29 November 2018 Afternoon Session Analysis

Dollar slumped amid US escalating trade war plans.

Dollar downed against its basket of six major pairs amid concerns from US President Donald Trump to propose tariff in automobile industry to protect its nation’s interest. According to news resource, US President Donald Trump has announced on Wednesday he is exploring new tariff in automobile industry as a solution to promote domestic production and also protect jobs. The auto tariff would further worsen its trade relations with China and also escalate trade tensions with more countries, such as Japan which is a major automobile exporter in a global economy. Besides that, dollar sentiment was further pressured by Fed Powell’s dovish statement on early Thursday. Dollar index fell 0.07% to 96.57 as of writing. Meanwhile, GBPUSD rose 0.15% to 1.2845 at the time of writing amid optimism from BoE’s Governor Mark Carney over Brexit uncertainty. According to news, BoE Governor Mark Carney has reassured that BoE is fully prepared regardless of Brexit outcome and stated that it has “contingency plans in place to support market functioning if necessary.”

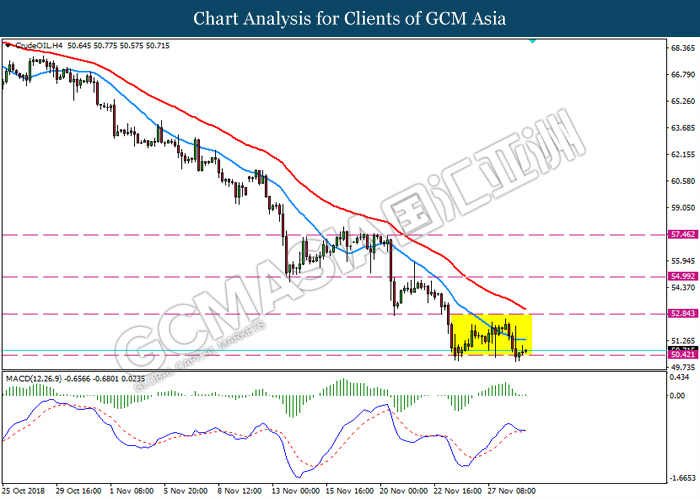

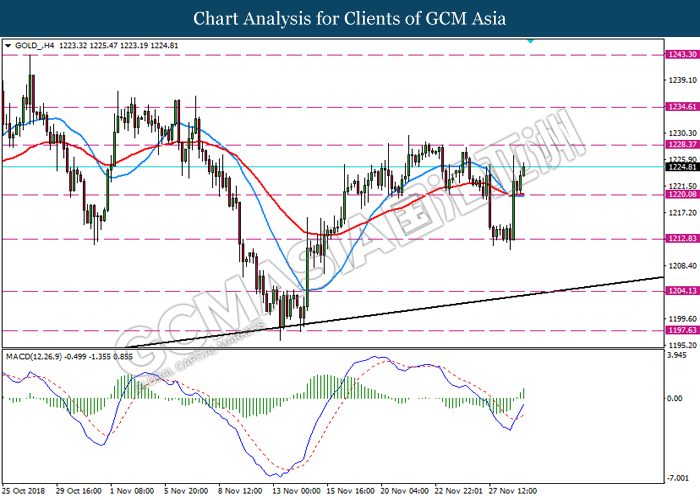

As for commodities market, crude oil price ticked higher by 0.72% to $50.63 per barrel amid market optimism in G20 meeting trade talk could improve crude oil’s demand outlook in the global economy despite increase in U.S crude oil inventories. On the other hand, gold price surged 0.34% to $1,224.90 a troy ounce following dollar’s weakness amid dovish Powell.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 EUR ECB President Draghi Speaks

