09 June 2023 Morning Session Analysis

Greenback plunged amid jobless claims spiked.

The dollar index, which was traded against a basket of six major currencies, teetered near the brink of collapse after the country reported downbeat job data yesterday. According to the Department of Labor, the US Initial Jobless Claims came in at 261K, significantly higher than the market consensus at 235K, refreshing the record high since the end of 2021. The big surprise in the initial jobless claims could be signaling that the mounting layoff is starting to translate into job cuts. However, a conclusion should not be attached with just a single weekly job data as the volatility of claims from week to week could influence the data reading easily. Prior to that, the Nonfarm Payrolls data were released with a stronger-than-expected reading, prompting investors to rush into the US dollar market despite a jump of 0.3% in the employment rate. With the backdrop of jobless claims spiked, the possibility of Fed to maintain the interest rate rose as the health condition of the labor market would exacerbated if more rate hikes were to implement. Nevertheless, the investors are now shifting their focus to the crucial data and events in next week, such as Consumer Price Index (CPI) and Fed’s meeting. As of writing, the dollar index plummeted -0.75% to 103.30.

In the commodities market, crude oil prices dropped by -2.90% to $71.00 per barrel as Iran and US were getting closer to a deal, which could allow Iran to resume its oil exportation of about 1 million per day. Besides, gold prices rose by 0.02% to $1966.05 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (May) | 41.4K | 23.2K | – |

