19 June 2023 Morning Session Analysis

Greenback wobbled amid mixed economic data.

The dollar index, which was traded against a basket of six major currencies, lingered near the 6 week low during later last week as a series of economic data showed unclear signal in the market. Last Thursday, the US reported that the number of American who filed for unemployment claims remained at 262K, far above the market expectations of 249K, showing the labor market in the US remained fragile. Besides, the Philadelphia Fed Manufacturing Index for the month of June came in at -13.7, slightly below the market forecast at -13.5. It was the 10th consecutive negative reading, where the current activity and new orders remained negative. However, the dollar market sentiment was lifted by the upbeat consumer sentiment data from the Michigan University. According to the Friday’s data, the June preliminary report for the Michigan Consumer Sentiment Index came in at 63.9, above the market expectation at 60.0. With that, it reflected that the American were having greater optimism as inflation eased and policymakers resolved the debt ceiling crisis. As of writing, the dollar index rose 0.06% to 102.30.

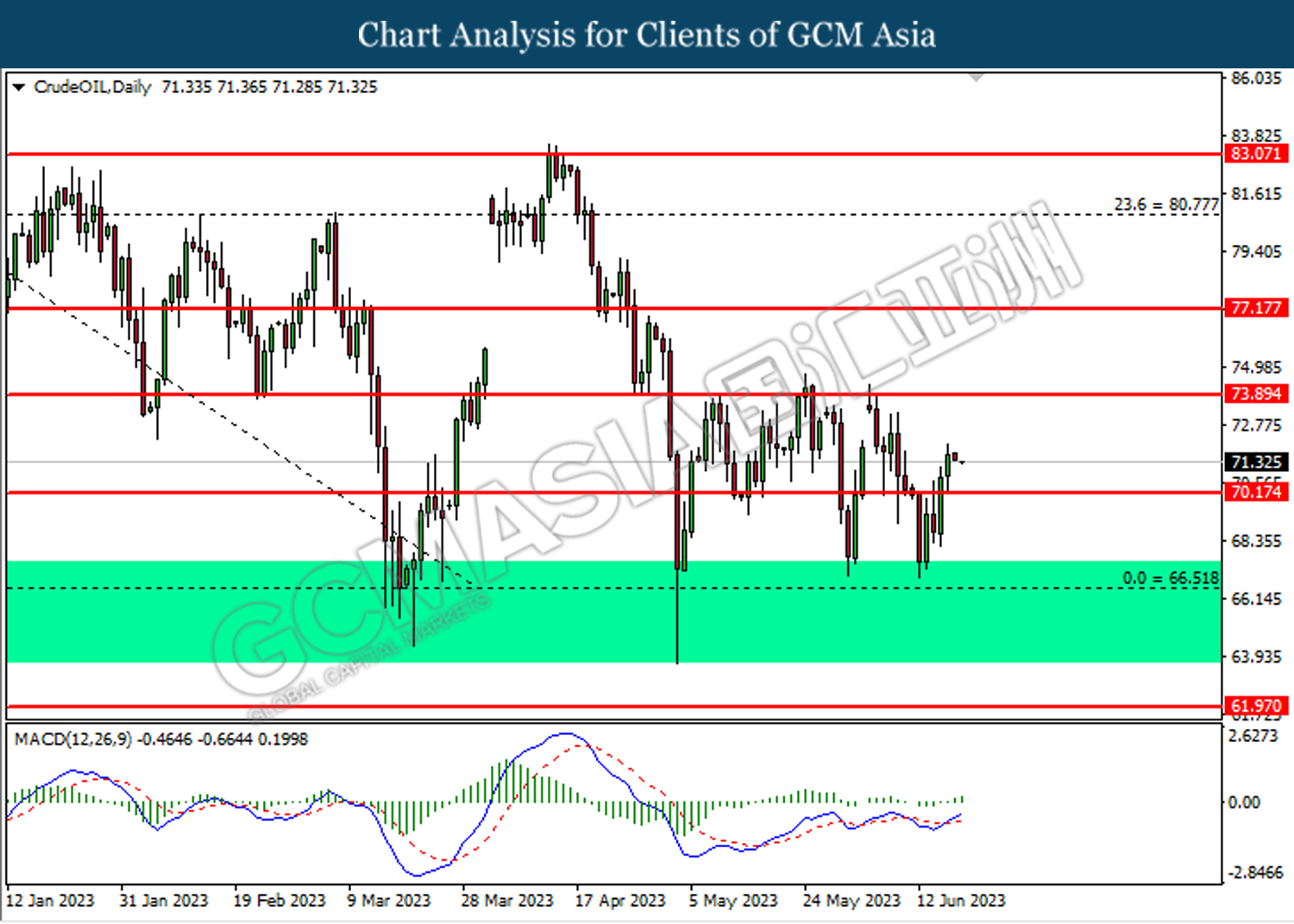

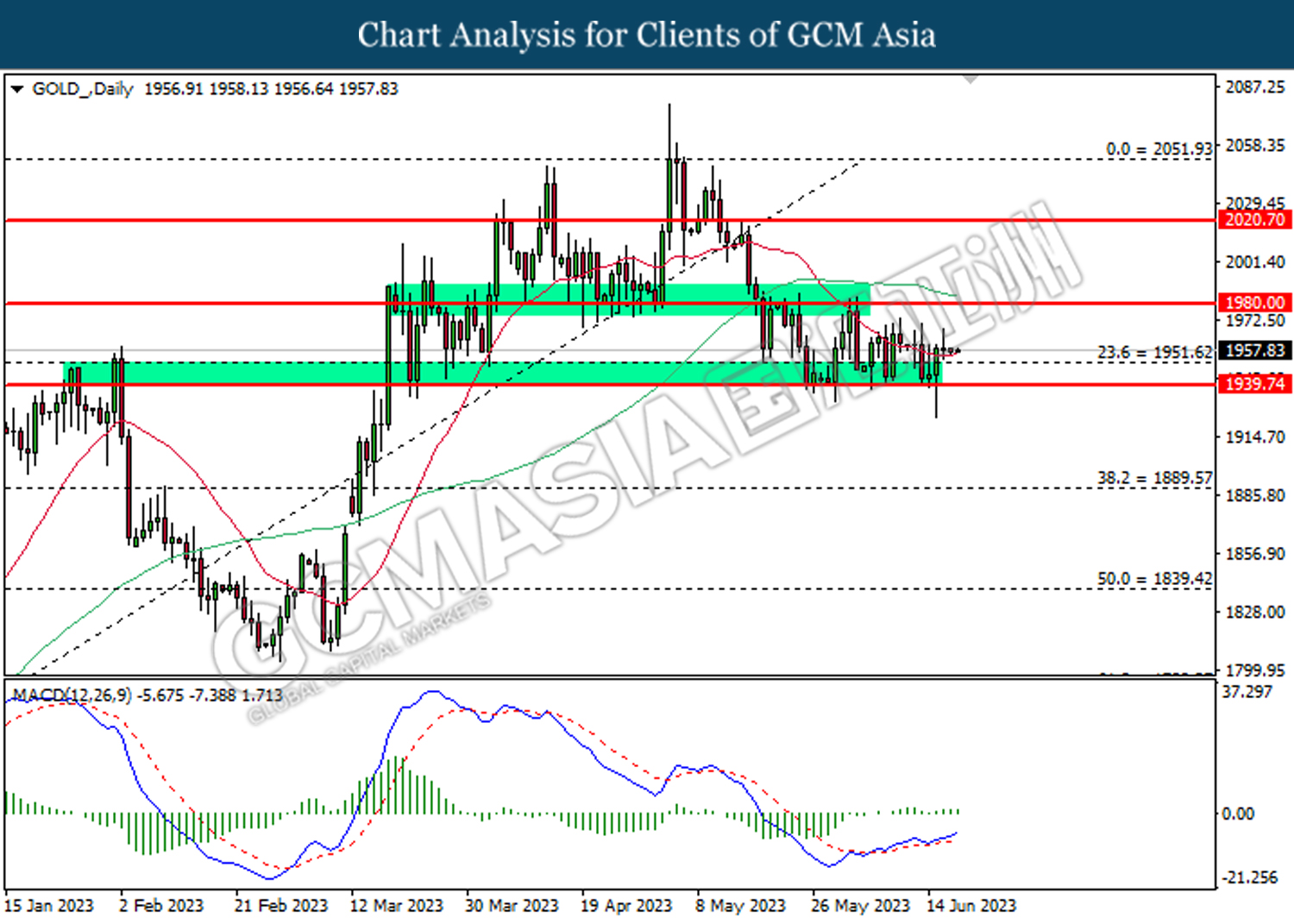

In the commodities market, crude oil prices dropped by -0.03% to $71.45 per barrel as Chinese higher demand and OPEC cut outbalanced the supply concern. Besides, gold prices edged down by -0.01% to $1957.85 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

