19 February 2019 Morning Session Analysis

Dollar remained pressured by trade talk optimism.

The dollar index which is measured against a basket of six major currency pairs fell 0.13% to 96.55 during early Asian trading session as new round of trade talk takes place this week. During last week round of trade talk at Beijing, both US and China reported a progress in reaching a deal while investors are expecting a positive outcome before 1st March deadline for additional tariffs are implemented. Last year December, both countries came to a 90-days peace treaty where additional tariff up to 25% on $200 billion worth of Chinese goods are put on hold while both sides try to reach a trade agreement that satisfy both parties. In other news, pair of AUD/USD edged lower by 0.11% to 0.7130 ahead of RBA meeting minutes. The Australian dollar remained pressured last week but managed to climbed higher on Friday as trade talk worries was lifted from the market. Being one of China’s major trading partner, a trade agreement will exert positive momentum for the Australian dollar.

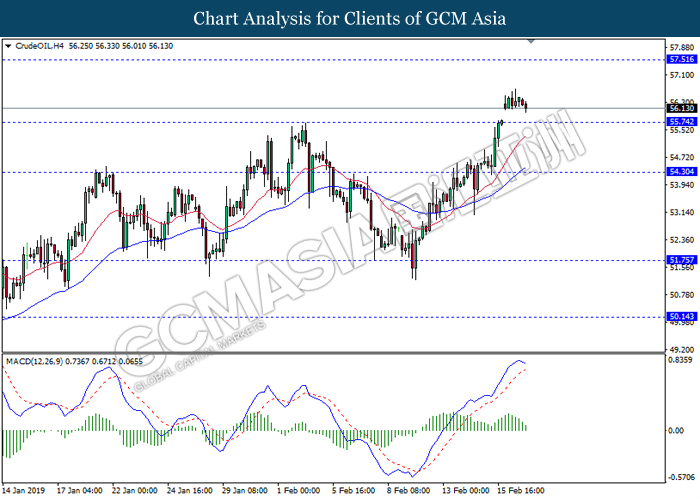

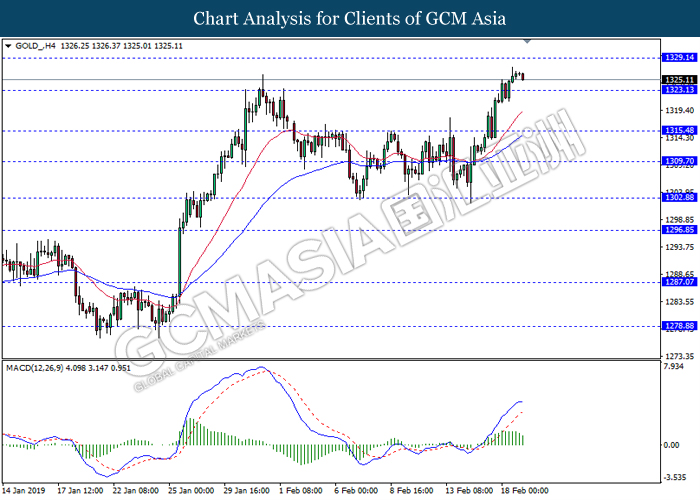

In the commodities market, crude oil price fell by 0.36% to $56.15 per barrel while remaining steady at high levels. Recent sentiment for oil market turned bullish as OPEC’s glut cut and US sanctions on Venezuela oil started to take effect onto oil prices. Investors are now awaiting trade negotiations outcome to further gauge the oil market’s momentum. Likewise, gold price ticked lower by 0.06% to $1325.15 per troy ounce after hitting 2019 high as investors shifted out from the dollar market into strong safe-haven gold while investors wait for the outcome of trade talks.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual | |

| 17:30 | GBP – Average Earnings Index +Bonus (Dec) | 3.4% | 3.5% | – | |

| 17:30 | GBP – Claimant Count Change (Jan) | 20.8K | 12.3K | – | |

| 18:00 | EUR -German ZEW Economic Sentiment (Feb) | -15.0 | -14.1 | – |

Technical Analysis

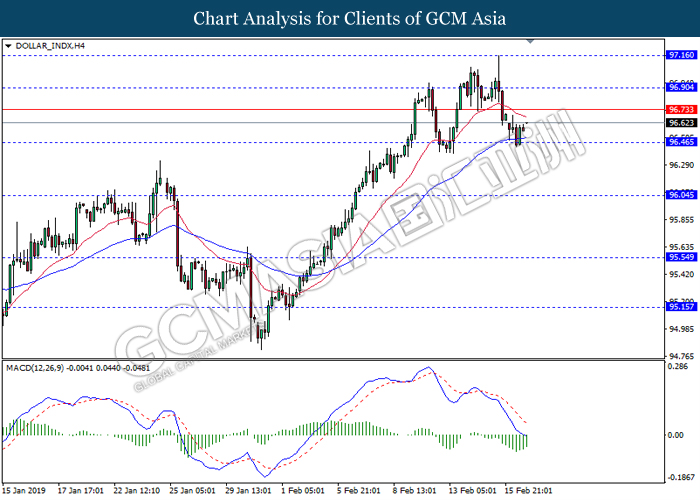

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level 96.45. MACD which illustrate diminishing bearish momentum suggest the dollar to extend its rebound towards the resistance level 96.90.

