19 June 2023 Afternoon Session Analysis

Japanese Yen slipped as BoJ’s move was widely expected.

The Japanese Yen against the US dollar slipped after the Bank of Japan (BoJ) maintained its policy rate at -0.1%, especially intervention in Yield Curve Control (YCC) to support economic growth and achieve a long-term 2% inflation target. Investors widely expected the BOJ’s ultra-loose rate decision as Governor Kazuo Ueda said last month that the central bank is “patiently” maintaining its current policy. As stubbornly low inflation in Japan forced the BoJ to hold YCC longer than expected and ultra loosen monetary policy to achieve a sustainable inflation rate of 2%. However, core inflation was recorded at 3.4% in April, well above the central bank’s 2% target, suggesting that the BOJ will adjust to the YCC sooner or later. In addition, the BoJ Governor also mentioned that inflation is expected to slow below the 2% target in the middle of the current fiscal year and rebound afterwards. As of writing, the pair of USD/JPY traded down by -0.03% to 142.70.

In the commodity market, the crude oil price depreciated by -1.40% as the market was waiting for more rate cuts on China loans. Besides, the gold price slipped by -0.21% to 1954.12 as investors awaited more cues from Fed monetary policy testimonial.

Today’s Holiday Market Close

Time Market Event

All Day USD Juneteenth

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

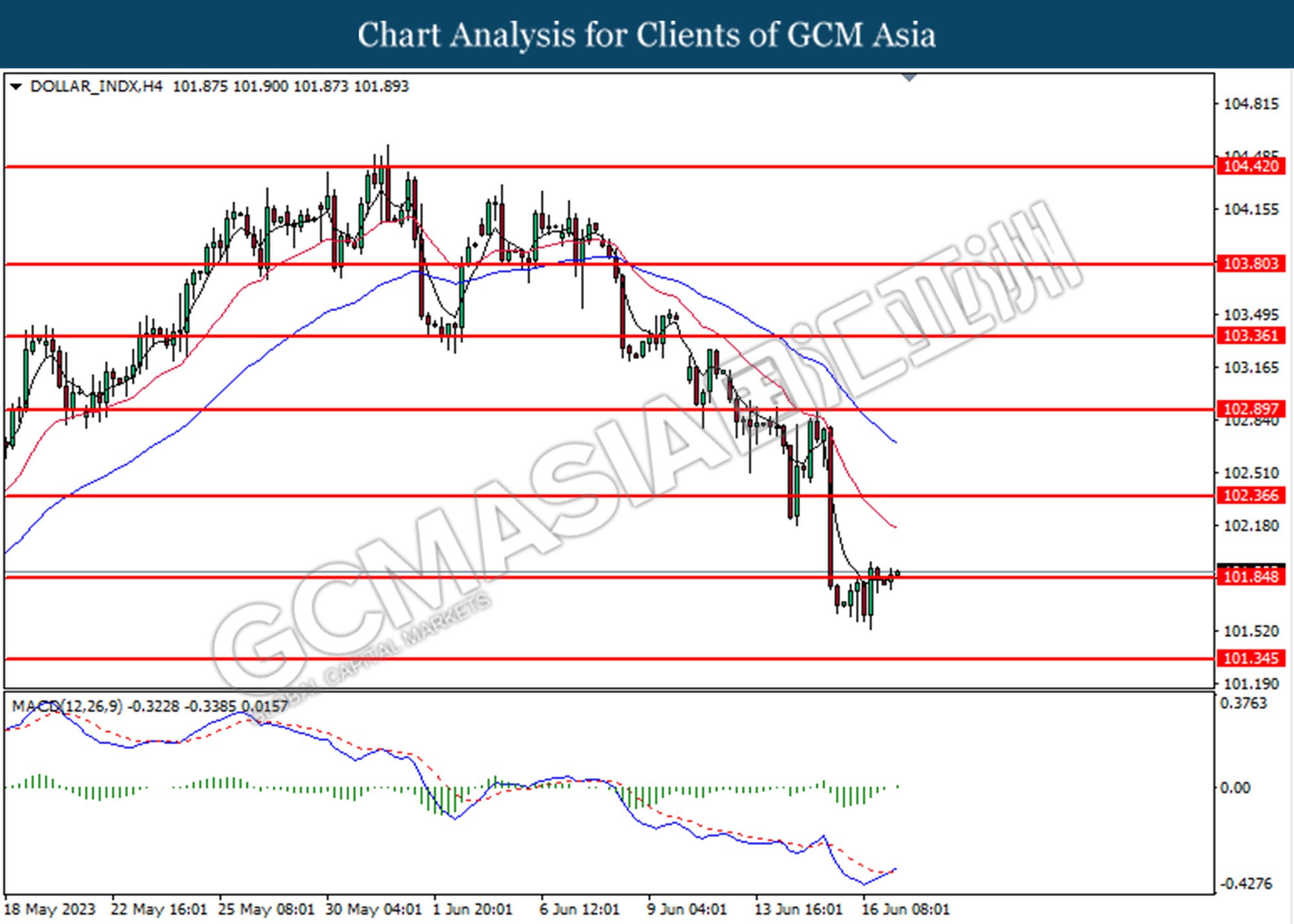

DOLLAR_INDX, H4: Dollar index was traded higher following the prior breakout above the previous resistance level at 101.85. MACD which illustrated increasing bullish momentum suggests the index to extend its gains toward the resistance level.

