13 June 2023 Morning Session Analysis

The dollar index range is bound ahead of the May consumer price index (CPI).

The dollar index, which was traded against a basket of six major currencies, range bound in the previous session ahead of the May consumer price index. The US Bureau of Labor Statistics is scheduled to release the May CPI on Tuesday and economists expect the readings will be down to 4.1% from the previous 4.9% on an annual basis. However, the greenback was largely unchanged in the previous session, as traders seemed reluctant to push the greenback weaker ahead of CPI if the price pressure continues to elevate. According to Refinitiv’s FedWatch, money markets are leaning toward a pause in the Fed’s rate hikes, but most expect a hike at its July meeting. If inflation is higher than consensus estimates, that could increase the chances of a rate hike at the July meeting and could change the dollar’s weak trajectory. Nonetheless, U.S. jobless claims surged to their highest level in 1-1/2 years last week, adding to pressure on the Federal Reserve to raise interest rates further. If labor market conditions continue to soften, the Fed may consider pausing rate hikes. As of writing, the dollar index edged up by 0.065 to 103.21.

In the commodities market, crude oil prices ticked up by 0.27% to $67.39 per barrel following the prior crude oil price plummet as Goldman Sachs cut the price forecasts to $81 per barrel from an earlier projection of $89. Besides, gold prices traded up by 0.15 % to $1960.42 per troy ounce ahead of the US May CPI data announcement.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German CPI (MoM) (May) | 0.4% | 0.1% | – |

