14 June 2023 Afternoon Session Analysis

US dollar slid ahead of Fed’s interest rate decision.

The dollar index, which was traded against a basket of six major currencies, lost it ground while extending its downside during the Asian trading session amid the weaker-than-expected inflation figure. Yesterday, the dollar index was being sell-off tremendously by investors as the US inflation rate dropped from 4.9% to 4.0% in May, lower than the market consensus at 4.1%. As a result, the market participants are expecting the Fed to leave the interest rate at the current level, with no any changes in tomorrow’s meeting. According to the CME FedWatch Tool, the probability of maintaining the interest rate is at 96.5% now, whereas the likelihood of another 25 basis points a rate hike is at 3.5% only. With the decent drop in the inflation data, it might cause the Fed’s members to be tilted dovish. Nonetheless, the FOMC Press Conference would be the main focus of the market participants as the Fed will revealed their view regarding the economic outlook and monetary policy path. As of writing, the dollar index ticked down -0.07% to 103.25.

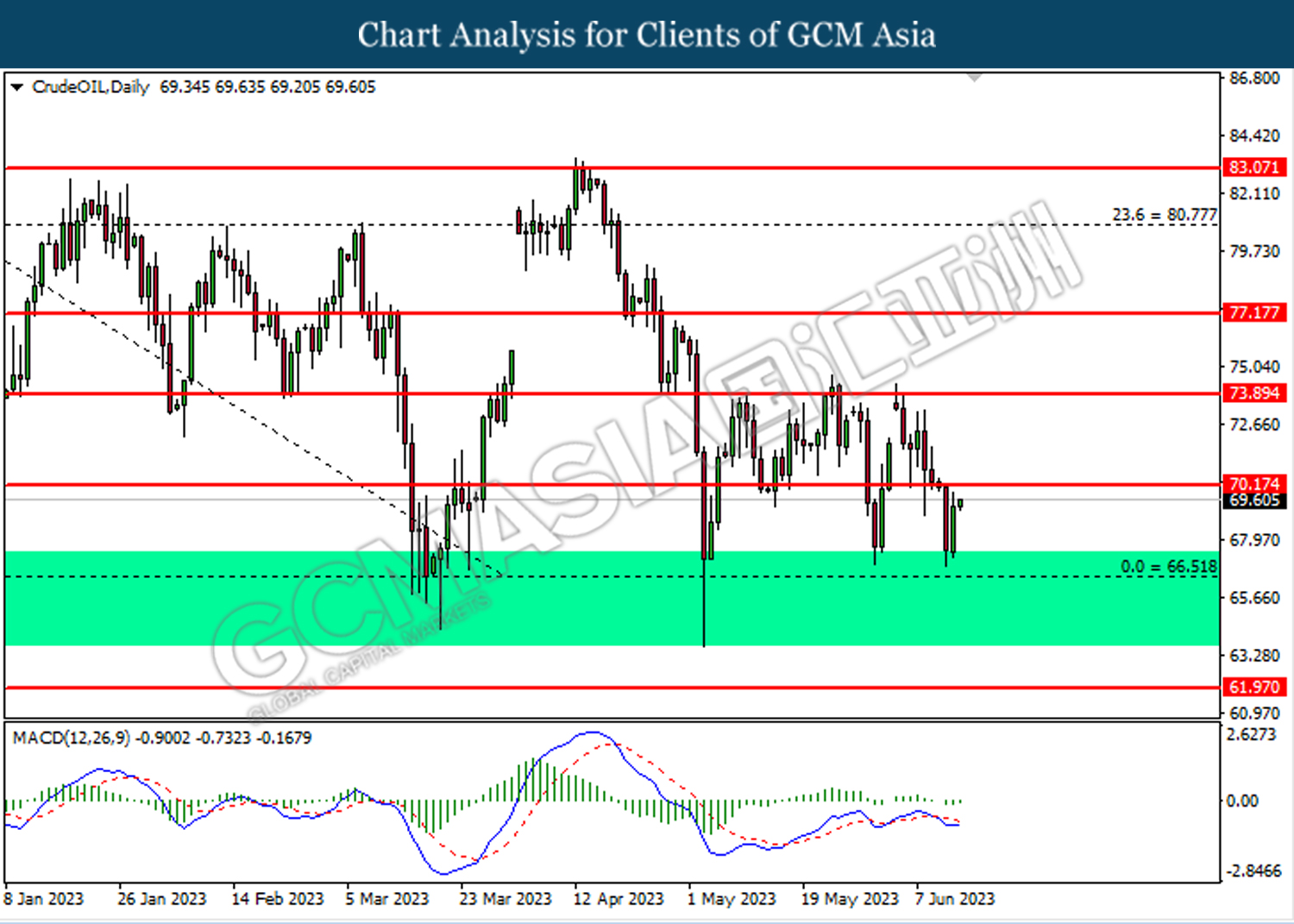

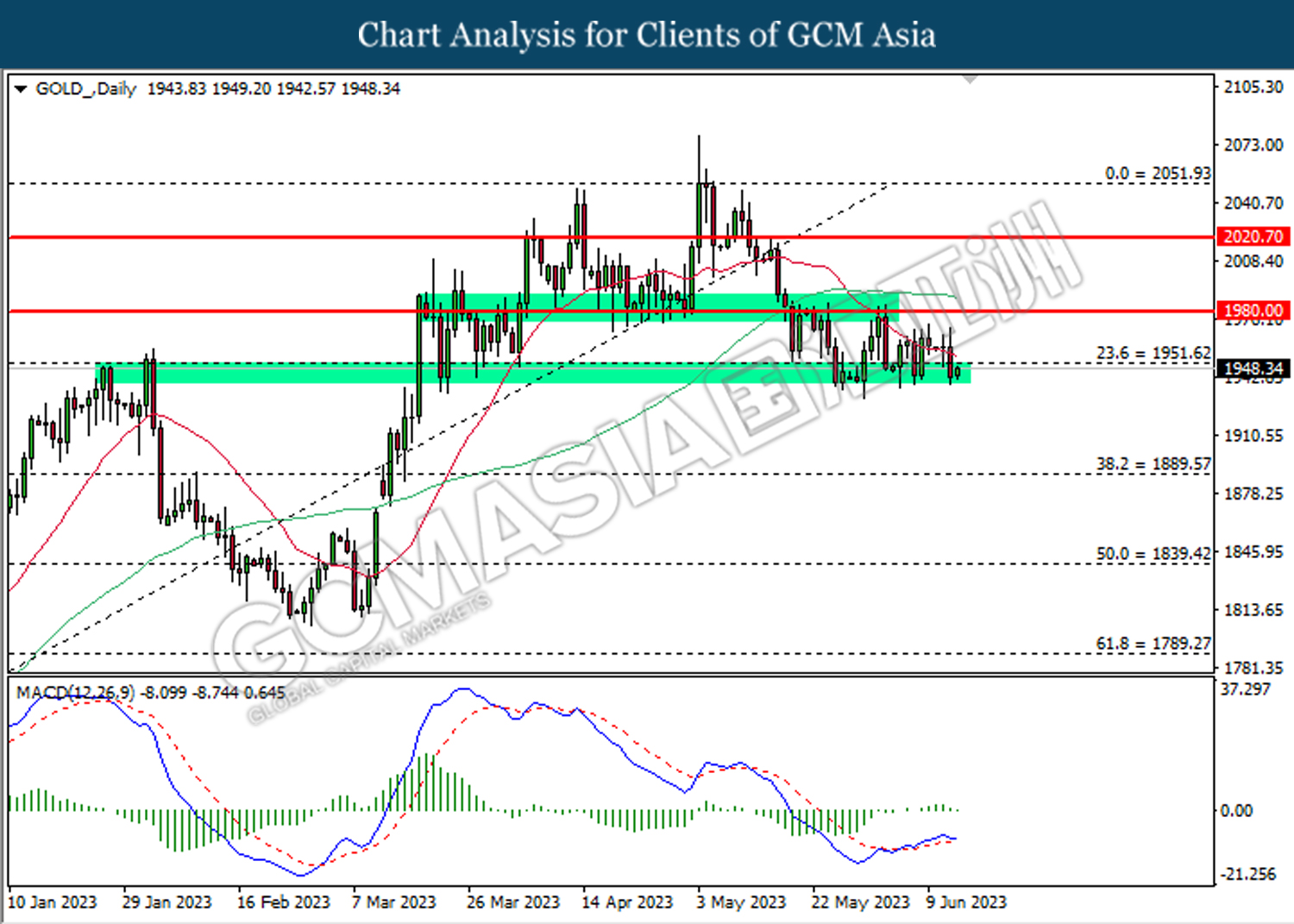

In the commodities market, crude oil prices edged up 0.22% to $69.45 per barrel as OPEC monthly report showed a consistent forecast as last month, signaling their optimistic view over the prospect of this black commodity. Besides, gold prices were up by 0.24% to $1948.15 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 CrudeOIL IEA Monthly Report

02:00 USD FOMC Economic Projections

(15th)

02:00 USD FOMC Statement

(15th)

02:30 USD FOMC Press Conference

(15th)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – PPI (MoM) (May) | 0.2% | -0.1% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | -0.451M | 1.482M | – |

