19 May 2023 Afternoon Session Analysis

The kiwi corrective bounce despite mixed economic data.

The Kiwi index, which was traded against the greenback, revise its trend after the mixed economic data released recently. The April Trade Balance data infused some strength in the New Zealand dollar as the monthly trade balance improved to $427 million from $-1586 million in monthly reading, higher than the market expectation of -235M. However, the number in the annual reading eased to -16.8B versus -17.08B slightly lower than the prior reading. The monthly trade export rose by 10% to $641 million as China contributed the most in importing dairy goods, the Statistics New Zealand data showed. Aside from the New Zealand trade balance data, the Reserve Bank of New Zealand’s (RBNZ) recent hawkish forecasts were mainly due to yesterday’s release of the annual budget. New Zealand Prime Minister Chris Hipkins has focused his Budget on people’s livelihoods as many New Zealanders struggle to meet day-to-day expenses due to high inflation. To solve the problems of NZ’s livelihood, more budgets are implemented by the government into the market, which will cause inflation to remain stubbornly high. Nonetheless, the gains of the Kiwi were limited by weakened consumer spending. Credit card spending growth was reduced to 11.4% versus 12.5% lower than prior readings of 19.7%. As of writing, the NZD/USD was lifted by 0.19% to 0.6238.

In the commodities market, crude oil prices ticked up by 0.81% to $72.44 per barrel as optimism over raising the US debt ceiling. Besides, gold prices rebounded by 0.23% to $1961.99 per troy ounce following the prior experienced a massive sell-off by global investors.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Core Retail Sales (MoM) (Mar) | -0.7% | -0.8% | – |