| 20:30 | USD – Core CPI (MoM) (May) | 0.4% | 0.4% | – |

| 20:30 | USD – CPI (MoM) (May) | 0.4% | 0.2% | – |

| 20:30 | USD – CPI (YoY) (May) | 4.9% | 4.1% | – |

Technical Analysis

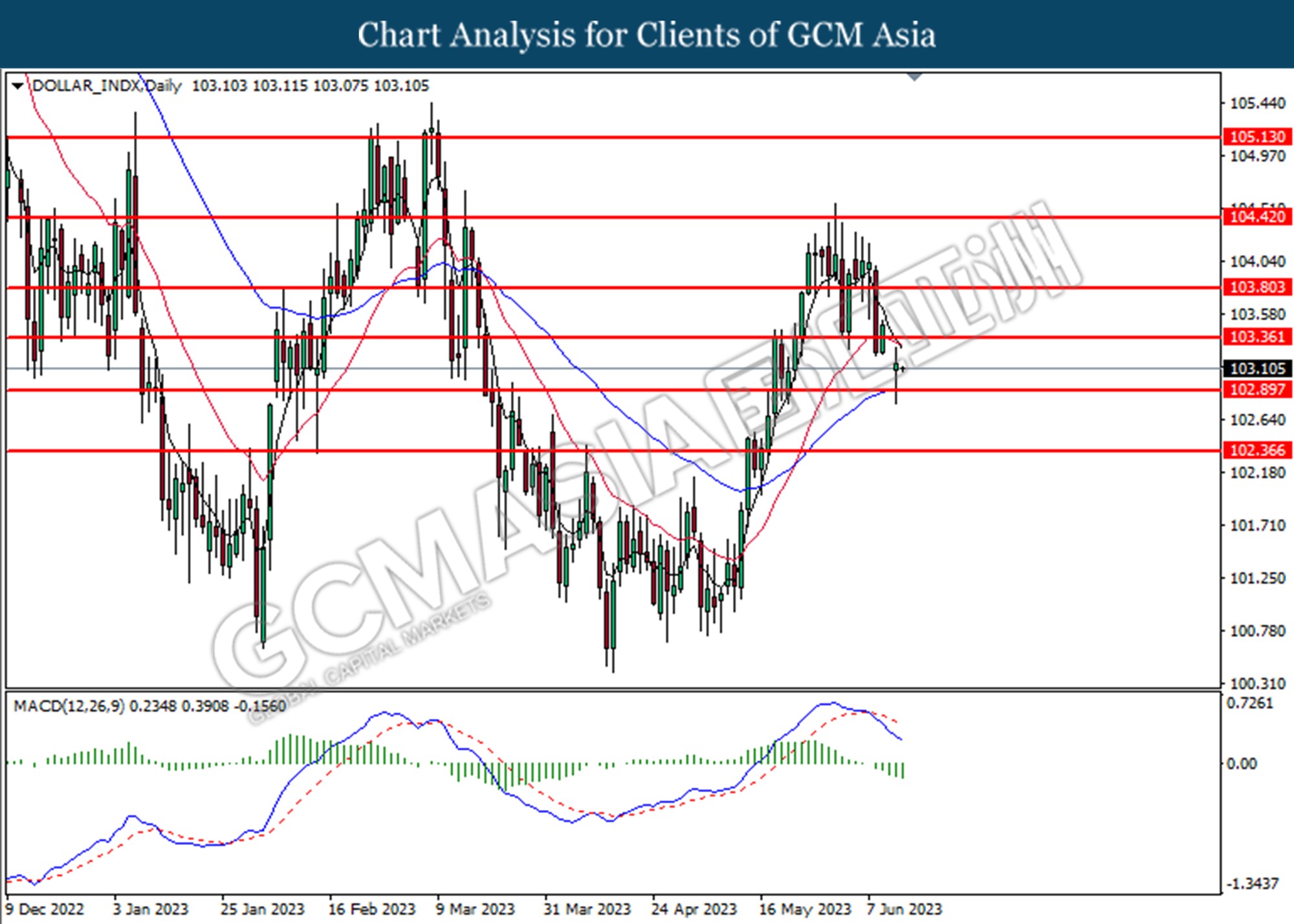

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the lower level. However, MACD which illustrated increasing bearish momentum suggests the index to undergo a technical correction in the short term.

Resistance level: 103.35, 103.80

Support level: 102.90, 102.35

GBPUSD, Daily: GBPUSD was traded lower following the prior breaks below the previous support level at 1.2520. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.2520, 1.2565