Technical Analysis

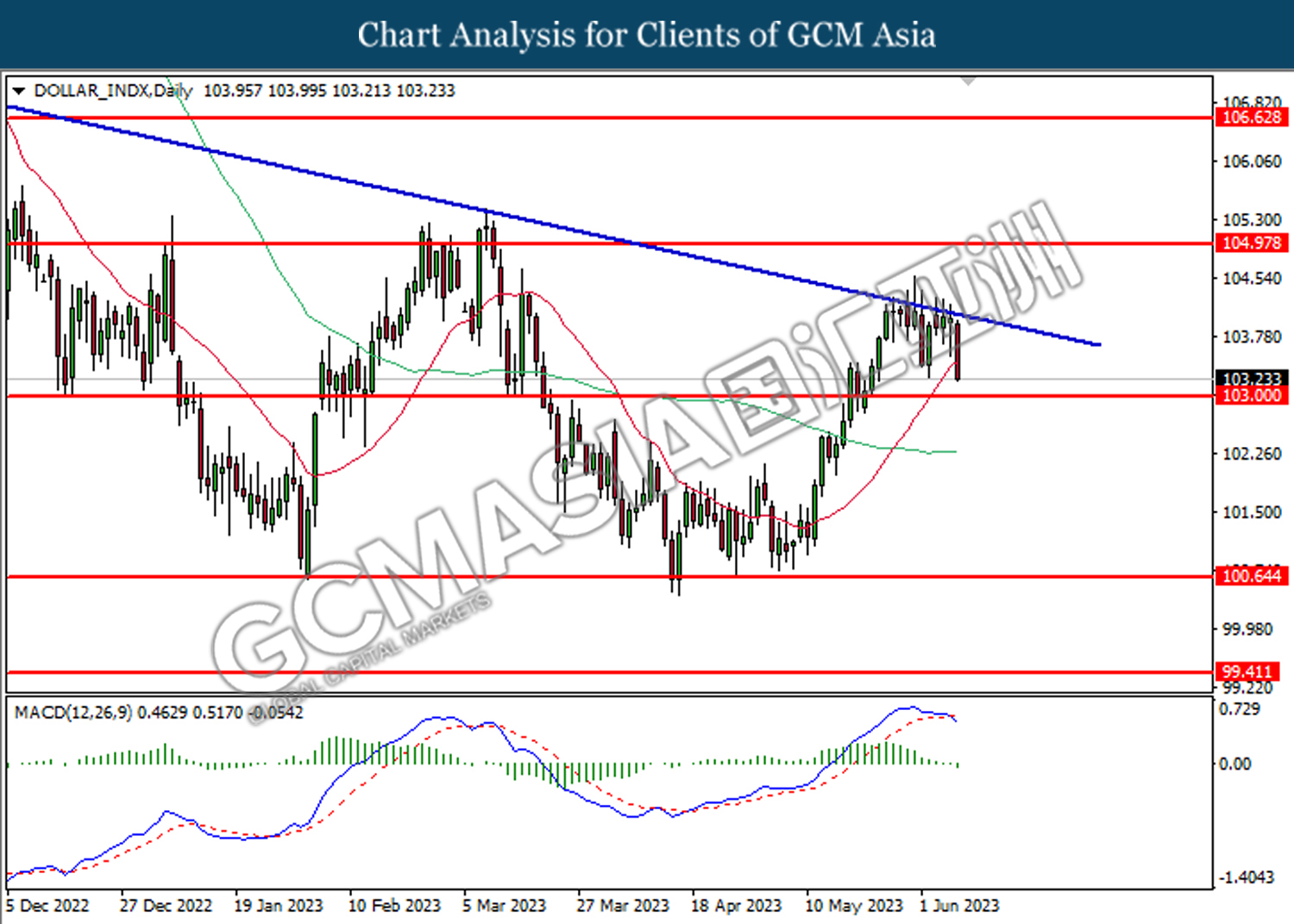

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the higher level. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 103.00.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

