14 August 2019 Morning Session Analysis

Dollar strengthened amid positive CPI, safe haven plunges.

Greenback received strong bullish momentum after the release of US Core CPI which exceeded economists’ expectation. According to US Bureau of Labor Statistics, US Core Consumer Price Index (CPI) came in at 0.3%, beating its forecasted value of 0.2% while lowering expectations for future rate cuts by the Federal Reserve (Fed) throughout this year. Previous comments from the Fed stated that they are open to further rate cuts while gauging future economic data to support their decision. With the strong inflationary status as shown in the CPI data, investors bet towards an aggressive cut by the Fed was lowered, causing them to sell of their safe-haven assets and entering into strong dollar market. In other news, pound sterling was supported by bullish jobs data from the UK. According to its Office for National Statistics, UK Claimant Count Change was lower at 28K, beating its forecasted value of 32K while indicating a stronger labor market. Overall negative sentiment from the region was lifted after the released of its data, where lower number of unemployed people will lead to a higher consumer spending and economic growth. However, the pound was later pressured by a stronger dollar and Brexit issues continues to worsen investors confident towards the single currency. As of writing, dollar index retraced by 0.06% to 97.53 while pair of GBP/USD falls by 0.03% to 1.2053.

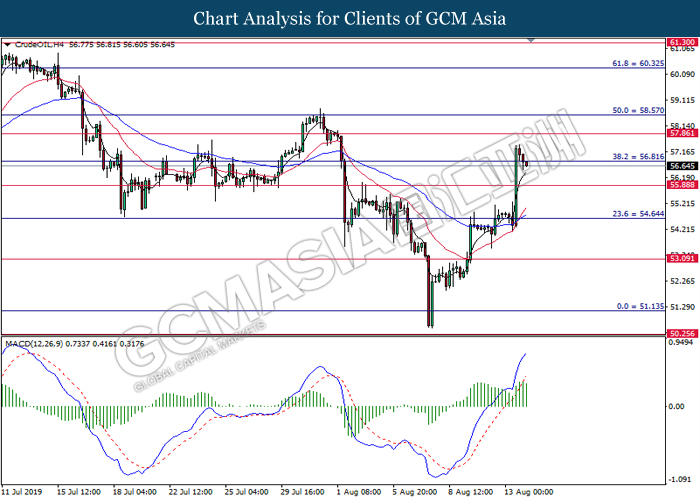

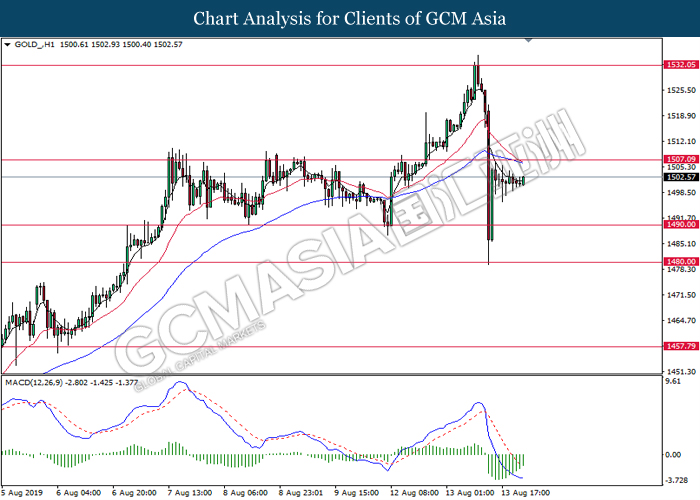

In the commodities market, crude oil price fell by 0.14% to $56.60 per barrel after surging more than 4% yesterday amid positive trade developments. The US Trade Representative announced the delay of 10% additional tariff on Chinese goods after China Vice Premier Liu He conducted a phone call with US trade officials. The delay of tariff lifted the bearish sentiment of oil market, providing hopes for a truce in trade war. On the other hand, gold price continues to fall by 0.34% to $1496.05 a troy ounce after plunging more than $40 amid bullish inflation data from the US as well as positive sentiment regarding trade developments.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | EUR – German GDP (QoQ) (Q2) | 0.4% | -0.1% | – |

| 16:30 | GBP – CPI (YoY) (Jul) | 2.0% | 1.9% | – |

| 17:00 | EUR – GDP (QoQ) (Q2) | 0.2% | 0.2% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 2.385M | -2.775M | – |

