20 June 2023 Afternoon Session Analysis

Aussie moves lower following RBA minutes.

The Aussie, which was traded against the dollar index, slipped following the Reserve Bank of Australia (RBA) released the meeting minutes. Investors choose to take profits as RBA gives simulated ambiguous monetary policy direction. The minutes from the reserve bank’s last meeting resulted in 25 basis points increase to 4.1% to tame high inflation in Australia. The inflation rate had continued to decline as energy prices fall and food price inflation eased, the headline inflation is well above the central bank target. However, growth in economic activity in Australia has been dampened by lower consumer spending and a sharp tightening of monetary policy, dividing RBA members over a rate hike. The board members discussed the imbalance of household spending, noting that some households have tapped into large amounts of extra savings accumulated during the pandemic, while others have faced considerable budget constraints. Nonetheless, the rebounding of housing markets and stronger-than-expected workforce has prompted expectations of further rate hikes. As of writing, the AUD/USD traded down by -0.70% to 0.6800.

In the commodities market, crude oil prices dropped by -0.20% to $71.20 per barrel as investors weighed on oil to China’s economic concerns. Besides, the gold prices edged down by -0.06% to $1948.99 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (May) | 1.417M | 1.435M | – |

Technical Analysis

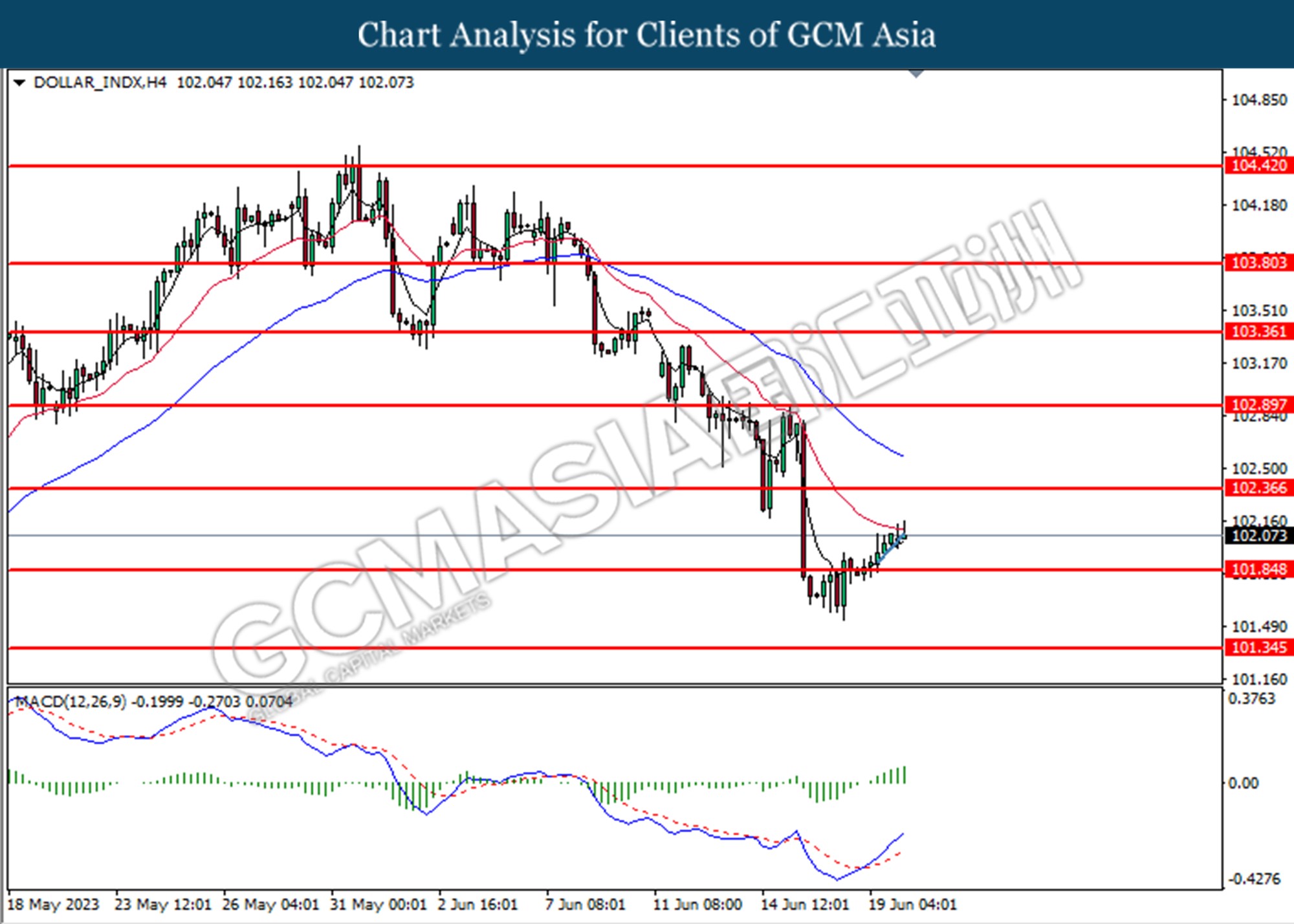

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the index extended its gains toward the resistance level.

