22 June 2023 Afternoon Session Analysis

Sterling price jitters as CPI steadily and the economy worsen.

The Pound Sterling, which traded against the dollar index, continued to jitter as the May CPI remained steady as the previous month’s reading, but the economic growth worsened. British headline inflation was unchanged at 8.7% in May compared to April’s data, figures from Office National Statistics showed on Wednesday. Economists polled by Reuters forecast that the annual CPI would drop to 8.4%, but the figures were above economists’ estimation. However, the UK Producer Price Index (PPI) revealed at -1.5% month-on-month in May, slipped more than expected by -0.5%. The ONS said that the fall in input prices was mainly driven by the fall in energy prices. The higher-than-expected CPI prompted investors that the BoE (Bank of England) is under pressure to turn more aggressive. With the CPI remaining steady, the probability of a 5bps hike now stands at 40% from 30%. Nonetheless, the pairs of GBP/USD traded lower following the CPI data revealed. The sterling experience a selloff by global investors after the ONS announced that UK public sector net debt surpassed 100% of gross domestic product (GDP) in May since the year of 1961. Meanwhile, the investors are an eye on BoE monetary policy decisions followed by meeting minutes. As of writing, the GBP/USD ticked down by -0.02% to 1.2769.

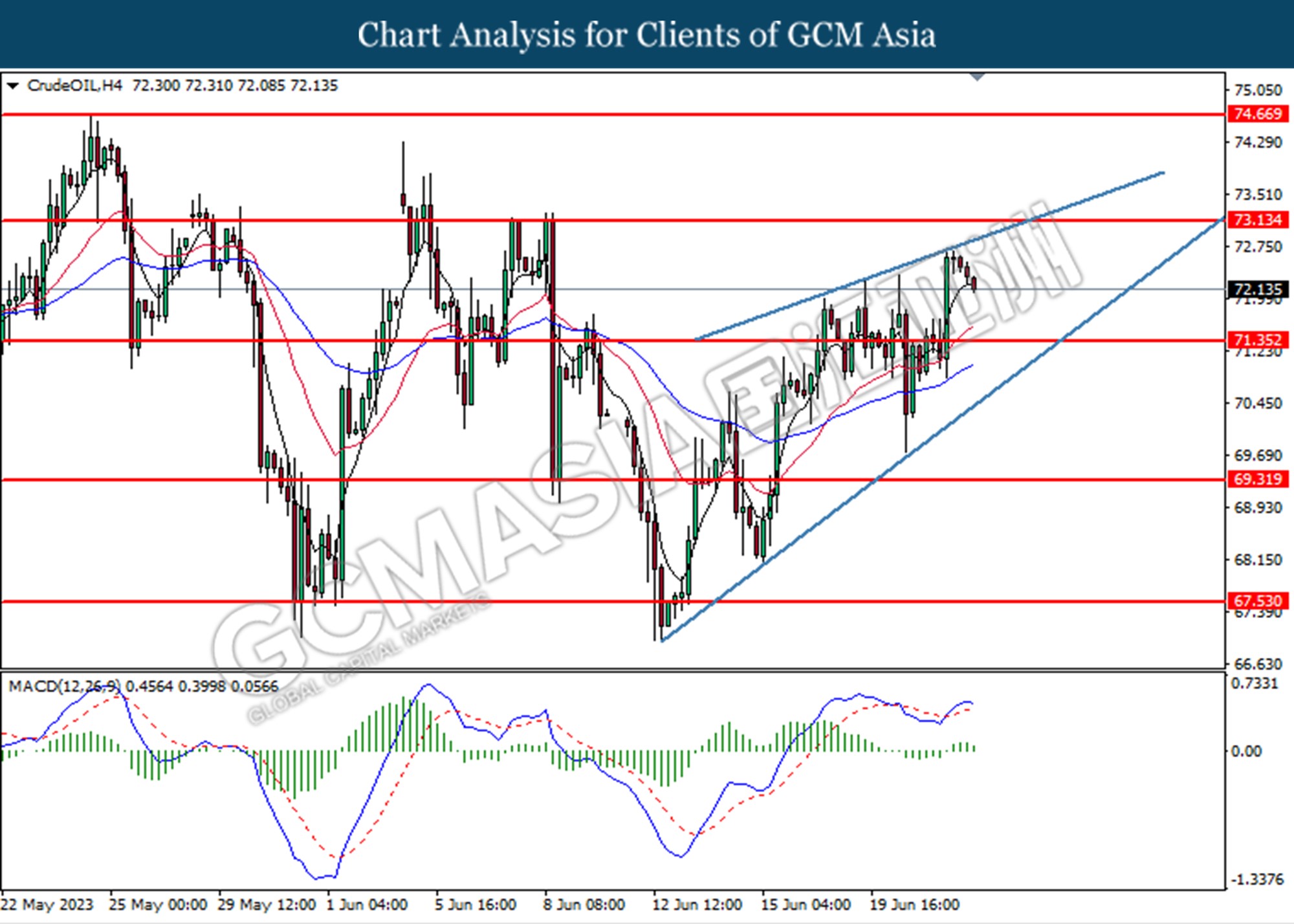

In the commodities market, crude oil prices traded lower by -0.30%% to $72.30 per barrel following the prior American Petroleum Institution (API) revealed crude oil inventory surprise dip at -1.246M. Besides, the gold prices appreciated by 0.02% to $1933.11 per troy ounce as the dollar weakened.