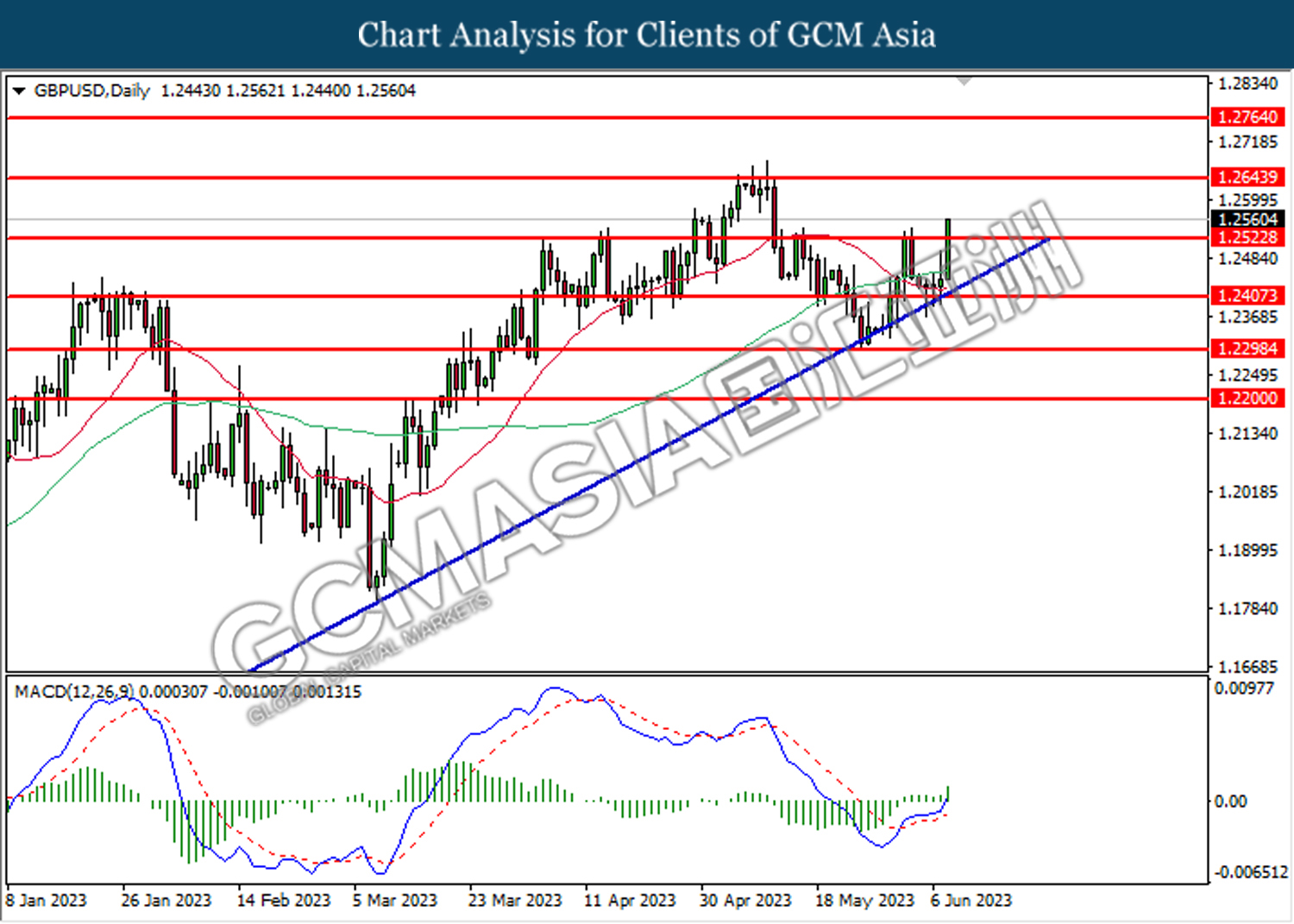

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2525. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2525, 1.2645

