23 August 2019 Morning Session Analysis

Greenback sags on weak PMI data; Jackson Hole eyed.

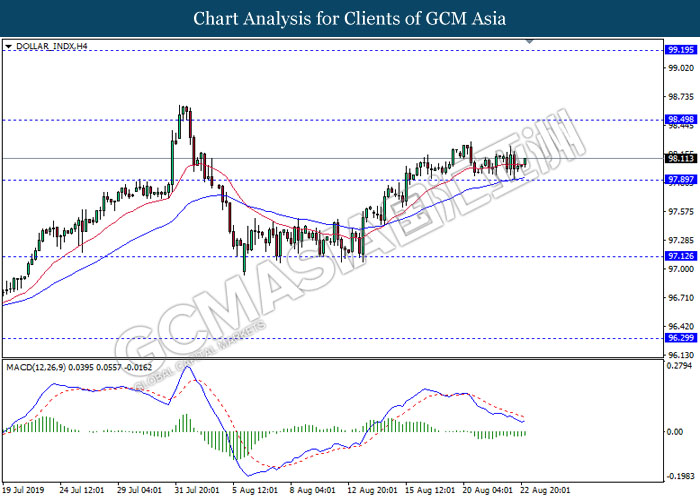

Dollar index which measured against a basket of six major currency pairs have gave up some of its gains and slips after the release of disappointing PMI data. According to Markit Economics, business conditions in the U.S manufacturing sector have weaken which the index came in 49.9, lower than market expectation of 50.5. At the same time, Service PMI also fell to 50.9 compared to expectations of 52.8. The decline in the manufacturing and service sector have businesses and investors remain wary about the economic health of U.S economy. Besides that, another inversion the 10-year to 2-year Treasury yield curve this morning put further pressure into the greenback. As Jackson Hole Symposium gets underway, market are now focused and anxiously awaits for clarity from Fed Chair Powell and other central bank officials on US economic outlook and the future path of monetary policy decisions, which will likely be laid out over the coming days. At the time of writing, dollar index fell 0.03% to 97.98 at the time of writing.

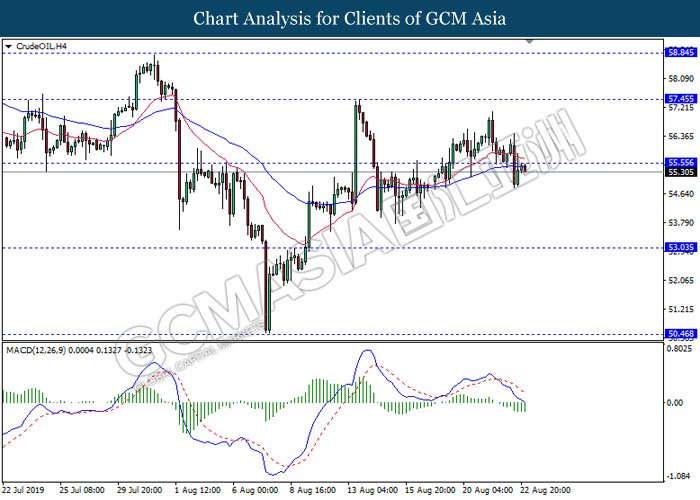

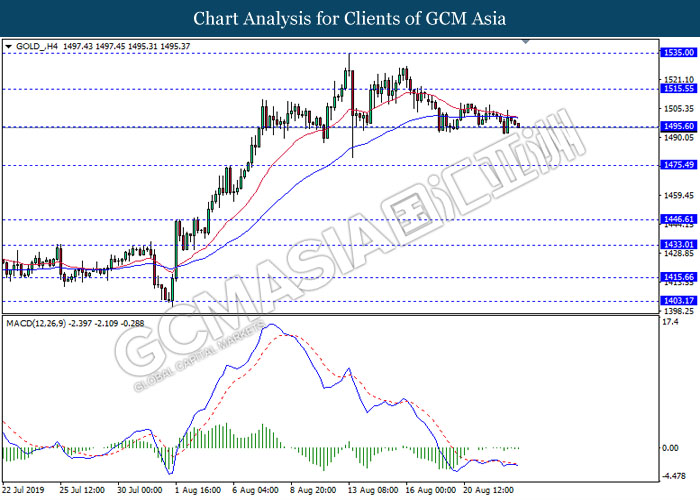

In terms of commodities market, crude oil price have edge lower 0.04% to $55.38 per barrel as of writing following ongoing demand concerns. Market remains worried as worldwide demand for petroleum-derived fuels to power trucks, trains, airplanes and ships has been imperiled by the trade war between the U.S. and China, signaling a slow demand which dragging down the commodity. On the other hand, gold price also fell 0.10% to $1496.51 at the time of writing as thin Fed appetite for a rate cut knocked some bullish wind out the yellow metal.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative USD Jackson Hole Symposium

22.00 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Core Retail Sales (MoM) (Jun) | -0.3% | -0.1% | – |

| 22.00 | USD – New Home Sales (Jul) | 646K | 649K | – |

| 01.00 (24th) | CrudeOIL – U.S. Baker Hughes Oil Rig Count | 770 | – | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level 97.90. MACD which illustrate diminishing bearish momentum suggest the dollar to extend its rebound towards the resistance level 98.50.

