29 January 2019 Morning Session Analysis

Dollar remained steady around 95.40 ahead of Fed conference.

Greenback slipped in value against a basket of six major currency pairs while remained sideways around 95.40 level ahead of tomorrow’s FOMC press conference. According to Wall Street Journal, Friday reports stated that Fed’s Chairman Jerome Powell is widely expected to carry a dovish note in his speech, while maintaining interest rate at the same level as well as ending the balance sheet unwind program to tackle against the economy slowdown. Market participants reacted by largely selling off the dollar while entering safe-haven assets as expectations for policy tightening by Fed diminishes. Besides that, the ongoing government shutdown reached a new record of 36-day, worrying investors that labor market would be affected as well as this week’s Nonfarm Payrolls data, sparkling more uncertainties into the market. As of writing, dollar index slipped by 0.04% to 95.38. In other news, pair of GBP/USD fell by 0.11% to 1.3145 ahead of Parliamentary vote on UK Prime Minister Theresa May’s amended Brexit deal. Current updates for Brexit caught the eyes of investors as another fail vote on the draft might lead to either hard-Brexit or a call for second referendum which would reverse Brexit entirely.

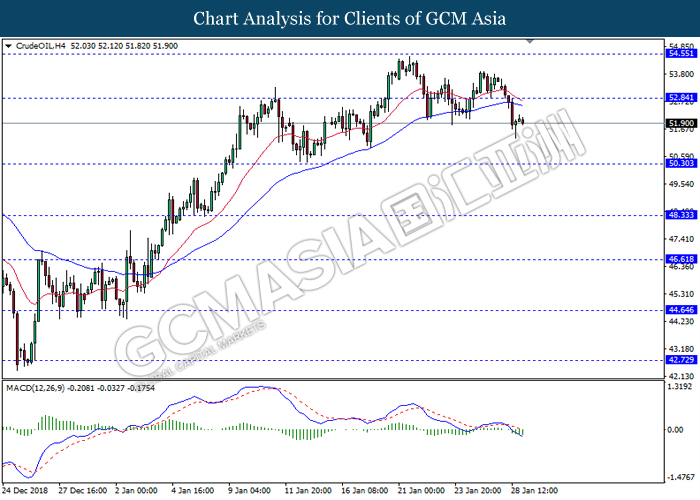

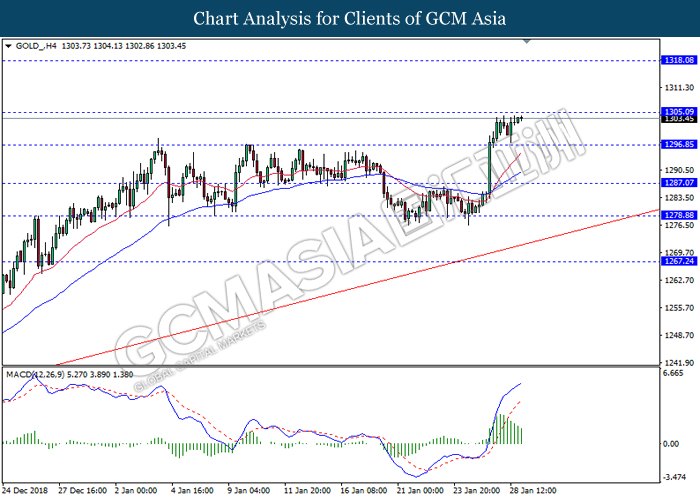

In the commodities market, crude oil price fell by 0.35% to $51.90 per barrel amid fears on China economy slowdown. Yesterday fall in Wall Street’s equities indexes alerted investors on the possible reduction in demand for crude oil as top importer China faces its’ slowest growth pace. However, oil prices remained above $50 level as OPEC goes into discussion for an increased in production cuts. On the other hand, gold price rose 0.06% to $1303.95 as market uncertainties continue to haunts the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 23:00 | USD – CB Consumer Confidence (Jan) | 128.1 | 124.7 | – |

