25 January 2019 Afternoon Session Analysis

Dollar slips as U.S – China trade spat continues.

Dollar index slips against its basket of six major currencies following increasing tension between U.S and China. According to reports, US Commerce Secretary Wilbur Ross stated that US was miles and miles away from resolving China trade issues. Recently US have cancelled planned trade meeting with Beijing due to outstanding disagreements over intellectual property rules. Besides that, US Senate lacked votes for President Trump’s border wall fund resulted the shutdown to continue, increasing further concerns of market sentiment. Dollar index fell 0.23% to 96.05 as of writing. Meanwhile, AUDUSD tumbled 0.10% to 0.7083 as of writing following increasing expectations of RBA rate cut. Aussie fell its biggest single day drop since 2nd of January after a surprising mortgage rate hike by National Bank of Australia (NAB) which increased the prospect of RBA rate cut.

In the commodities market, crude oil price surge 1.32% to 53.84 per barrel at the time of writing as oil markets remain supported by Venezuela turmoil. Following political turmoil in the country, Following leadership crisis in Venezuela, President of Venezuela Nicolas Maduro is breaking relations with the US and Trump administration considering sanction against Venezuelan oil to punish President Nicolas Maduro’s government which could decrease the oil inventories level further. On the other hand, gold price rose 0.11% to 1282.58 as of writing following a weakened dollar and a steady demand of safe haven asset.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 17:00 | EUR – German Ifo Business Climate Index | 101.0 | 100.7 | – |

| 21:30 | USD – Core Durable Goods Orders (MoM) (Dec) | 0.4% | 0.3% | – |

| 23:00 | USD – New Home Sales (Nov) | 544K | 560K | – |

| 02:00

(26th) |

CrudeOIL – US Baker Hughes Oil Rig Count | 825 | – | – |

Technical Analysis

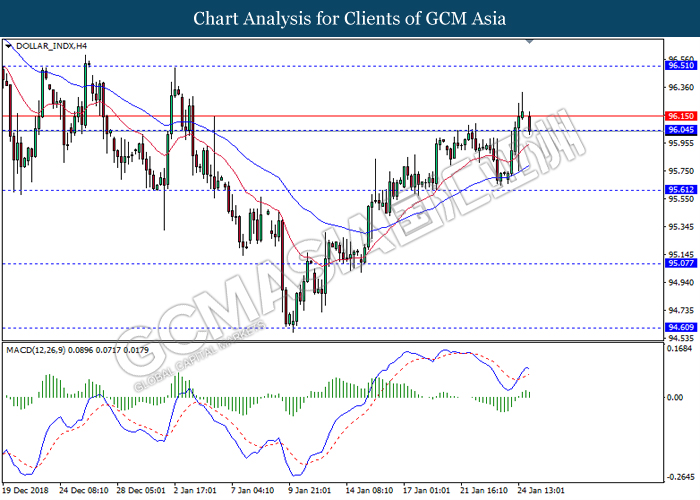

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level 96.05. MACD which illustrate diminishing bullish momentum suggest the pair to extend its retracement after it breaks below the support level.

Resistance level: 96.50, 97.15

Support level: 95.60, 95.05

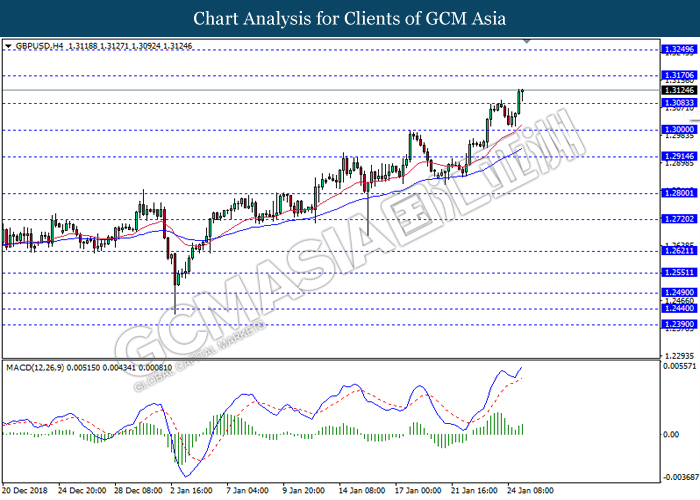

GBPUSD, H4: GBPUSD was traded higher following prior breakout above previous resistance level 1.3085. MACD which illustrate persistent bullish momentum suggest the pair to extend its gains towards the resistance level 1.3170.