Resistance level: 102.40, 102.90

Support level: 101.85, 101.35

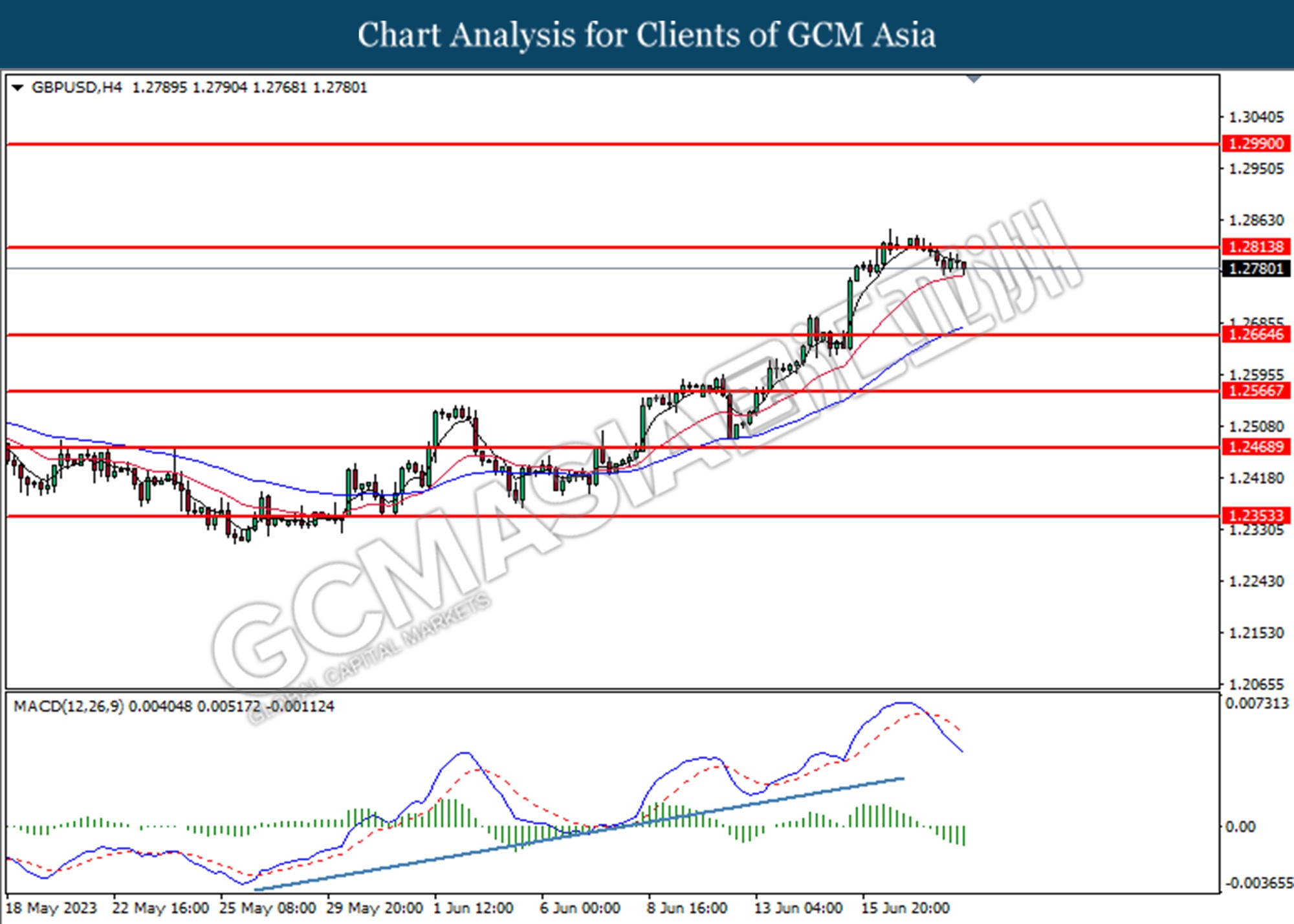

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

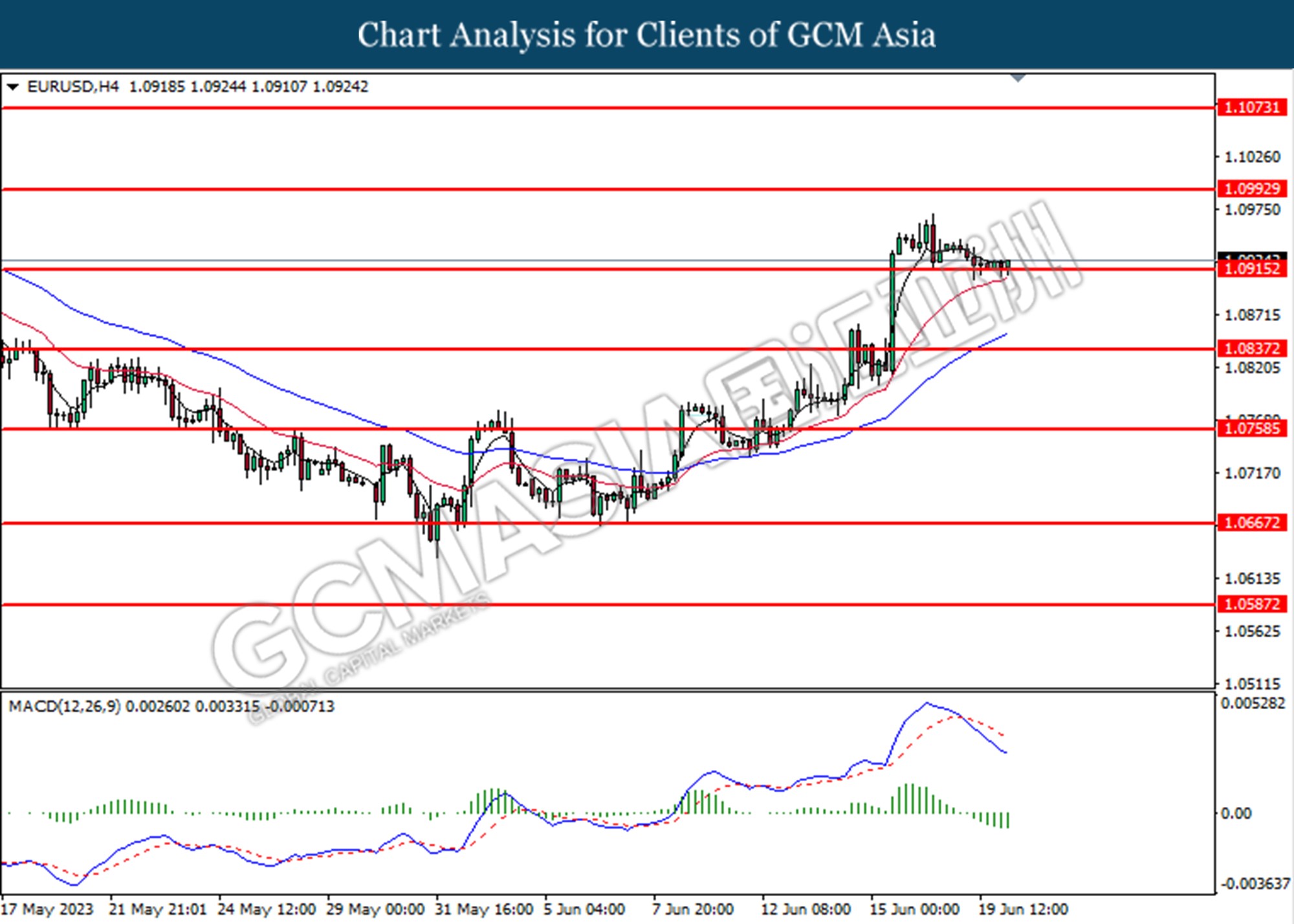

EURUSD, H4: EURUSD was traded higher following the prior rebound from the support level at 1.0915. However, MACD which illustrated increasing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0640

