20 June 2023 Morning Session Analysis

US dollar remained silent amid Juneteenth holiday.

The dollar index, which was traded against a basket of six major currencies, lingered near the 6-week low as the Americans are enjoying the Juneteenth holiday, which resulted into lower volumes and less big movement in the forex trading. Also, with the Juneteenth holiday, the stock market in the US remained closed. Hence, the investors are basically awaiting for the upcoming crucial event of this week, such as several speeches from the Fed officials, including the chairman of Fed Jerome Powell. A clearer picture could be provided to the investors regarding how the member’s view the current economic situation and also their outlook on the interest rate path. On top of that, the investor were also eyeing on the meeting between U.S. Secretary of State Antony Blinken and Chinese President Xi Jinping. During the meeting, the Chinese President said that the world needed a “generally stable” China-U.S. relationship, especially after a period of simmering tensions. Besides, US also agreed on the need for the U.S. and China to stabilize bilateral ties. As a result, the first U.S. Secretary of State visit after five years to China could have paved the way for a November meeting between Biden and Xi, orientating to reduce the geopolitical tensions and consolidate bilateral relations. As of writing, the dollar index rose by 0.23% to 102.48.

In the commodities market, crude oil prices dropped by -0.20% to $71.20 per barrel as the strengthening of US dollar sparked bearish pressures on the black commodity. Besides, the gold prices edged down by -0.05% to $1951.65 per troy ounce amid the optimism of Blinken’s trip to China.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (May) | 1.417M | 1.435M | – |

