15 June 2023 Afternoon Session Analysis

Greenback jumped amid Fed’s hawkish comment.

The dollar index, which was traded against a basket of six major currencies, extended its gains during the Asian trading session as the Fed’s hawkish comment continued to spur the sentiment in the dollar market. Prior to the Asian trading hour, the Fed unanimously decided to hold its interest rate at 5.25% as there were some progress in curbing the inflation. In the FOMC Press Conference, the Fed’s chairman Jerome Powell expressed optimism over their effort on cooling down the inflation, where he pointed that the inflationary pressure in the US is meaningfully below trend. However, the Fed predicted that they will still increase the interest rate by twice where the terminal rate would eventually reach 5.6% before 2024. Also, Jerome Powell also said that he does not see a rate cut until inflation comes down meaningfully and significantly. He highlighted that none of the member was considering a rate cut by this year. After all, the investors are now anticipating a 61.5% chance of the Fed hiking rate by a quarter point in the next meeting, according to the CME FedWatch Tool. As of writing, the dollar index rose 0.38% to 103.35.

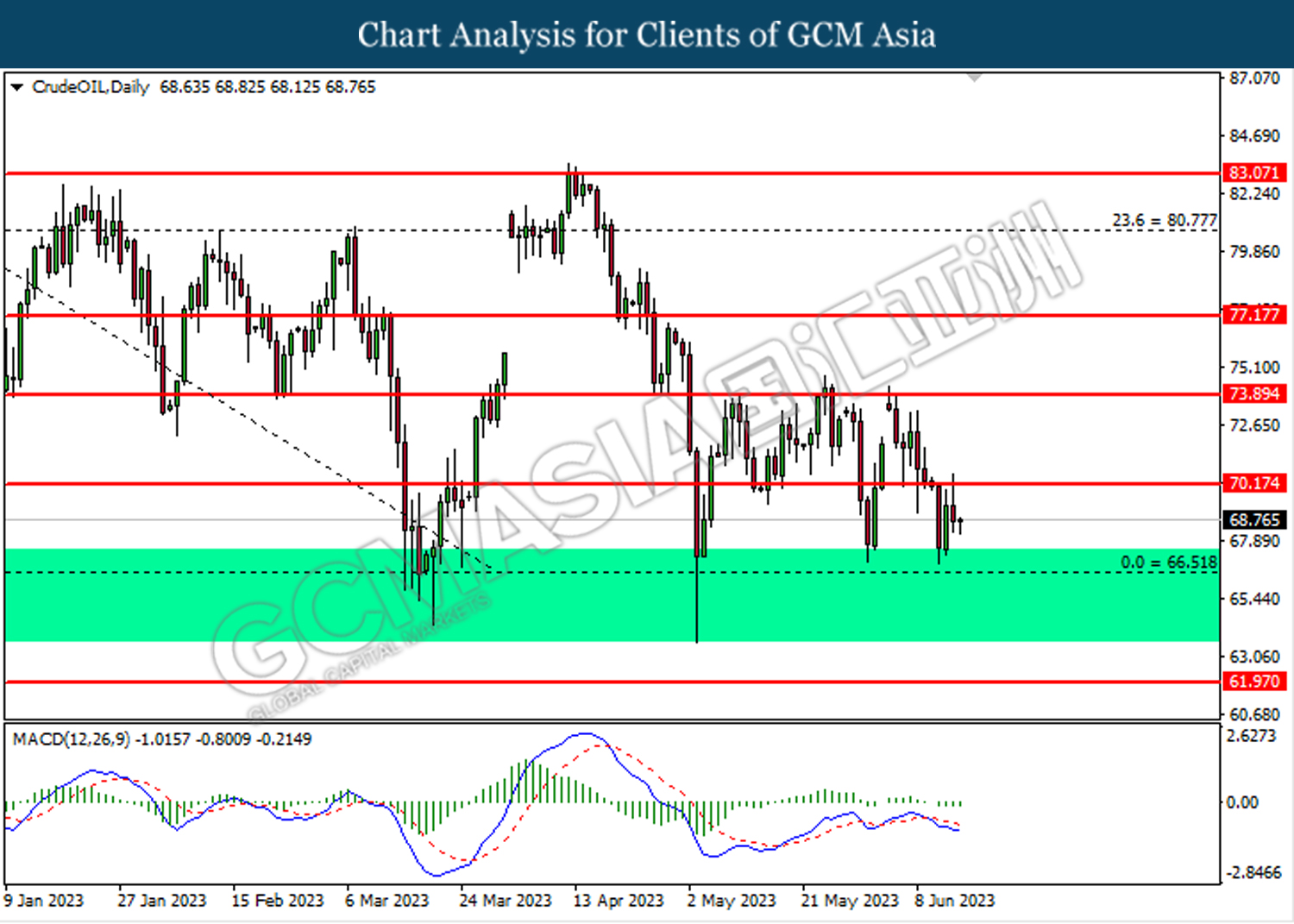

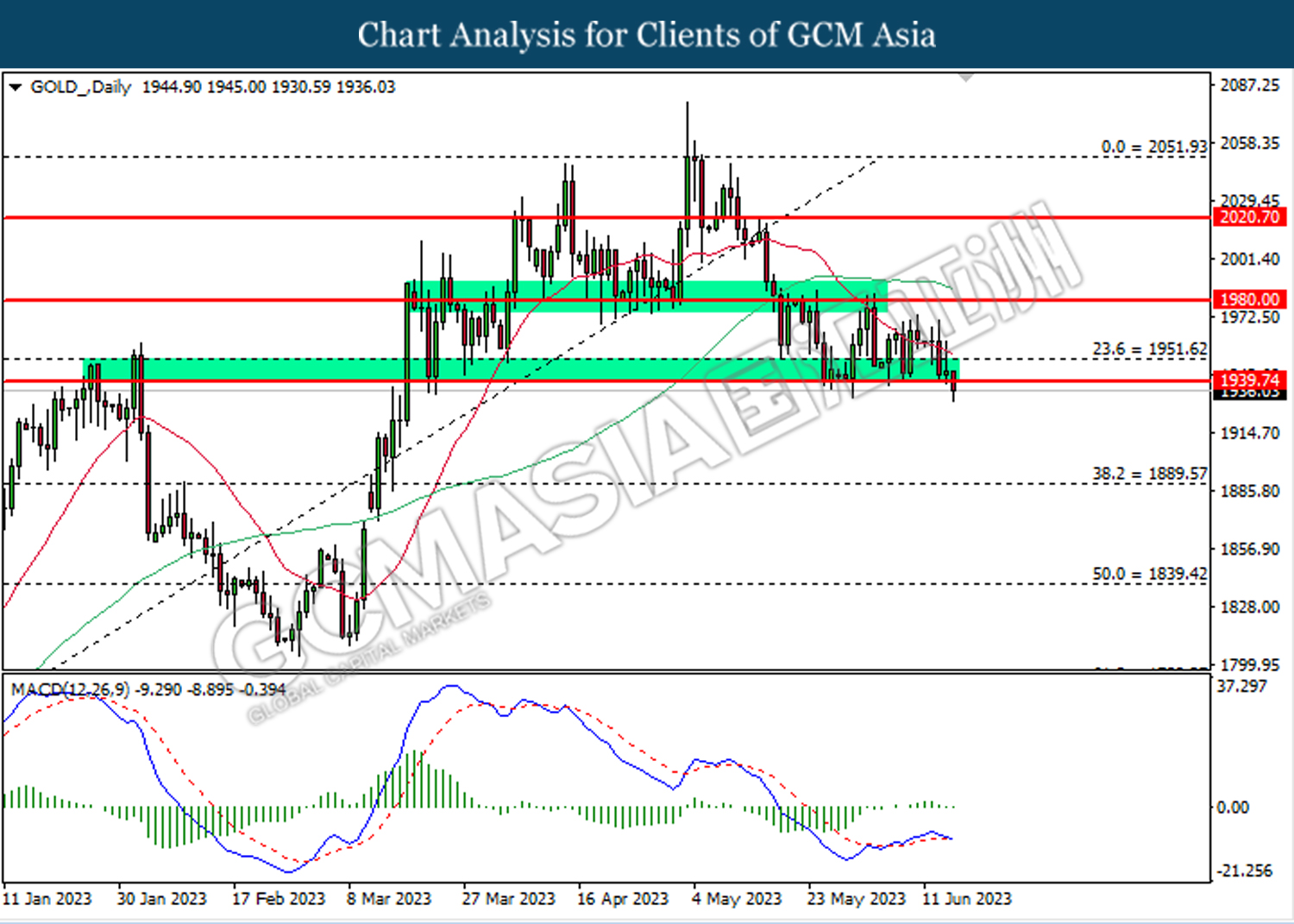

In the commodities market, crude oil prices edged down -0.01% to $68.70 per barrel as the EIA reported some stockpiles in the inventory level. Besides, gold prices were down by -0.30% to $1936.05 per troy ounce as the dollar strengthened following the hawkish statement from Jerome Powell.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:45 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – Deposit Facility Rate (Jun) | 3.25% | 3.50% | – |

| 20:15 | EUR – ECB Interest Rate Decision (Jun) | 3.75% | 4.00% | – |

| 20:30 | USD – Core Retail Sales (MoM) (May) | 0.4% | 0.1% | – |

| 20:30 | USD – Initial Jobless Claims | 261K | 250K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jun) | -10.4 | -13.5 | – |