Today’s Holiday Market Close

Time Market Event

All Day CNY Dragon Boat Festival

Today’s Highlight Events

Time Market Event

16:00 CHF SNB Press Conference

20:00 GBP BOE Inflation Letter

22:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | CHF – SNB Interest Rate Decision (Q2) | 1.50% | 1.75% | – |

| 19:00 | GBP – BoE Interest Rate Decision (Jun) | 4.50% | 4.75% | – |

| 20:30 | USD – Initial Jobless Claims | 262K | 260K | – |

| 22:00 | USD – Existing Home Sales (May) | 4.28M | 4.24M | – |

| 23:00 | CrudeOIL – Crude Oil Inventories | 7.919M | 1.873M | – |

Technical Analysis

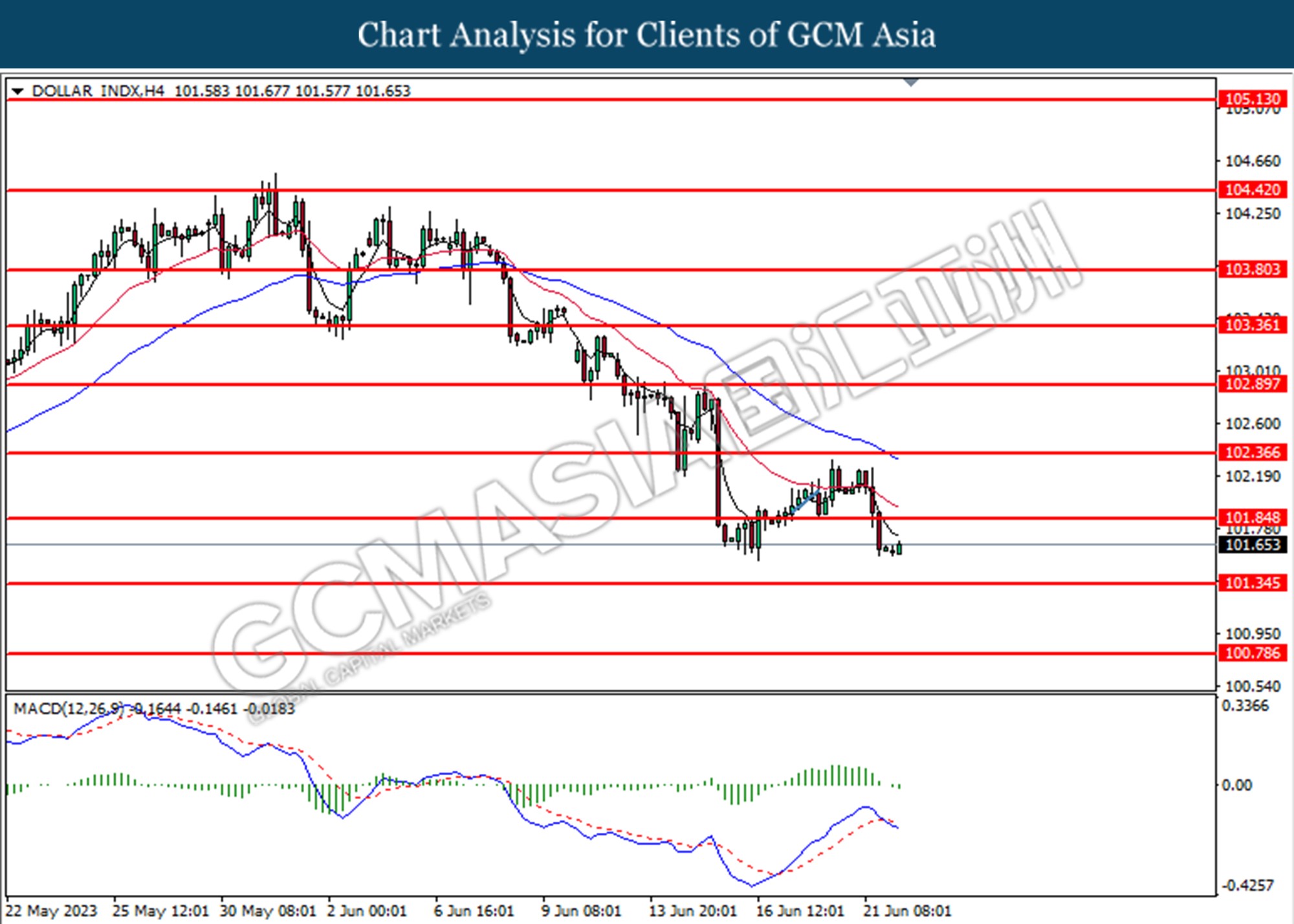

DOLLAR_INDX, H4: Dollar index was traded higher following the prior rebound from lower level. However, MACD which illustrated bearish momentum suggests the index undergoes a technical correction in the short term.