Technical Analysis

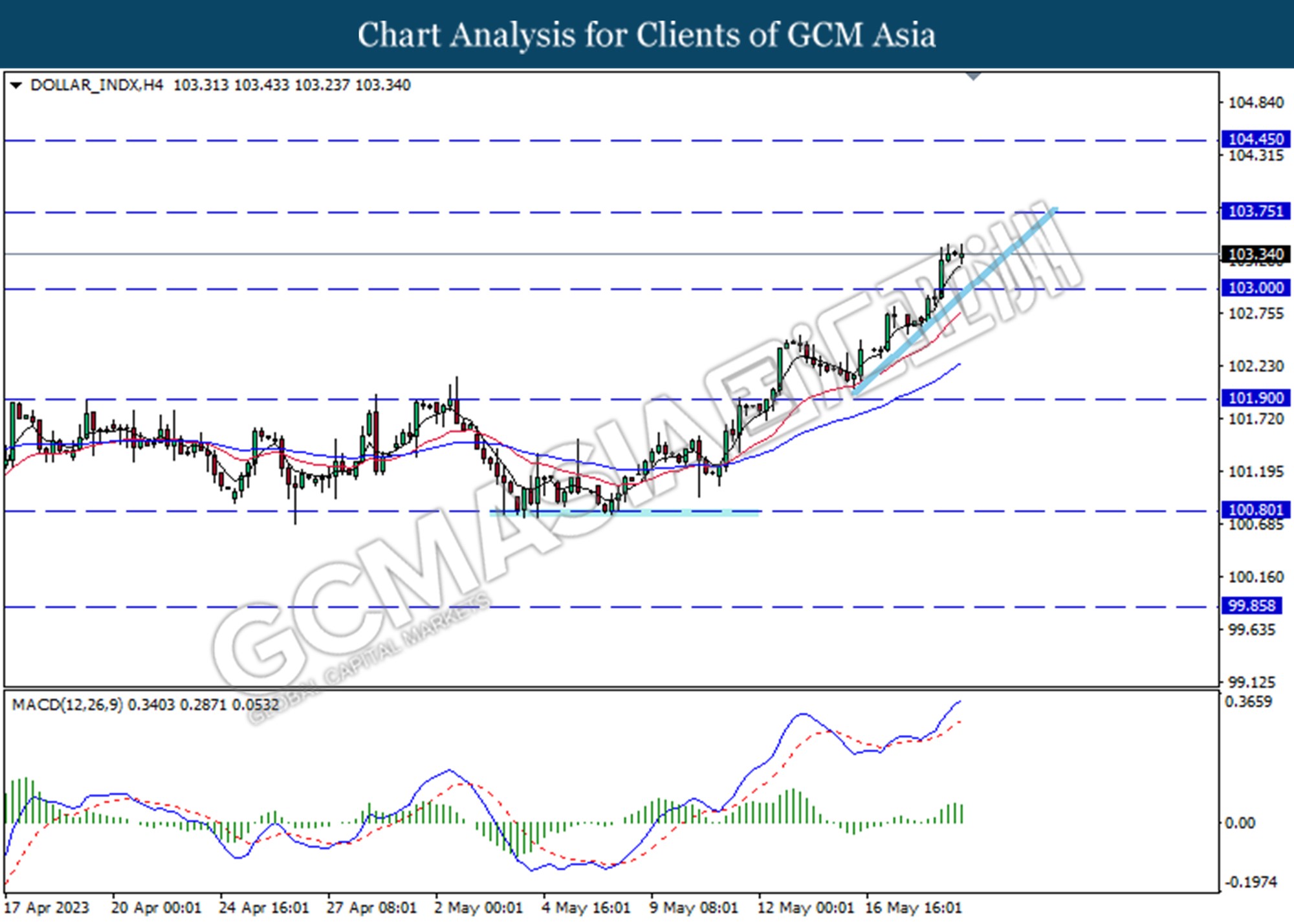

DOLLAR_INDX, H4: Dollar index was traded higher following the prior breaks above the resistance level at 103.00. However, MACD which illustrated diminishing bullish momentum suggests the index traded lower as a technical correction.

