11 May 2023 Afternoon Session Analysis

The pound muted ahead of the BoE interest rate decision.

The Pound Sterling, which was traded against the greenback, continued to be muted during Asian trading ahead of the Bank of England (BoE) interest rate decision. As of now, the markets are largely priced in that the BoE will hike the interest rate by 25 basis points A 98% chance of a 25-basis point rate hike from the BoE will further boost confidence in the decision, according to Refinitiv data. The Bank of England’s more tightened moves to come were largely due to the still-high March consumer price index (CPI). The previous data expected the CPI to fall to 9.8%, lower than the previous value of 10.4%, but the actual result was slightly higher than market expectations of 10.1%. Apart from this, the recent unemployment data achieved 3.8% showed the labor market reflects some softer conditions, despite its close to historical lows. The recent unemployment rate unexpectedly rose to 3.8% from 3.7%, the Office for Nations Statistics (ONS) data showed. With that, it increases the potential dilemma for the BoE to consider 50 basis points in upcoming interest rate decisions. As of writing, the GBP/USD shrunk by -0.02% to $1.2621.

In commodity markets, crude oil rose 0.73% to $73.09 a barrel as the dollar weakened, but gains were offset by Chinese CPI data. Elsewhere, gold edged up 0.09% to $2,032.20 a troy ounce as the market digested mixed US CPI data.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 GBP BoE Interest Rate Decision (May)

