12 June 2023 Afternoon Session Analysis

US dollar at a standstill as US CPI looms.

The dollar index, which was traded against a basket of six major currencies, hovered near the lowest level in two weeks as the investors remained cautious ahead of a crucial week, where the long-awaited CPI and Fed’s interest rate decision will be released on Tuesday and Thursday, respectively. Since last year’s March, the Fed has been increasing the official cash rates by more than ten times consecutively. The core intention of the rate-hiking still remained the same, whereby 2% is still the long-term inflation target of the Fed. With that, the investors expect the high-interest rate would cool down the inflation rate from the prior month’s reading of 4.9% to a lower level. Besides, according to the CME FedWatch Tool, the probability of the Fed maintaining the interest rate at the current level is at 73.6%, whereas the chances of implementing another 25 basis points rate hike are at 26.4%. It is noteworthy to highlight that investors are suggested to relook at the FedWatch Tool again following the release of the CPI data, as it would make a huge difference in the target rate probabilities. A lower-than-expected inflation rate would diminish the likelihood of a further rate hike in the upcoming meeting. As of writing, the dollar index is up by 0.09% to 103.65.

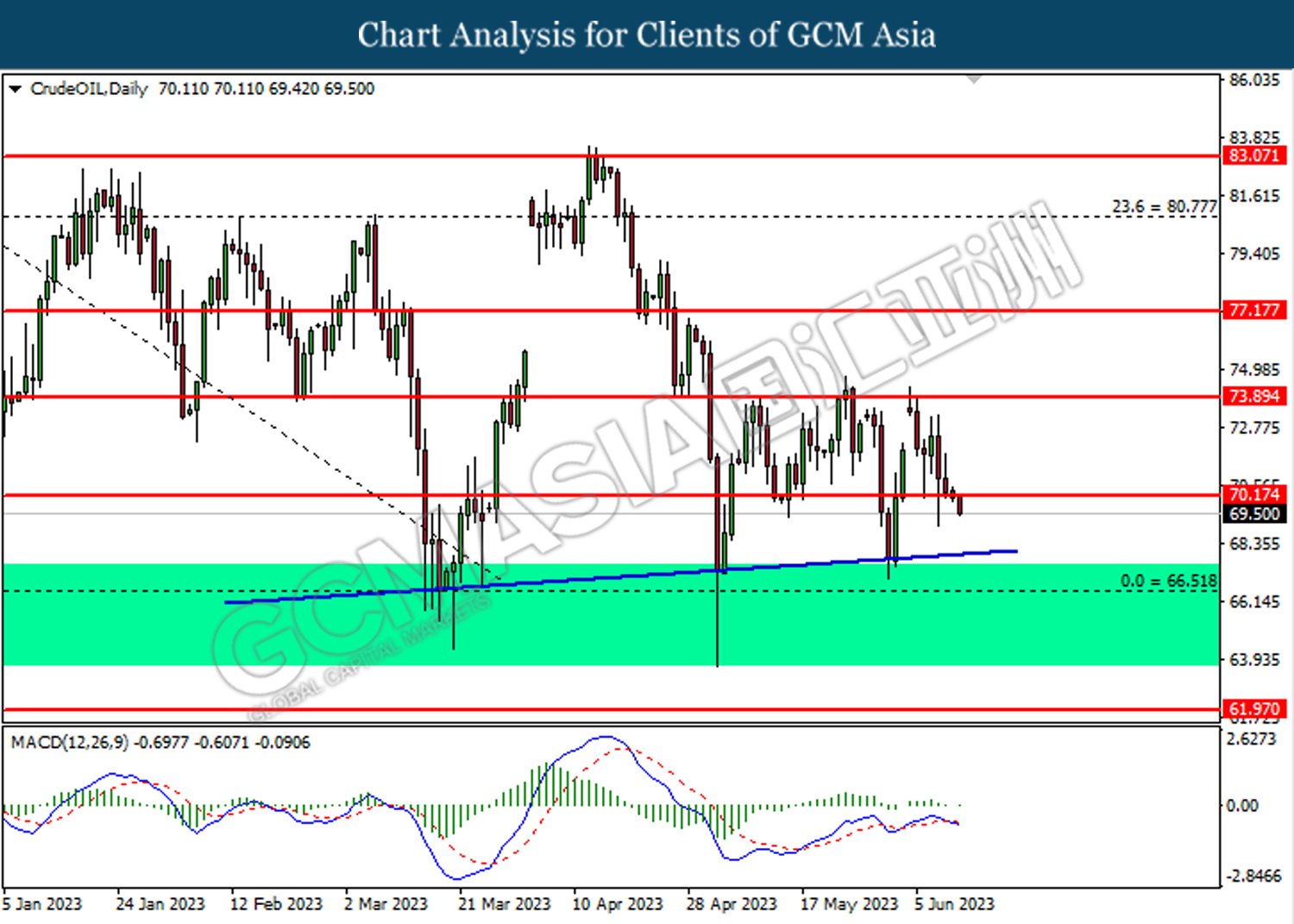

In the commodities market, crude oil prices edged down -1.24% to $69.40 per barrel as the possibility of Iran reaching a nuclear deal with the US surged. Besides, gold prices were down by -0.24% to $1956.30 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

All Day AUD King’s Birthday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 105.00, 106.65