Resistance level: 101.85,102.35

Support level: 101.35, 100.80

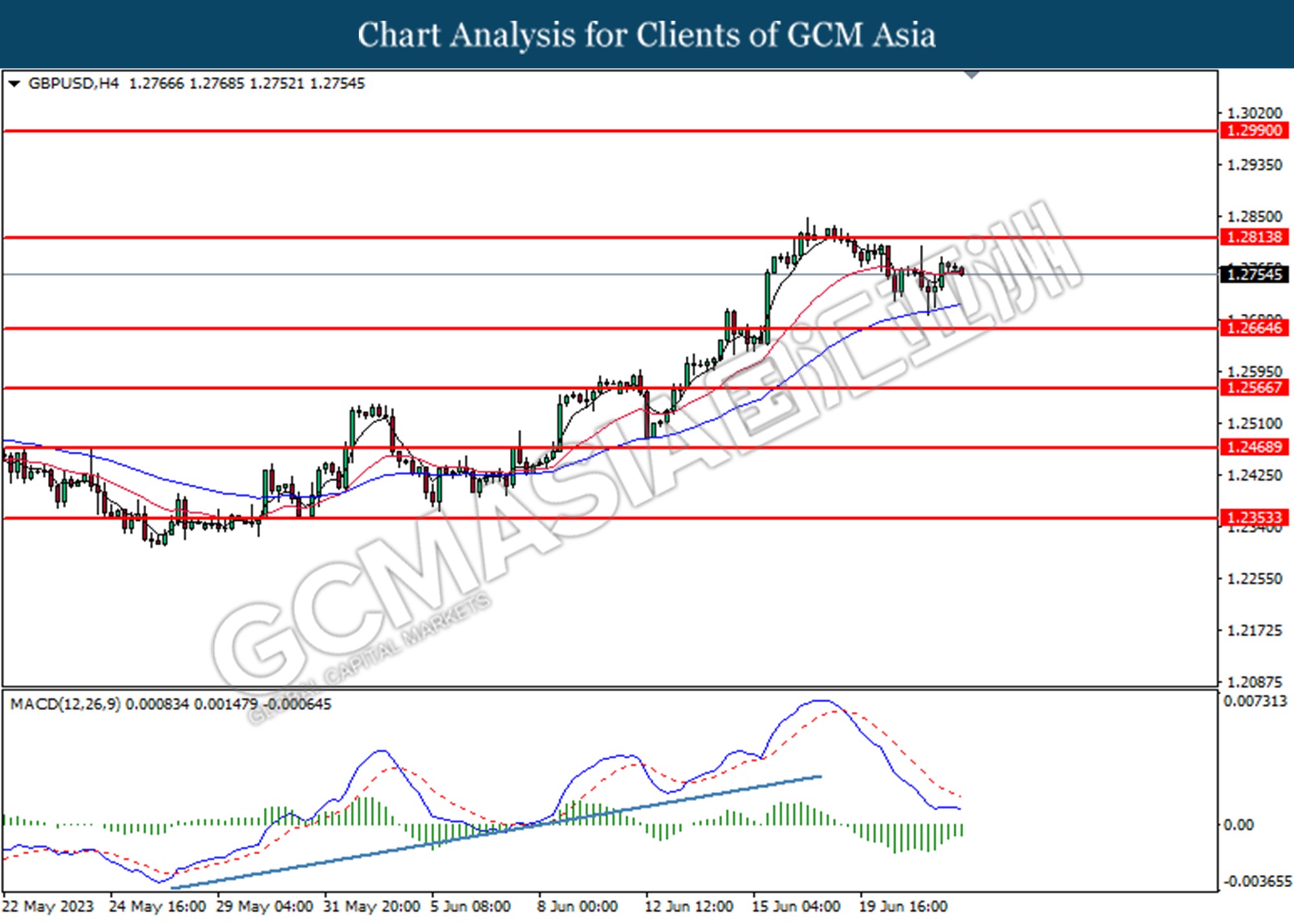

GBPUSD, H4: GBPUSD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.2815, 1.2990

