01 March 2023 Morning Session Analysis

Risk-on sentiment weighed on Greenback.

The dollar index, which is traded against a basket of six major currencies, extended its losses in the previous trading session as the market risk appetite revived after UK and EU sealed the Northern Ireland protocol deal. Earlier of the week, both parties finally struck a decisive breakthrough on a post-Brexit deal to avoid a hard border on the island of Ireland. With such a backdrop, the surge in market risk appetite has infused some strength into the riskier currencies such as Pound and Euro. On top of that, the dollar index dragged down further following the announcement of the CB Consumer Confidence Index. According to the Conference Board, the US Consumer Confidence data declined from the prior month’s reading of 106 to 102.9 in February, missing the consensus forecast at 108.5. However, the losses of the dollar index were limited as the recent strong economic data boosted the market expectation that the Federal Reserve will bring a bigger rate hike plan onto the table in the upcoming meeting. According to the CME FedWatch Tool, the likelihood of a 50 basis point rate hike in the upcoming meeting lies at 26.2%, which increased from the previous week’s reading at 24.0%, while there is a 73.8% of possibility that the Fed will carry out a 25-basis point of a rate hike. As of writing, the dollar index surged 0.26% to 104.95.

In the commodities market, crude oil prices were up by 1.55% to $76.75 per barrel as investors expected a strong economic rebound in China. Besides, gold prices edged up by 0.58% to $1827.90 per troy ounce as the US dollar lost its ground during the early Asian trading session.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 GBP BoE Gov Bailey Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Feb) | 46.5 | 46.5 | – |

| 16:55 | EUR – German Unemployment Change | -15K | 9K | – |

| 17:30 | GBP – Manufacturing PMI (Feb) | 49.2 | 49.2 | – |

| 21:00 | EUR – German CPI (YoY) (Feb) | 8.7% | 8.7% | – |

| 23:00 | USD – ISM Manufacturing PMI (Feb) | 47.4 | 48.0 | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 7.648M | 0.440M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 105.00. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.15.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