Support level: 103.00, 100.65

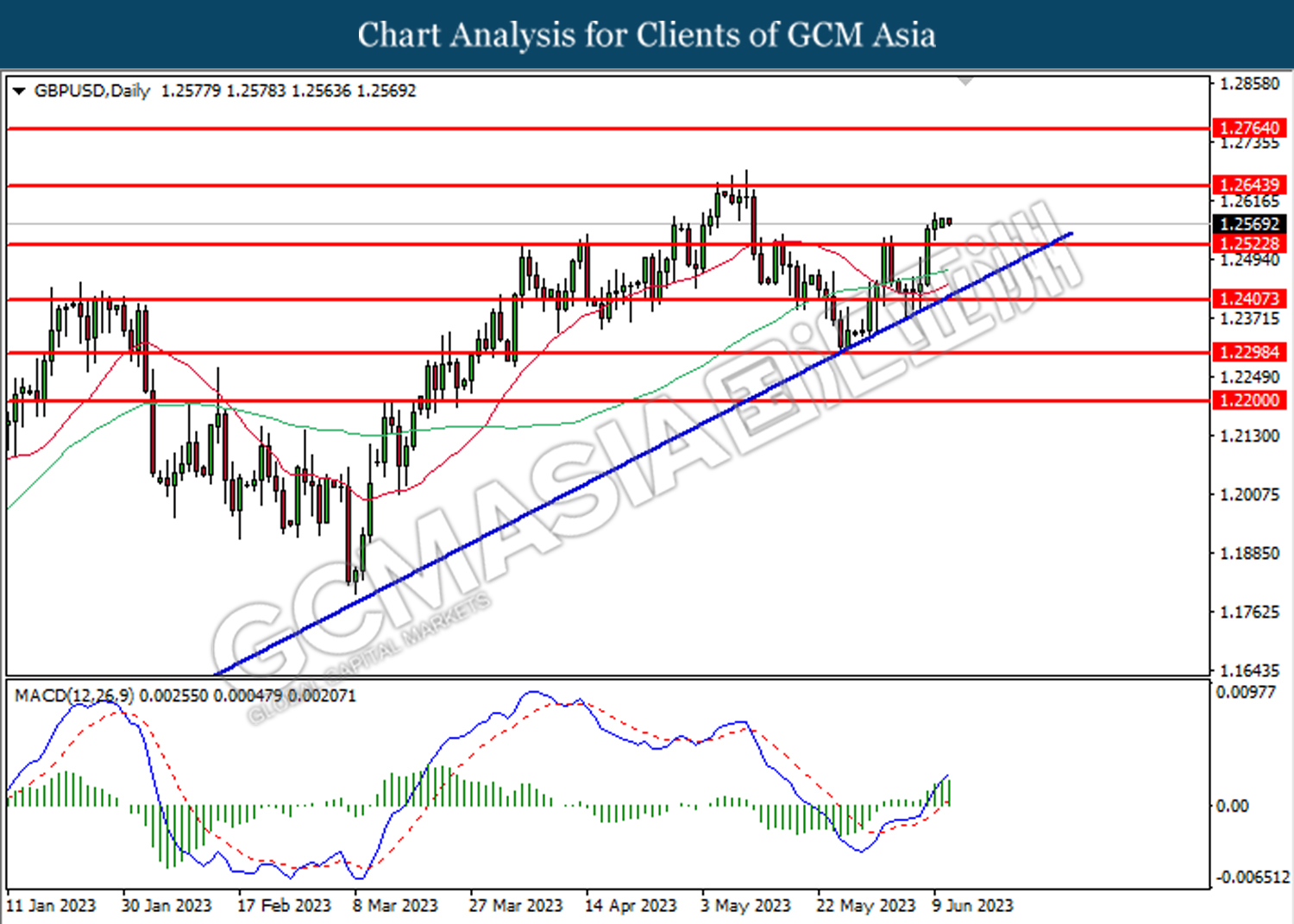

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2525. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2645.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

