1 February 2019 Morning Session Analysis

Dollar recoup losses amid New Home Sales, investors eye on NFP.

Dollar index was traded higher by 0.23% to 95.22 against a basket of six major currency pairs yesterday amid higher than expected New Home Sales data. The housing data which measures the total sale of new homes came in at 657K, exceeding economists’ expectation of 560K, indicating a growing economy although being pressured by global growth slowdown. However, yesterday’s Initial Jobless Claims data showed an increasing number of claims from unemployed workers in the US which may affect the monthly Nonfarm Payrolls (NFP) data but showed no significant impact to the dollar. Investors will now place their attention towards today’s highlighted data including NFP, Unemployment Rate and also ISM Manufacturing Employment to further determine greenback’s momentum. In other news, pair of USD/CAD ticks higher by 0.02% to 1.3125 while remaining strong against the dollar following yesterday Canada GDP data which met its expectations of -0.1%. The Canadian dollar was gaining for the past few weeks while being supported by increasing crude oil prices. As Canada is one of the top oil exporters in the world, the positive sentiment surrounding oil markets now continue to push the currency higher, providing a strong economy outlook for the country.

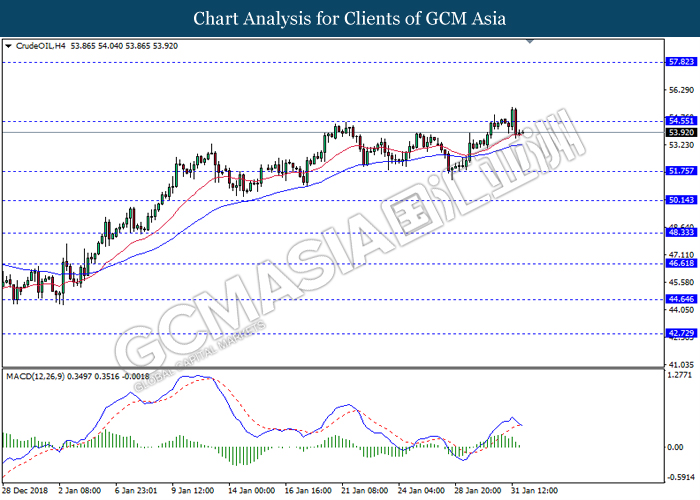

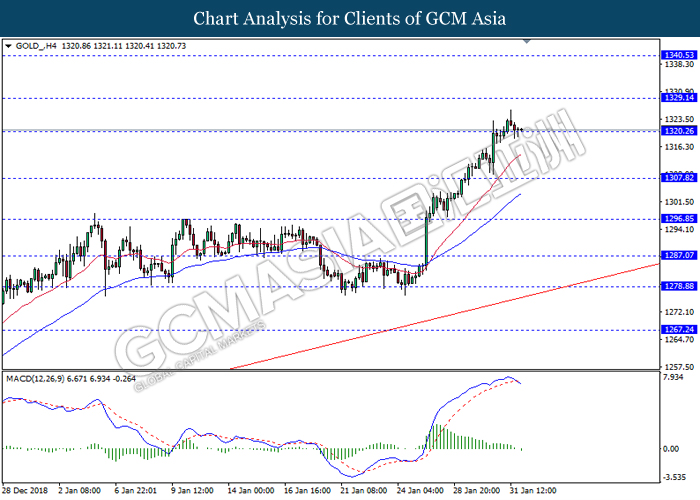

In the commodities market, crude oil price remained traded flat at $54.00 per barrel after falling off from high levels following yesterday’s updates on US-Sino trade talks. According to reports, White House stated that US might increase its’ tariffs on Chinese goods if no satisfactory deal is achieved by March 1. In accordance to the report, US President Donald Trump also stated that he might meet his Chinese counterpart Xi Jinping again to try reaching a deal. The trade tensions put pressure onto the oil market, causing investors to sell the commodity. On the other hand, gold price falls 0.05% to $1321.20 while remaining at high levels while market uncertainties and global growth worries continues to haunt the market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Jan) | 49.9 | 49.9 | – |