Resistance level: 102.35, 102.90

Support level: 101.85, 101.35

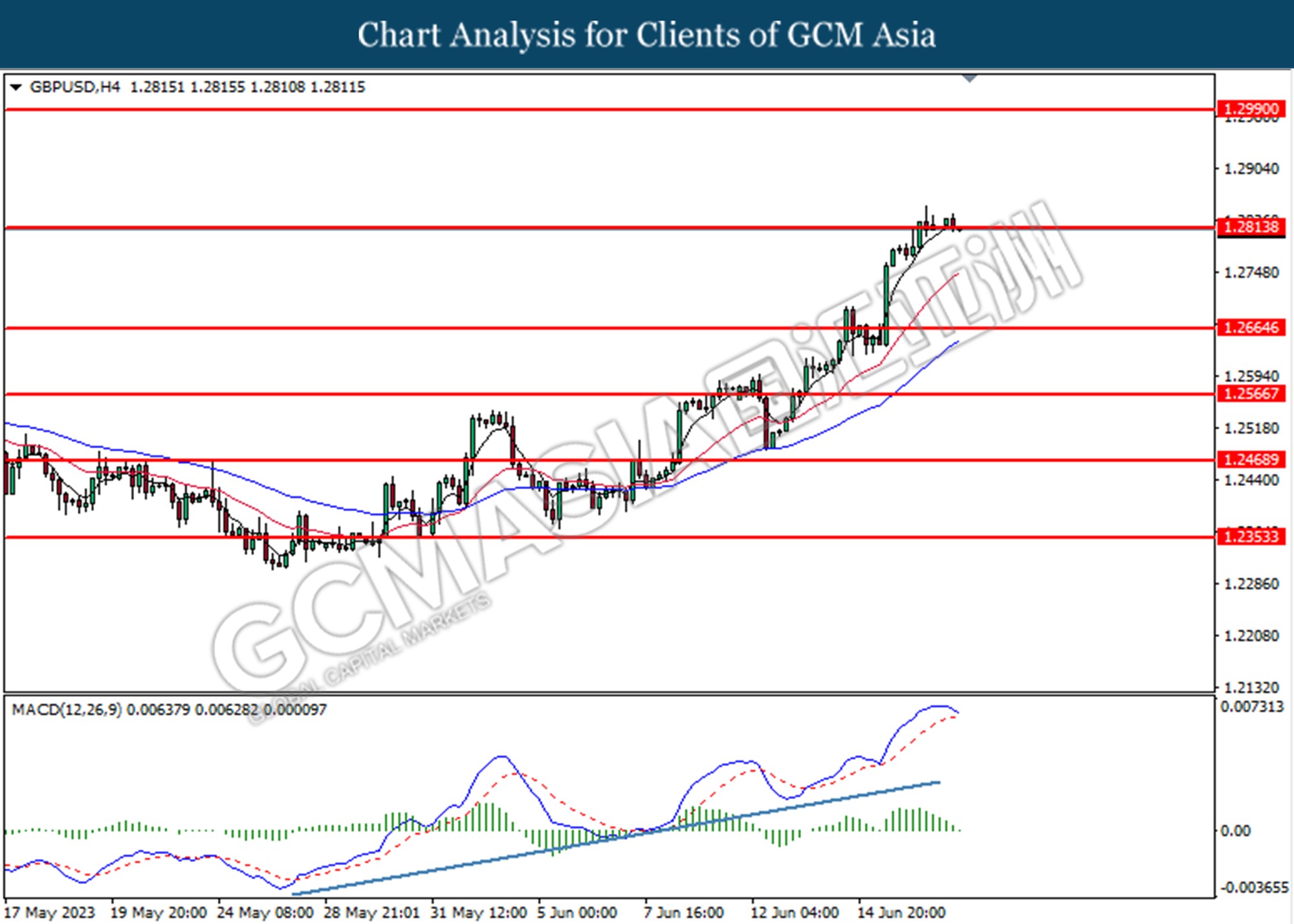

GBPUSD, H4: GBPUSD was traded lower following the prior breakout below the previous support level at 1.2815. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