All Day USD Juneteenth

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

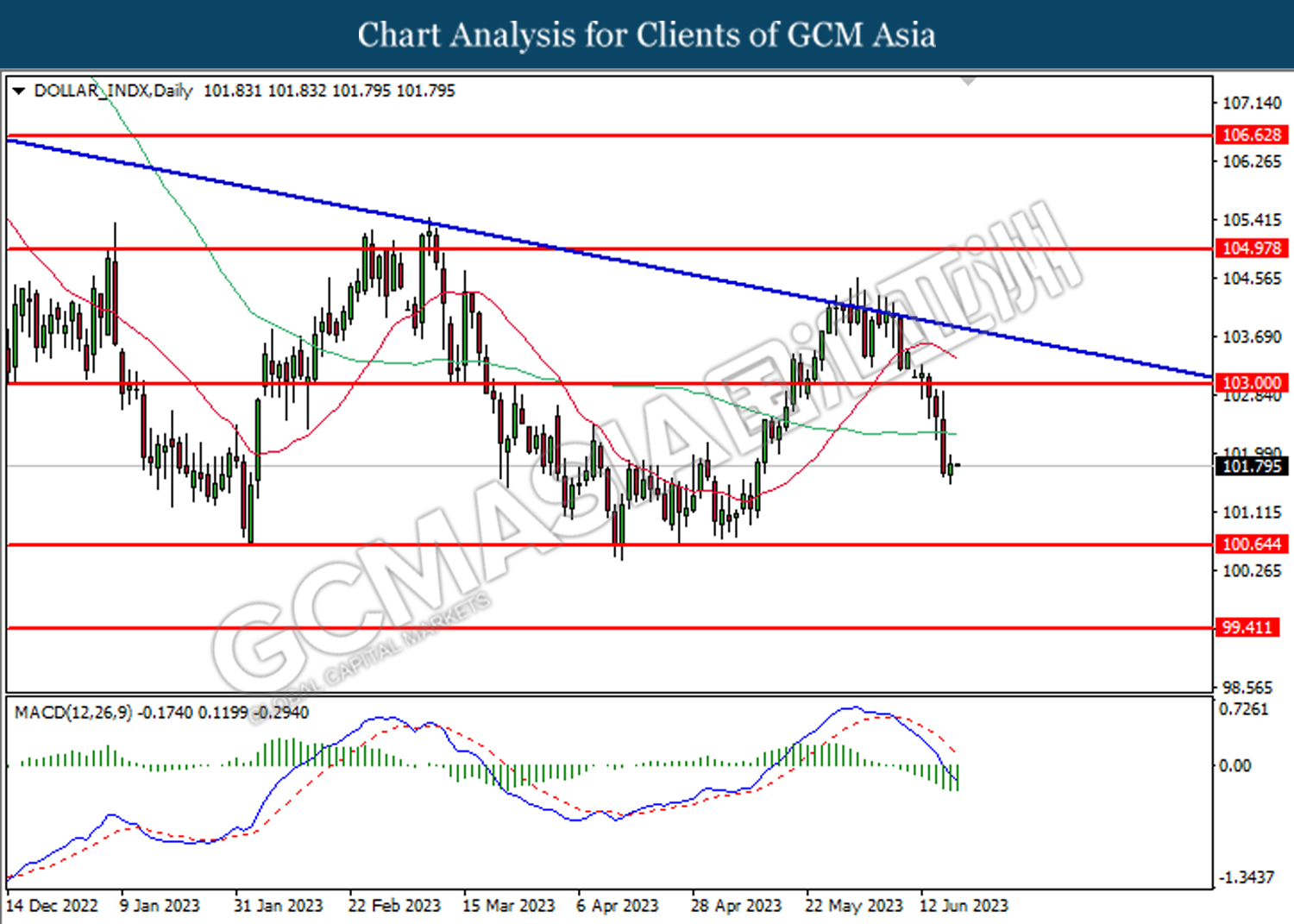

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

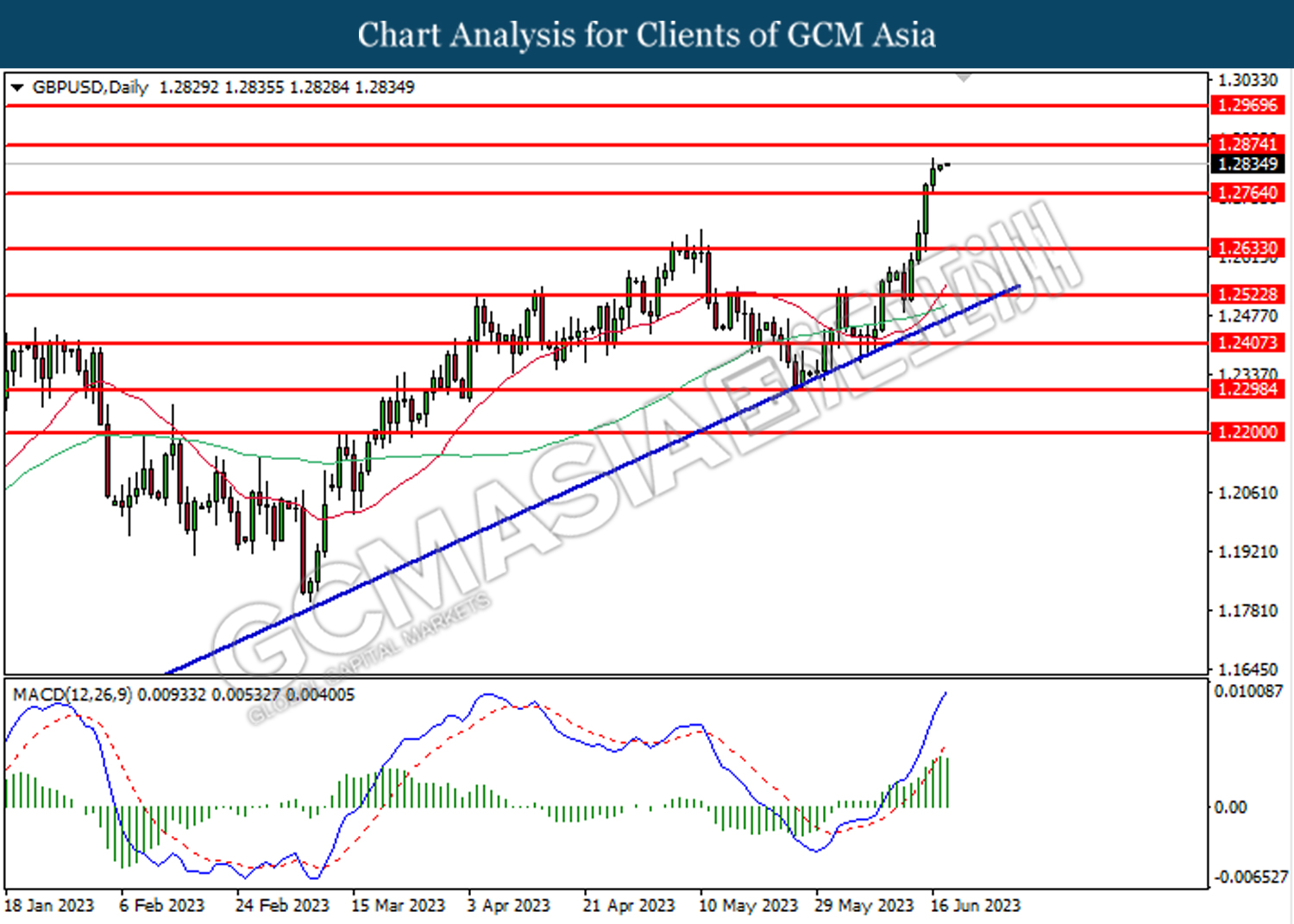

GBPUSD, Daily: GBPUSD was traded higher following the prior breakout above the previous resistance level at 1.2765. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2875.