Resistance level: 103.75, 104.45

Support level: 103.00, 101.90

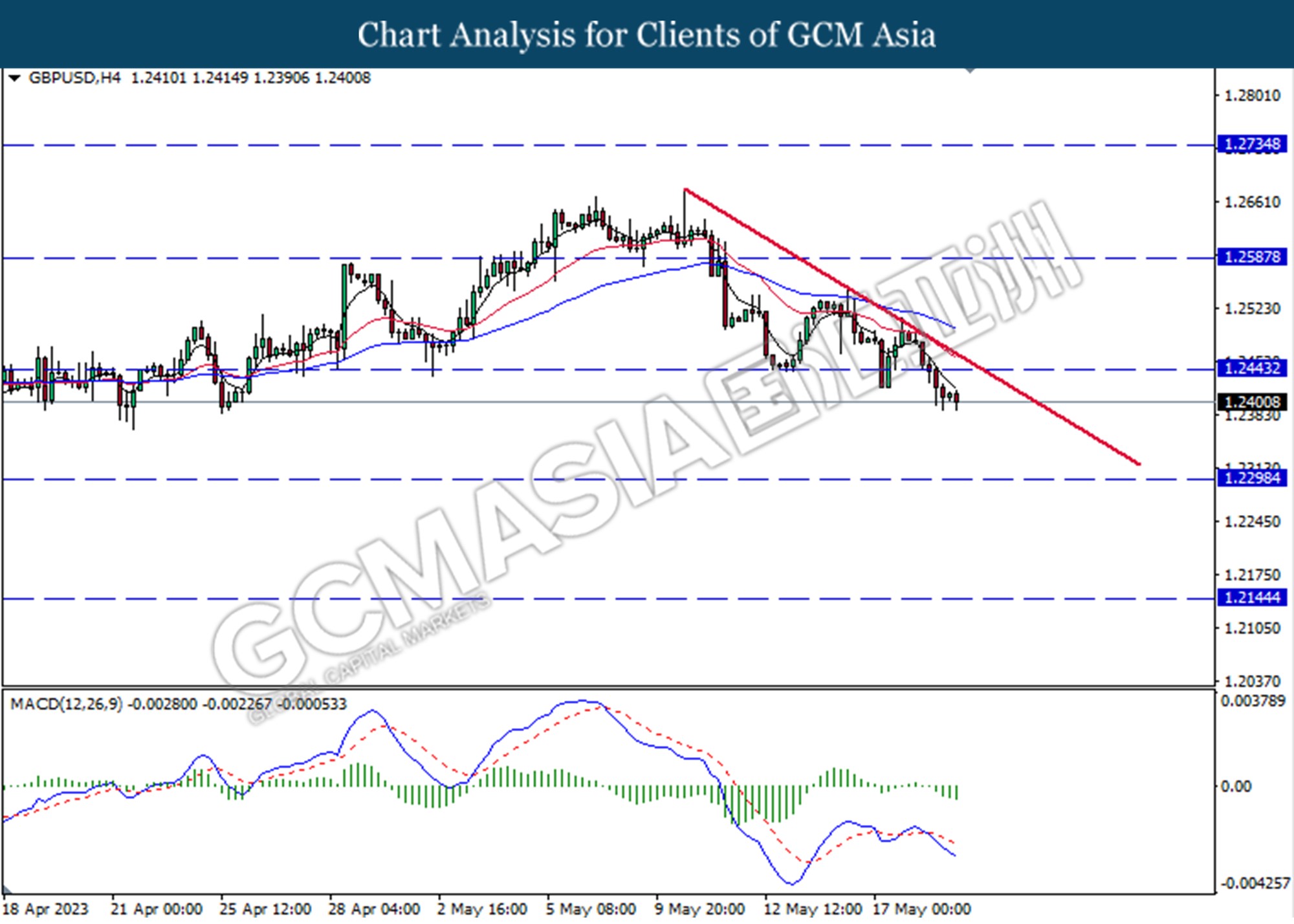

GBPUSD, H4: GBPUSD was traded lower following the prior breaks below the previous support level at 1.2445. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.2300.