Support level: 1.2470, 1.2410

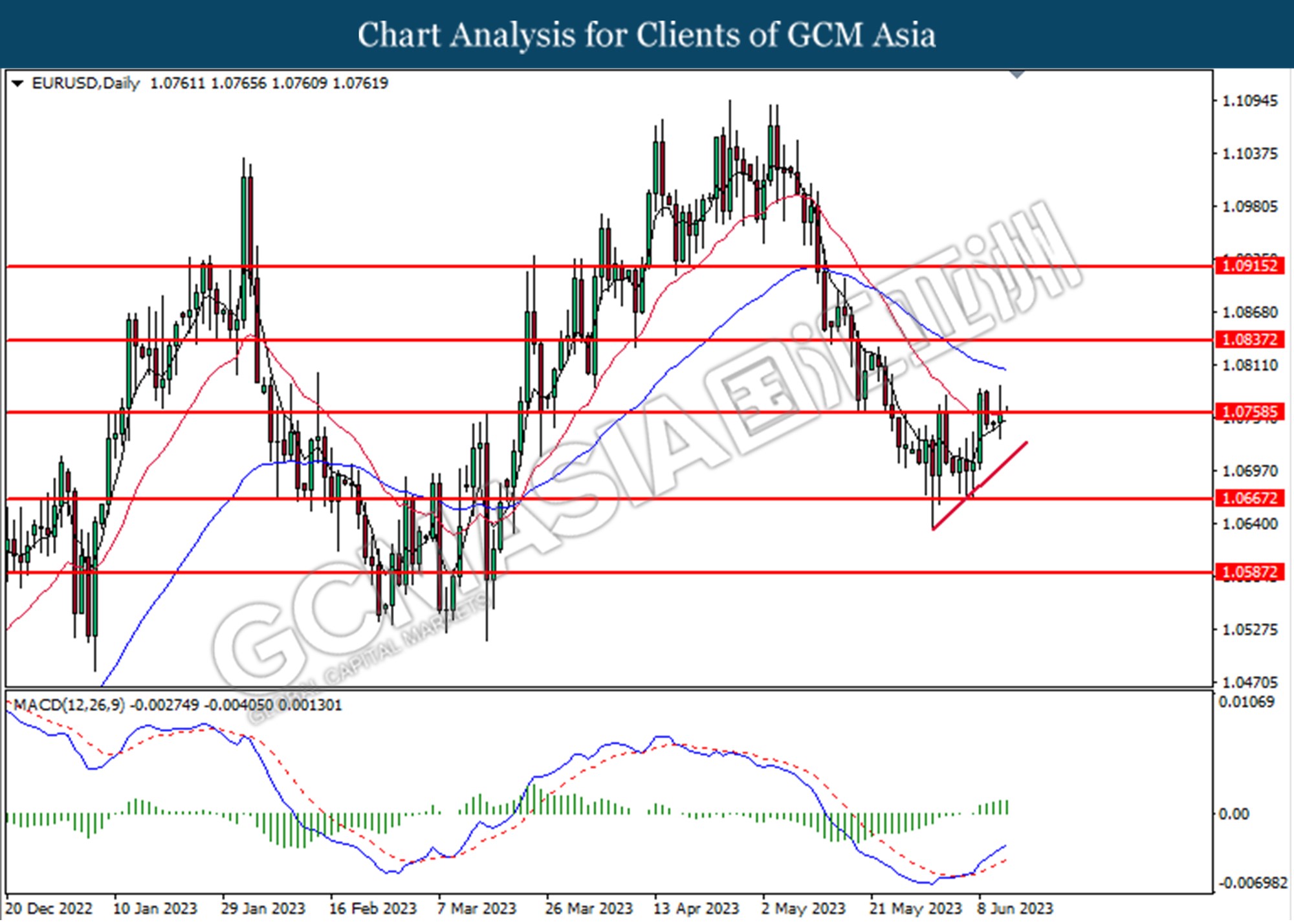

EURUSD, Daily: EURUSD was traded higher following the prior breaks above the previous resistance level at 1.0760. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 1.0760, 1.0835