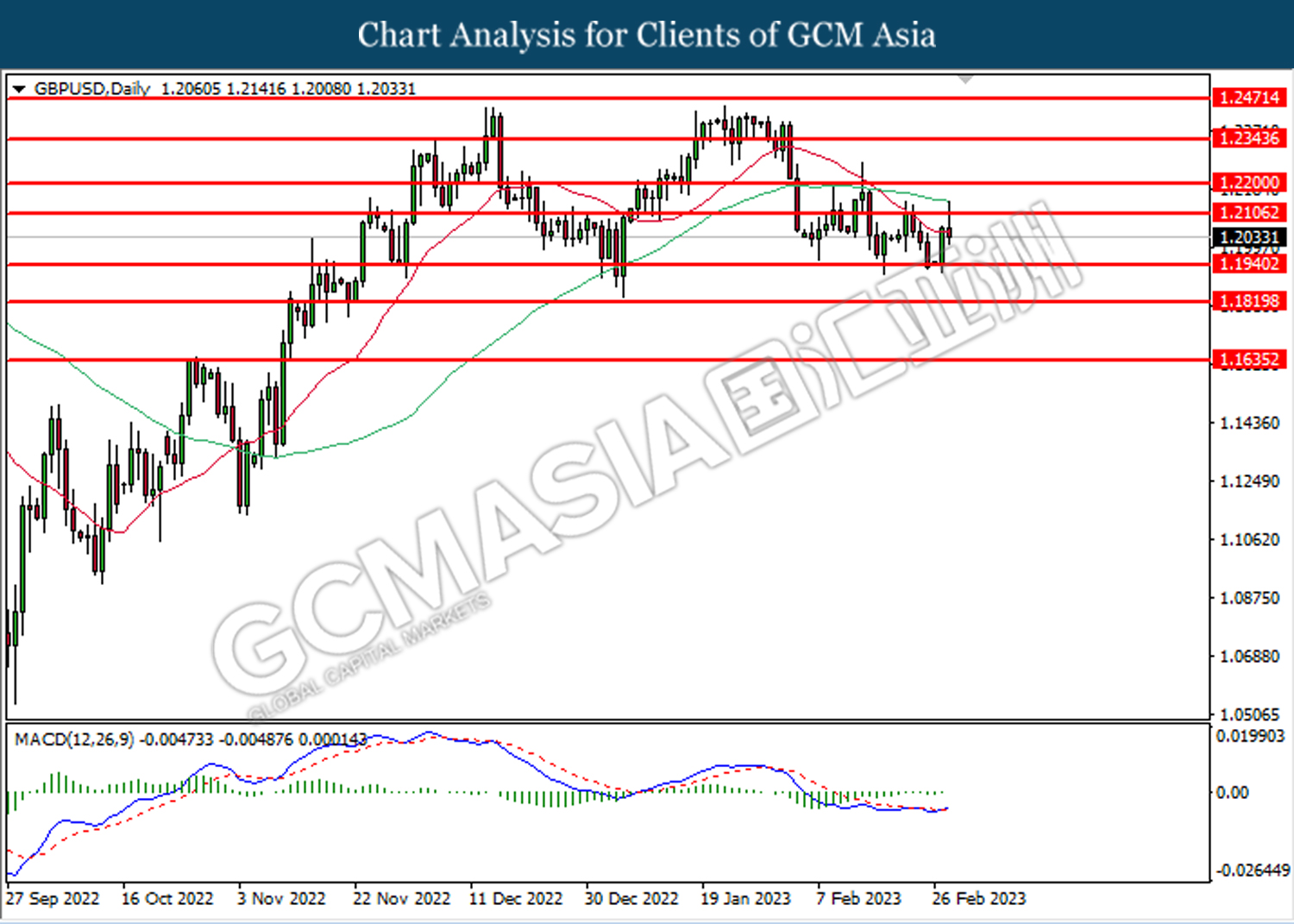

GBPUSD, Daily: GBPUSD was traded higher following the prior rebound from the support level at 1.1940. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.2105.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

