30 January 2019 Morning Session Analysis

Dollar recovered from poor data driven by pound major sell-off.

Dollar index ticked up by 0.03% to 95.46 against a basket of six major currency pairs during early Asian trading session after being sold off amid poor consumer confidence data. According to US Conference Board, consumer confidence came in at 120.2, missing economists’ expectation of 124.7 while indicating a poorer economic growth prior to the government shutdown and volatile stock market. However, the temporary fall in dollar was later cushioned by the major sell-off in pound sterling amid the rejection of amendment to extend the deadline for Brexit. Without extending the Article 50, UK will be forced to leave the EU by 29th March with no exceptions, thus increasing the likelihood of a no-deal Brexit. However, amendments regarding the renegotiation of the Irish backstop and the case of a no-deal Brexit won the backing of UK Lawmakers. UK Prime Minister Theresa May will be expected to persuade EU lawmakers regarding the amendments made to the Brexit deal while facing large pressures as EU had since been reluctant to reopen negotiations. As of writing, pair of GBP/USD edged higher by 0.15% to 1.3085

In the commodities market, crude oil price increased by 0.14% to $53.30 per barrel after being supported by the sanction on the export of Venezuela oil into the US which had brightened the cloudy sentiment for crude oil. Besides that, API reports on weekly crude oil stock indicated a major drop in stock level from 6.550M to 2.098M. Oil bulls cheered on the positive data by buying oil and hoping that OPEC may increase its production cut in the near future to further support oil prices. On the other hand, gold price falls 0.07% to $1310.45 after undergoing a large demand following the market uncertainties caused by the arrestment Huawei CFO which will in turn harm the trade talks between US and China.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

03:00 (31st) USD FOMC Statement

03:00 (31st) USD FOMC Press Conference

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 21:00 | EUR – German CPI (MoM) (Jan) | 0.1% | -0.7% | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Jan) | 271K | 170K | – |

| 21:30 | USD – GDP (QoQ) (Q4) | 3.4% | 2.6% | – |

| 23:00 | USD – Pending Home Sales (MoM) (Dec) | -0.7% | 1.1% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 7.970M | – | – |

| 03:00 (31st) | USD – Fed Interest Rate Decision | 2.50% | 2.50% | – |

Technical Analysis

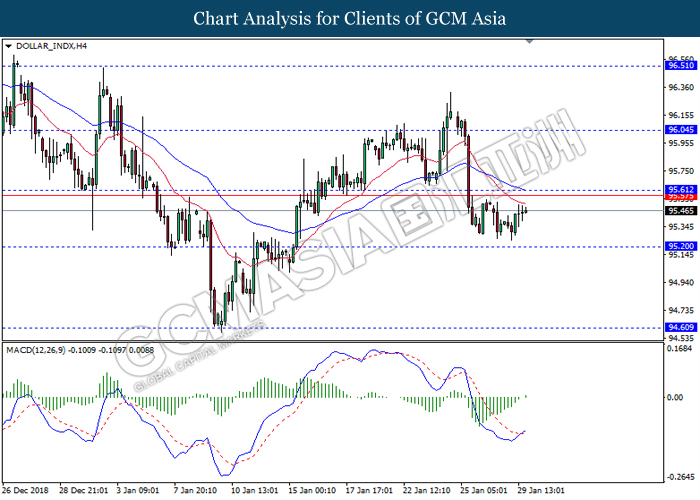

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level 95.20. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the dollar to extend its rebound towards the resistance level 95.60.

Resistance level: 95.60, 96.05

Support level: 95.05, 94.60

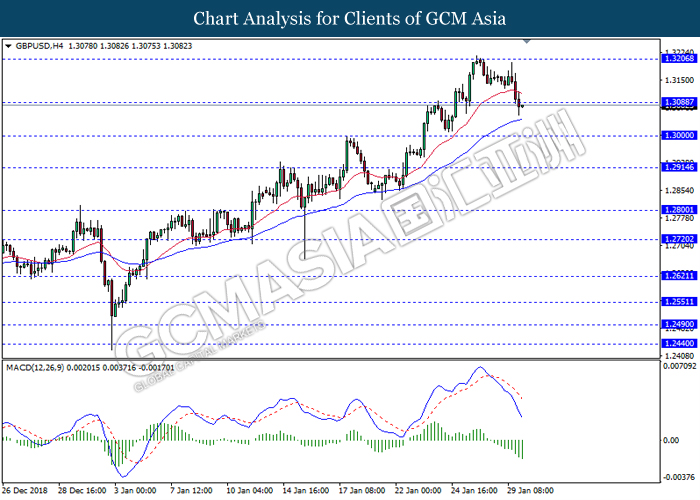

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level 1.3090. MACD which illustrate bearish bias with the formation of death cross suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.3205, 1.3350