| 20:30 | USD – Retail Sales (MoM) (May) | 0.4% | -0.1% | – |

Technical Analysis

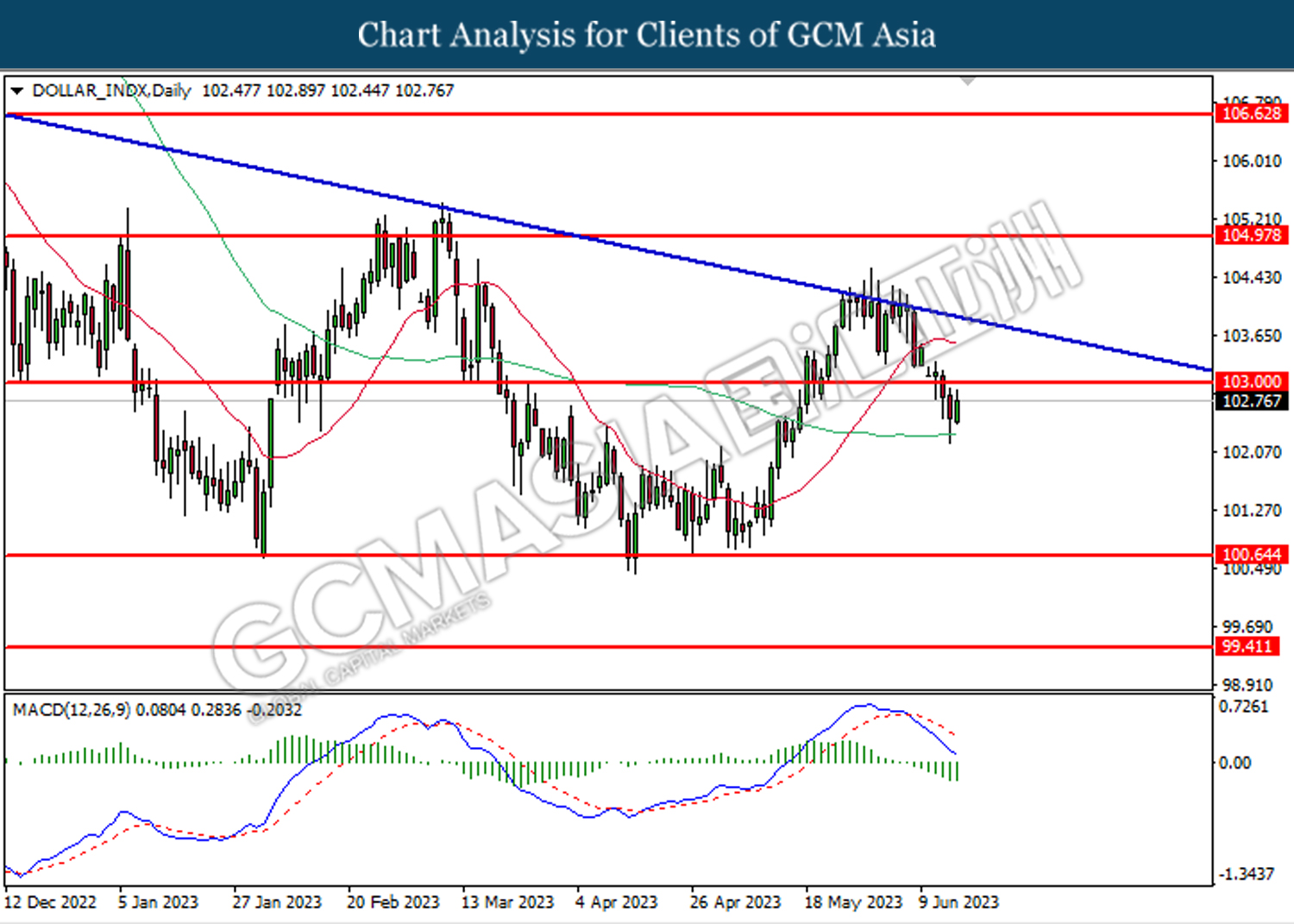

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

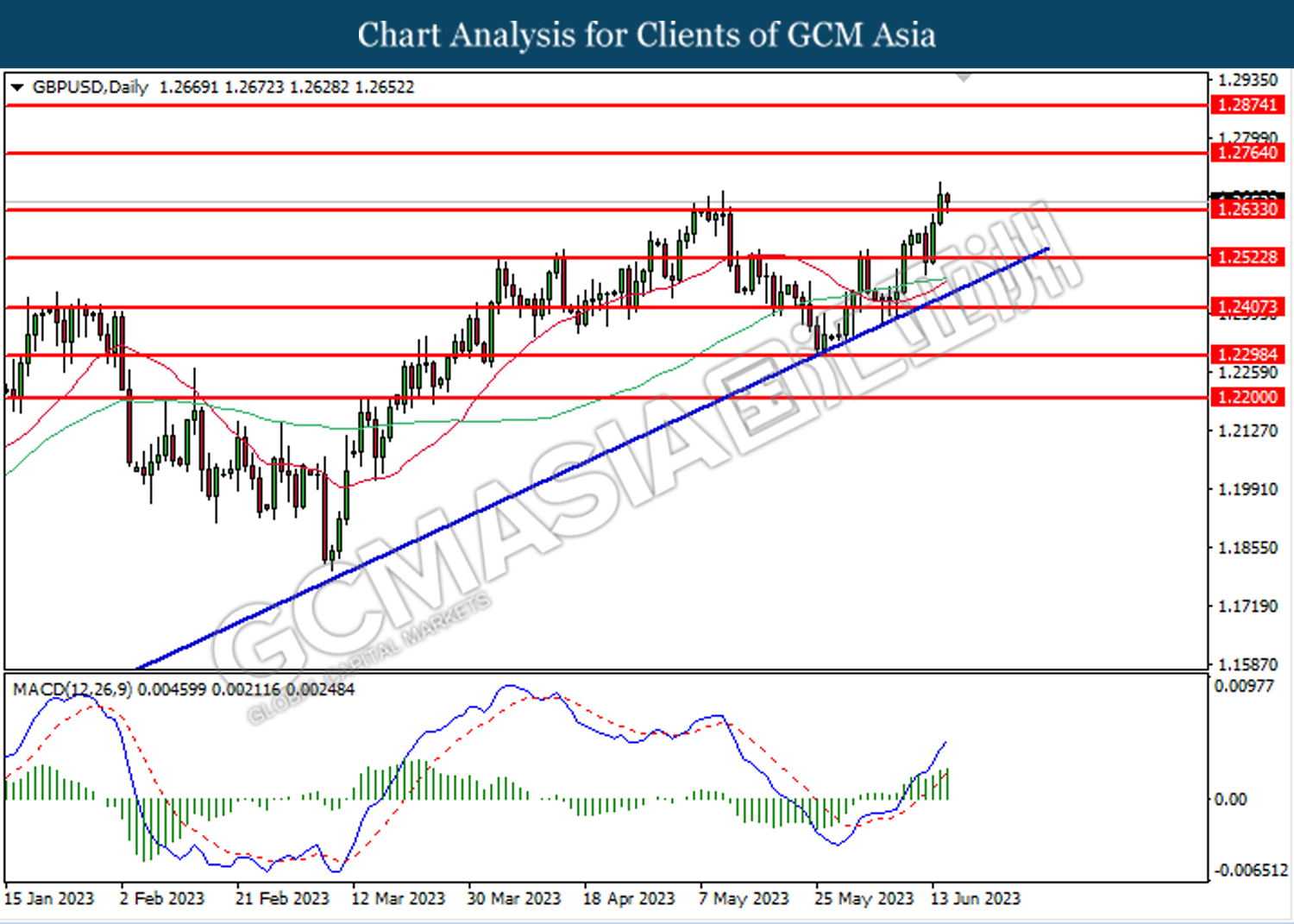

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2635. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2765.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2525

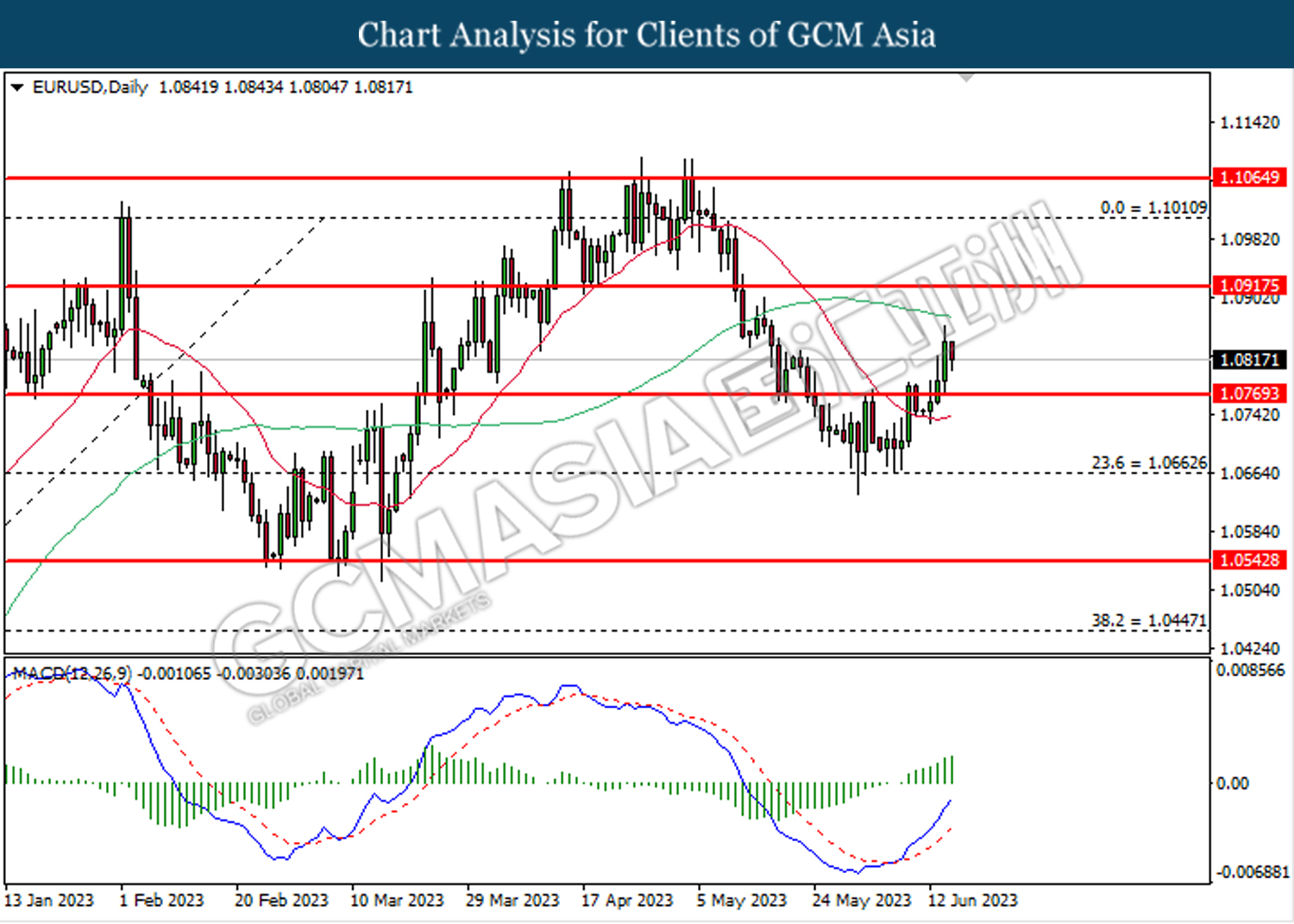

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0770. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0915.

