21 June 2023 Afternoon Session Analysis

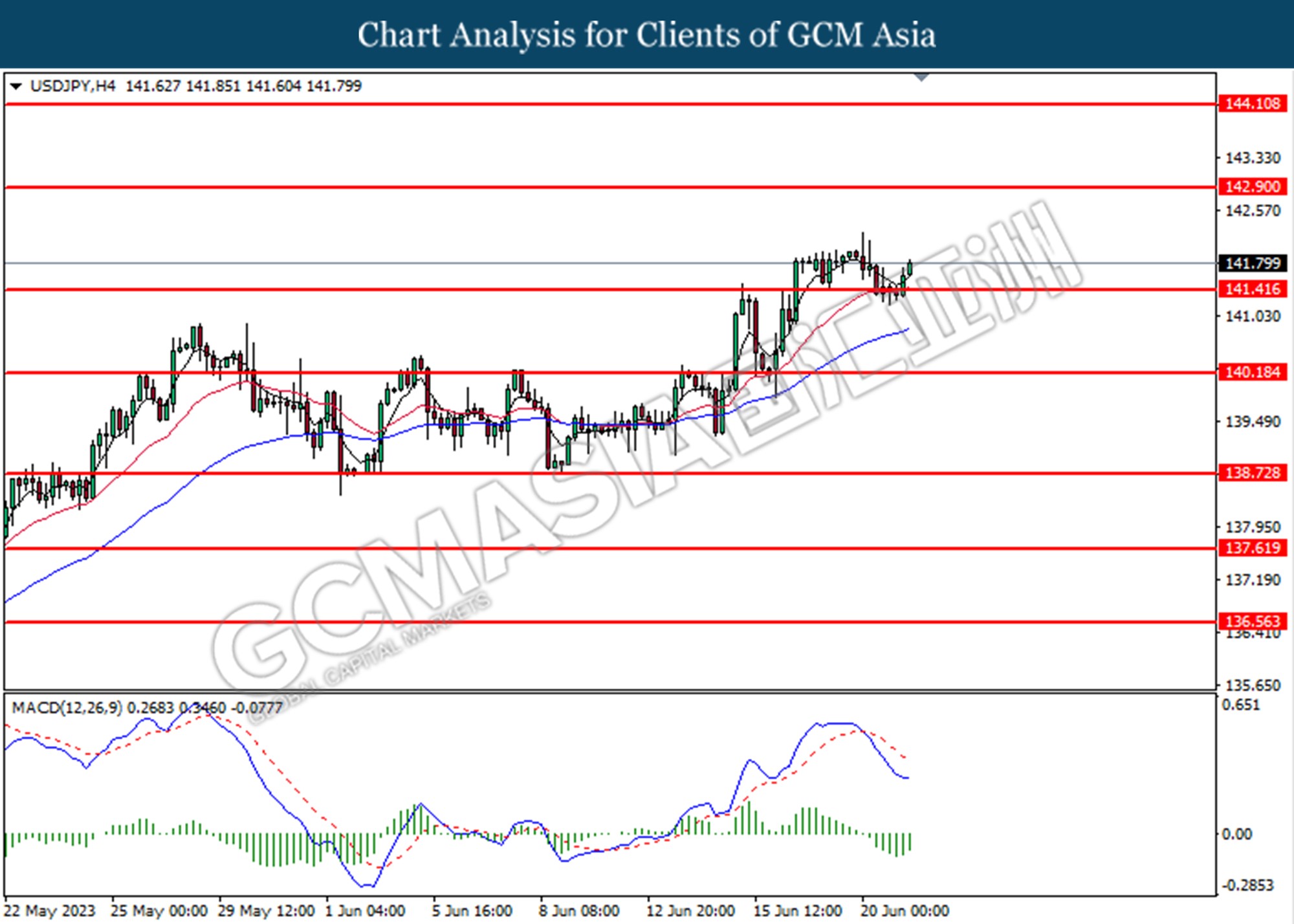

The Yen depreciates following the BoJ minutes release

The Japanese Yen, which was traded against the dollar index, slipped after the Bank of Japan (BoJ) release meeting minutes. Investors’ expectations for BOJ rate hikes drop sharply after meeting minutes. The board member expressed the view that inflation was likely to decline temporarily, overseas economies remain uncertain and it was difficult to assess the sustainability of future wage hikes. Japan won’t be able to maintain 2% inflation target without big wage hikes. Although wages were projected to raise more than expected, the board members voted for the central bank to continue to support momentum for wage hikes by maintaining monetary easing. Furthermore, the BoJ will continue its Yield Curve Control (YCC) to maintain its long-term bond yield at 0% to 1%. By largely purchasing the Japanese Government Bond (JGB), the bond price increase and the bond yield decrease. This allows companies to further stimulate the economy by issuing new bonds at lower rates, using JGB yields as a reference rate. With such a backdrop, the Yen extended its losses against the dollar index. As of writing, the USD/JPY edged up by 0.12% to 141.62.