Support level: 1.2405, 1.2300

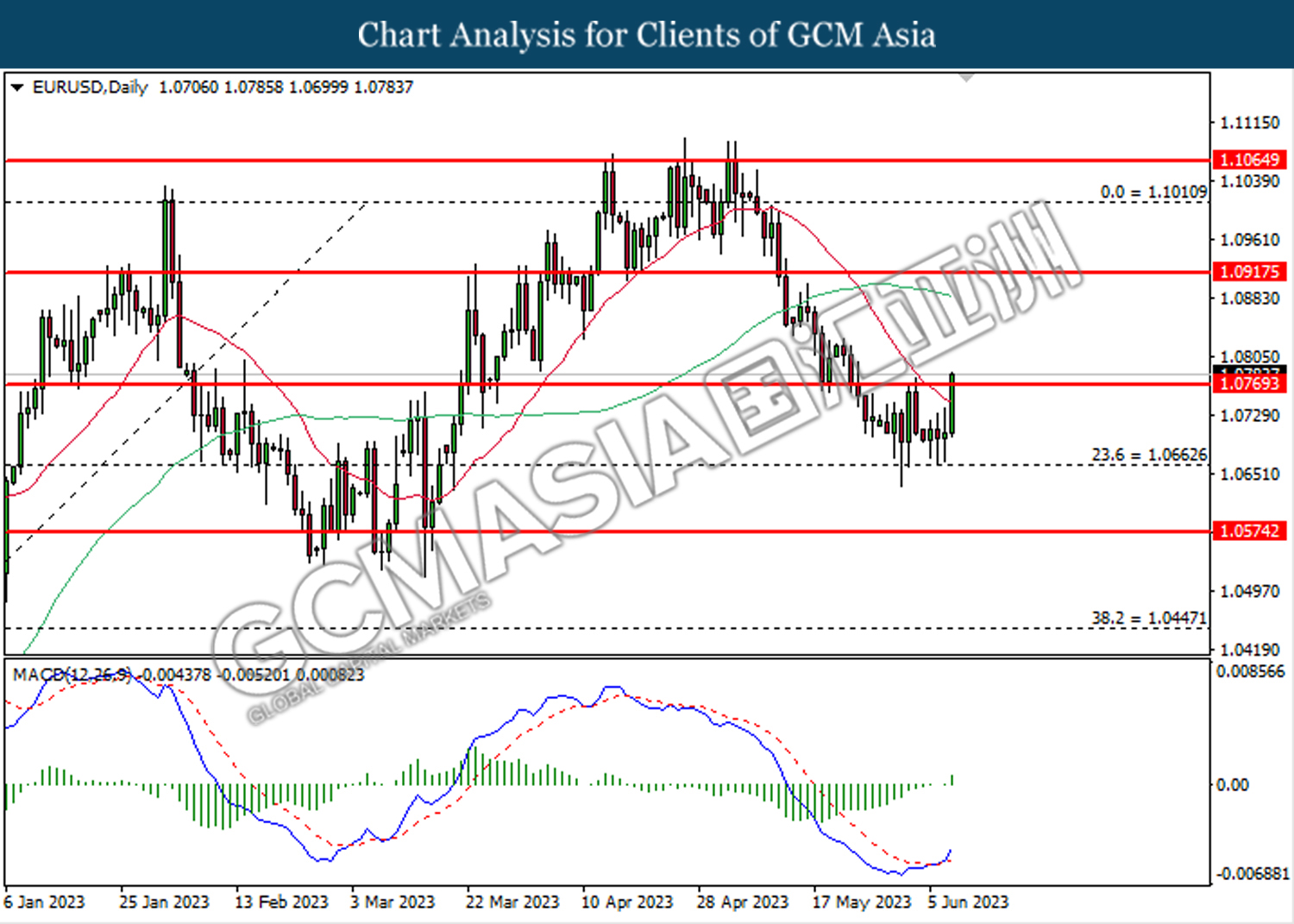

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

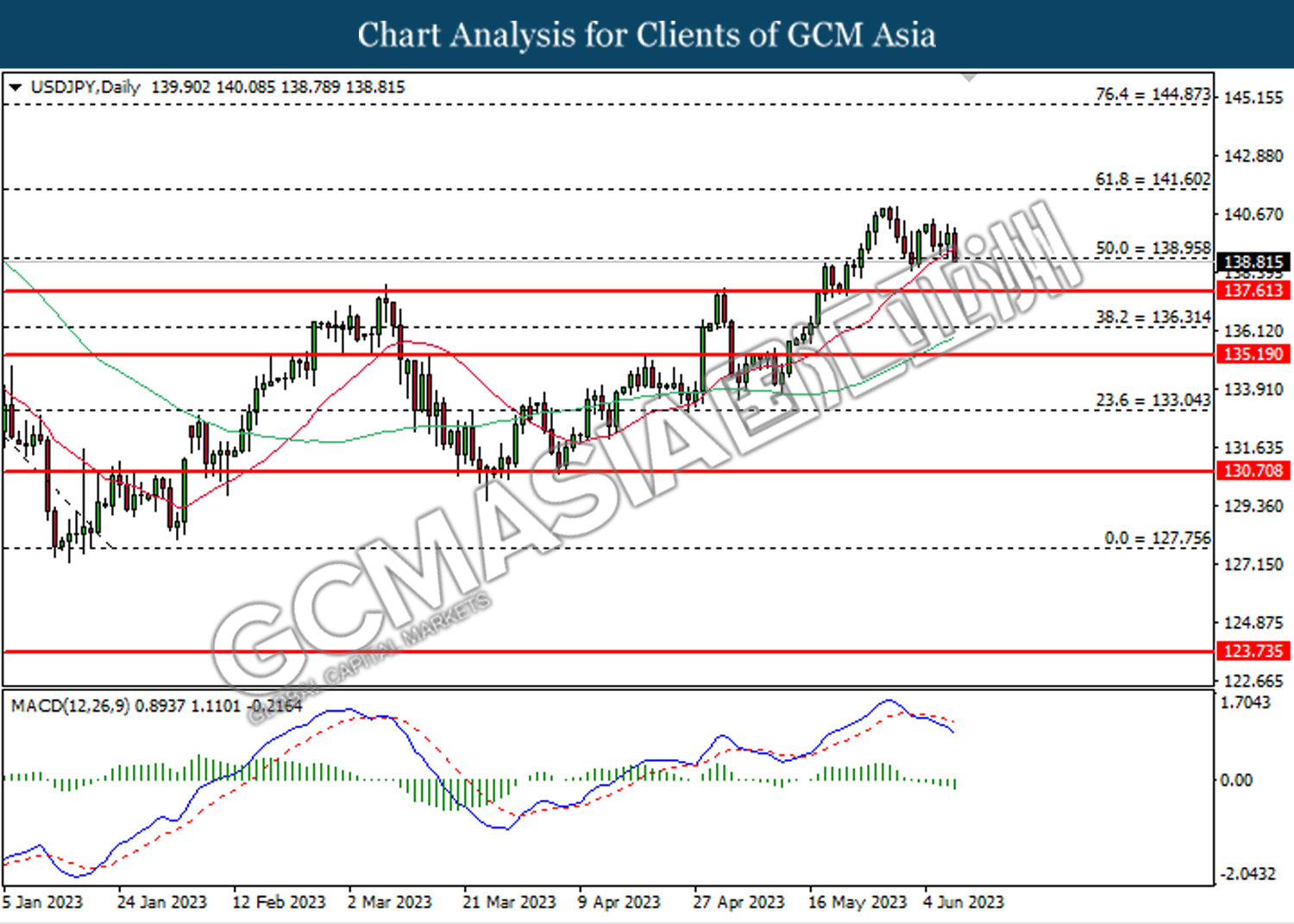

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.95. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 138.95.