Resistance level: 1.0915, 1.1010

Support level: 1.0770, 1.0665

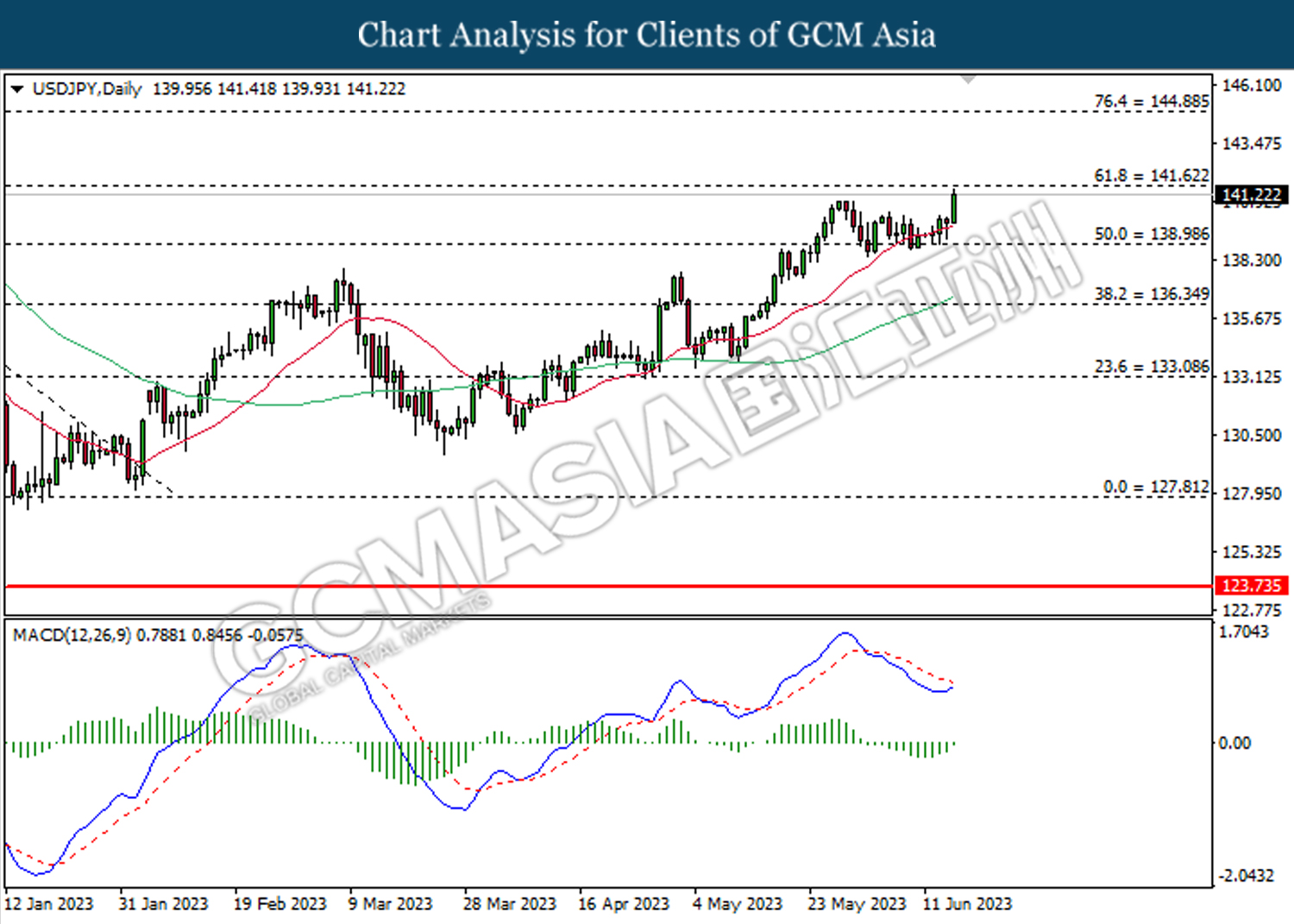

USDJPY, Daily: USDJPY was traded higher following the prior rebound from the support level at 139.00. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 141.60.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