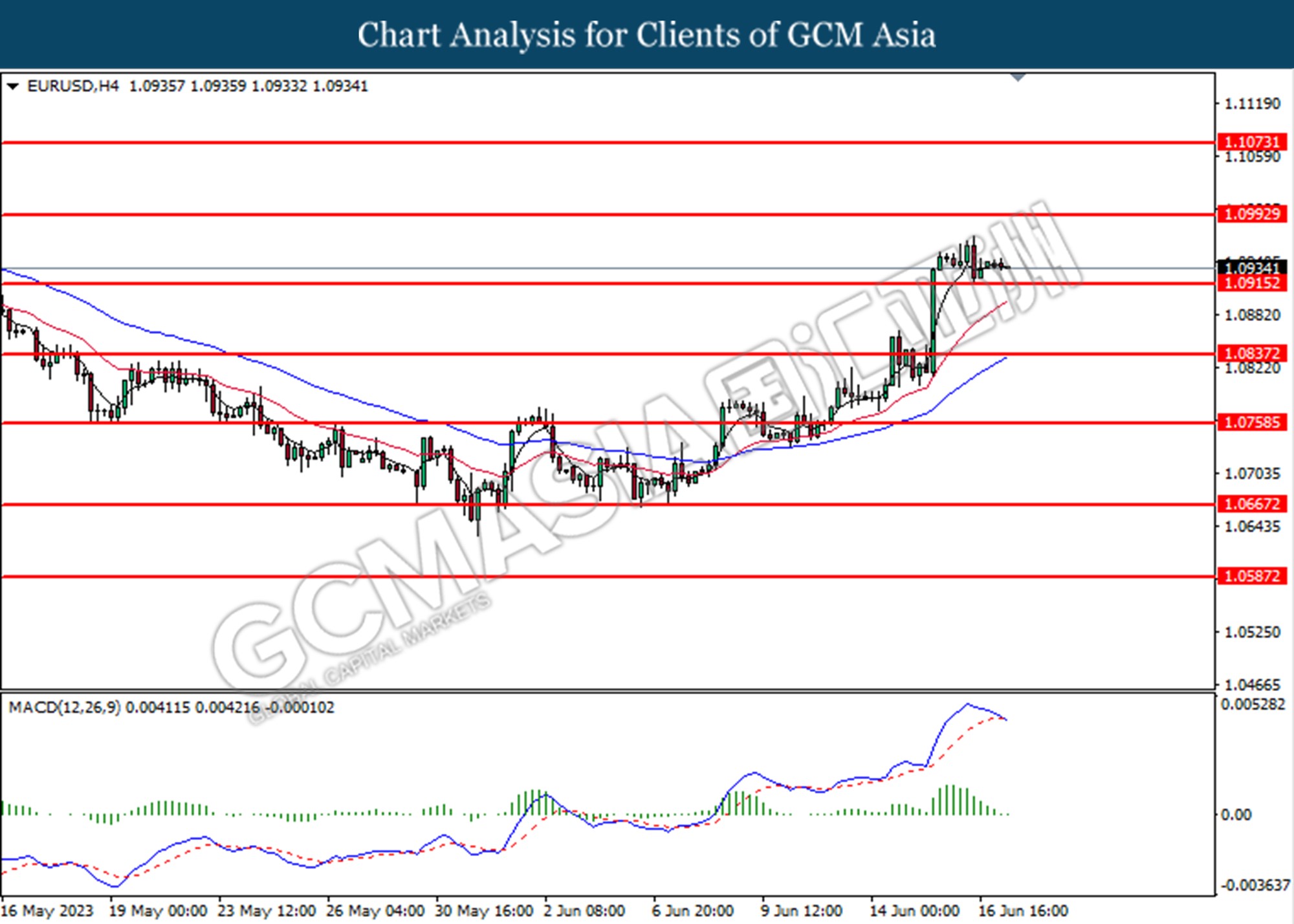

EURUSD, H4: EURUSD was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.0915.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0840