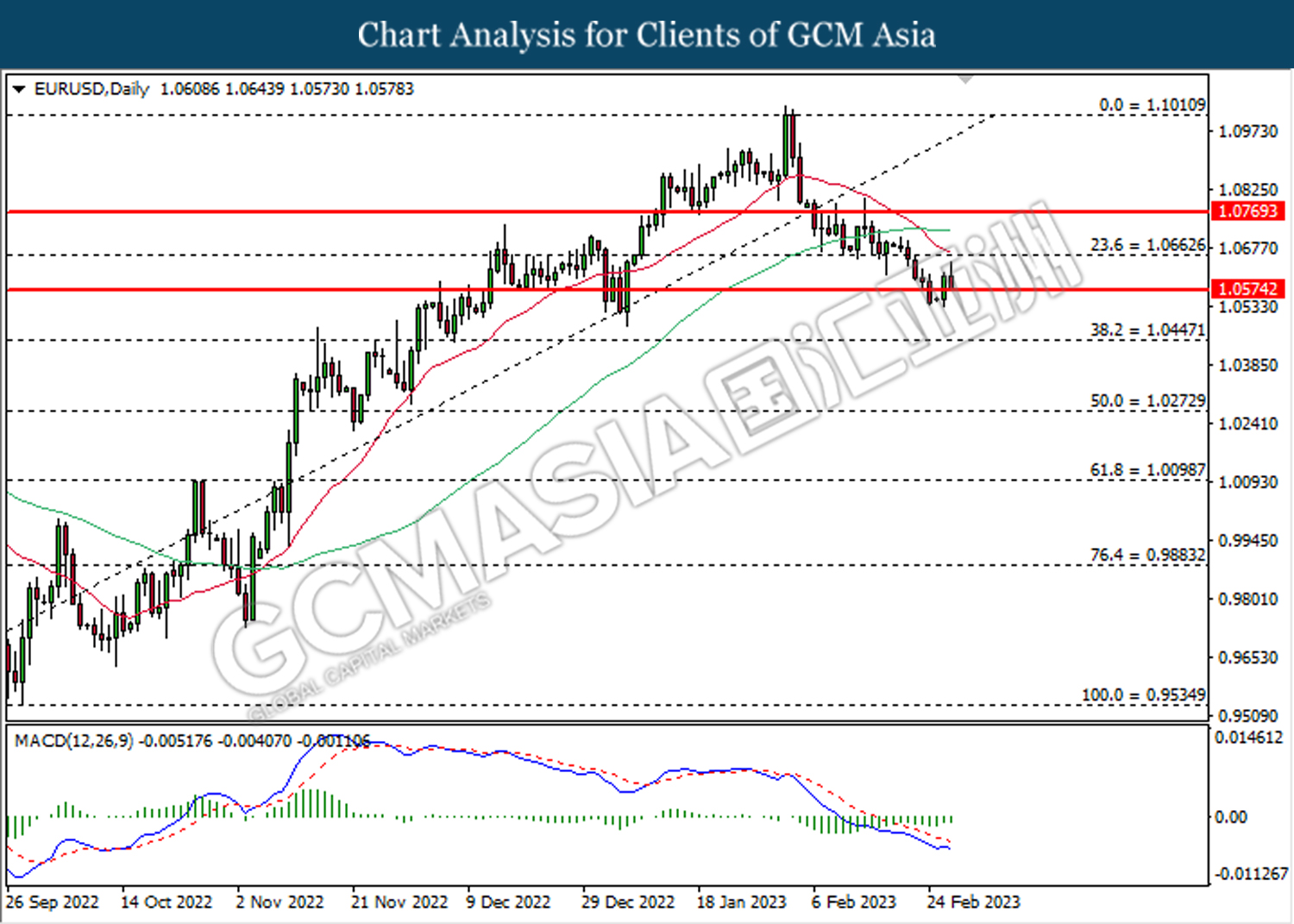

EURUSD, Daily: EURUSD was traded lower while currently retesting the support level at 1.0575. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.0665, 1.0770