Technical Analysis

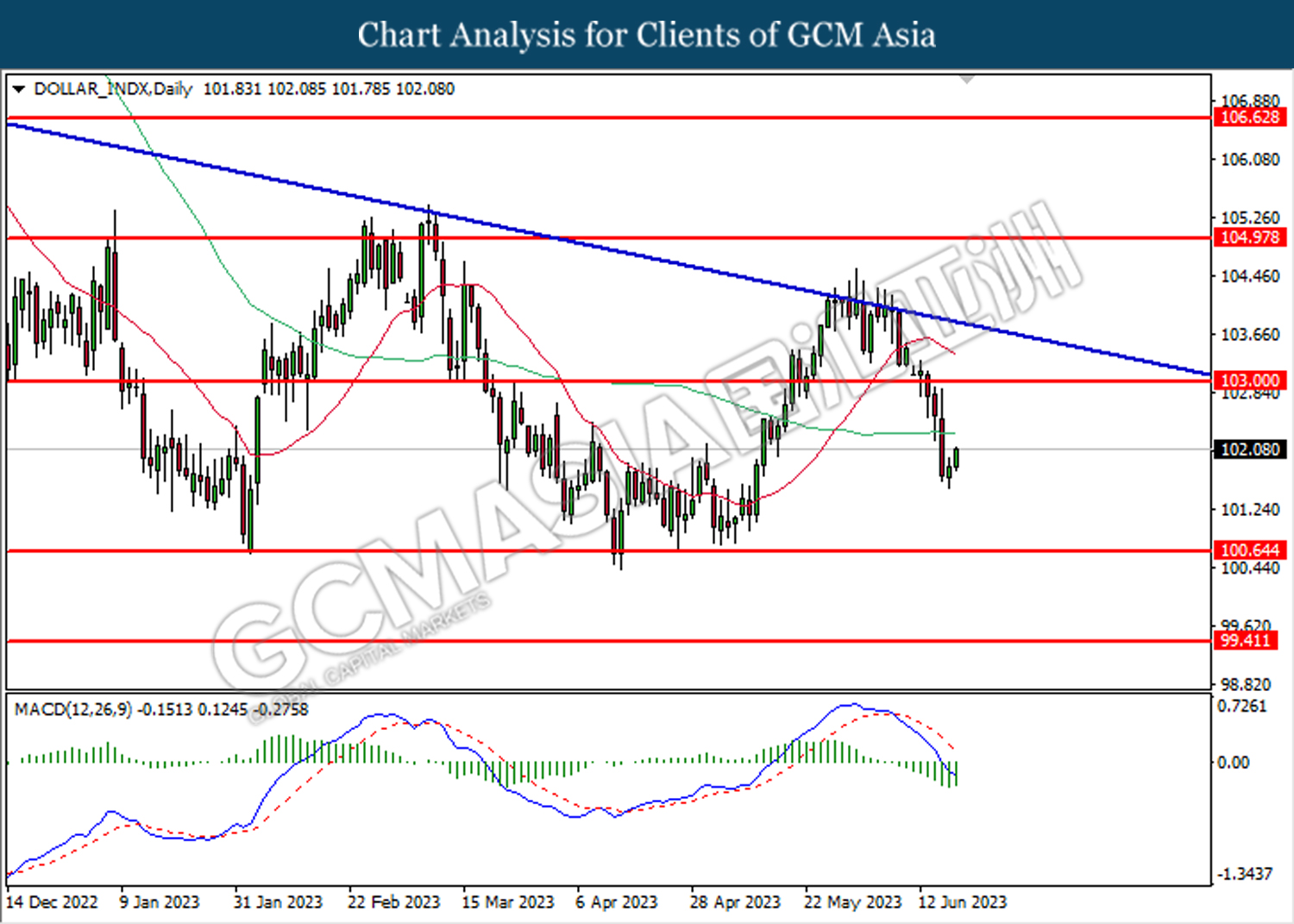

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior breakout below the previous support level at 103.00. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 100.65

Resistance level: 103.00, 105.00

Support level: 100.65, 99.40

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2765. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2875, 1.2970

Support level: 1.2635, 1.2525

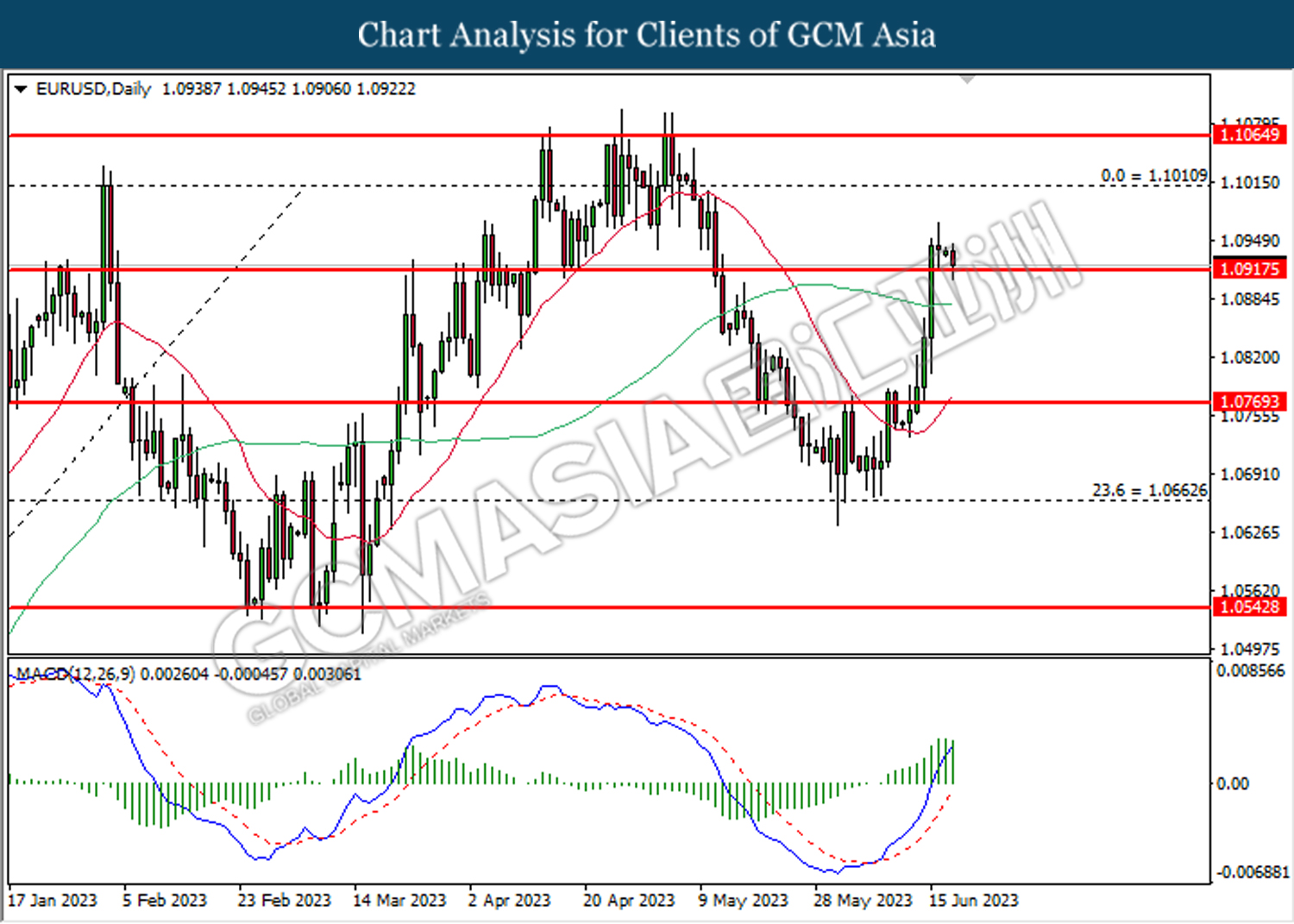

EURUSD, Daily: EURUSD was traded lower while currently testing the support level at 1.0915. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1010, 1.1065