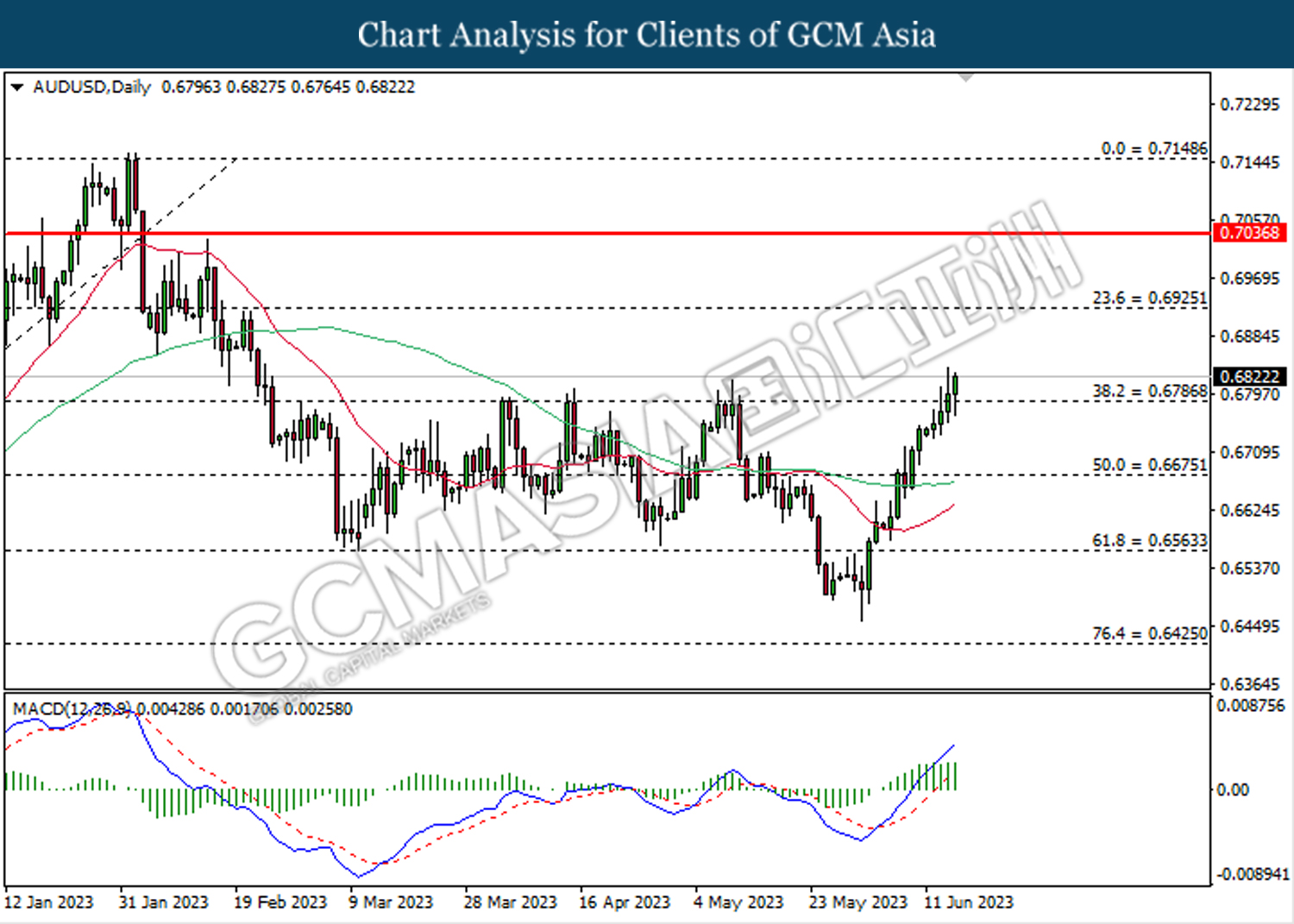

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 0.6925.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