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

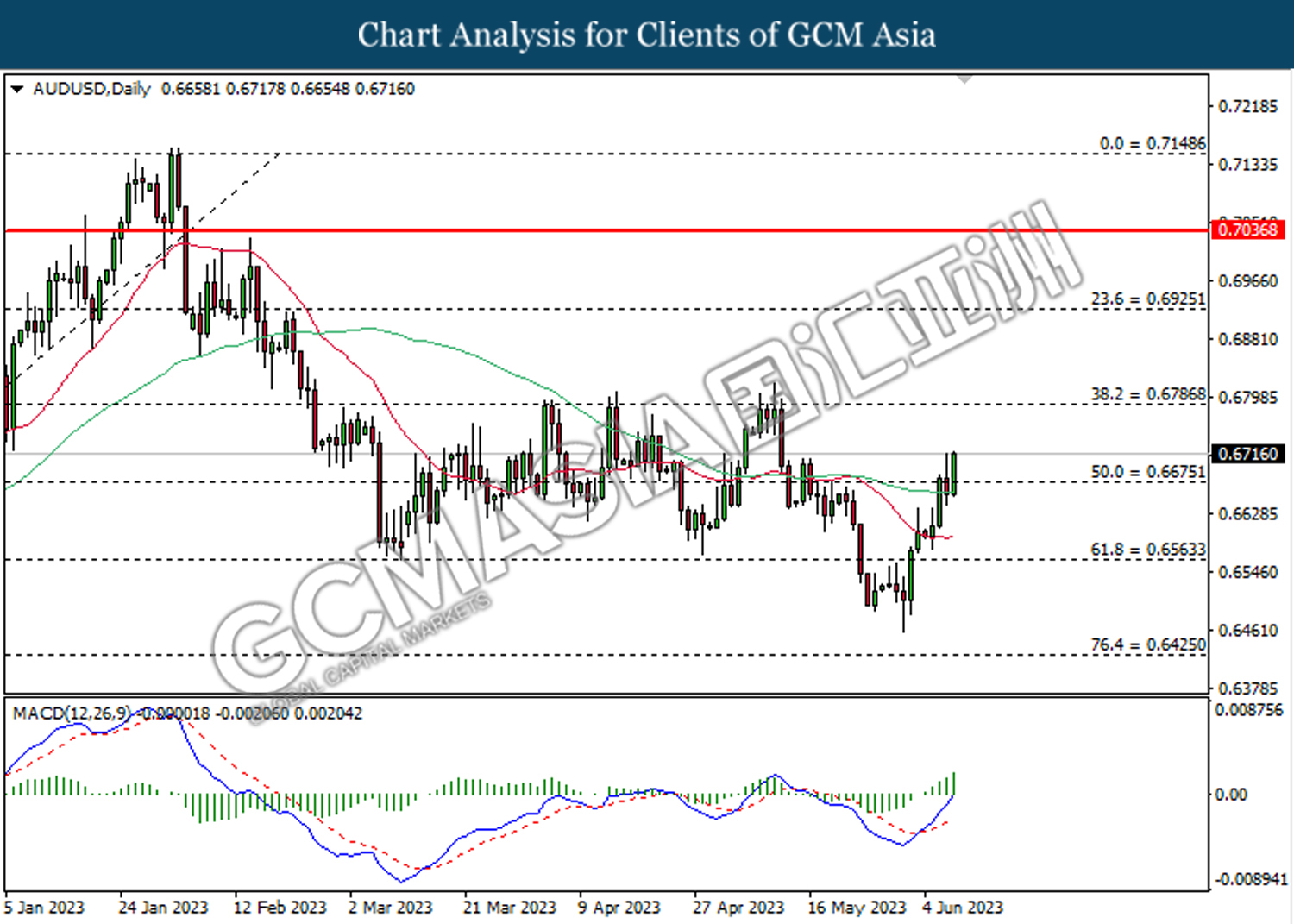

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6675.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6040. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