Resistance level: 98.50, 99.20

Support level: 97.90, 97.10

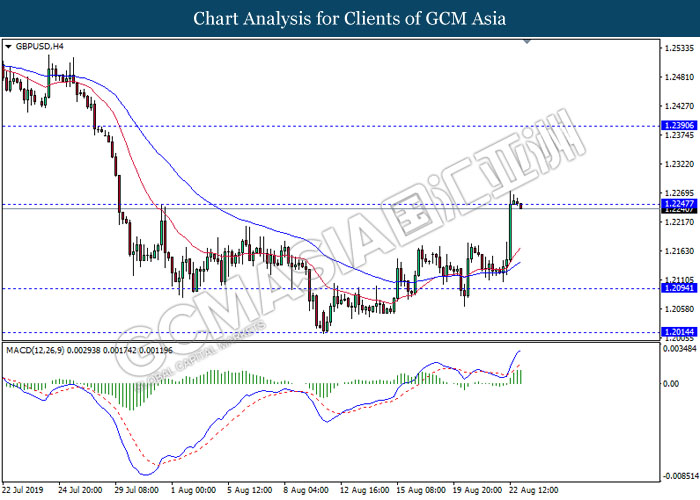

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level 1.2245. However, MACD which illustrate diminishing bullish momentum suggest the pair to experience a technical correction towards the support level 1.2095.

Resistance level: 1.2245, 1.2390

Support level: 1.2095, 1.2015

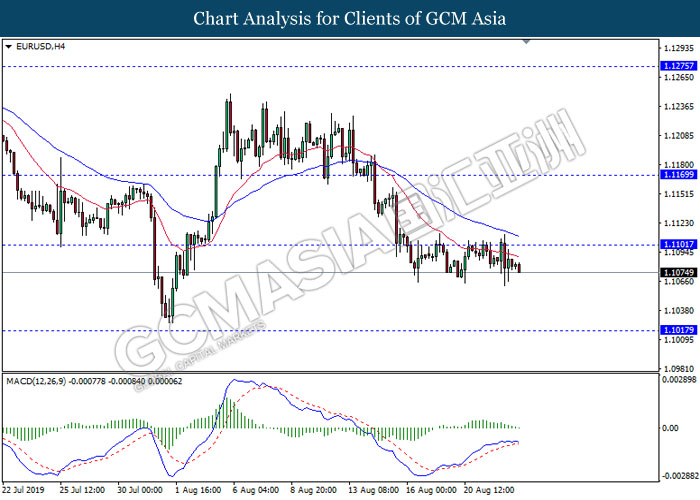

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level 1.1100. MACD which illustrate diminishing bullish momentum suggest the pair to extend its losses towards the support level 1.1015.

Resistance level: 1.1100, 1.1170

Support level: 1.1015, 1.0950

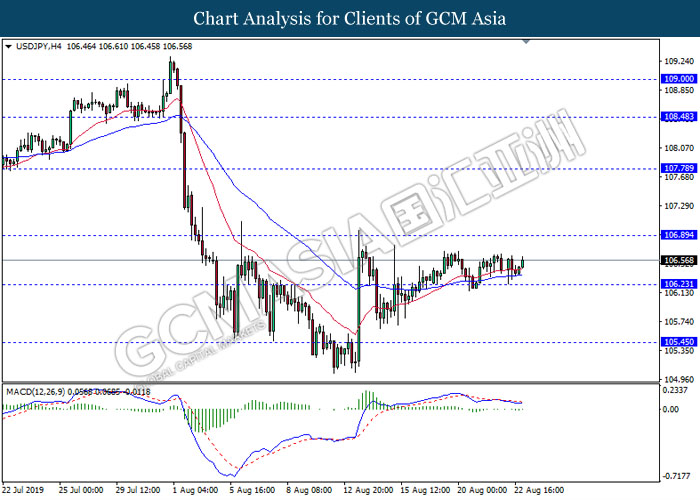

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level 106.25. MACD which illustrate bullish bias signal suggest the pair to extend its rebound in short term towards the resistance level 106.90.

Resistance level: 106.90, 107.80

Support level: 106.25, 105.45

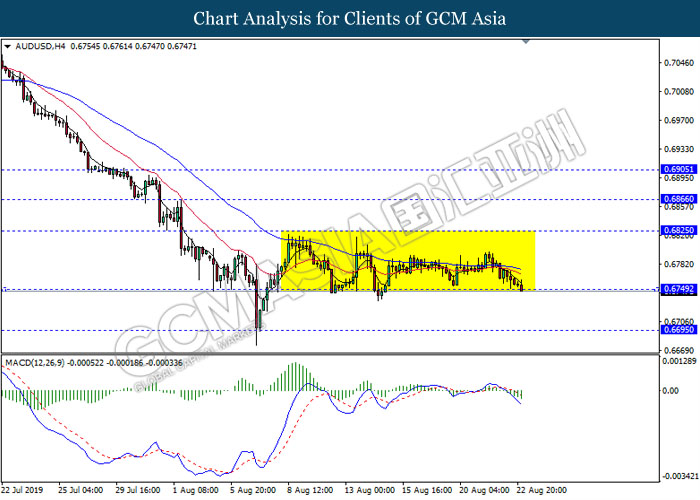

AUDUSD, H4: AUDUSD remain traded in a sideway channel while currently testing the support level 0.6750. However, MACD which illustrate bearish momentum signal suggest the pair to be traded lower after it breaks below the support level 0.6750.

