08 June 2023 Morning Session Analysis

Greenback trod water at high ahead of inflation data and Fed interest rate decision.

The dollar index, which was traded against a basket of six major currencies, lingered near its 11 week highs as the market sentiment remained vague, where the investors are awaiting for the US inflation figure for the month of May and also the Fed’s rate hike decision next week. At this point in time, the market participants are expecting the Fed would likely to take a step back from its aggressive rate hike policy, maintaining the cash rate at current level before further rate hike to be taken. The majority of the Fed’s members have mentioned that they intended to avoid another rate hike in the June meeting as they need to evaluate the impact of the recent rate hike on the economy thoroughly. However, minority of the Fed’s member such as James Bullard revealed that further rate hike is needed in order to cool down the still-high inflation toward their long term target, which is at 2%. Nonetheless, investors are reminded to understand that the core objective of the rate adjustment were to slowdown the inflation level. With that, the US Consumer Price Index (CPI), which is scheduled on next Wednesday, would be the crucial data for the Fed as it would influence the next Thursday interest rate decision. As of writing, the dollar index edged down -0.01% to 104.10.

In the commodities market, crude oil prices edged up by 2.35% to $72.44 per barrel as the EIA data showed some draw in the US crude oil inventories. According to EIA, the US crude oil inventories reduced by -0.451M, while the economist expectation was an increase of 1.022M in the oil inventory. Besides, gold prices were up by 0.12% to $1942.40 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 238K | 232K | – |