| 02:00

(15th) |

USD – Fed Interest Rate Decision | 5.25% | 5.25% | – |

Technical Analysis

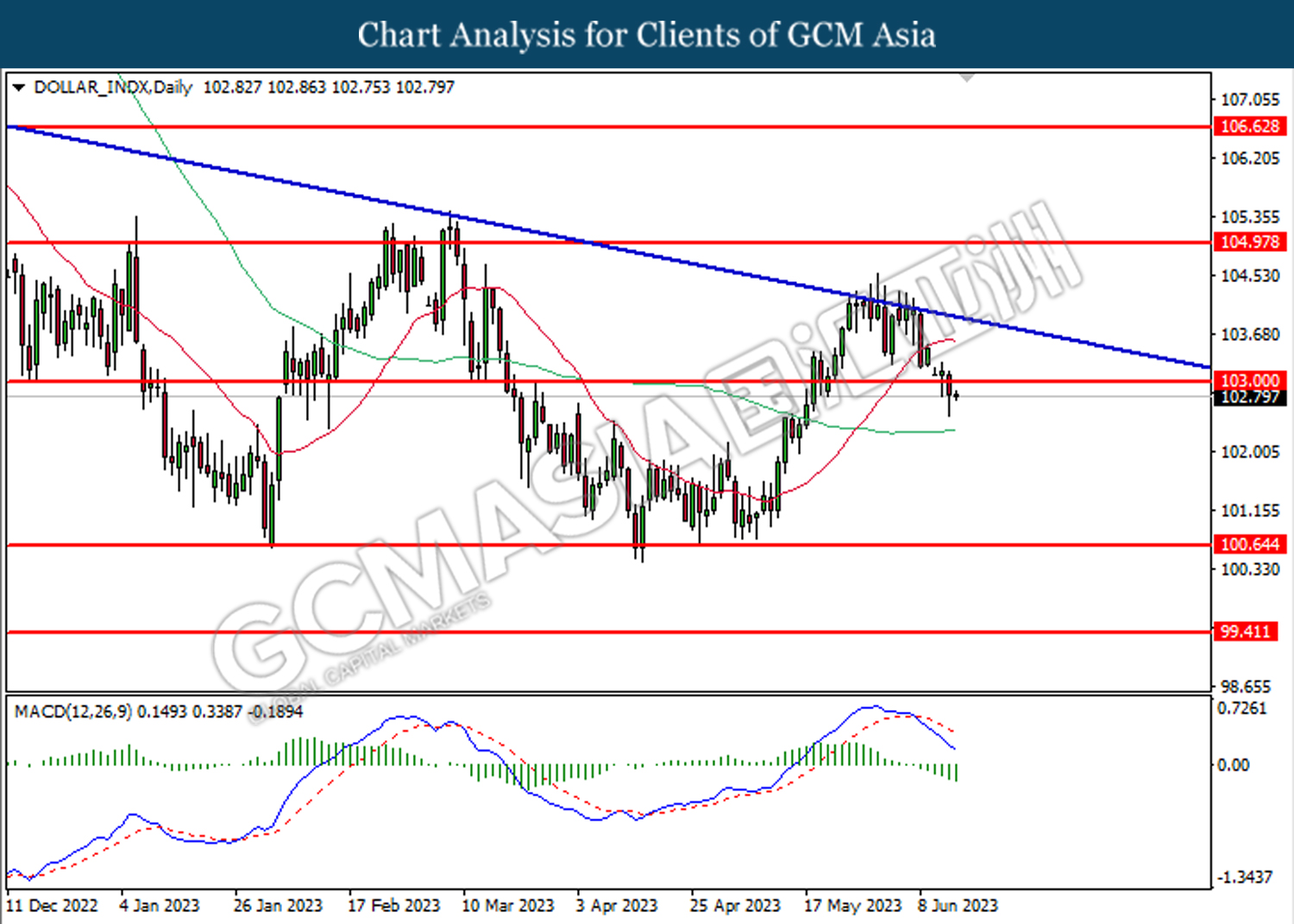

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

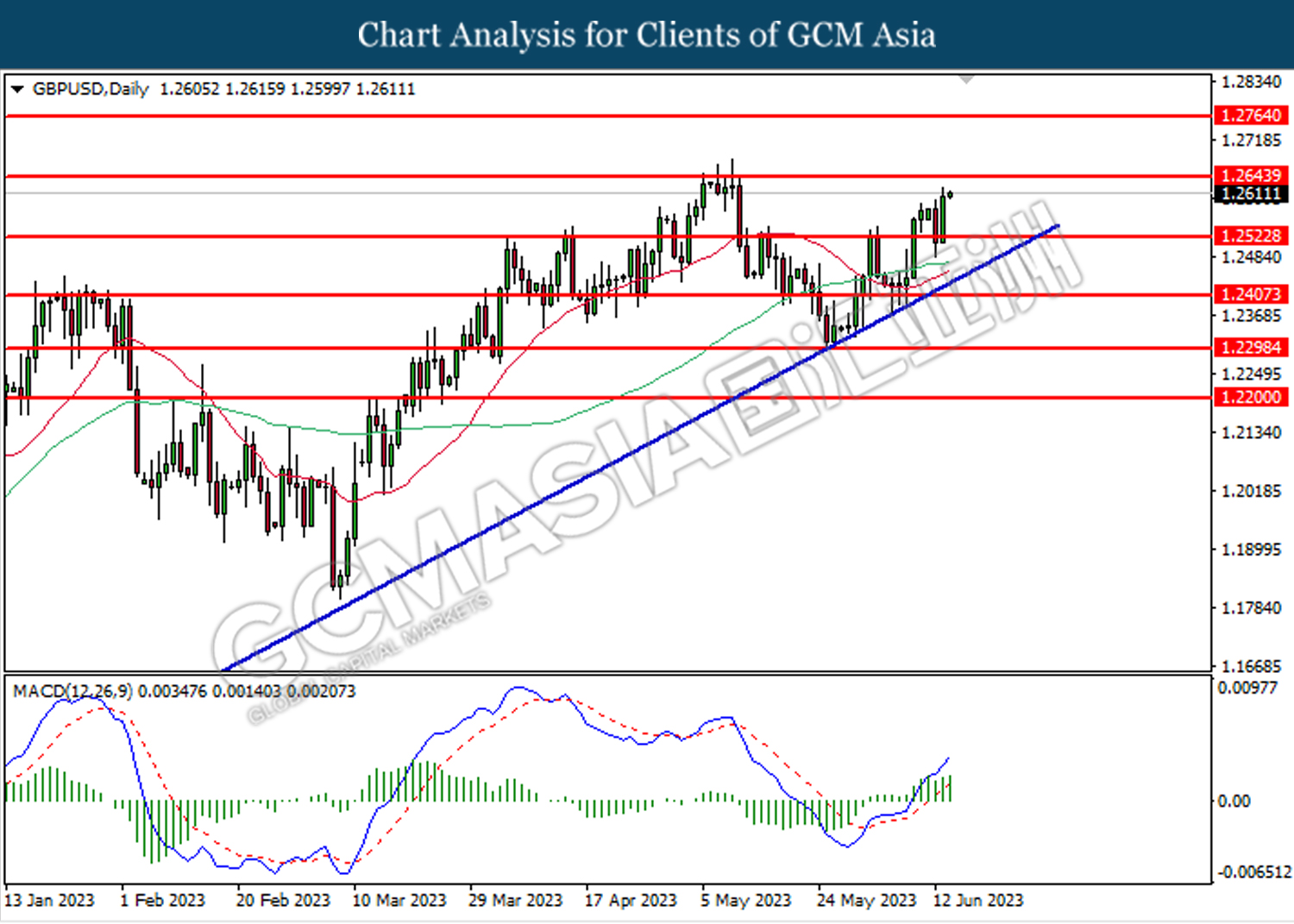

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.2525. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2645.

Resistance level: 1.2645, 1.2765

Support level: 1.2525, 1.2405

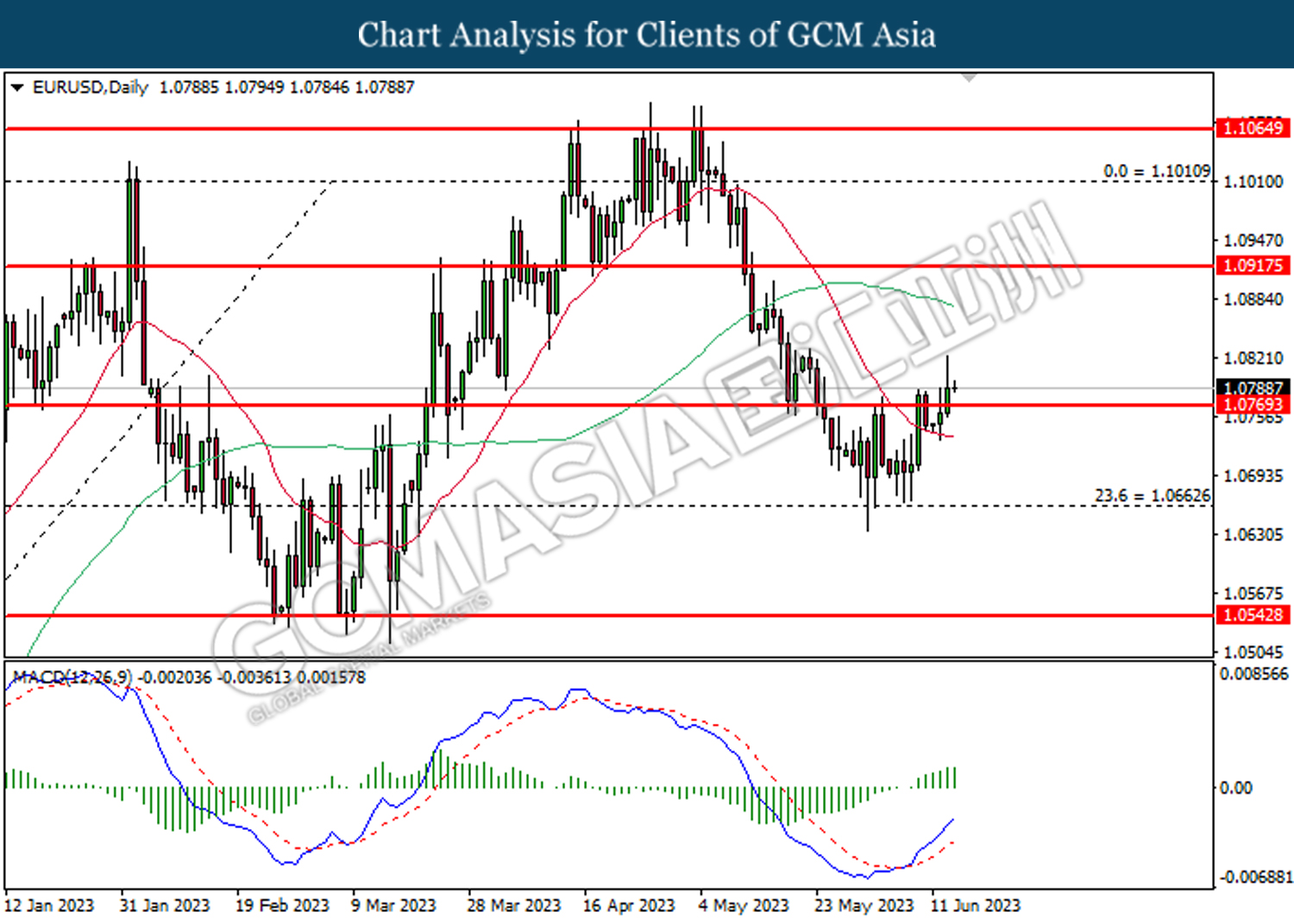

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0915.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