Resistance level: 1.2875, 1.2970

Support level: 1.2635, 1.2525

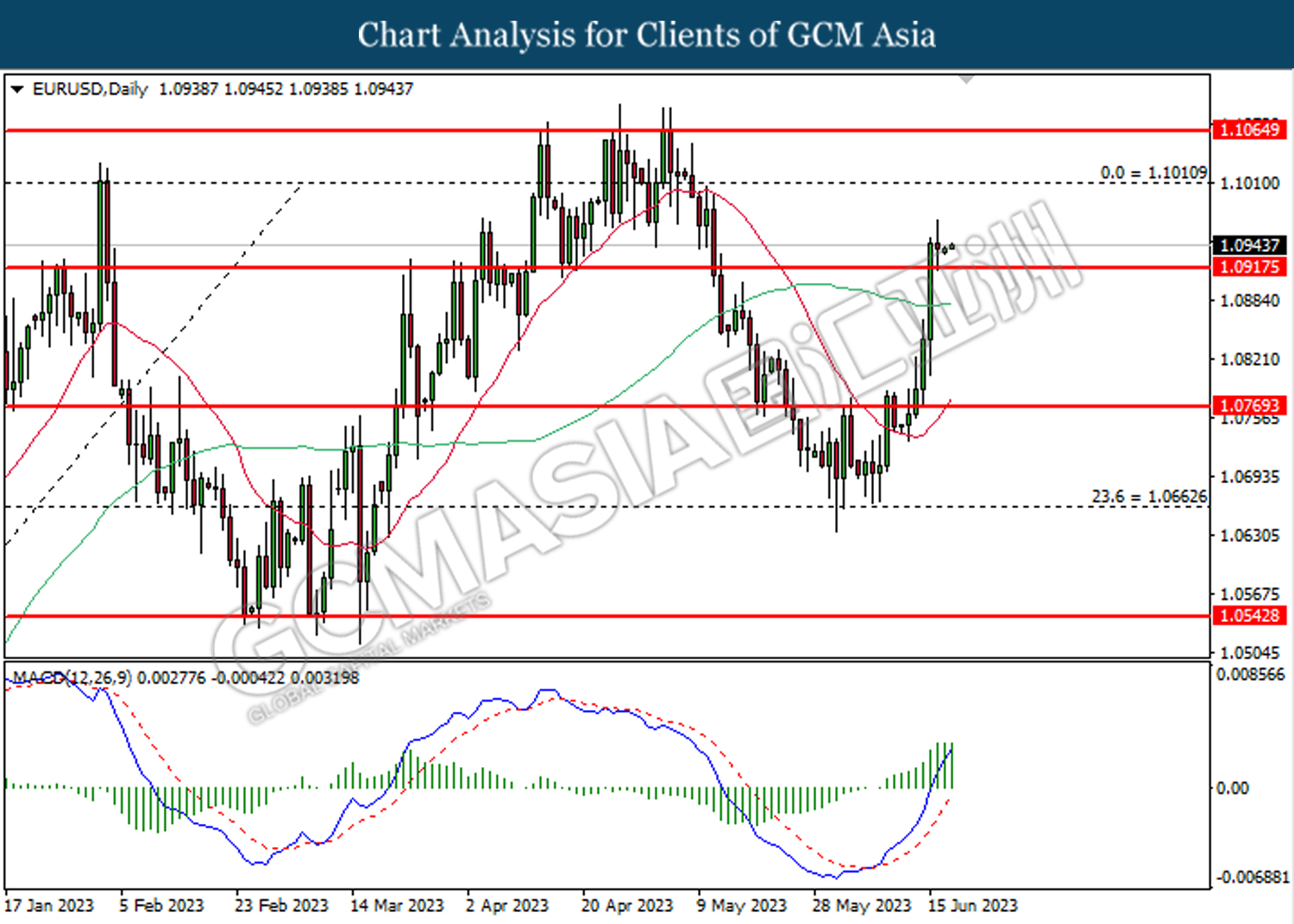

EURUSD, Daily: EURUSD was traded higher following the prior breakout above the previous resistance level at 1.0915. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.1010.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