Support level: 1.2665, 1.2565

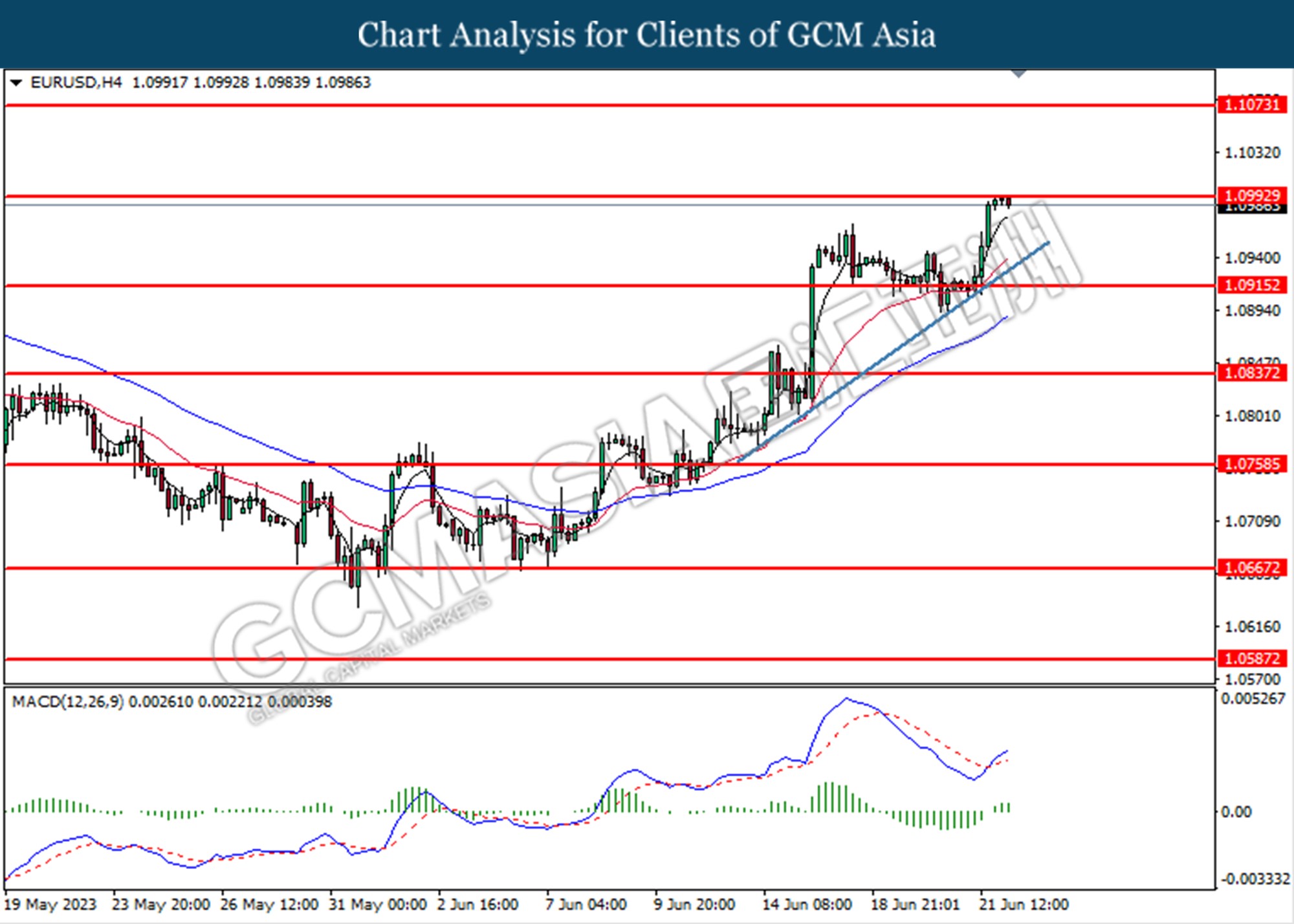

EURUSD, H4: EURUSD was traded lower following the prior retracement from below from the resistance level at 1.0990. However, MACD which illustrated increasing bullish momentum suggests the pair undergoes a technical correction in a short term.

Resistance level: 1.0990, 1.1075

Support level: 1.0915, 1.0840

USDJPY, H4: USDJPY was traded higher following the prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the pair extended its gains toward the resistance level.

