01 February 2023 Morning Session Analysis

US Dollar tumbled amid lower consumer optimism.

The dollar index, which is traded against a basket of six major currencies, lost its foot and reversed a large part of its gain in the previous trading session as downbeat data wiped the positive sentiment in the dollar market. According to the Conference Board, US CB Consumer Confidence printed a reading at 107.1, missing both the consensus forecast and the prior month’s reading at 109.0, pointing to a deterioration of consumer confidence in the economic activity. In fact, the reduction of consumer confidence was mainly attributed to the aggressive rate hike plan from the Federal Reserve (Fed), whereby it had led to lower wage growth and higher borrowing costs in the US as the objective of the Fed was to achieve a dual mandate which includes price stability and full employment, thus, investors are now eyeing on the Fed pivot to scrutinize the future trend of the markets. Despite the fact that the market has fully priced in a 25-basis point rate hike that would be implemented in the Fed meeting, the still-high inflation in the US likely put the US interest rate at an elevated level for an extended period of time. As of writing, the dollar index dropped -0.18% to 102.10.

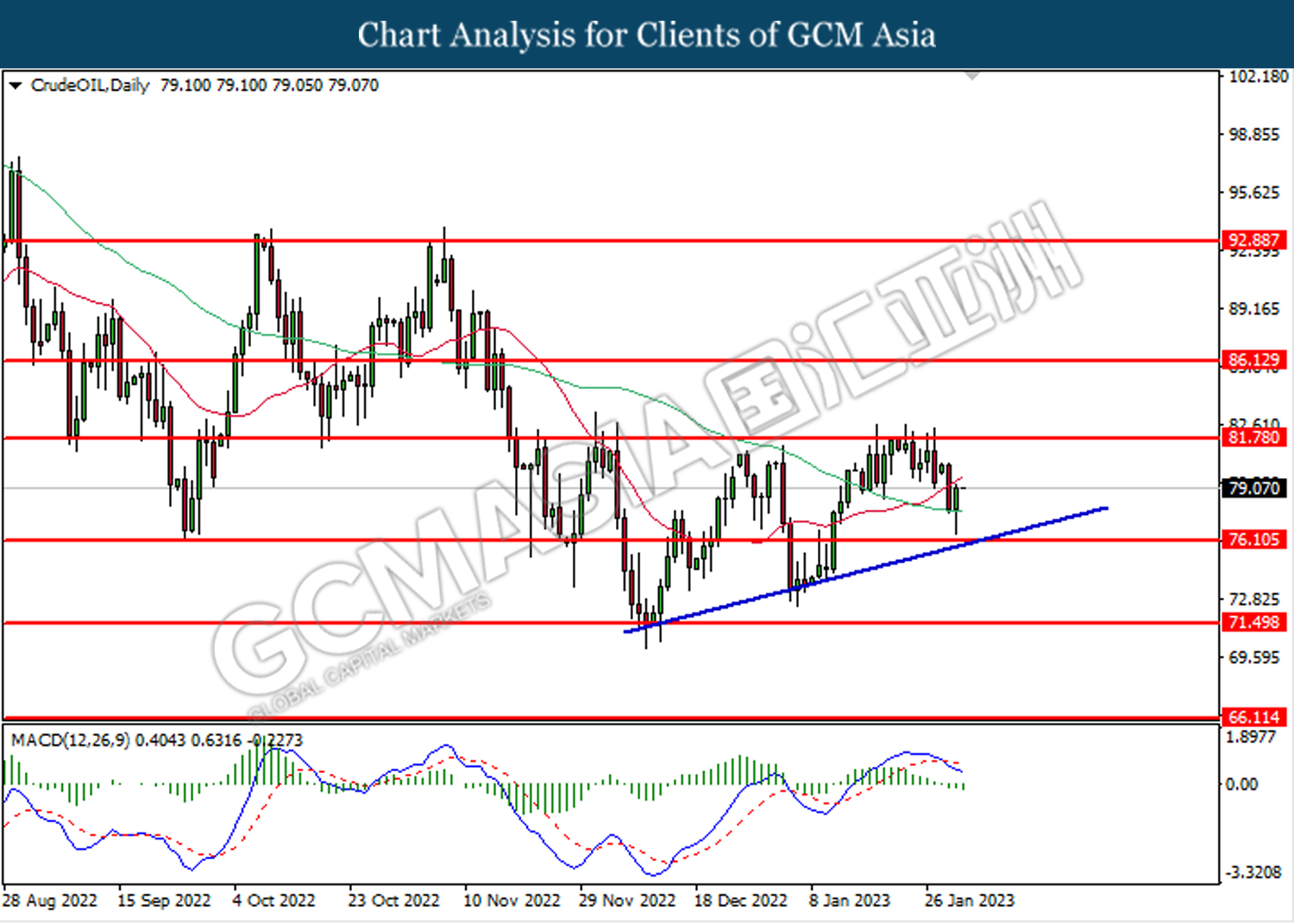

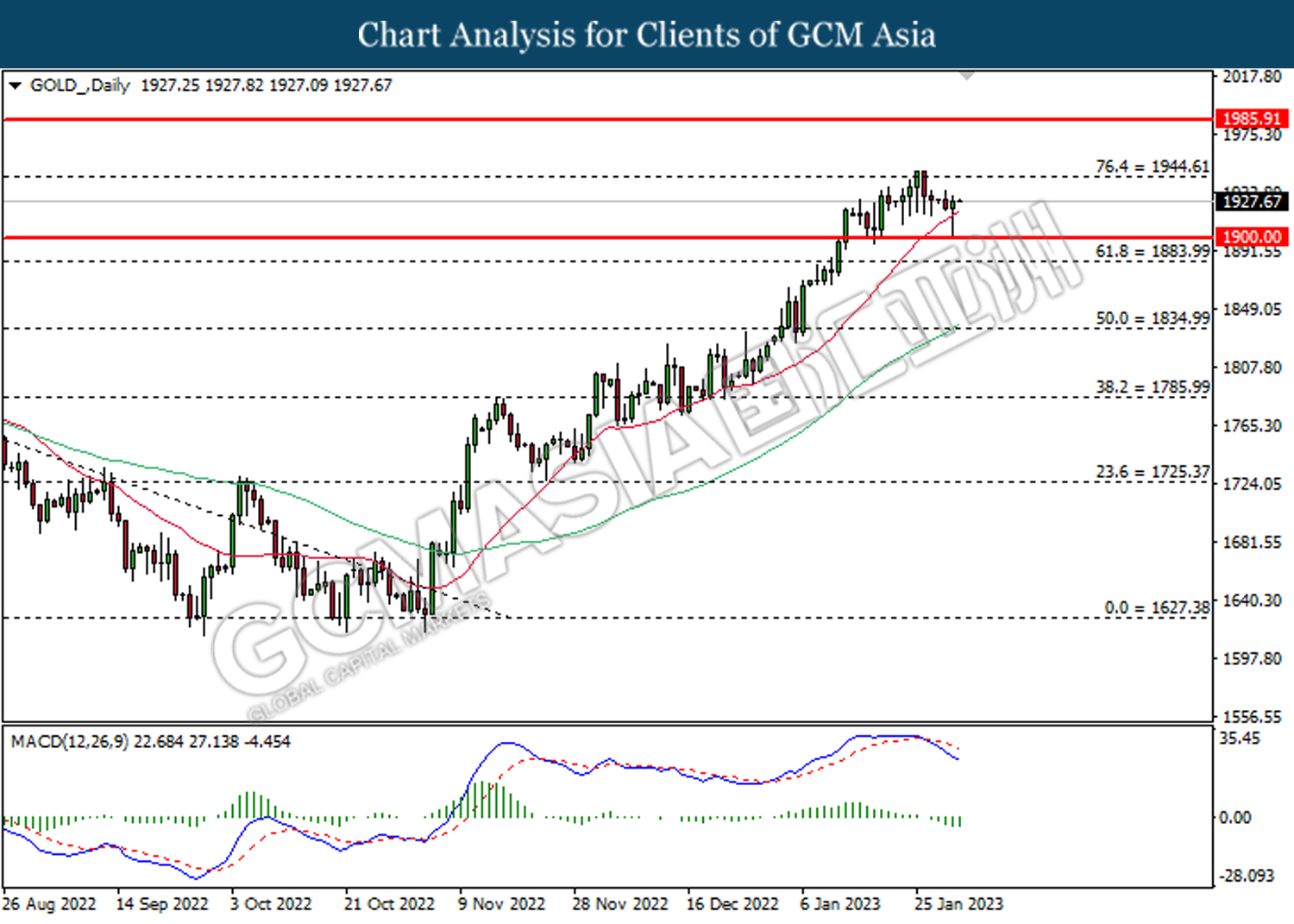

In the commodities market, crude oil prices rose by 1.67% to $79.00 per barrel as the oil demand surged with the backdrop of dollar’s weakness. Besides, gold prices appreciated 0.26% to $1928.20 per troy ounce amid the weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 CrudeOIL OPEC Meeting

3:00 USD FOMC Statement

(2nd Feb)

3:00 USD FOMC Press Conference

(2nd Feb)

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Jan) | 47.0 | 47.0 | – |

| 17:30 | GBP – Manufacturing PMI (Jan) | 46.7 | 46.7 | – |

| 18:00 | EUR – CPI (YoY) (Jan) | 9.20% | 9.10% | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Jan) | 235K | 170K | – |

| 23:00 | USD – ISM Manufacturing PMI (Jan) | 48.4 | 48 | – |

| 23:00 | USD – JOLTs Job Openings (Dec) | 10.458M | 10.200M | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 0.533M | 0.376M | – |