19:00 GBP BoE MPC Meeting Minutes

19:00 CrudeOIl OPEC Monthly Report

21:15 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 242K | 245K | – |

| 20:30 | USD – PPI (MoM) (Apr) | -0.5% | 0.3% | – |

Technical Analysis

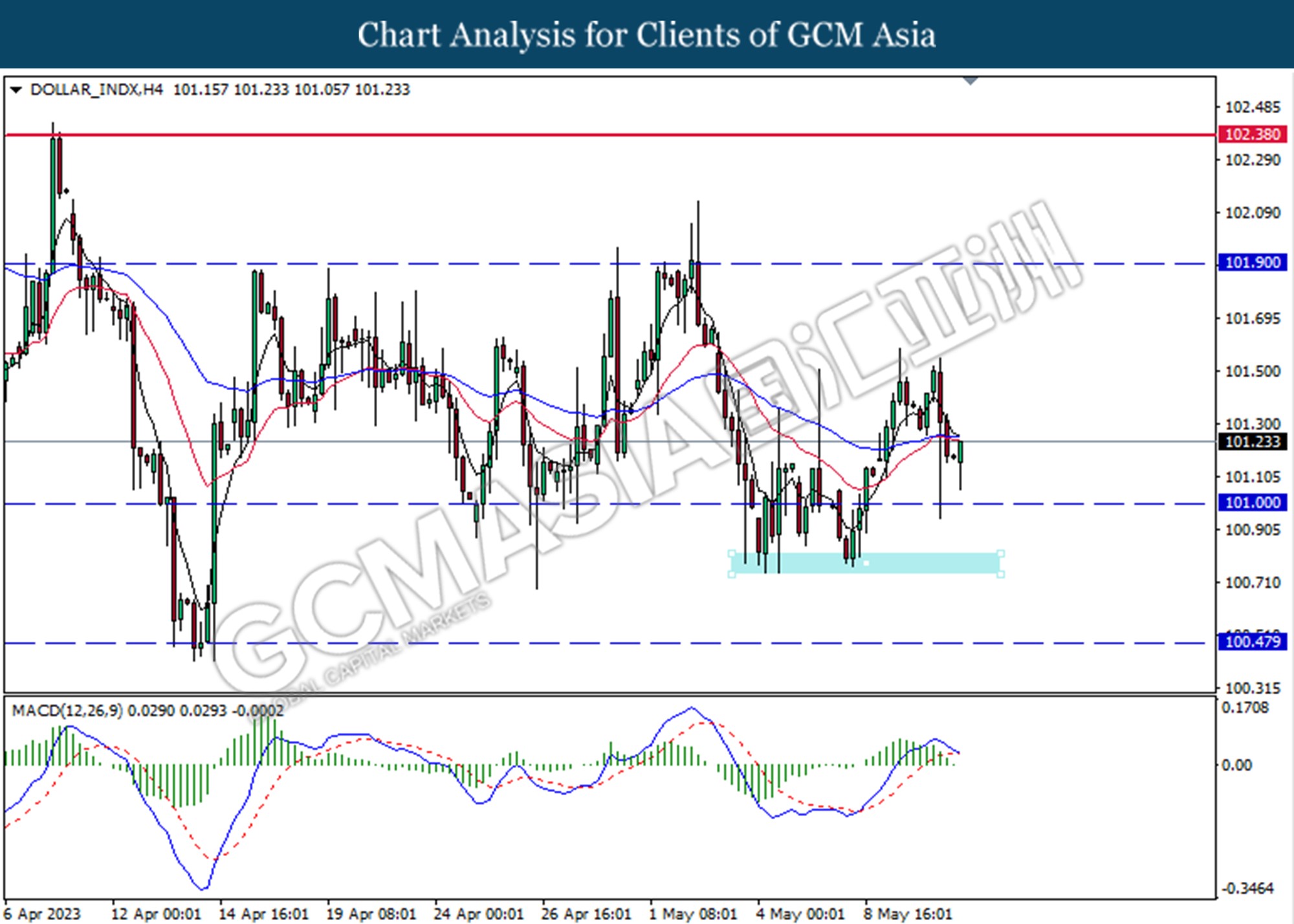

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level at 101.00.

Resistance level: 101.90, 102.40

Support level: 101.00, 100.50

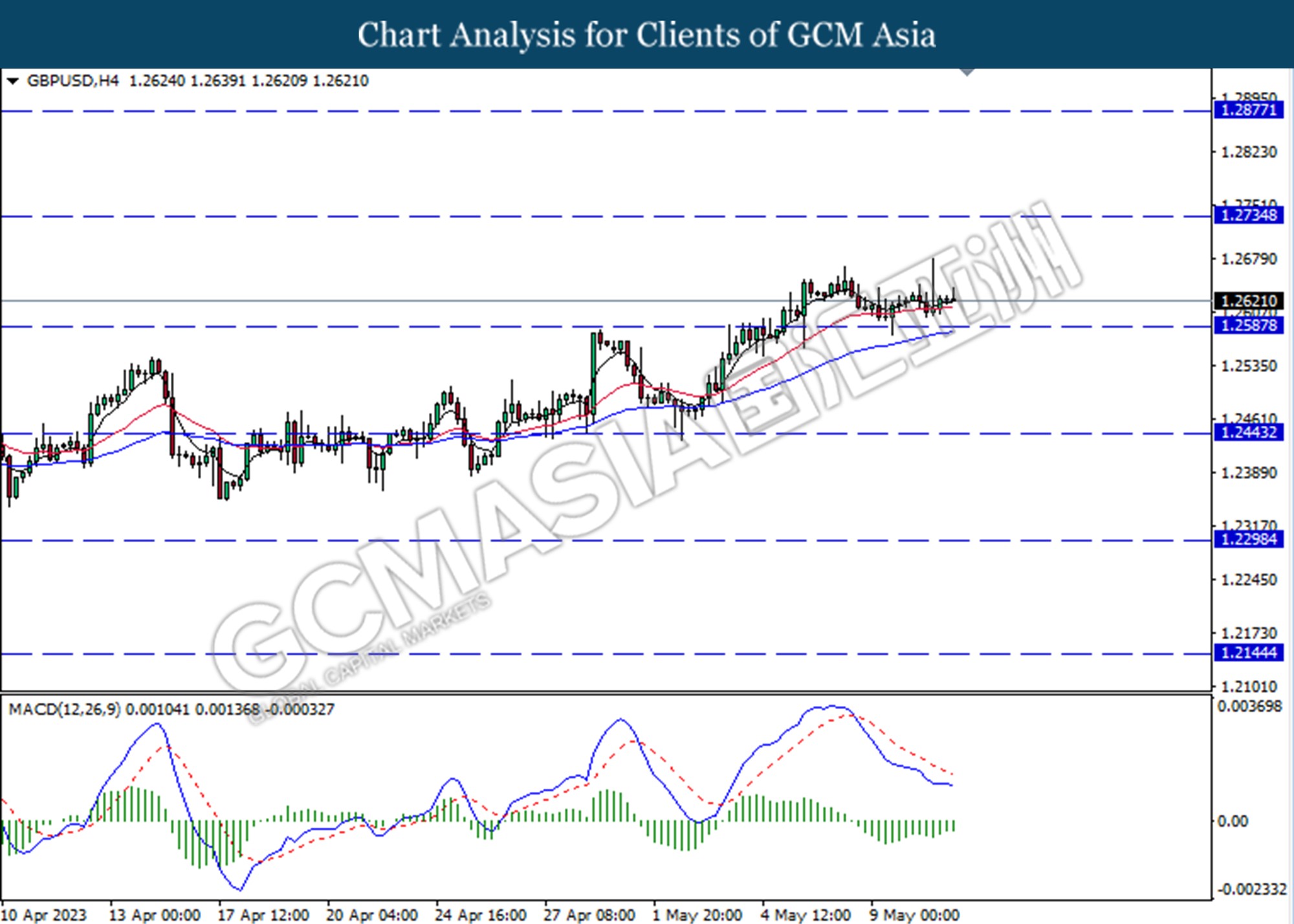

GBPUSD, H4: GBPUSD was traded higher following a prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.2735, 1.2880