03:00 (30th) USD FOMC Meeting Minutes

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Nov) | -11K | -10K | – |

| 21:30 | USD – Initial Jobless Claims | 224K | 221K | – |

| 21:30 | USD – Core PCE Price Index (MoM) (Oct) | 0.2% | 0.2% | – |

| 21:30 | USD – Personal Spending (MoM) (Oct) | 0.4% | 0.4% | – |

| 21:30 | USD – Personal Income (MoM) (Oct) | 0.2% | 0.4% | – |

| 23:00 | USD – Pending Home Sales (MoM) (Oct) | 0.5% | 0.8% | – |

Technical Analysis

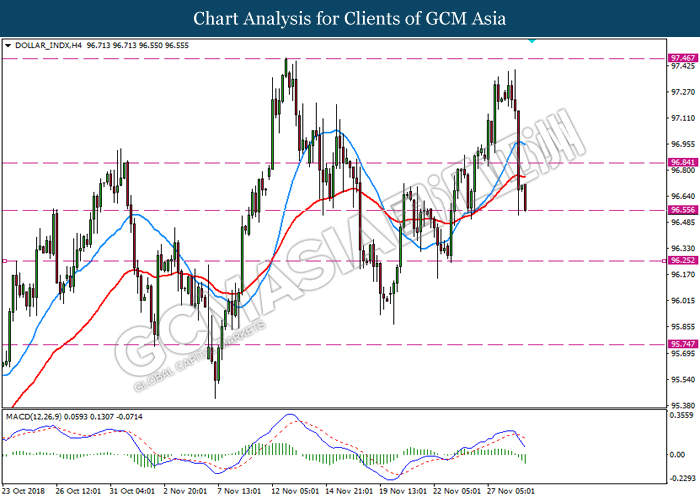

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level 96.55. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level 96.55.

Resistance level: 96.85, 97.45

Support level: 96.55, 96.25

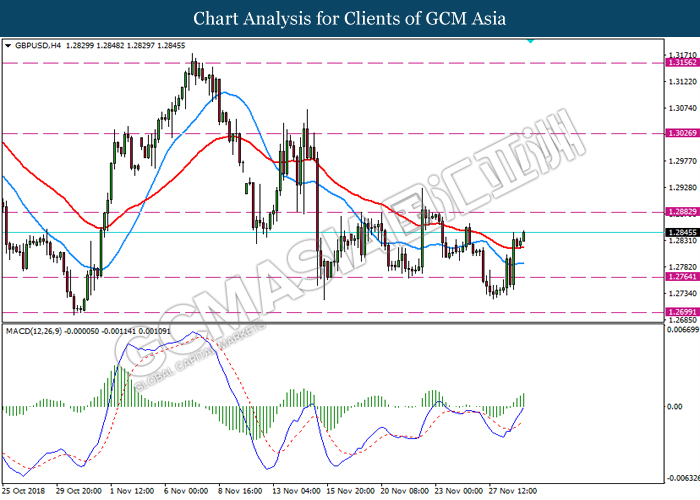

GBPUSD, H4: GBPUSD was traded lower following prior rebound from the support level 1.2765. MACD which display bullish momentum with the formation of golden cross suggest the pair to extend its gains towards the resistance level 1.2880.

Resistance level: 1.2880, 1.3025

Support level: 1.2765, 1.2700

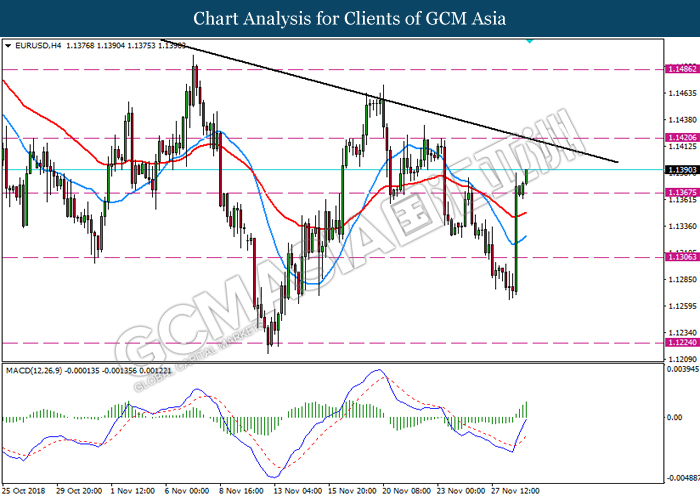

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level 1.1365. MACD which display bullish bias with the formation of golden cross suggest the pair to extend its gains towards the resistance level 1.1420.