Support level: 1.0445, 1.0275

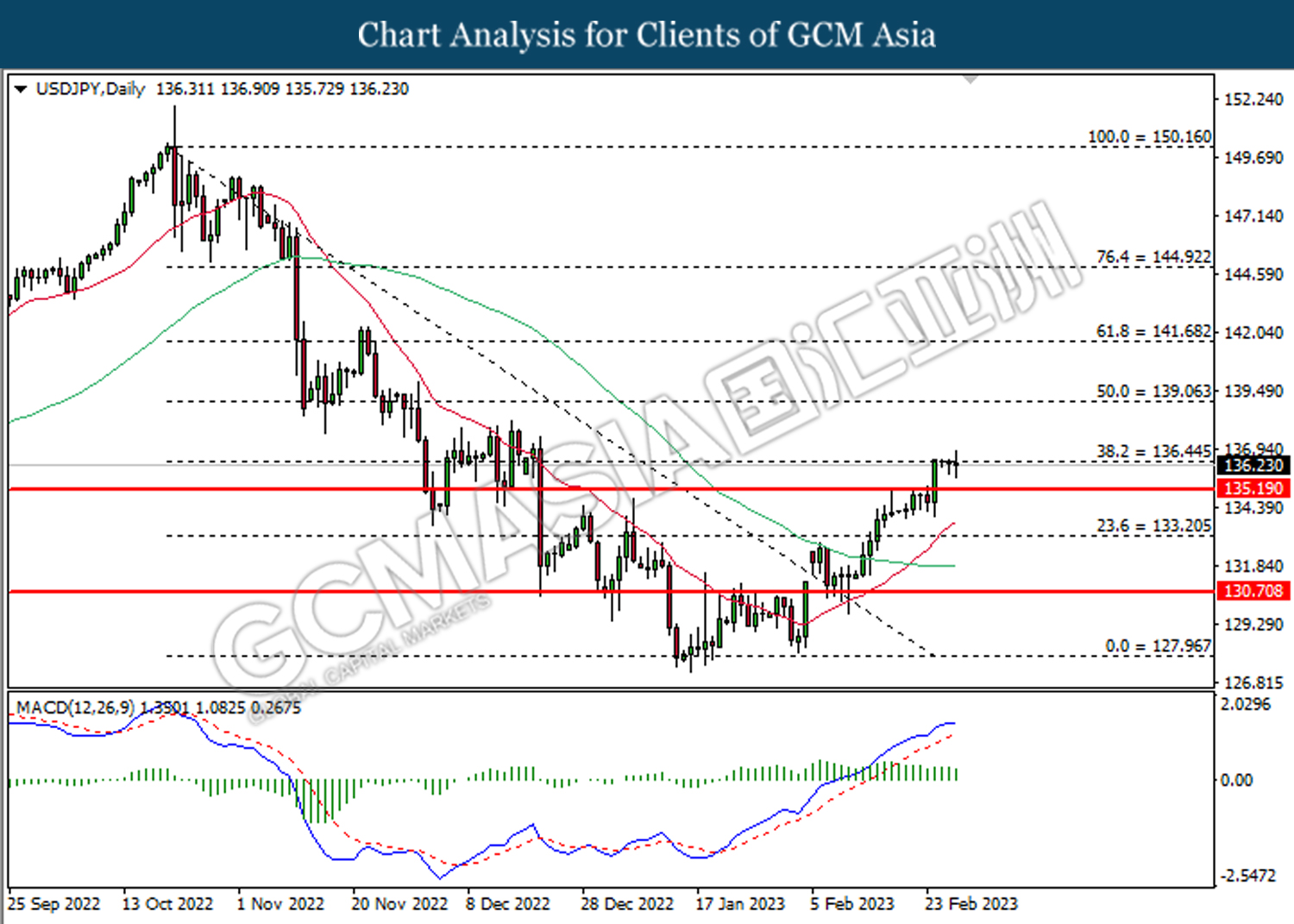

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 139.05

Support level: 135.20, 133.20

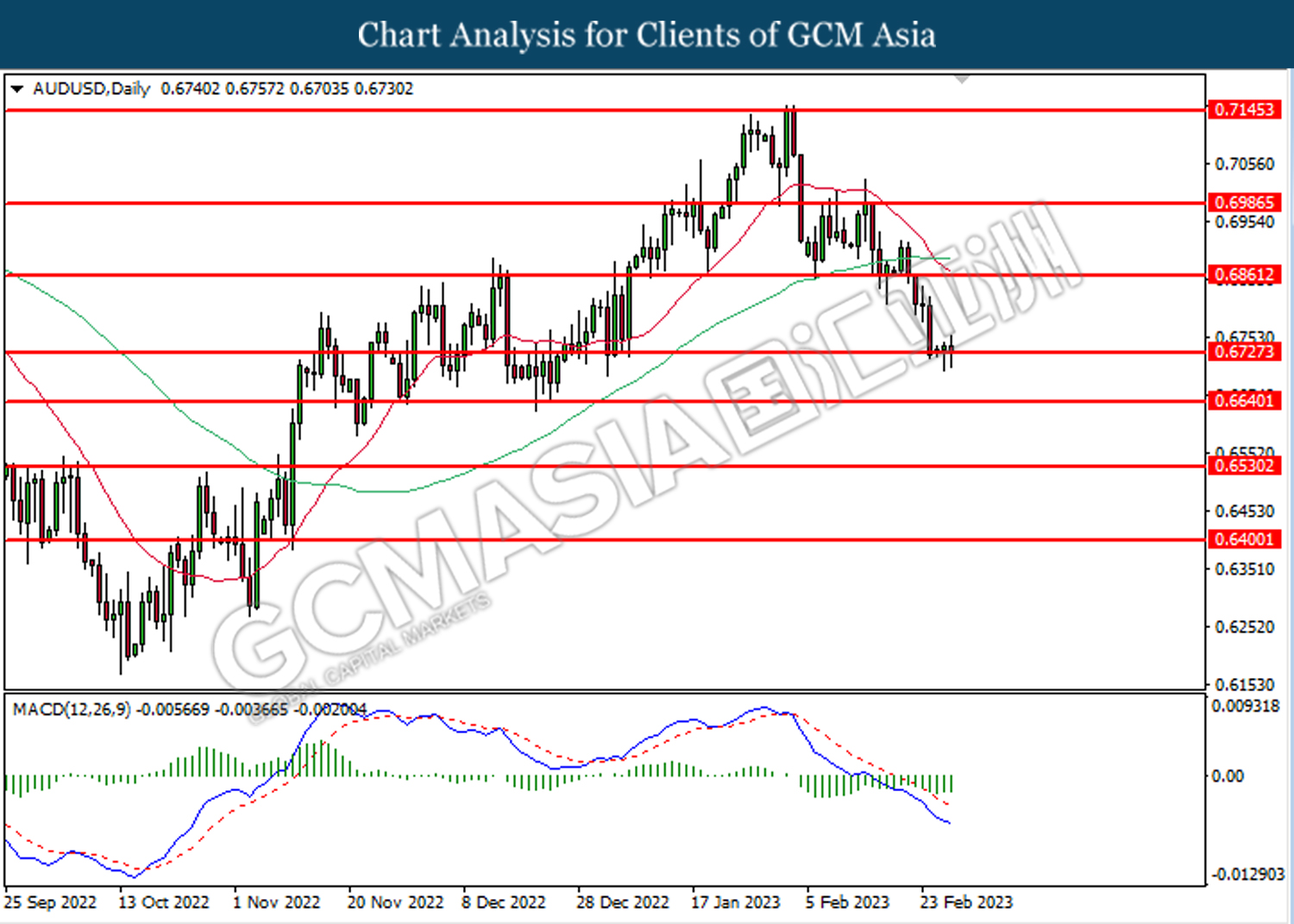