Support level: 1.0670, 1.0590

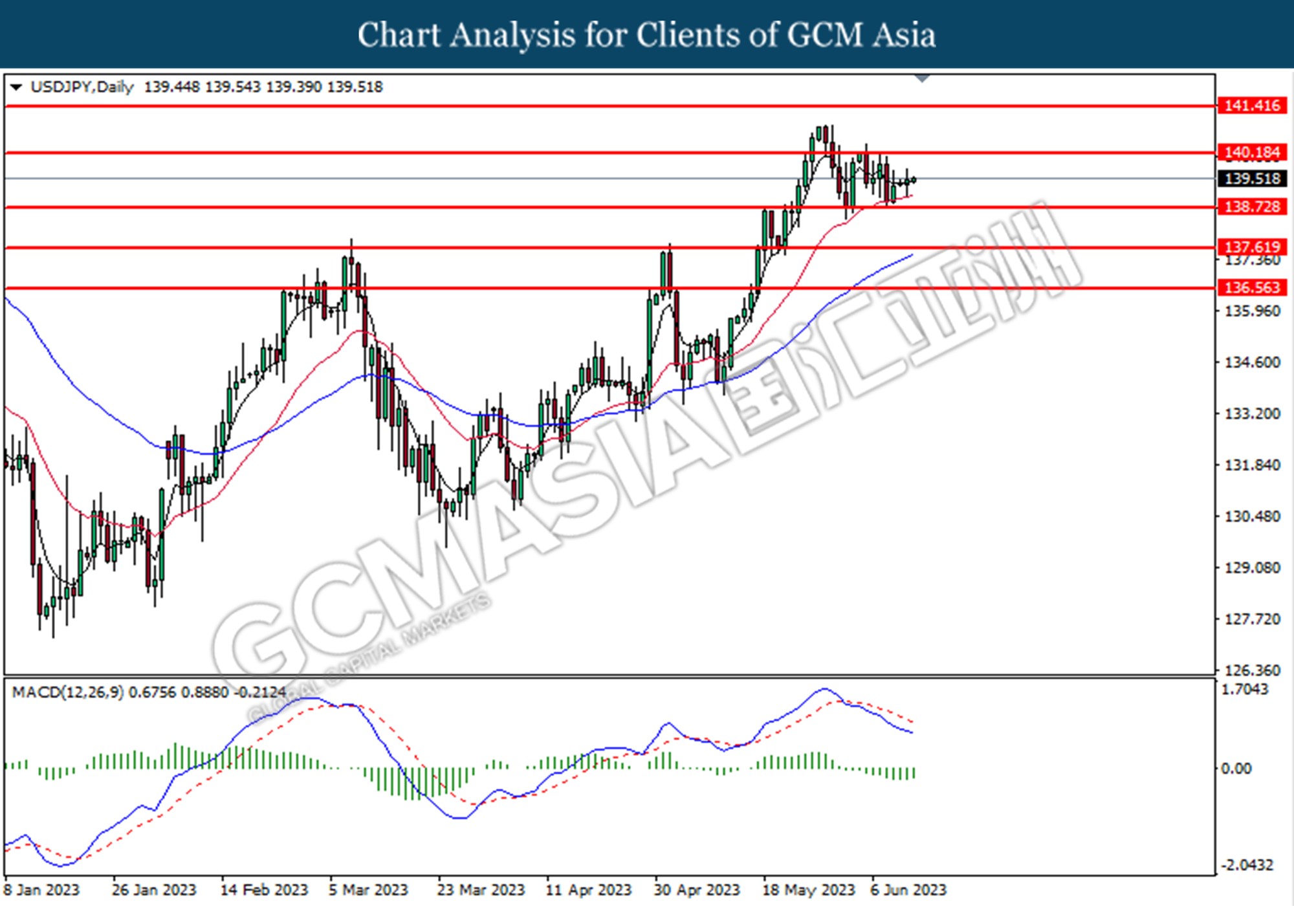

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 140.20

Resistance level: 140.20, 141.40

Support level: 138.70, 137.60