| 3:00

(2nd Feb) |

USD – Fed Interest Rate Decision | 4.50% | 4.75% | – |

Technical Analysis

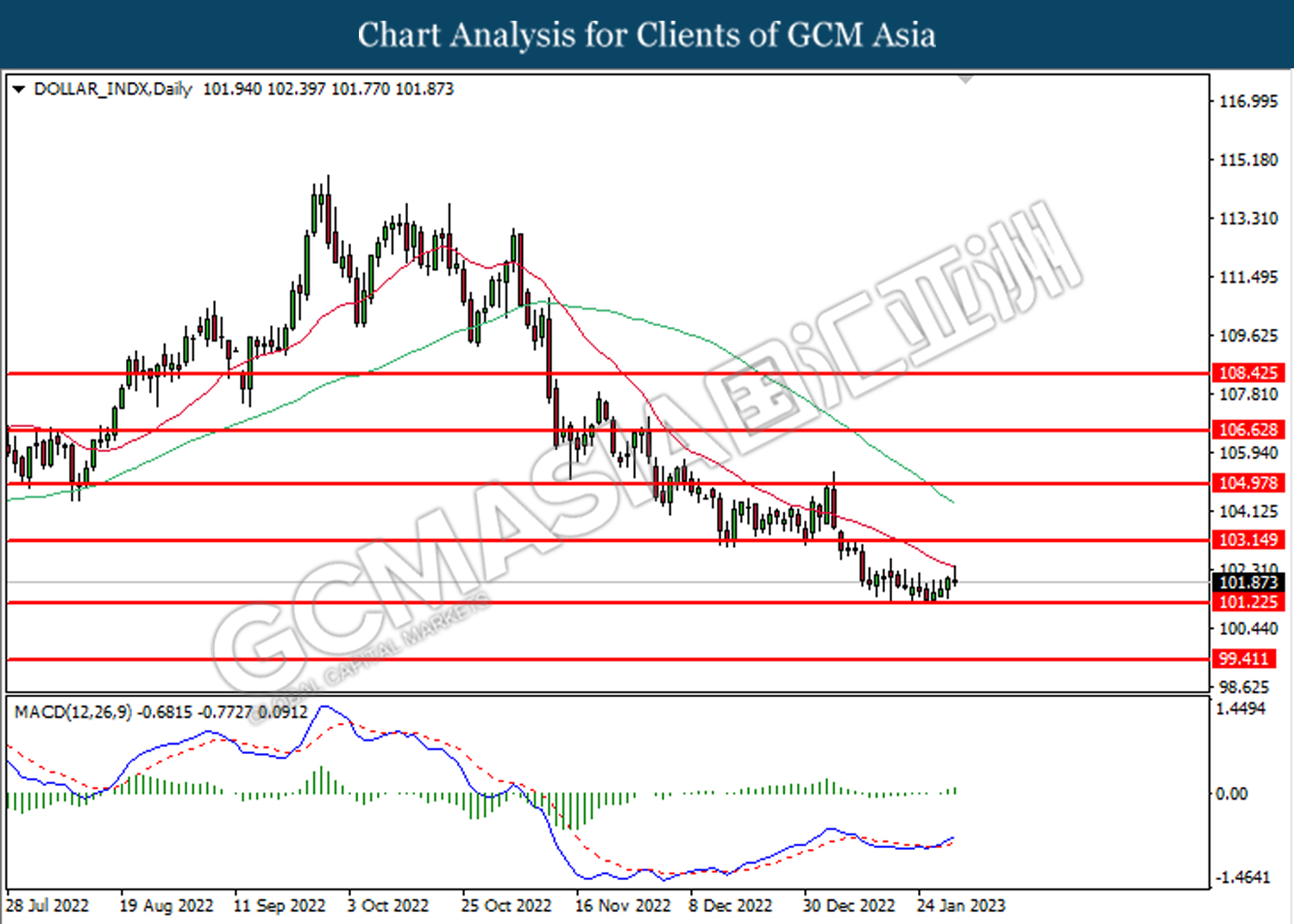

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 101.25. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 105.00