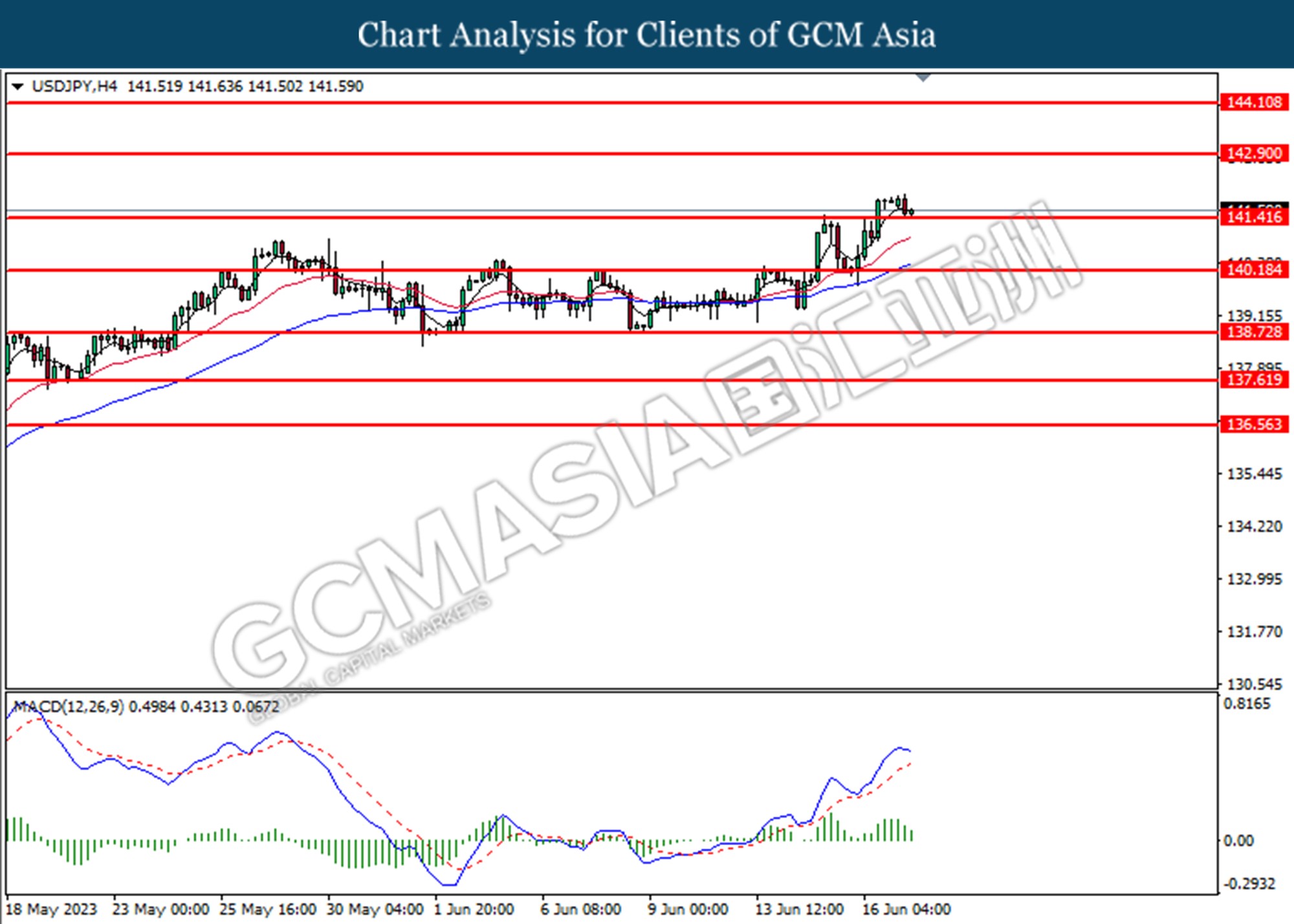

USDJPY, H4: USDJPY was traded higher following the prior rebound from the support level at 141.40. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 142.90, 144.10

Support level: 141.40, 140.20

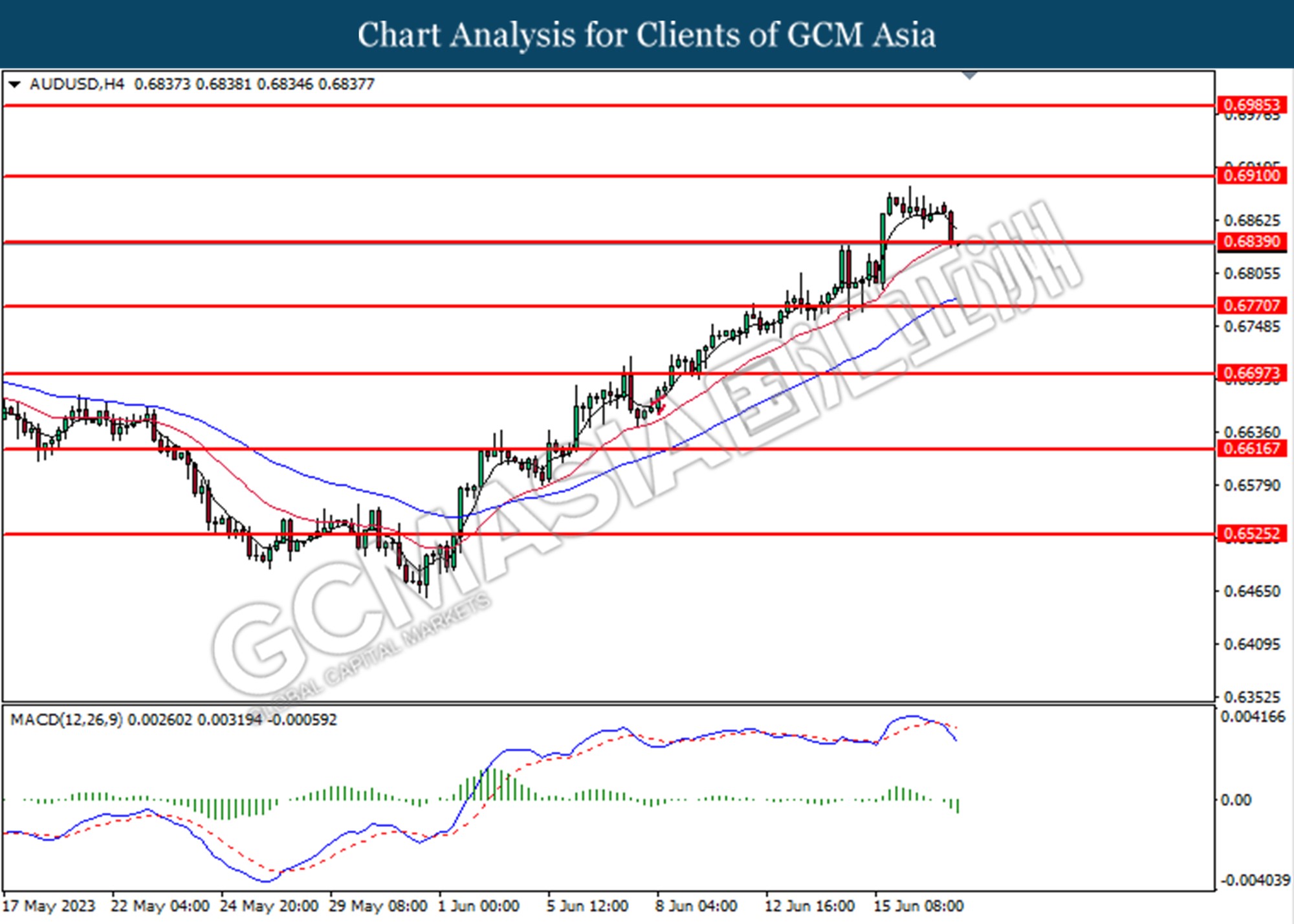

AUDUSD, H4: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6840. MACD which illustrated increasing bullish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 0.6840, 0.6910