Resistance level: 142.90, 144.10

Support level: 141.40, 140.20

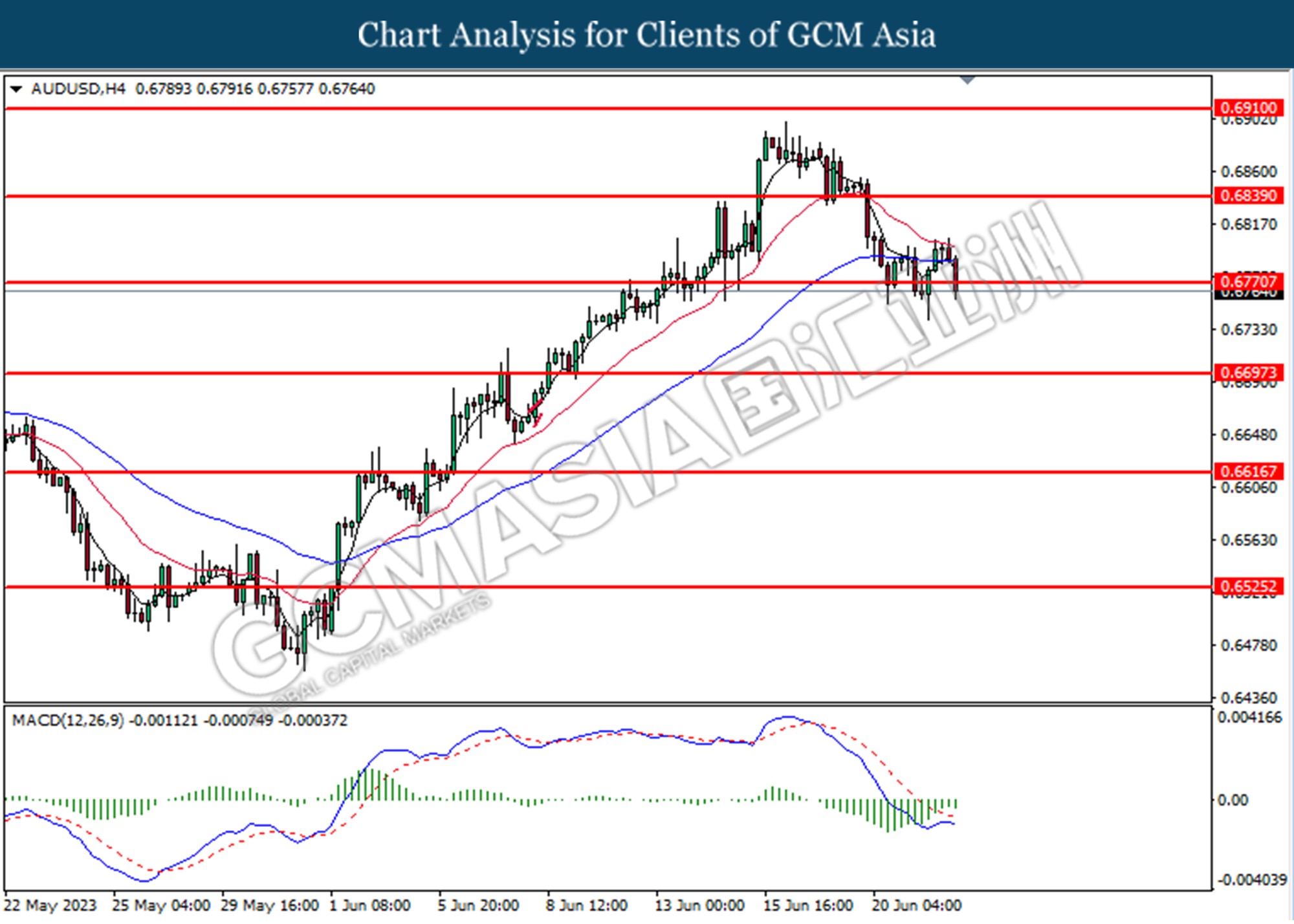

AUDUSD, H4: AUDUSD was traded lower following the prior breaks below from the previous support level at 0.6770. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.6770, 0.6840