Technical Analysis

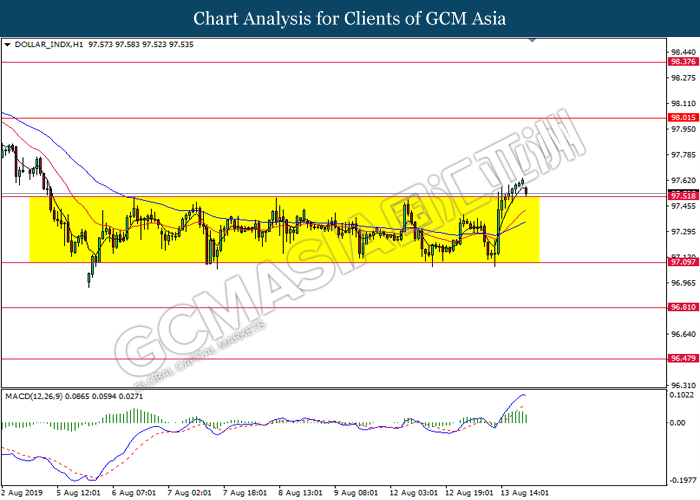

DOLLAR_INDX, H1: Dollar index was traded lower while currently testing the support level at 97.50. MACD which illustrate diminishing bullish momentum suggest index to extend its losses after successfully breakout below the support level at 97.50.

Resistance level: 98.00, 98.40

Support level: 97.50, 97.10

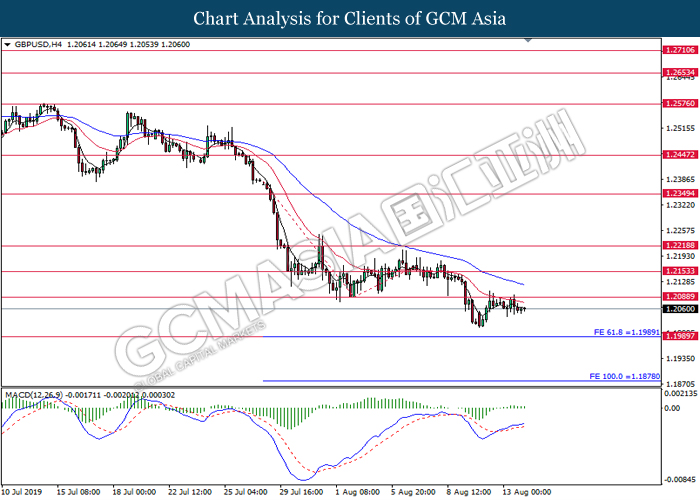

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2090. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses towards the support level 1.1990

Resistance level: 1.2090, 1.2155

Support level: 1.1990, 1.1880

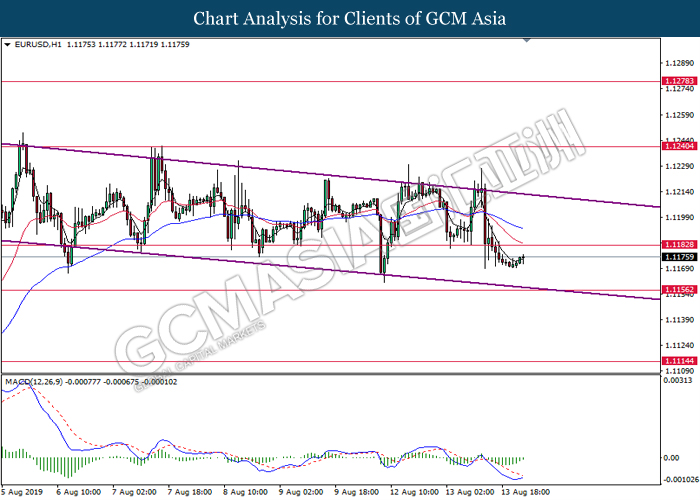

EURUSD, H1: EURUSD was traded higher following prior rebound from the lower level. MACD which display diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.1180.