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

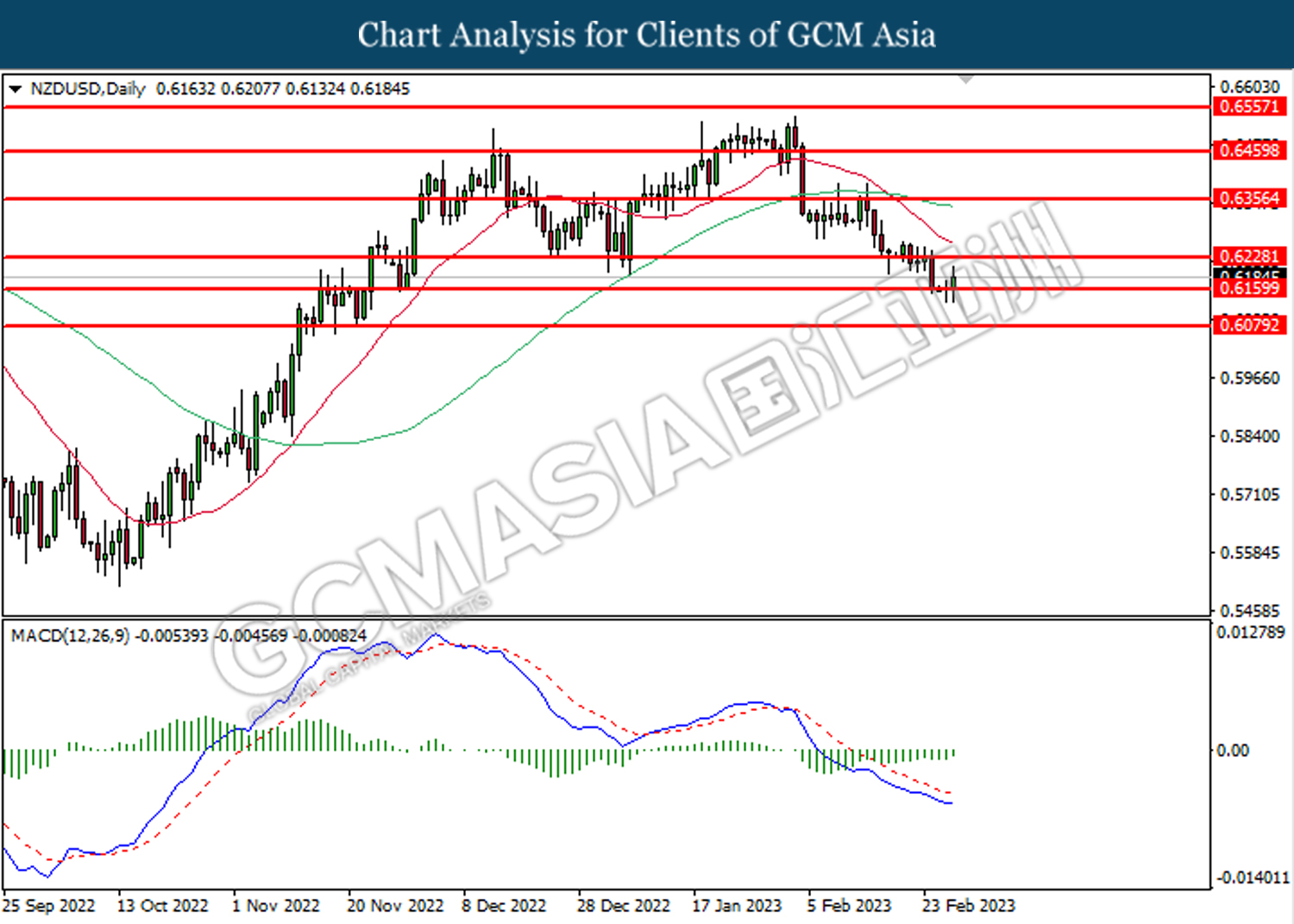

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6160. MACD which illustrated bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6230, 0.6355

