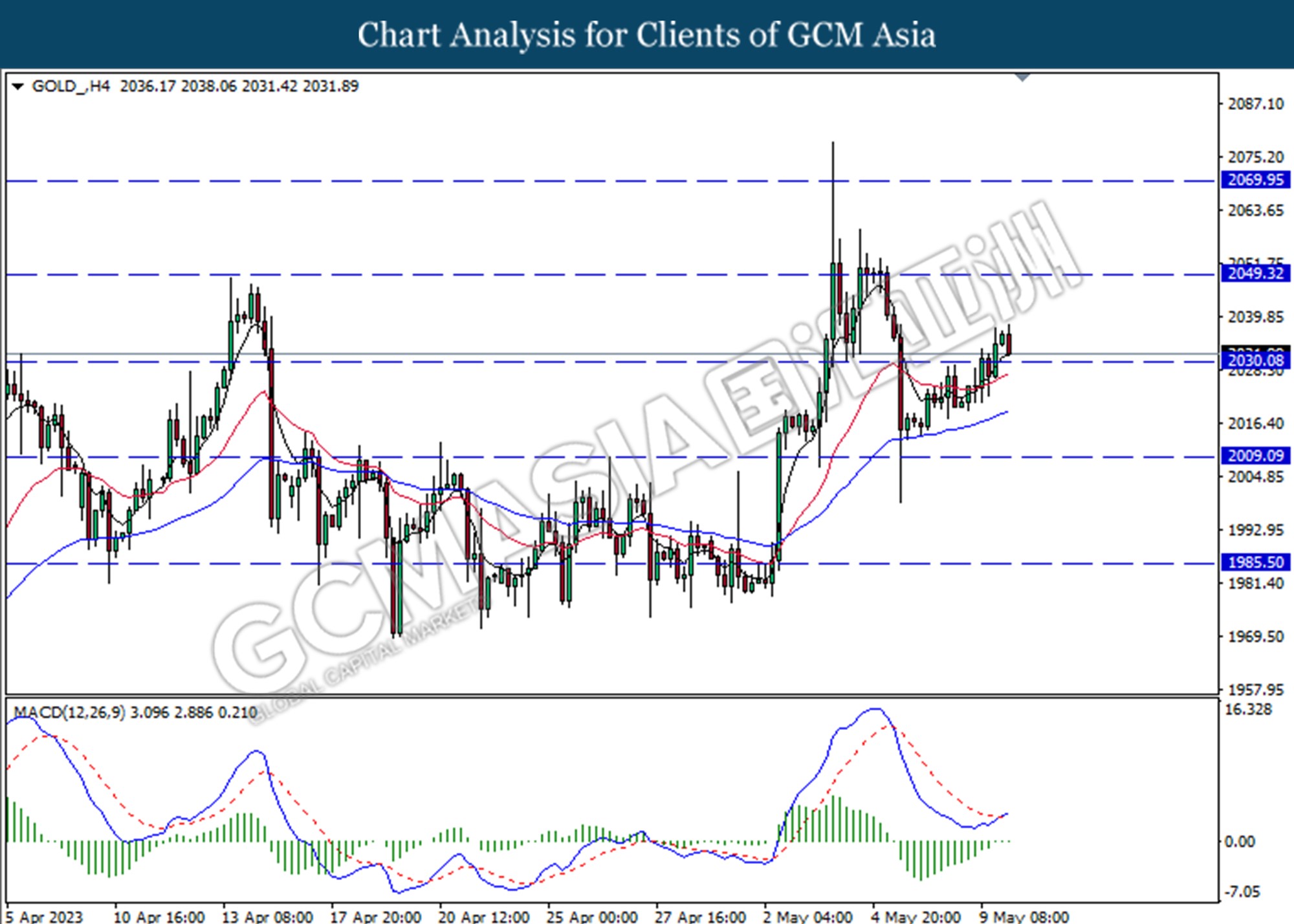

GOLD_, H4: Gold price was traded lower following a prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the commodity traded higher as a technical correction.

Resistance level: 2049.30, 2069.95

Support level: 2030.10, 2009.10