10 September 2018 Weekly Analysis

GCMAsia Weekly Report: September 10 – 14

Market Review (Forex): September 3 – September 7

US Dollar

The US dollar had undergone appreciation amid the release of economic data, Non-farm Payrolls which created positive sentiment for the dollar and boosted investors’ confidence towards the greenback. The dollar index edged up by 0.33% while closing the price at 95.34 last Friday.

The NFP data economy released last Friday for the month of August had an actual reading of 201K, beating the forecasted data of 191K which reflected a healthy job market in the US. Furthermore, the wage growth of the country as reported from the Average Hourly Earnings was performing better as well with the actual reading of 2.9% which is 0.2% higher than the forecasted of 2.7%. The strengthening of the dollar was bolstered by positive sentiments from Friday’s economic data as investors changed their position to a buy for the dollar.

Overall, the dollar regained its strength against its rivals while trade tensions between the US and China grew with the US having the upper hand in creating confidence for investors, bolstered by strong economic data from US NFP and also the Average Hourly Earnings.

USD/JPY

USDJPY pair rose 0.25% to 111.03 during late Friday trading session.

EUR/USD

EURUSD had dropped 0.59% to 1.1553 during last week Friday session.

GBP/USD

GBPUSD had decreased 0.10% to 1.2916 during late Friday New York session. The single currency had regained its strength right before the release of NFP data and now faces a loss while possibly to continue as the turmoil in Brexit grows with former foreign minister Boris Johnson criticized Prime Minister Theresa May Brexit deal as a ‘suicide vest’.

Market Review (Commodities): September 3 – September 7

GOLD

Gold price plunged as dollar strengthened amid positive economic data of NFP and Average Hourly Earnings of the US last Friday. The yellow metal closed last week markets at a loss of 0.36% to 1195.86 a troy ounce.

The gold price was seen falling as the greenback started gaining a bullish momentum from the positive sentiment amid the release of economic data NFP which has since boosting investors’ confidence towards the dollar.

Crude Oil

The price of crude oil continues fall on Friday despite the strong release of US Crude Oil Inventories data. The commodity price plunged 0.16% to 68.17 per barrel during last Friday’s session.

According to EIA report on Crude Oil Inventories, the actual data of -4.302M was much lower than the forecasted data of -1.294M where it indicates the reduction of crude oil supplies should generally increase the price of crude oil. But despite the positive data reading, the oil price continues to fall amid the increasing tension of the trade war between the US and China where an additional tariff will be imposed onto $200 billion worth of Chinese goods. This has worsened the confidence of investors towards the crude oil as China is one of the major markets for the US oil, and fears grew as China might find another supplier for the crude oil as the trade war continues.

Overall, crude oil price can be seen falling for the past week as lack of positive sentiment boosted the fear of investors towards the commodity. Until the tension of trade wars eases off, the commodity may have a hard time in regaining its strengths.

Weekly Outlook: September 10 – 14

For the week ahead, investors will remain focus on the release of various economics data especially UK GDP which is scheduled on this week. The data which is an indicator of inflationary pressure that may anticipate interest rates to rise. Thus, investor will keep an eye for the release to attain further signals regards of the pound sterling momentum.

As for oil traders, they will be eyeing on US inventories level reported by API and EIA to gauge the strength of crude demand for world’s largest oil consumer.

Highlighted economy data and events for the week: September 10 – 14

| Monday, September 10 |

Data GBP – GDP (MoM) GBP – Manufacturing Production (MoM) (Jul)

Events N/A

|

| Tuesday, September 11 |

Data GBP – Average Earnings Index + Bonus (Jul) GBP – Claimant Count Change (Aug)

Events N/A

|

| Wednesday, September 12 |

Data USD – PPI (MoM) (Aug) CrudeOIL – Crude Oil Inventories

Events USD – FOMC Member Bullard Speaks

|

| Thursday, September 13 |

Data AUD – Employment Change (Aug) GBP – BoE Interest Rate Decision (Sep) EUR – Deposit Facility Rate EUR – ECB Marginal Lending Facility EUR – ECB Interest Rate Decision (Sep) USD – Core CPI (MoM) (Aug)

Events EUR – ECB Press Conference

|

|

Friday, September 14

|

Data CNY – Industrial Production (YoY) (Aug) RUB – Interest Rate Decision (Sep) USD – Core Retail Sales (MoM) (Aug) USD – Retail Sales (MoM) (Aug)

