01 March 2022 Afternoon Session Analysis

Australia Dollar surged following RBA statement.

The Australian Dollar surged following the Reserve Bank of Australia unleashed their hawkish tone toward the economic progression in Australia region. According to monetary policy statement from the Governor Philip Lowe, he claimed that the Monetary Policy Committee (MPC) decided to maintain the cash rate target at 10 basis points and the interest rate at zero per cent. He also reiterated that the Australian economy remains resilient while consumer spending is picking up following the Covid-19 cases waned. Despite the inflation has picked up more quickly than the central bank expectation, but it still remains lower than in many other countries. Though, the war between Ukraine and Russia is a major new source of uncertainty, hence the Monetary Policy Committee (MPC) will still continue to monitor the situation in order to decide the implementation of monetary policy decision in future. As of writing, AUD/USD appreciated by 0.05% to 0.7255.

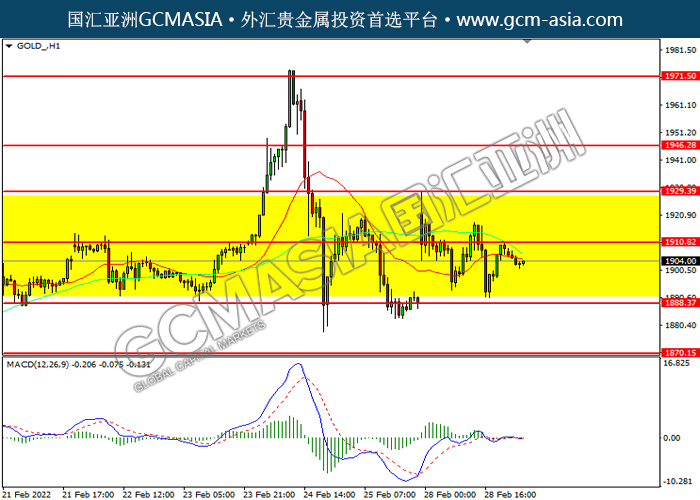

In the commodities market, the crude oil price surged 0.68% to $97.85 per barrel as of writing. The oil market edged higher amid rising tensions between Russia-Ukraine had continue to insinuate concerns upon the supply disruption in future. On the other hand, the gold price depreciated by 0.25% to $1904.35 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Feb) | 58.5 | 58.5 | – |

| 17:30 | GBP – Manufacturing PMI (Feb) | 57.3 | 57.3 | – |

| 21:30 | CAD – GDP (MoM) (Dec) | 0.60% | 0.10% | – |

| 23:00 | USD – ISM Manufacturing PMI (Feb) | 57.6 | 58 | – |

Technical Analysis

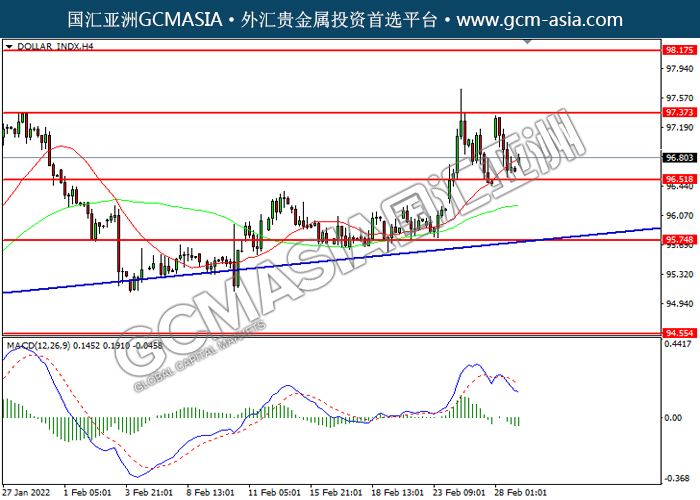

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level at 96.50. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after it successfully breakout below the support level.

Resistance level: 97.35, 98.20

Support level: 96.50, 95.75

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.3440. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3440, 1.3500

Support level: 1.3355, 1.3275

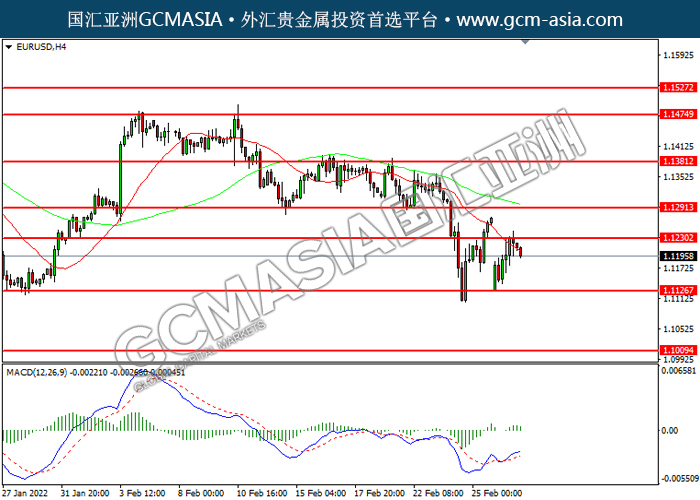

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.1230. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level at 1.1125.