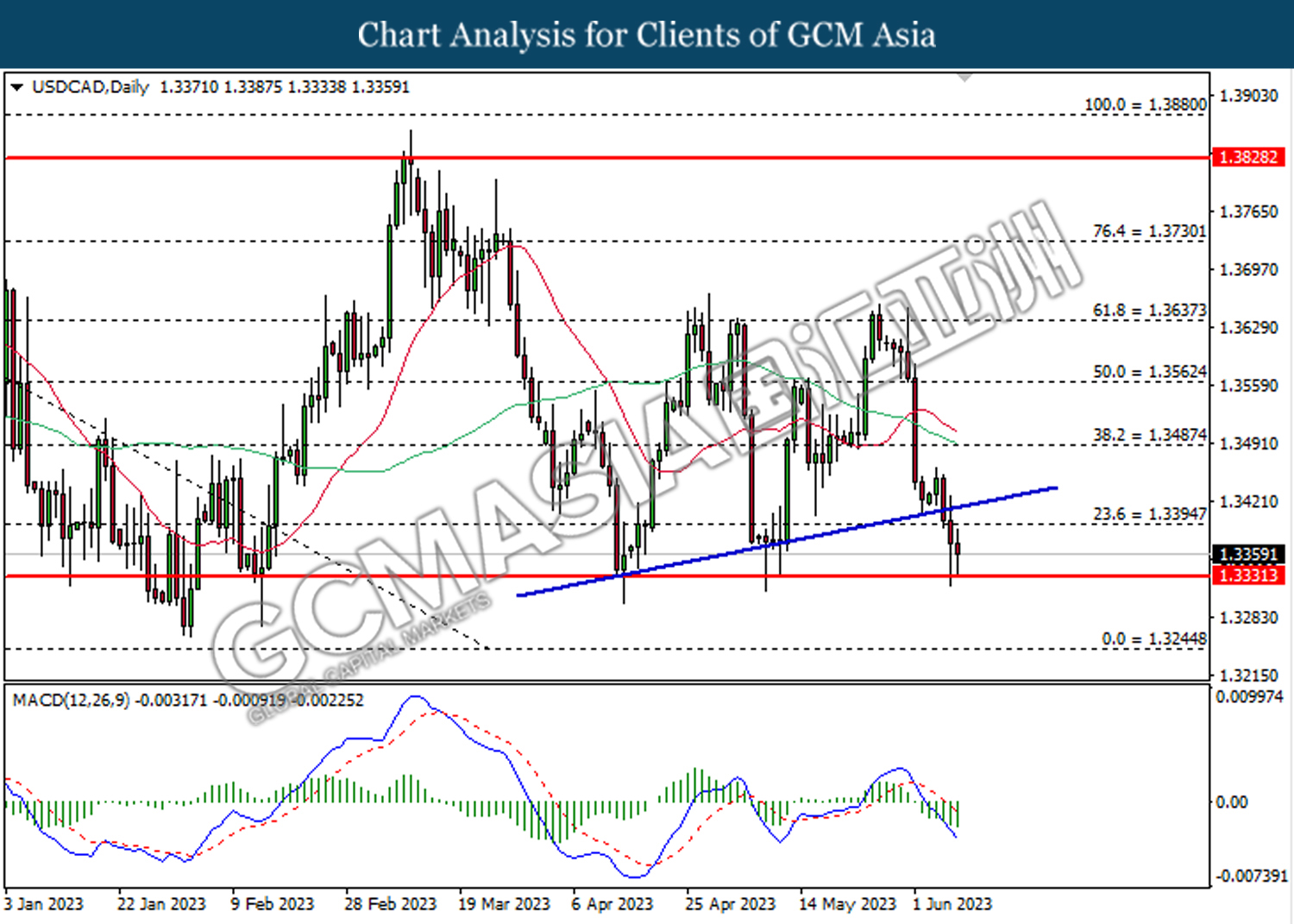

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3330. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