Support level: 1.0915, 1.0770

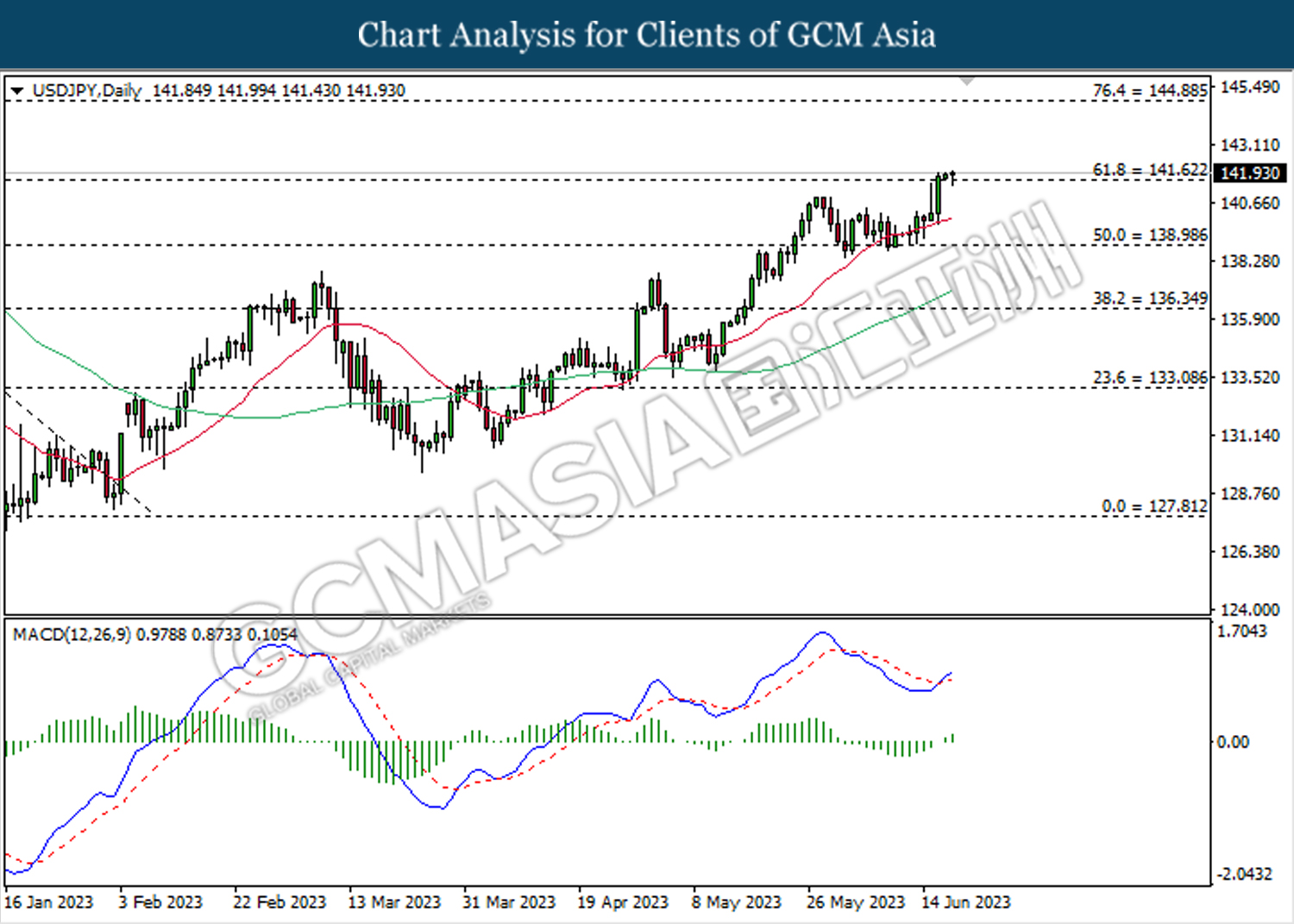

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 141.60. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 141.60, 144.85

