24 August 2018 Daily Analysis

Dollar rose amid release of positive job data.

Index dollar continue extending its gain following the release of recent jobs data. According to the US Department of Labor, the Initial Jobless Claims and Continuous Jobless Gains has receded, with Continues Jobless Claims reading of 1.727 million against forecast of 1.731 million while another reading of 210K against 215K for Initial Jobless Claims. The drop in the data has hinted a stable labor market in the current US, therefore provide further boost for the already strong dollar. Dollar rose 0.06% to 95.50 as of writing. Meanwhile, GBPUSD slumped 0.05% to 1.2805 at the time of writing amid UK has prepared for a worst-case scenario of a no deal Brexit. CNBC reports that the UK Brexit Department has proposed a document with contingency plan in Brexit case if the discussion of trade agreement with UK and EU went south. Thus, creating further no deal confidence in the market and weakening the pound sterling further.

In the commodity market, crude oil prices have retreat 0.02% to $68.00 a barrel following with the latest US – China salvo. With the US recently fired a new shot where it has imposed 25% tariffs in 16 billion worth of Chinese goods and China also confirmed it will retaliate soon. With the current state, the market fears that a full potential trade war between the U.S. and China will slow the growth of the global economy and curb energy consumption. On the other hand, gold price has slip 0.07% to $ 1185.31 per troy ounce following the dollar strength that is boosted by a variety of encouraging factors such as positive economic data as well as expectations of rising interest rates

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22.00 USD Fed Chair Powell Speaks

Today’s Highlight Economy Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15.30 | EUR – German GDP (QoQ) (Q2) | 2.3% | 2.3% | – |

| 20.30 | USD – Core Durable Goods Orders (MoM) (Jul) | 0.8% | -0.5% | – |

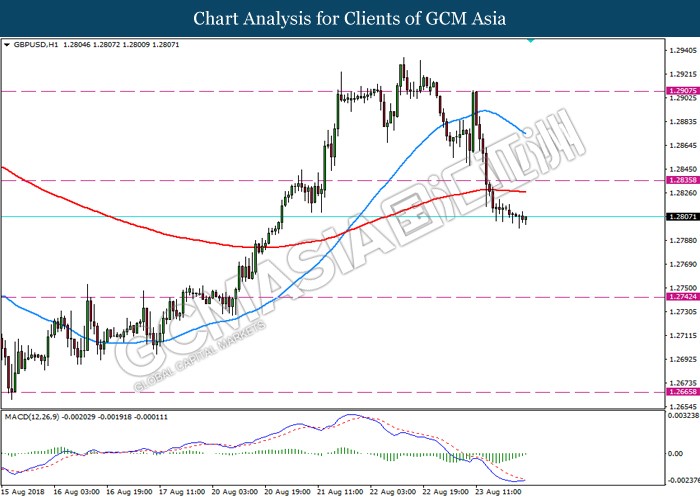

GBPUSD

GBPUSD. H1: GBPUSD was traded lower following prior breakout below the previous support level 1.2835. Although MACD which illustrate ongoing bearish momentum, however recent price action and fundamental side which mostly subjected to bearish momentum suggest the pair to extend its losses towards the support level 1.2740.

Resistance level: 1.2835, 1.2905

Support level: 1.2740, 1.2665

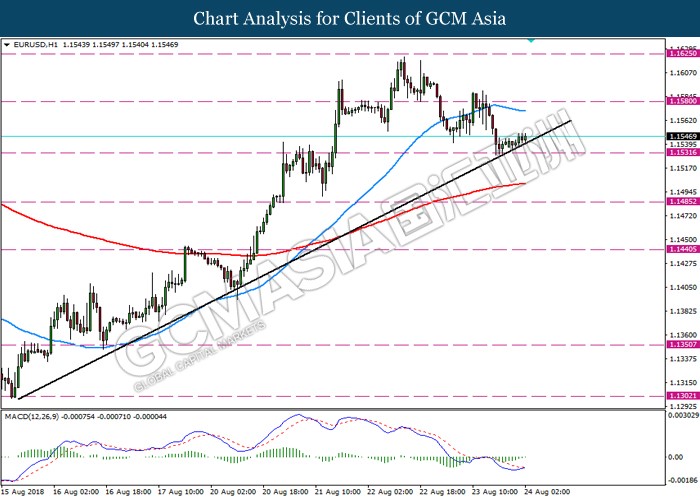

EURUSD

EURUSD, H1: EURUSD was traded higher following prior rebound from the support level 1.1530. Recent price action and MACD which display diminished bearish momentum suggest the pair to extend its gains in accordance with its major trend towards the resistance level 1.1580.