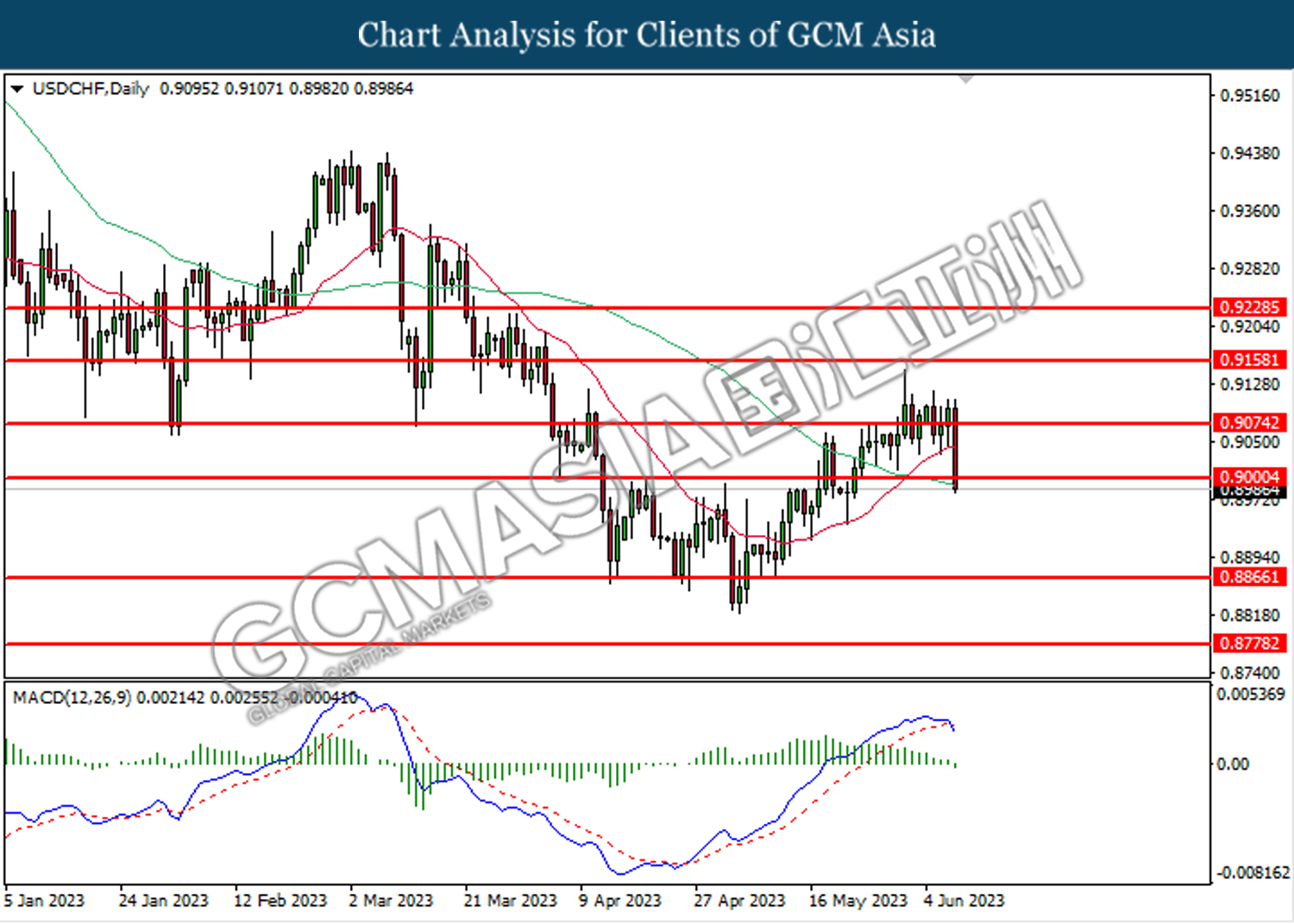

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9000. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9075, 0.9160