Support level: 0.6160, 0.6080

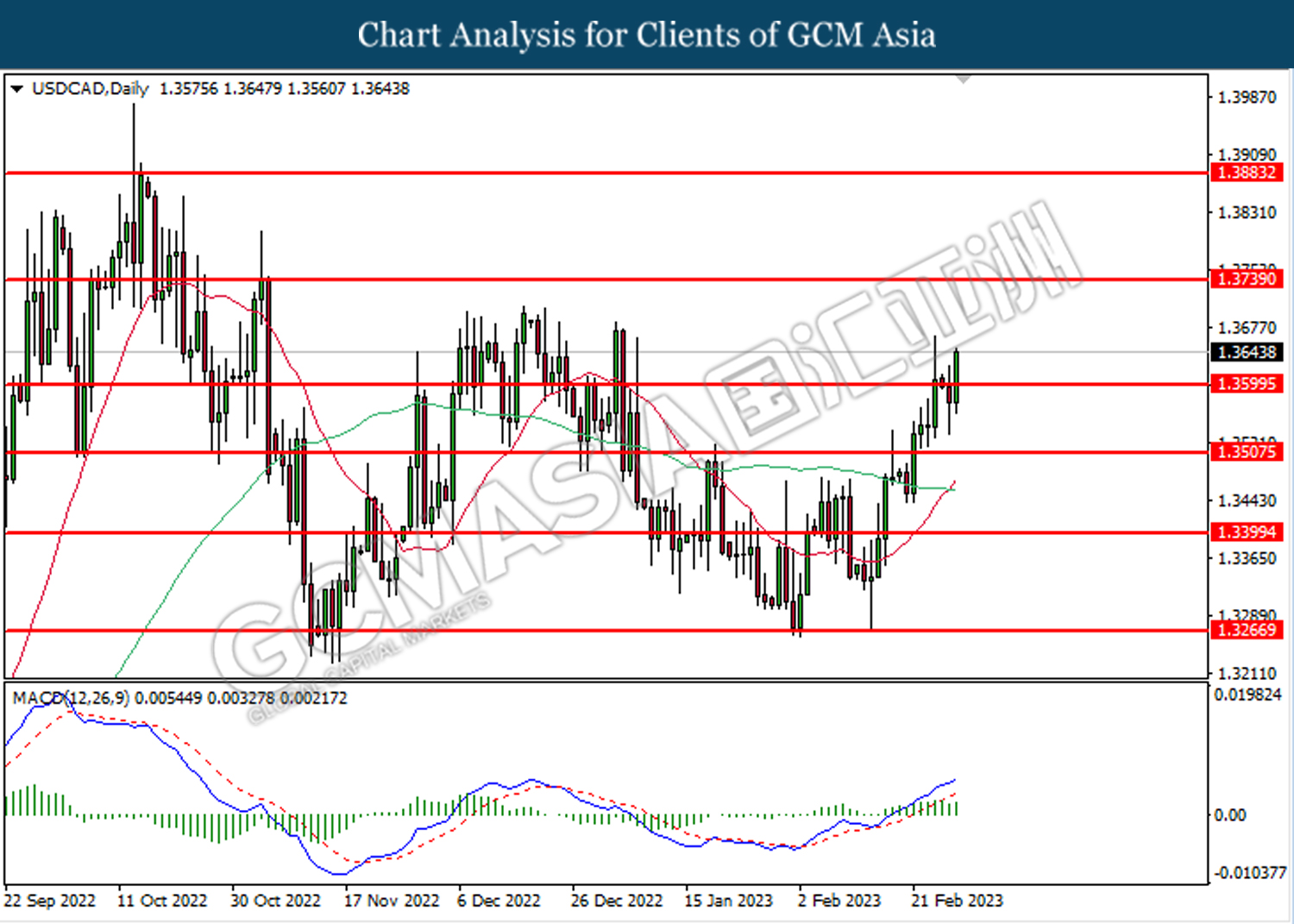

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3600. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3600, 1.3740