Support level: 138.95, 137.60

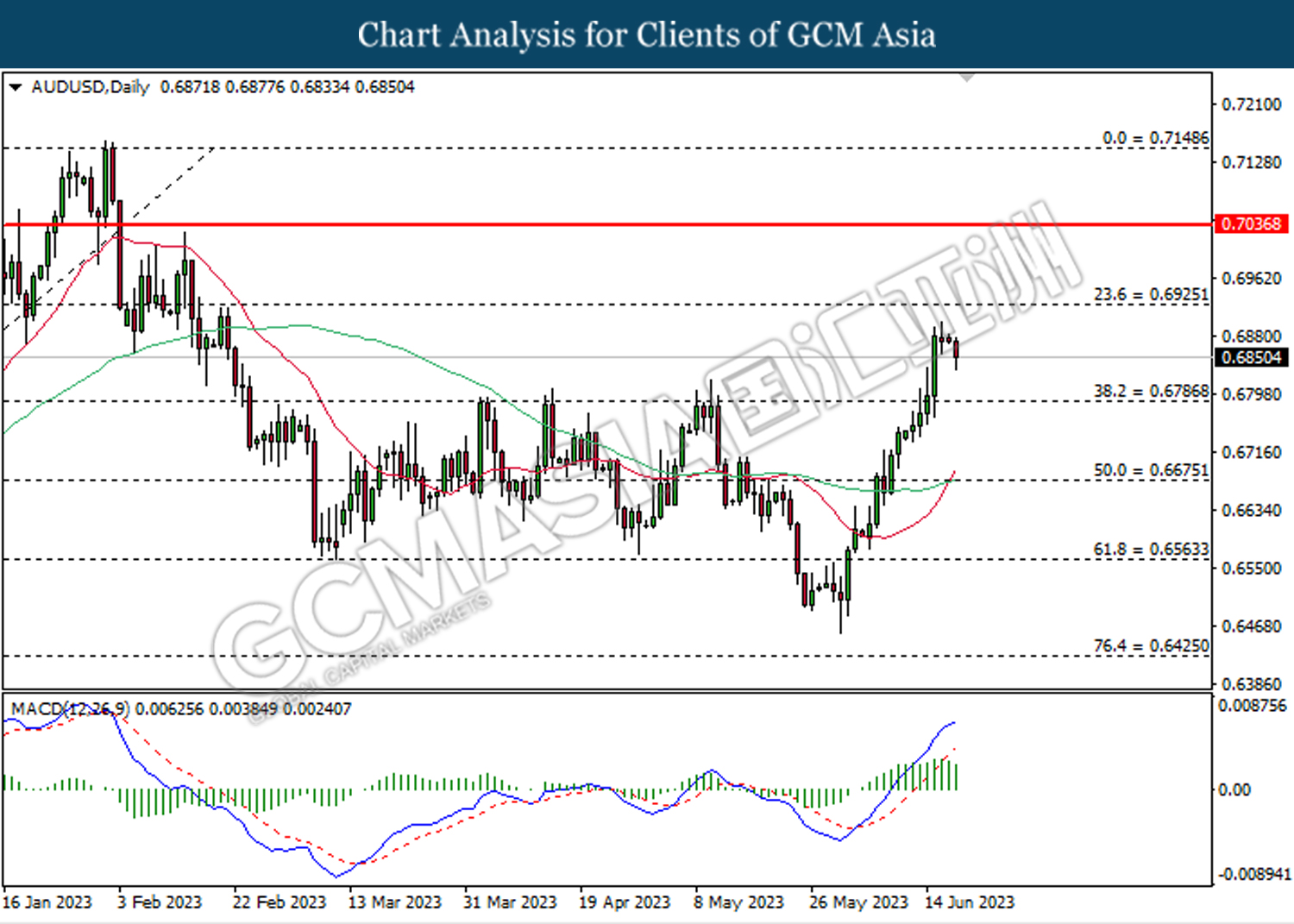

AUDUSD, Daily: AUDUSD was traded higher following the prior breakout above the previous resistance level at 0.6785. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level at 0.6925.