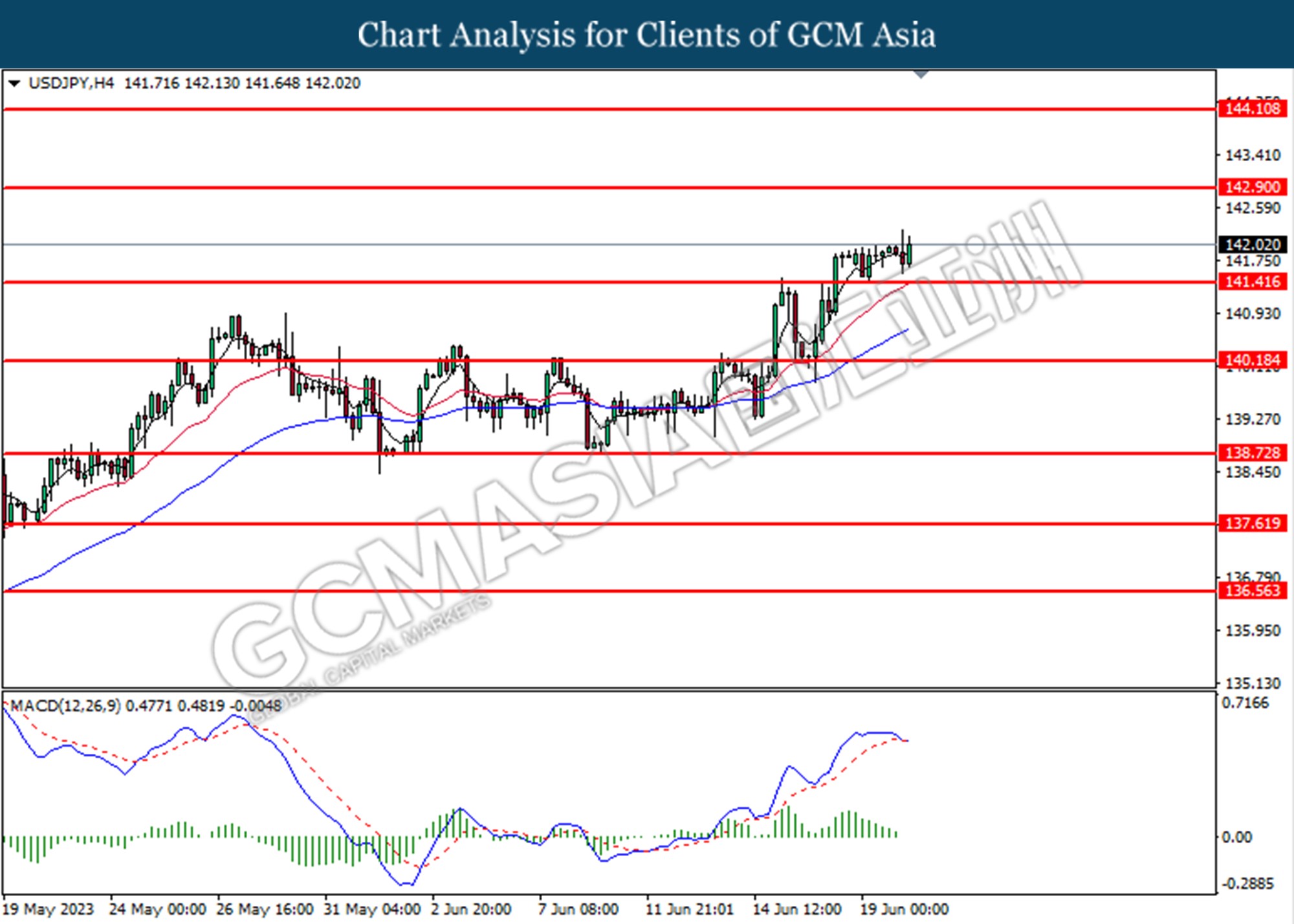

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. However, MACD which illustrated diminishing bullish momentum suggest the pair undergoes a technical correction in a short term.