Resistance level: 1.2445, 1.2590

Support level: 1.2300, 1.2145

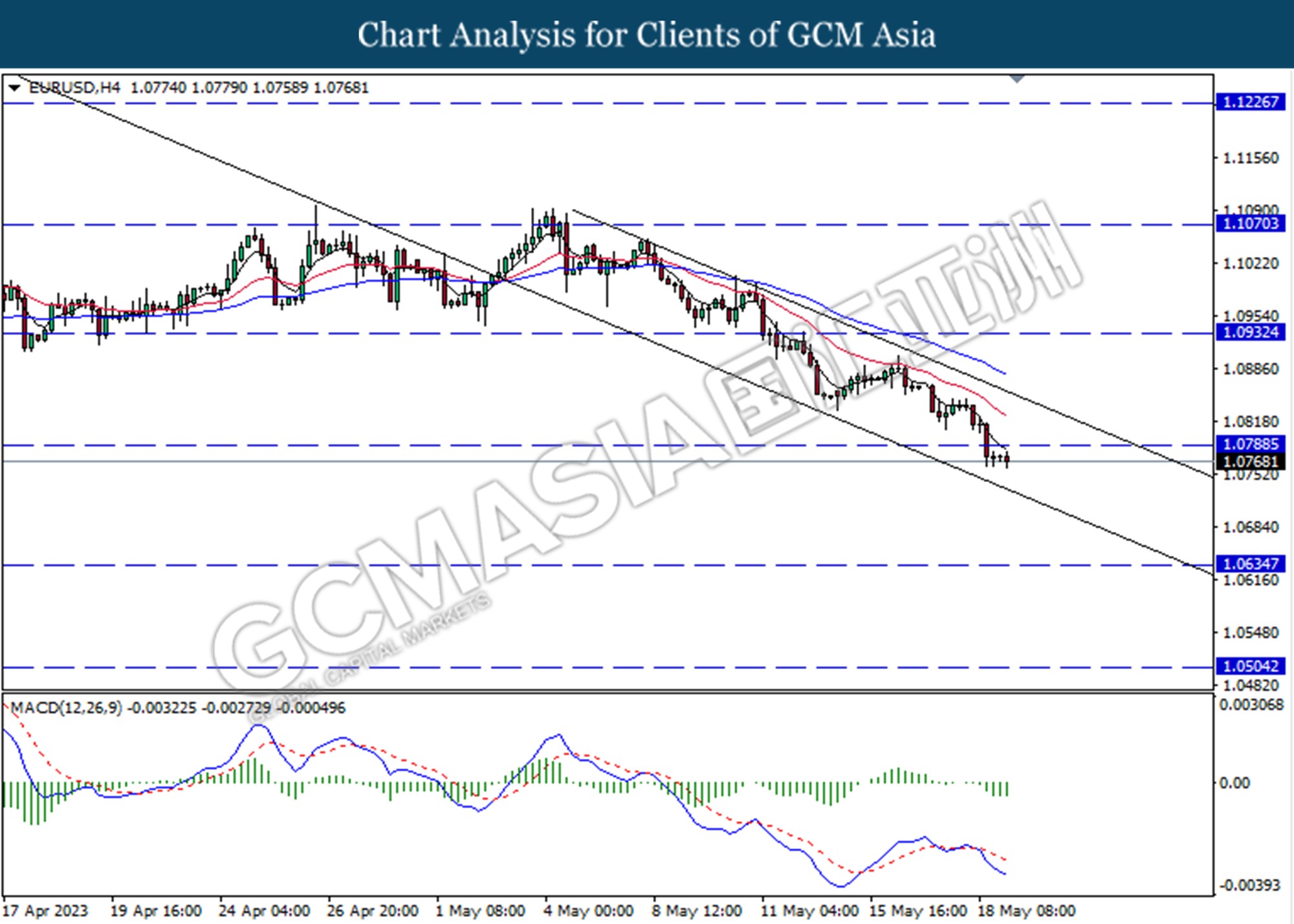

EURUSD, H4: EURUSD was traded lower following the prior breaks below the previous support level at 1.0790. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.0635.

Resistance level: 1.0790, 1.0935

Support level: 1.0635, 1.0505

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 138.15.