Technical Analysis

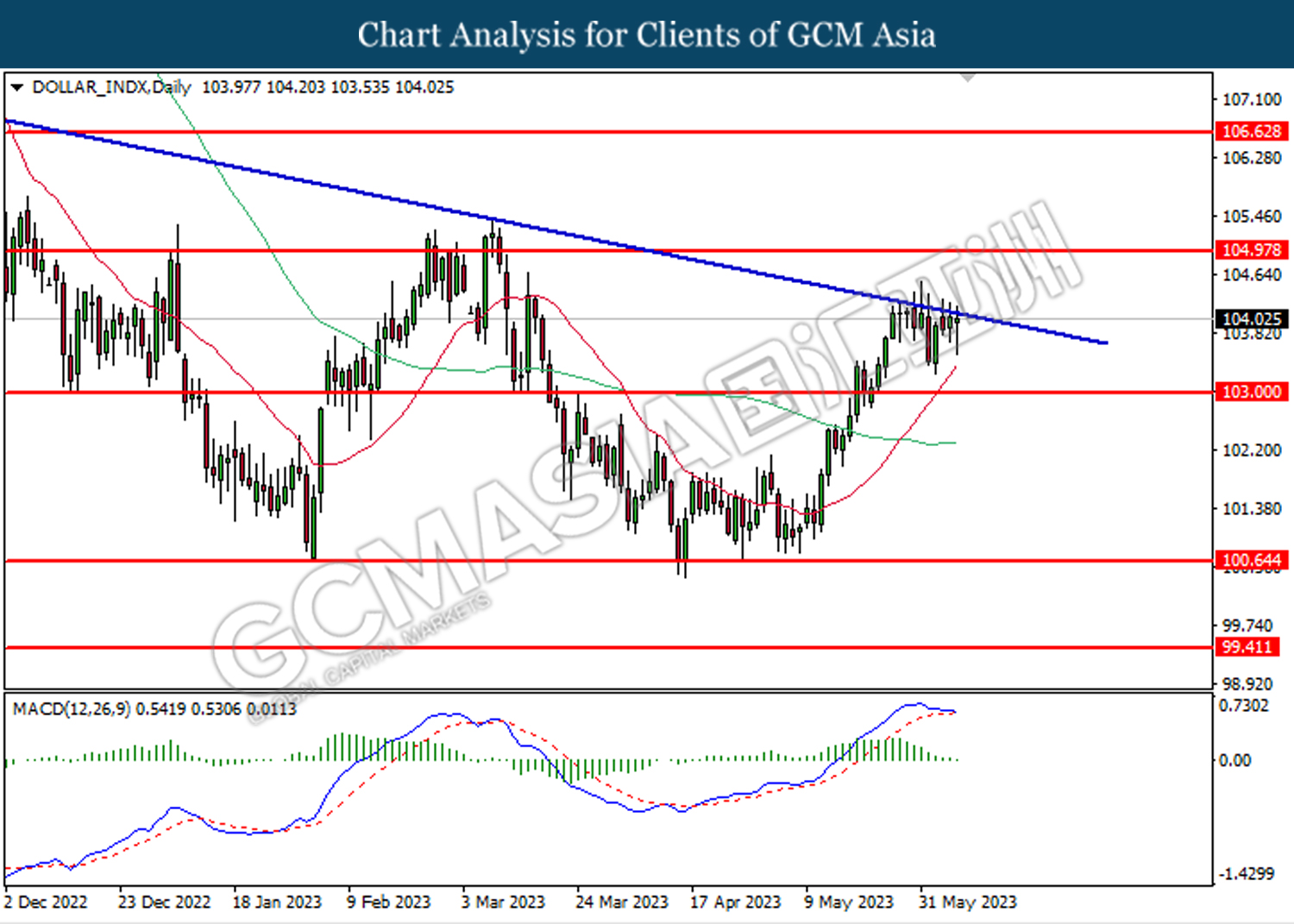

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

GBPUSD, Daily: GBPUSD was traded lower while currently testing support level at 1.2405. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level at 1.2405.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