Resistance level: 142.90, 144.10

Support level: 141.40, 140.20

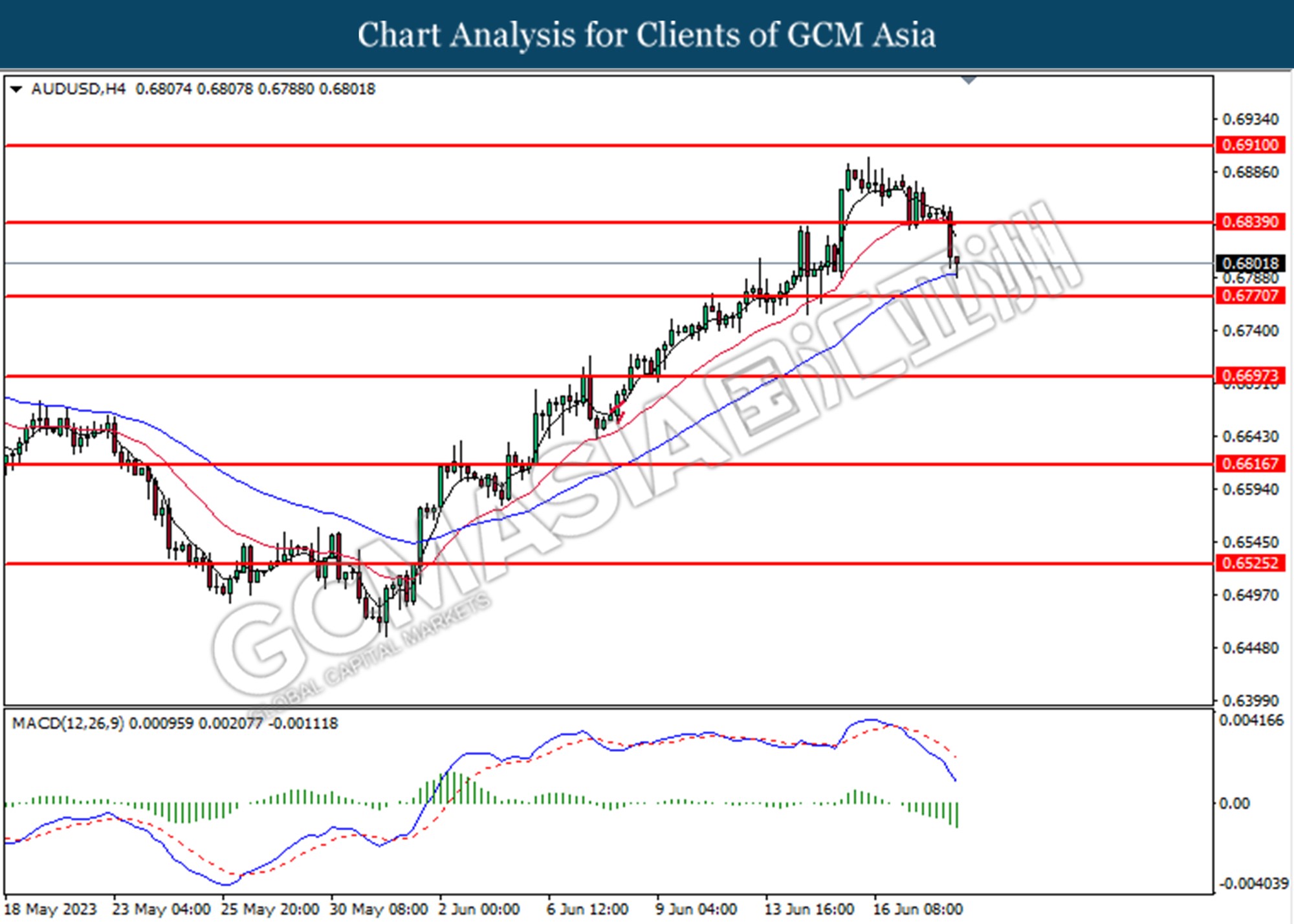

AUDUSD, H4: AUDUSD was traded lower following the prior breakout below the previous support level at 0.6840. MACD which illustrated increasing bearish momentum suggest the pair extended its losses toward the support level at 0.6770.