Resistance level: 1.1420, 1.1485

Support level: 1.1305, 1.1225

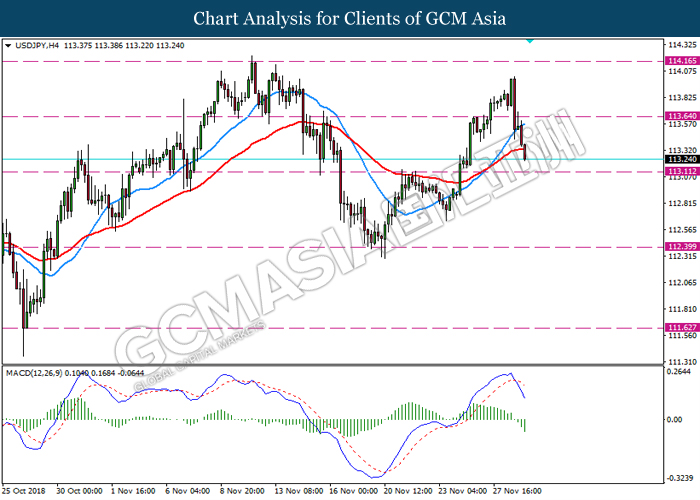

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level 113.65. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses towards the support level 113.10.

Resistance level: 113.65, 114.15

Support level: 113.10, 112.40

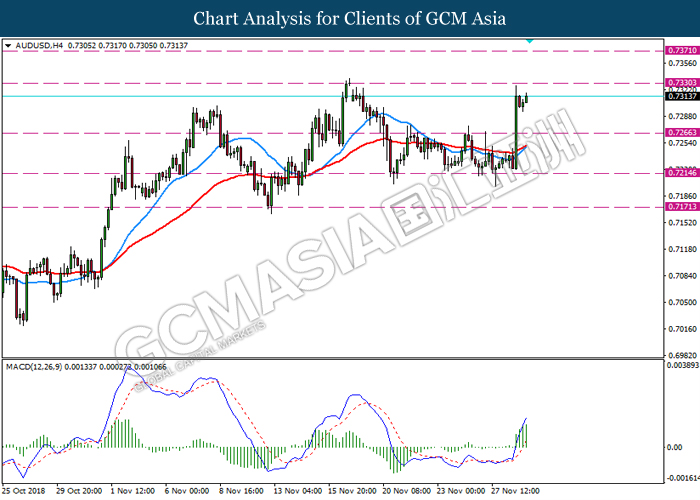

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level 0.7265. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its gains towards the resistance level 0.7330.

Resistance level: 0.7330, 0.7370

Support level: 0.7265, 0.7215

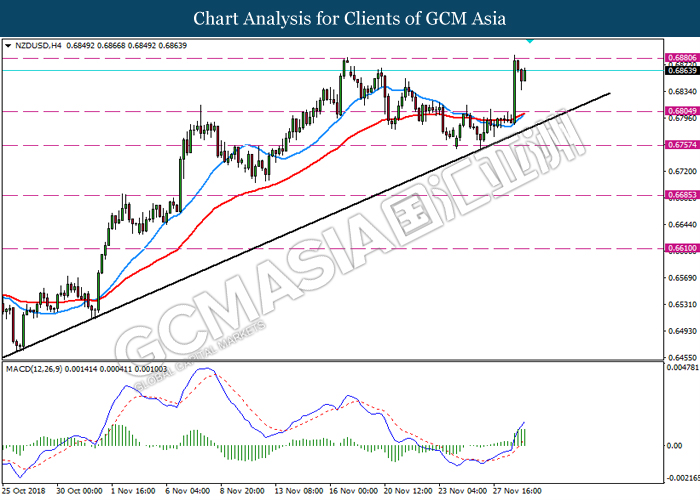

NZDUSD, H4: NZDUSD was traded higher following recent breakout above the previous resistance level 0.6805. MACD which display bullish bias signal with the formation of golden cross suggest the pair to extend its gains towards the resistance level 0.6880.

