5 August 2019 Afternoon Session Analysis

Safe-haven rose as trade relations worsens.

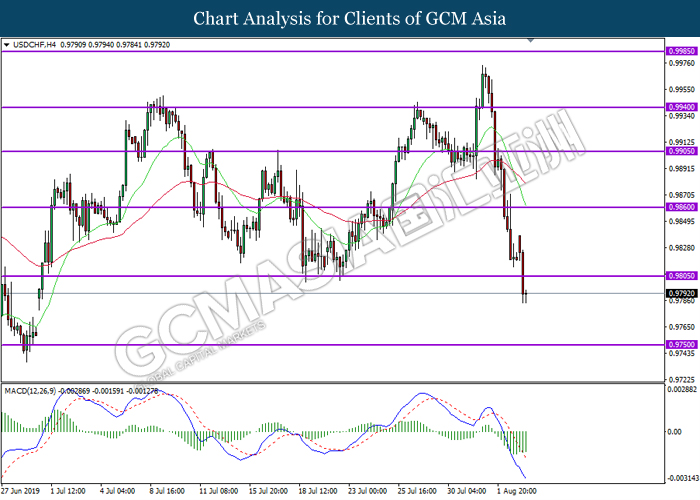

As tensions between U.S and China heightens after U.S President Donald Trump raised the stakes in and Beijing pledged to retaliate, market demand for safe-haven assets such as Yen and Swiss Franc rises sharply. Last week, Washington have announced that the U.S will impose an additional $300b in Chinese import tariffs on September 1 just after U.S negotiators returned from the latest round of trade talks. China’s government accused Trump of violating his June agreement with President Xi Jinping to revive negotiations and vowed that China will have to take necessary countermeasures to resolutely defend its core interests. At the same time, European markets were also trembling ahead of Donald Trump’s statement on EU trade. Recently, President Donald Trump have signed an agreement to make access for beef exporters to the EU easier. However, he also added that EU auto tariffs “are never off the table”, expanding his threats over to EU zone. Increasing tension among U.S and multiple countries continue to overshadow market sentiment, instigating the market to increase their bets into safe haven assets for risk aversion. As of writing, USD/JPY sinks 0.47% to 106.05 while USD/CHF fell 0.18% to 0.9800.

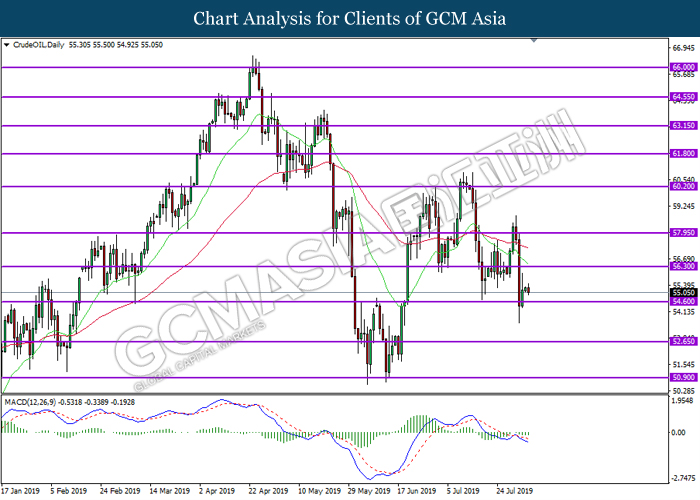

In the commodities market, crude oil price fell 0.12% to $55.25 per barrel as of writing following as crude oil price remained pressured by trade war fears and increasing expectation of weak global demand. According to reports, Iranian oil tankers have been quietly offloading their supply into Chinese ports despite U.S. sanctions on Iran. As tension in between U.S-Sino rises, it could seriously disrupt U.S.-China trade talks as well as oil markets if Beijing decides to actually use them and the process showed no sign of stopping. On the other hand, gold price surged 0.40% to $1446.80 a troy ounce at the time of writing following a weakening dollar and increasing tension between U.S and multiple nations.

Today’s Holiday Market Close

Time Market Event

All Day CAD Civic Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16.30 | GBP – Composite PMI (Jul) | 49.7 | 49.8 | – |

| 16:30 | GBP – Services PMI (Jul) | 50.2 | 50.4 | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (Jul) | 55.1 | 55.5 | – |

Technical Analysis

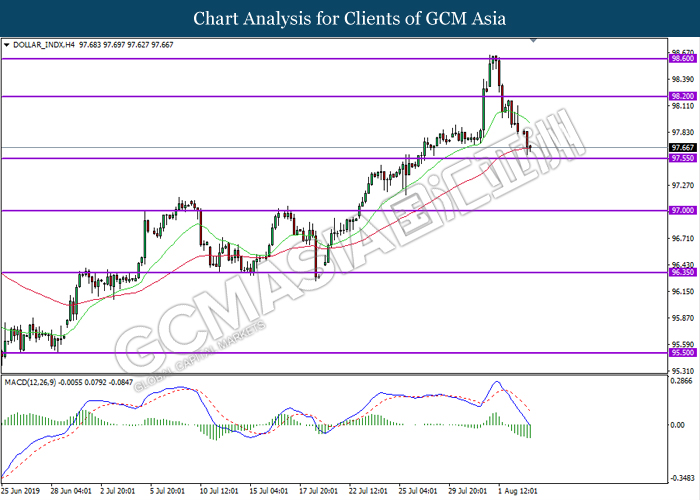

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing near the support level 97.55. MACD which illustrate bearish momentum suggest index to extend its losses after successfully breaking below the support level.