Resistance level: 0.6840, 0.6910

Support level: 0.6770, 0.6700

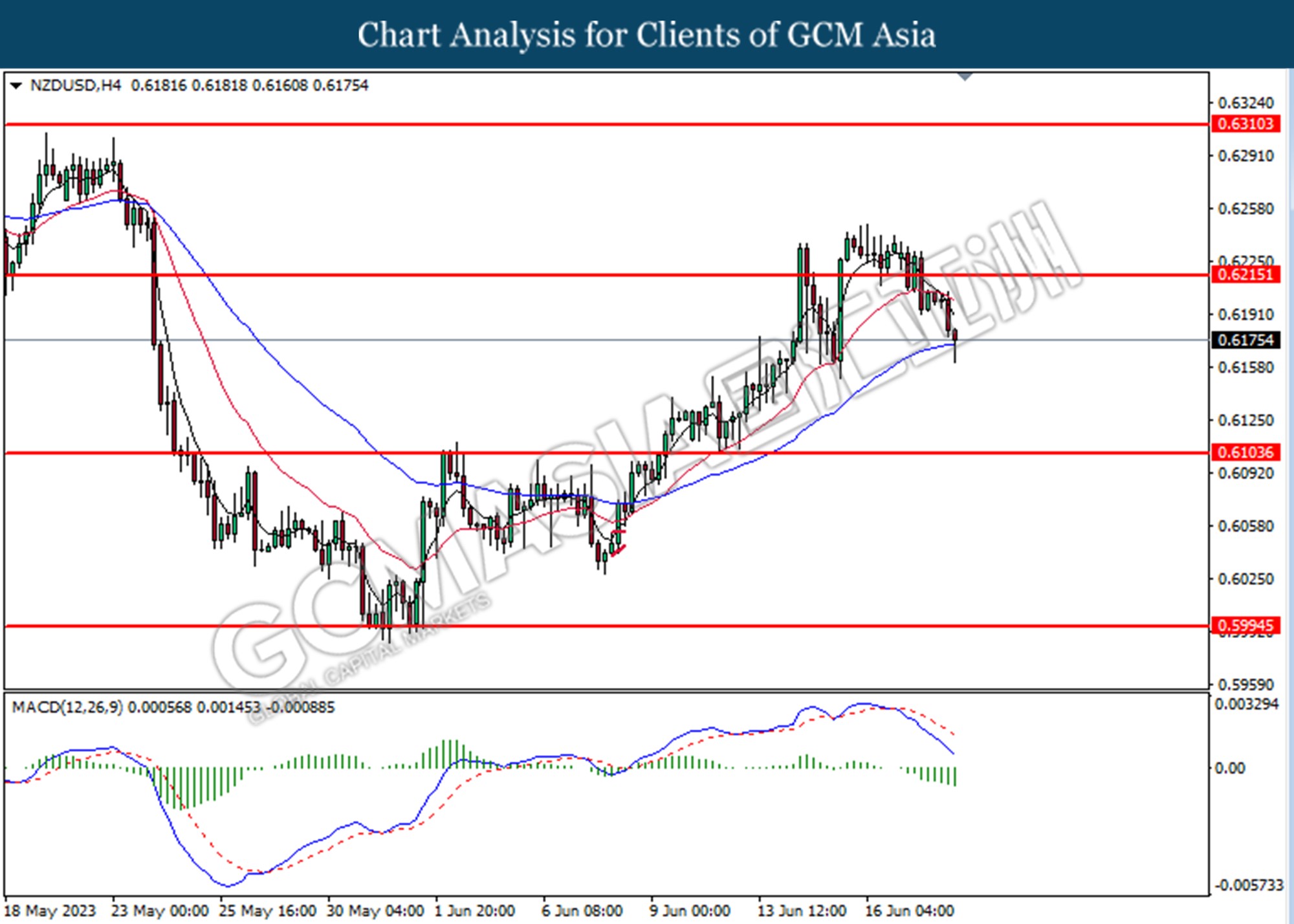

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the higher level. MACD which illustrated increasing bullish momentum suggest the pair extended its losses toward the support level.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

