15 May 2023 Afternoon Session Analysis

The pound extended losses after weak economic conditions.

The pound which traded against the greenback extended its losses after the crucial economic data was released last Friday. The UK Q1 GDP was expected to shrink to 0.4% of growth, but the actual result marked at 0.3%, slipped more than market expectations. The growth of the service sectors was contributed by information and communication 1.2% and administrative and support services 1.3%. While the consumer spending sector showed no increase after the household remains in a cautious mood as incomes continue to squeeze by high inflation. Nonetheless, the Office for National Statistics (ONS) said that the UK economy suffered from the awful weather during the month which caused household spending reduced. The reason for the contraction came from the 6th Wettest March since 1836 caused the consumers to stay indoors and retail sales suffered. Besides that, both industrial and manufacturing production continues to present in contraction moves, which are remarked at -0.1% and 0.1% respectively. Both readings slipped from the 0.7% in the prior month. With such backdrops, the pound against the greenback extended its losses toward the 1.2460 level. As of writing, the GBPUSD was increased by 0.08% to $1.2466.

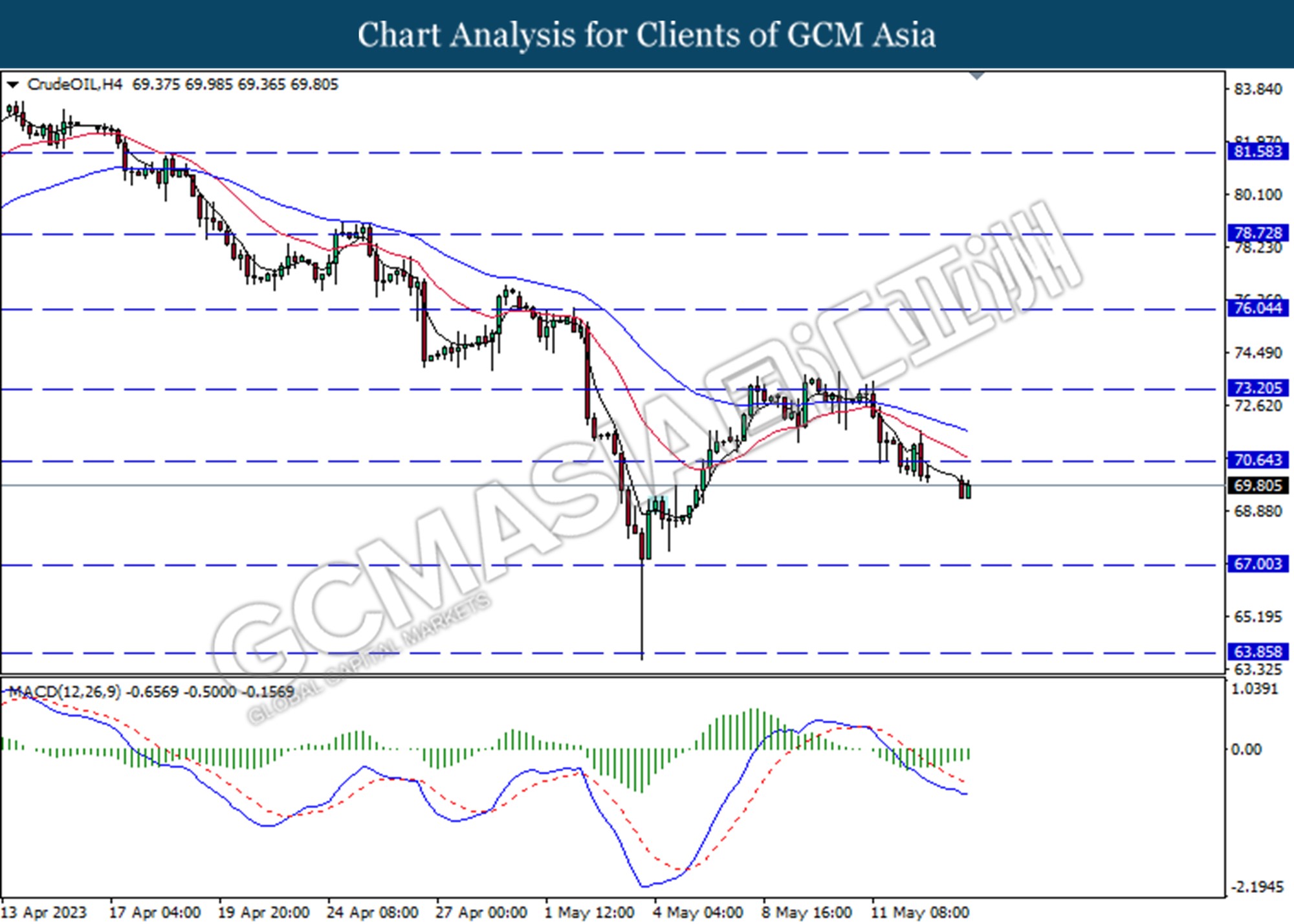

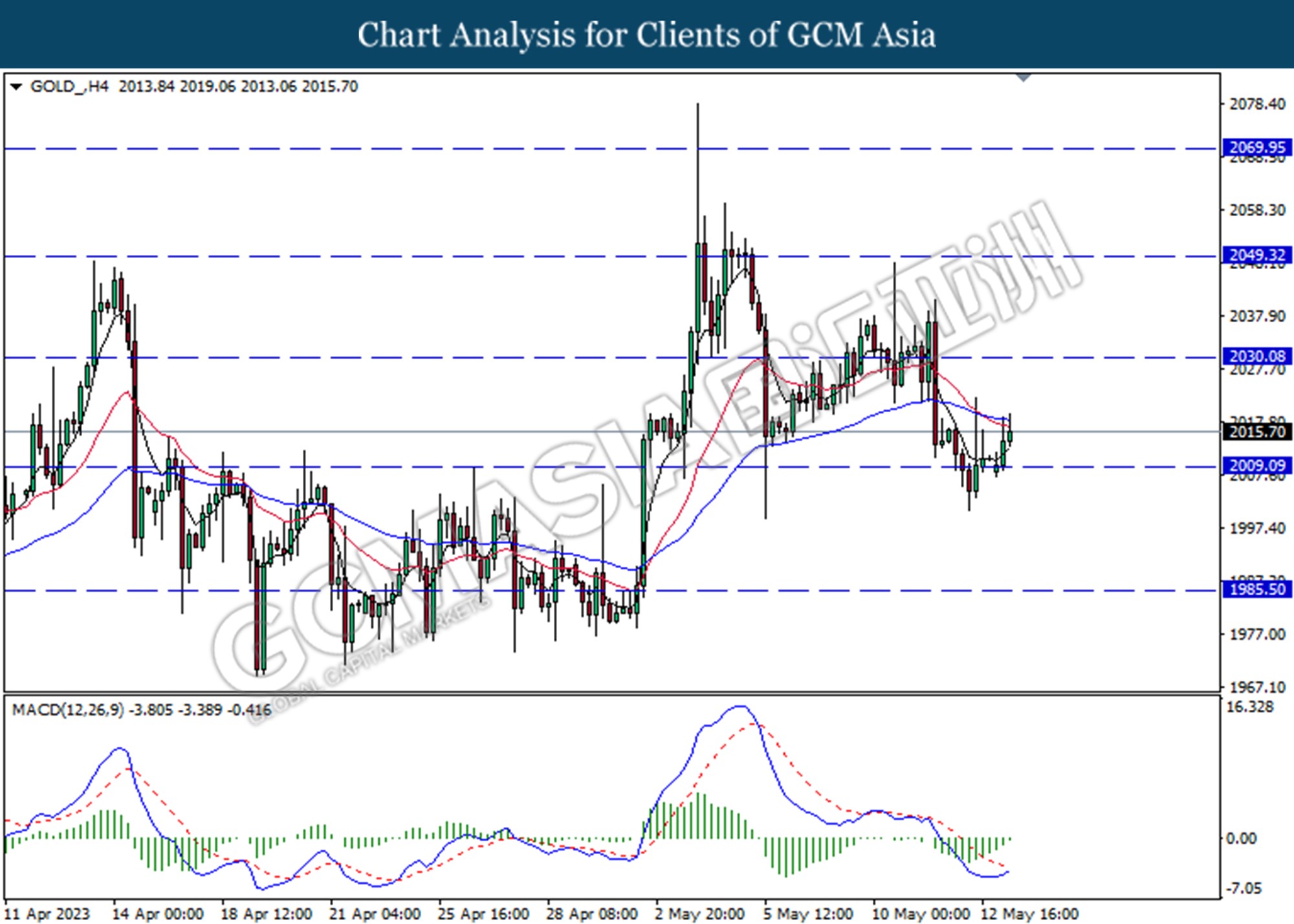

In the commodities market, crude oil prices were traded lower by -0.34% to $69.80 per barrel amid economic concern over a potential US recession affecting the oil demand. Besides, gold prices edged up by 0.26% to $2016.04 per troy ounce following the prior weakening in the US dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