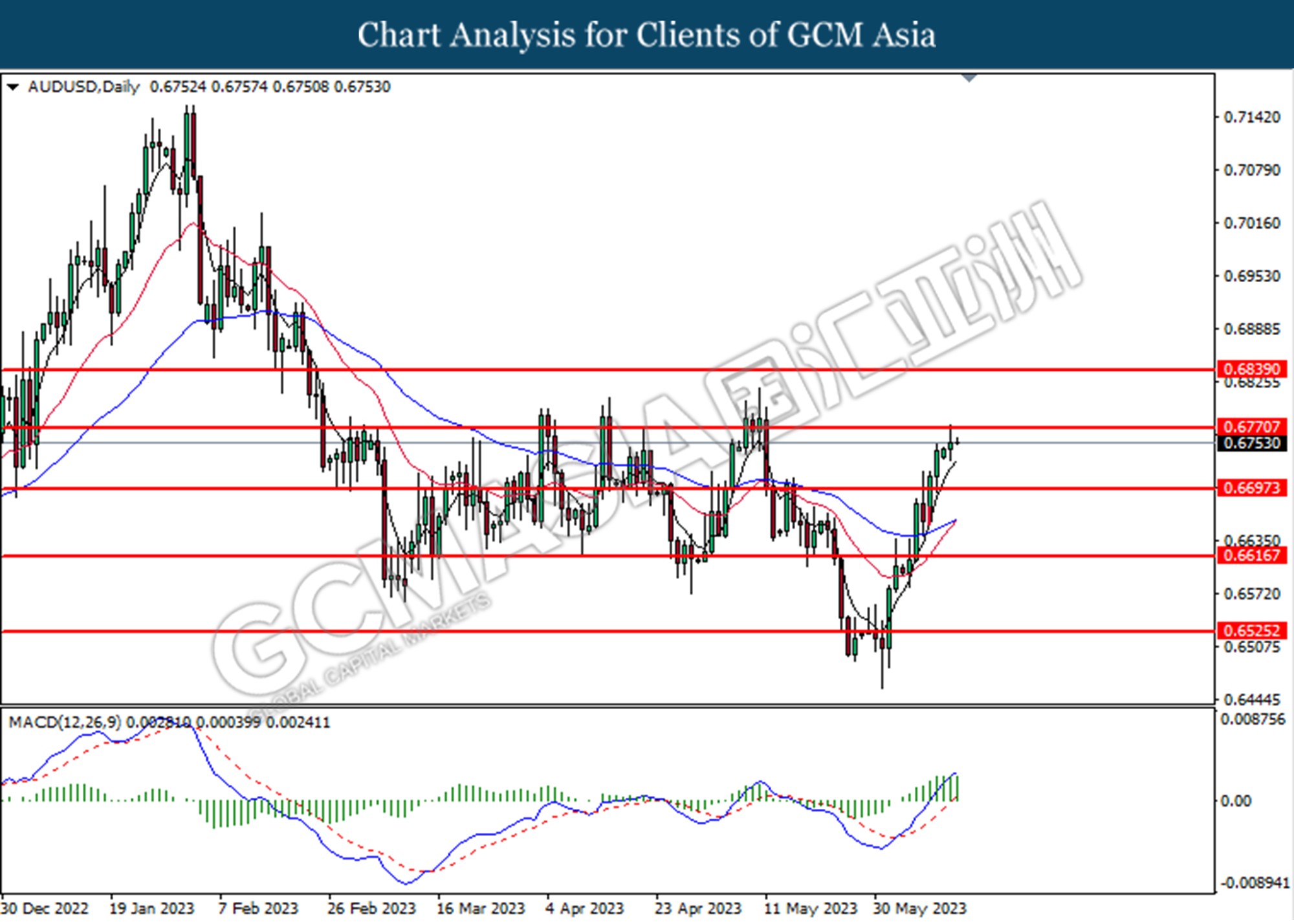

AUDUSD, Daily: AUDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated bullish momentum suggests the pair to extend its gains toward the resistance level at 0.6770.