Resistance level: 1.1230, 1.1290

Support level: 1.1125, 1.1010

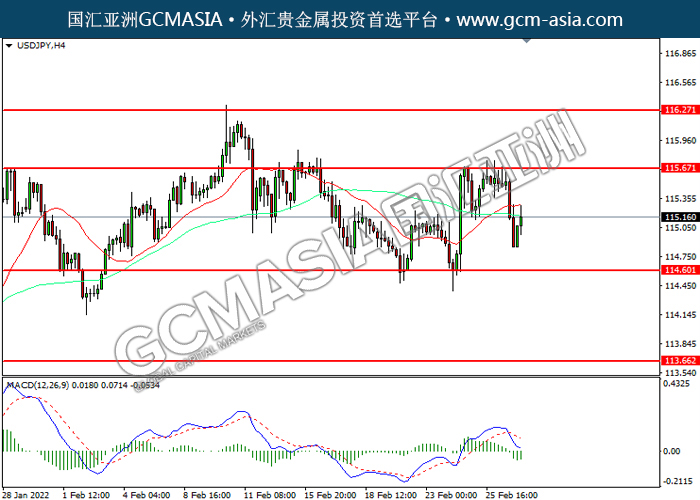

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level at 115.65. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher in short-term as technical correction.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

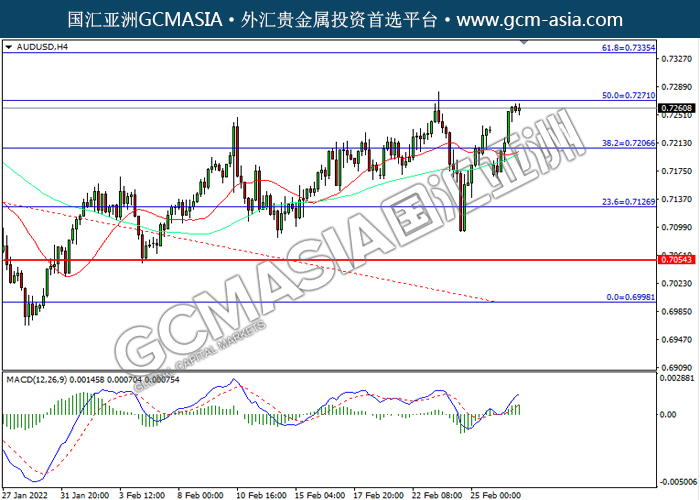

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7270. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.7270, 0.7335

Support level: 0.7205, 0.7125

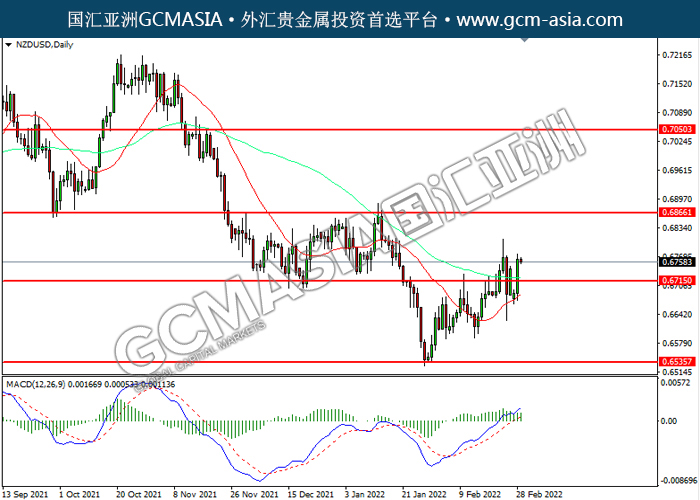

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6715. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6865.

Resistance level: 0.6865, 0.7050

Support level: 0.6715, 0.6535

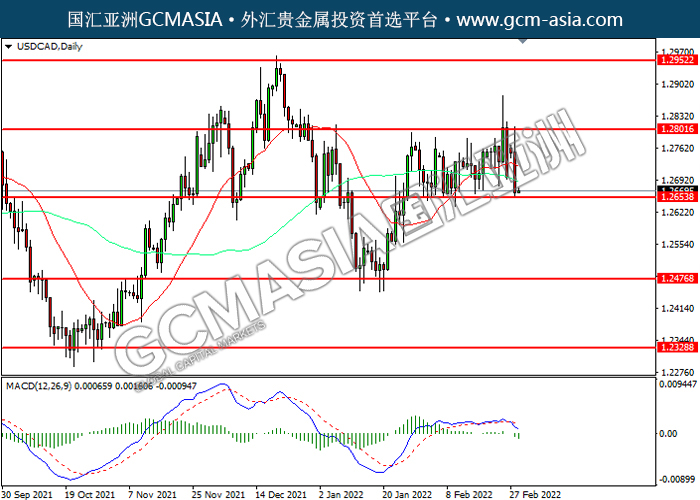

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2655. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2800, 1.2950

Support level: 1.2655, 1.2475

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9175. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level at 96.50. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 96.50, 98.05

Support level: 94.75, 93.05

GOLD_, H1: Gold price was traded lower following prior retracement from the resistance level at 1910.80. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level at 1888.35.

Resistance level: 1910.80, 1929.40

Support level: 1888.35, 1870.15