26 August 2019 Morning Session Analysis

Dollar swoop amid escalation of US-Sino tensions.

Dollar index which gauge its value against a basket of six major currencies plunged amid heightened of trade tensions between US and China where both parties decided to impose higher tariff on each other. Last Friday, China levy retaliatory tariff on $75 billion worth of US imported goods, including autos. This move by China has mark the latest escalation of between two parties and leaving the deal even more unlikely, eventually angered the US President Donald Trump. In a moment of second, Donald Trump tweeted that they cannot stand it anymore while emphasizing US would be better if without China and announced to raise the tariff on $250 billion of China goods from previous 25% to 30%, via twitter. Moreover, Trump also announced to fight back against China’s tariff by ordering domestic companies in carrier services industry to stop all deliveries of Fentanyl from China. All Trump’s tweets seem to showed that he has given up on structuring a deal with China and urged the investors threw off the riskier assets such as dollar and flee into safe haven asset, Japanese Yen. During early Asian trading session, dollar index inched up 0.07% to 97.50 and the pair of USD/JPY tumbled 0.17% to 105.20.

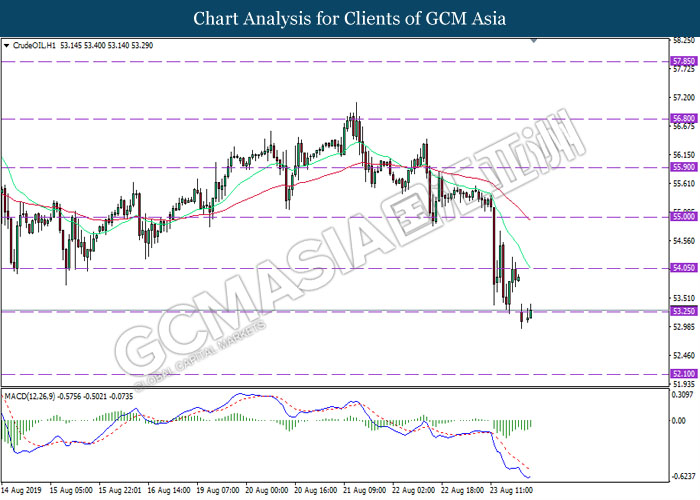

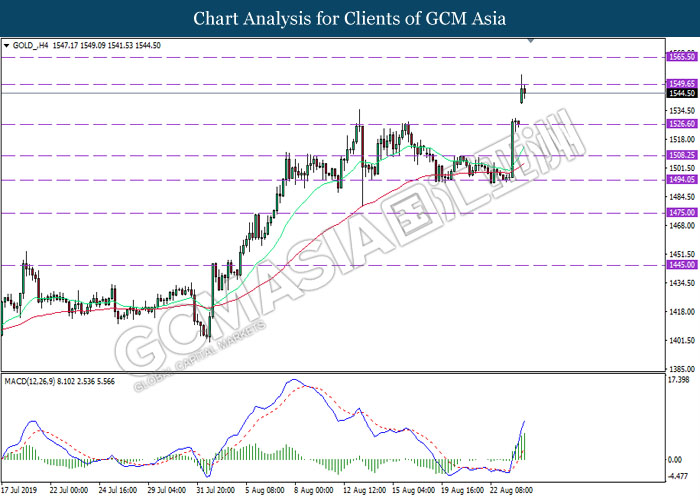

In terms of commodities market, crude oil price fell by 0.91% to $53.45 per barrel amid China imposed 10% of retaliatory tariff on US crude oil product, starting from 1th September 2019. Heightening of trade dispute increased the market concern over global demand of crude oil may dip. On the other hand, gold price skyrocketed 1.18% to $1544.50 amid escalation of trade war between China and US.

Today’s Holiday Market Close

Time Market Event

All Day GBP Summer Bank Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Aug) | 95.7 | 95.1 | – |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Jul) | 1.0% | 0.1% | – |

Technical Analysis

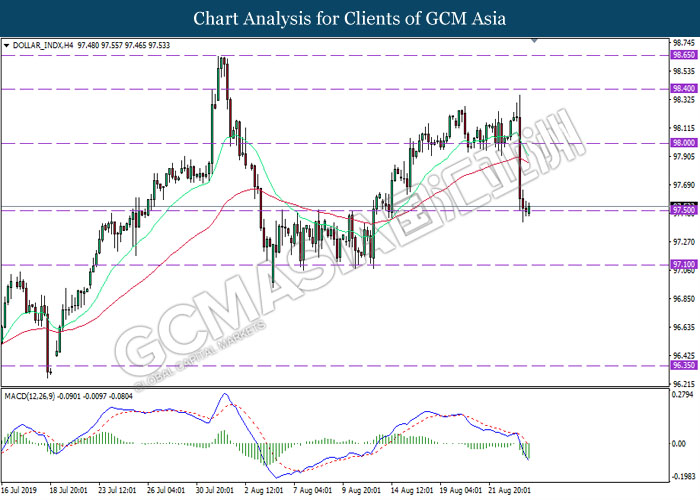

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level 97.50. MACD which illustrate bearish momentum suggest index to extend its losses after successfully breaking below the support level.