Support level: 1.3090, 1.3000

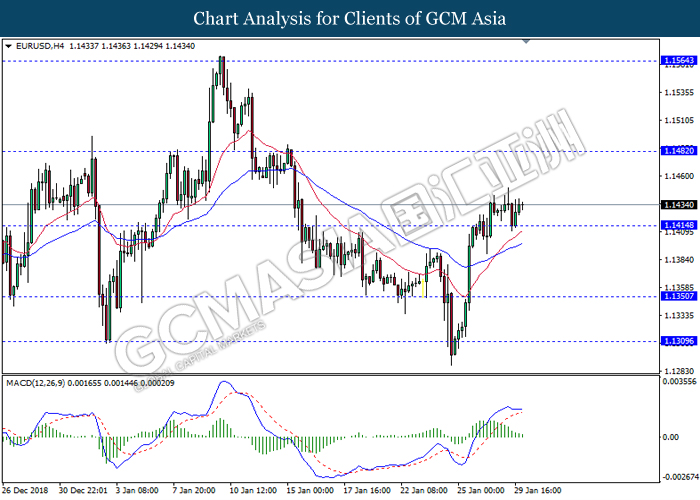

EURUSD, H4: EURUSD was traded higher following recent rebound from the support level 1.1415. However, MACD which display diminishing bullish momentum suggest the pair to be traded lower as a technical correction towards back the support level 1.1415.

Resistance level: 1.1480, 1.1565

Support level: 1.1415, 1.1350

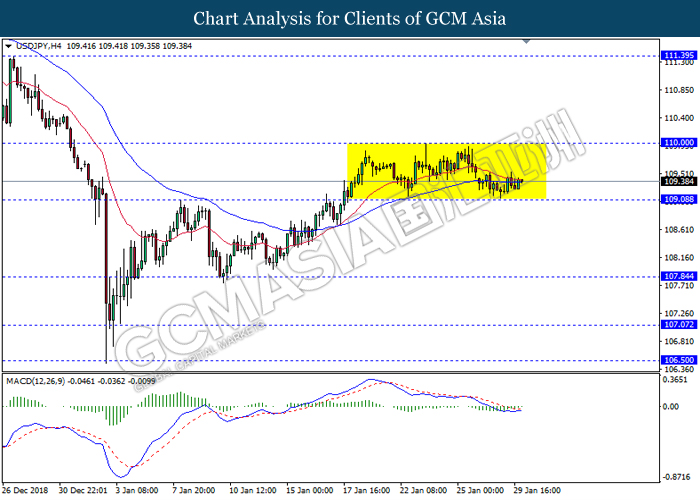

USDJPY, H4: USDJPY remain traded in a sideway channel following recent rebound from the support level 109.10. MACD which illustrate bullish momentum signal suggest the pair to extend its rebound towards the resistance level 110.00.

Resistance level: 110.00, 111.40

Support level: 109.10, 107.85

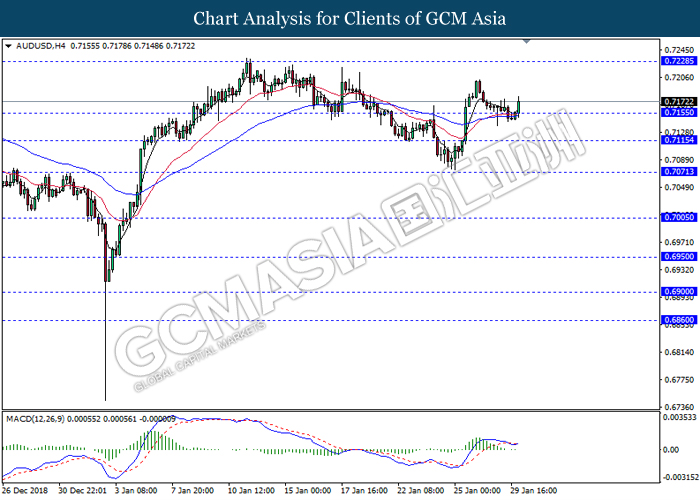

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level 0.7155. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains towards the resistance level 0.7230.

Resistance level: 0.7230, 0.7270

Support level: 0.7155, 0.7115

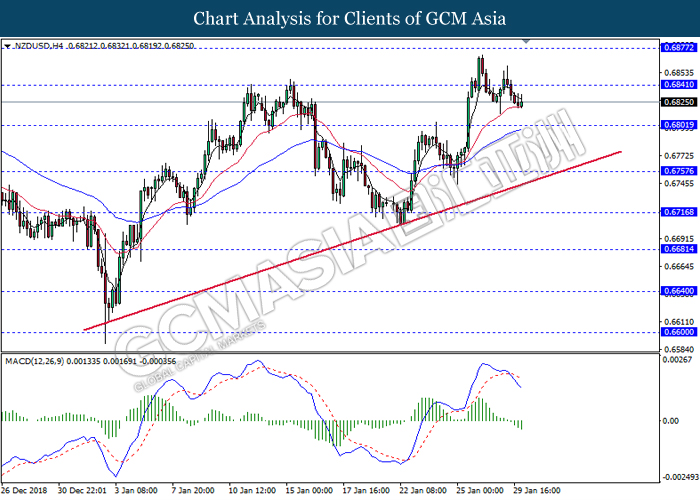

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level 0.6840. MACD which display bearish momentum signal with the formation of death cross suggest the pair to extend its losses towards the support level 0.6800.