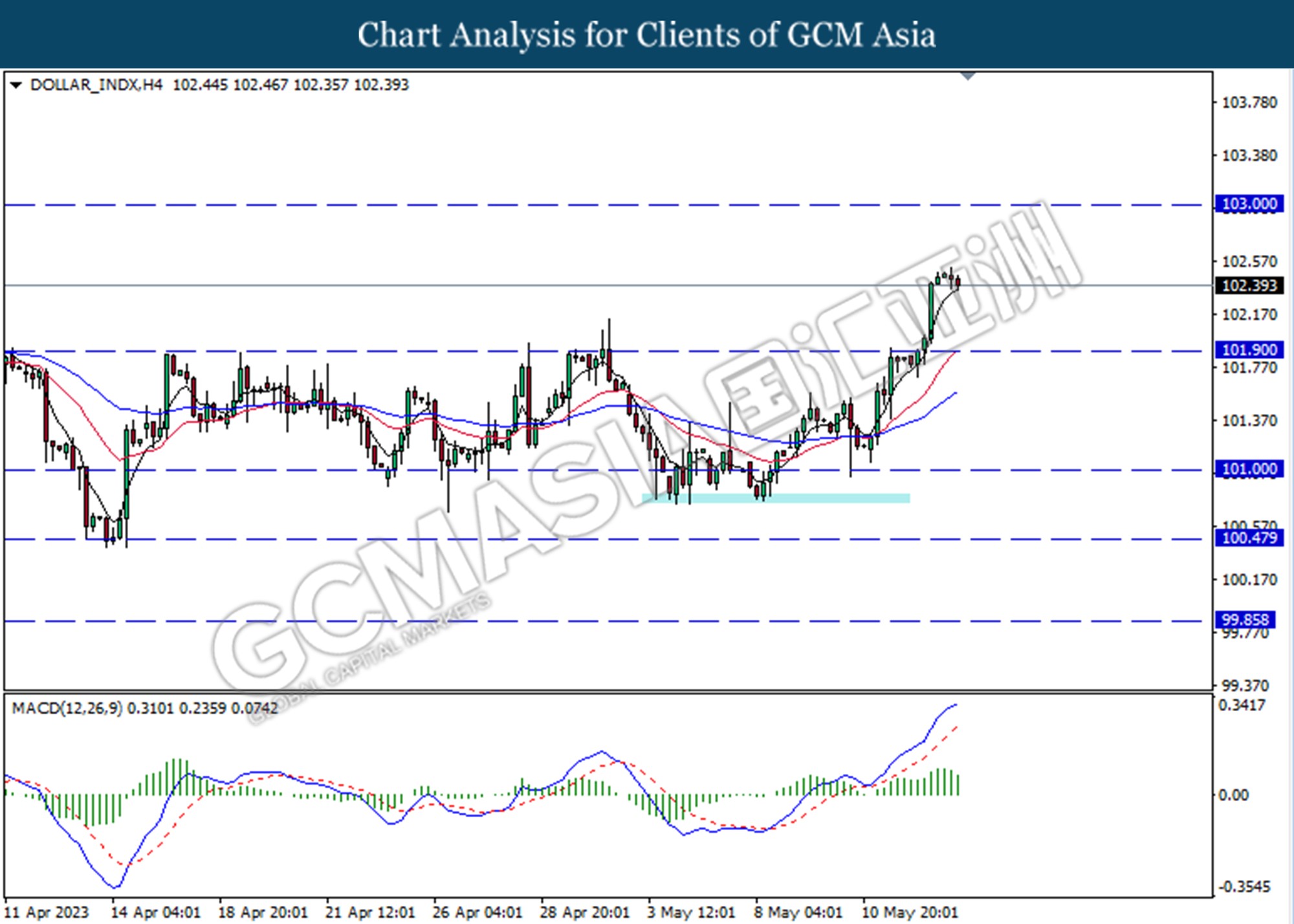

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level at 101.90.