Resistance level: 0.6770, 0.6840

Support level: 0.6700, 0.6615

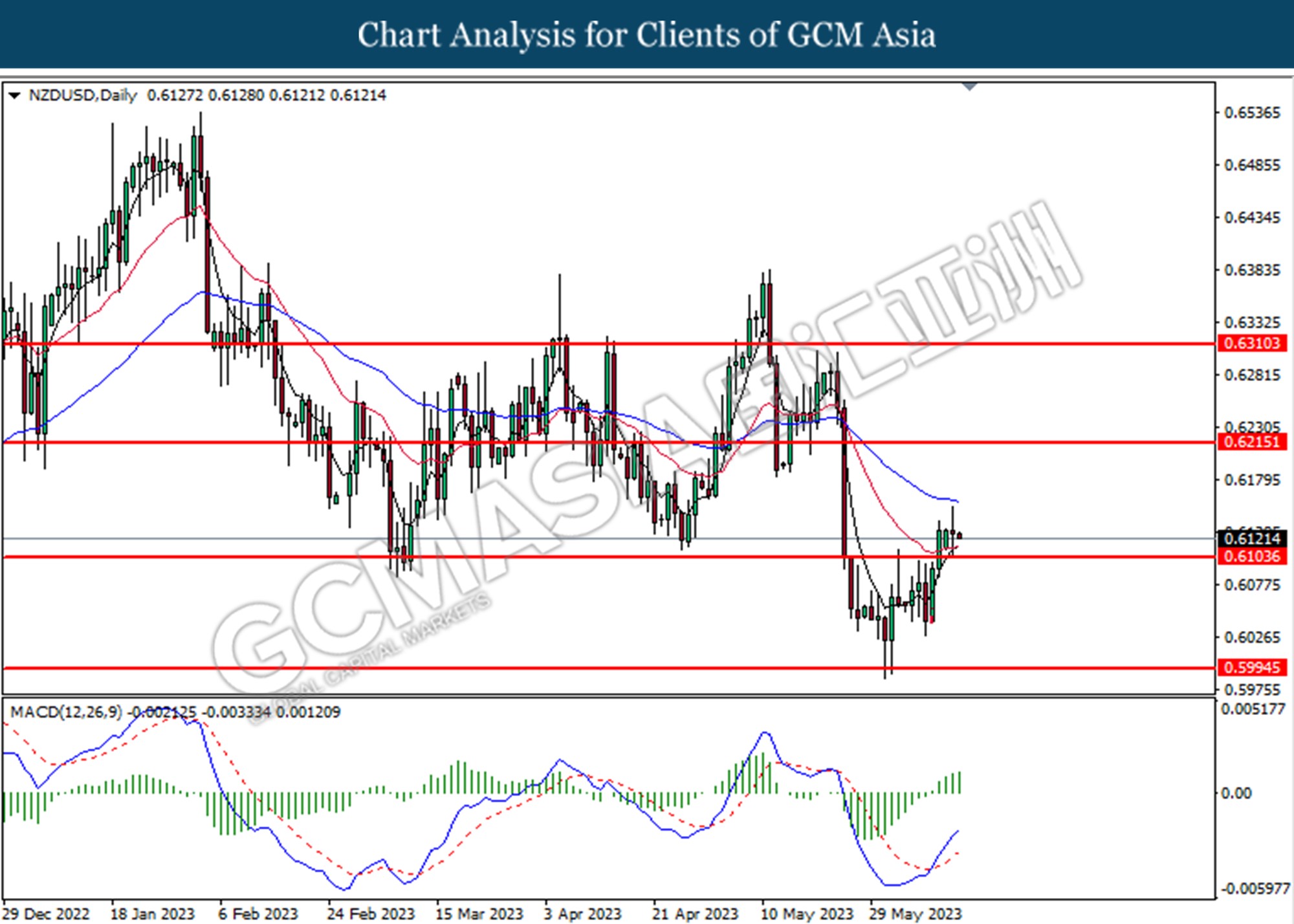

NZDUSD, Daily: NZDUSD was traded higher following the prior rebound from the support level at 0.6105. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 0.6215, 0.6310

Support level: 0.6100, 0.5995

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3335. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level.