Support level: 1.2590, 1.2445

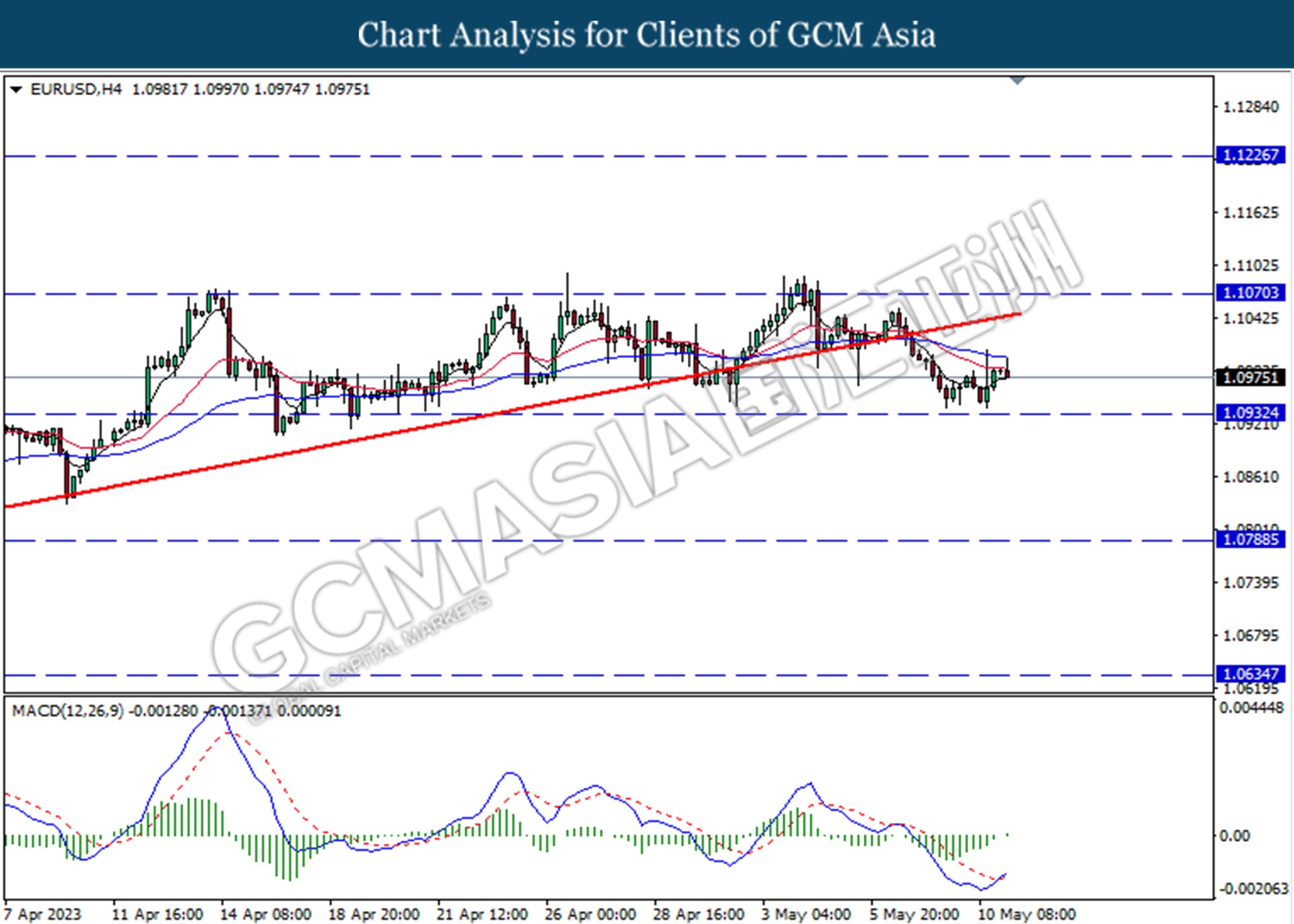

EURUSD, H4: EURUSD was traded higher following the prior rebound from the support level at 1.0930. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