| 05:30 (30th) | CrudeOIL – API Weekly Crude Oil Stock | 6.550M | – | – |

Technical Analysis

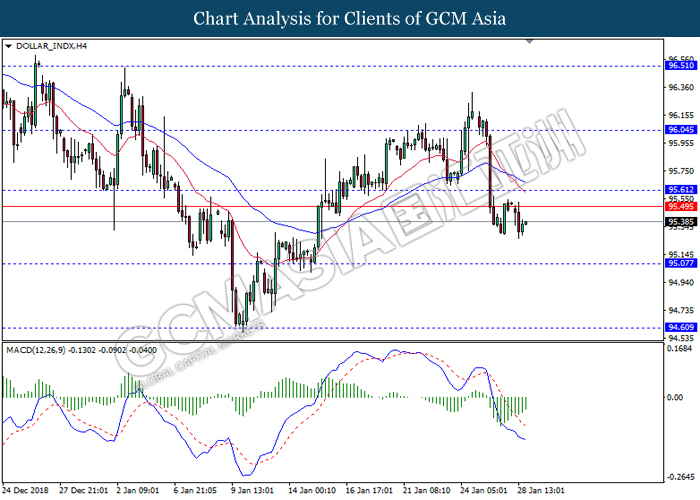

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level 95.60. However, MACD which display diminishing bearish momentum suggest the dollar to be traded higher as a short term technical correction towards the resistance level 95.60.

Resistance level: 95.60, 96.05

Support level: 95.05, 94.60

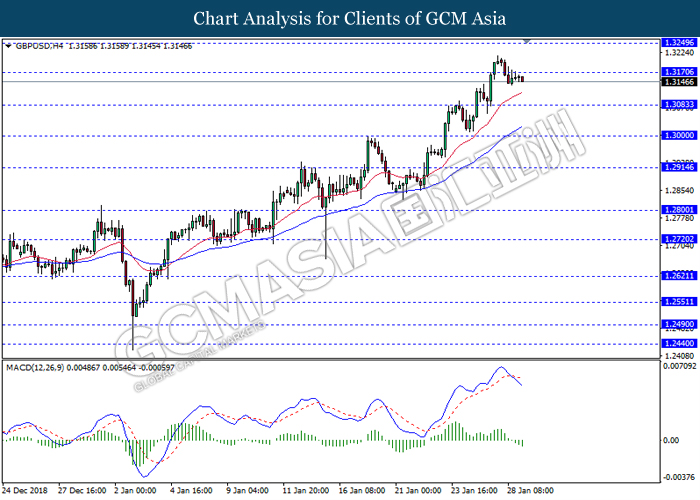

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level 1.3170. MACD which illustrate bearish bias signal with the formation of death cross suggest the pair to extend its losses towards the support level 1.3085.

Resistance level: 1.3170, 3.3250

Support level: 1.3085, 1.3000

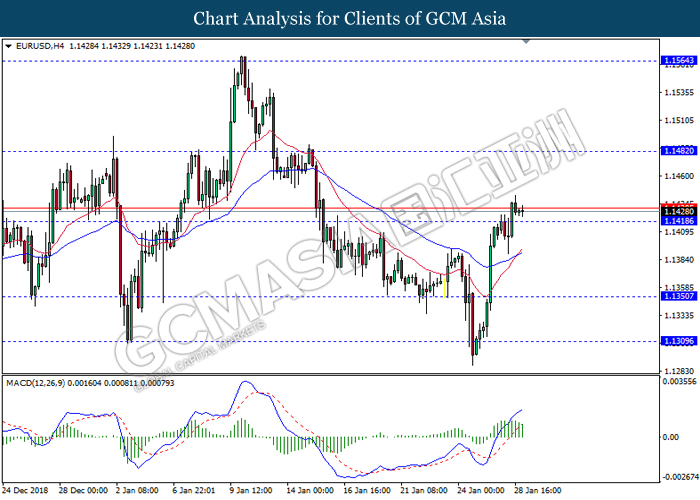

EURUSD, H4: EURUSD was traded higher following recent breakout above the previous resistance level 1.1420. However, MACD which illustrate diminishing bullish momentum suggest the pair to experience a short term technical correction towards the support level 1.1420.