Support level: 101.25, 99.40

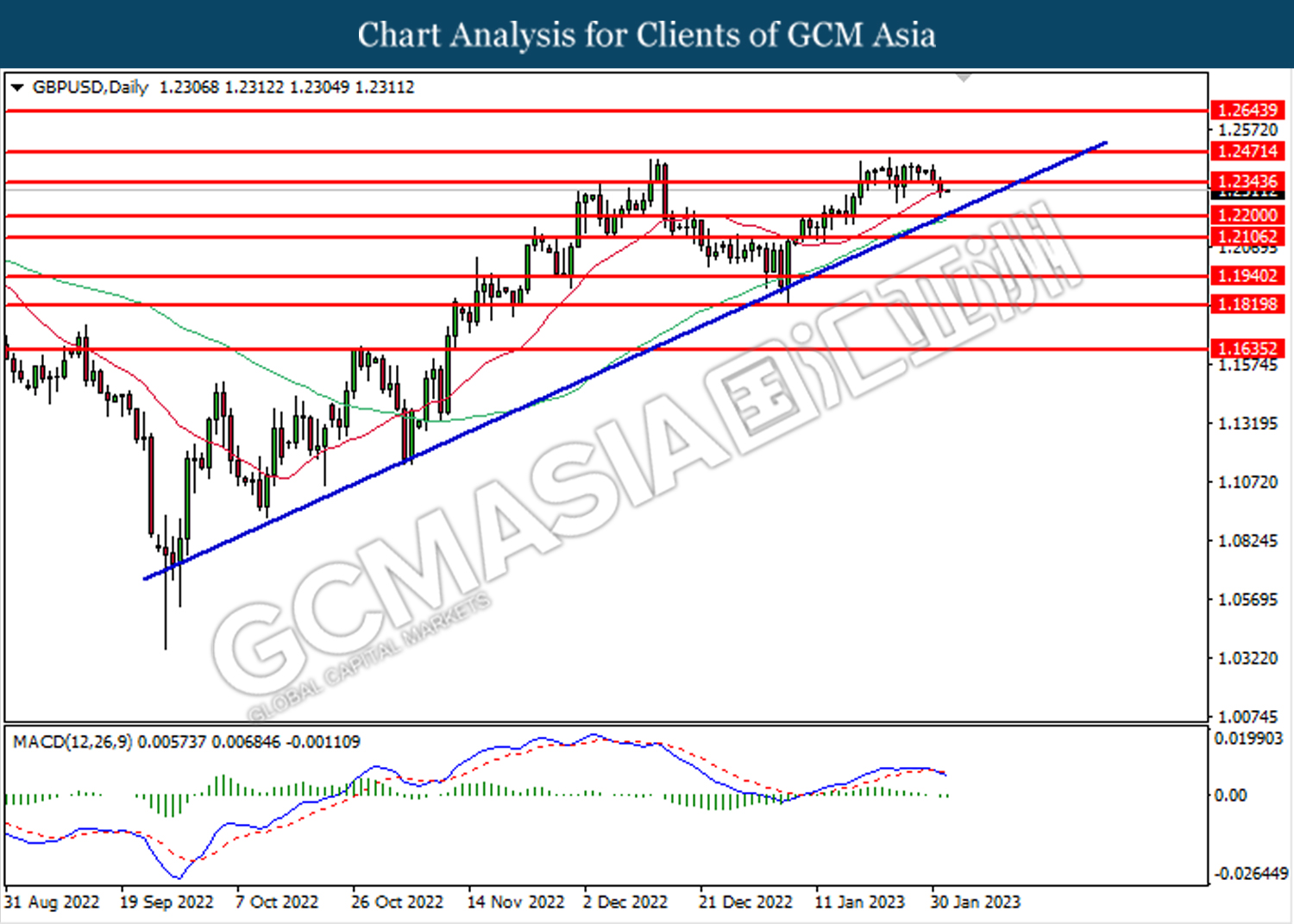

GBPUSD, Daily: GBPUSD was traded lower following a prior breakout below the previous support level at 1.2345. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2200.

Resistance level: 1.2345, 1.2470

Support level: 1.2200, 1.2105

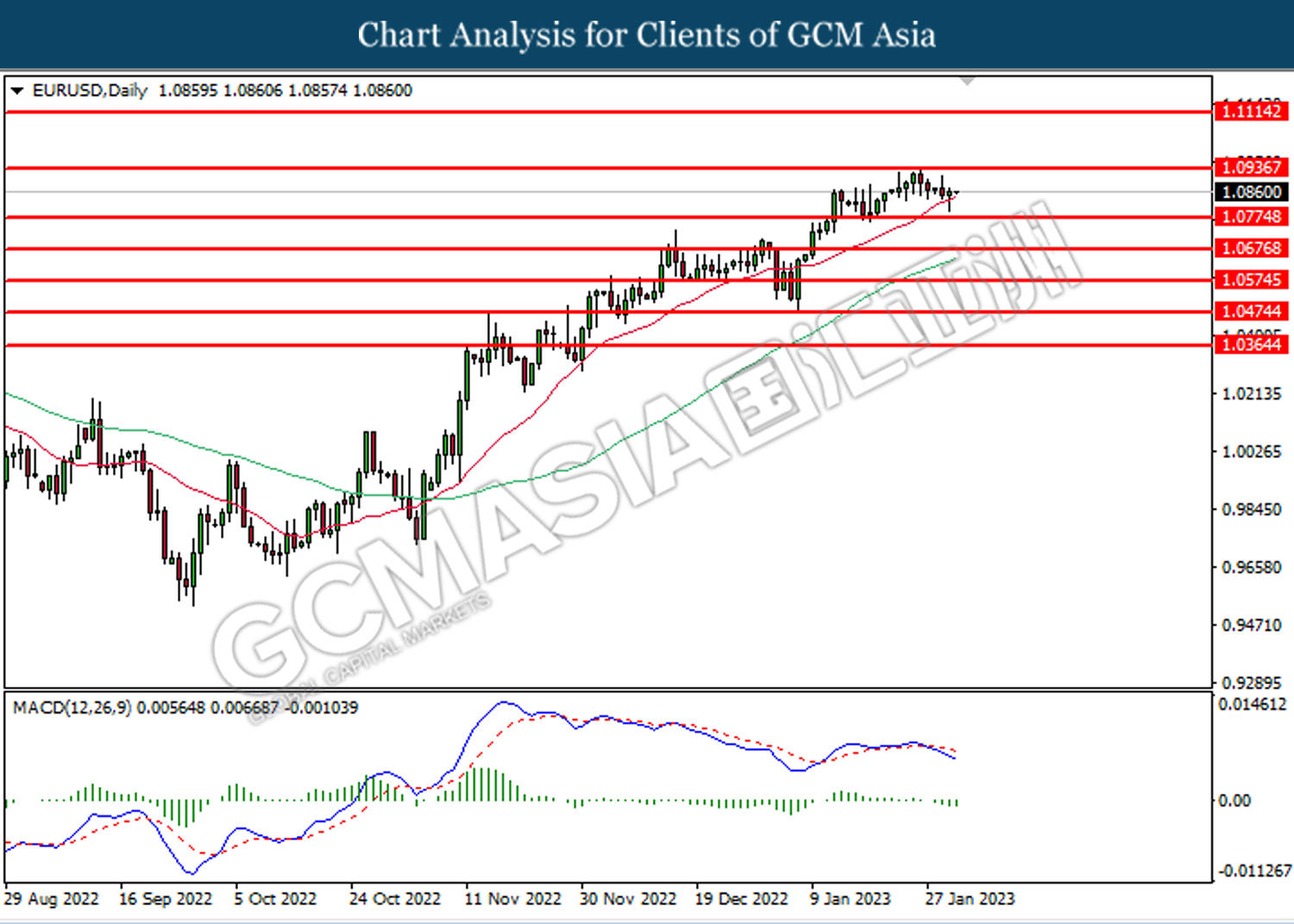

EURUSD, Daily: EURUSD was traded lower following prior retracement from the resistance level at 1.0935. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0775.