Resistance level: 1.3375, 1.3425

Support level: 1.3335, 1.3300

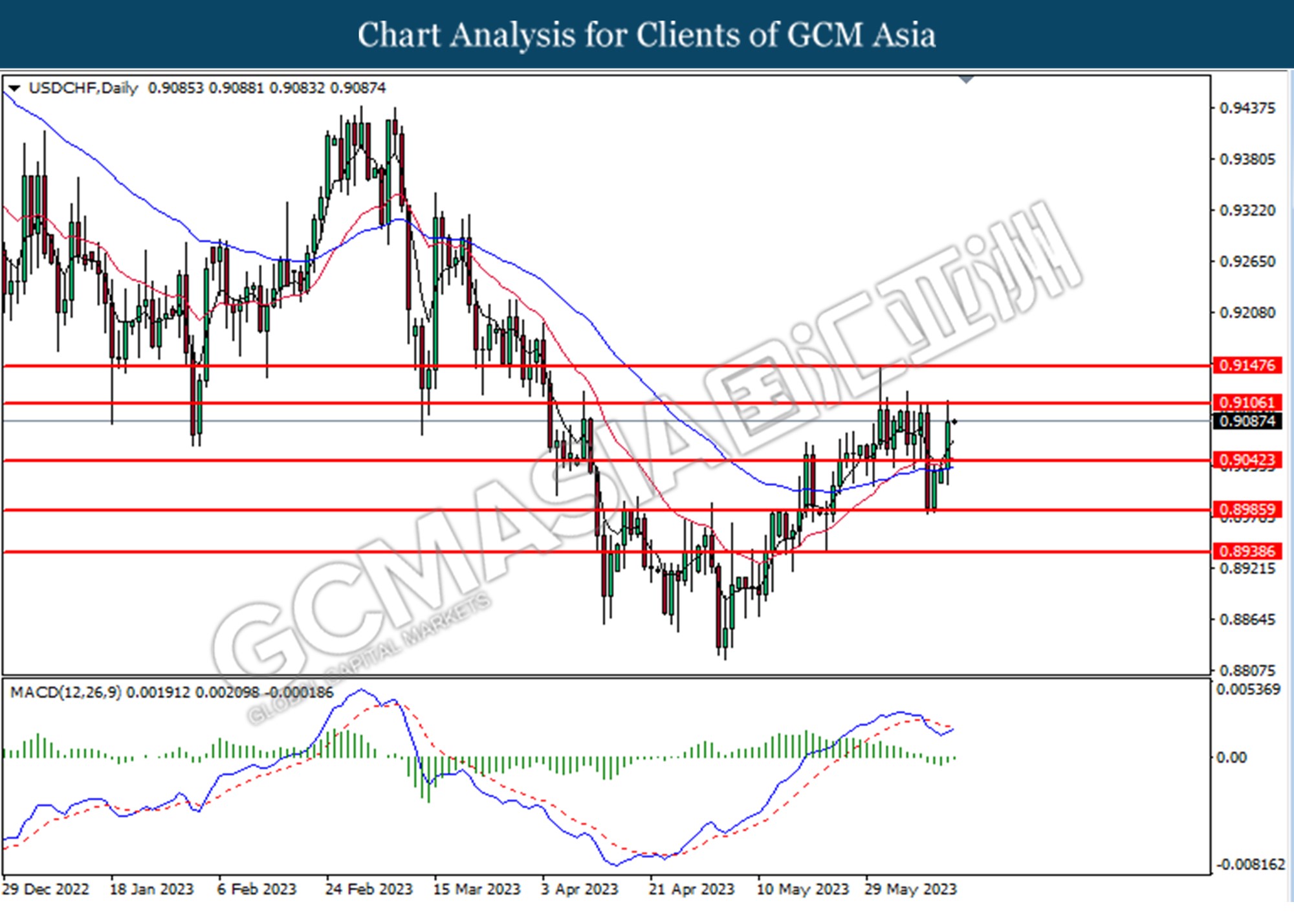

USDCHF, Daily: USDCHF was traded higher following the prior breaks above the previous resistance level at 0.9040. MACD which illustrated diminishing bearish momentum suggests the pair extend its gains toward the resistance level at 0.9105

Resistance level: 0.9105, 0.9150

Support level: 0.9040, 0.8985

CrudeOIL, Daily: Crude oil price was traded lower following the prior breaks below from the previous support level at 67.55. MACD which illustrated increasing bearish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 67.55, 69.30