Support level: 0.6770, 0.6700

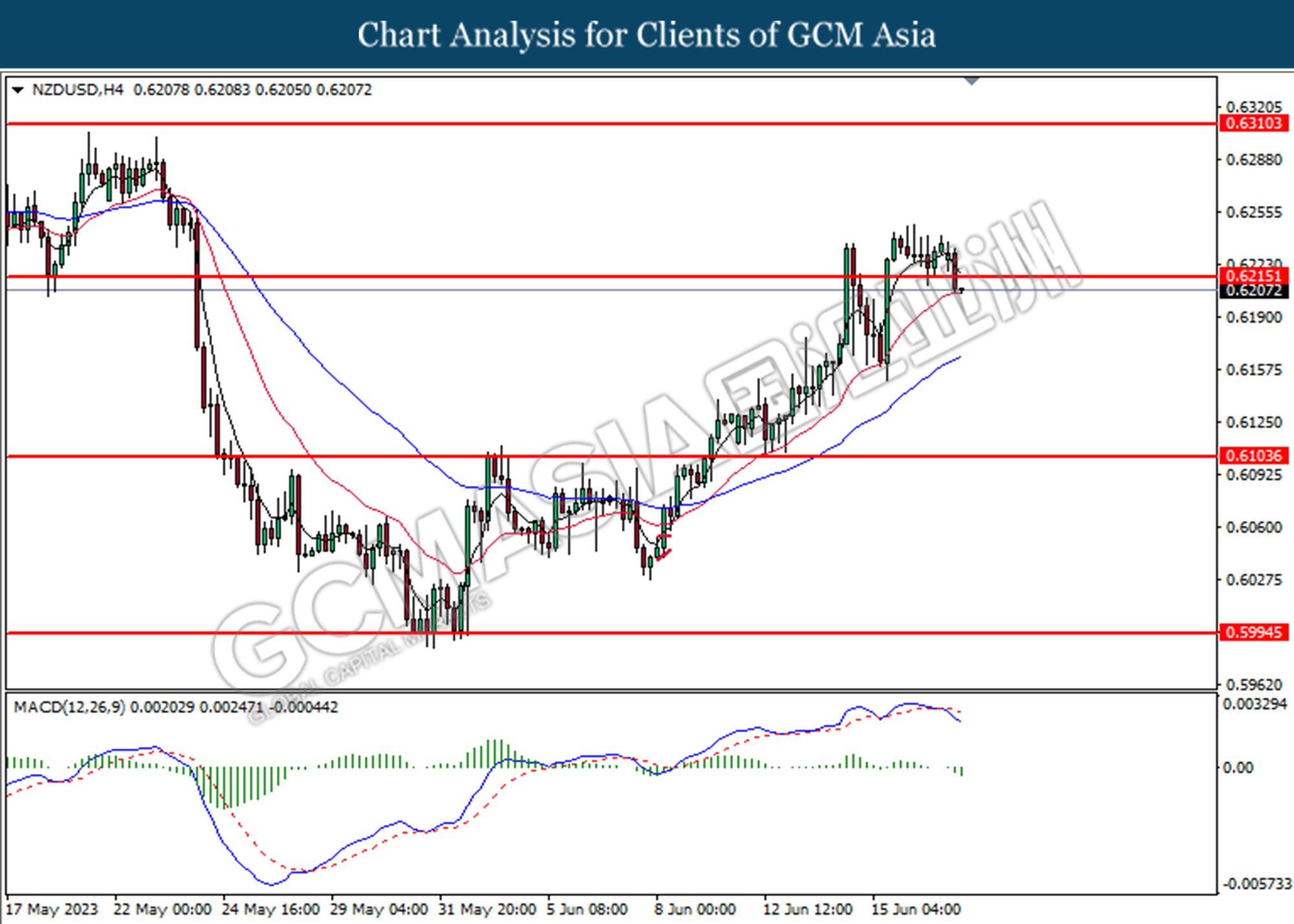

NZDUSD, H4: NZDUSD was traded lower following the prior breakout below the previous support level at 0.6215. MACD which illustrated increasing bearish momentum suggests the pair to extend its losses toward the support level.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