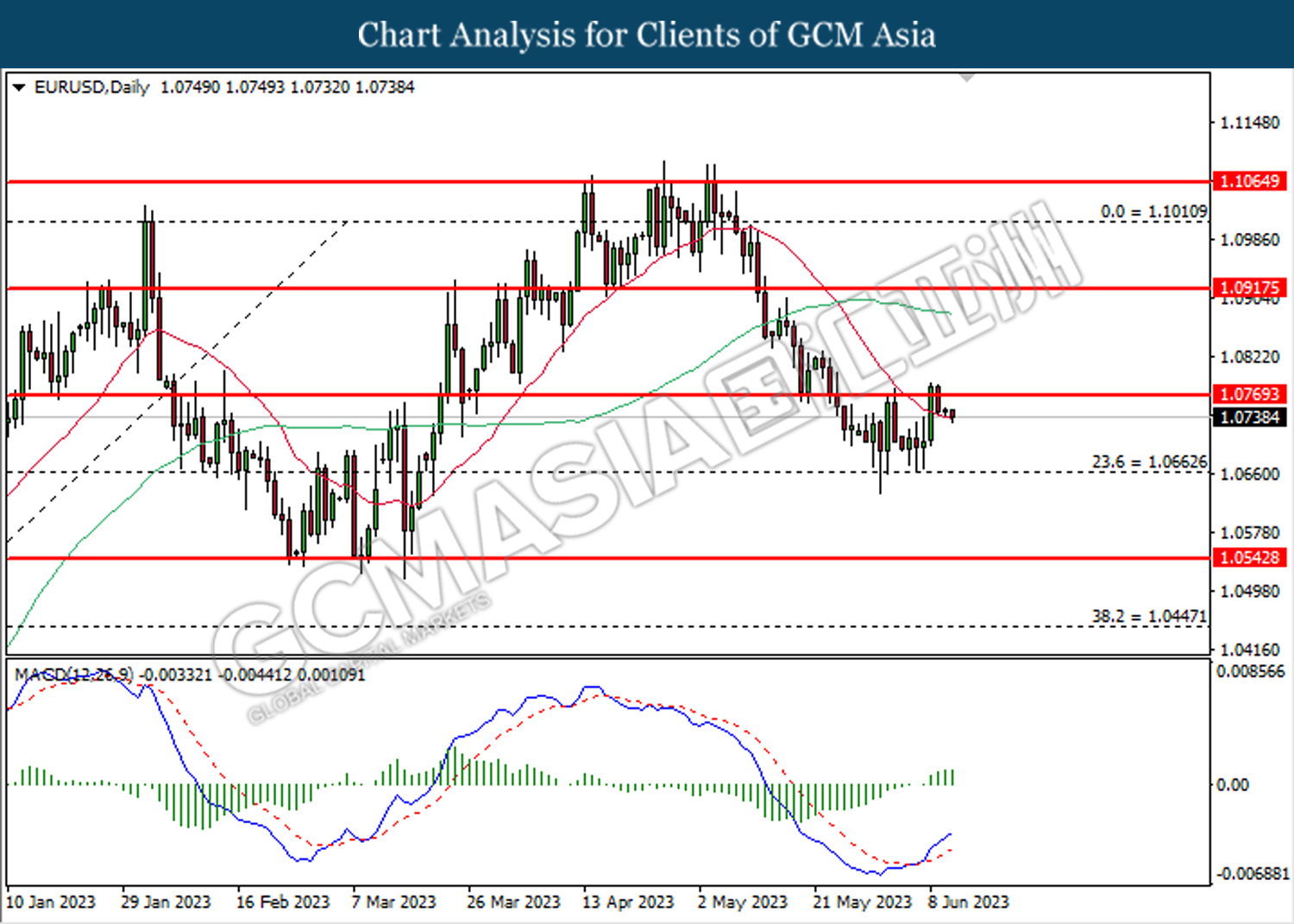

EURUSD, Daily: EURUSD was traded lower following the prior retracement from the resistance level at 1.0770. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.0665.