Resistance level: 98.00, 98.40

Support level: 97.50, 97.10

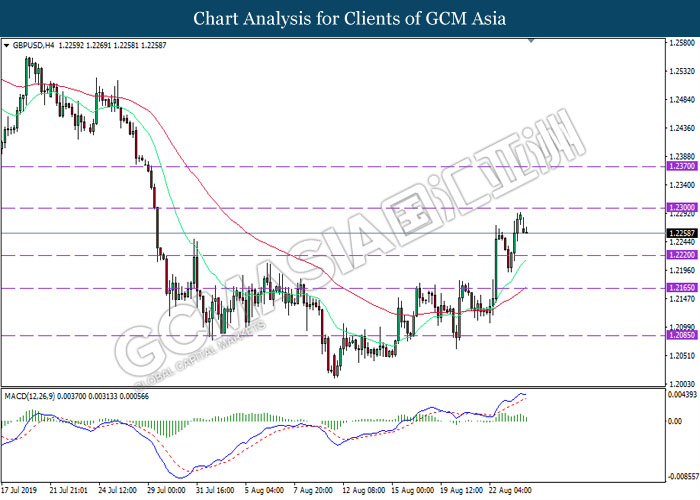

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level 1.2300. MACD which display diminishing bullish momentum suggest the pair to extend its retracement towards the support level 1.2220.

Resistance level: 1.2300, 1.2370

Support level: 1.2220, 1.2165

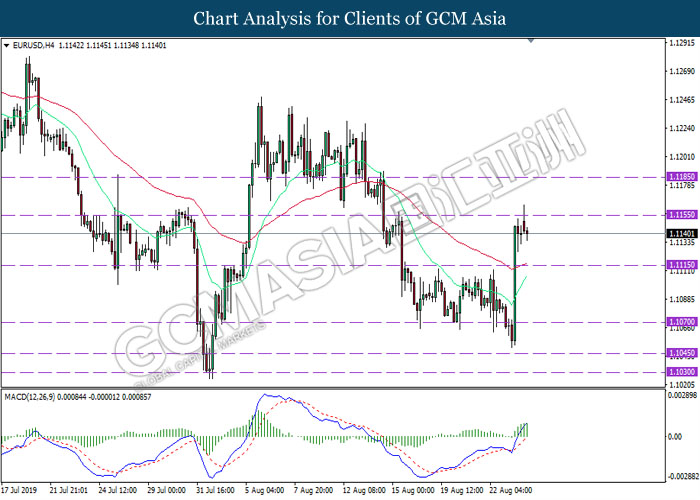

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level 1.1150. MACD which illustrate diminishing bullish momentum suggest the pair to extend its retracement towards the support level 1.1115.

Resistance level: 1.1155, 1.1185

Support level: 1.1115, 1.1070

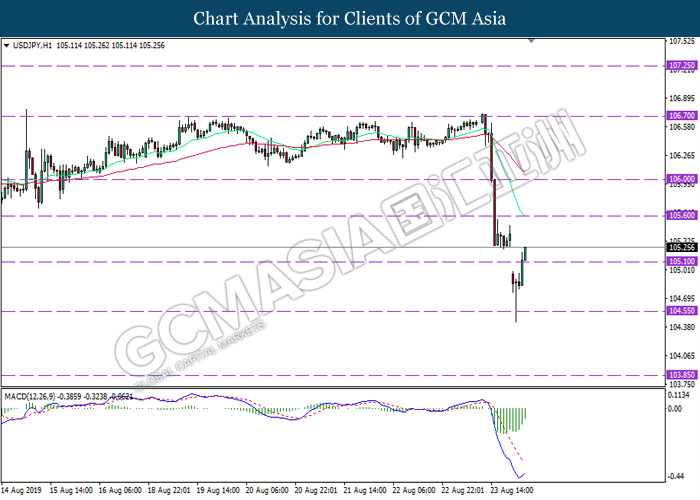

USDJPY, H1: USDJPY was traded higher following prior breakout from previous resistance level 105.10. MACD which display diminishing bearish momentum suggest the pair to extend its gains towards the resistance level 105.60.

Resistance level: 105.60, 106.00

Support level: 105.10, 104.55

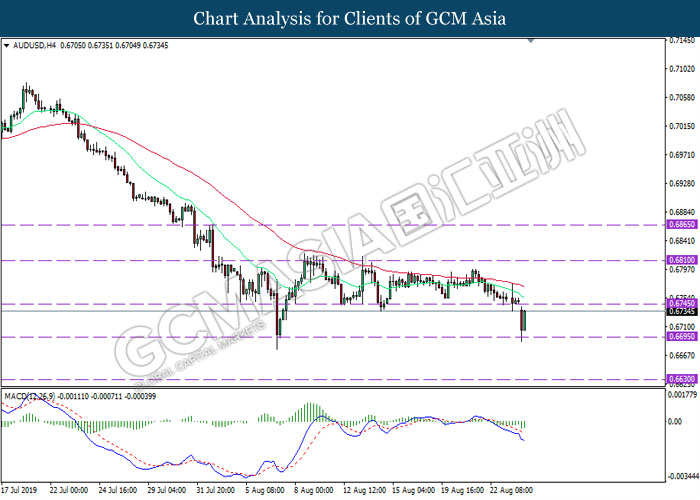

AUDUSD, H4: AUDUSD was traded higher while currently testing near the resistance level 0.6745. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains after successfully breaking above the resistance level 0.6745.