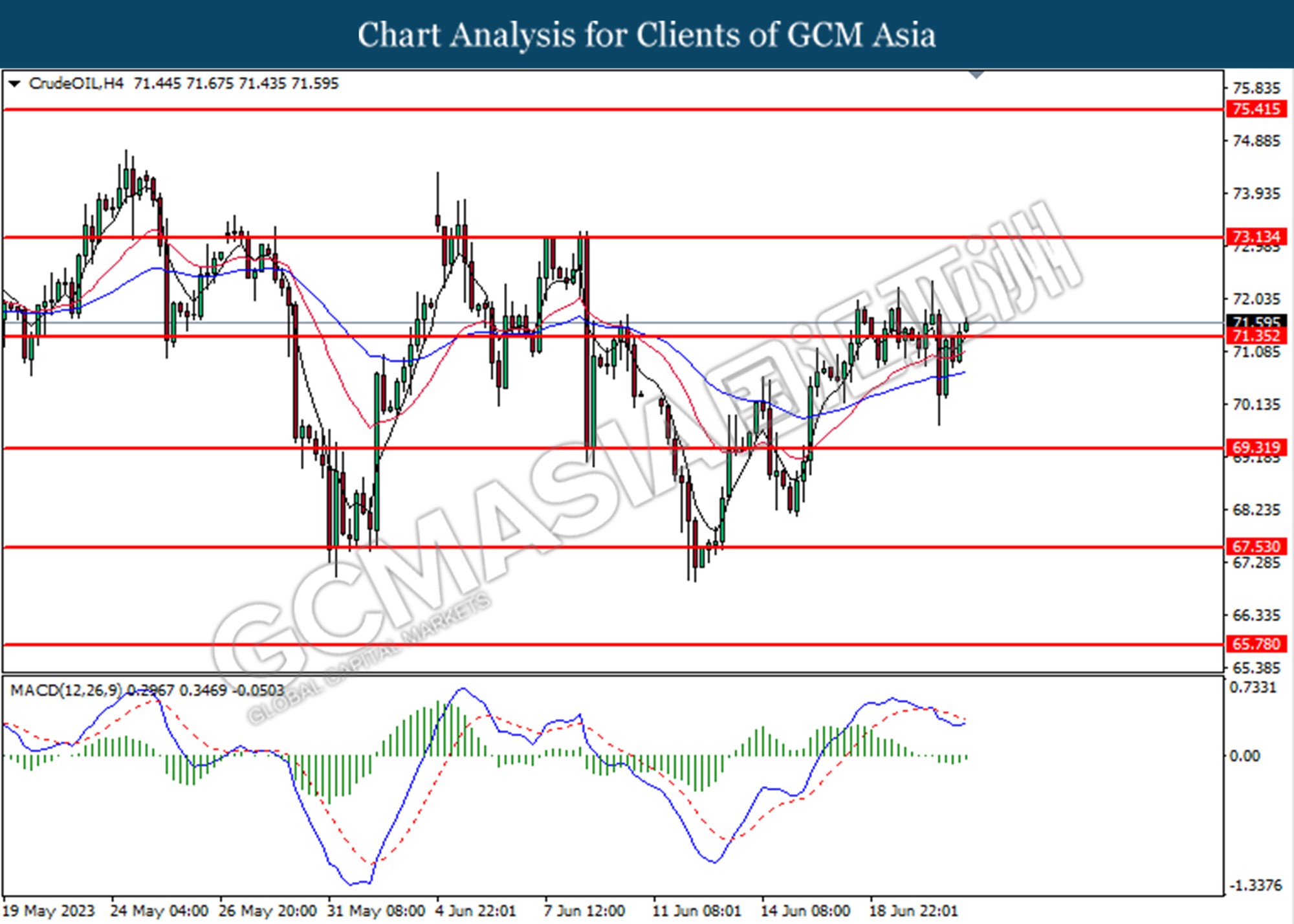

In the commodities market, crude oil prices shrug by 0.44% to $71.50 per barrel as traders weighed on China rate cuts and Fed Powell’s testimony. Besides, the gold prices traded up by 0.05% to $1937.26 per troy ounce ahead of Powell’s testimony approaches.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 04:30