Resistance level: 139.80, 141.60

Support level: 138.15, 136.30

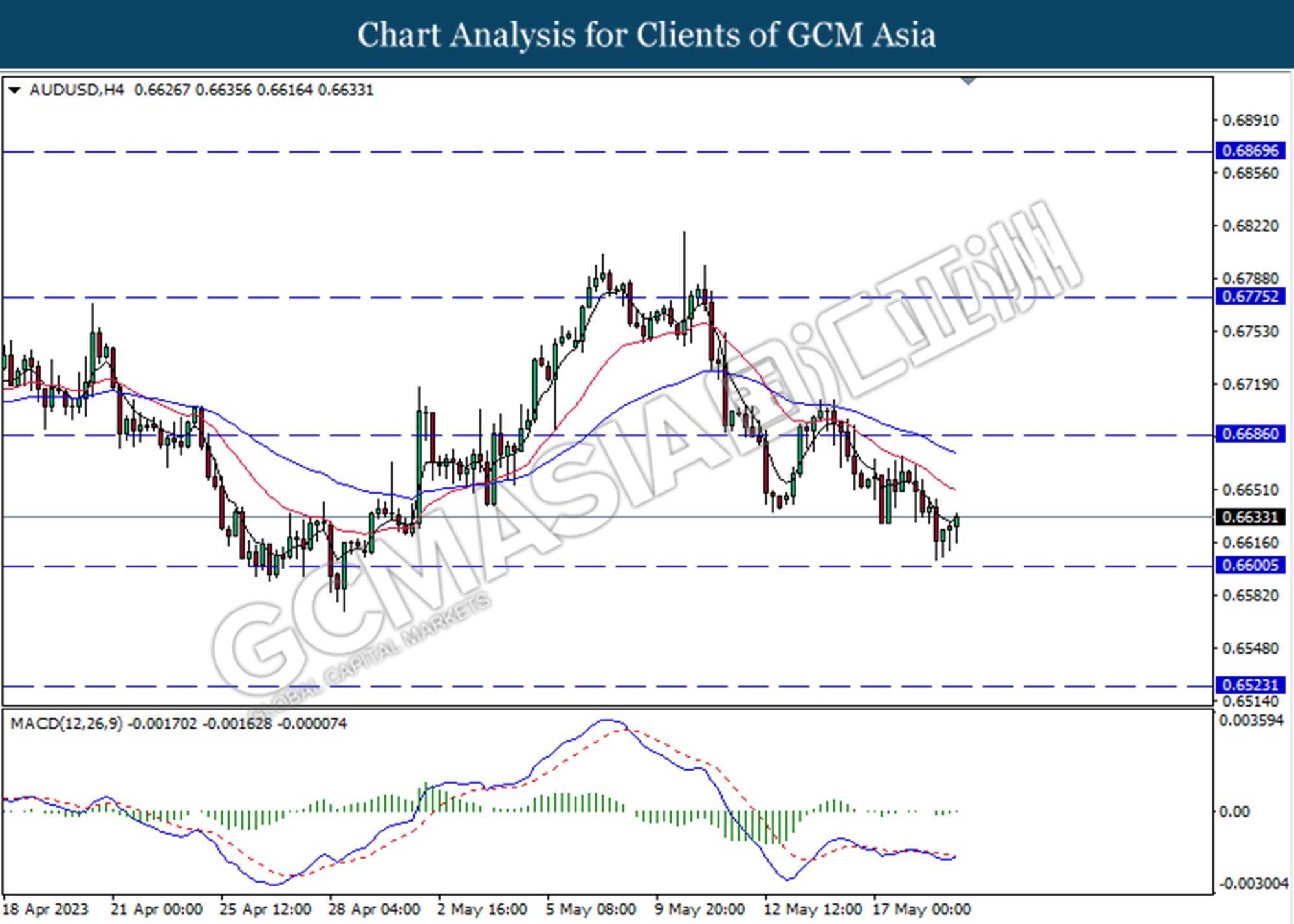

AUDUSD, H4: AUDUSD was traded higher following the prior rebound from the support level at 0.6600. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