Resistance level: 1.3170, 1.3250

Support level: 1.3085, 1.3000

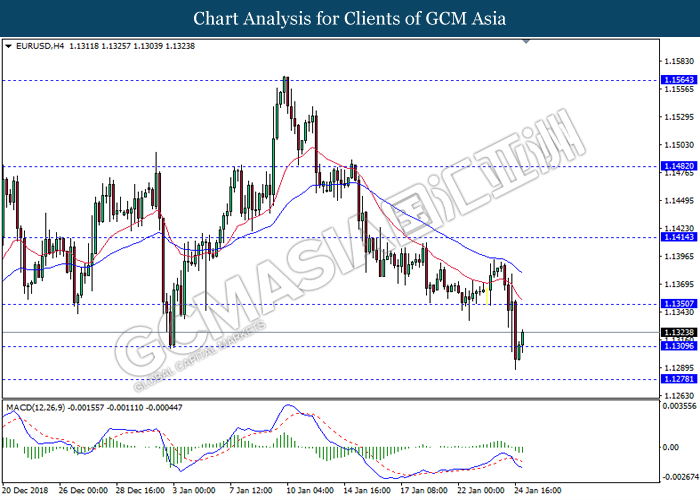

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level 1.1310. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound towards the resistance level 1.1350

Resistance level: 1.1350, 1.1415

Support level: 1.1310, 1.1265

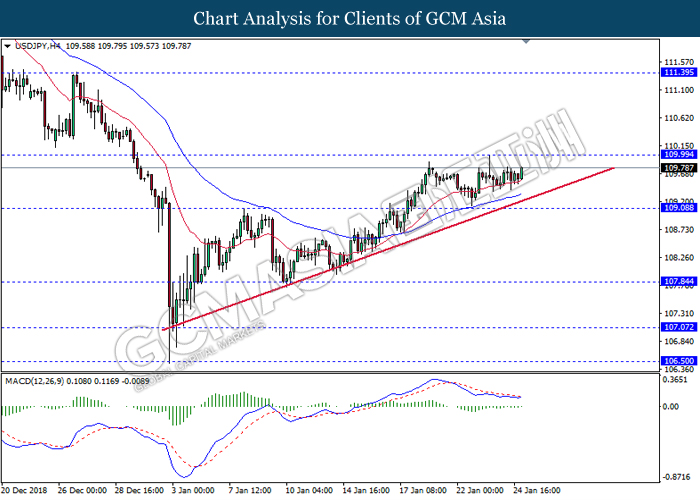

USDJPY, H4: USDJPY was traded higher following rebound from the MA line 20 (red). MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains towards the resistance level 110.00.

Resistance level: 110.00, 111.40

Support level: 109.10, 107.85

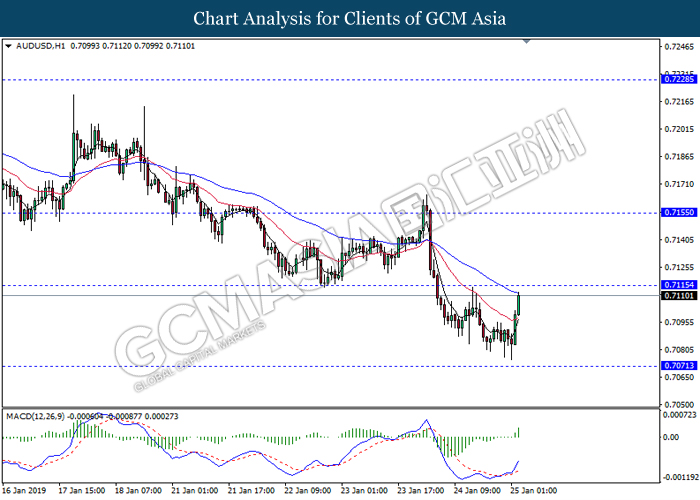

AUDUSD, H4: AUDUSD was traded higher following prior rebound near the support level 0.7070. MACD which display bullish bias signal with the formation of golden cross suggest the pair to extend its rebound towards the resistance level 0.7115.