(22th) |

CrudeOIL – API Weekly Crude Oil Stock | 1.024M | – | – |

Technical Analysis

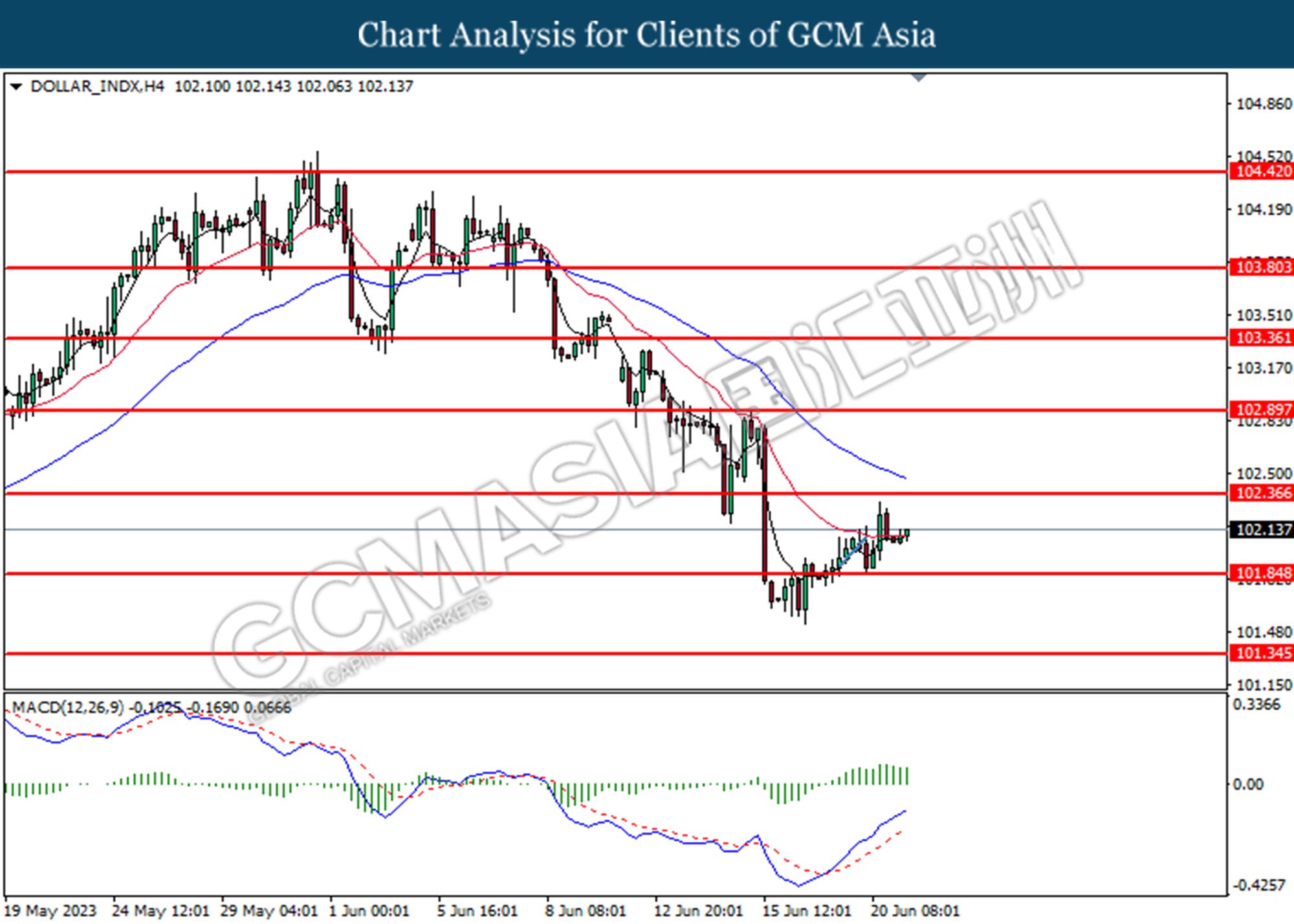

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from lower level. MACD which illustrated bullish momentum suggests the index extended its gains toward the resistance level at 102.35.