Support level: 1.3505, 1.3400

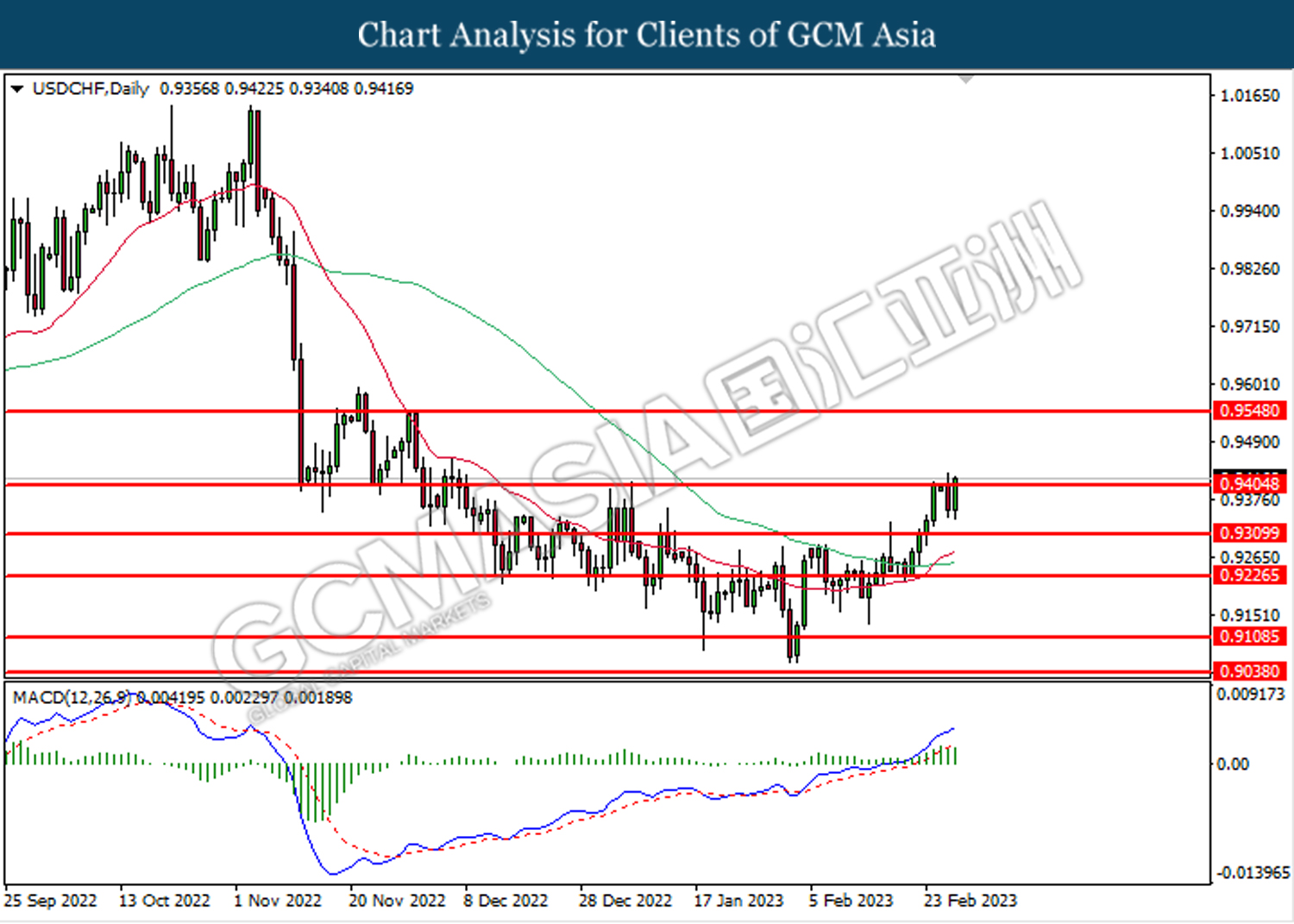

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9405. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9405, 0.9550

Support level: 0.9310, 0.9225

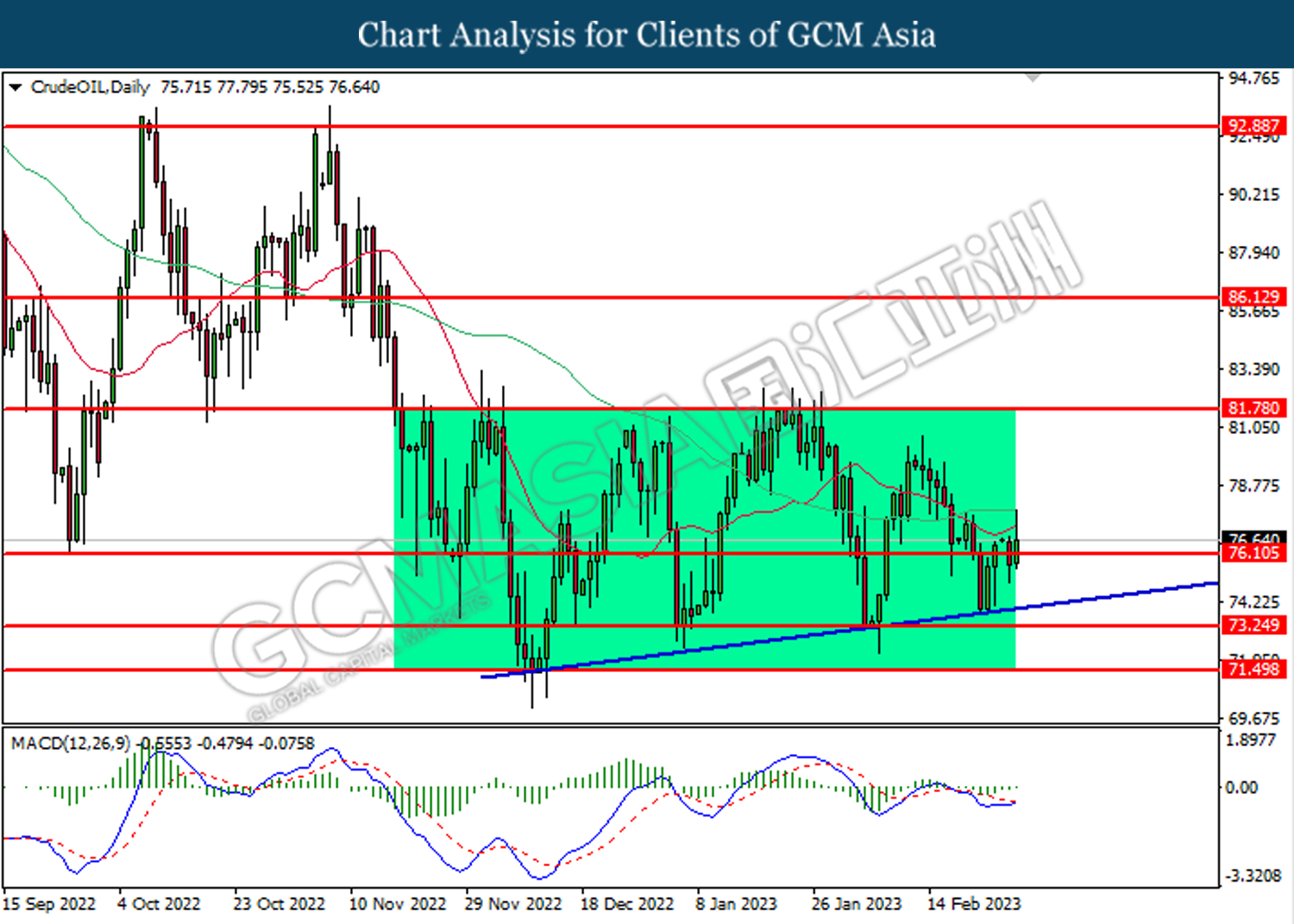

CrudeOIL, Daily: Crude oil price was traded higher while currently retesting the resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 76.10, 81.80