Resistance level: 0.6925, 0.7035

Support level: 0.6785, 0.6675

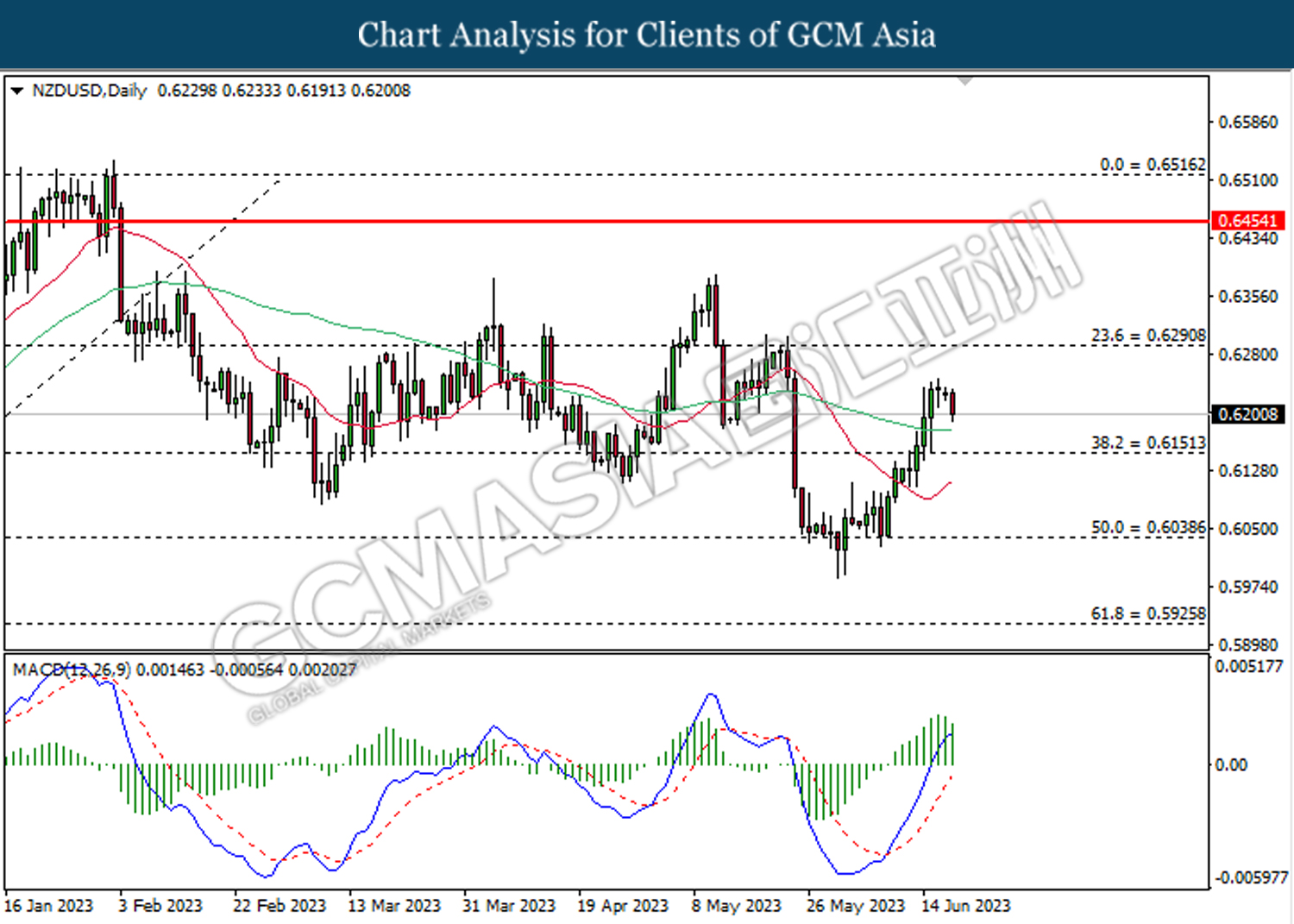

NZDUSD, Daily: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated bullish bias momentum suggest the pair to extend its losses toward the support level at 0.6150.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