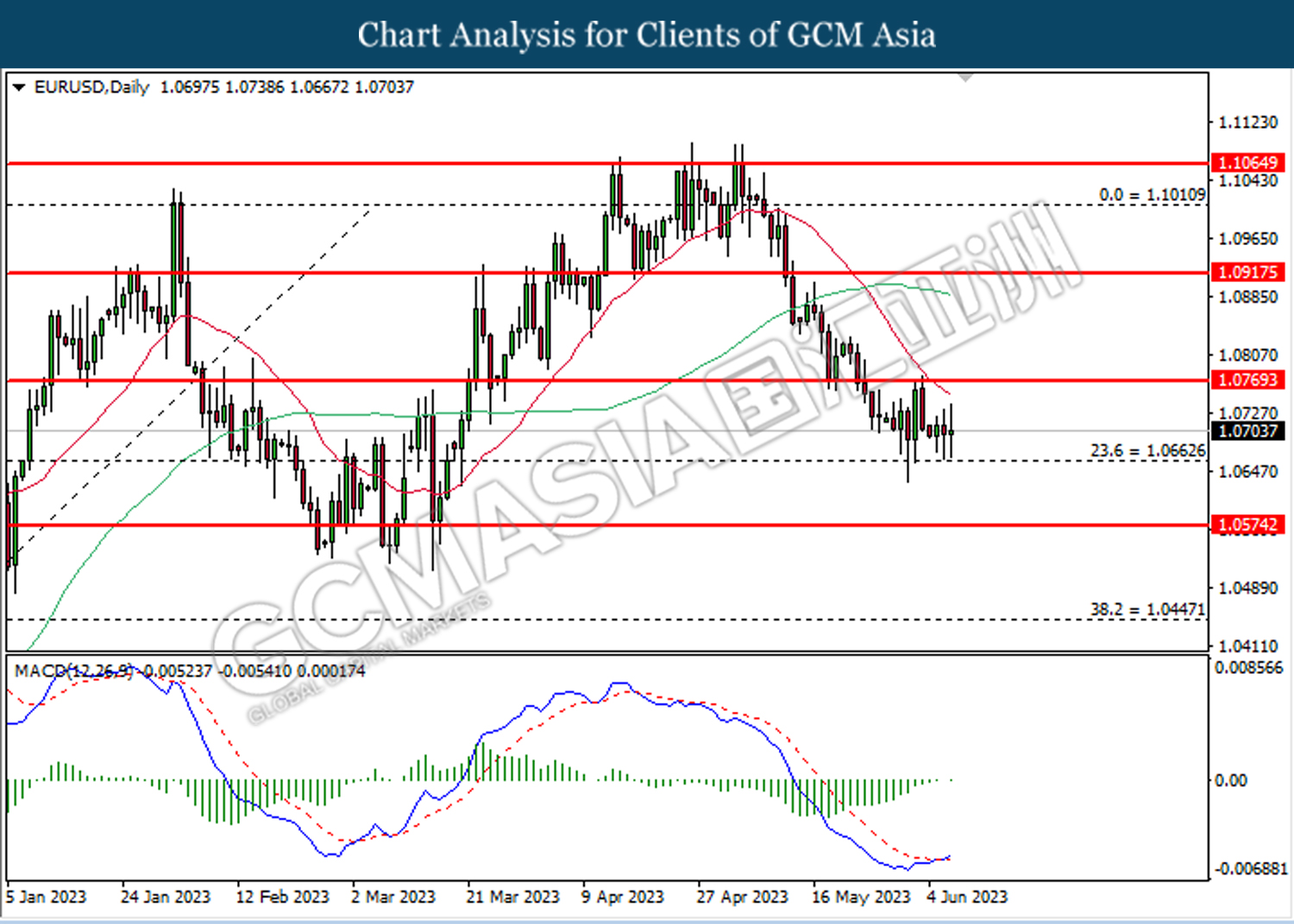

EURUSD, Daily: EURUSD was traded higher following the prior rebound from the support level at 1.0665. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0770.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