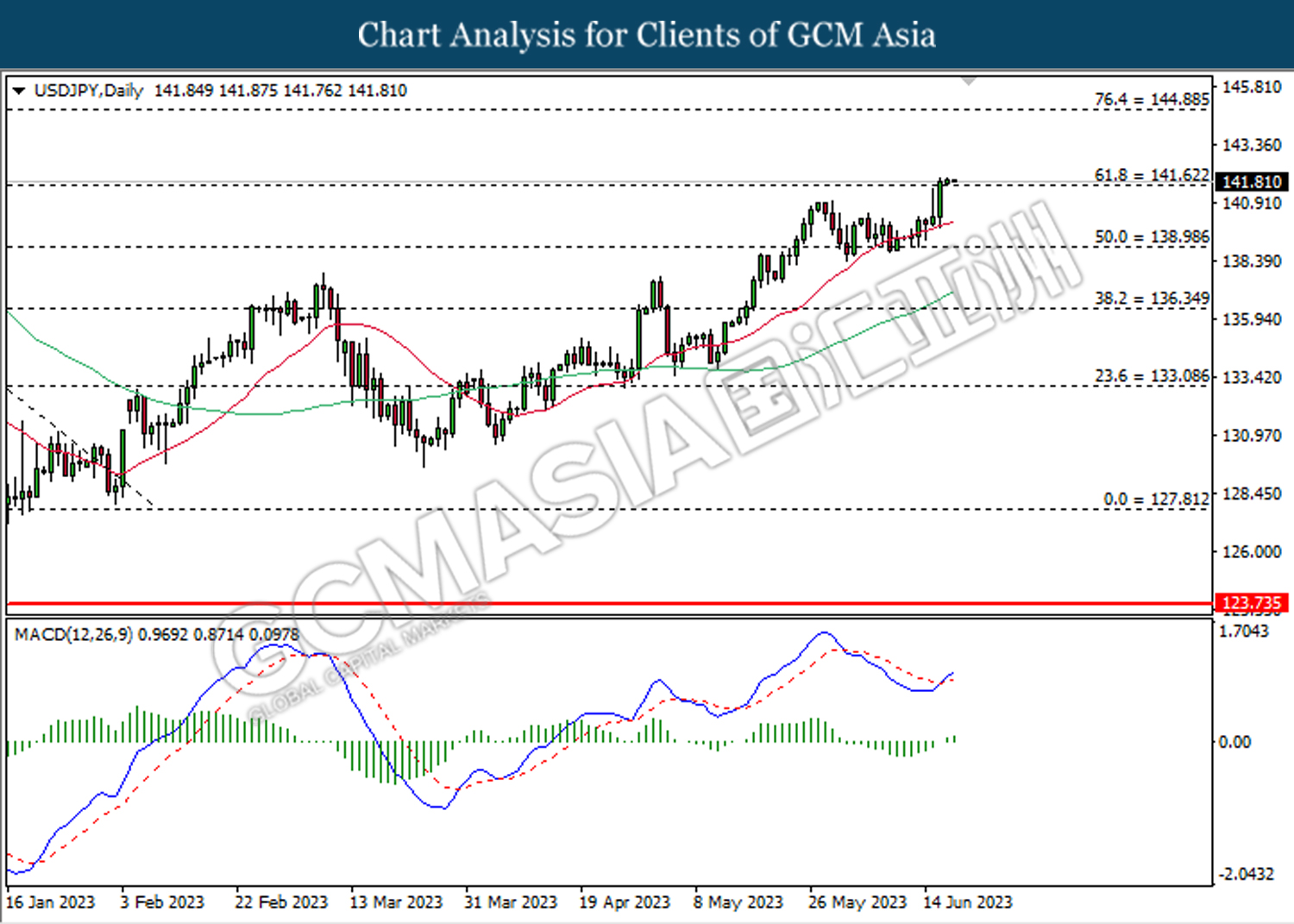

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

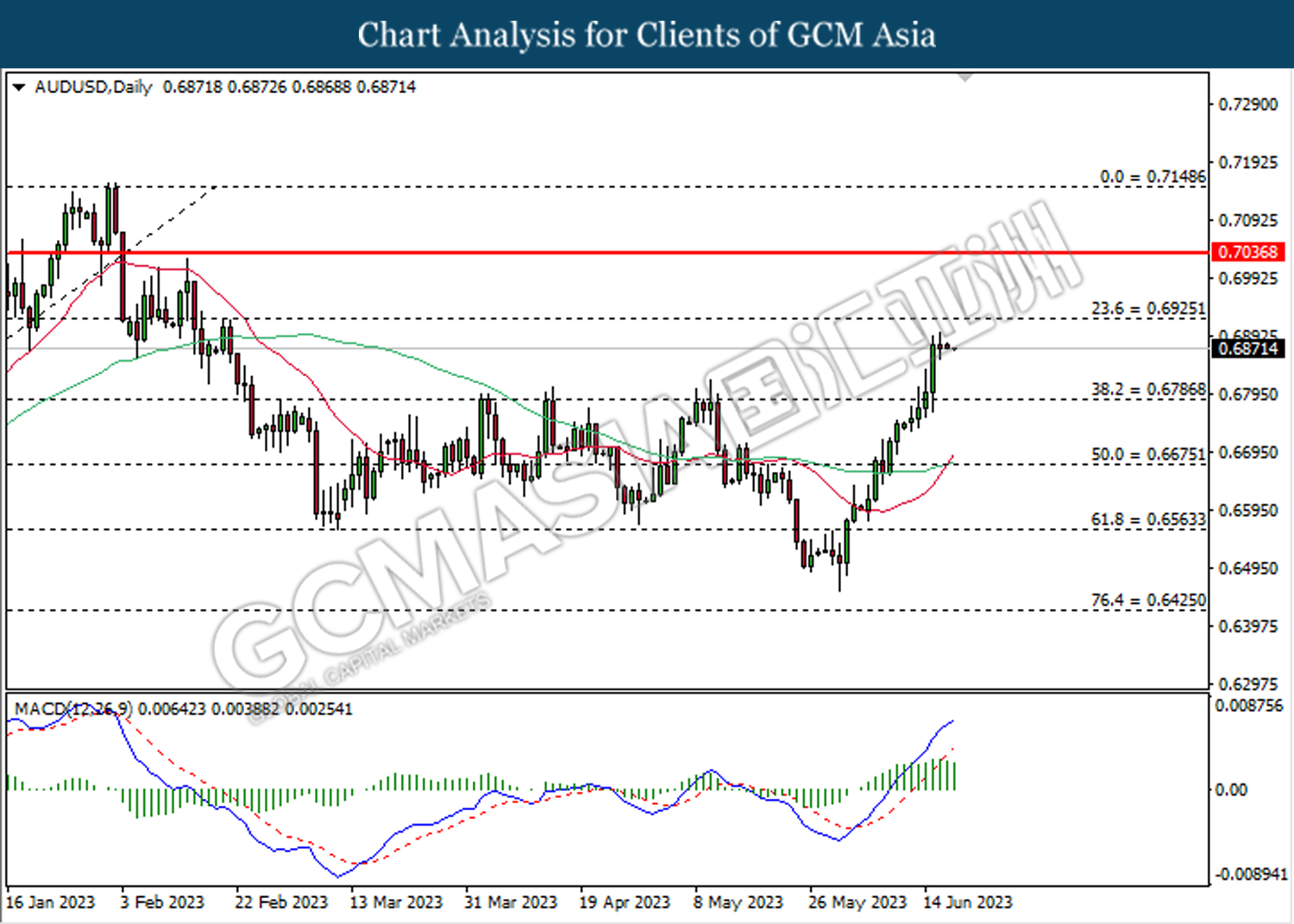

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 0.6925.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