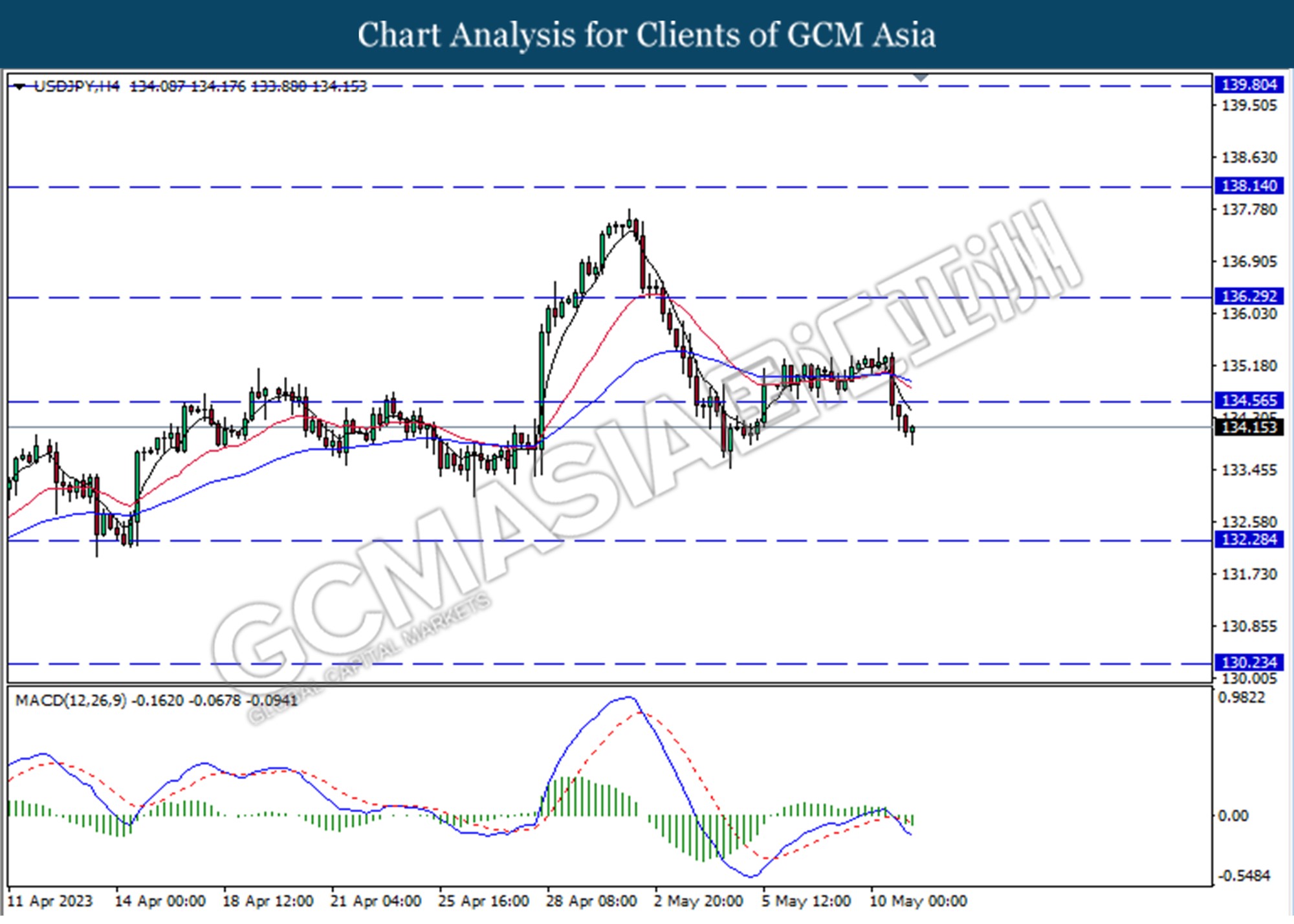

USDJPY, H4: USDJPY was traded lower following the prior break below from the previous support level at 134.55. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 134.55, 136.30