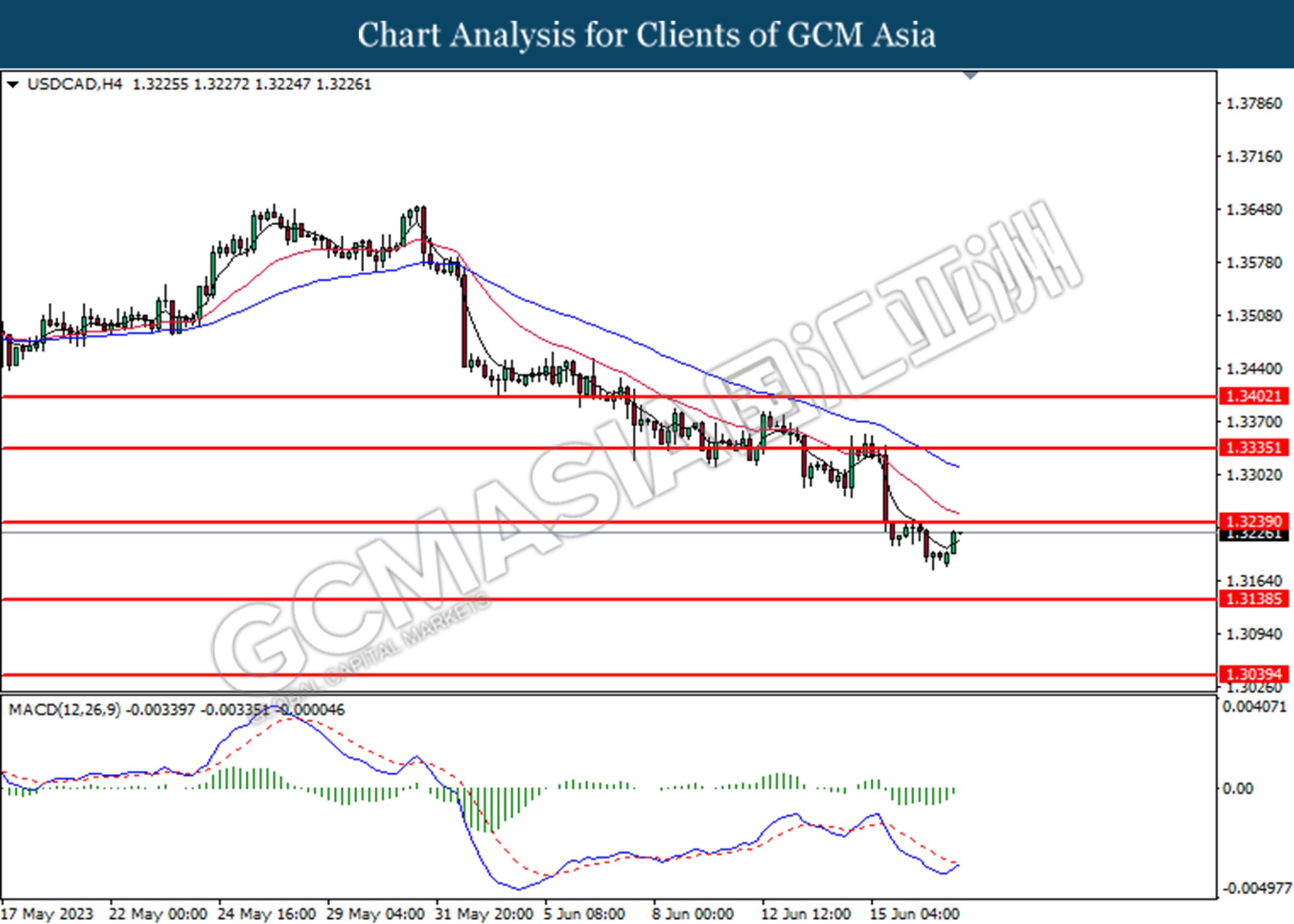

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3240.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