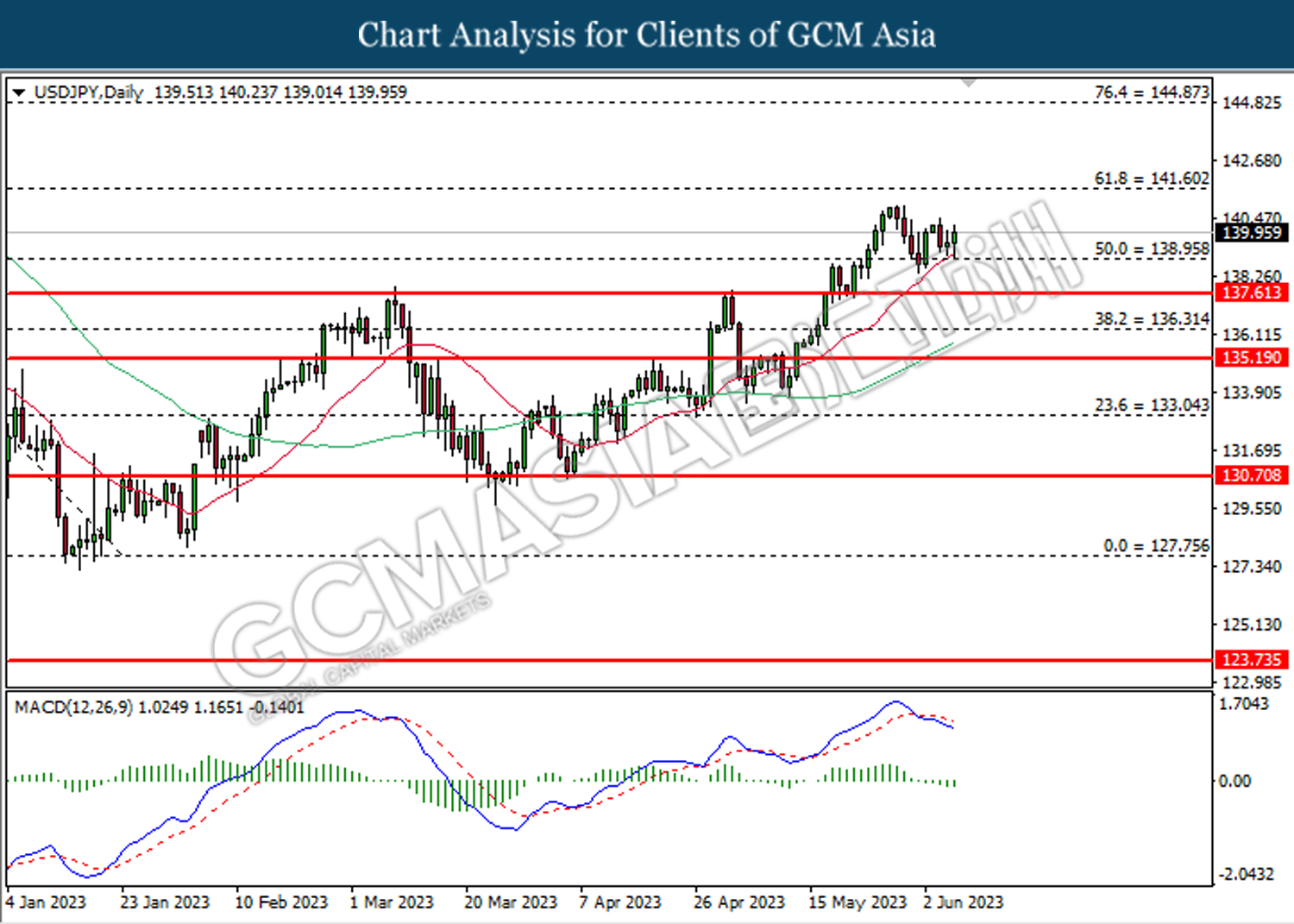

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 138.95. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