Resistance level: 0.6825, 0.6865

Support level: 0.6750, 0.6695

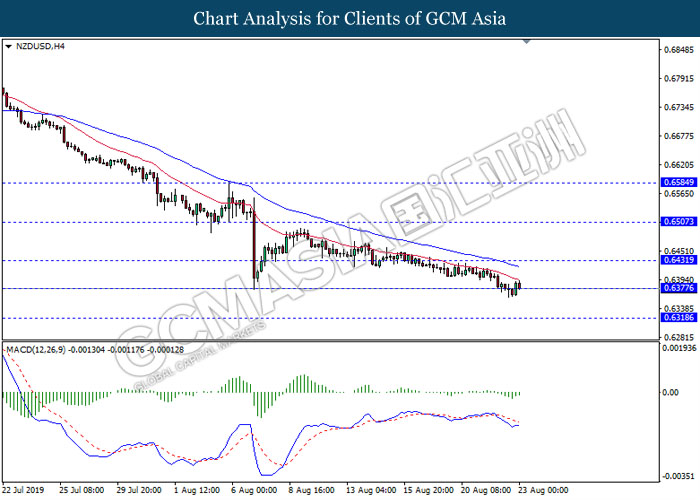

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level 0.6375. However, MACD which illustrate diminishing bearish momentum signal suggest the pair to experience a technical correction in short term towards the resistance level 0.6430.

Resistance level: 0.6430, 0.6505

Support level: 0.6375, 0.6320

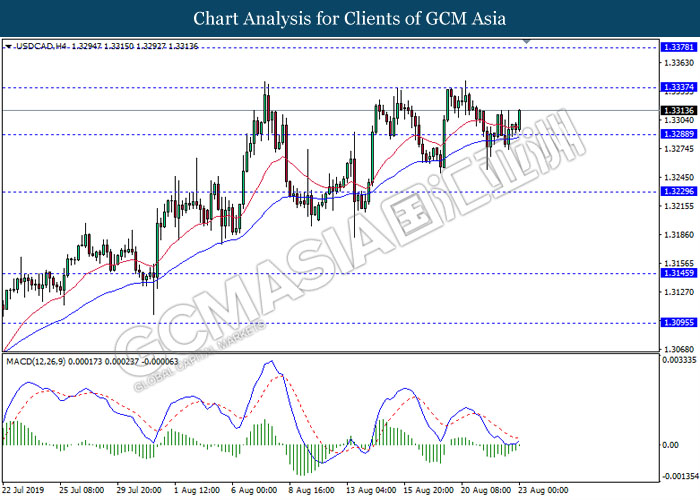

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level 1.3290. MACD which illustrate diminishing bearish momentum suggest the pair to extend its rebound towards the resistance level 1.3335.

Resistance level: 1.3335, 1.3380

Support level: 1.3290, 1.3230

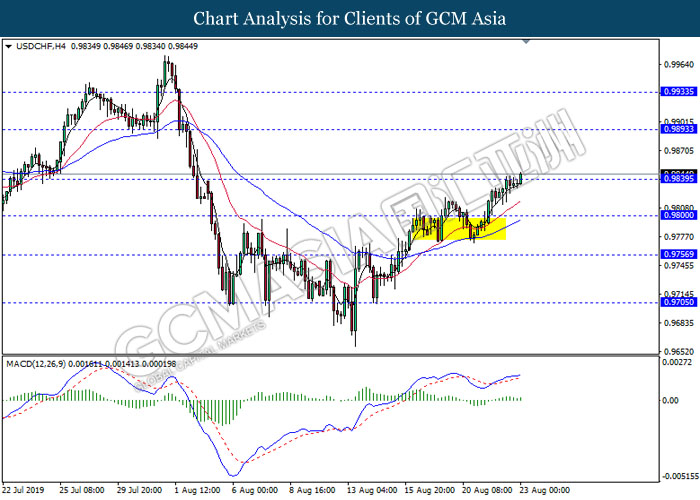

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level 0.9840. MACD which illustrate ongoing bullish momentum signal suggest the pair to extend its gains after it breaks above the resistance level.

Resistance level: 0.9840, 0.9895

Support level: 0.9800, 0.9755

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level 55.55. MACD which illustrate ongoing bearish momentum suggest the commodity to extend its losses towards the support level 53.05.

Resistance level: 55.55, 57.45

Support level: 53.05, 50.45

GOLD_, H4: Gold price was traded lower while currently testing the support level 1495.60. MACD which display bearish bias signal suggest the commodity to extend its losses after it breaks below the support level.

Resistance level: 1515.55, 1535.00

Support level: 1495.60, 1475.50.