Resistance level: 1.0770, 1.0915

Support level: 1.0665, 1.0575

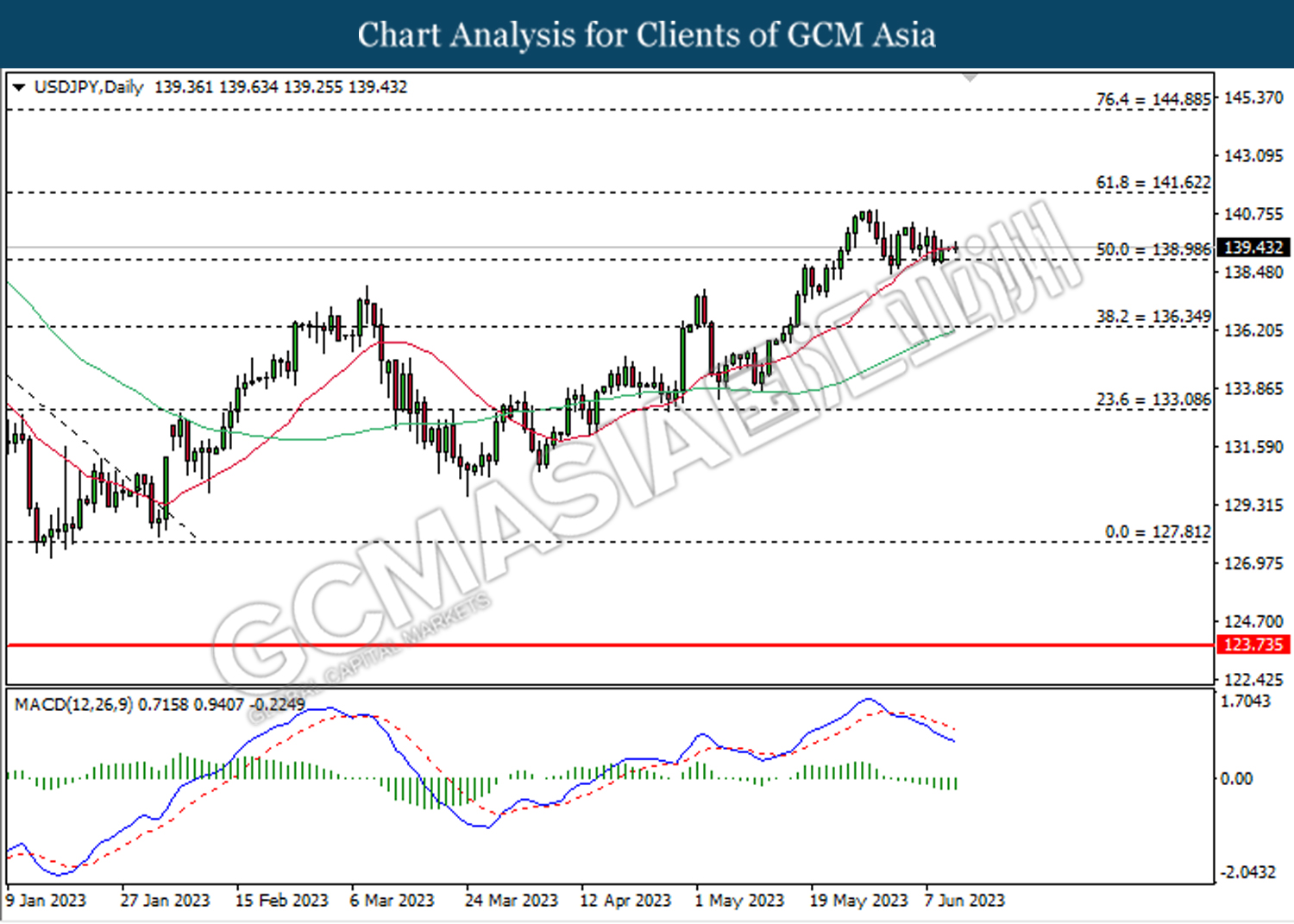

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 138.95. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 138.95.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