Tahap rintangan: 101.90, 104.50

Tahap sokonagan: 101.00, 100.50

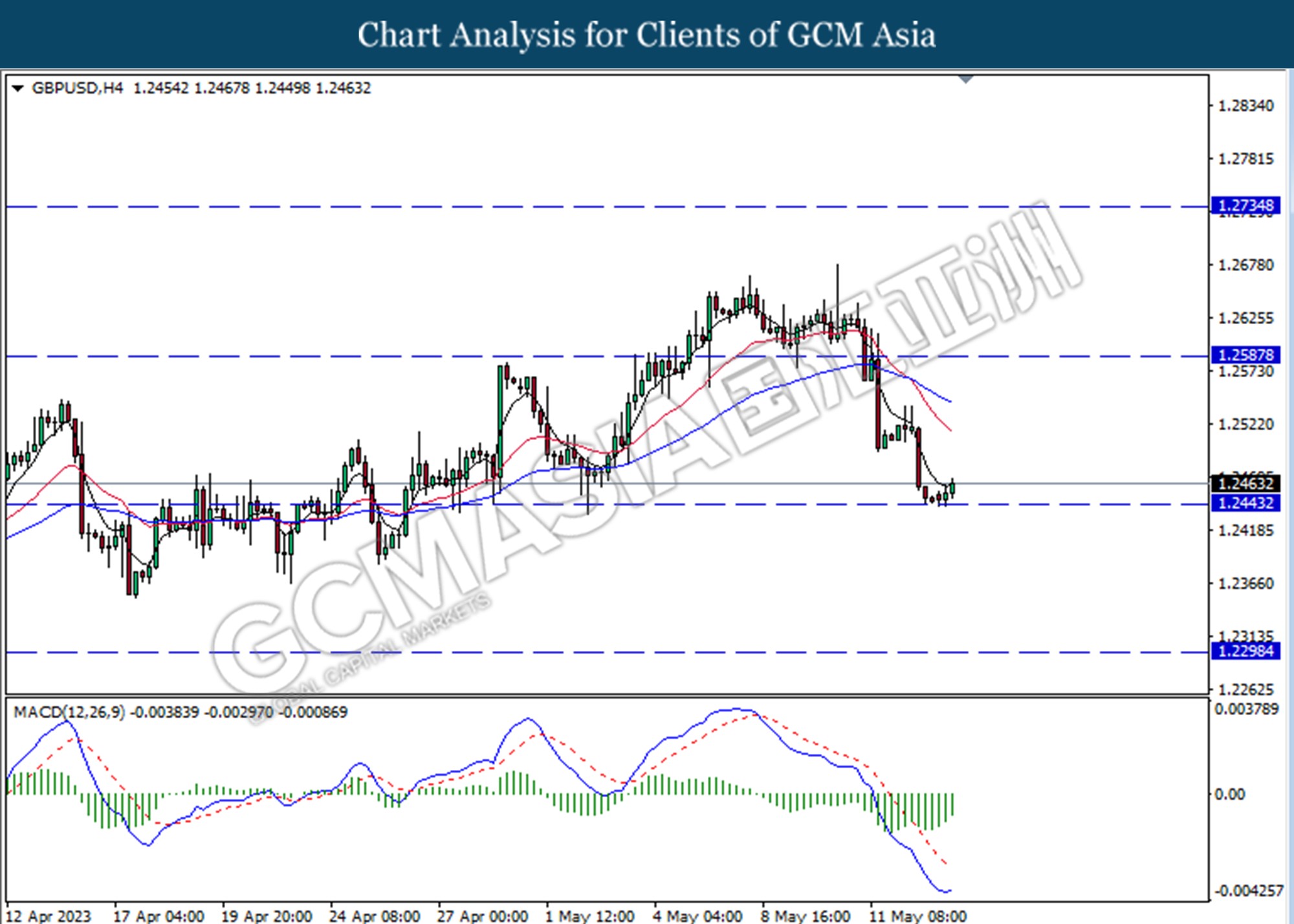

GBPUSD, H4: GBPUSD was traded higher following the prior rebound from the support level at 1.2445. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Tahap rintangan: 1.2590, 1.2735