Resistance level: 102.35, 102.90

Support level: 101.85, 101.35

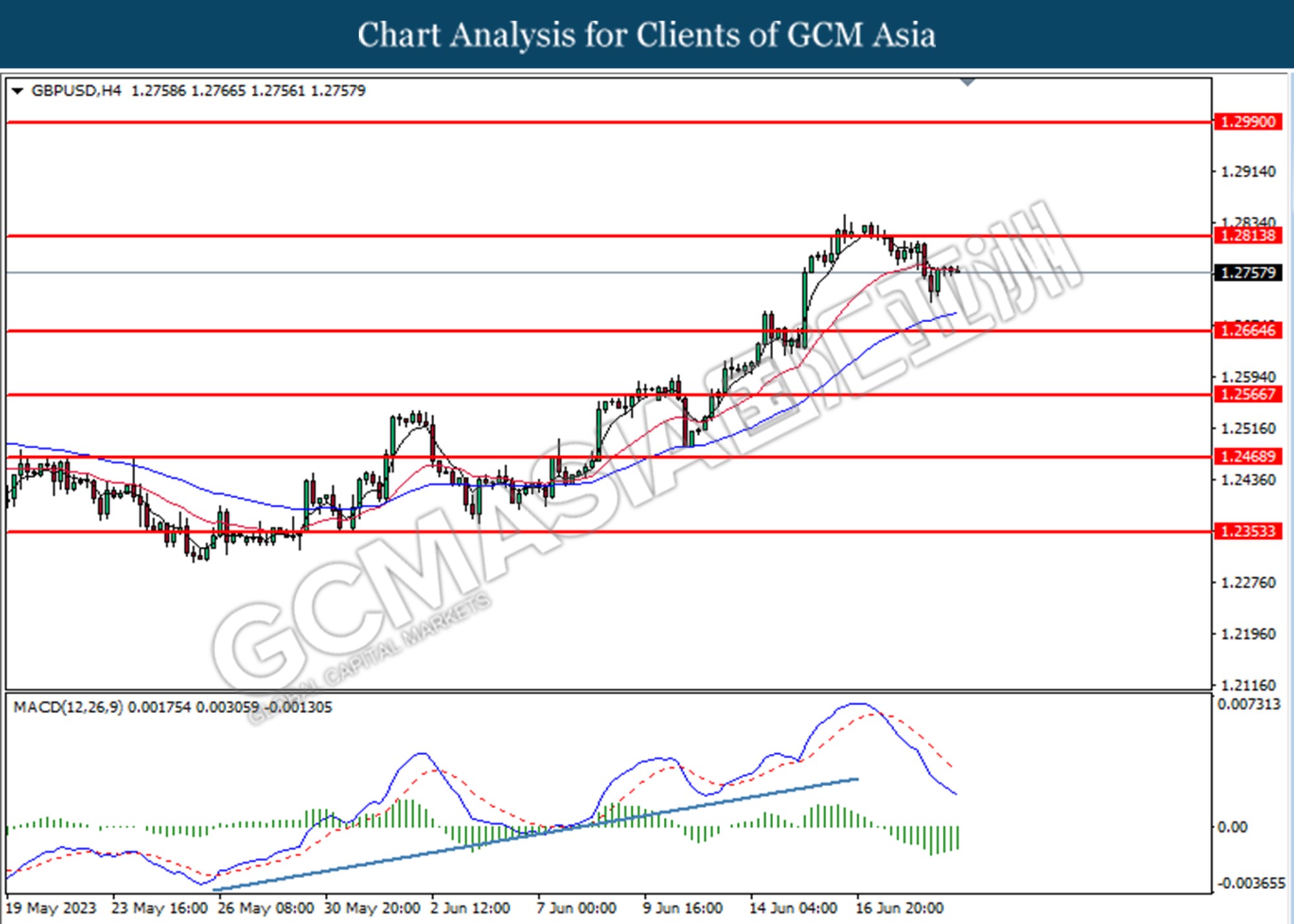

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

EURUSD, H4: EURUSD was traded lower following the prior breaks below from the previous support level at 1.0915. MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.0915, 1.0990

Support level: 1.0840, 1.0760

USDJPY, H4: USDJPY was traded higher following the prior rebound from the support level at 141.40. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 142.90, 144.10