Support level: 0.9000, 0.8865

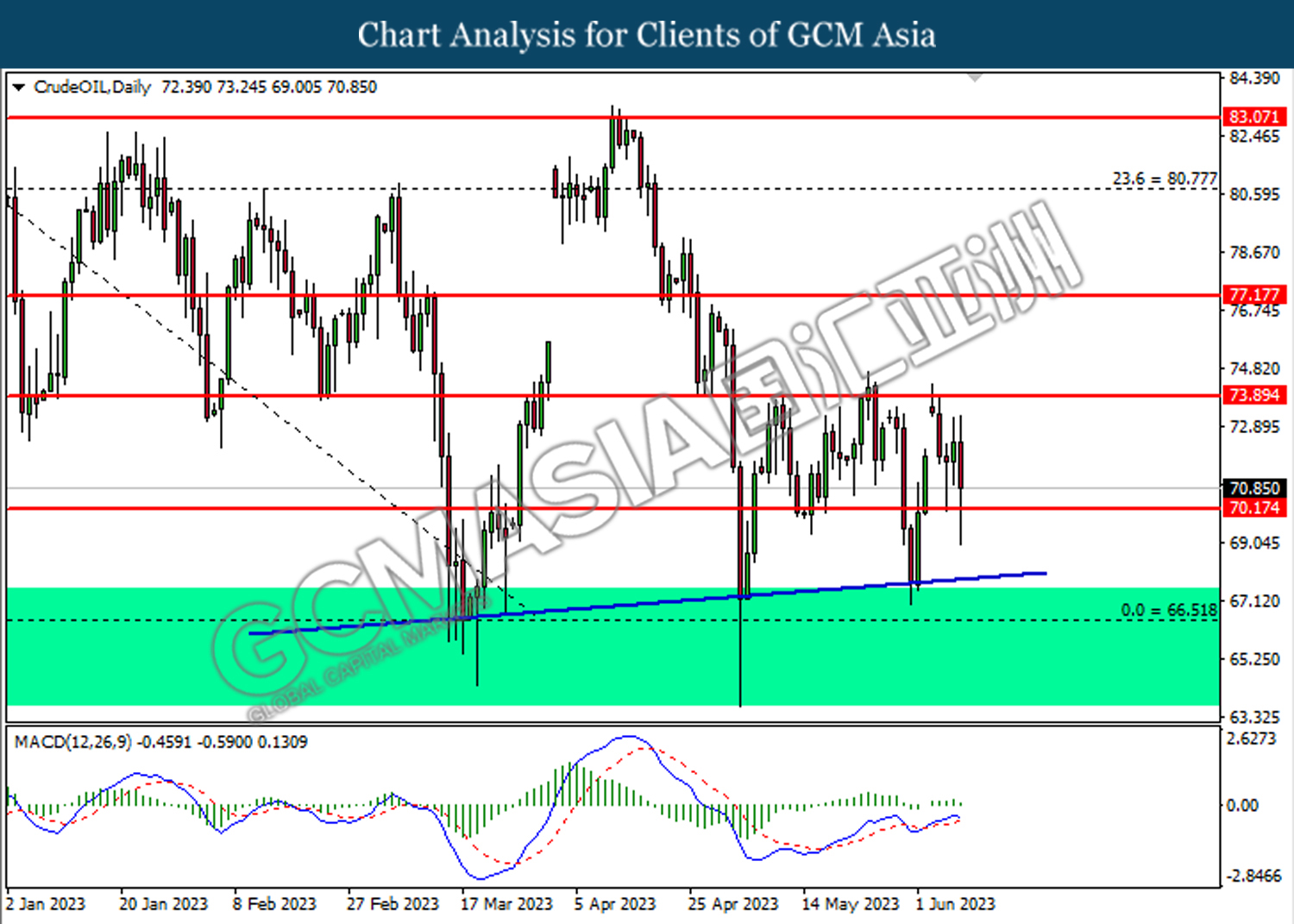

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 70.15. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior rebound from the support level at 1951.60. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55