Resistance level: 0.6840, 0.6875

Support level: 0.6800, 0.6755

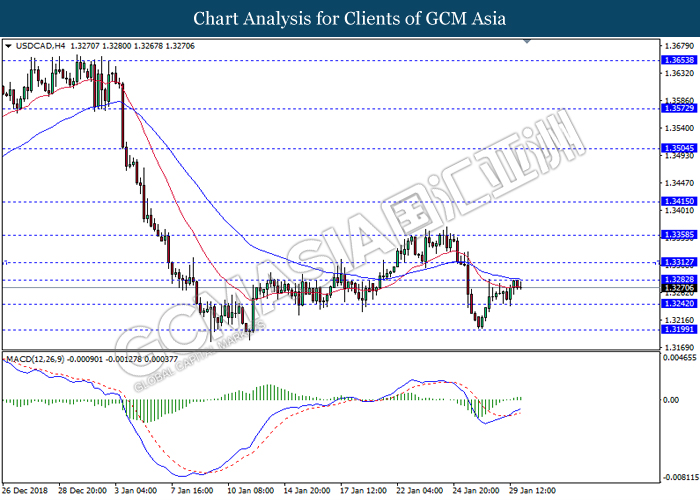

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level 1.3280. MACD which illustrate diminishing bullish momentum suggest the pair to extend its retracement towards the support level 1.3240.

Resistance level: 1.3280, 1.3310

Support level: 1.3240, 1.3190

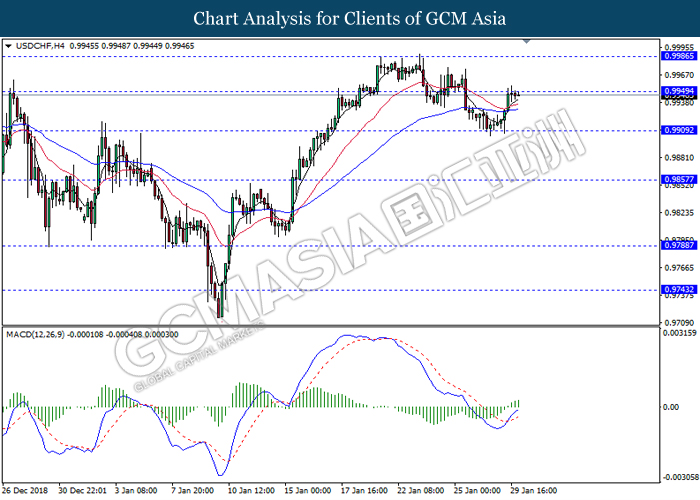

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level 0.9950. However, MACD which display lack of bullish momentum suggest the pair to be traded lower towards the support level 0.9910.

Resistance level: 0.9950, 0.9985

Support level: 0.9910, 0.9855

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level 51.75. MACD which illustrate bullish momentum signal with the formation of golden cross suggest the pair to extend its gains towards the resistance level 54.55.

Resistance level: 54.55, 57.80

Support level: 51.75, 48.35

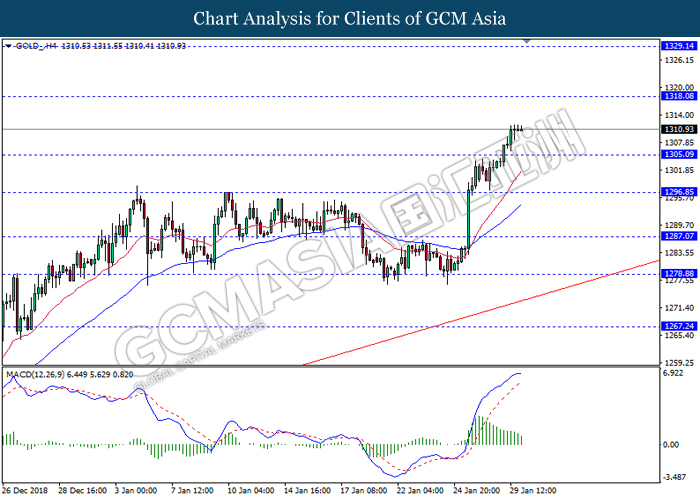

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level 1305.10. However, MACD which illustrate diminishing bullish momentum suggest the pair to undergo a short-term technical correction towards the support level 1305.10.

Resistance level: 1318.10, 1329.15

Support level: 1305.10, 1296.85