Resistance level: 1.0935, 1.1115

Support level: 1.0775, 1.0675

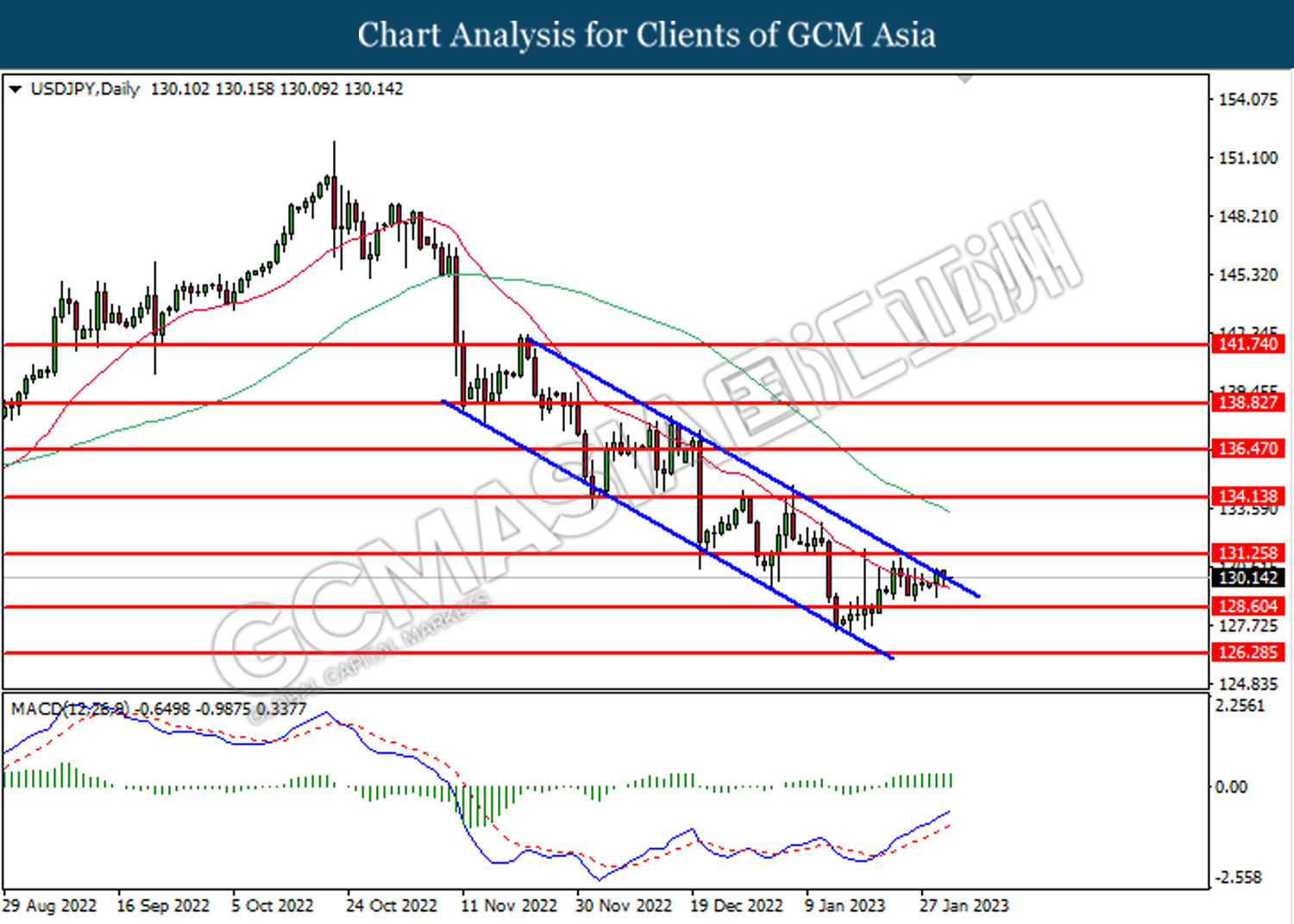

USDJPY, Daily: USDJPY was traded higher while currently testing the upper level of the downward channel. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the upper level.