Support level: 141.40, 140.20

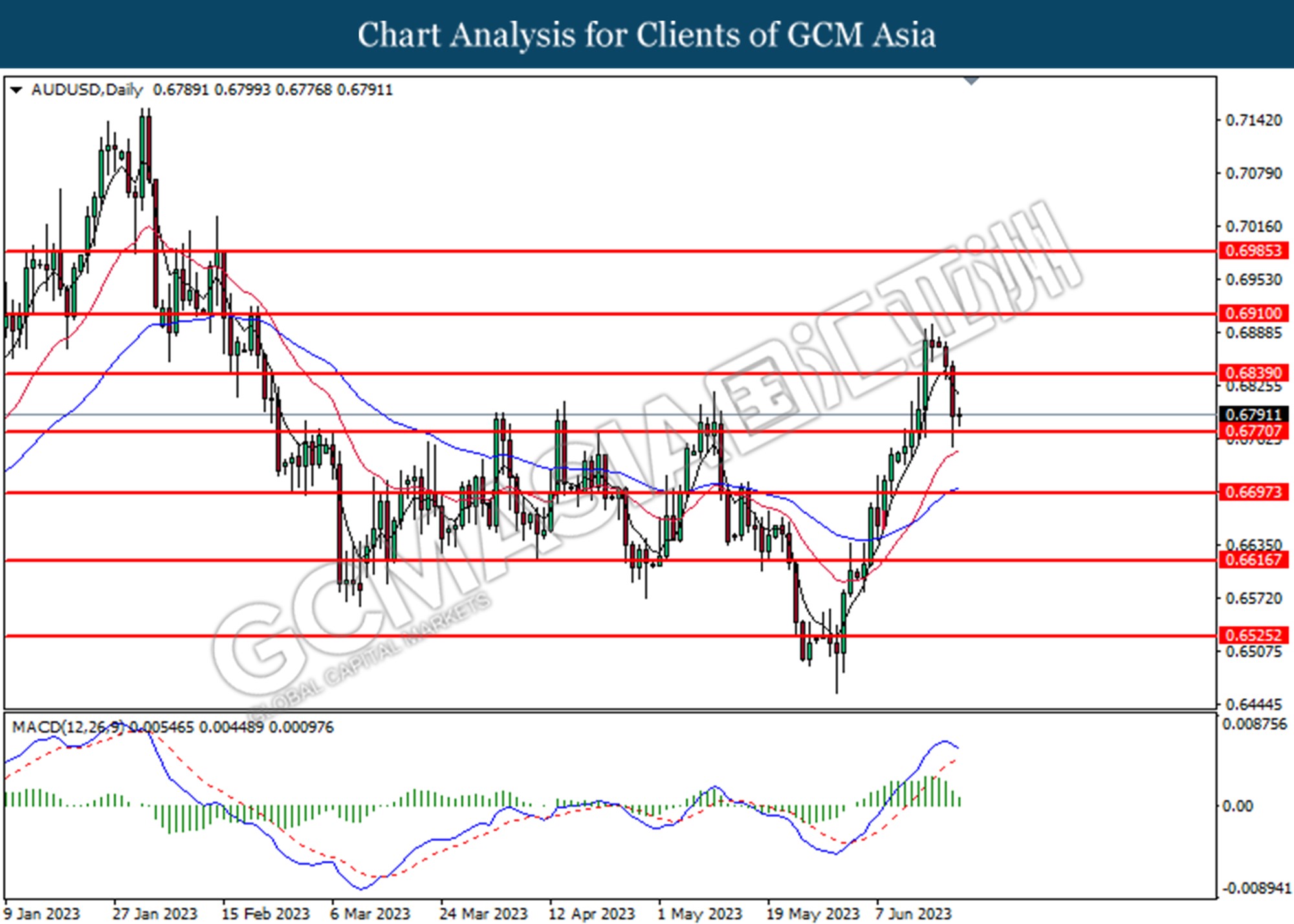

AUDUSD, Daily: AUDUSD was traded lower following the prior breaks below from the previous support level at 0.6840. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.6770.