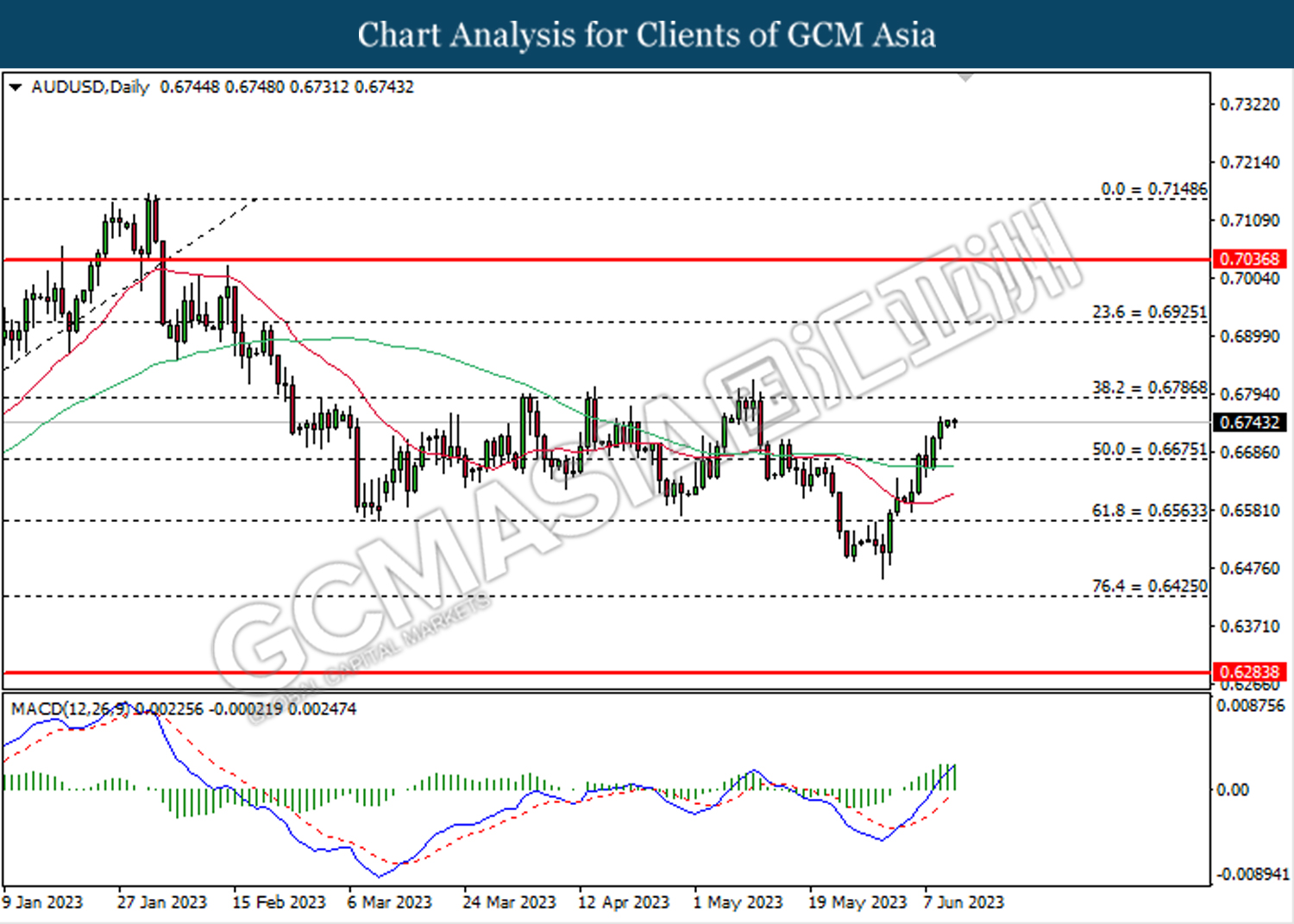

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6675. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6785.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