Resistance level: 0.6880, 0.6975

Support level: 0.6805, 0.6755

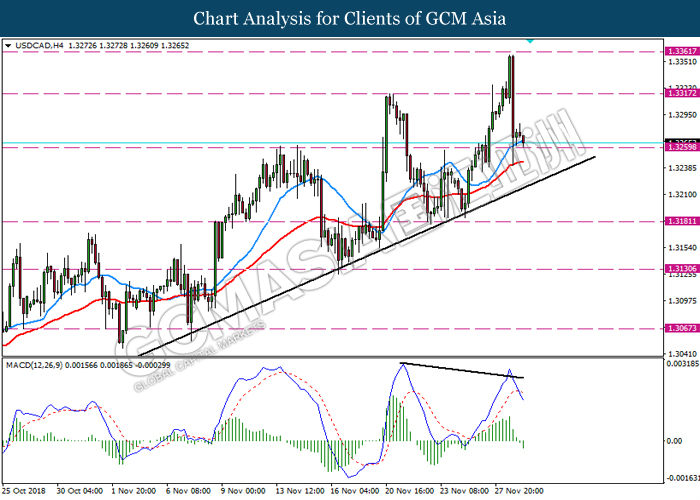

USDCAD, H4: USDCAD was traded lower while currently testing the support level 1.3260. MACD which illustrate bearish momentum with the formation of death cross and negative divergence suggest the pair to extend its losses after it breaks below the support level 1.3260.

Resistance level: 1.3315, 1.3360

Support level: 1.3260, 1.3180

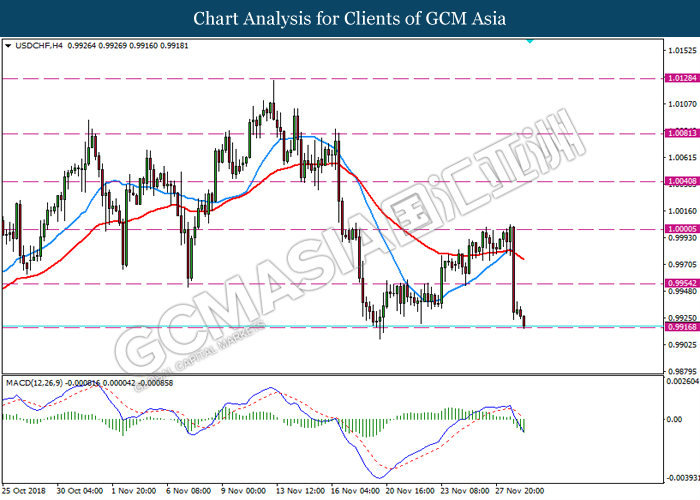

USDCHF, H4: USDCHF was traded lower while currently testing the support level 0.9915. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair extend its losses after its breaks below the support level 0.9915.

Resistance level: 0.9955, 1.0000

Support level: 0.9915, 0.9860

CrudeOIL, H4: Crude oil price remains traded in sideway while currently testing the support level 50.40. MACD which illustrate bearish momentum signal suggest the pair to extend its losses after it breaks below the support level 50.40.

Resistance level: 52.85, 55.00

Support level: 50.40, 49.05

GOLD_, H4: Gold was traded higher following prior breakout above the previous resistance level 1220.00. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its gains towards the resistance level 1228.50.

Resistance level: 1228.50, 1234.50

Support level: 1220.00, 1212.50