| 17:00 | EUR – Manufacturing PMI (Jan) | 50.5 | 50.5 | – |

| 17:30 | GBP – Manufacturing PMI | 54.2 | 53.5 | – |

| Tentative | EUR – CPI (YoY) (Jan) | 1.6% | 1.4% | – |

| 21:30 | USD – Nonfarm Payrolls (Jan) | 312K | 165K | – |

| 21:30 | USD – Unemployment Rate (Jan) | 3.9% | 3.9% | – |

| 23:00 | USD – ISM Manufacturing PMI (Jan) | 54.3 | 54.2 | – |

| 02:00 (2nd) | CrudeOIL – US Baker Hughes Oil Rig Count | 862 | – | – |

Technical Analysis

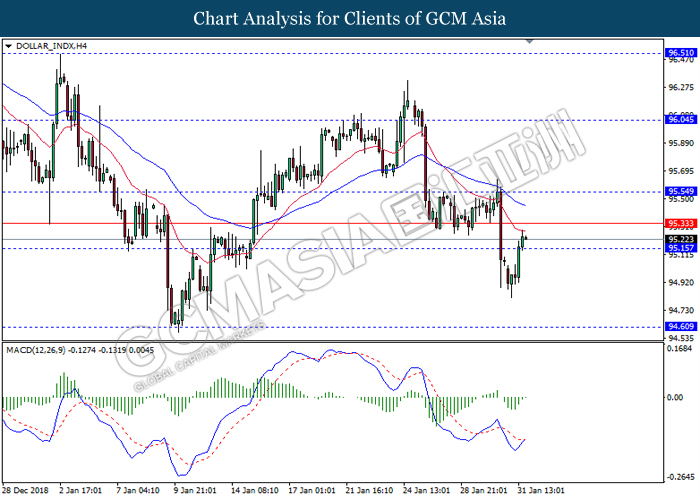

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level 96.15. MACD which illustrate bullish momentum with the formation of golden cross suggest the pair to extend its rebound towards the resistance level 95.55.

Resistance level: 95.55, 96.05

Support level: 95.15, 94.60

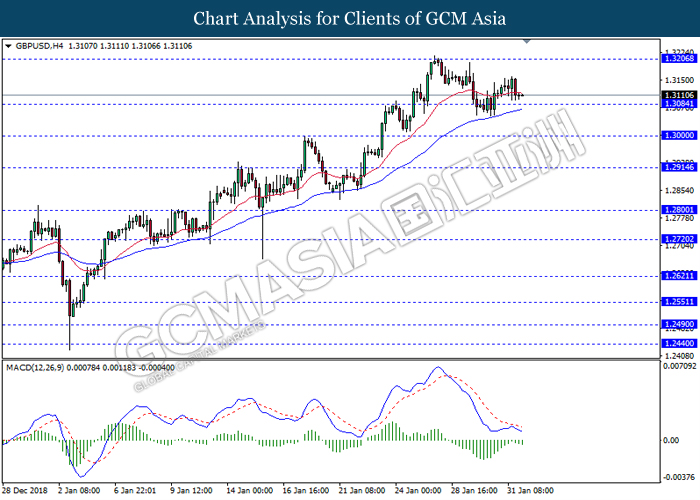

GBPUSD, H4: GBPUSD was traded lower following recent retracement from its high. MACD which illustrate bearish momentum suggest the pair to extend its losses towards the support level 1.3085.