Support level: 132.30, 130.25

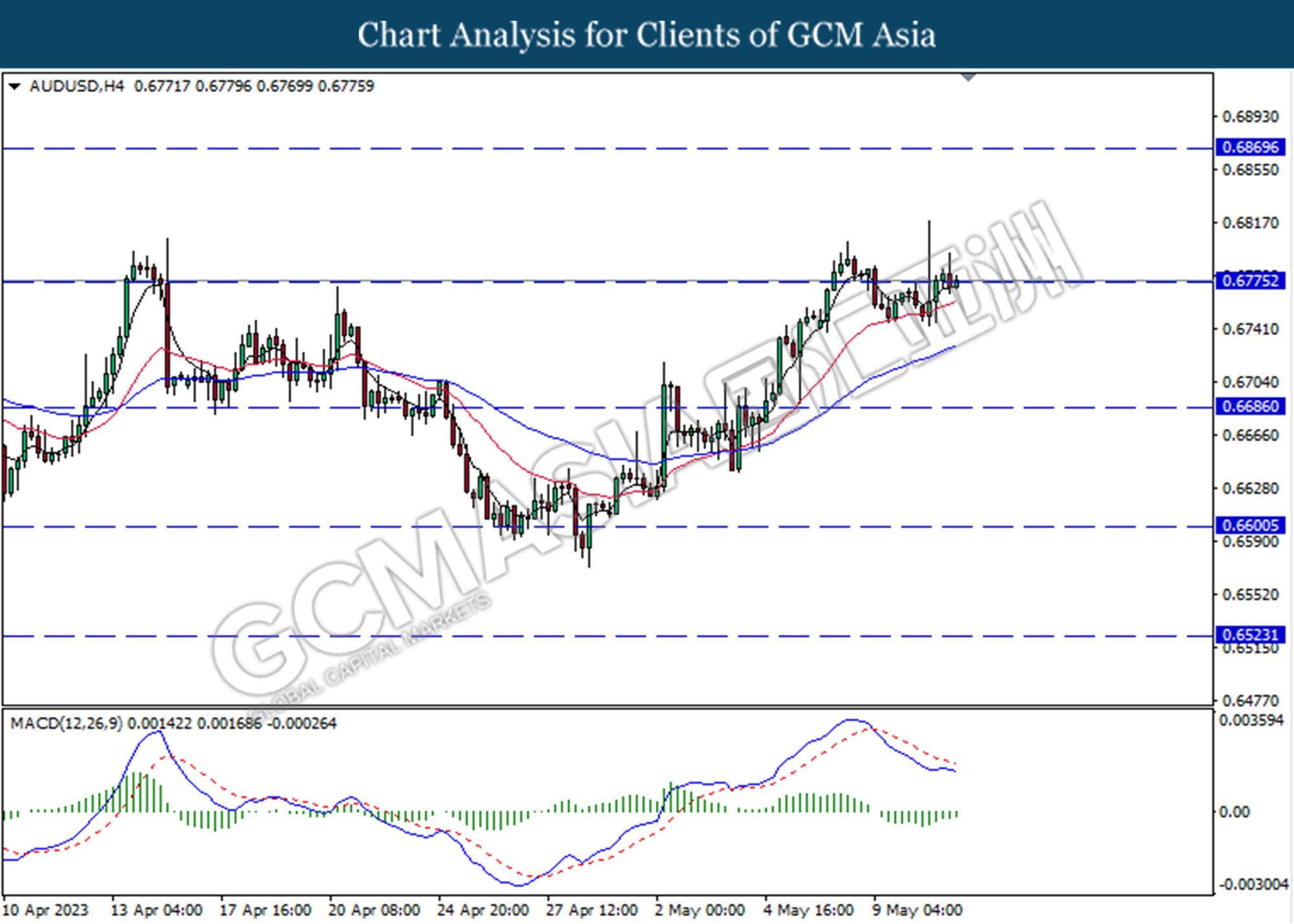

AUDUSD, H4: AUDUSD was traded higher while currently testing for the resistance level at 0.6775. MACD which illustrated bullish momentum suggests the pair extended it gains if successfully break above the resistance level.

Resistance level: 0.6775, 0.6870

Support level: 0.6685, 0.6600

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the support level at 0.6325. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6400.