Support level: 0.6700, 0.6615

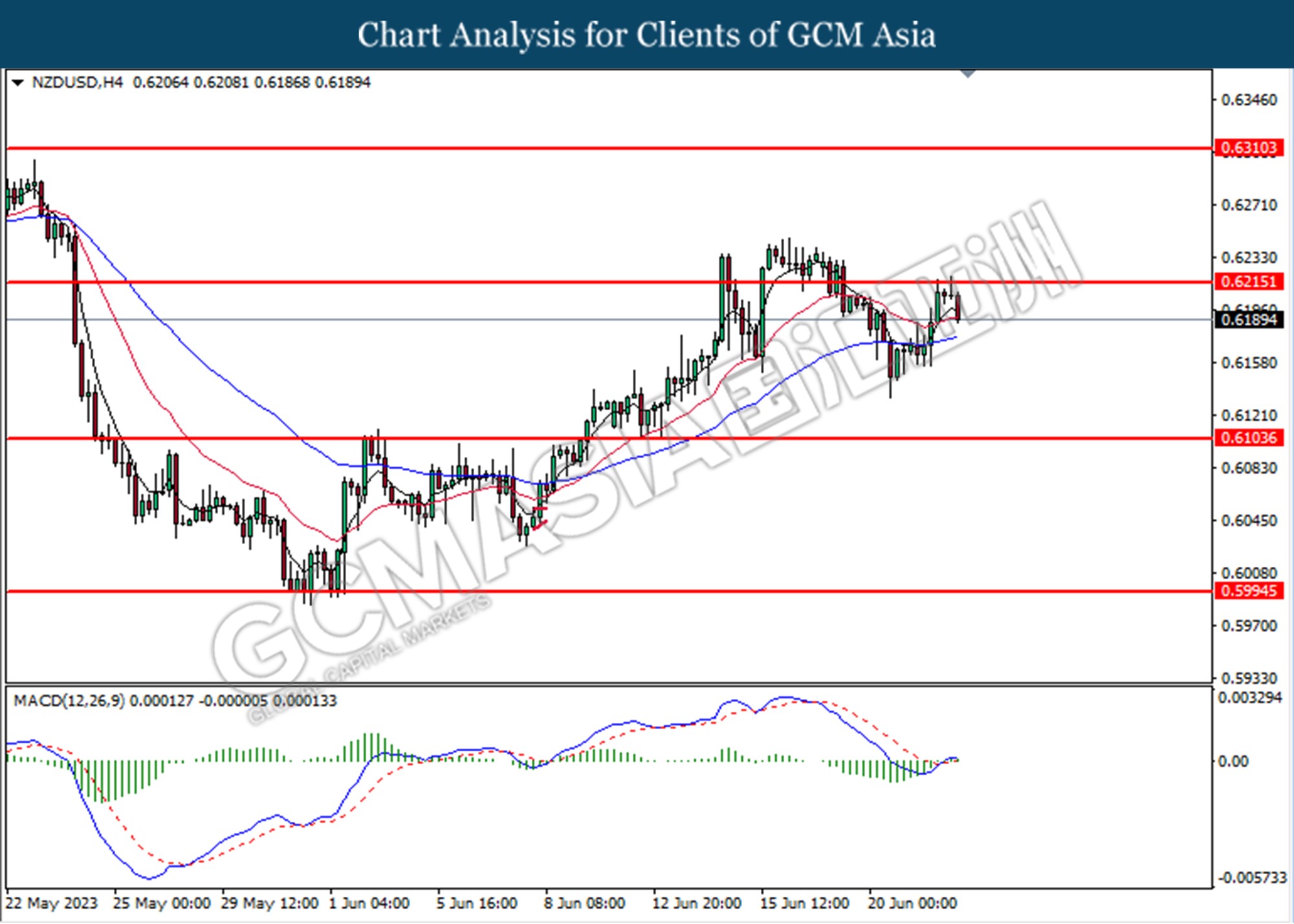

NZDUSD, H4: NZDUSD was traded lower following the prior retracement from the resistance level at 0.6215. However, MACD which illustrated diminishing bearish momentum suggests the pair undergoes a technical correction in the short term.