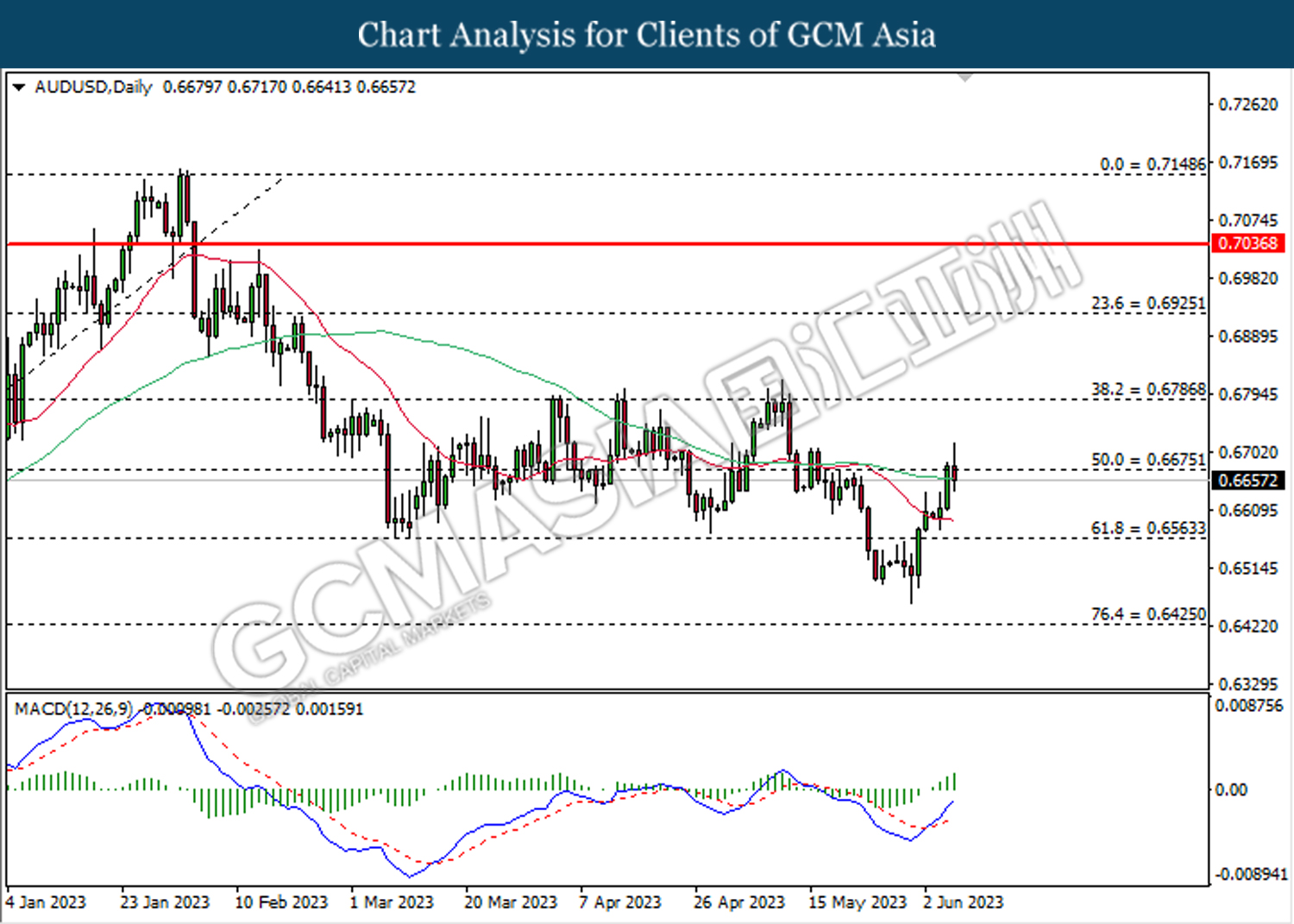

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

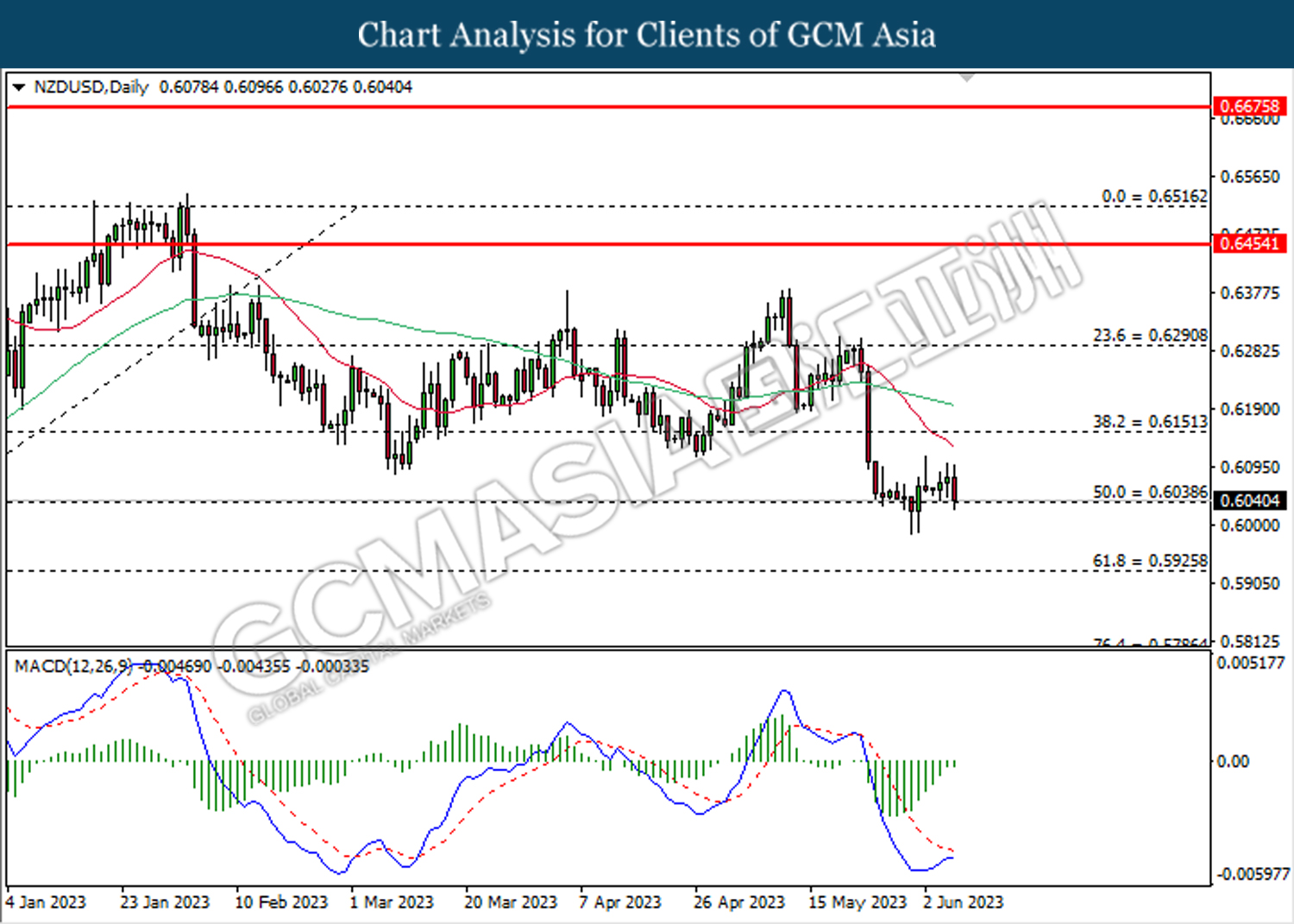

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6040. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6040.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