Resistance level: 1.1180, 1.1240

Support level: 1.1155, 1.1115

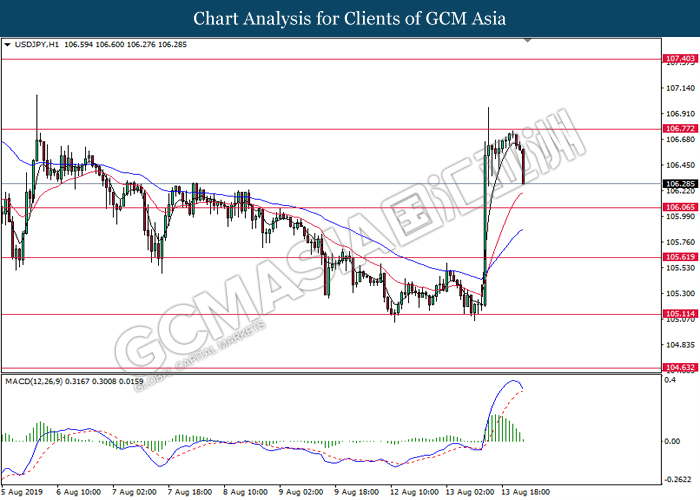

USDJPY, H1: USDJPY was traded lower following prior retracement from the resistance level at 106.75. MACD which display diminishing bullish momentum suggest the pair to extend its losses toward the support level at 106.05.

Resistance level: 106.75, 107.40

Support level: 106.05, 105.60

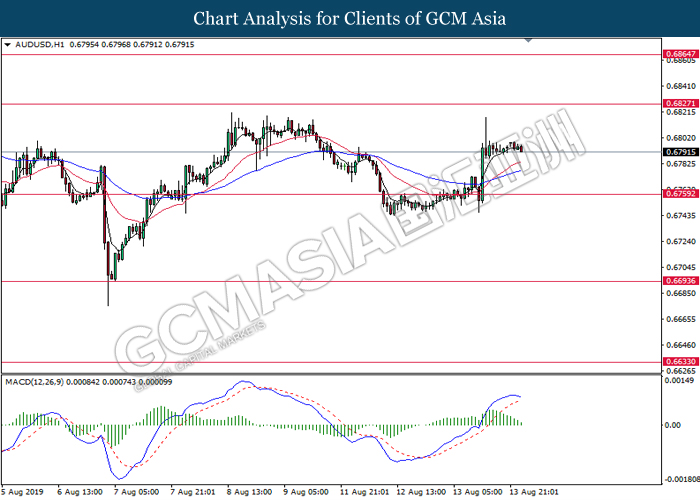

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the higher level. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses towards the support level 0.6760.

