27 February 2019 Afternoon Session Analysis

Dollar on defensive ahead of Powell’s second testimonial.

Dollar index remained pressured against a basket of six major currency pair as market sentiment remains affected by Fed Chairman Jerome Powell’s dovish remarks recently in his speech on Tuesday. Despite appreciating consumer’s confidence and upbeat housing data release on Tuesday, the data was unable to spark joy for market participants as Fed Chairman Jerome Powell reiterate its plans to stay patient on monetary policy and adjusting balance sheet according to economic outlook. Market participants currently remain in cautious as they await further iteration from Powell’s second testimonial in Washington, DC today which could trigger a major momentum. Dollar index was down 0.05% to 95.86 as of writing. Meanwhile NZDUSD slips 0.07% to 0.6885 as of writing following New Zealand Trade Balance data shows weaker than expected reading with -914M against economist forecast reading of -300M, indicating an economy slowdown in New Zealand.

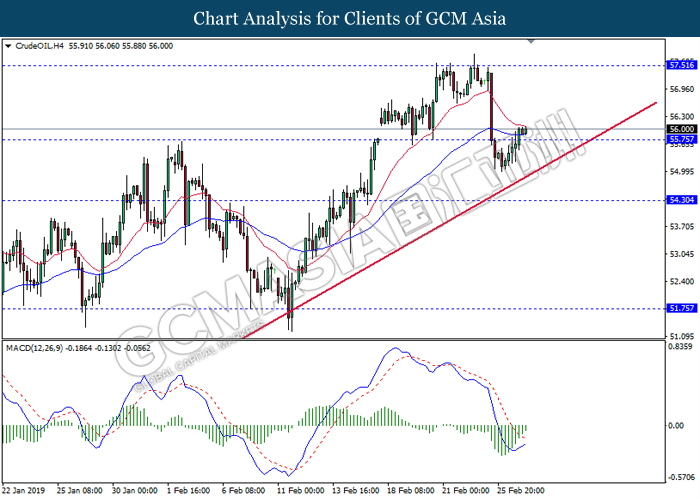

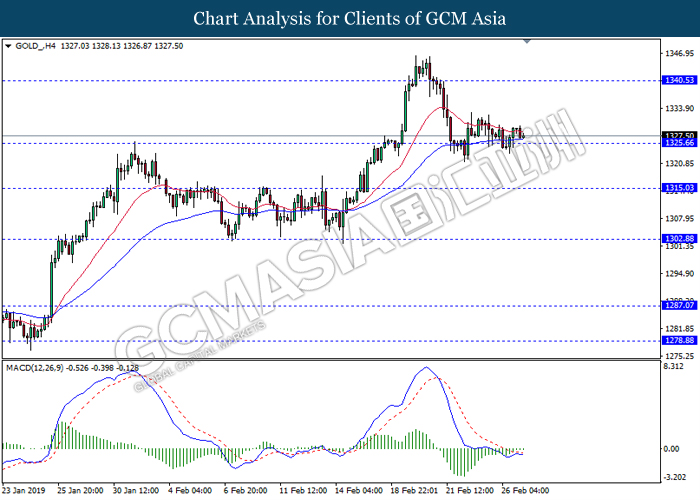

In the commodities market, crude oil price rose 0.11% to to $55.85 per barrel as recent news cited OPEC and its allies have reaffirmed their thoughts to continue stick to the plan of supply cut despite pressure from US President. On the other hand, gold price remains steady and edge up 0.09% to 1327.75 as dollar weakness continue to support the demand for the safe-haven gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