Resistance level: 0.6840, 0.6910

Support level: 0.6770, 0.6700

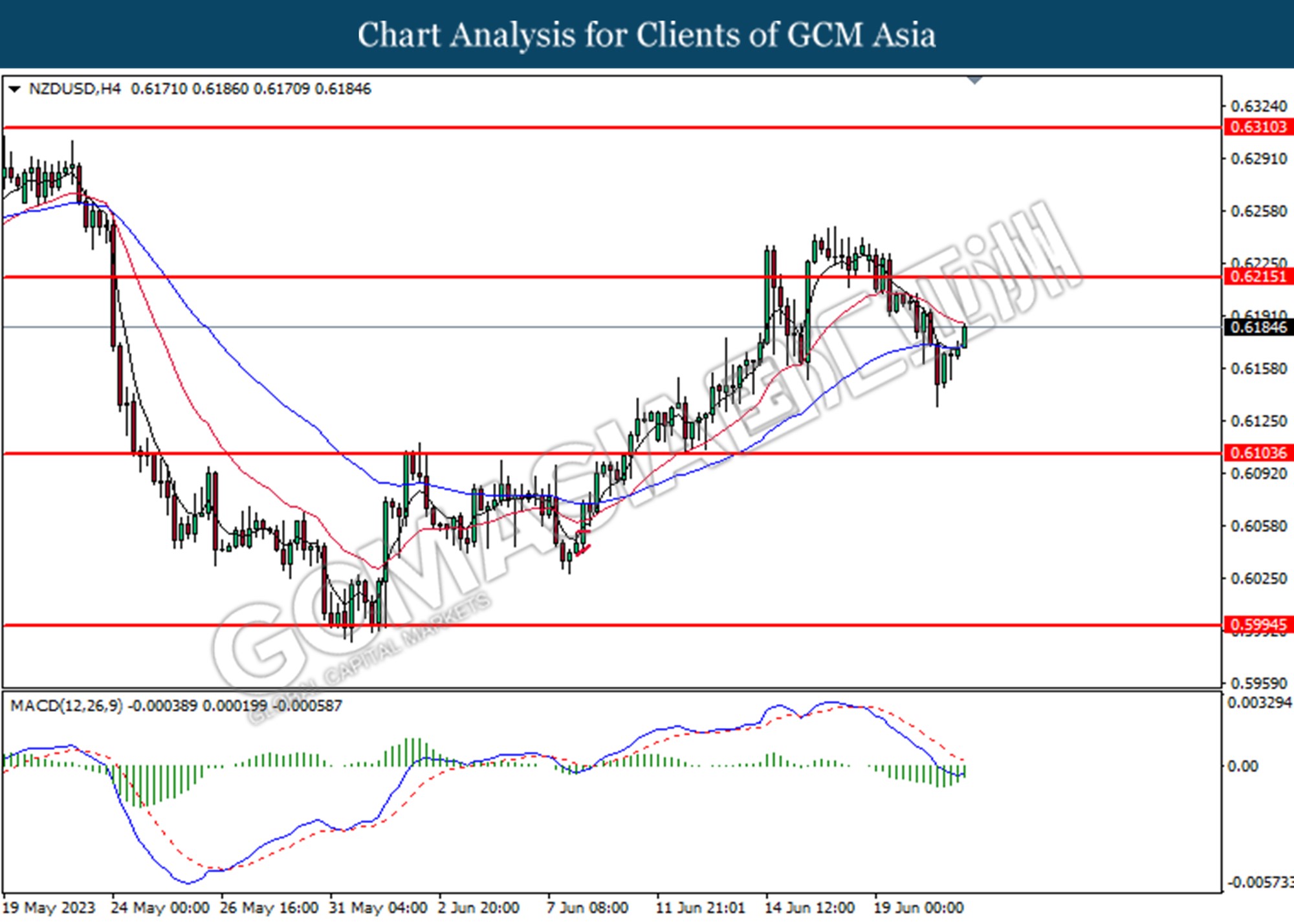

NZDUSD, H4: NZDUSD was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level at 0.6215.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