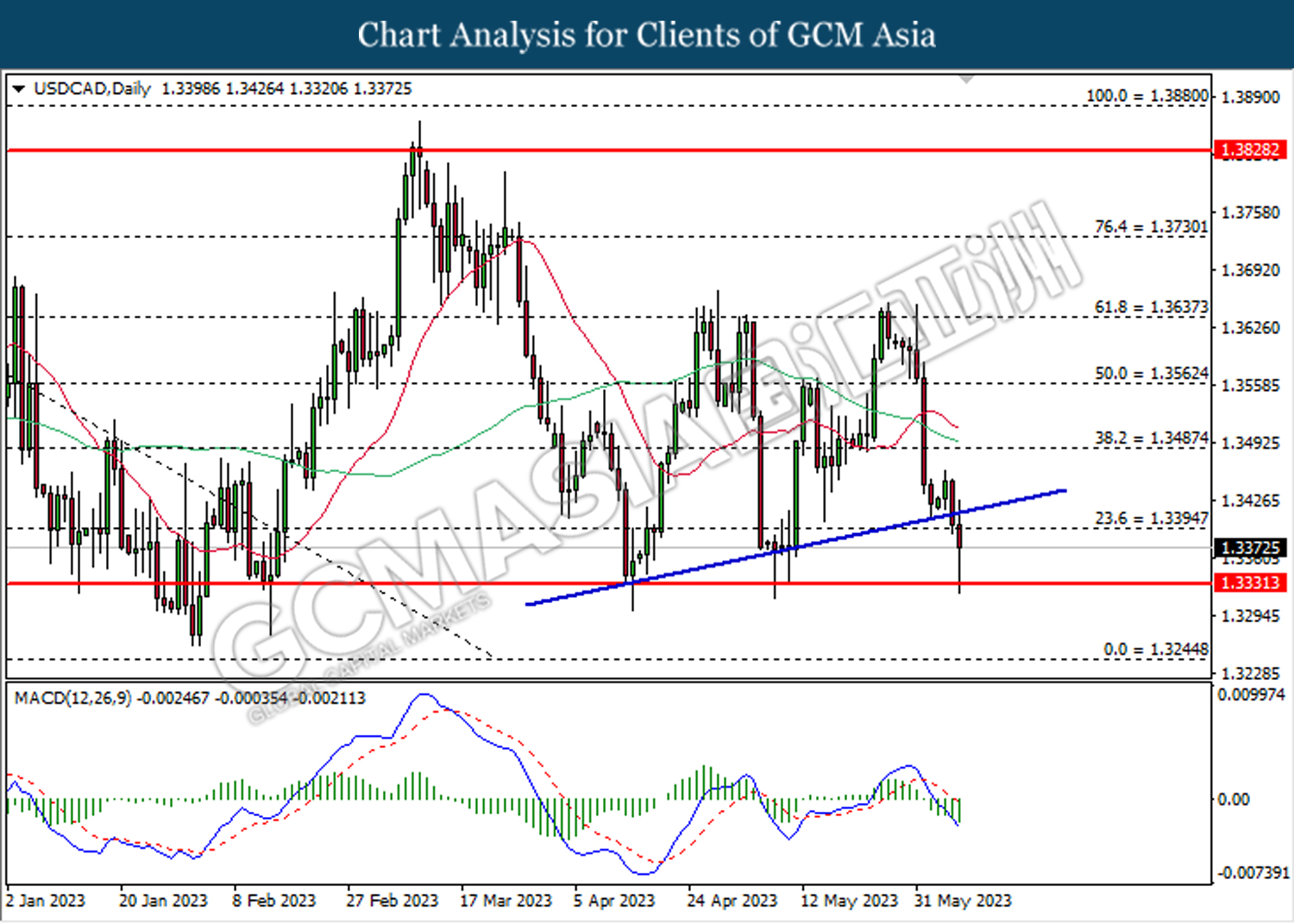

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3330. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