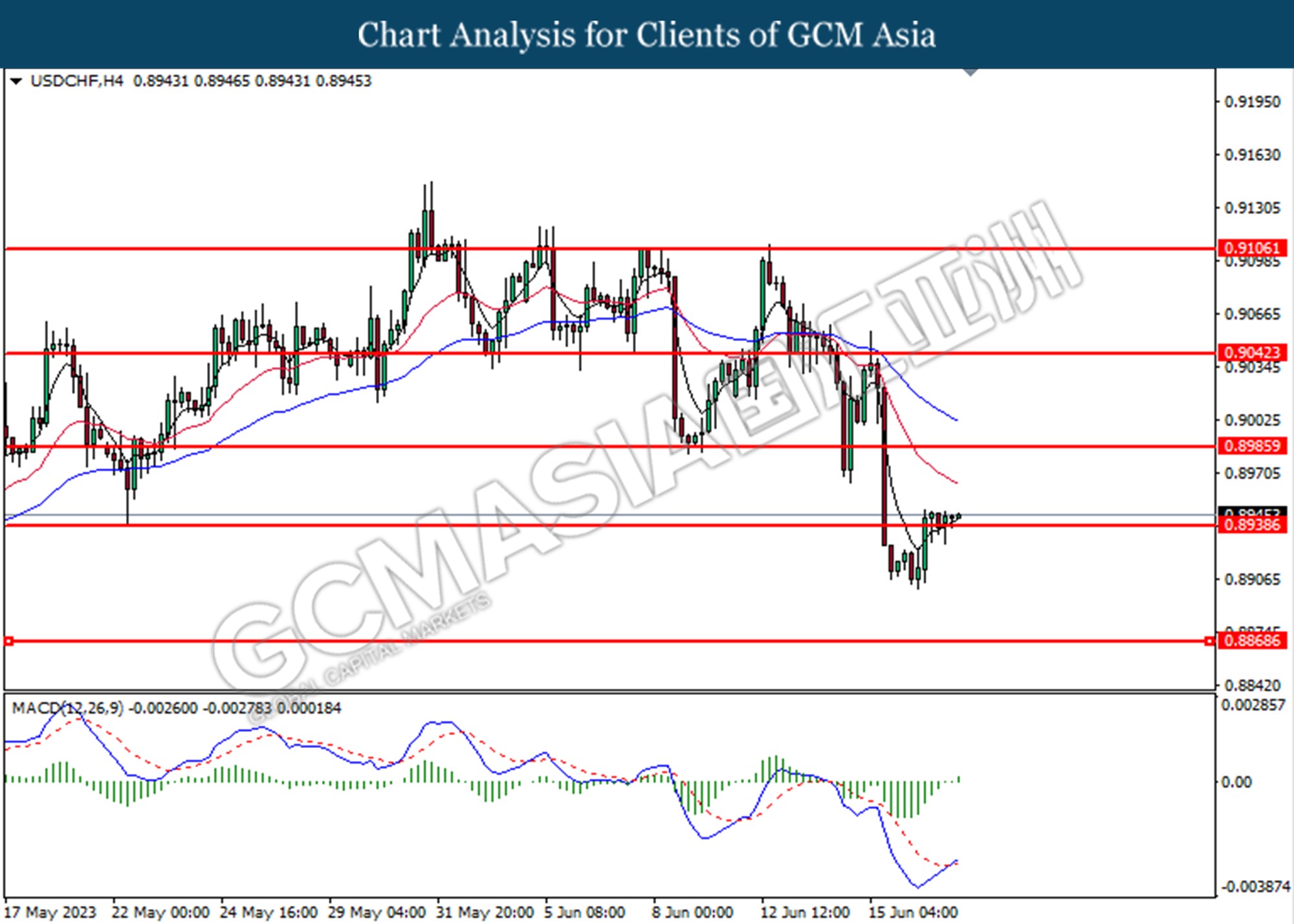

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair to extend its gains toward the resistance level.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