Resistance level: 0.6215, 0.6310

Support level: 0.6105, 0.5995

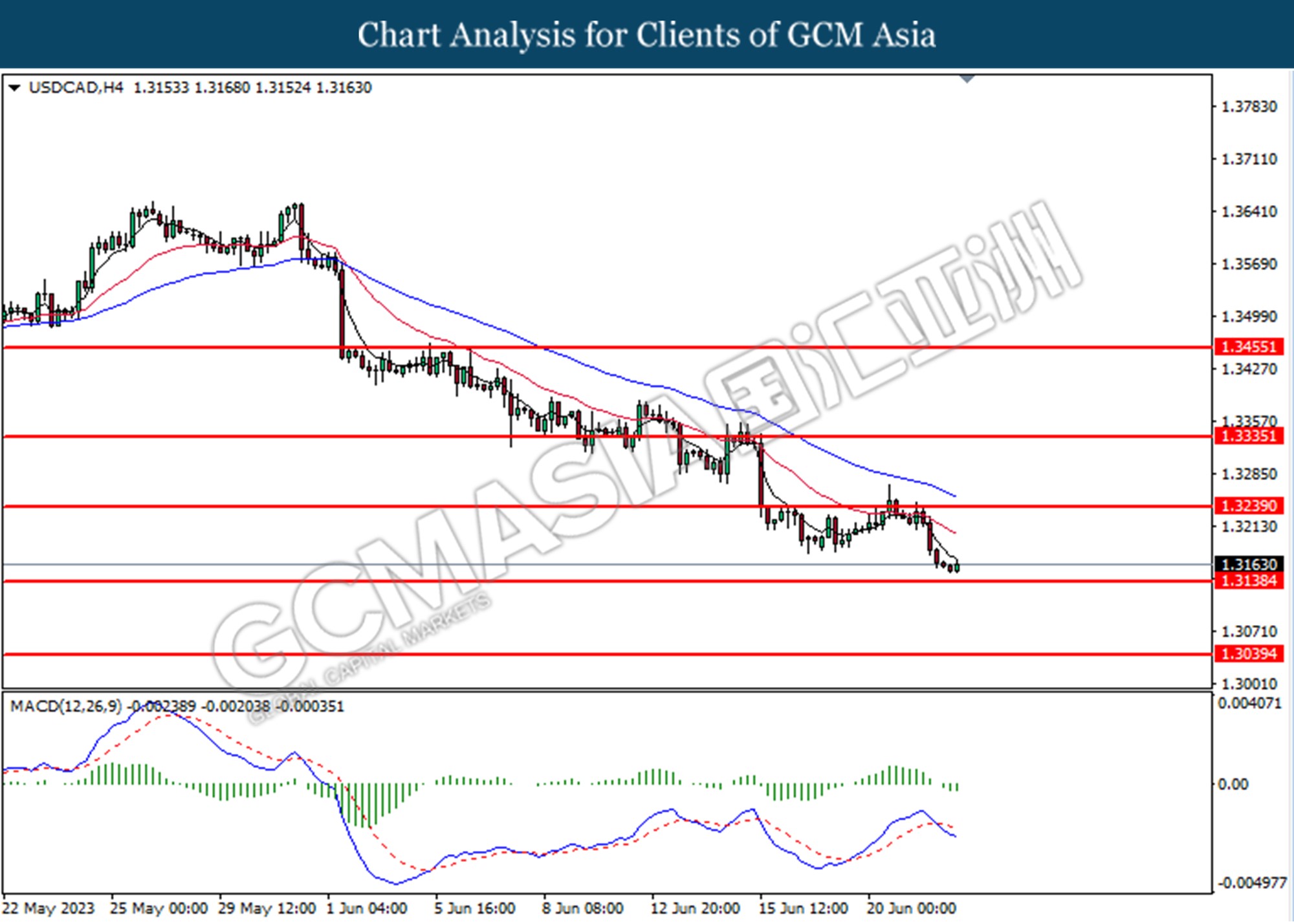

USDCAD, H4: USDCAD was traded lower following the prior retracement from the resistance level at 1.3240. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level at 1.3140.

Resistance level: 1.3240, 1.3335

Support level: 1.3140, 1.3040

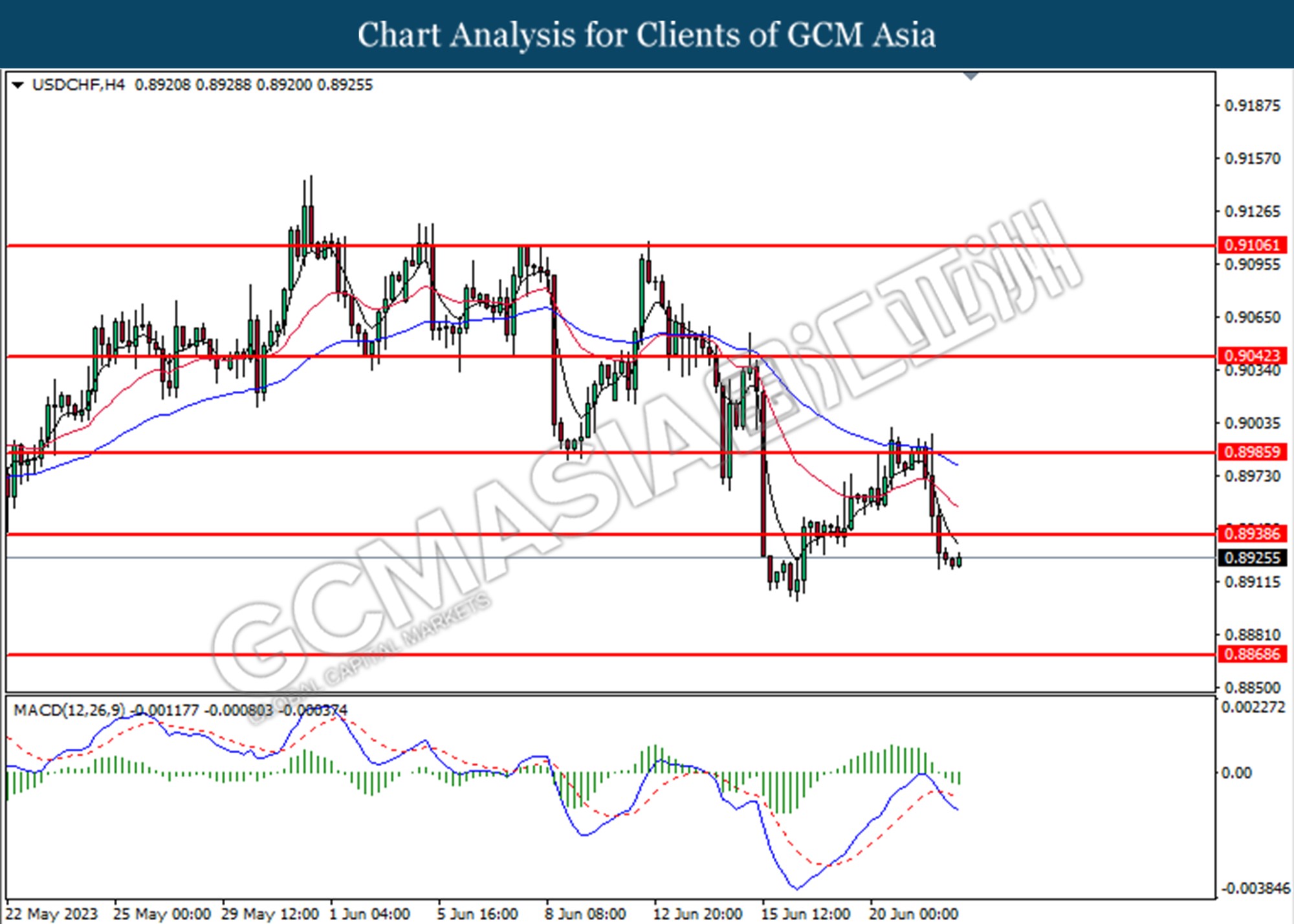

USDCHF, H4: USDCHF was traded lower following the prior breaks below the previous support level at 0.8940. MACD which illustrated increasing bearish momentum suggests the pair extended its losses toward the support level.