Resistance level: 1.1480, 1.1565

Support level: 1.1420, 1.1350

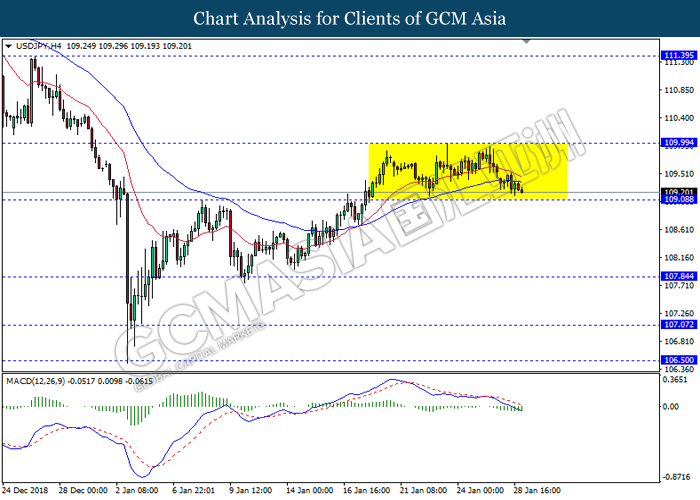

USDJPY, H4: USDJPY remain traded in a sideway channel while currently testing the support level 109.10. MACD which illustrate bearish bias signal suggest the pair to be traded lower after it breaks below the support level.

Resistance level: 110.00, 111.40

Support level: 109.10, 107.85

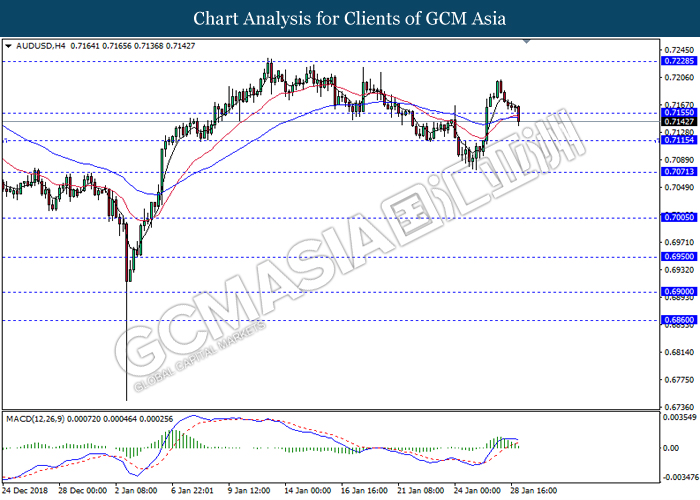

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level 0.7155. MACD which display bearish momentum signal suggest the pair to extend its losses towards the support level 0.7115.

Resistance level: 0.7155, 0.7230

Support level: 0.7115, 0.7070

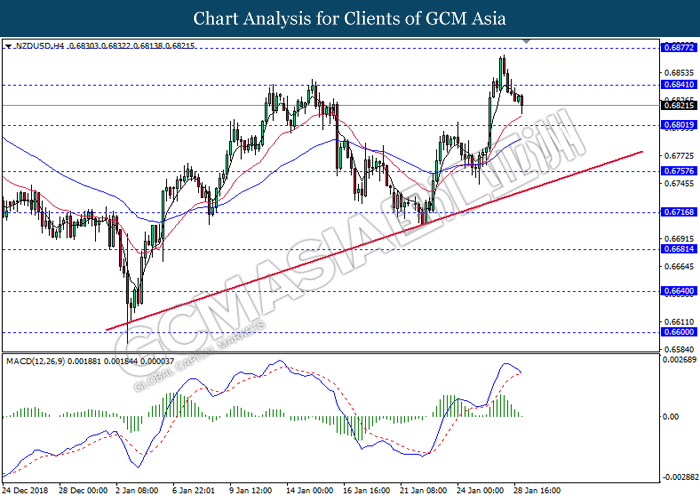

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level 0.6840. MACD which display bearish momentum signal with the starting formation of death cross suggest the pair to extend its losses towards the support level 0.6800.