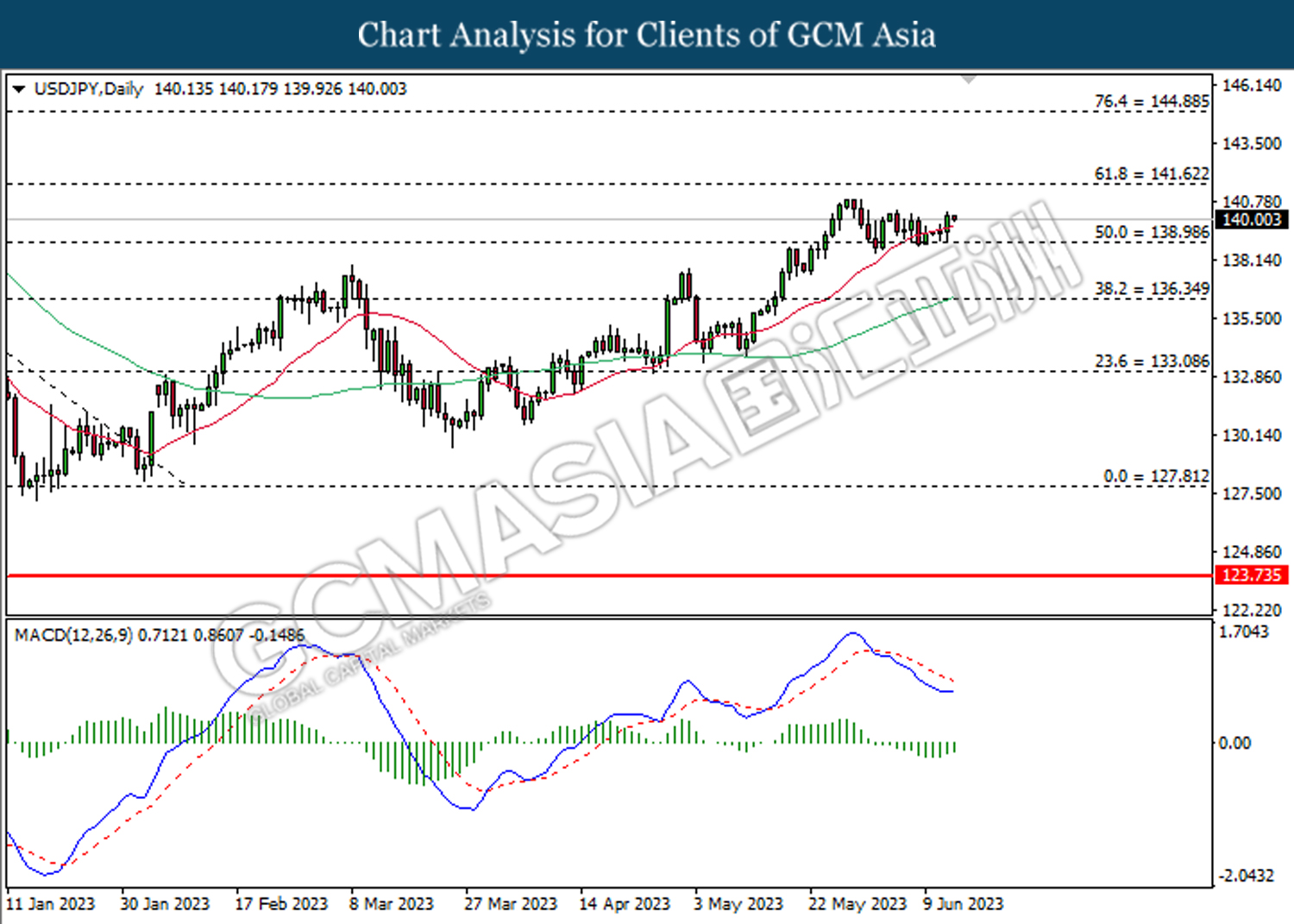

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 139.00. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 141.60.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