Resistance level: 0.6400, 0.6495

Support level: 0.6325, 0.6265

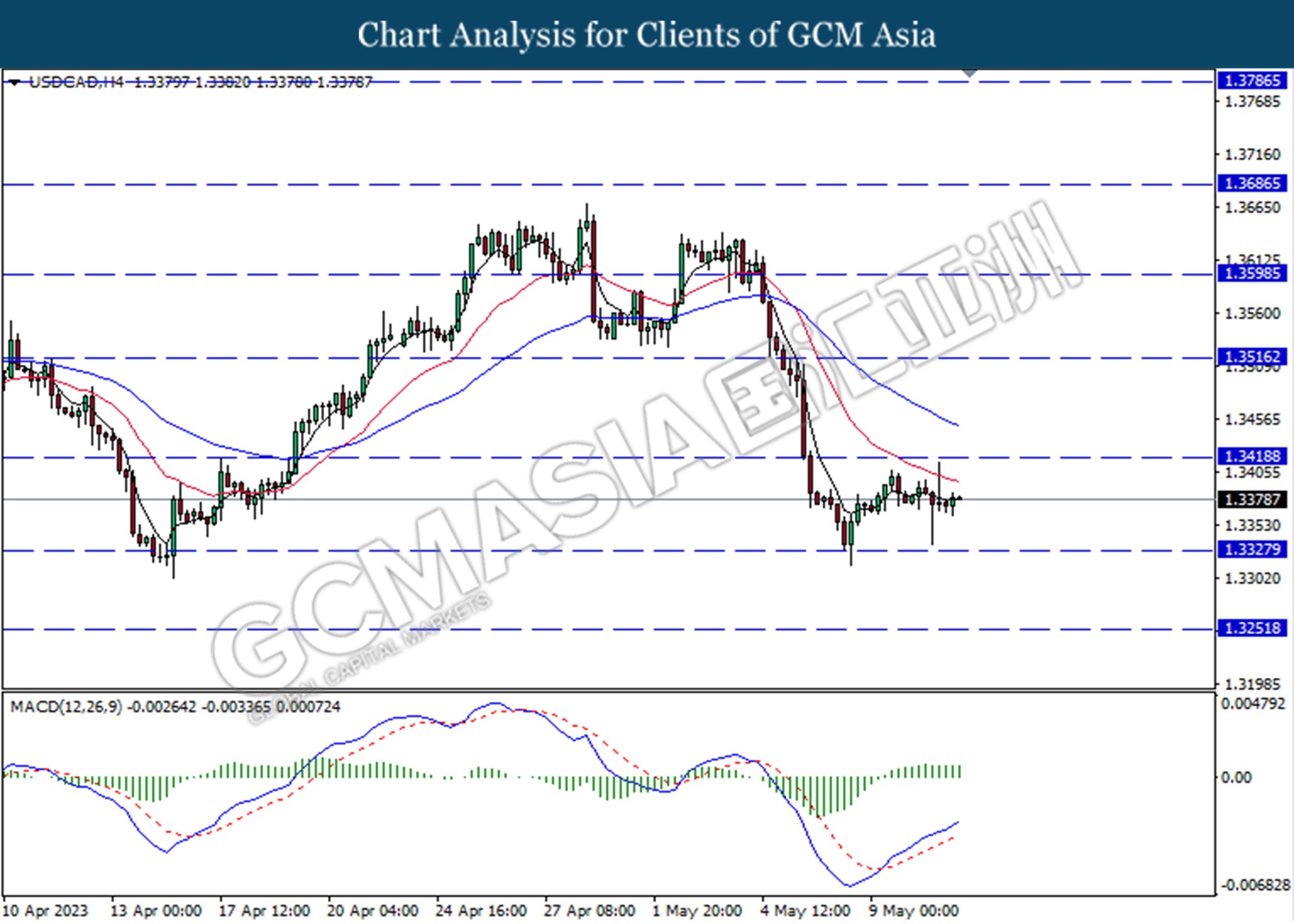

USDCAD, H4: USDCAD was traded higher following a prior rebound from the lower level. MACD which illustrated bullish momentum suggests the pair extended it gains toward the resistance level at 1.3420