Resistance level: 131.25, 134.15

Support level: 128.60, 126.30

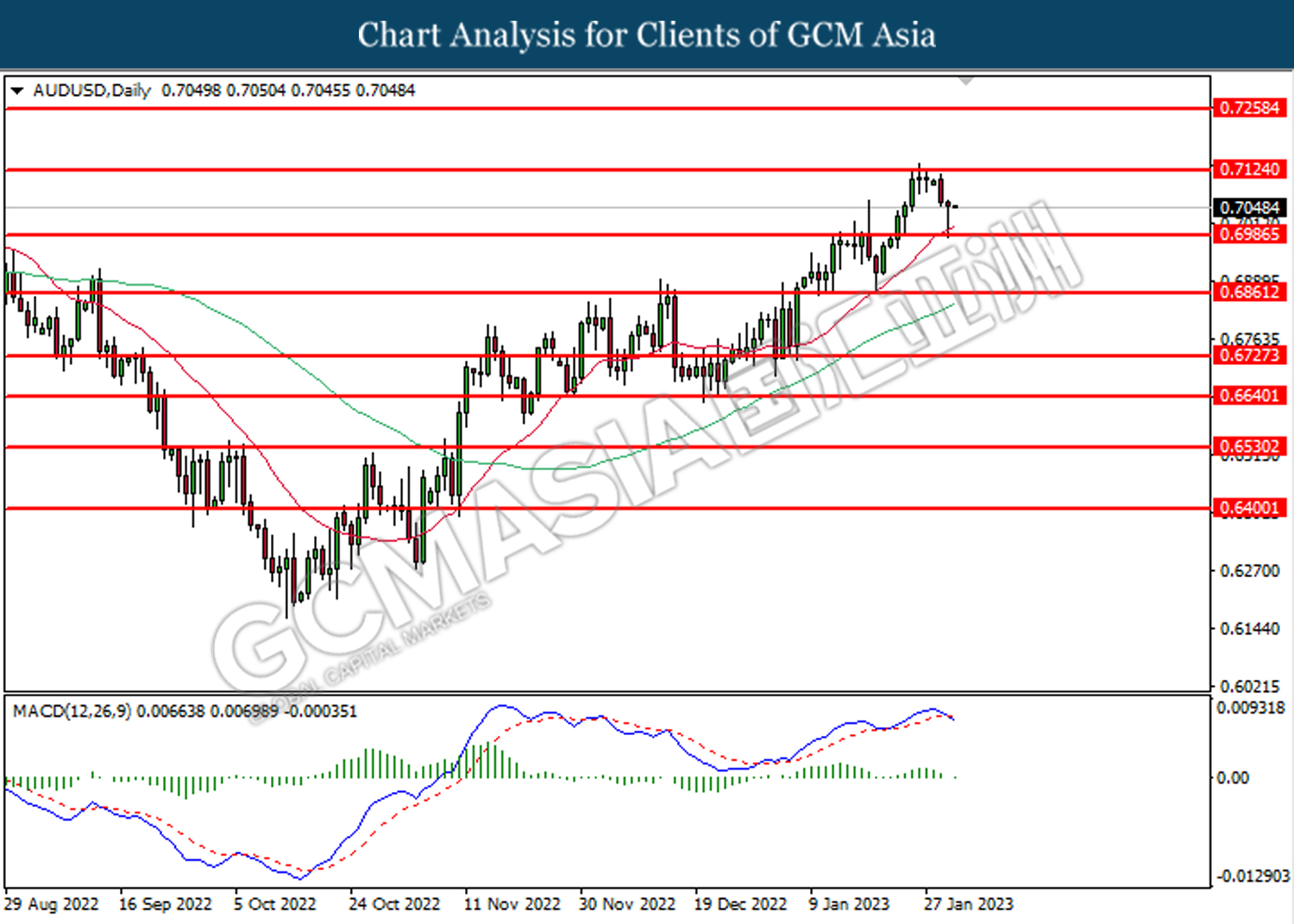

AUDUSD, Daily: AUDUSD was traded lower following the prior retracement from the resistance level at 0.7125. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6985.