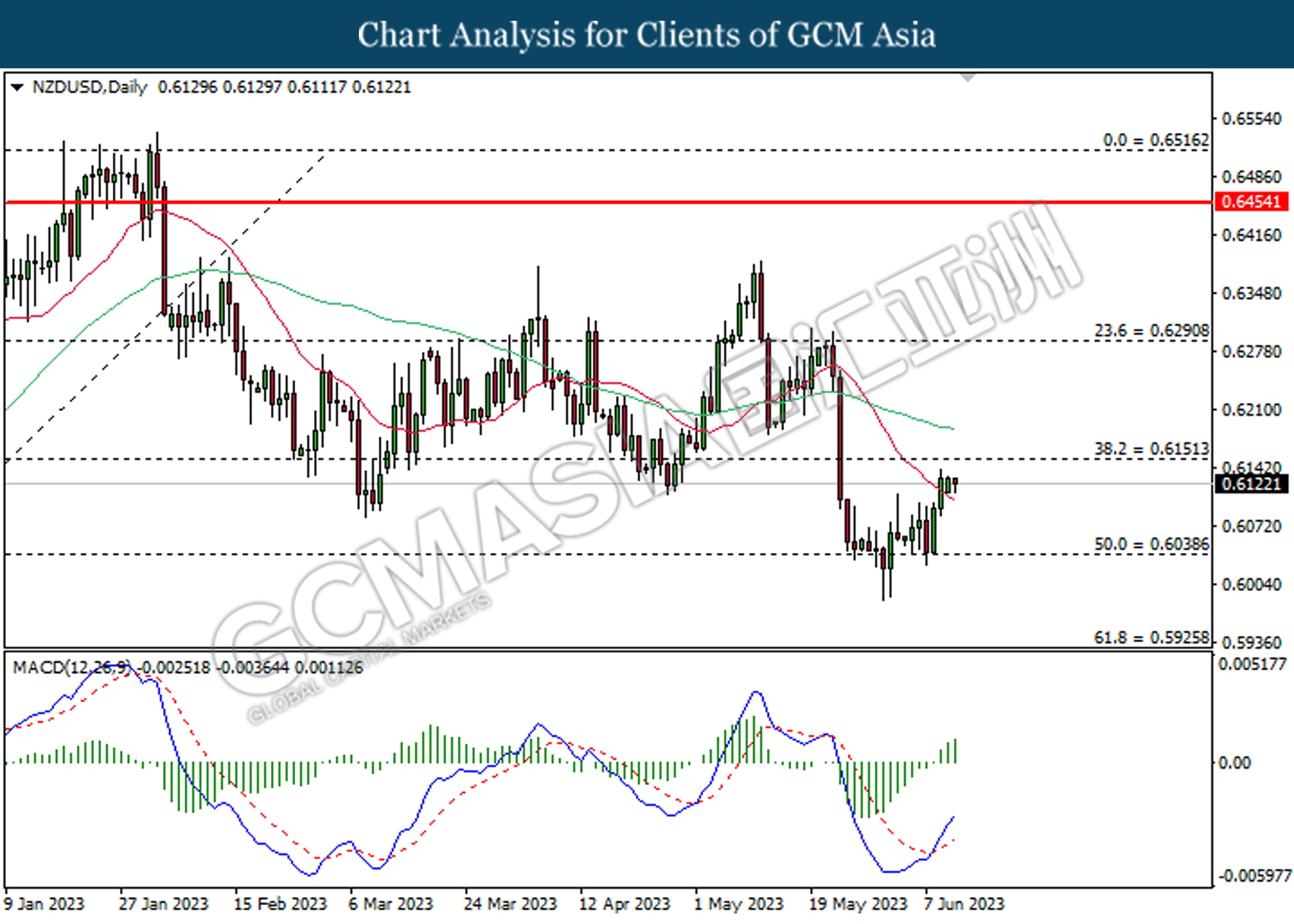

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6040. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6150.