Resistance level: 1.3420, 1.3515

Support level: 1.3330, 1.3250

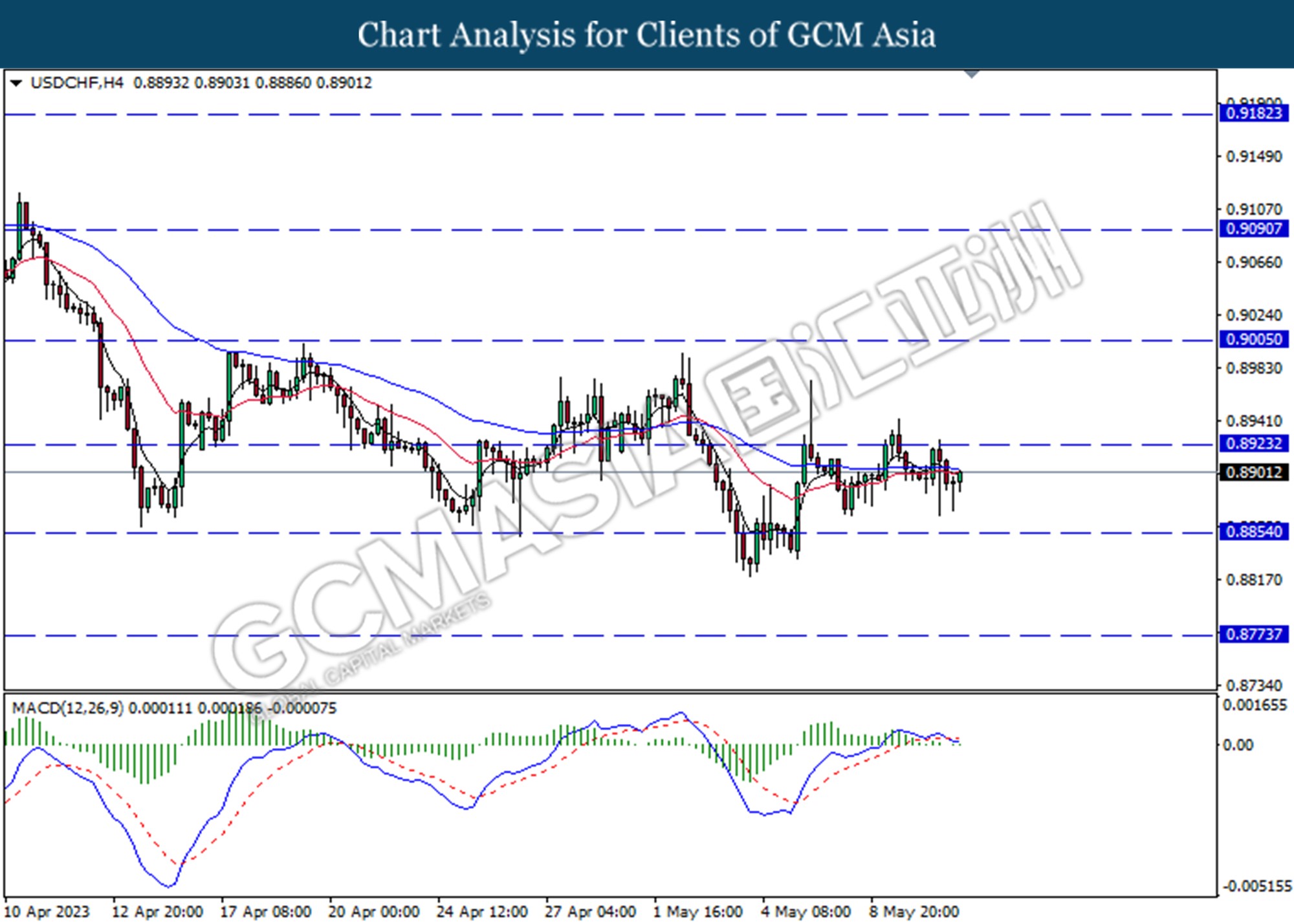

USDCHF, H4: USDCHF was traded lower following the prior retracement from the resistance level at 0.8925. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.8925, 0.9005