Resistance level: 1.1580, 1.1625

Support level: 1.1530, 1.1485

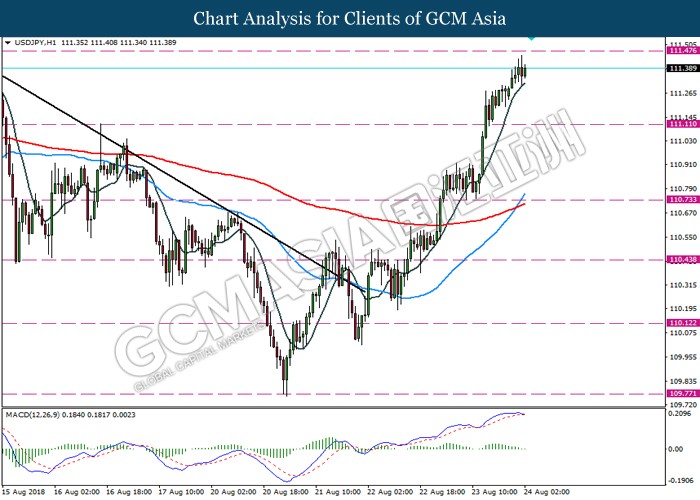

USDJPY

USDJPY, H1: USDJPY was traded higher following recent breakout above the previous resistance level 111.10. MACD which diminished bullish momentum suggest the pair to experience a short-term technical correction towards the support level 111.10.

Resistance level: 111.45, 111.90

Support level: 111.10, 110.75

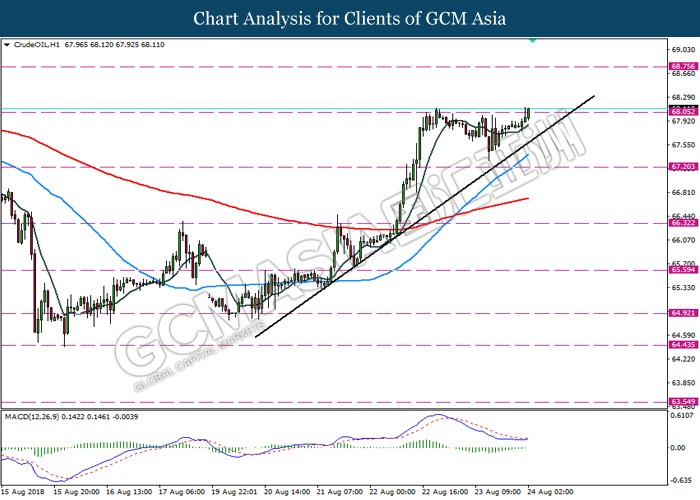

CrudeOIL

CrudeOIL, H1: Crude oil price was traded higher following recent breakout above the resistance level 68.05. Price action and formation of golden cross pattern in MA lines suggest the pair to extend its gains towards the resistance level 68.75.

Resistance level: 68.75, 69.25

Support level: 68.05, 67.20

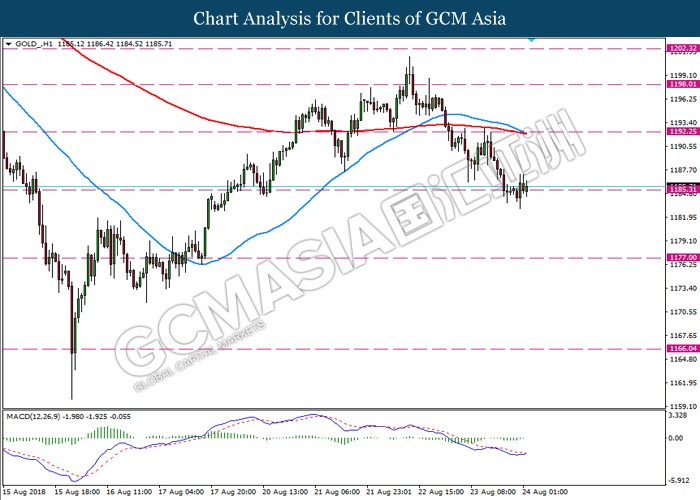

GOLD

GOLD_, H1: The price of gold was traded lower while currently testing the support level 1185.00. MACD which illustrate diminished bearish signal suggest the commodity to experience a short-term technical correction towards the resistance level 1192.00.

Resistance level: 1192.00, 1198.00

Support level: 1185.00, 1177.00