Resistance level: 0.6150, 0.6290

Support level: 0.6040, 0.5925

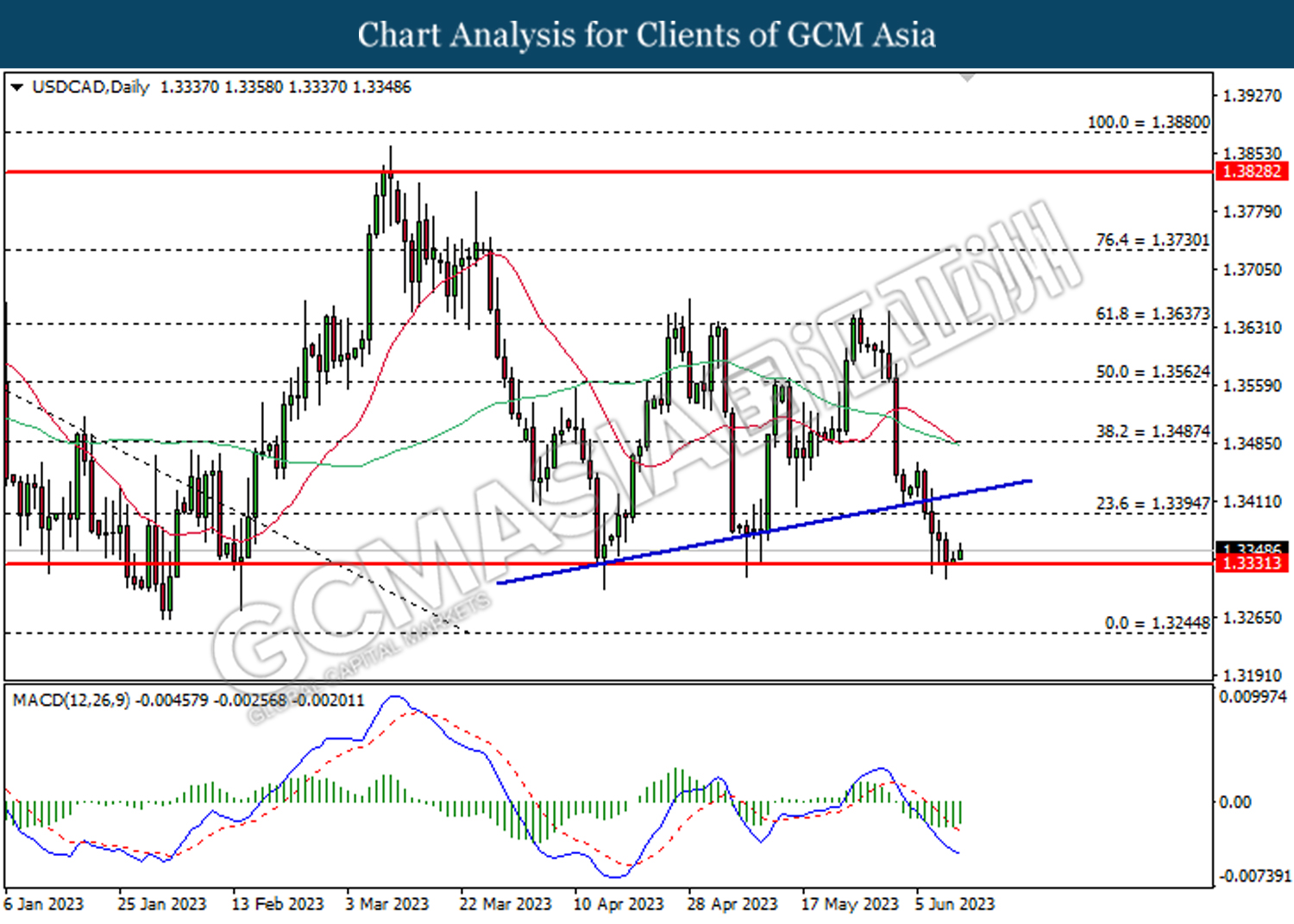

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3330. MACD which illustrated bearish bias momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3395, 1.3485