Resistance level: 98.20, 98.60

Support level: 97.55, 97.00

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level 1.2125. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses after successfully breaking below the support level.

Resistance level: 1.2220, 1.2300

Support level: 1.2125, 1.2045

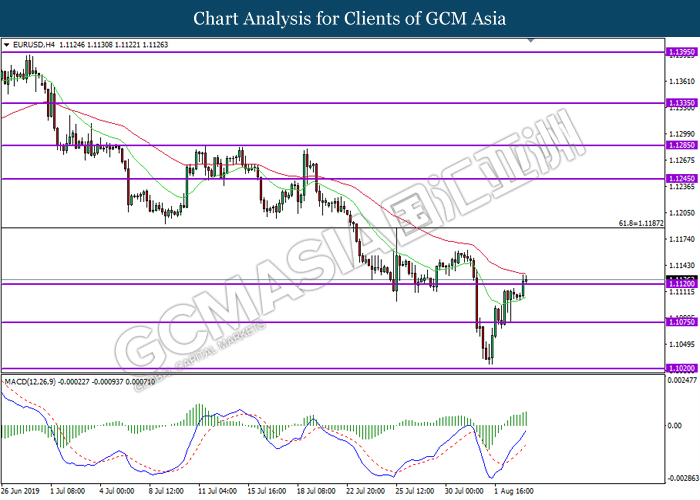

EURUSD, H4: EURUSD was traded higher following prior breakout above previous resistance level 1.1120. MACD which display bullish momentum suggest the pair to extend its gains towards the resistance level 1.1185.

Resistance level: 1.1185, 1.1245

Support level: 1.1120, 1.1075

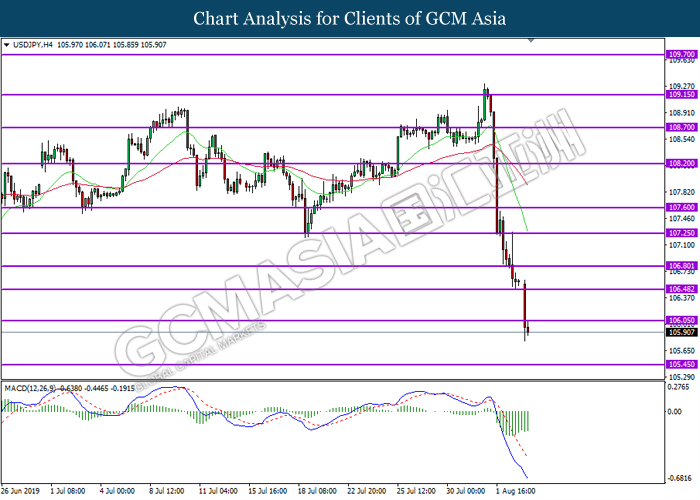

USDJPY, H4: USDJPY was traded lower following prior breakout below previous support level 106.05. MACD which display bearish momentum suggest the pair to extend its losses towards the support level 105.45.

Resistance level: 106.05, 106.50

Support level: 105.45, 104.70

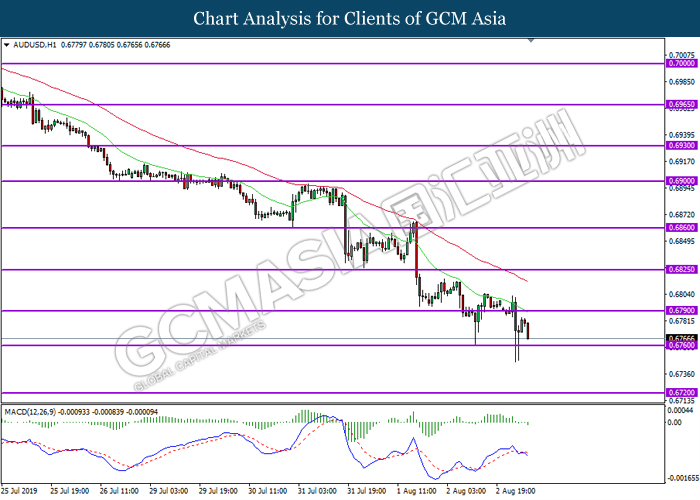

AUDUSD, H1: AUDUSD was traded lower while currently testing near the support level 0.6760. MACD which illustrate bearish momentum with the formation of death cross suggest the pair to extend its losses after successfully breaking below the support level.