Resistance level: 0.7125, 0.7260

Support level: 0.6985, 0.6725

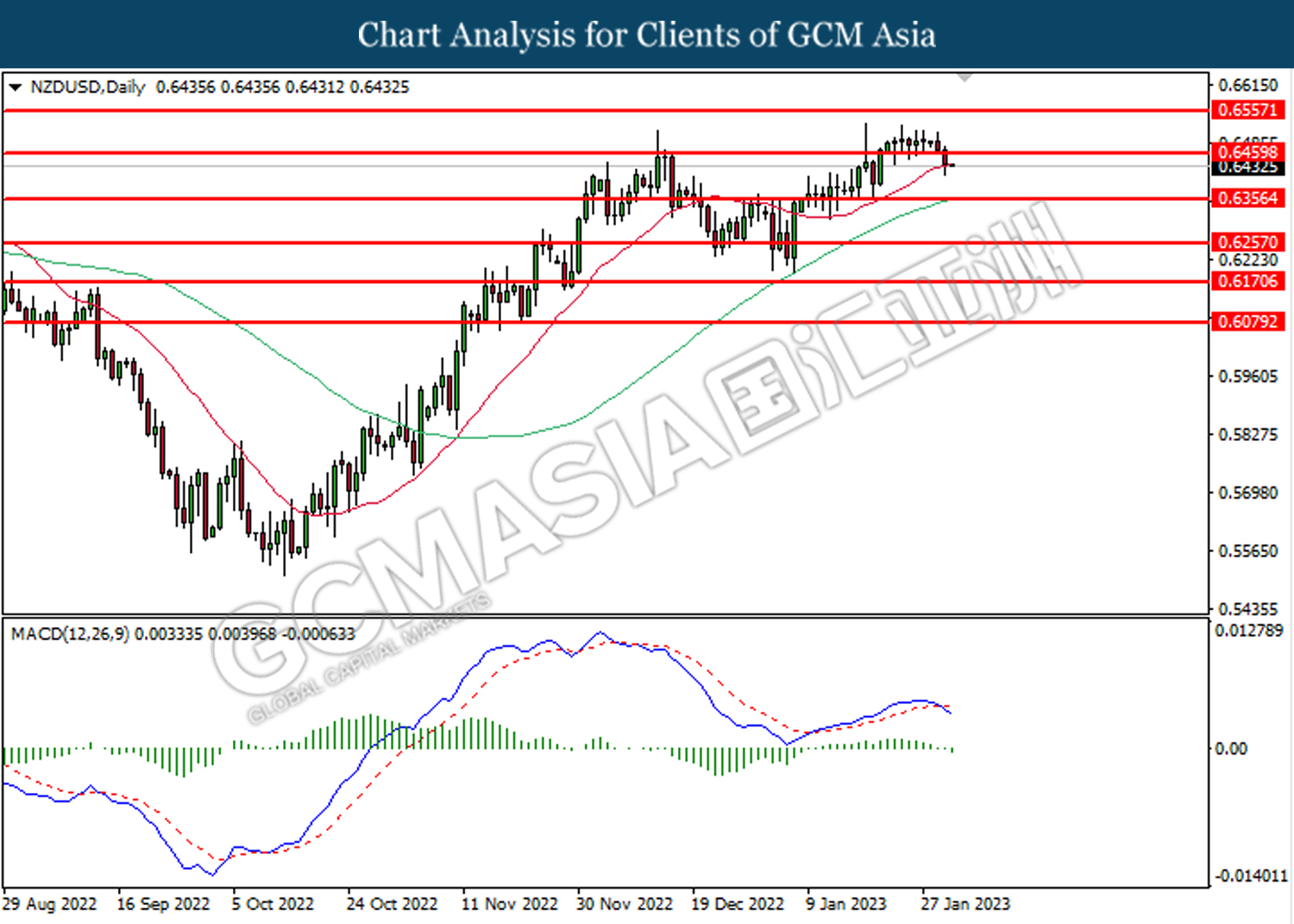

NZDUSD, Daily: NZDUSD was traded lower following a prior breakout below the previous support level at 0.6460. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6355.