Support level: 65.80, 64.10

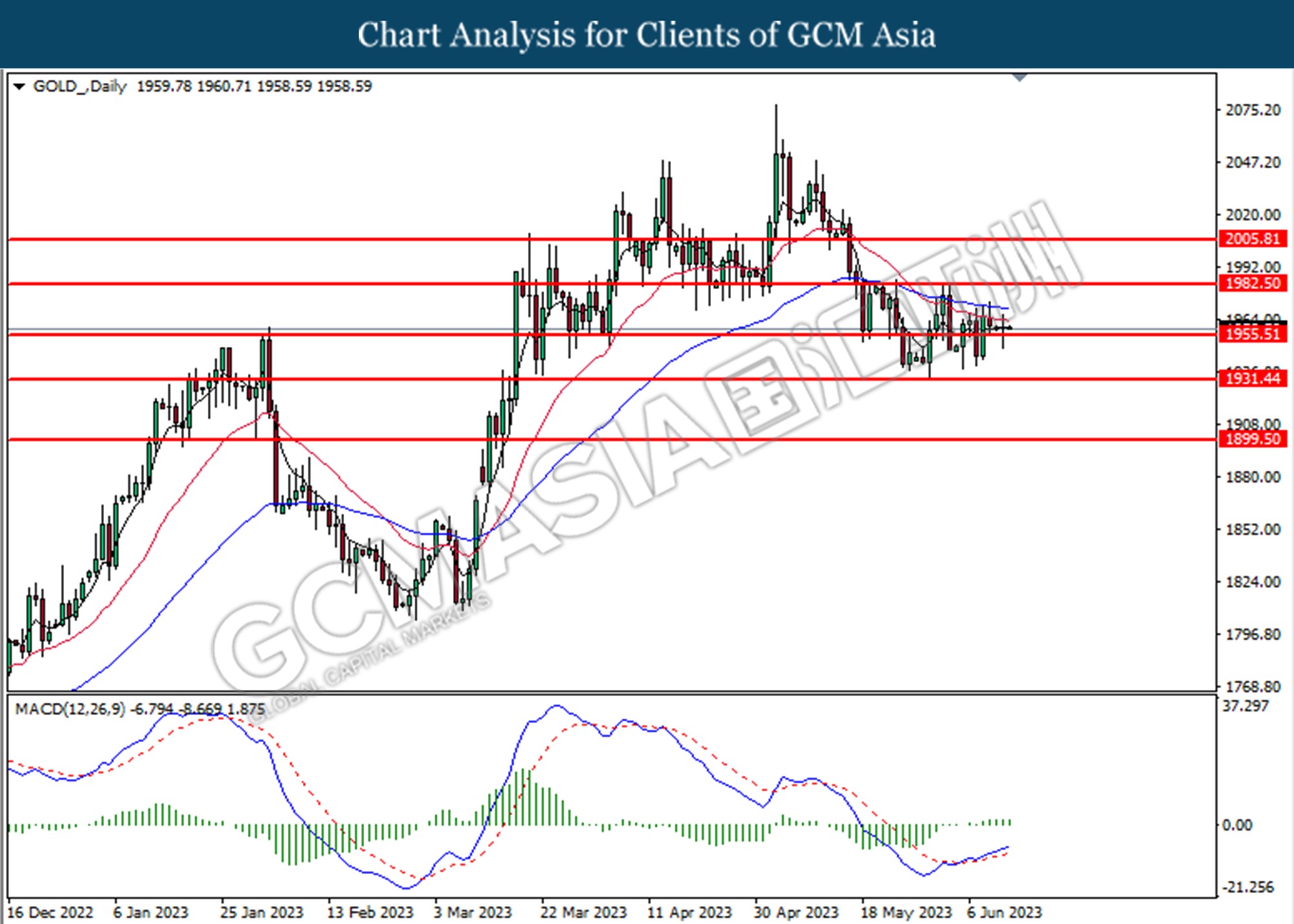

GOLD_, Daily: Gold price was traded lower following the prior retracement from the higher level. However, MACD which illustrated increasing bullish momentum suggests the commodity to undergo a technical correction in the short term.

Resistance level: 1982.50, 2005.80

Support level: 1955.50, 1930.45