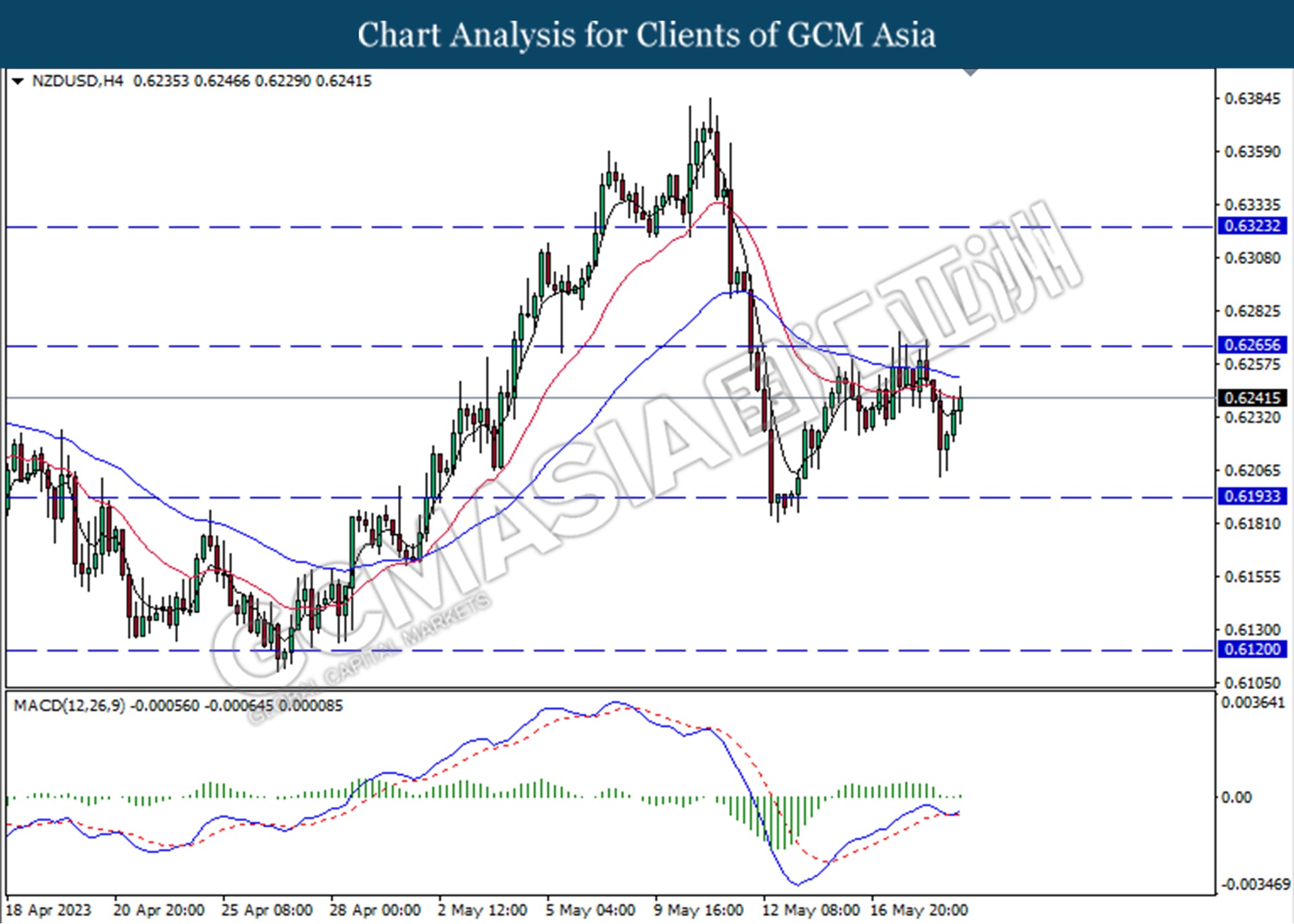

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 0.6265, 0.6325

Support level: 0.6195, 0.6120

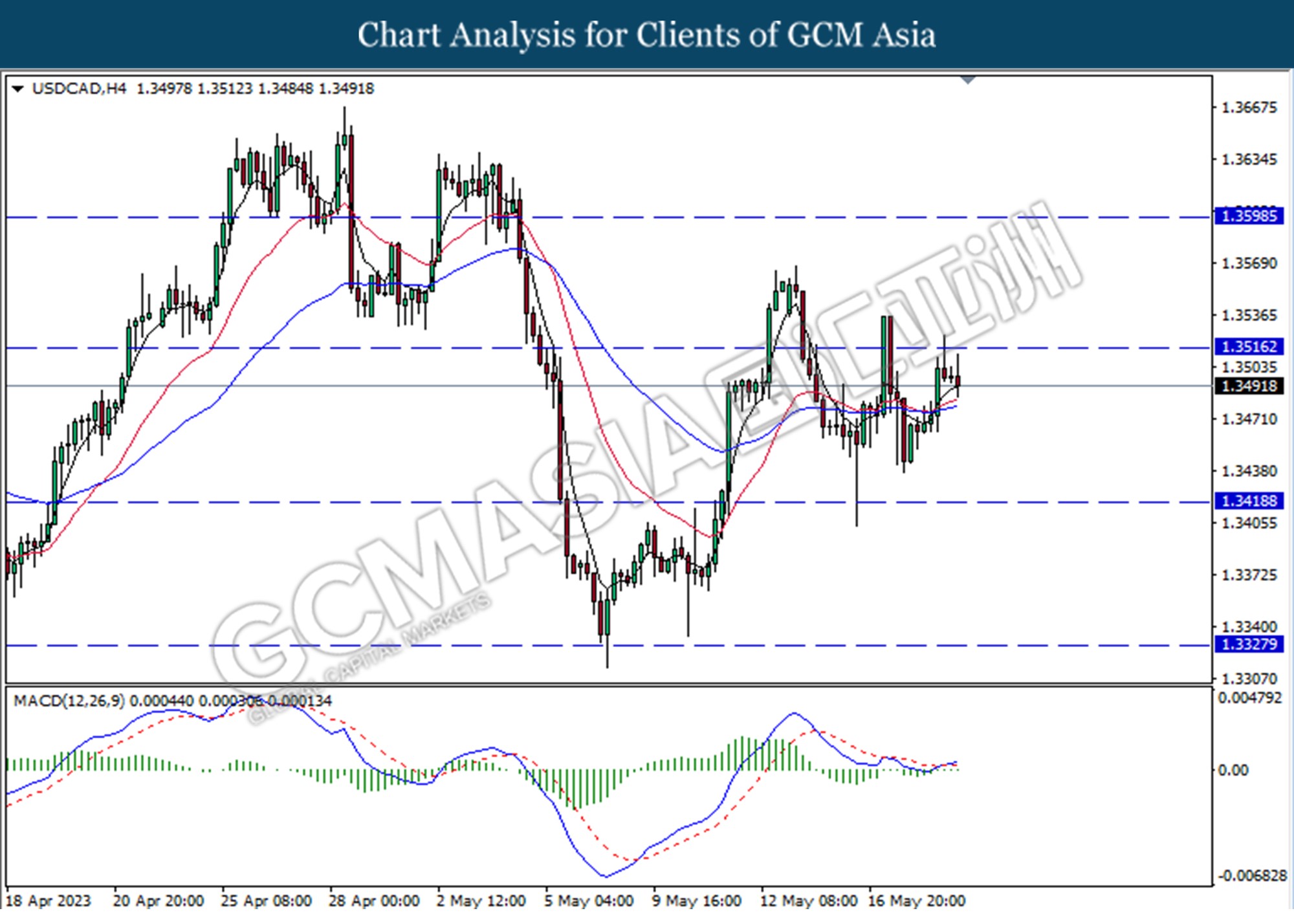

USDCAD, H4: USDCAD was traded lower following the prior retracement from the resistance level at 1.3515. However, MACD which illustrated diminishing bearish momentum undergo technical correction in the short term.