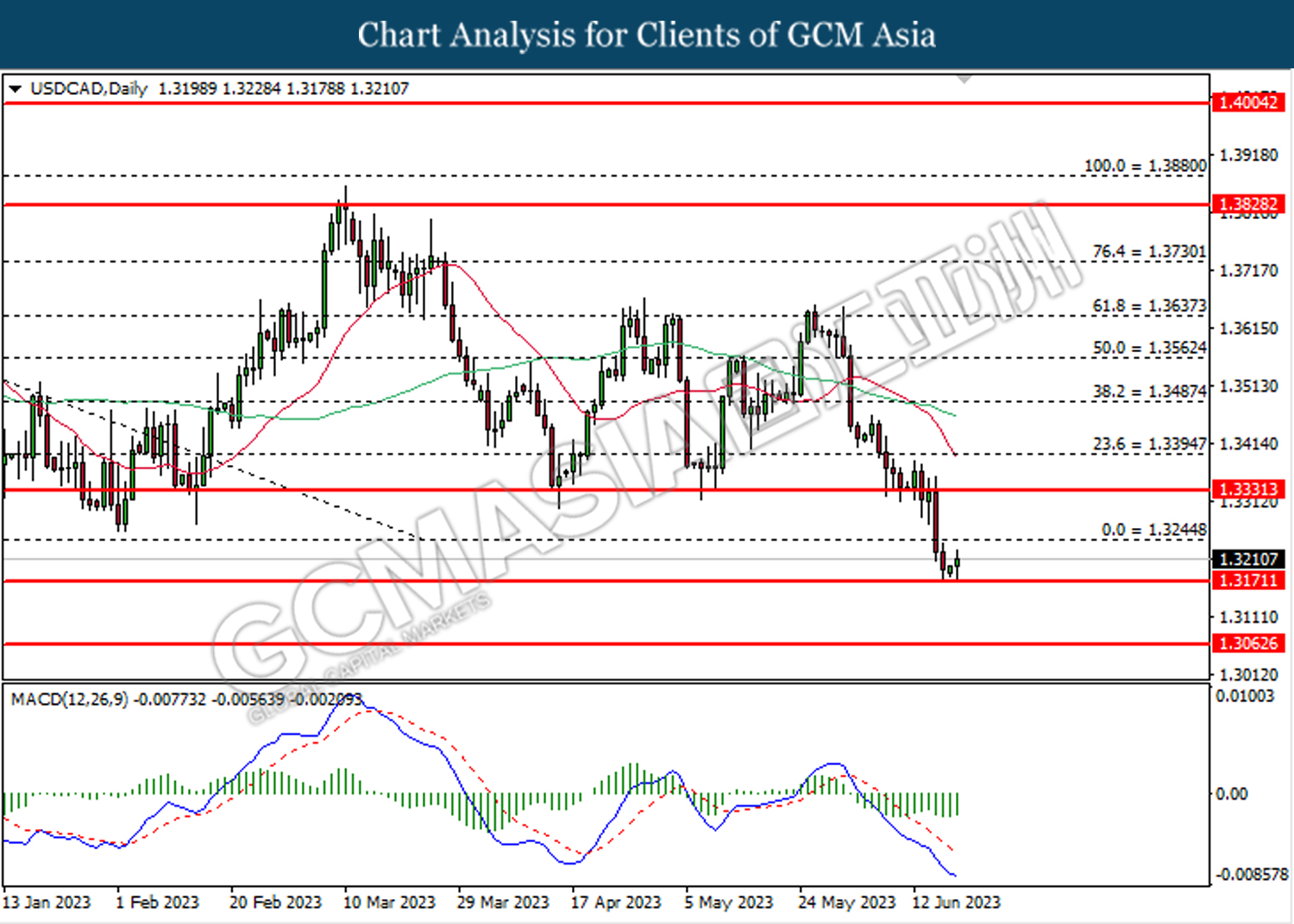

USDCAD, Daily: USDCAD was traded higher following the prior rebound from the support level at 1.3170. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3245, 1.3330