Support level: 1.3330, 1.3245

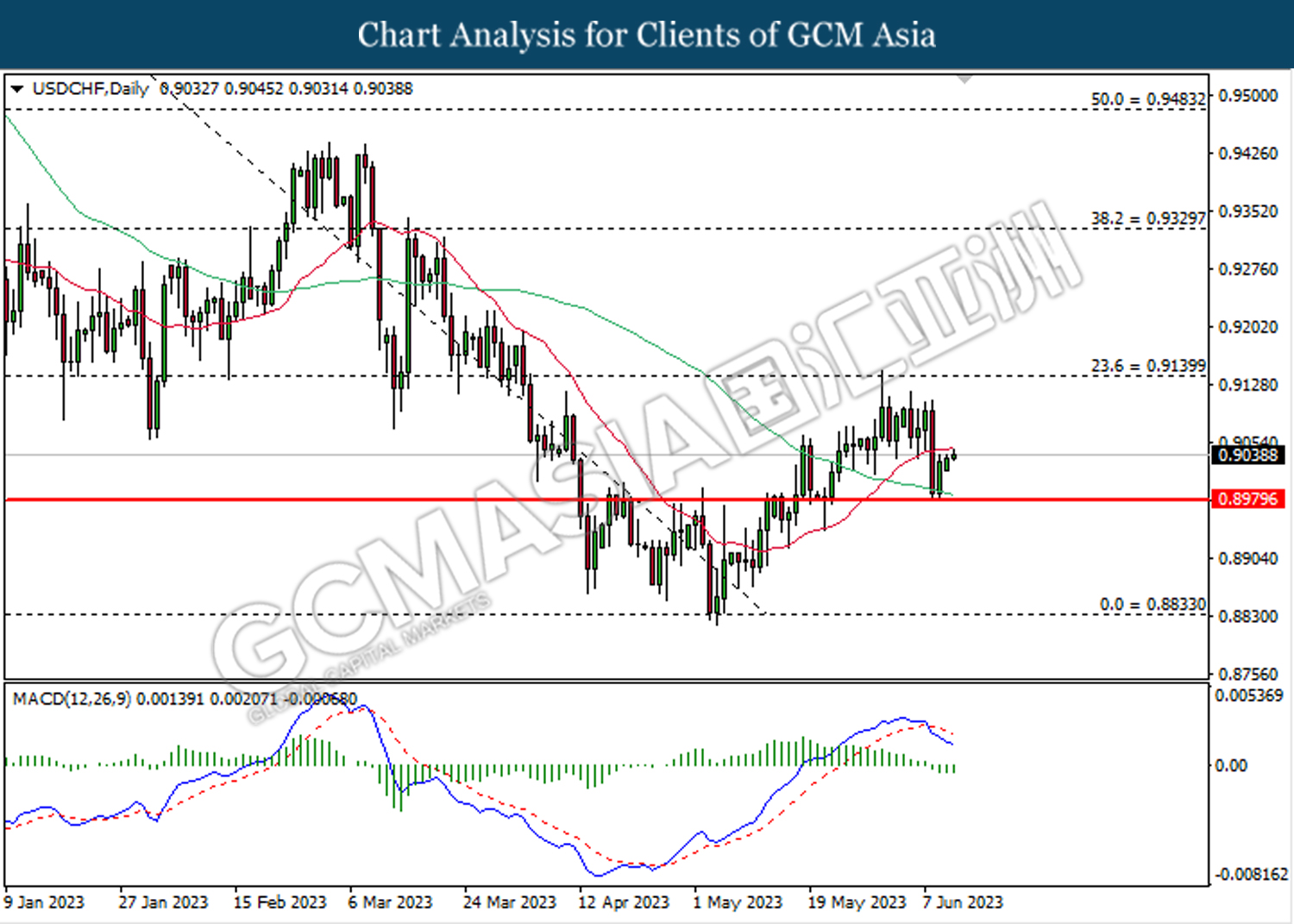

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8980. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9140, 0.9330

Support level: 0.8980, 0.8835

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 70.15. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1951.60. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1889.55