Resistance level: 1.3515, 1.3600

Support level: 1.3420, 1.3330

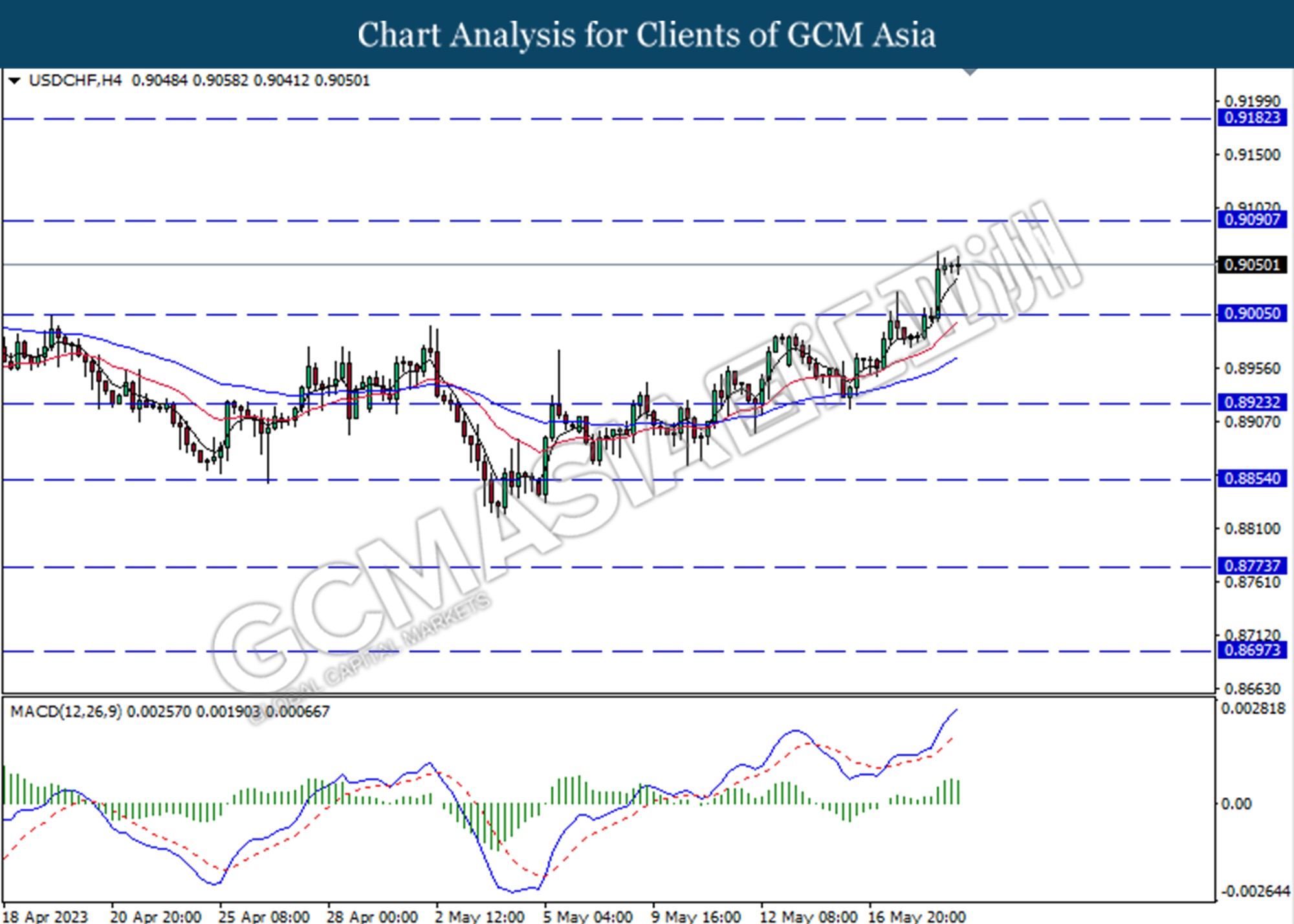

USDCHF, H4: USDCHF was traded higher following the prior breakout above the previous resistance level at 0.9005. However, MACD which illustrated diminishing bullish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 0.9090, 0.9180