Tahap sokonagan: 1.2445, 1.2300

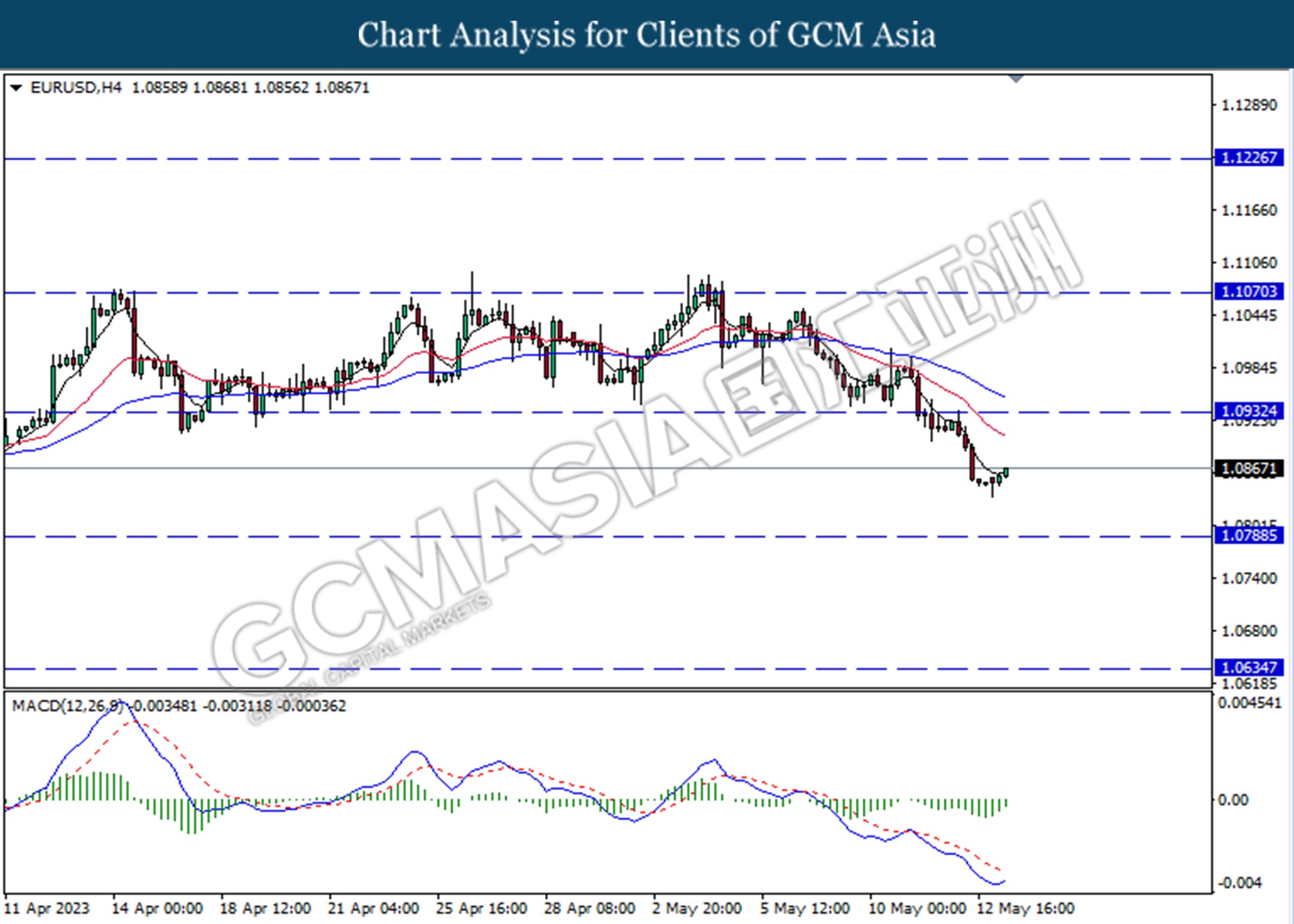

EURUSD, H4: EURUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Tahap rintangan: 1.0930, 1.1070

Tahap sokonagan: 1.0790, 1.0635

USDJPY, H4: USDJPY was traded higher while currently testing for the resistance level at 136.30. MACD which illustrated increasing bullish momentum suggests the pair extended its gains if successfully break above the resistance level.