23:00 USD Fed Chair Powell Testifies

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 21:30 | CAD – Core CPI (MoM) (Jan) | -0.2% | – | – |

| 23:00 | USD – Factory Orders (MoM) (Dec) | -0.6% | 1.5% | – |

| 23:00 | USD – Pending Home Sales (MoM) (Jan) | -2.2% | 0.8% | – |

| 23:30 | CrudeOIL – EIA Crude Oil Inventories | 3.672M | 2.842M | – |

Technical Analysis

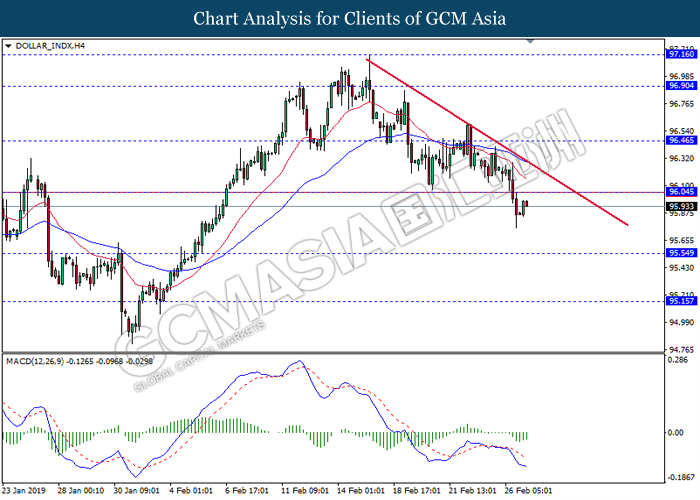

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below previous support level at 96.05. MACD which illustrate bearish momentum suggest dollar to extend its losses towards the support level at 95.55.

Resistance level: 96.05, 96.45

Support level: 95.55, 95.15

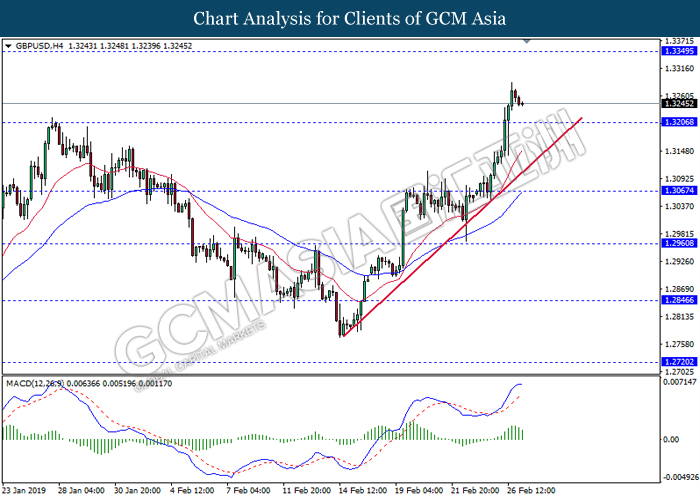

GBPUSD, H4: GBPUSD was traded lower following prior retracement from top levels. MACD which illustrate diminishing bullish momentum suggest the pair to extend its retracement towards the support level at 1.3205.

Resistance level: 1.3350, 1.3415

Support level: 1.3205, 1.3065

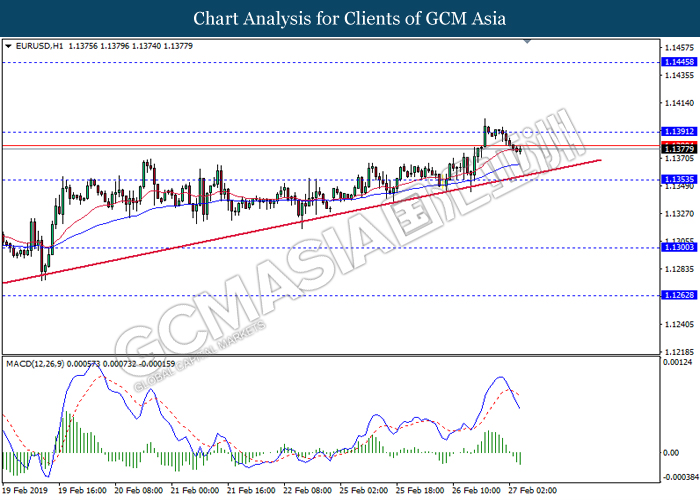

EURUSD, H1: EURUSD was traded lower following prior retracement from the resistance level 1.1390. MACD which display bearish momentum with the formation of death cross suggest the pair to extend its retracement towards the support level at 1.1355.