Support level: 0.9005, 0.8925

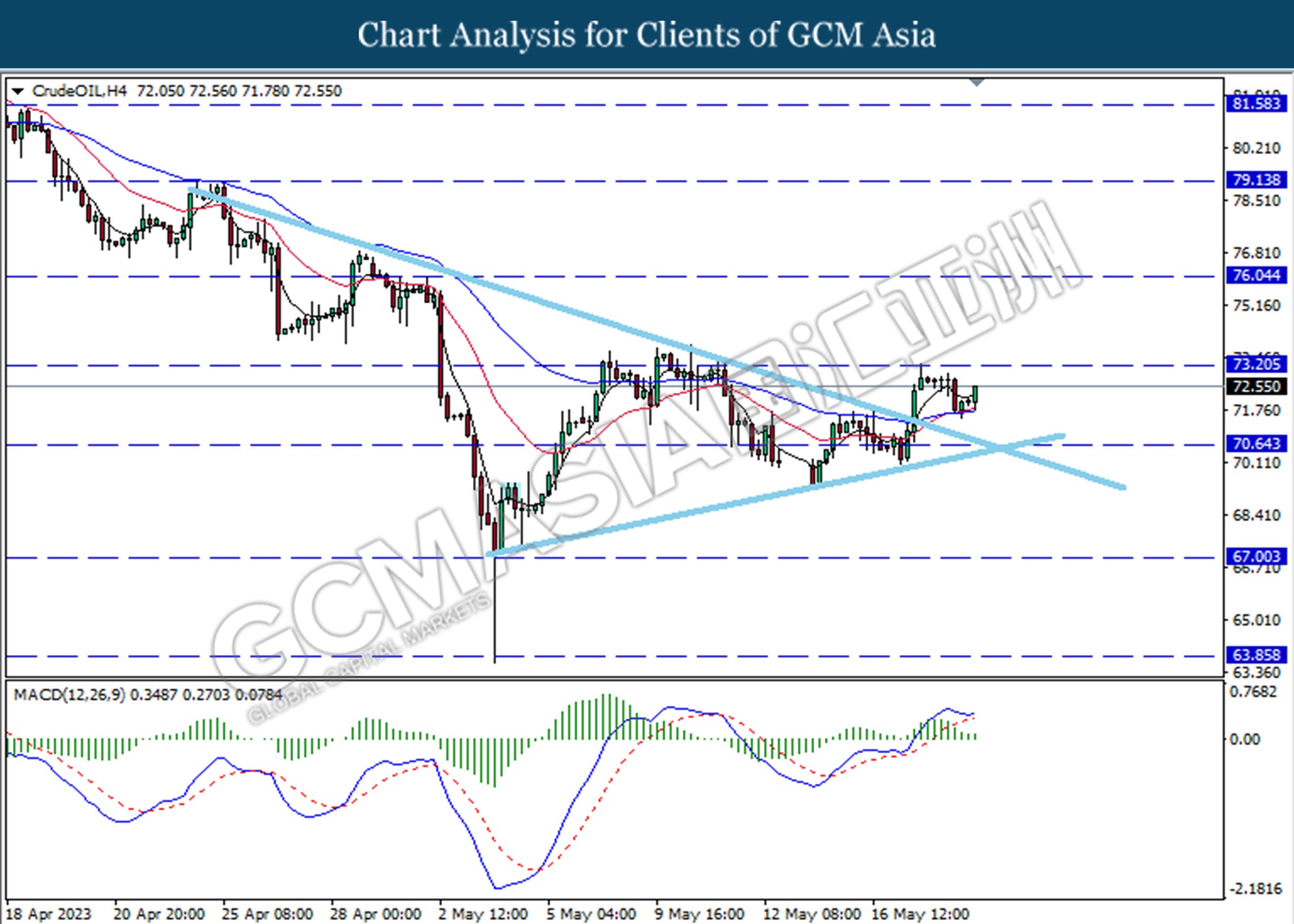

CrudeOIL, H4: Crude oil price was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bullish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 73.20, 76.05

Support level: 70.65, 67.00

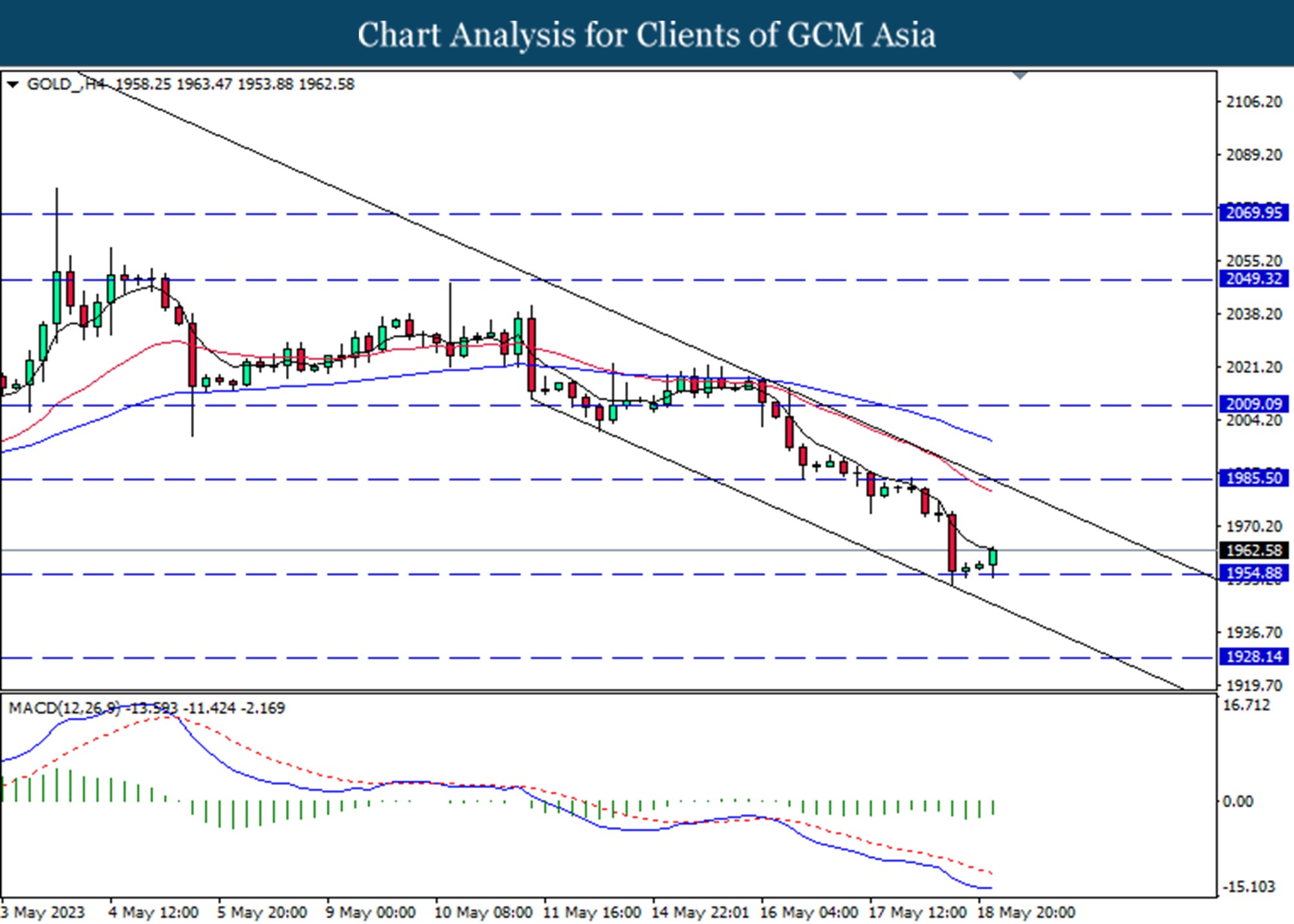

GOLD_, H4: Gold price was traded higher following the prior rebound from the support level at 1954.90. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1828.15