Resistance level: 0.8940, 0.8985

Support level: 0.8870, 0.8820

CrudeOIL, H4: Crude oil price was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the commodity extended its losses toward the support level at 71.35.

Resistance level: 73.15, 75.40

Support level: 71.35, 69.30

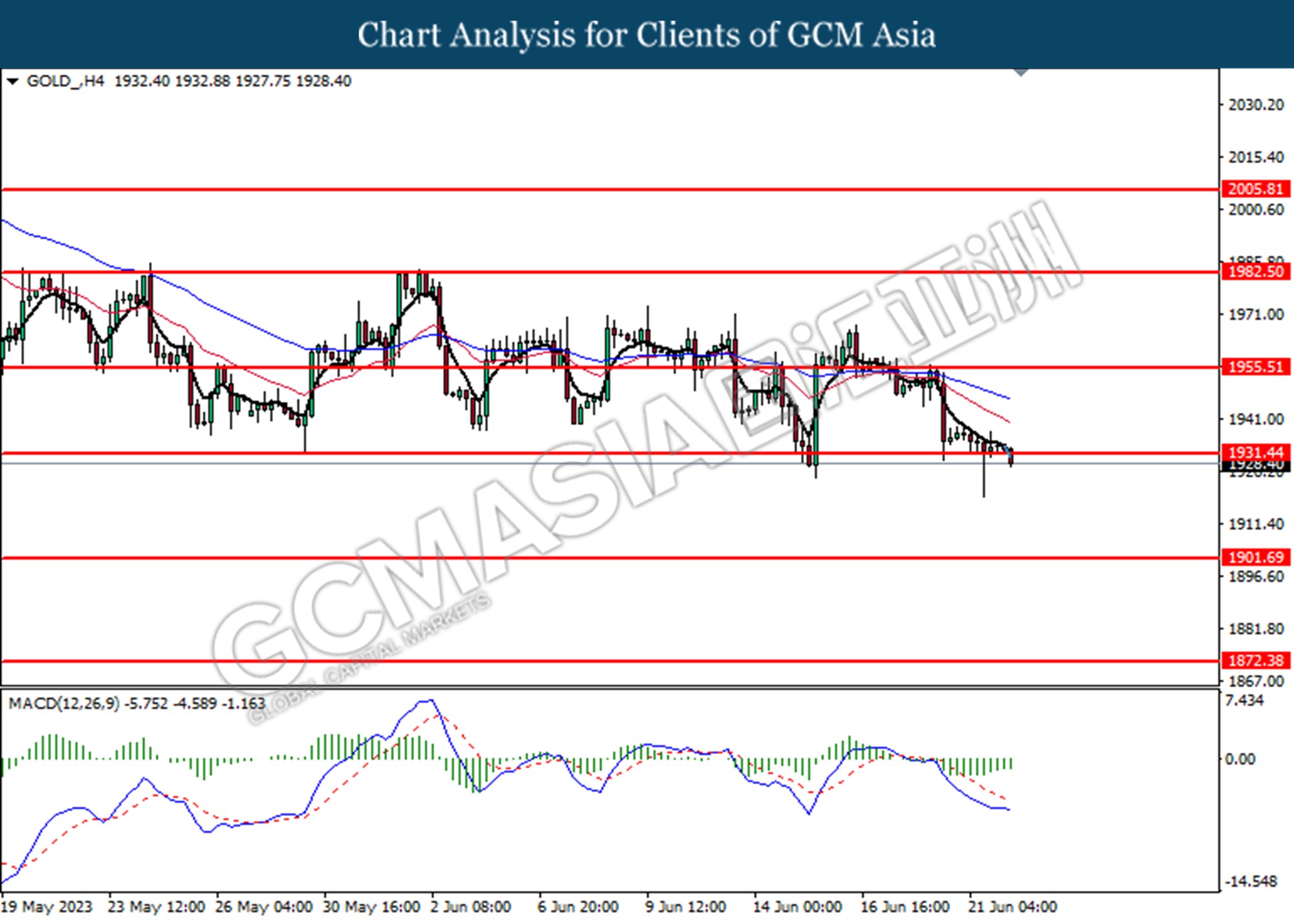

GOLD_, H4: Gold price was traded lower following the prior breaks below from the previous support level at 1931.45. However, MACD which illustrated diminishing bearish momentum suggests the commodity undergoes a technical correction in the short term.

Resistance level: 1931.45, 1955.50

Support level: 1901.70, 1872.40