Support level: 73.25, 71.50

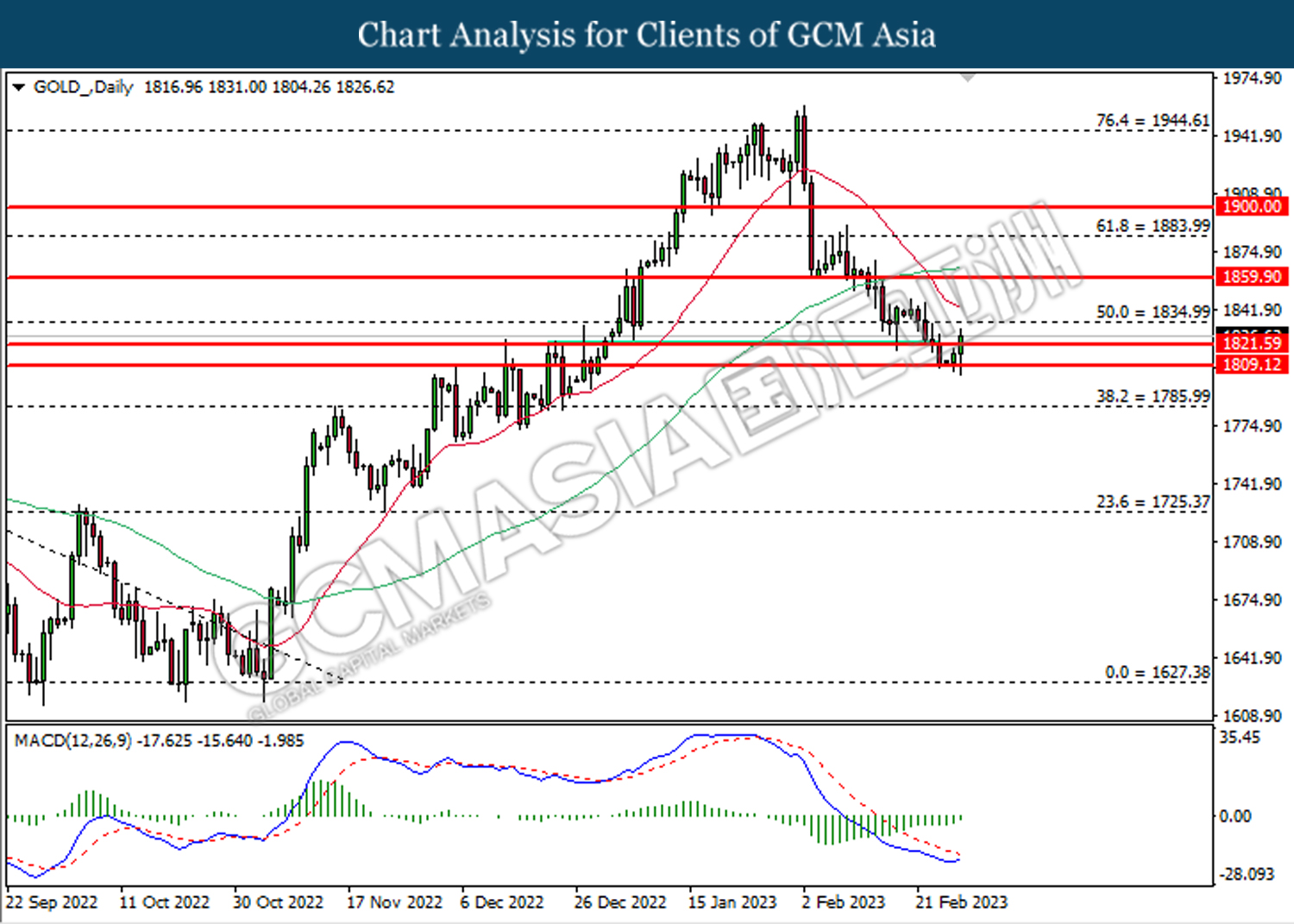

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1821.60. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level at 1821.60.

Resistance level: 1821.60, 1835.00

Support level: 1809.10, 1786.00