Resistance level: 0.7115, 0.7230

Support level: 0.7070, 0.7005

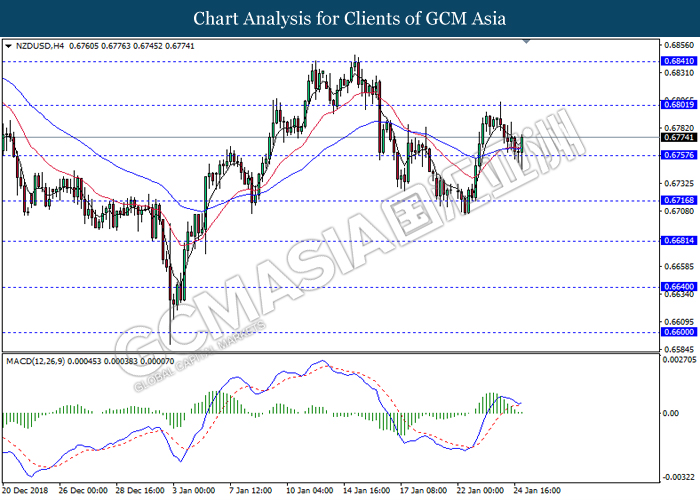

NZDUSD, H4: NZDUSD was traded higher following recent rebound from the support level 0.6755. MACD which illustrate diminishing bearish momentum suggest the pair to extend rebound towards the resistance level 0.6800.

Resistance level: 0.6800, 0.6840

Support level: 0.6755, 0.6715

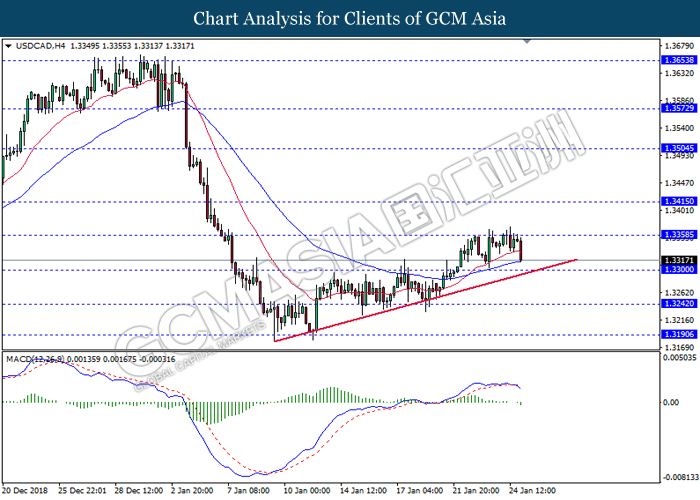

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level 1.3360. MACD which illustrate bearish momentum suggest the pair extend its losses towards the support level 1.3300.

Resistance level: 1.3360, 1.3415

Support level: 1.3300, 1.3240

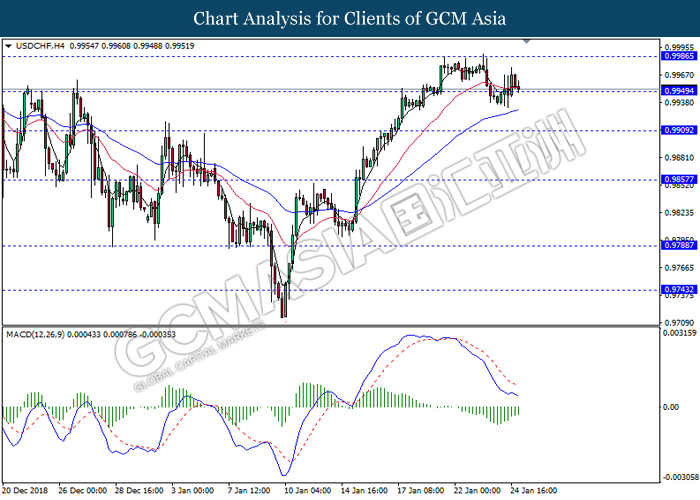

USDCHF, H4: USDCHF was traded lower while currently retest the support level 0.9950. However, MACD which illustrate diminishing bearish momentum suggest the pair to be traded higher towards the resistance level 0.9985.

Resistance level: 0.9985, 1.0010

Support level: 0.9950, 0.9910

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level 52.85. MACD which display diminishing bearish momentum suggest the commodity to extend its gains towards the resistance level 54.55.

Resistance level: 54.55, 57.80

Support level: 52.85, 50.30

GOLD_, H4: Gold price was traded higher following prior rebound from the support level 1278.90. MACD which illustrate bullish momentum and the formation of golden cross suggest gold to extend its rebound towards the resistance level 1287.00.

Resistance level: 1287.00, 1296.85

Support level: 1278.90, 1267.25