Resistance level: 0.6825, 0.6865

Support level: 0.6760, 0.6695

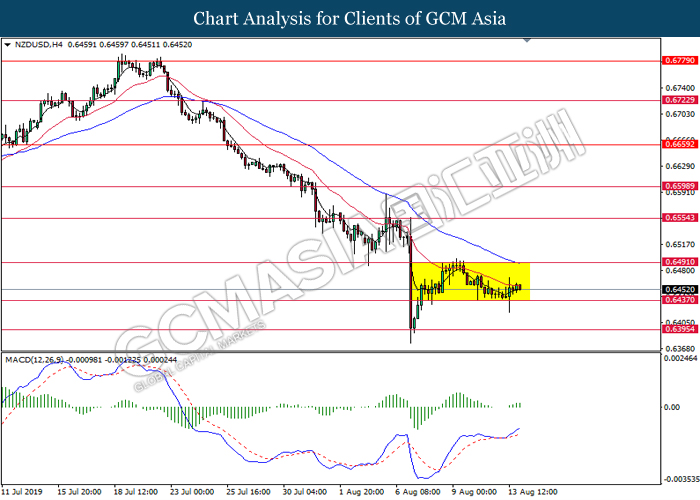

NZDUSD, H4: NZDUSD was traded higher while currently testing 20 moving average line (Red). MACD which illustrate bullish momentum suggest the pair to extend its gains after successfully breakout above the 20 moving average line (Red).

Resistance level: 0.6490, 0.6555

Support level: 0.6435, 0.6395

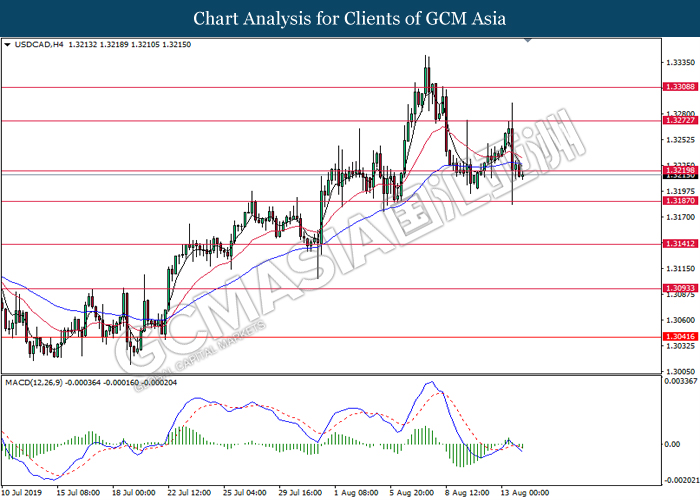

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level at 1.3220. MACD which display bearish momentum signal with the formation of death cross suggest the pair to extend its losses toward the support level at 1.3185.

Resistance level: 1.3220, 1.3275

Support level: 1.3185, 1.3140

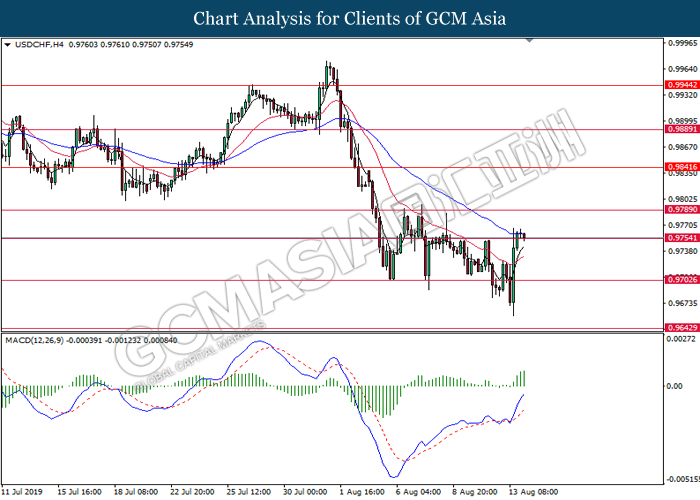

USDCHF, H4: USDCHF was traded higher while currently testing the 50 moving average line (blue). MACD which illustrate bullish bias momentum suggest the pair to extend its gains after successfully breakout above the 50 moving average line (Blue).

Resistance level: 0.9790, 0.9840

Support level: 0.9755, 0.9705

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 56.80. MACD which display diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 55.90.

Resistance level: 56.80, 57.85

Support level: 55.90, 54.65

GOLD_, H1: Gold price was traded higher following prior rebound from the support level near 1490.00. MACD which display diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 1507.10.

Resistance level: 1507.10, 1532.05

Support level: 1490.00, 1480.00