Resistance level: 1.3205, 1.3350

Support level: 1.3085, 1.3000

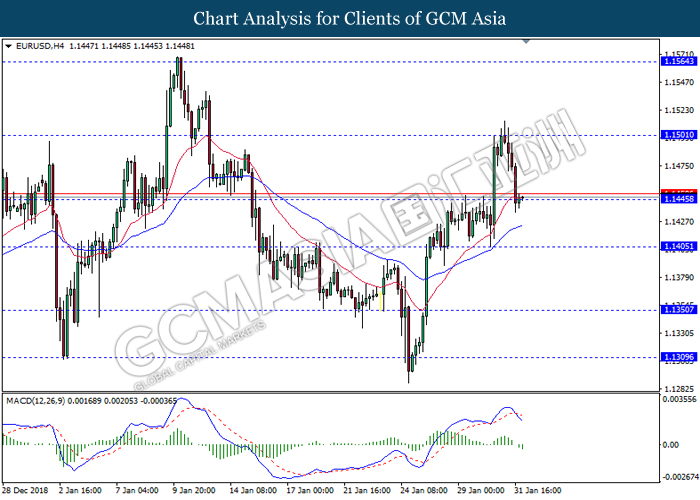

EURUSD, H4: EURUSD was traded lower while currently testing the support level 1.1445. MACD which illustrate bearish signal with the formation of death cross suggest the pair to extend its losses after it breaks below the support level 1.1445.

Resistance level: 1.1500, 1.1565

Support level: 1.1445, 1.1405

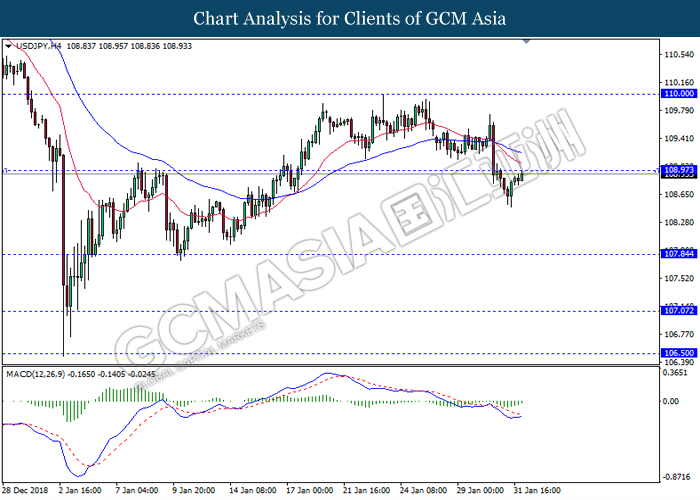

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level 108.95. MACD which illustrate diminishing bearish momentum suggest the pair to extend its bullish momentum after it breaks above the resistance level 108.95.

Resistance level: 108.95, 110.00

Support level: 107.85, 107.05

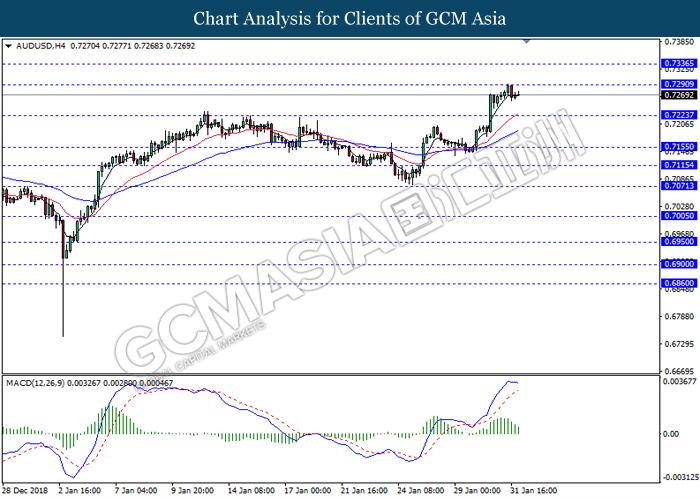

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level 0.7290. MACD which display diminishing bullish momentum suggest the pair to extend its retracement towards the support level 0.7225.