Events GBP – BoE Gov Carney Speaks

|

Technical Weekly Outlook: September 10 – 14

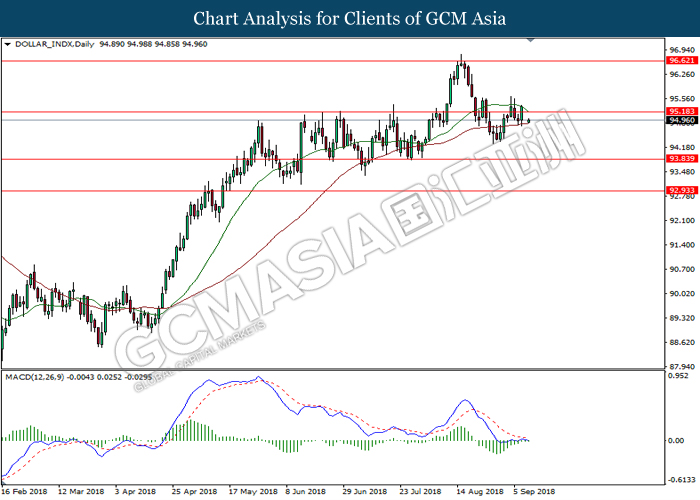

Dollar Index

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level 95.20. MACD which display the start of a bearish momentum suggest the dollar to extend its losses towards the support level 93.85.

Resistance level: 95.20, 96.60

Support level: 93.85, 92.95

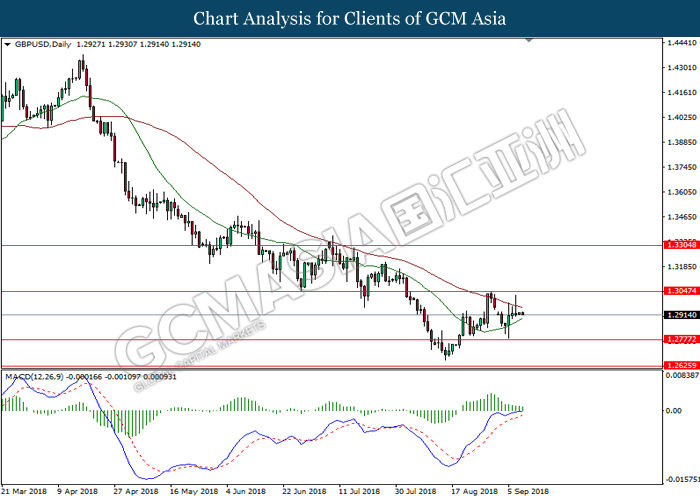

GBPUSD

GBPUSD, Daily: GBPUSD was traded higher following prior rebound from the support level 1.2775. Recent price action and MACD which illustrate a bullish momentum suggest the pair to extend its rebound towards the resistance level 1.3045.

Resistance level: 1.3045, 1.3305

Support level: 1.2775, 1.2625

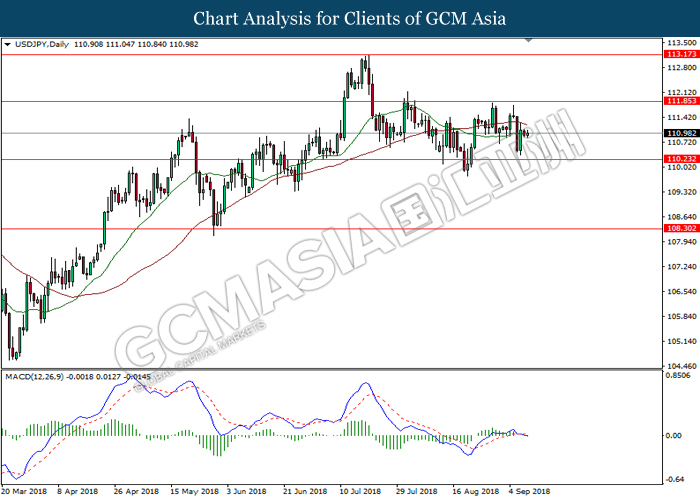

USDJPY

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level 111.85. Recent price action and MACD which display a bearish momentum and the formation of a death cross suggest the pair to extend its retracement towards the support level 110.25.