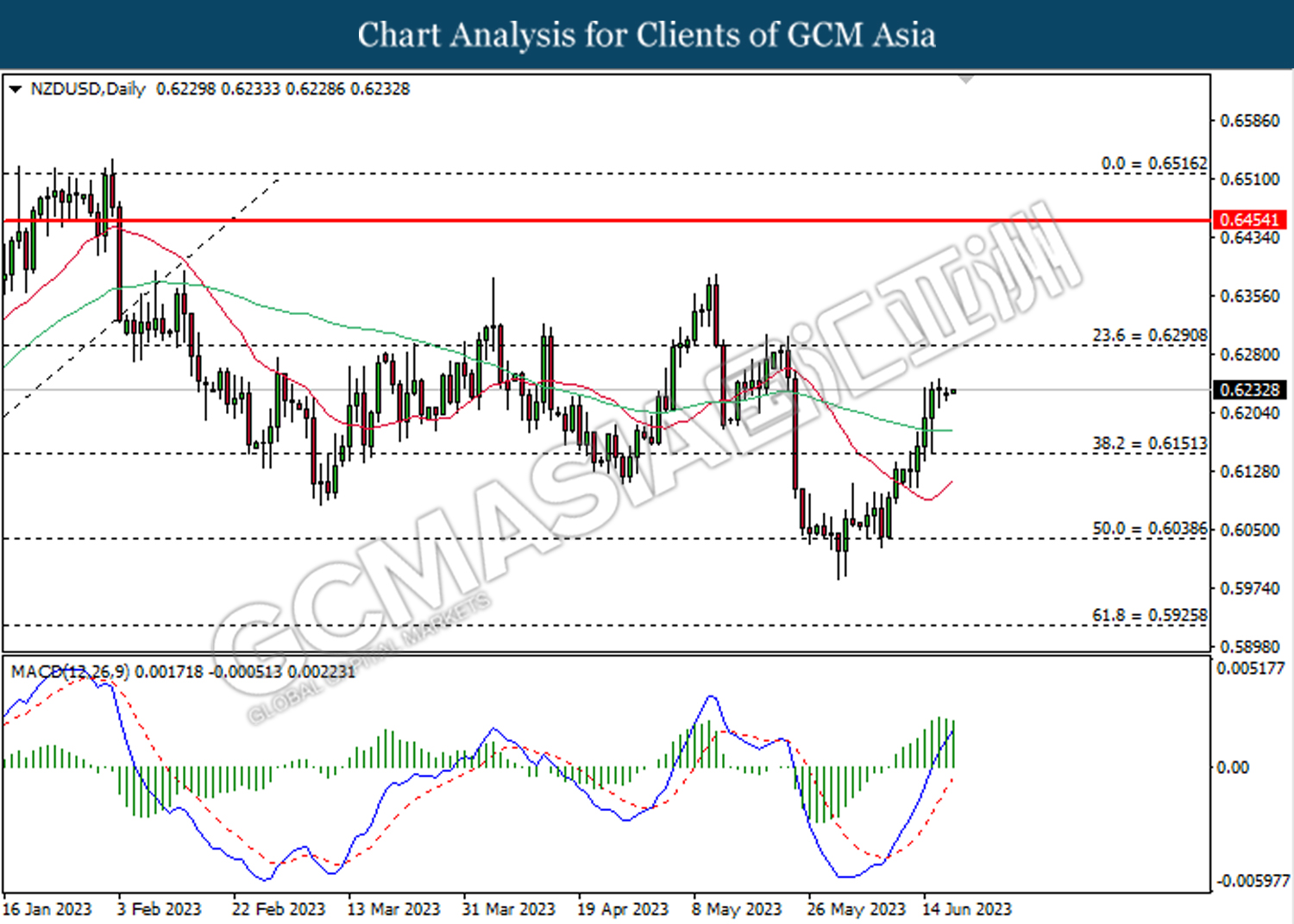

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

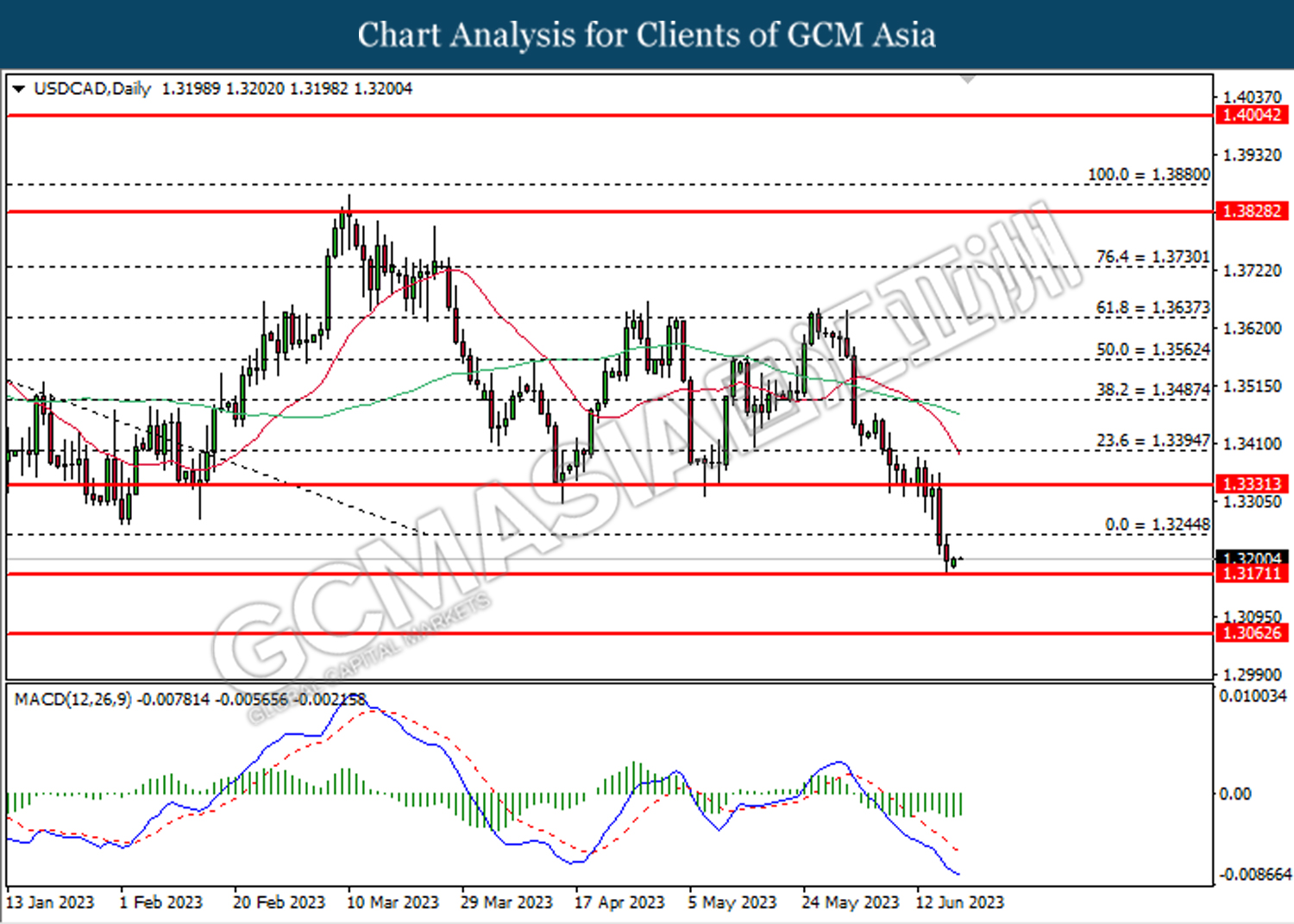

USDCAD, Daily: USDCAD was traded lower following the prior breakout below the previous support level at 1.3245. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3170.

Resistance level: 1.3245, 1.3330

Support level: 1.3170, 1.3065