Resistance level: 0.7290, 0.7335

Support level: 0.7225, 0.7155

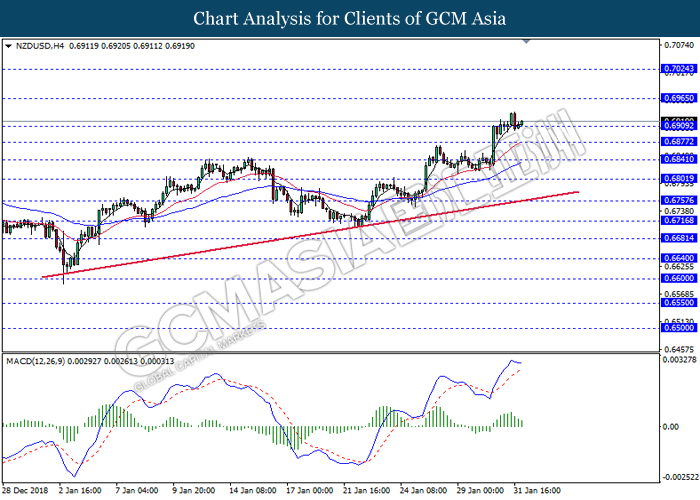

NZDUSD, H4: NZDUSD was lower while currently testing the support level 0.6910. MACD which illustrate diminishing bearish momentum suggest the pair to extend its retracement after if breaks below the support level 0.6910.

Resistance level: 0.6965, 0.7025

Support level: 0.6910, 0.6875

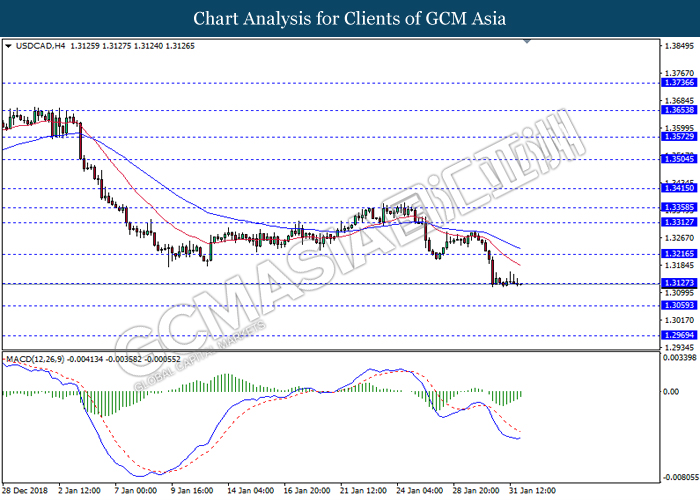

USDCAD, H4: USDCAD was traded lower while currently testing the support level 1.3125. However, MACD which illustrate diminishing bearish momentum suggest the pair to be traded higher as a short term technical correction toward the resistance level 1.3215.

Resistance level: 1.3215, 1.3310

Support level: 1.3125, 1.3060

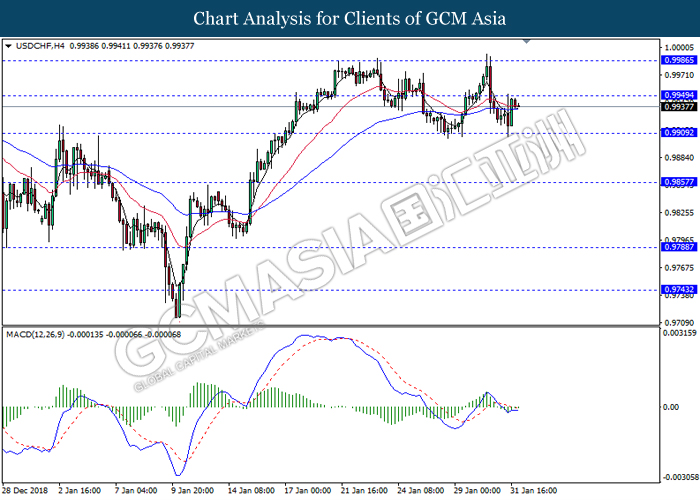

USDCHF, H4: USDCHF was traded higher while currently testing near the resistance level 0.9950. However, lack of clear signal and momentum from MACD suggest the pair to wait until further clear signal appear such as breakout above or below the closest resistance or support level before entering the market.

Resistance level: 0.9950, 0.9985

Support level: 0.9910, 0.9855

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level 54.55. MACD which display bearish bias signal with the starting formation of death cross suggest the pair to extend its retracement towards the support level 51.75

Resistance level: 54.55, 57.80

Support level: 51.75, 50.15

GOLD_, H4: Gold price was traded lower while currently testing the support level 1320.25. MACD which illustrate bearish bias signal with the formation of death cross suggest the pair to extend it bearish momentum after it breaks below the support level.

Resistance level: 1329.15, 1340.50

Support level: 1320.25, 1307.80