Resistance level: 0.6460, 0.6555

Support level: 0.6355, 0.6255

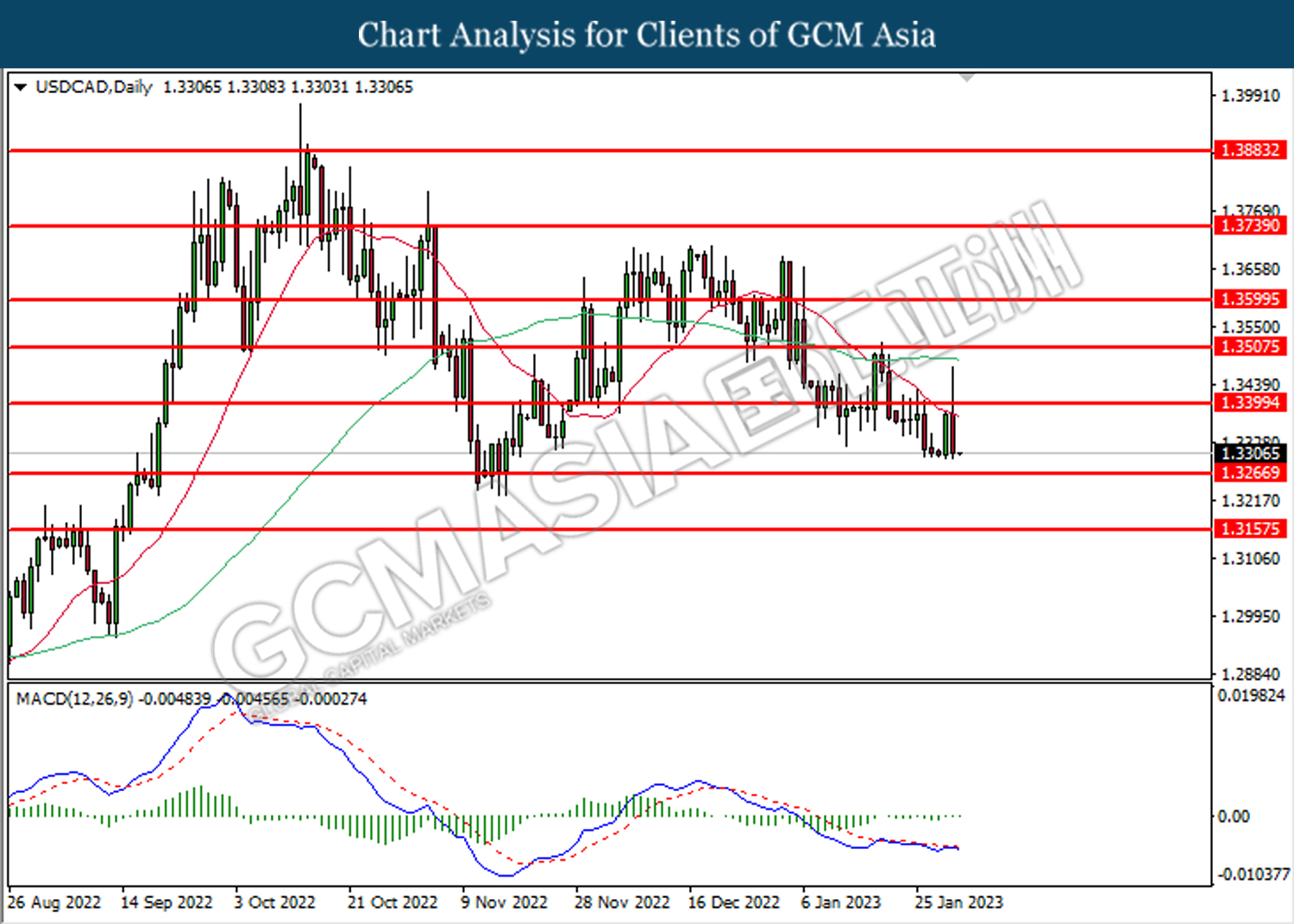

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level at 1.3400. MACD which illustrated bearish bias momentum suggests the pair to extend its losses toward the support level at 1.3265.

Resistance level: 1.3400, 1.3505

Support level: 1.3265, 1.3155

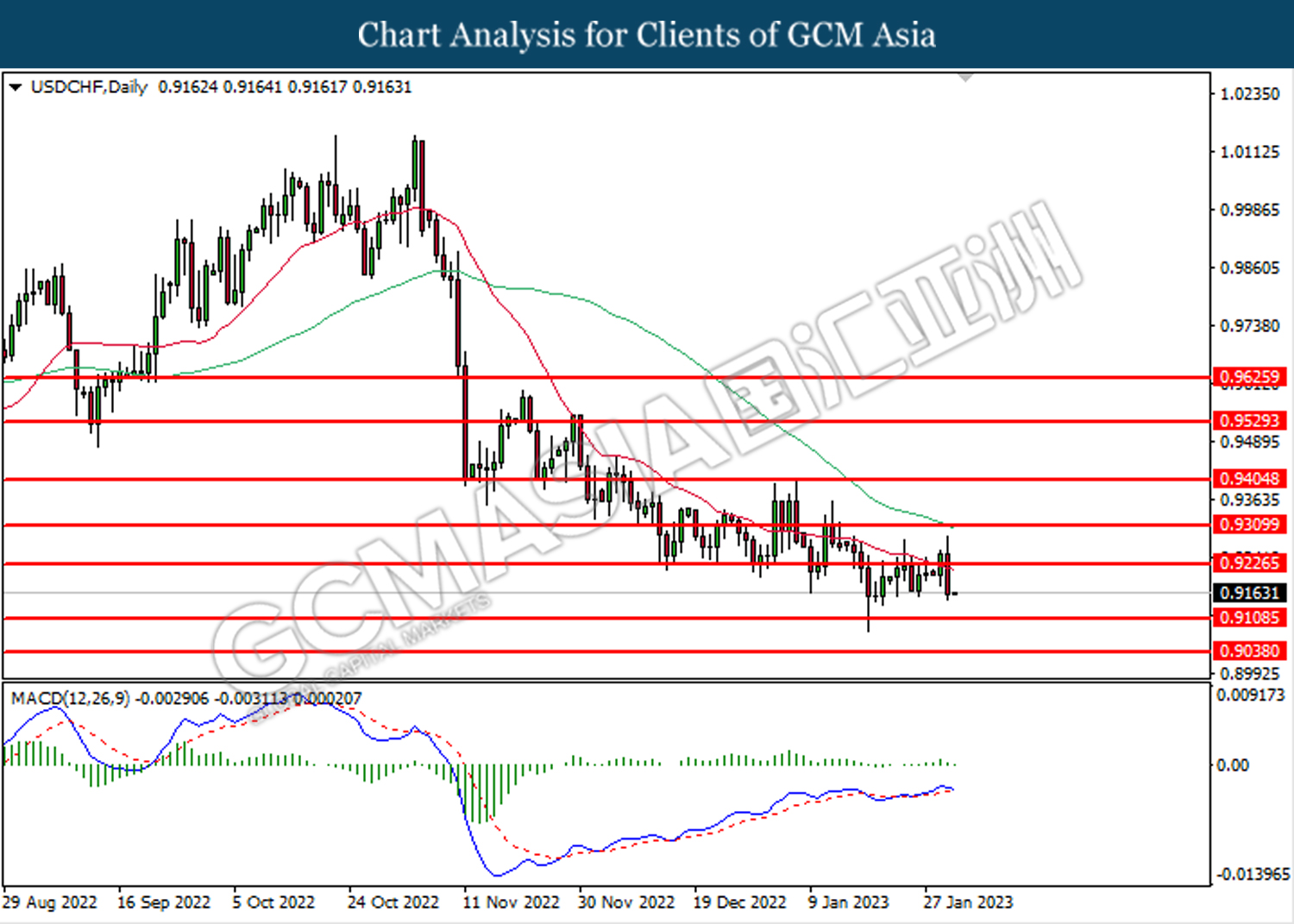

USDCHF, Daily: USDCHF was traded lower following prior retracement from the resistance level at 0.9225. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.9110.

Resistance level: 0.9225, 0.9310

Support level: 0.9110, 0.9040

CrudeOIL, Daily: Crude oil price was traded higher following prior rebound from the support level at 76.10. However, MACD which illustrated bearish bias momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 81.80, 86.15

Support level: 76.10, 71.50

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1900.00. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains toward the resistance level at 1944.60.

Resistance level: 1944.60, 1985.90

Support level: 1900.00, 1884.00