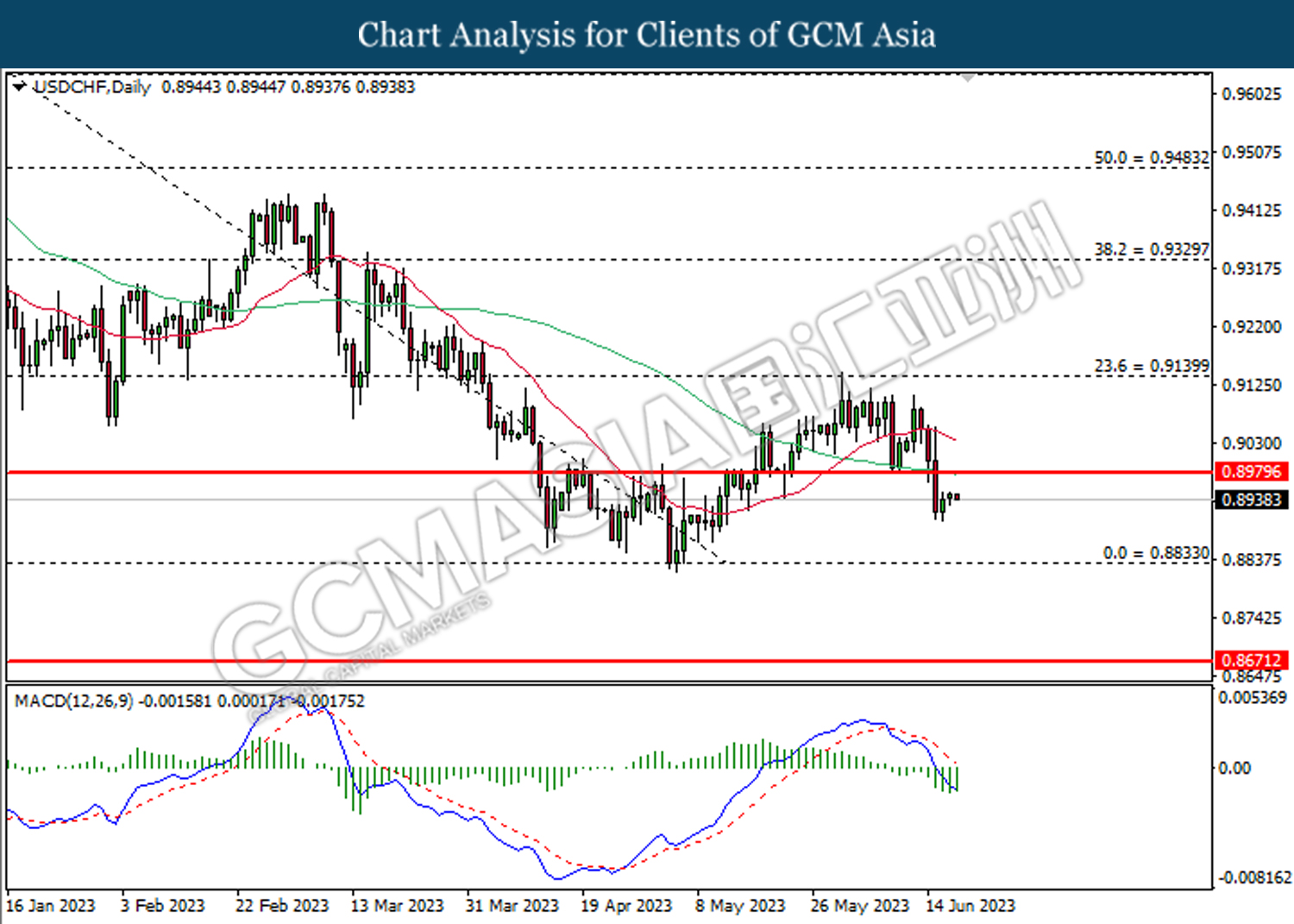

USDCHF, Daily: USDCHF was traded lower following the prior breakout below the previous support level at 0.8980. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.8835.

Resistance level: 0.8980, 0.9140

Support level: 0.8835, 0.8670

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1951.60. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75