Resistance level: 96.90, 97.15

Support level: 96.45, 96.05

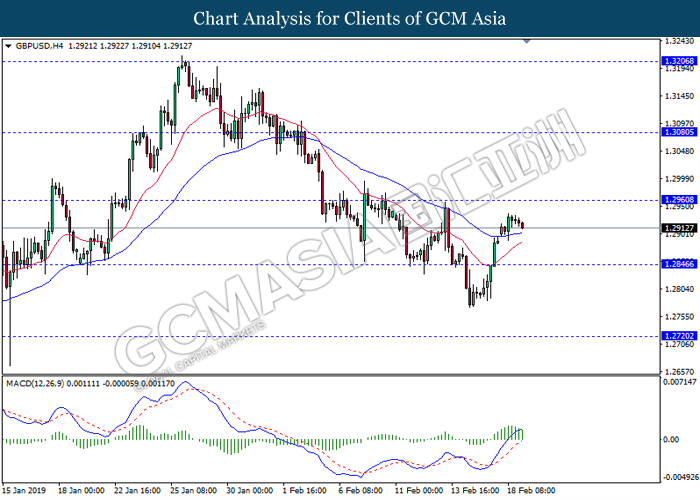

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level 1.2960. MACD which display diminishing bullish momentum suggest the pair to extend its retracement towards the support level 1.2845.

Resistance level: 1.2960, 1.3080

Support level: 1.2845, 1.2720

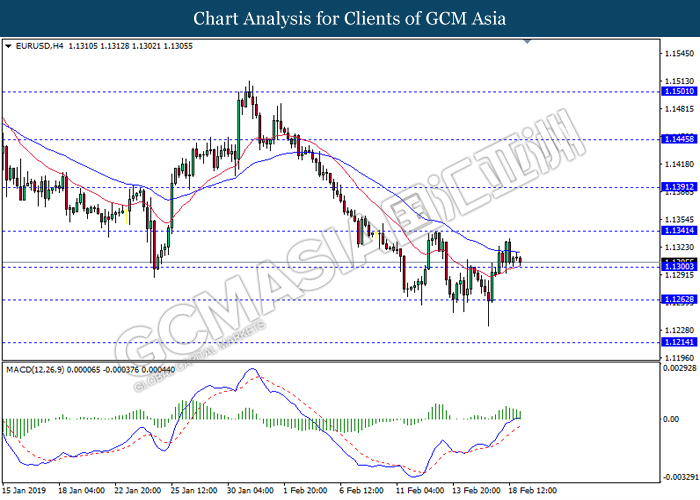

EURUSD, H4: EURUSD was traded lower while currently testing near the support level 1.1300. MACD which illustrate bearish bias signal suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 1.1340, 1.1390

Support level: 1.1300, 1.1260

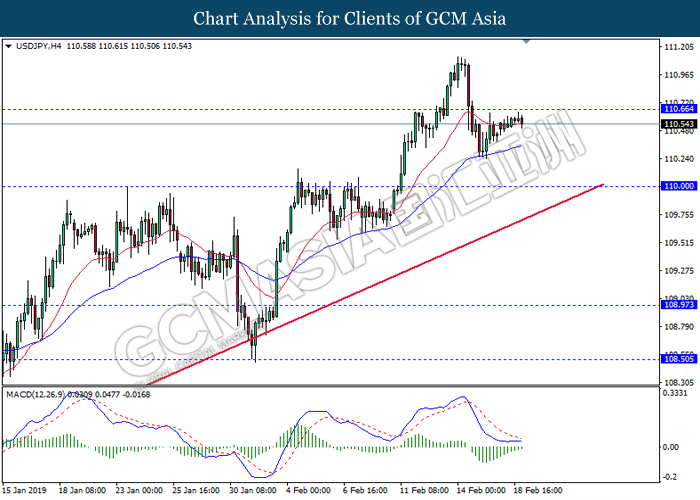

USDJPY, H4: USDJPY was traded higher while currently testing near the resistance level 110.65. MACD which illustrate bullish bias signal suggest the pair to extend its gains after It successfully breaks above the resistance level.

Resistance level: 110.65, 111.40

Support level: 110.00, 108.95

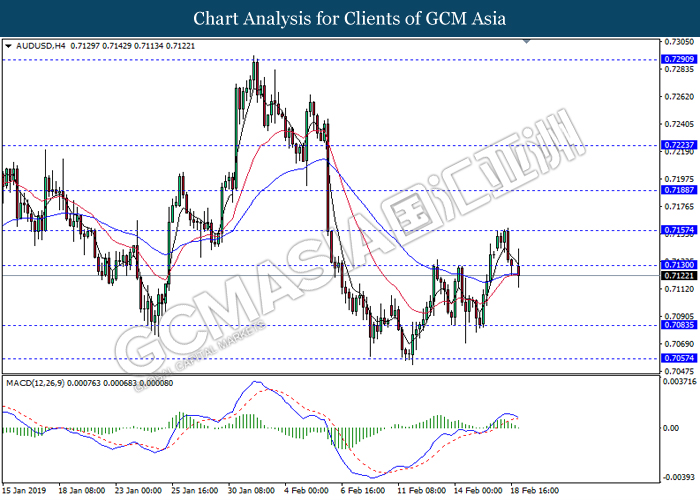

AUDUSD, H4: AUDUSD was traded lower following recent breakout below the previous support level 0.7130. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses towards the support level 0.7085.