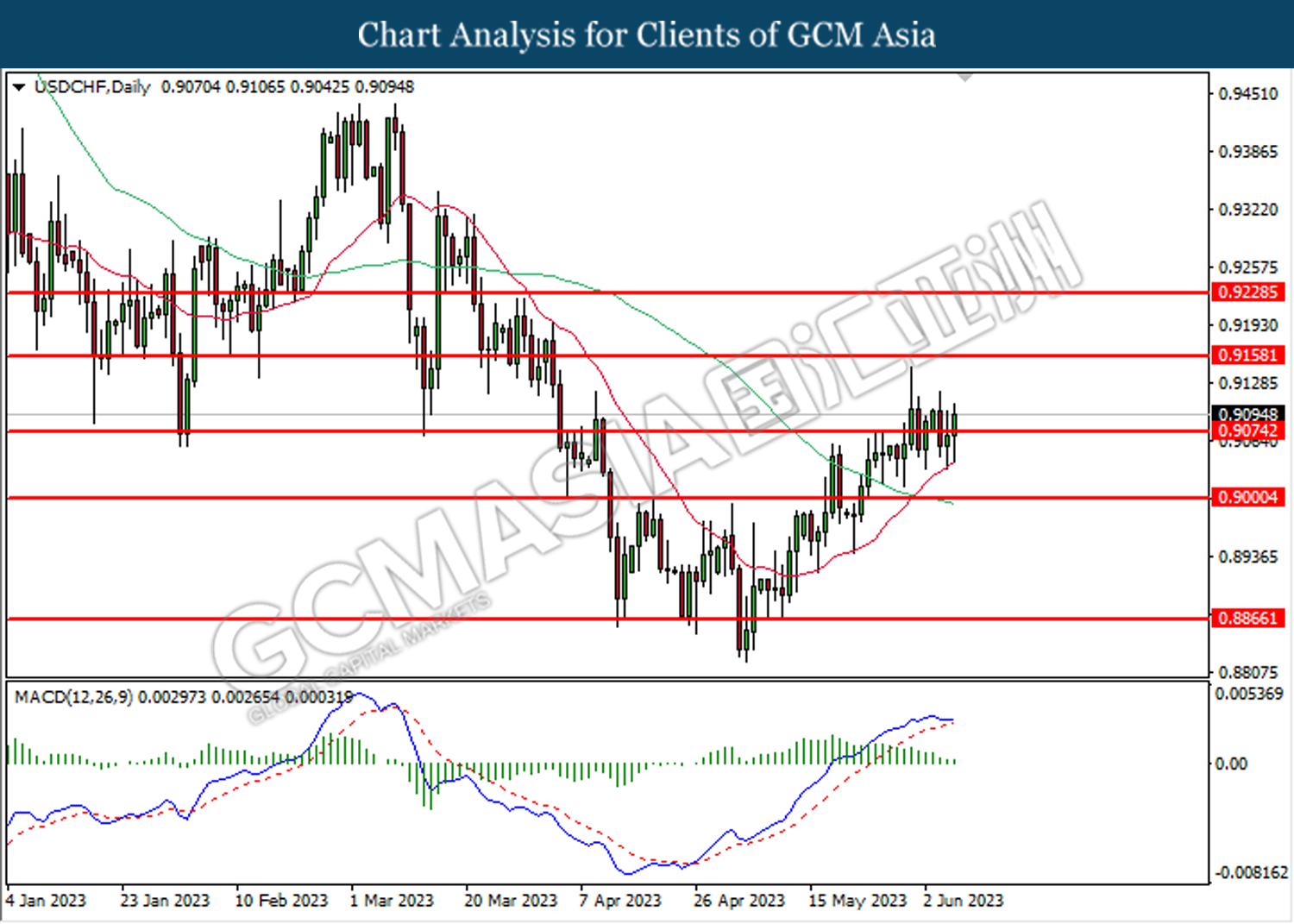

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9075. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9075, 0.9160