Tahap rintangan: 136.30, 138.15

Tahap sokonagan: 134.55, 132.30

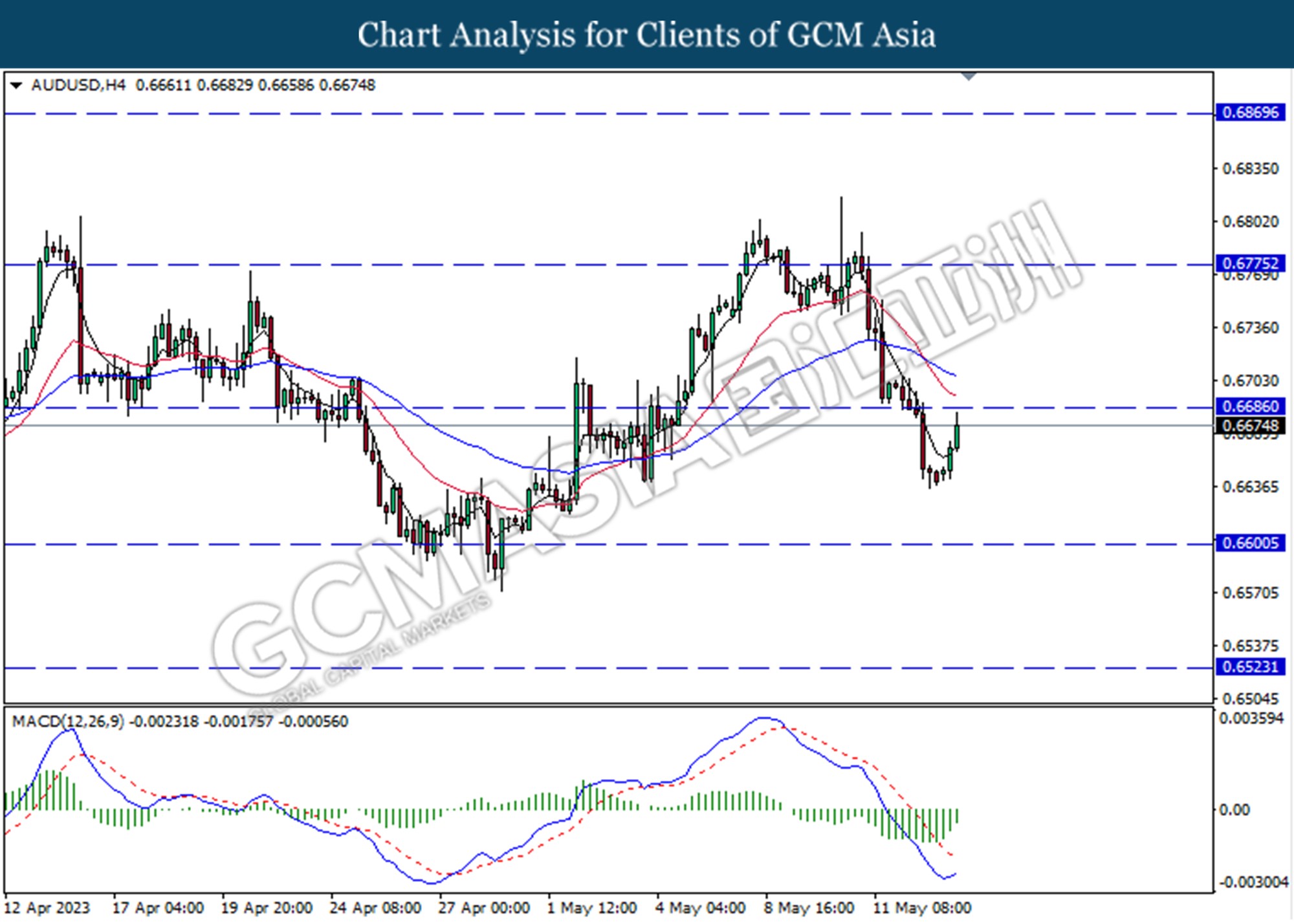

AUDUSD, H4: AUDUSD was traded higher while currently testing for the resistance level at 0.6685. MACD which illustrated increasing diminishing bearish momentum suggests the pair extended its gains if successfully break above the resistance level.