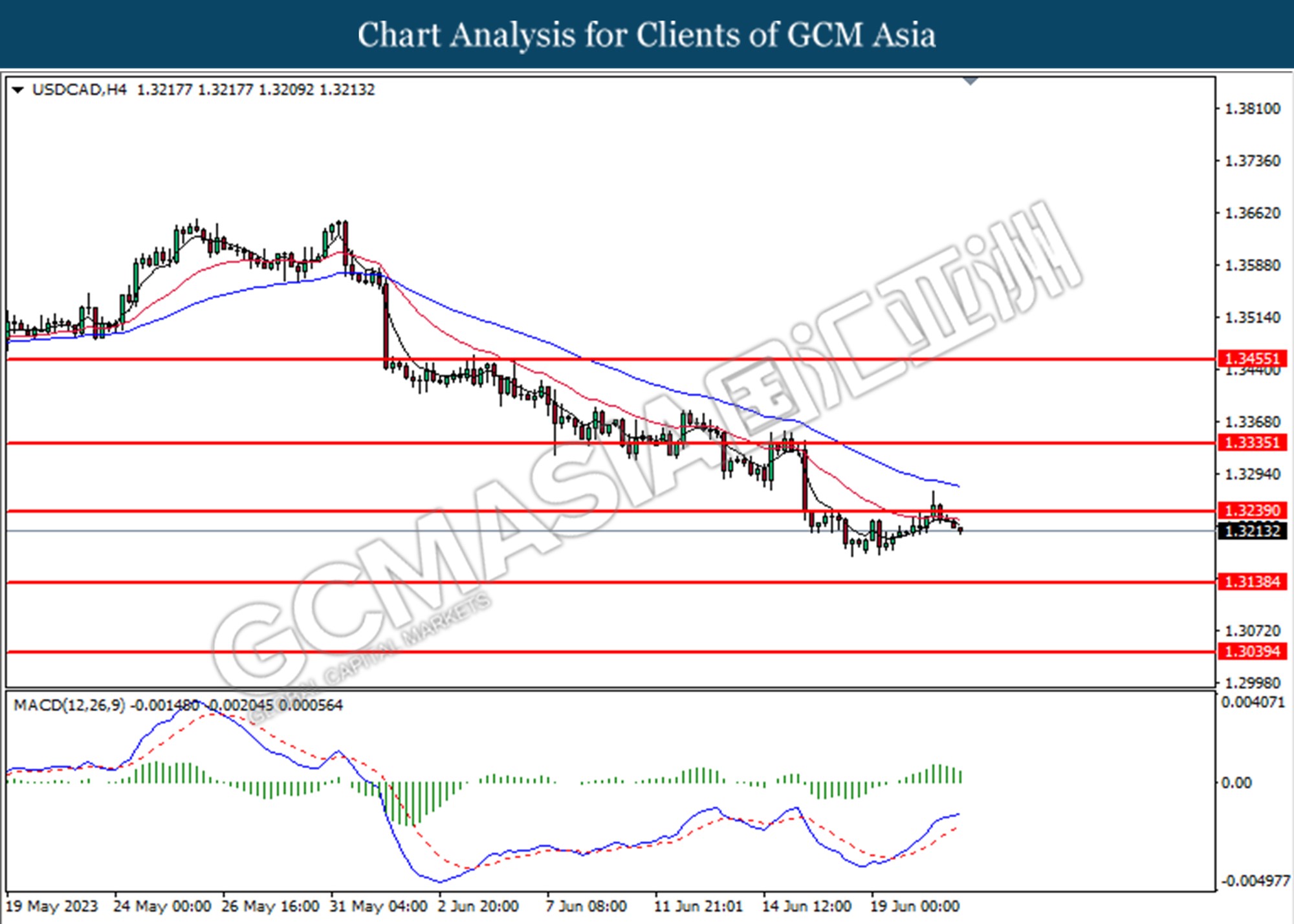

USDCAD, H4: USDCAD was traded lower following the prior retracement from the resistance level at 1.3240. MACD which illustrated diminishing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

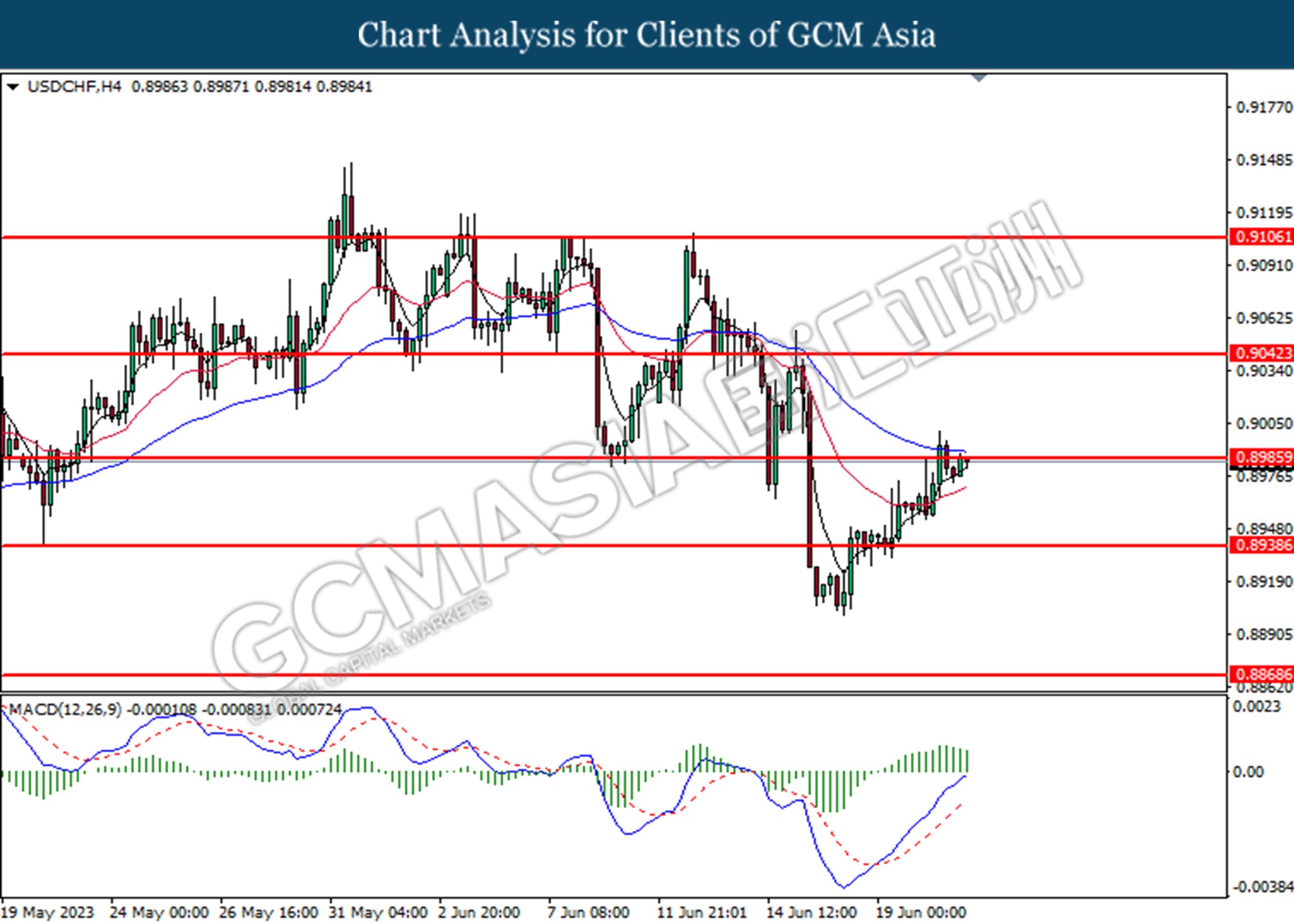

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.8985. However, MACD which illustrated diminishing bullish momentum suggests the pair undergoes technical correction in a short term.