Resistance level: 111.85, 113.15

Support level: 110.25, 108.30

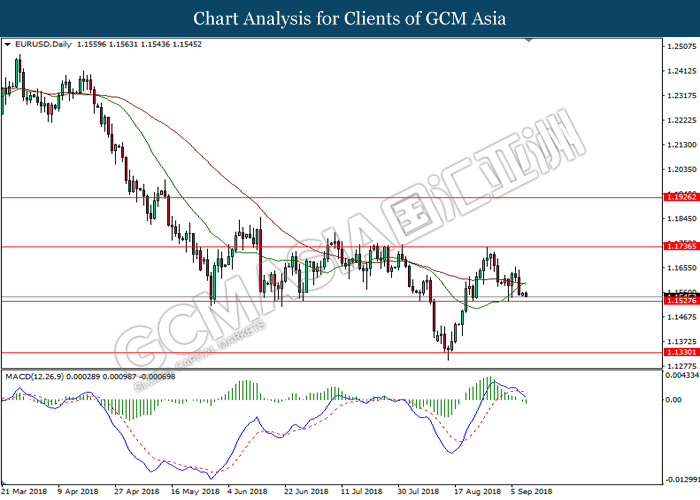

EURUSD

EURUSD, Daily: EURUSD was traded lower while currently testing the support level 1.1530. Recent price action and MACD which illustrate a bearish momentum and formation of a death cross suggest the pair to extend its losses after a breakout below the support level 1.1530.

Resistance level: 1.1735, 1.1925

Support level: 1.1530, 1.1330

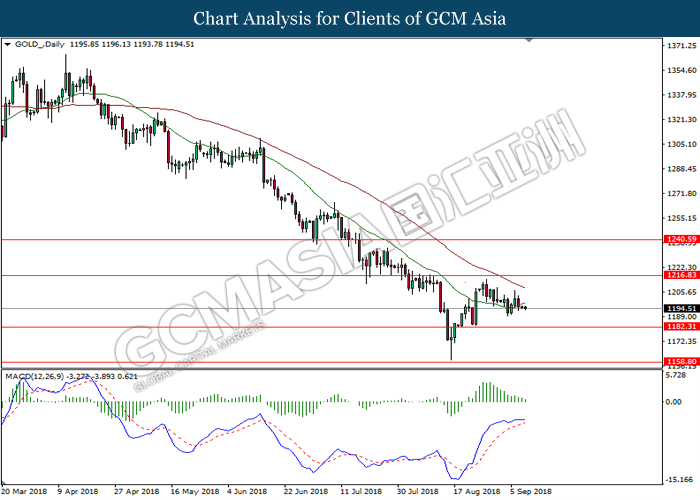

GOLD

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level 1216.85. Recent price action and MACD which illustrate a diminished bullish momentum suggest the commodity to extend its losses towards the support level 1182.30.

Resistance level: 1216.85, 1240.60

Support level: 1182.30, 1158.80

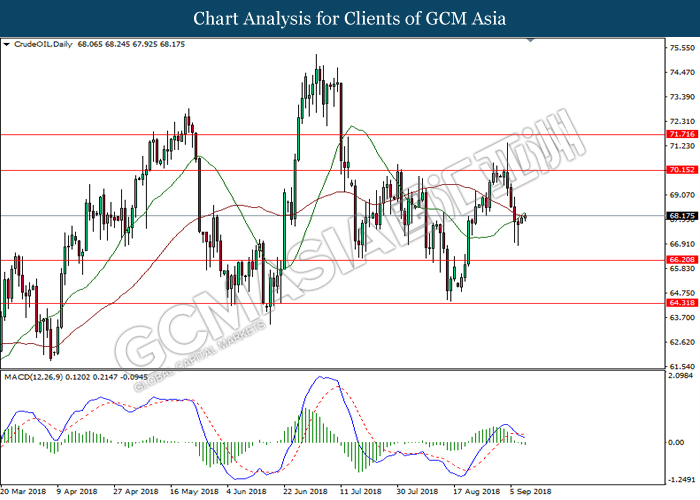

Crude Oil

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level 70.15. Recent price movement and MACD which display bearish momentum and formation of a death cross suggest the commodity to extend its retracement towards the support level 66.20.

Resistance level: 70.15, 71.70

Support level: 66.20, 64.30