Resistance level: 0.6745, 0.6810

Support level: 0.6695, 0.6630

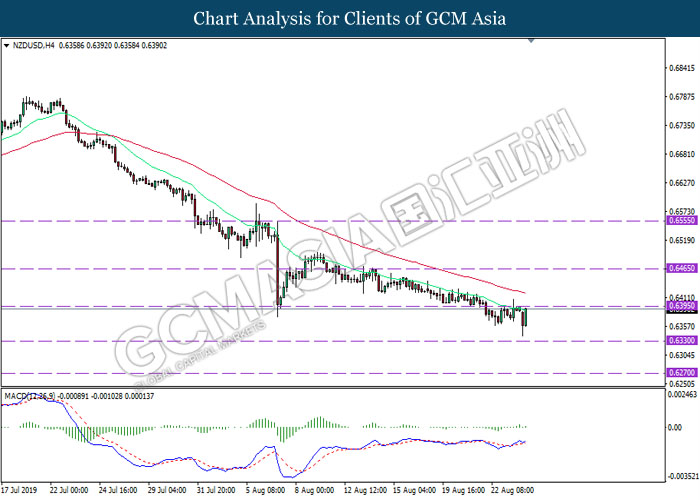

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level 0.6395. However, due to lack of momentum and signal from the MACD, a breakout or retracement from the resistance level is required to obtain further confirmation before entering the market.

Resistance level: 0.6395, 0.6465

Support level: 0.6330, 0.6270

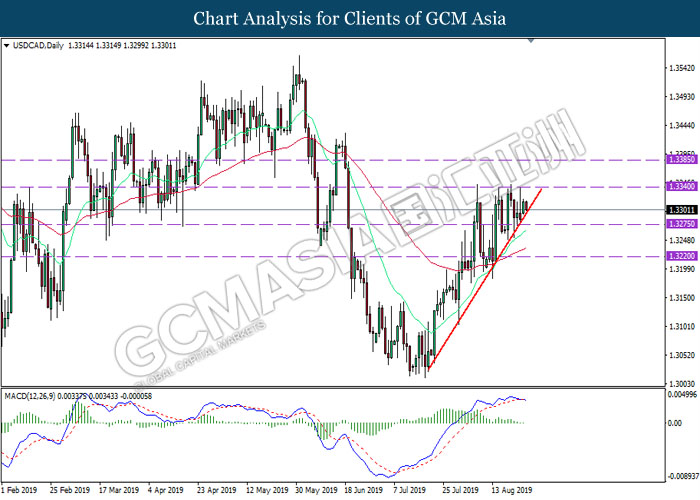

USDCAD, Daily: USDCAD was traded lower while currently testing the upward trend line. MACD which illustrate bearish bias signal suggest the pair to extend its losses after successfully closing below the upward trend line.

Resistance level: 1.3340, 1.3385

Support level: 1.3275, 1.3220

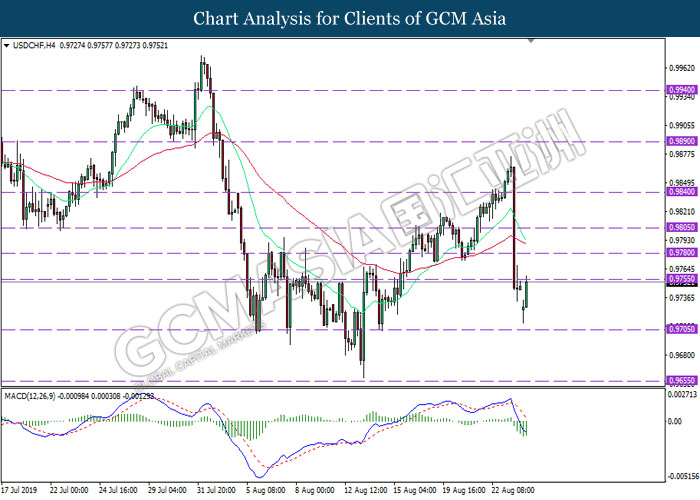

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level 0.9755. MACD which illustrate diminishing bearish momentum suggest the pair to extend its gains after successfully breaking above the resistance level.

Resistance level: 0.9755, 0.9780

Support level: 0.9705, 0.9655

CrudeOIL, H1: Crude oil price was traded higher following while currently testing the resistance level 53.25. MACD which display diminishing bearish momentum suggest the commodity to extend its gains after successfully breaking above the resistance level.

Resistance level: 53.25, 54.05

Support level: 52.10, 50.60

GOLD_, H4: Gold price was traded higher while currently testing near the resistance level 1549.65. MACD which display bullish momentum suggest the commodity to extend its gains after successfully breaking above the resistance level.

Resistance level: 1549.65, 1565.50

Support level: 1526.60, 1508.25