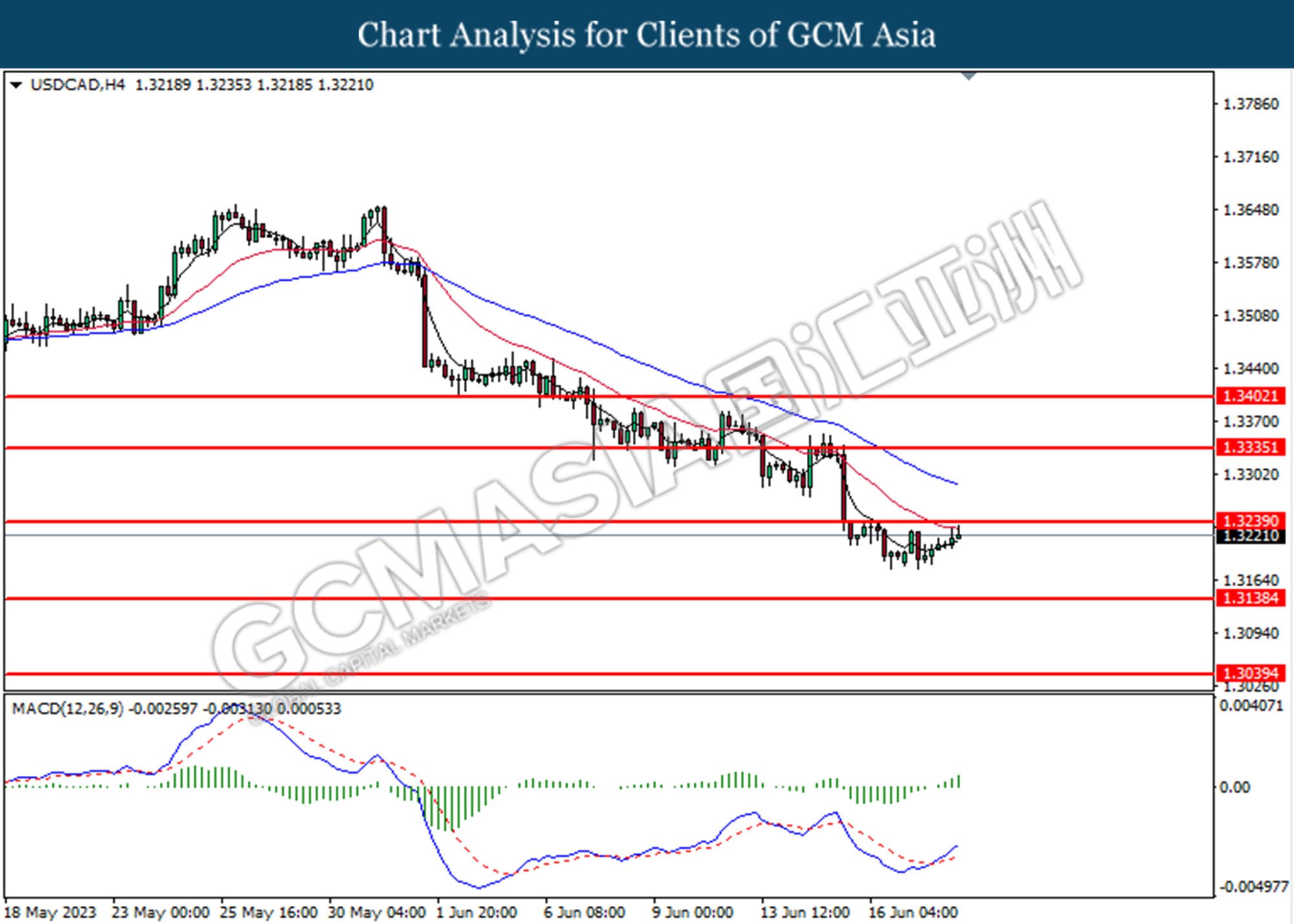

USDCAD, H4: USDCAD was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggests the pair extended its gains toward the resistance level at 1.3240.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

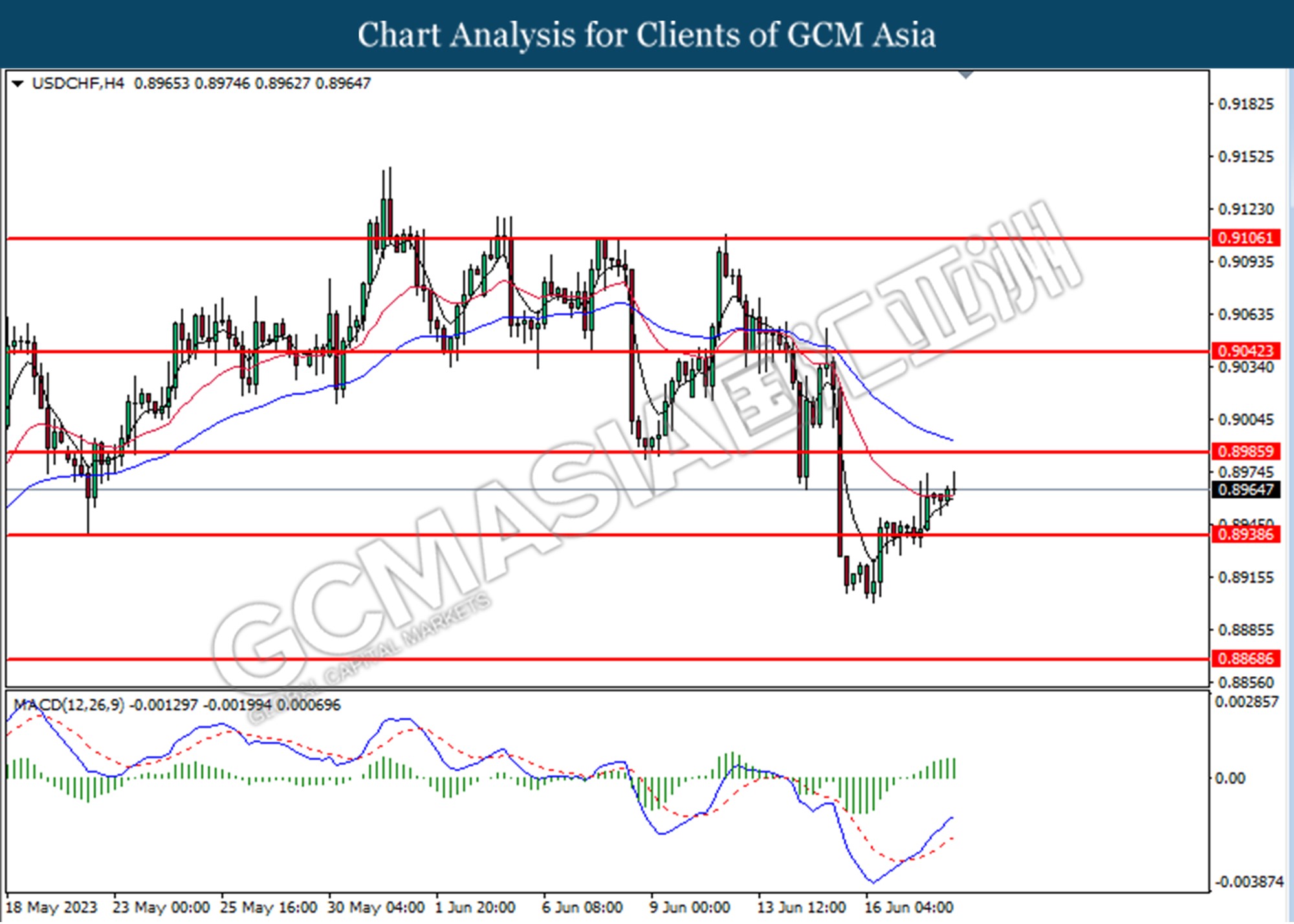

USDCHF, H4: USDCHF was traded higher following the prior rebound from the lower level. MACD which illustrated increasing bullish momentum suggest the pair extended its gains toward the resistance level at 0.8985.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