Tahap rintangan: 0.6685, 0.6775

Tahap sokonagan: 0.6600, 0.6525

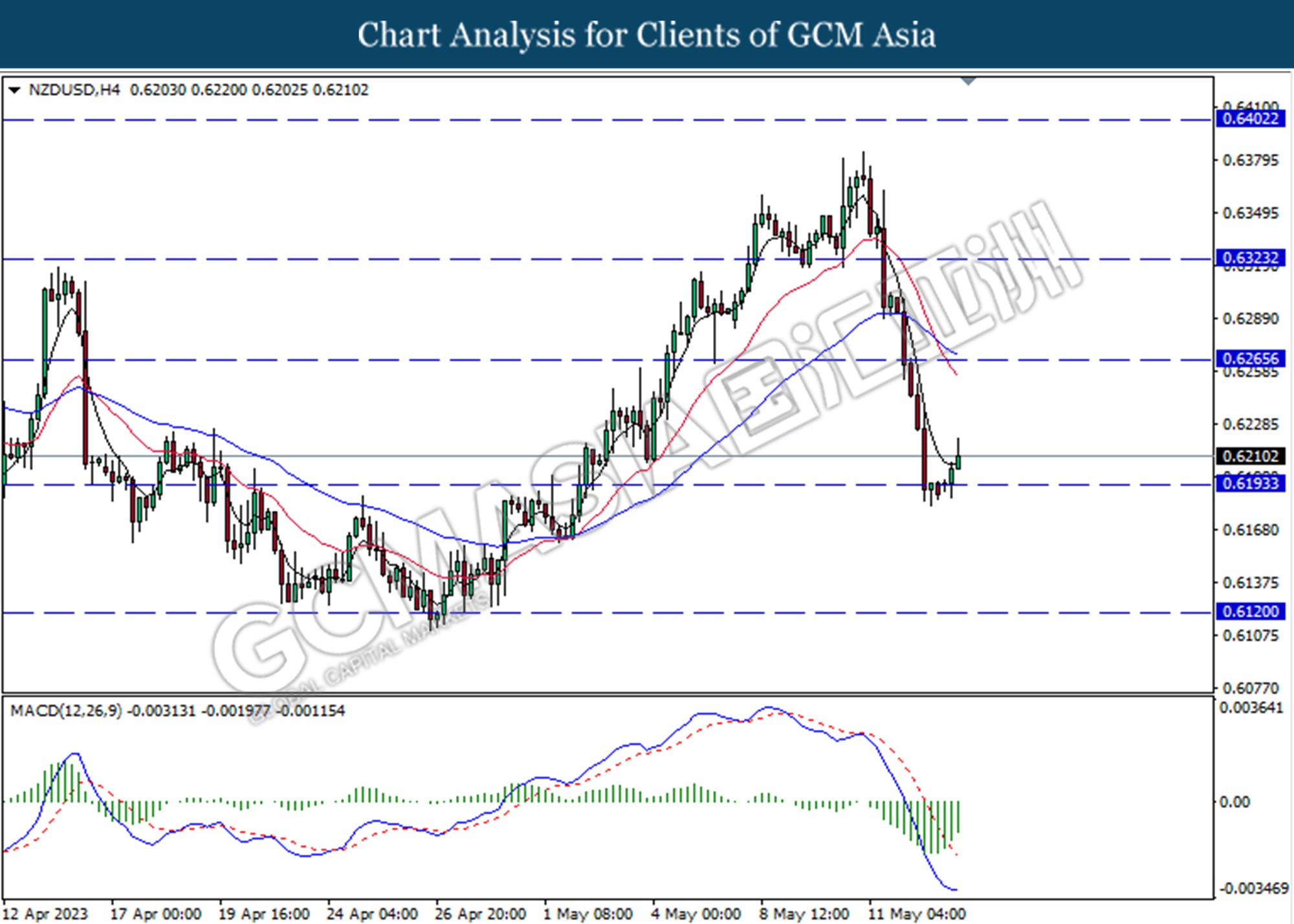

NZDUSD, H4: NZDUSD was traded higher following a prior rebound from the support level at 0.6195. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Tahap rintangan: 0.6265, 0.6320