Support level: 1.3170, 1.3065

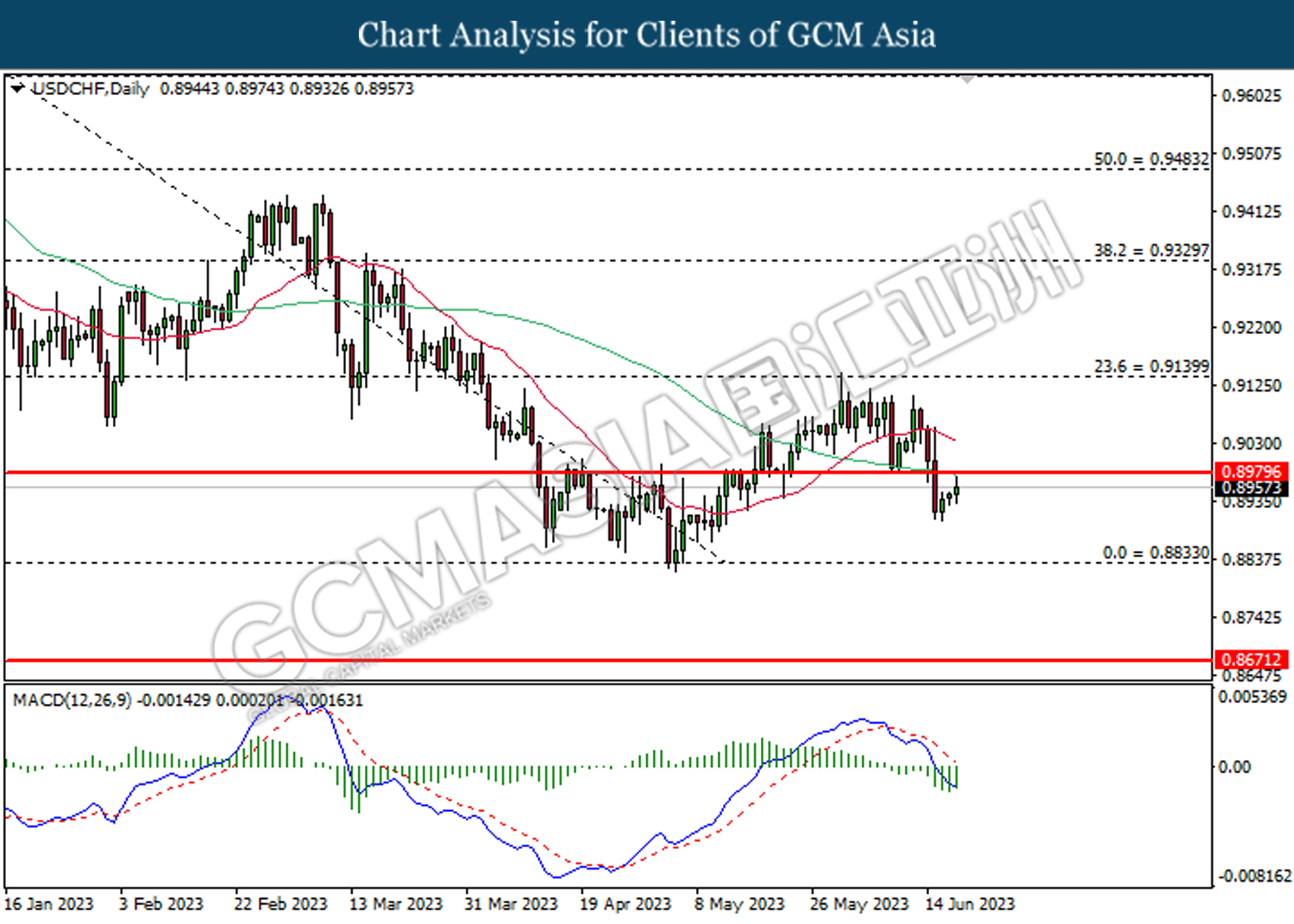

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.8980. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.8980, 0.9140

Support level: 0.8835, 0.8670

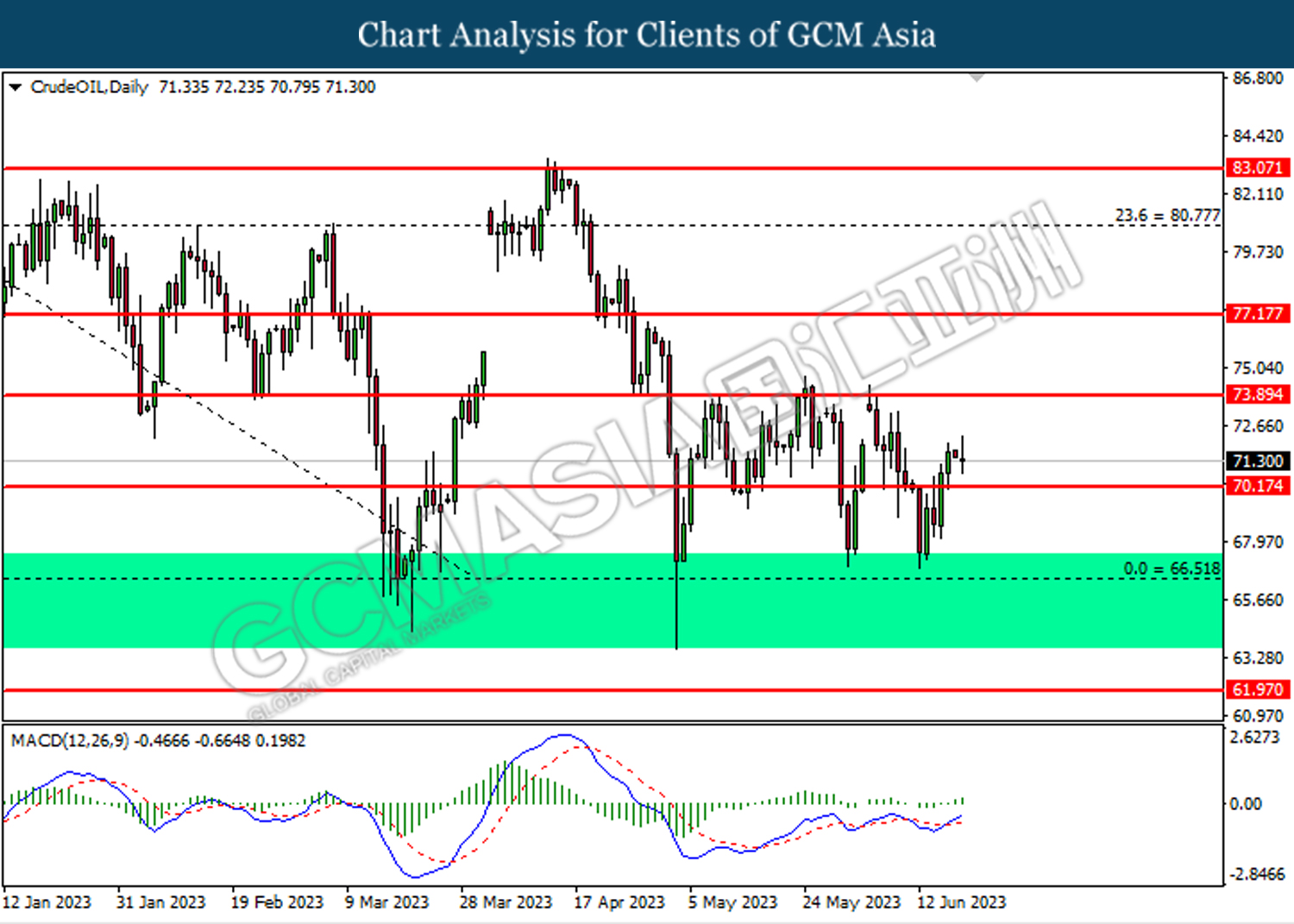

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 70.15. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 73.90.