Resistance level: 0.6840, 0.6875

Support level: 0.6800, 0.6755

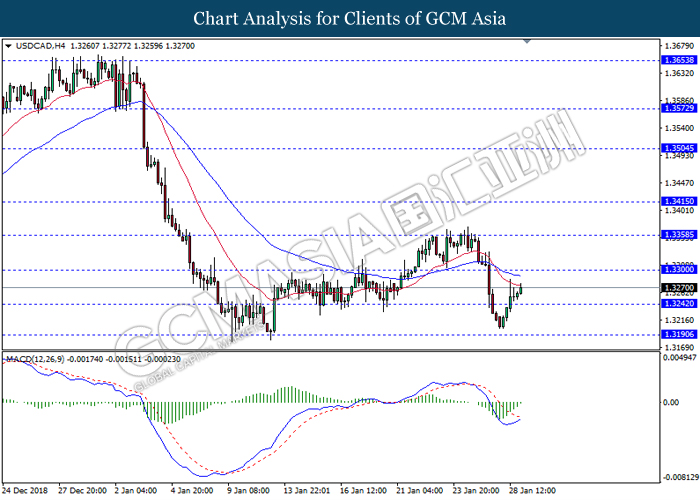

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level 1.3240. MACD which illustrate bullish bias signal with the starting formation of golden cross suggest the pair to extend its gains towards the resistance level 1.3300.

Resistance level: 1.3300, 1.3360

Support level: 1.3240, 1.3190

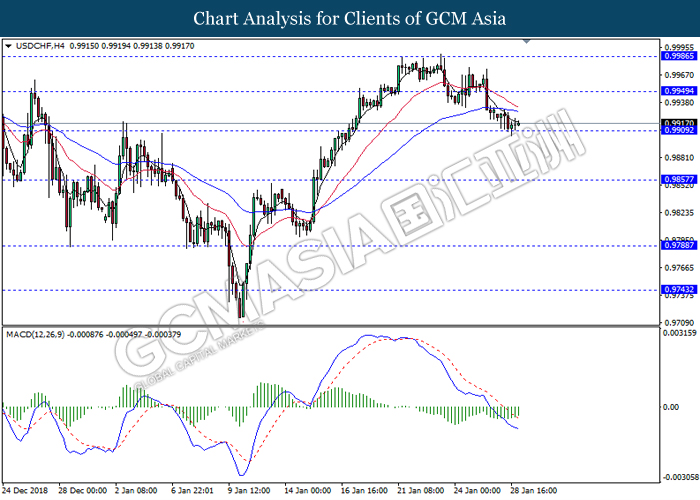

USDCHF, H4: USDCHF was traded lower while currently testing the support level 0.9910. However, MACD which illustrate diminishing bearish momentum suggest the pair to be traded higher as a short term technical correction towards the resistance level 0.9950.

Resistance level: 0.9950, 0.9985

Support level: 0.9910, 0.9855

CrudeOIL, H4: Crude oil price was traded lower following recent breakout below the previous support level 52.85. MACD which illustrate persistent bearish momentum suggest the commodity to extend its losses towards the support level 50.30.

Resistance level: 52.85, 54.55

Support level: 50.30, 48.35

GOLD_, H4: Gold price was traded higher while currently testing the resistance level 1305.10. However, MACD which illustrate diminishing bullish momentum suggest the commodity to be traded lower as a short term technical correction towards the support level 1296.85.

Resistance level: 1305.10, 1318.10

Support level: 1296.85, 1287.05