Tahap sokonagan: 0.6195, 0.6120

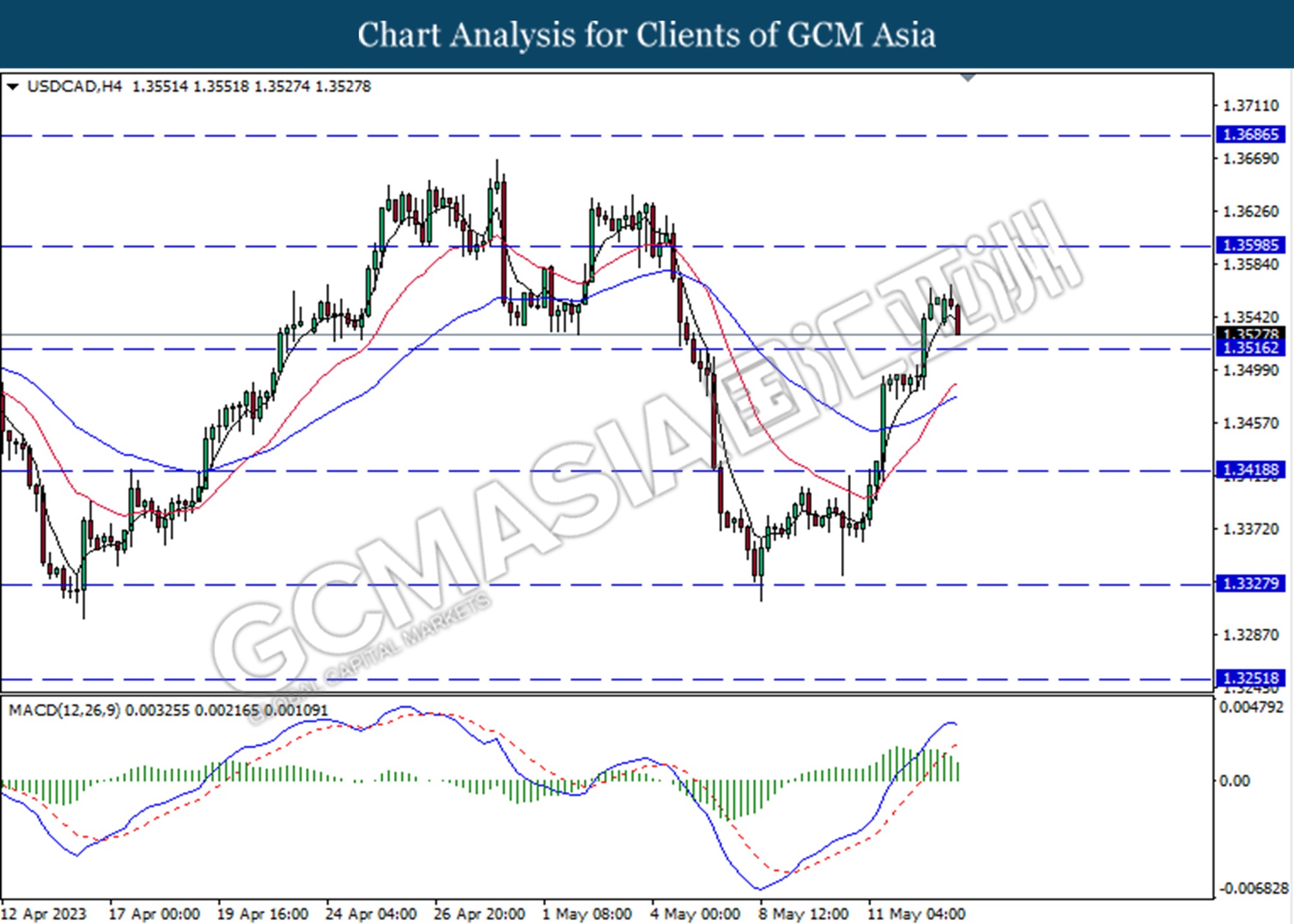

USDCAD, H4: USDCAD was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 1.3515.

Tahap rintangan: 1.3600, 1.3685

Tahap sokonagan: 1.3515, 1.3420

USDCHF, H4: USDCHF was traded lower following a prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.8925.

Tahap rintangan: 0.9005, 0.9090

Tahap sokonagan: 0.8925, 0.8855

CrudeOIL, H4: Crude oil price was traded lower following a prior break below the previous support level at 70.65. However, MACD which illustrated diminishing bearish momentum suggests the commodity to undergo technical correction in the short term.

Tahap rintangan: 70.65, 73.20

Tahap sokonagan: 67.00, 63.85

GOLD_, H4: Gold price was traded higher following a prior rebound from the support level at 2009.10. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Tahap rintangan: 2030.10, 2049.530

Tahap sokonagan: 2009.10, 1985.50