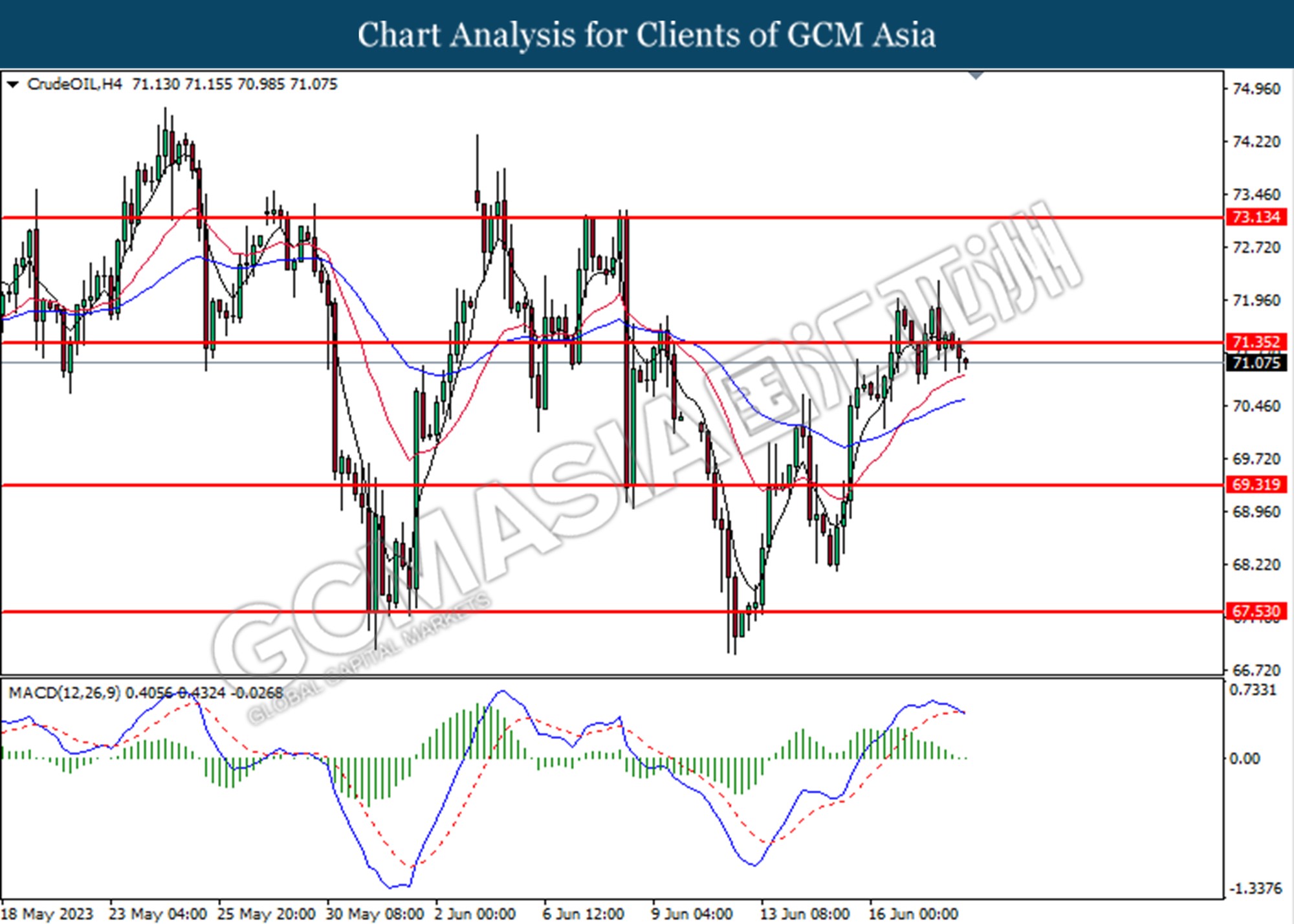

CrudeOIL, H4: Crude oil price was traded lower following the prior breakout below the previous support level at 71.35. MACD which illustrated diminishing bullish momentum suggest the commodity extended its losses toward the support level.

Resistance level: 71.35, 73.15

Support level: 69.30, 67.55

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 1955.50, 1982.50

Support level: 1931.45, 1901.70