Resistance level: 0.6790, 0.6825

Support level: 0.6760, 0.6720

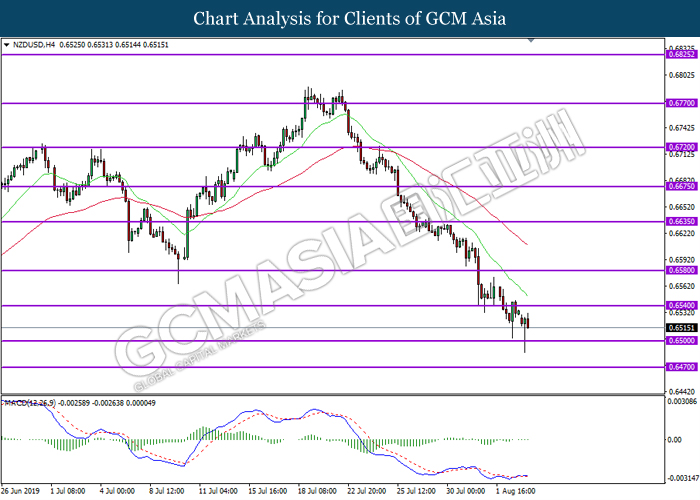

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level 0.6540. Due to lack of momentum and signal from MACD, a breakout above or below the resistance and support level is required to obtain further confirmation before entering the market.

Resistance level: 0.6540, 0.6580

Support level: 0.6500, 0.6470

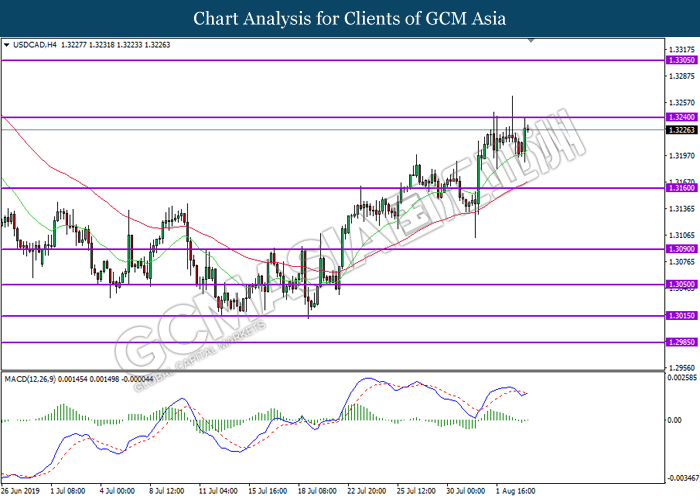

USDCAD, H4: USDCAD was traded higher while currently testing near the resistance level 1.3240. MACD which display bullish bias signal suggest the pair to extend its gains after successfully breaking above the resistance level.

Resistance level: 1.3240, 1.3305

Support level: 1.3160, 1.3090

USDCHF, H4: USDCHF was traded lower following prior breakout below previous support level 0.9805. MACD which illustrate ongoing bearish momentum suggest the pair to extend its losses towards the support level 0.9750.

Resistance level: 0.9805, 0.9860

Support level: 0.9750, 0.9715

CrudeOIL, Daily: Crude oil price was traded lower while currently testing near the support level 54.60. MACD which display bearish bias signal suggest the commodity to extend its losses after successfully breaking below the support level.

Resistance level: 56.30, 57.95

Support level: 54.60, 52.65

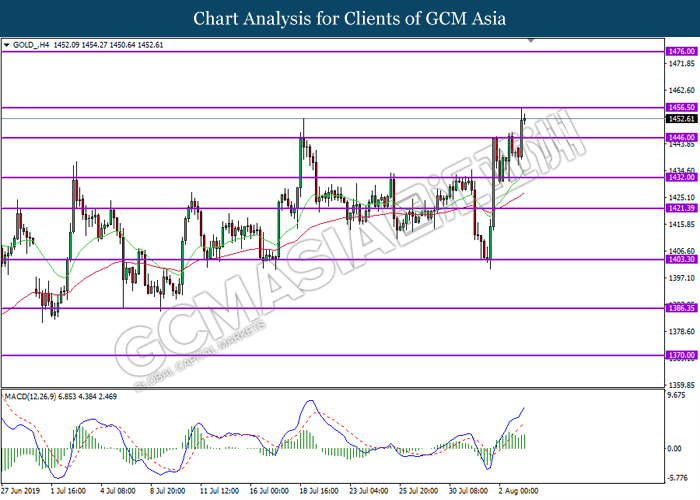

GOLD_, H4: Gold price was traded higher while currently testing near the resistance level 1456.50. MACD which display ongoing bullish momentum suggest the commodity to extend its gains after successfully breaking above the resistance level.

Resistance level: 1456.50, 1476.00

Support level: 1446.00, 1432.00