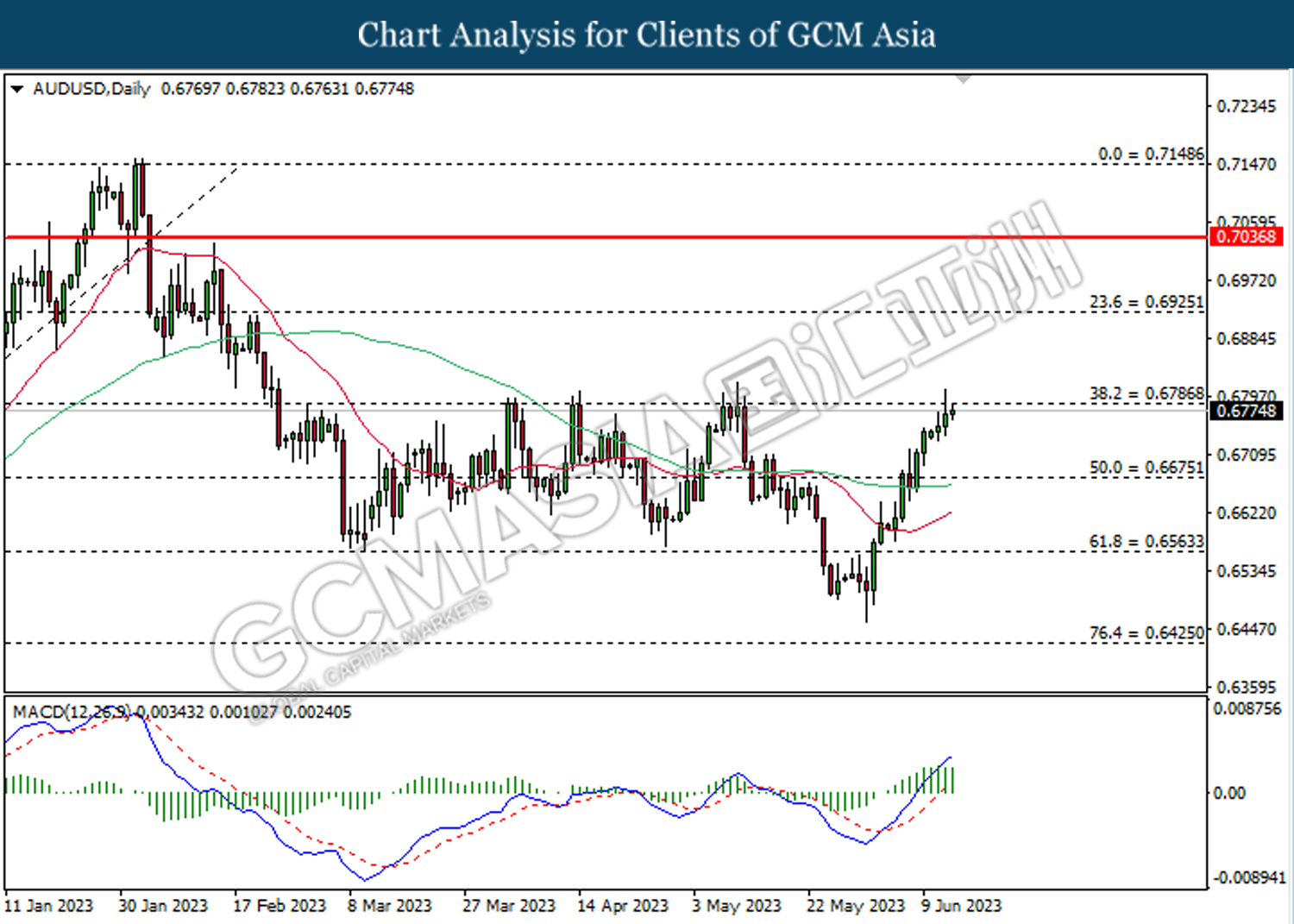

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6785, 0.6925

Support level: 0.6675, 0.6565

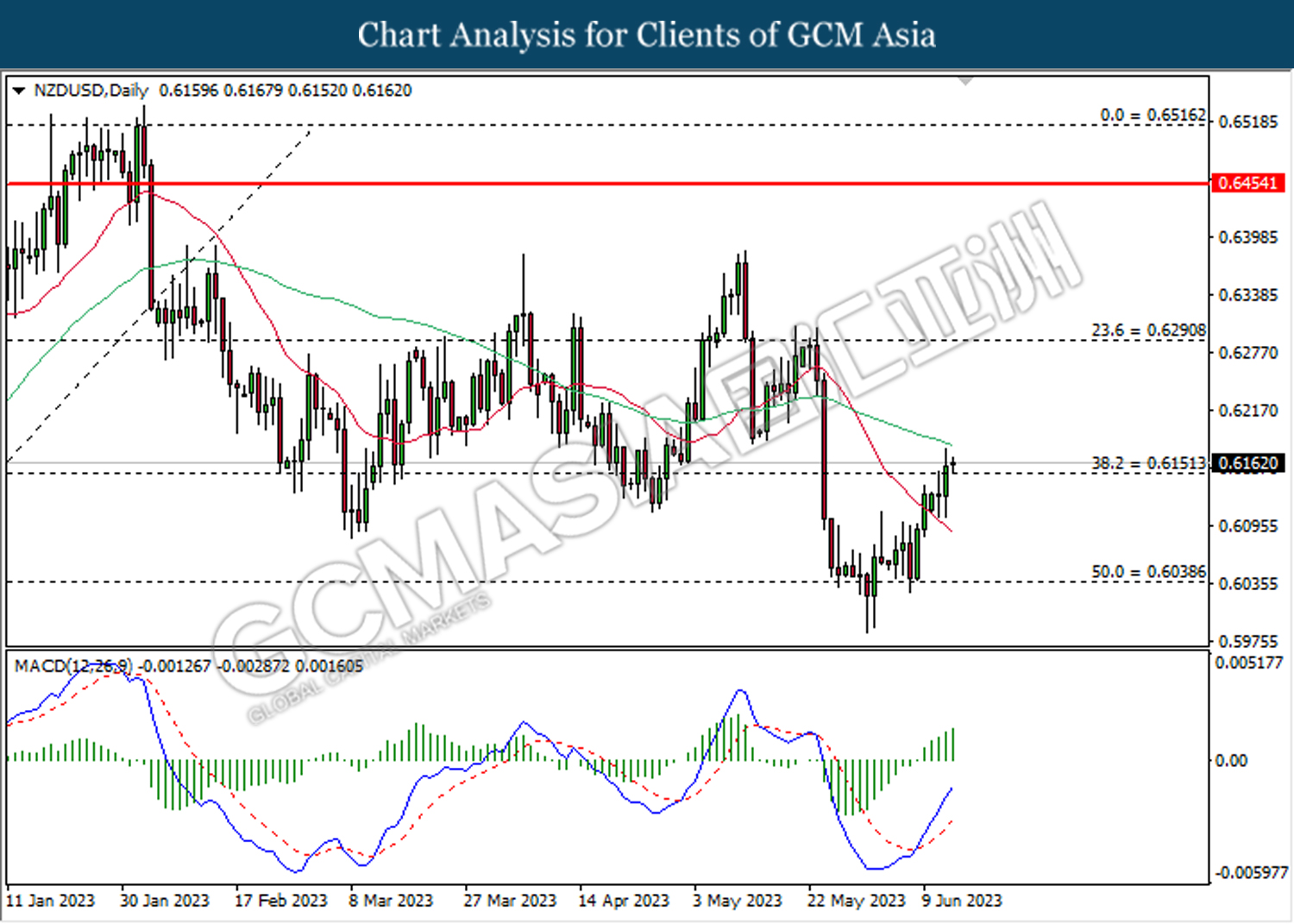

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

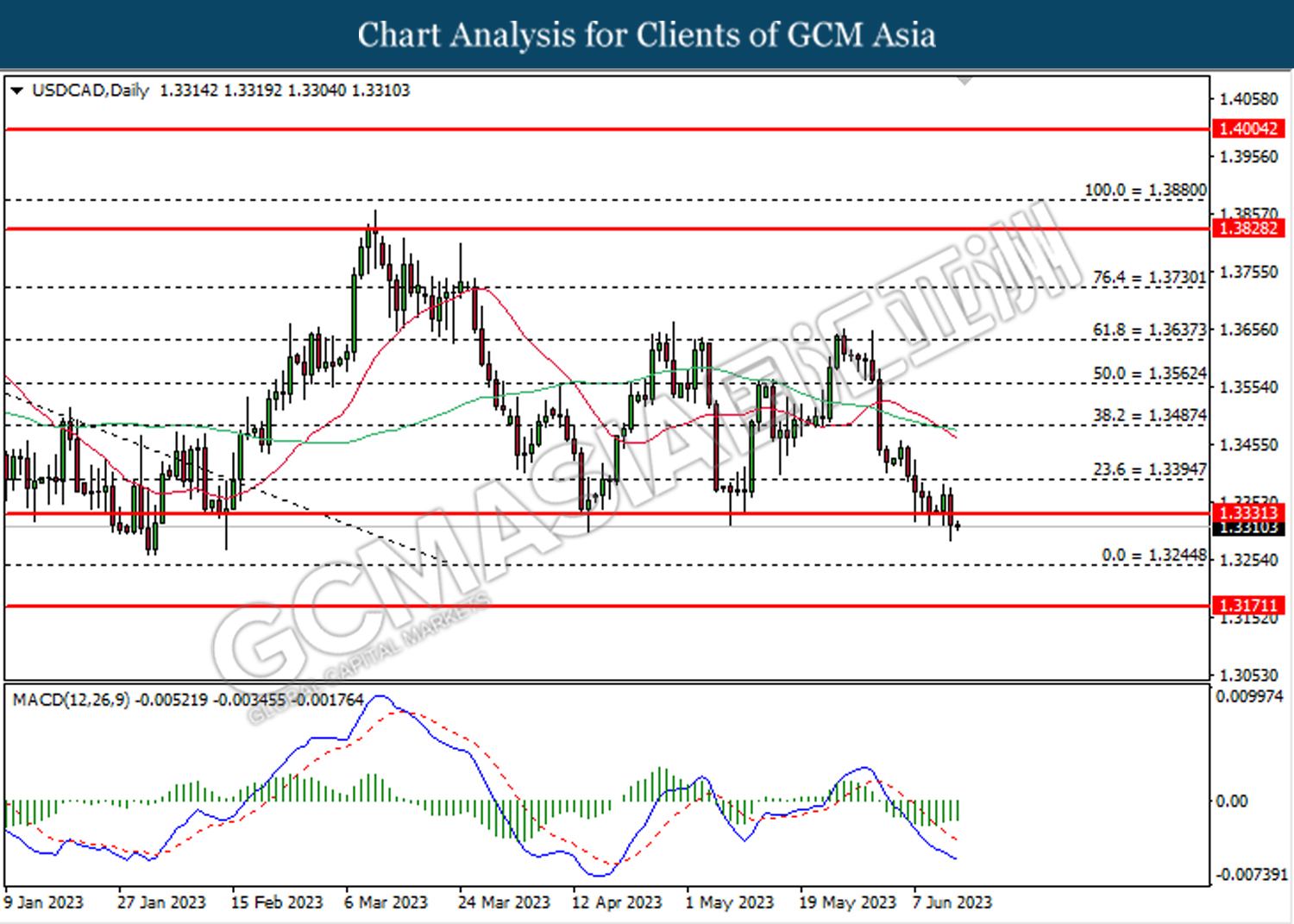

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3330. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3245.