Resistance level: 73.90, 77.15

Support level: 70.15, 66.50

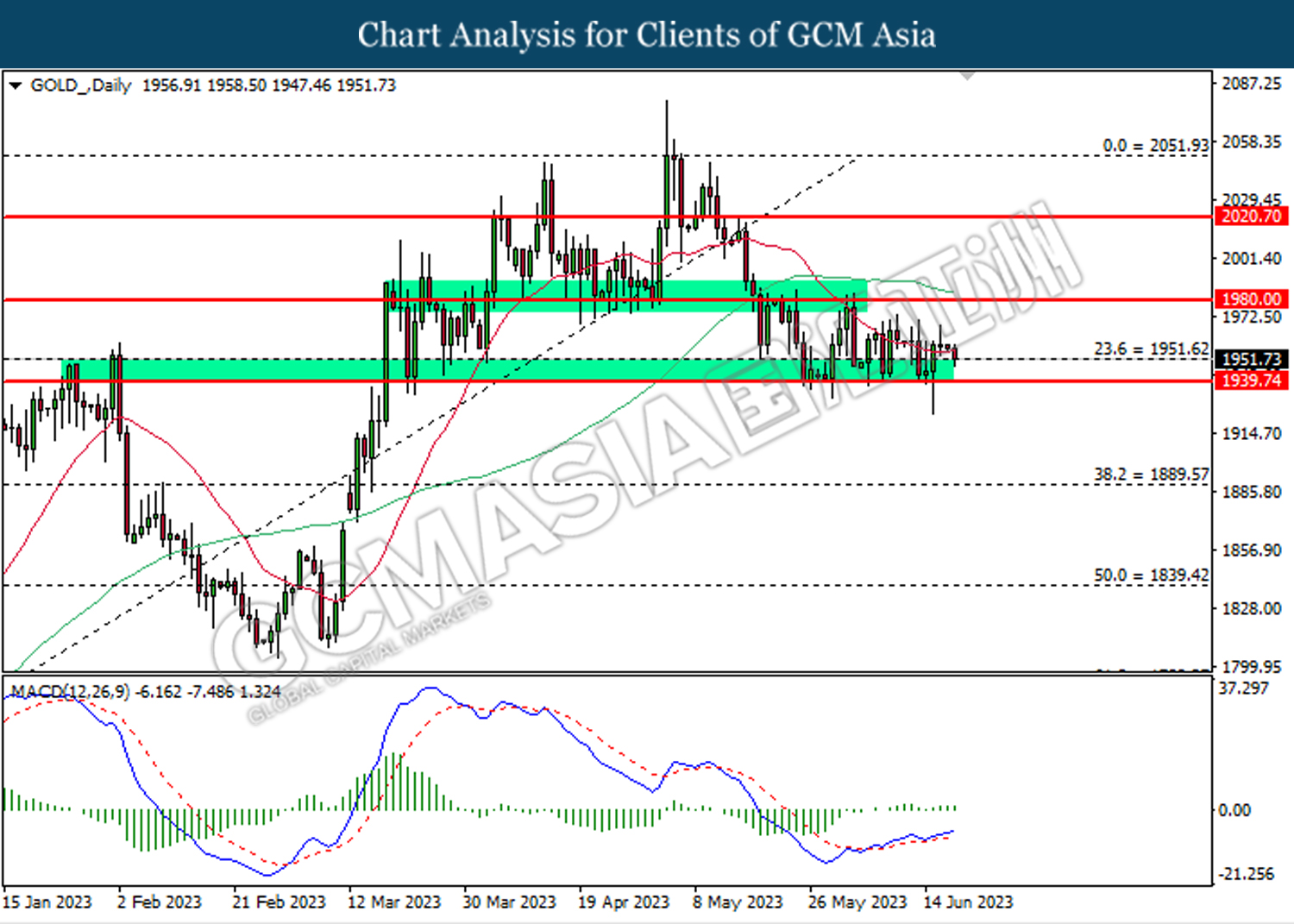

GOLD_, Daily: Gold price was traded higher following the prior breakout above the previous resistance level at 1951.60. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains toward the resistance level at 1980.00.

Resistance level: 1980.00, 2020.70

Support level: 1951.60, 1939.75