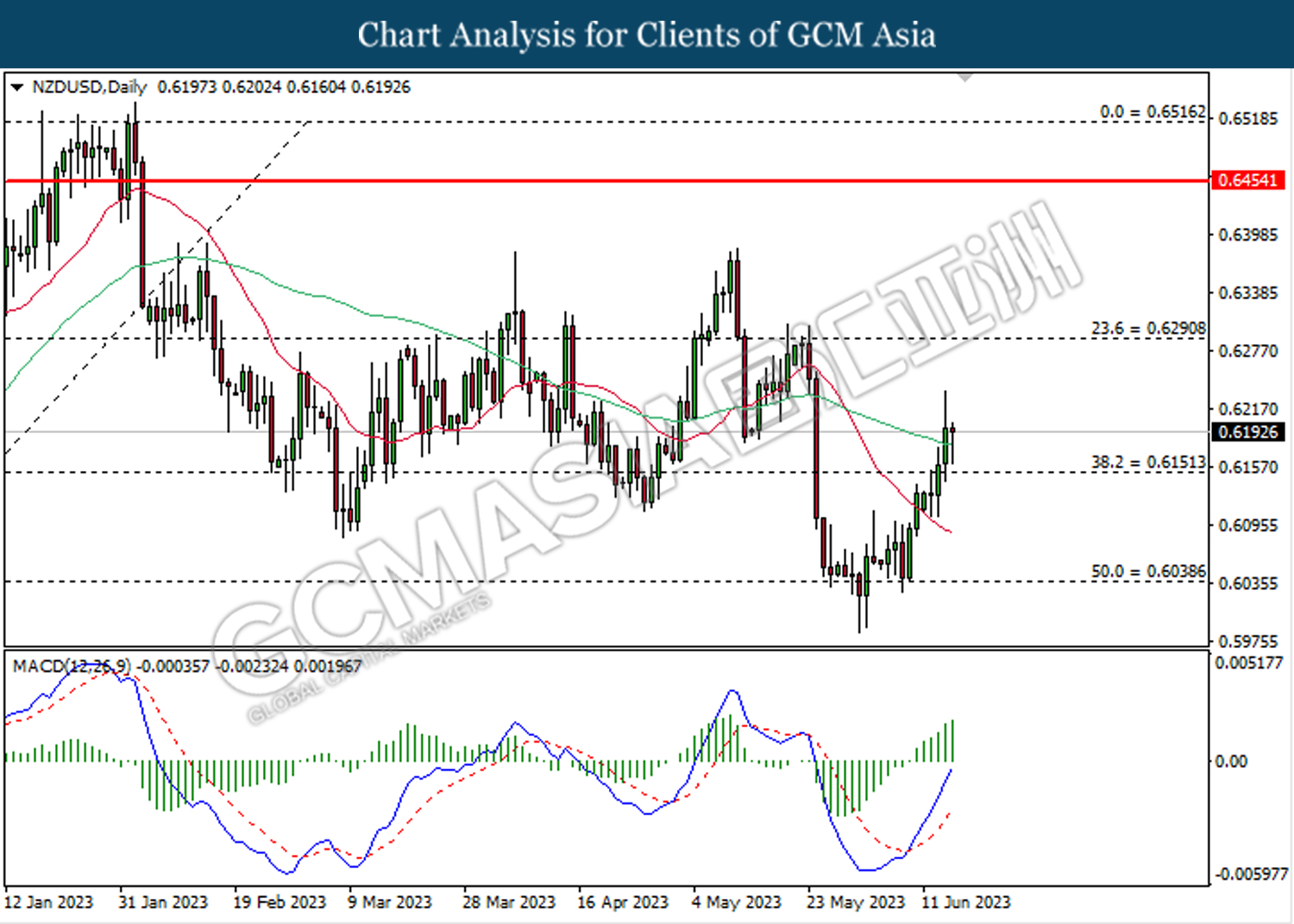

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

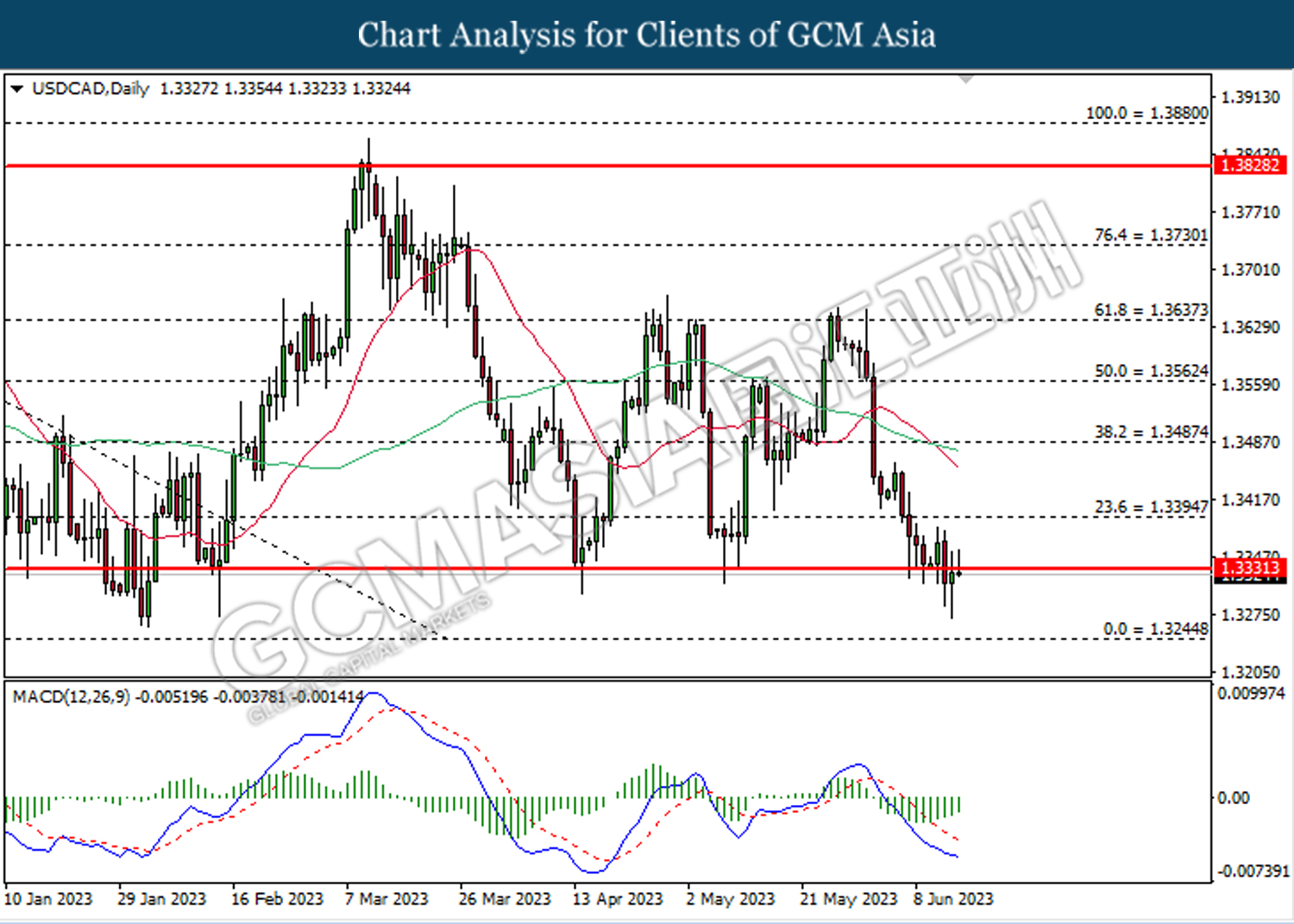

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3330. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3245.

Resistance level: 1.3330, 1.3395

Support level: 1.3245, 1.3170

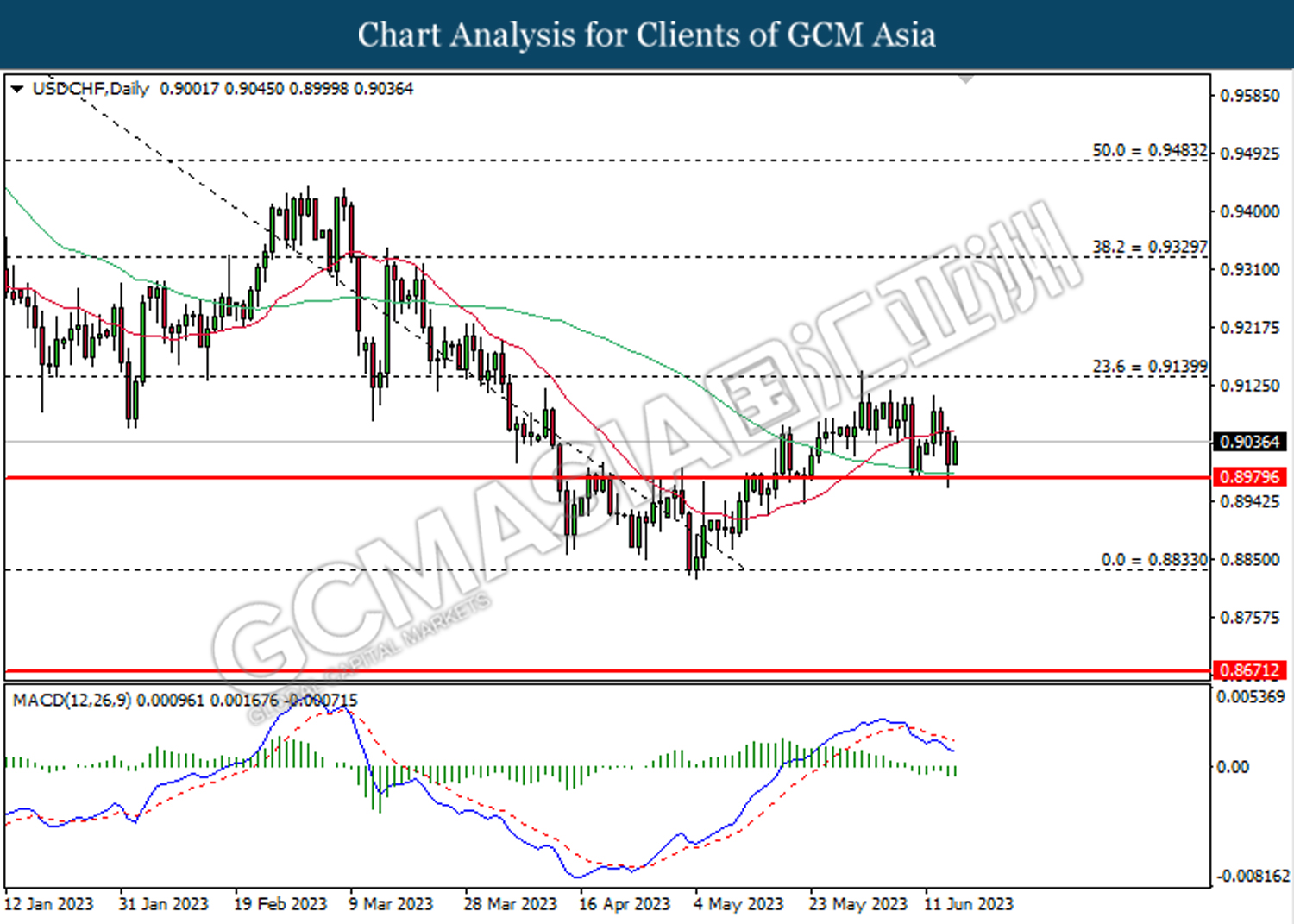

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9140.

Resistance level: 0.9140, 0.9330

Support level: 0.8980, 0.8835

CrudeOIL, Daily: Crude oil price was traded higher following the prior rebound from the support zone. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 70.15.

Resistance level: 70.15, 74.00

Support level: 66.50, 62.00

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1939.75. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1951.60, 1980.00

Support level: 1939.75, 1889.55