Resistance level: 1.3330, 1.3395

Support level: 1.3245, 1.3170

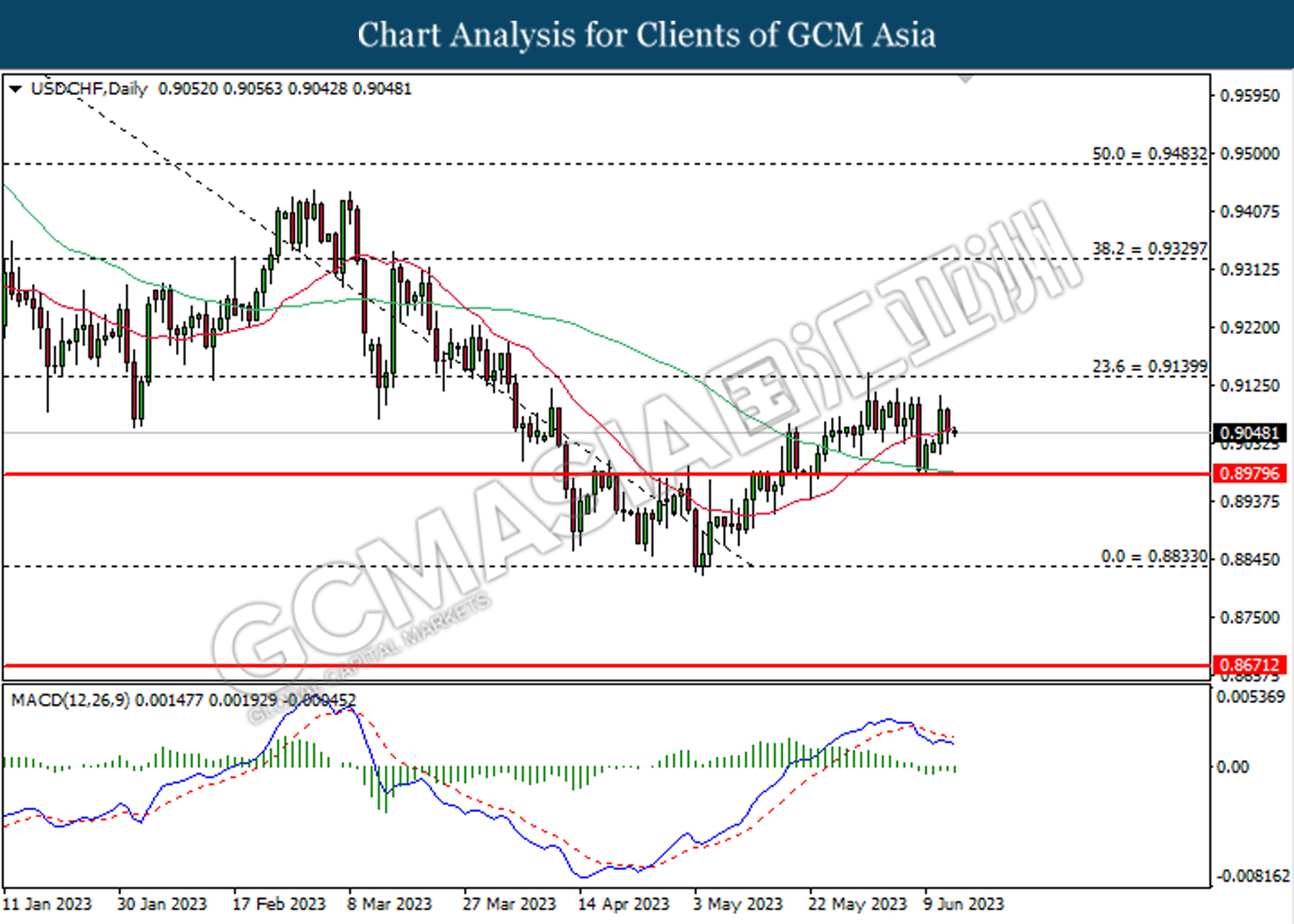

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9140.

Resistance level: 0.9140, 0.9330

Support level: 0.8980, 0.8835

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support zone. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 70.15.

Resistance level: 70.15, 74.00

Support level: 66.50, 62.00

GOLD_, Daily: Gold price was traded lower following the prior breakout below the previous support level at 1951.60. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level at 1889.55.

Resistance level: 1951.60, 1980.00

Support level: 1889.55, 1839.40