Resistance level: 0.7130, 0.7155

Support level: 0.7085, 0.7055

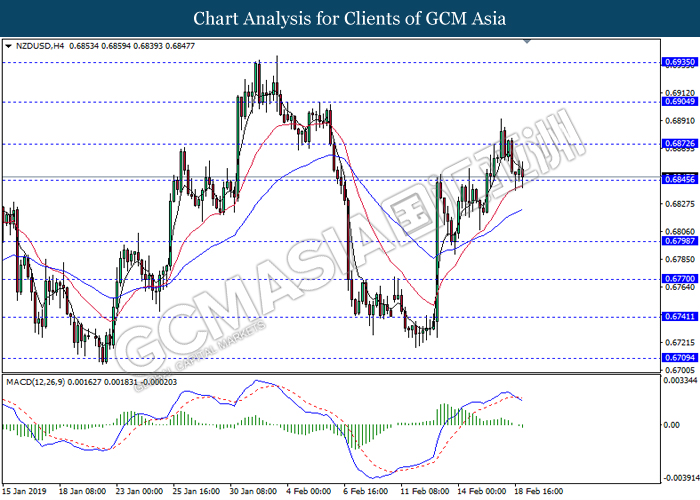

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level 0.6845. MACD which illustrate bearish momentum signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level.

Resistance level: 0.6870, 0.6905

Support level: 0.6845, 0.6800

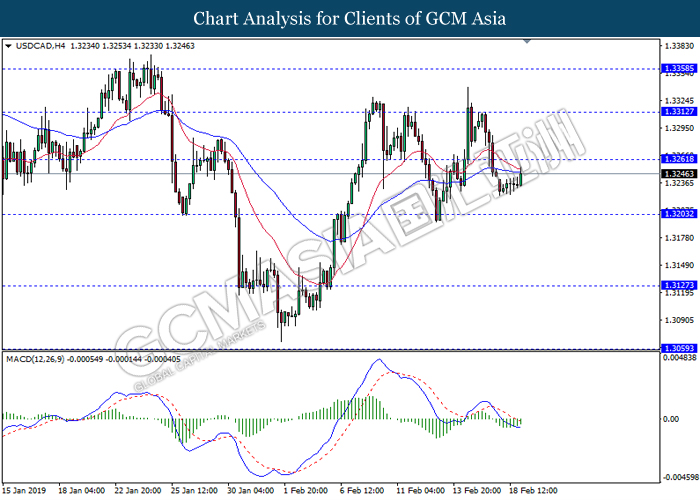

USDCAD, H4: USDCAD was traded higher following prior rebound from its low level. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound towards the resistance level 1.3260.

Resistance level: 1.3260, 1.3310

Support level: 1.3205, 1.3125

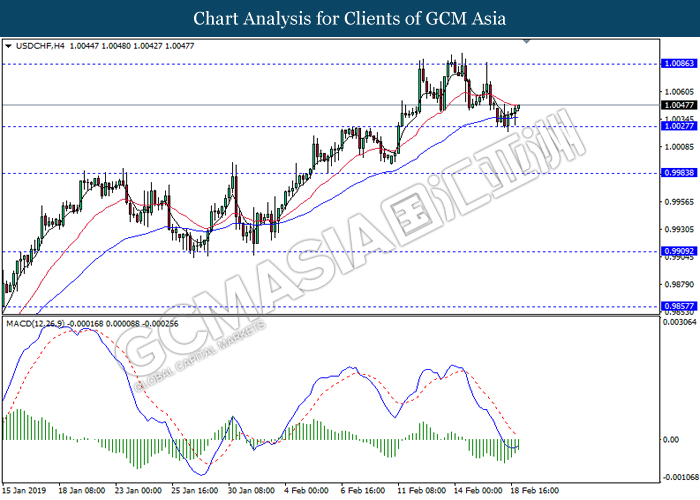

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level 1.0025. MACD which illustrate bullish bias signal suggest the pair to extend its gains towards the resistance level 1.0085.

Resistance level: 1.0085, 1.0115

Support level: 1.0025, 0.9985

CrudeOIL, H4: Crude oil price was traded flat after it breaks above the resistance level 55.75. However, MACD which illustrate diminishing bullish momentum suggest the pair to be traded lower as a short term technical correction towards the support level 55.75.

Resistance level: 57.50, 59.20

Support level: 55.75, 54.30

GOLD_, H4: Gold price was traded higher following recent breakout above the resistance level 1323.15. However, MACD which display diminishing bullish momentum suggest the commodity to experience a short-term technical correction towards the support level 1323.15.

Resistance level: 1329.15, 1340.55

Support level: 1323.15, 1315.50