Support level: 0.9000, 0.8865

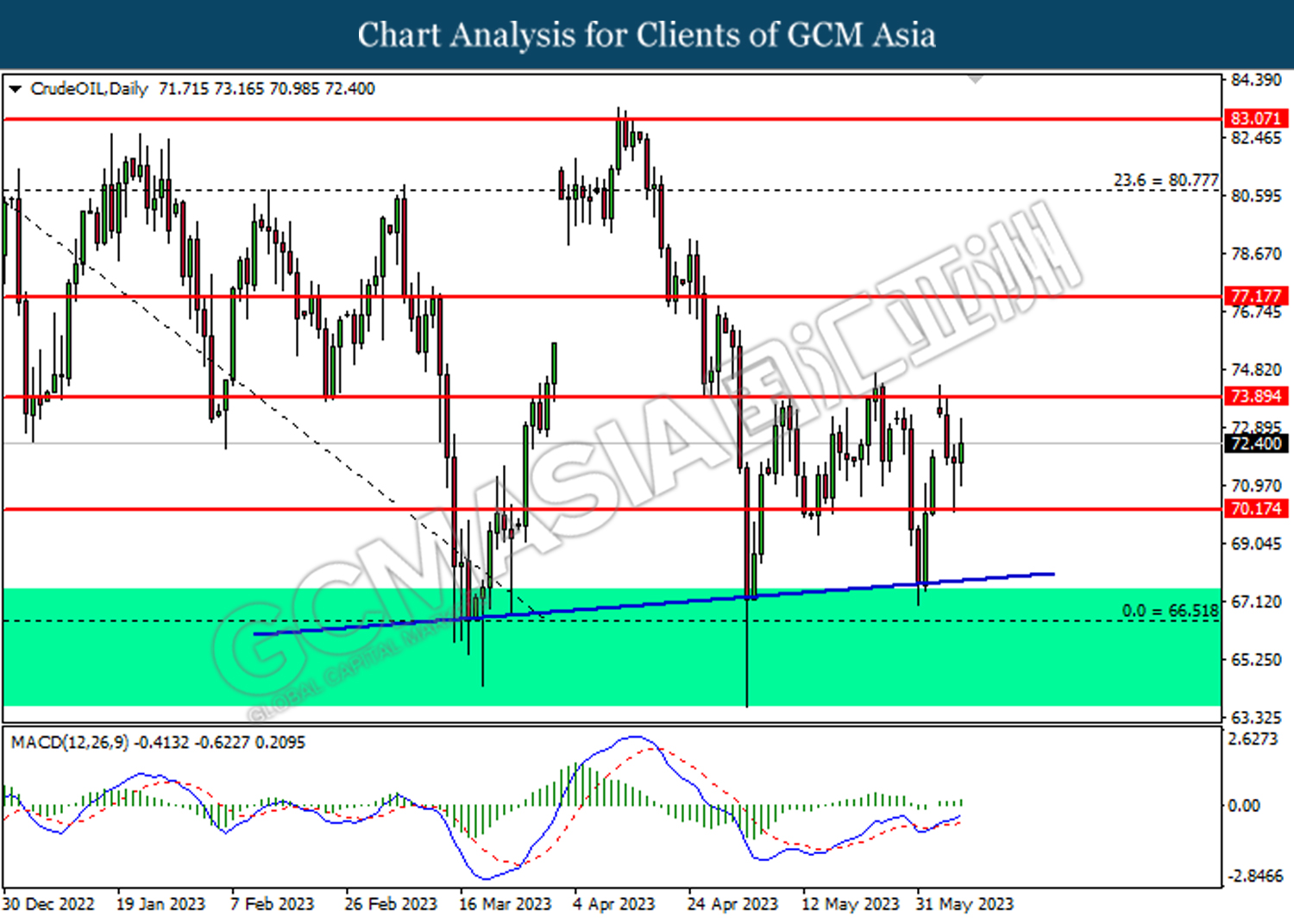

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

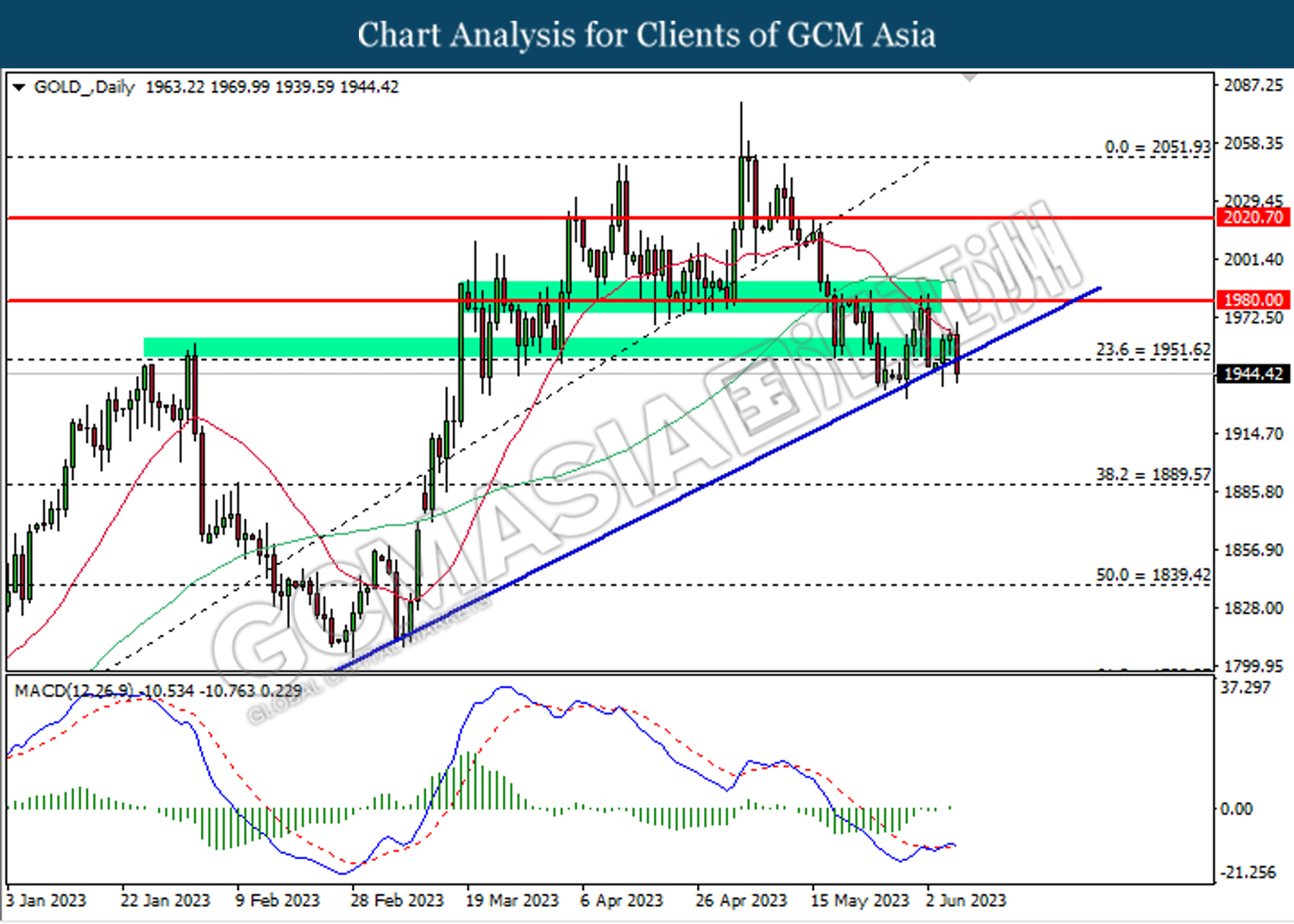

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1951.60. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55