Support level: 0.8855, 0.8775

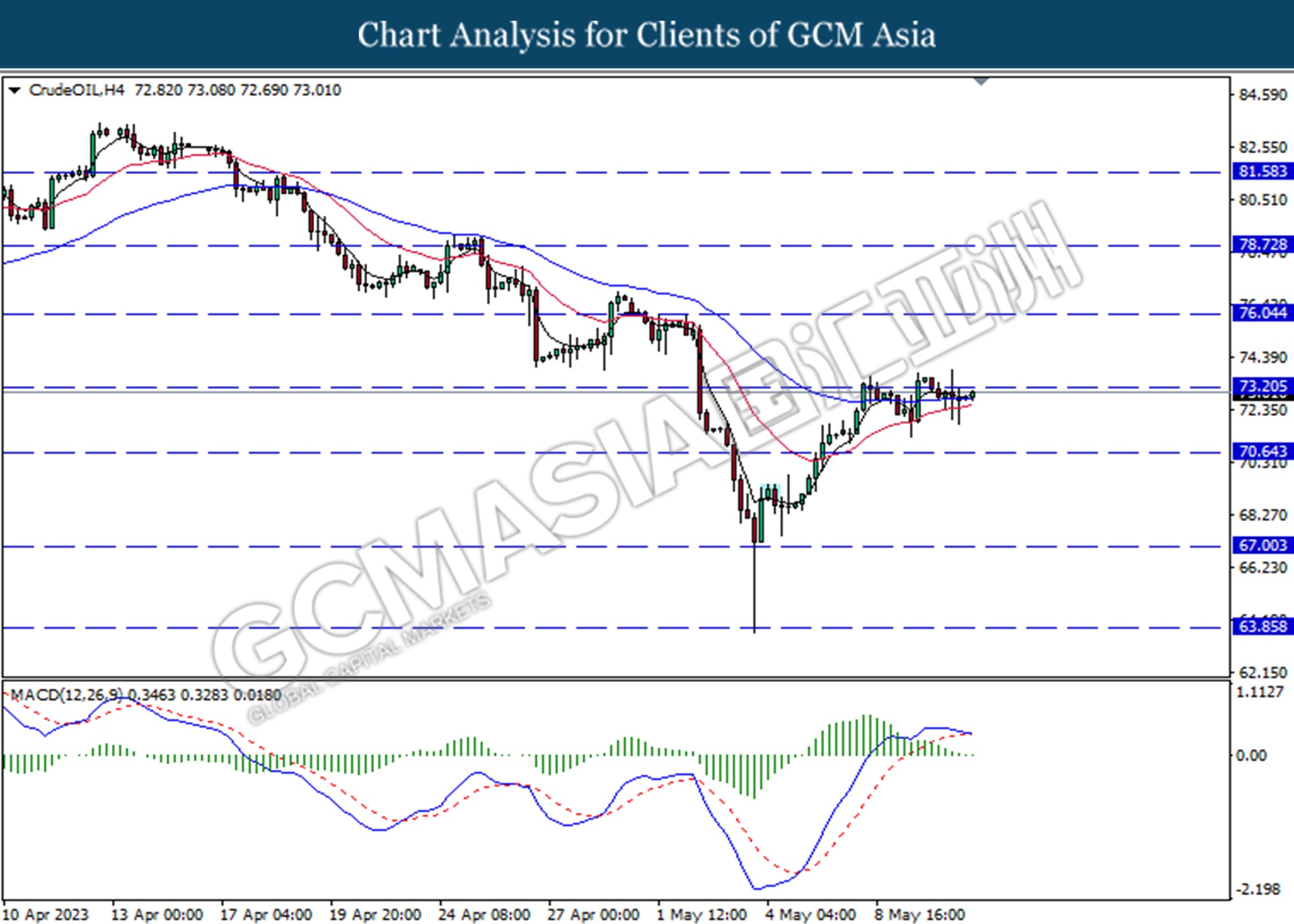

CrudeOIL, H4: Crude oil price was traded higher while currently testing for the resistance level at 73.20. However, MACD which illustrated diminishing bullish momentum suggests the commodity to undergo technical correction in short term.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

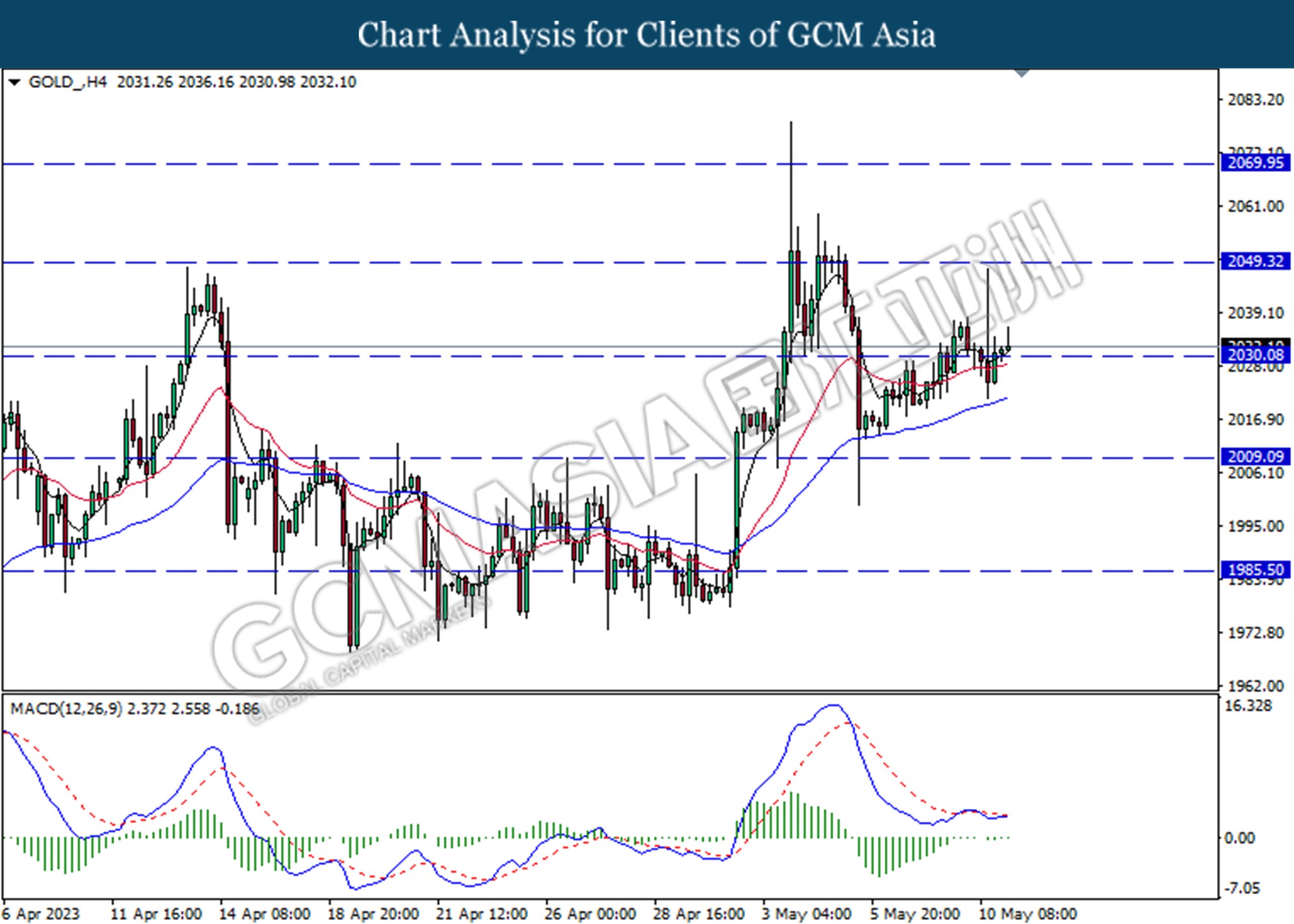

GOLD_, H4: Gold price was traded higher following the prior breakout above the previous resistance level at 2030.10. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 2049.30, 2069.95

Support level: 2030.10, 2009.10