Resistance level: 1.1390, 1.1445

Support level: 1.1355, 1.1300

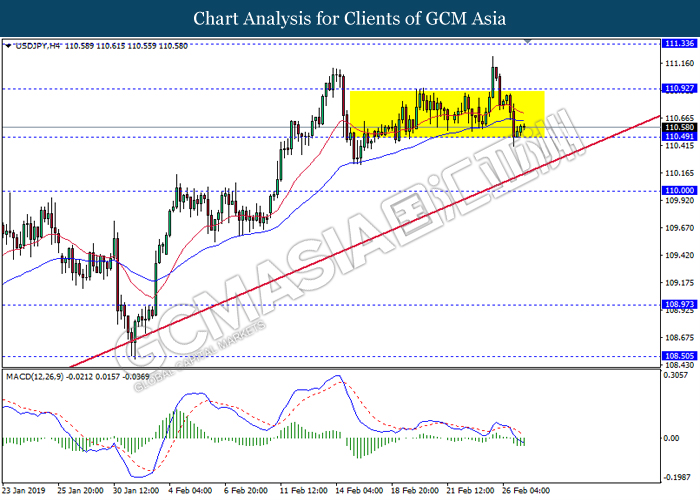

USDJPY, H4: USDJPY was traded lower while currently testing near the bottom-level of the sideway channel. MACD which illustrate bearish momentum suggest the pair to extend its losses after breaking below the support level at 110.50.

Resistance level: 110.90, 111.35

Support level: 110.50, 110.00

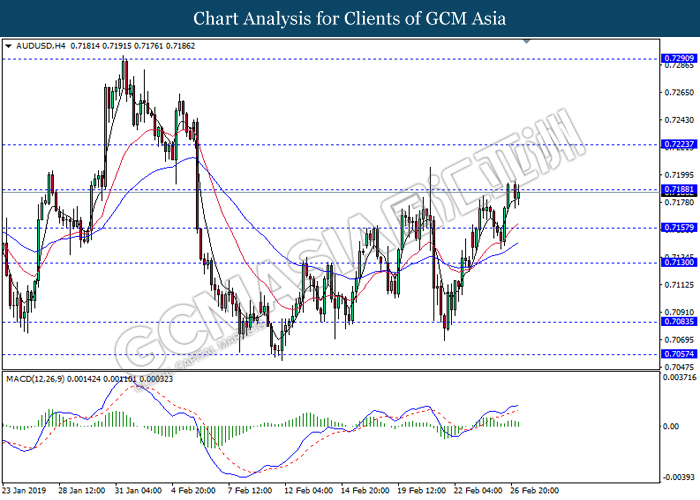

AUDUSD, H4: AUDUSD was traded higher while currently testing near the resistance level 0.7190. MACD which illustrate bearish bias signal suggest the pair to undergo short-term technical correction and retrace towards the support level 0.7155.

Resistance level: 0.7190, 0.7225

Support level: 0.7155, 0.7130

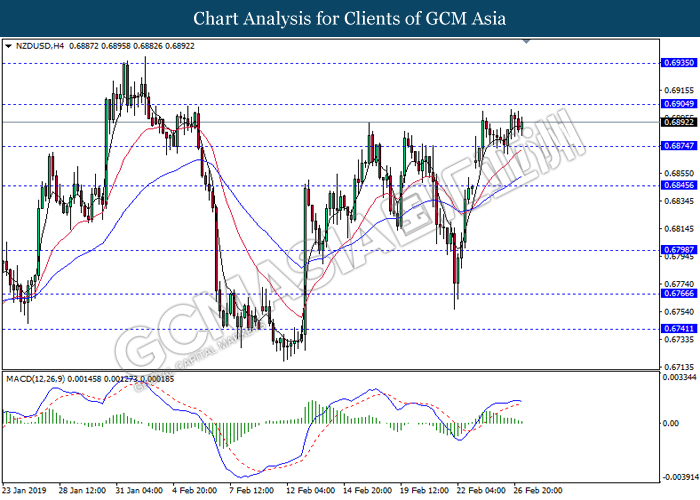

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level 0.6905. MACD which display diminished bullish momentum suggest the pair to extend its retracement towards the support level 0.6875.