Resistance level: 0.8985, 0.9040

Support level: 0.8940, 0.8870

CrudeOIL, H4: Crude oil price was traded higher following the prior breakout above the previous resistance level at 71.35. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains toward the resistance level.

Resistance level: 73.15, 75.40

Support level: 71.35, 69.30

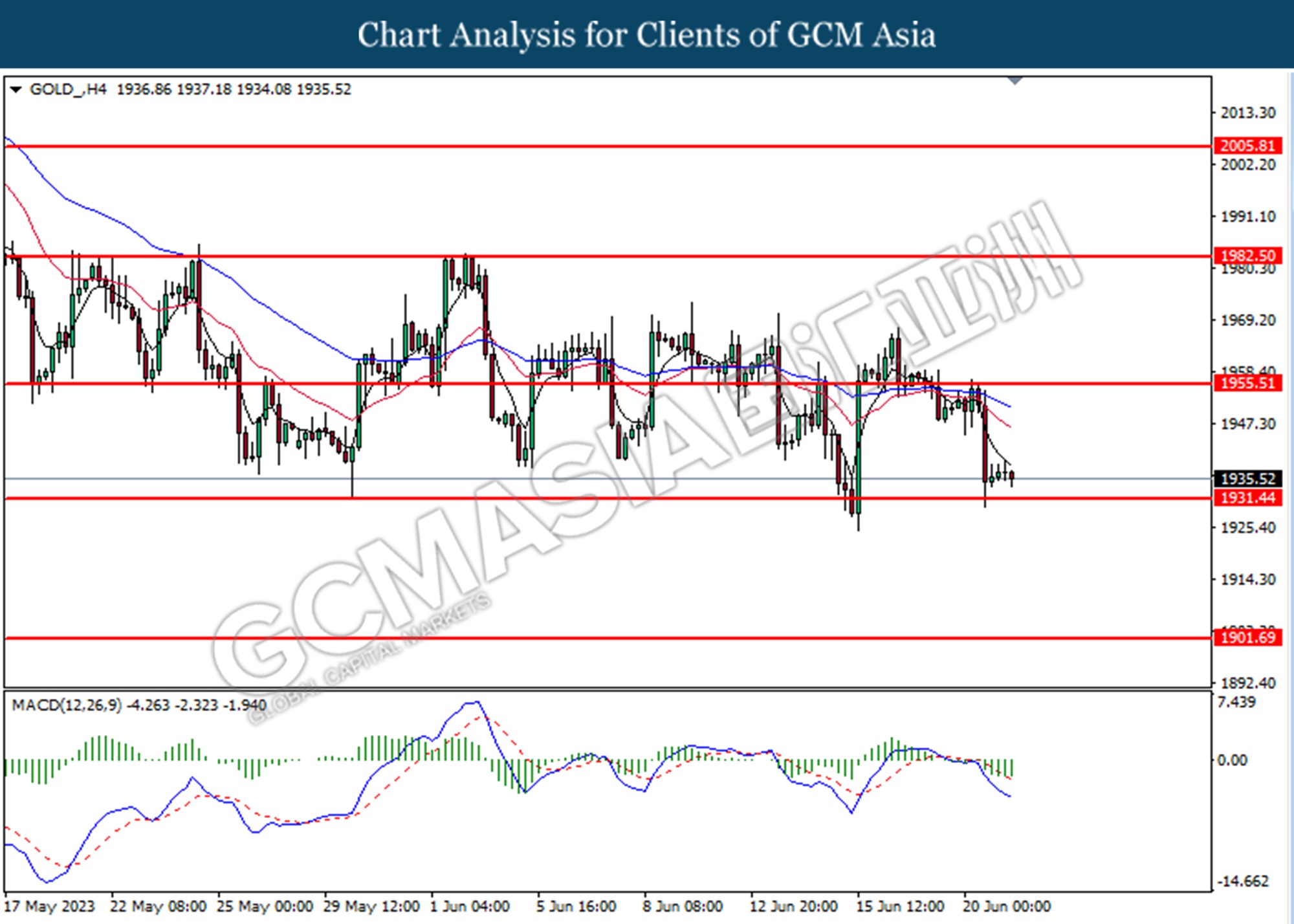

GOLD_, H4: Gold price was traded lower following the prior retracement from the higher level. MACD which illustrated bearish momentum suggests the commodity extended its losses toward the support level.

Resistance level: 1955.50, 1982.50

Support level: 1931.45, 1901.70