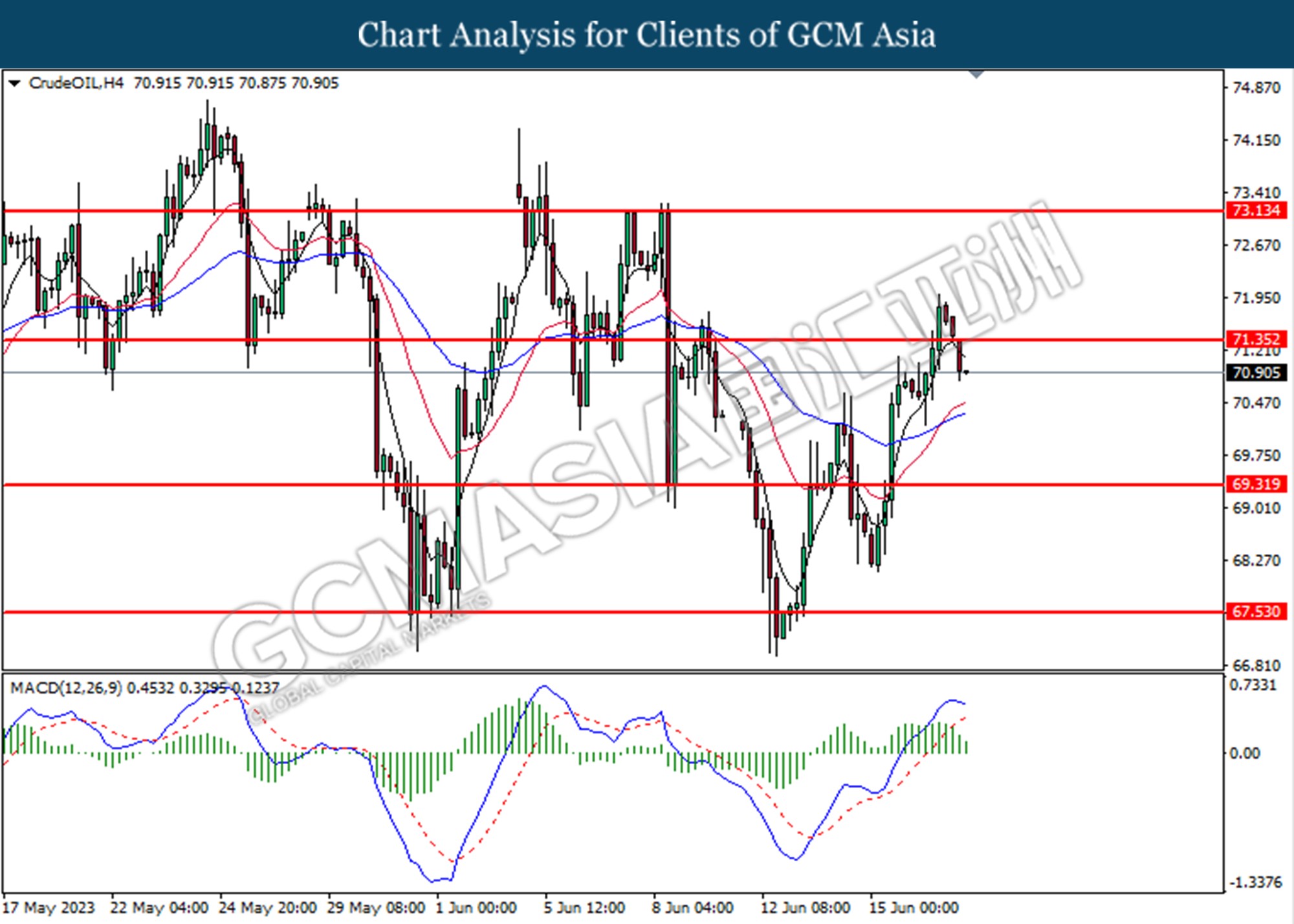

CrudeOIL, H4: Crude oil price was traded lower following the prior breakout below from the previous support level at 71.35. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 71.35, 73.15

Support level: 69.30, 67.55

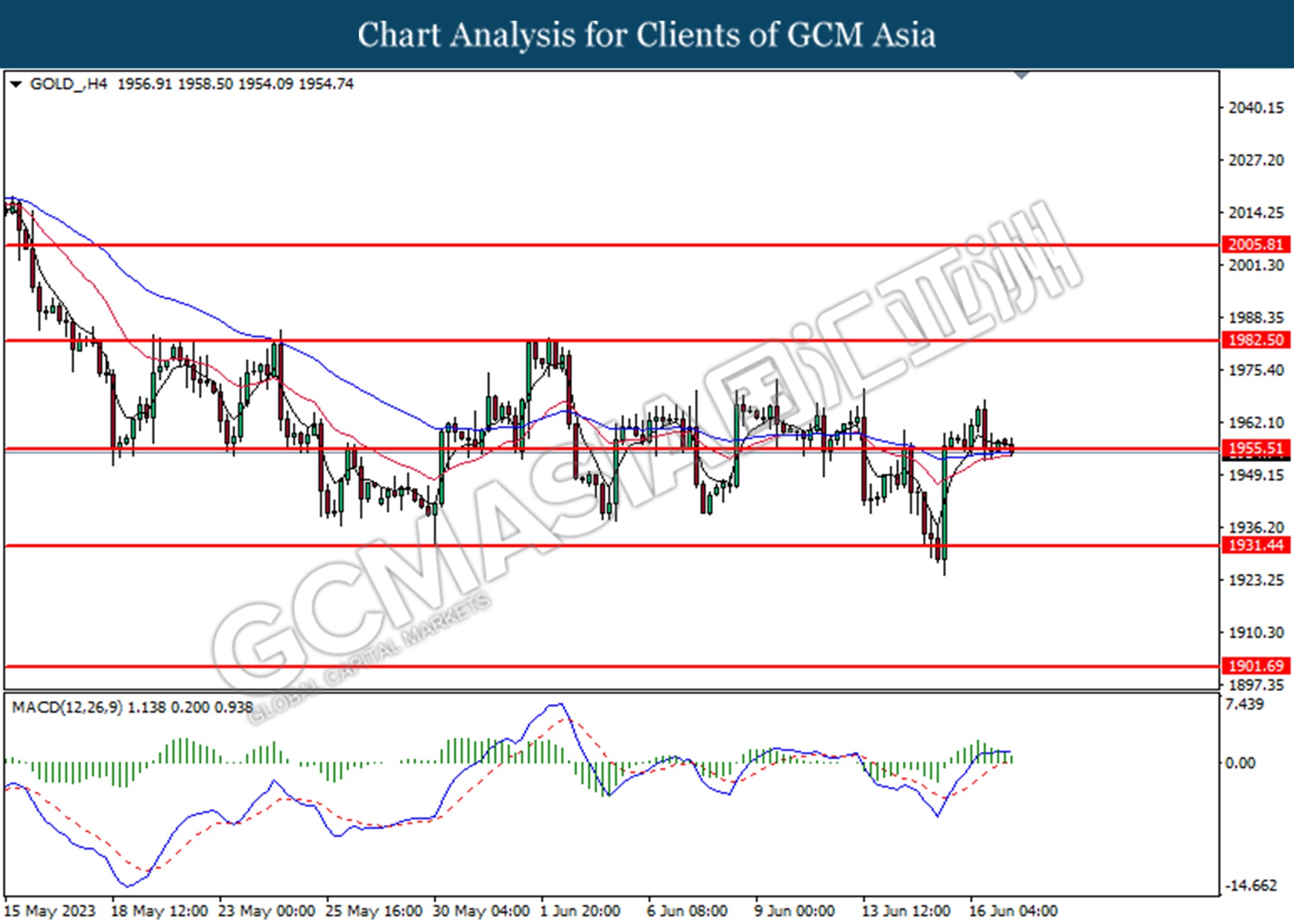

GOLD_, H4: Gold price was traded lower following the prior breakout below the previous support level at 1955.50. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses toward the support level.

Resistance level: 1955.50, 1982.50

Support level: 1931.45, 1901.70