Resistance level: 0.6905, 0.6935

Support level: 0.6875, 0.6845

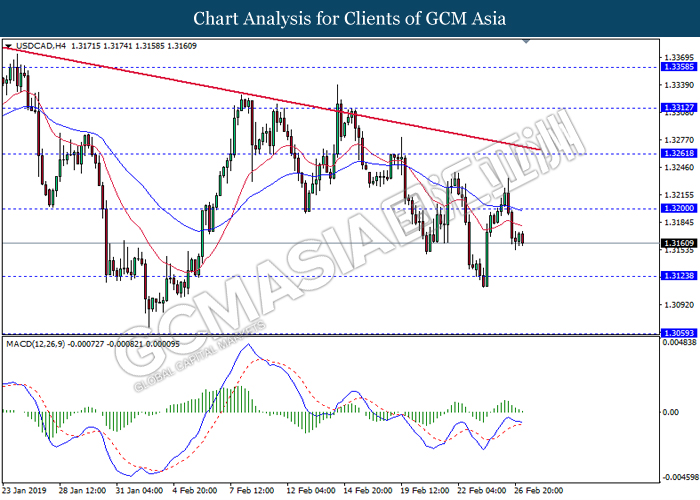

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level at 1.3200. MACD which illustrate diminished bullish momentum suggest the pair to extend its losses towards the support level at 1.3125.

Resistance level: 1.3200, 1.3260

Support level: 1.3125, 1.3060

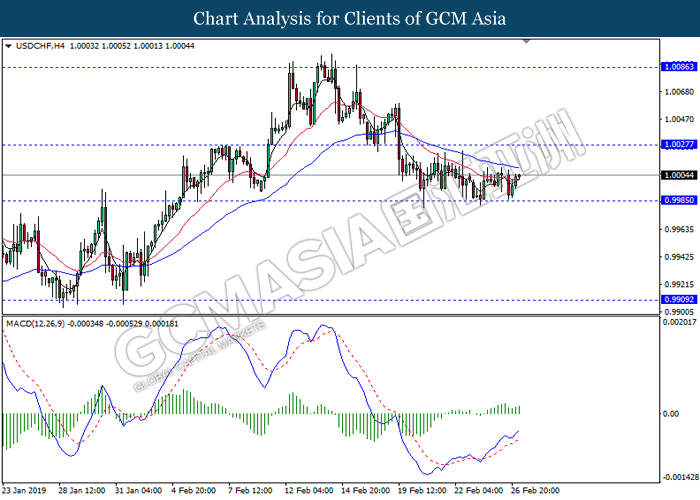

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level 0.9985. MACD which display bullish bias signal suggest the pair to extend its rebound towards the resistance level 1.0025.

Resistance level: 1.0025, 1.0085

Support level: 0.9985, 0.9910

CrudeOIL, H4: Crude oil price was traded higher following prior breakout from previous resistance level at 55.75. MACD which illustrate bullish bias signal suggest the commodity to extend its gains towards the resistance level 57.50.

Resistance level: 57.50, 59.20

Support level: 55.75, 54.30

GOLD_, H4: Gold price was traded lower while currently testing near the support level 1325.65. MACD which illustrate bearish bias signal suggest gold to extend its losses after successfully breaking below the support level.

Resistance level: 1340.55, 1353.10

Support level: 1325.65, 1315.05