1 April 2022 Afternoon Session Analysis

Australia Dollar slump following passive economic data.

AUDUSD edged down since Thursday amid the backdrop of passive economic data of China. According to China Logistics Information Center, China Manufacturing Purchasing Managers Index (PMI) notched down from the previous reading of 50.2 to 49.5, lower than the market forecast of 49.9. China Manufacturing Purchasing Managers Index (PMI) provides an early indication each month of economic activities in the Chinese manufacturing sector. The data presented is compiled from the enterprises responses about their purchasing activities and supply situations. Hence, the upbeat index data would indicate a better economic prospect. Nonetheless, the index data did not meet market expectations, which dialed down the market optimism toward economic progression in China. As China is the largest trading partner for Australia, negative economic prospect in China would likely to drag down Australia economic momentum, prompting investors to selloff Australia Dollar as the market optimism toward Australia Dollar has been dialed down. Besides, Shanghai is set to put the vast majority of its residents under COVID lockdown from Friday, as it expands curbs to include the western half of the city and extends restrictions in the east, according to Reuters, spurring further bearish momentum on the pair. As of writing, AUDUSD depreciated by 0.04% to 0.7477.

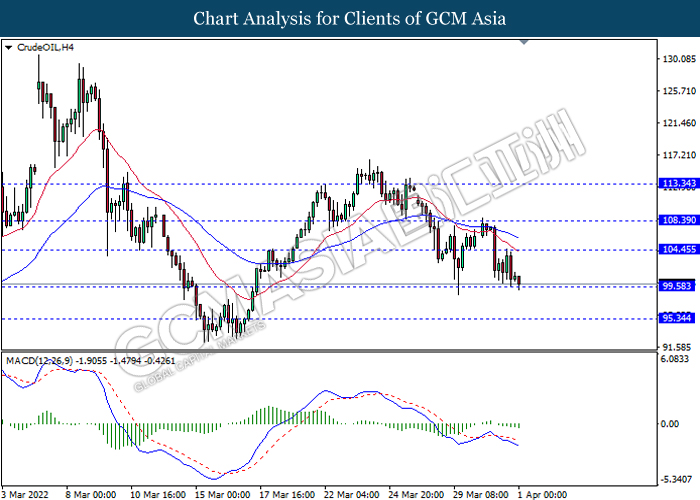

In commodities market, crude oil price extend its losses by 0.40% to $99.88 per barrel as of writing following additional oil supply from President Biden. On the other hand, gold price depreciated by 0.75% to 1934.60 per troy ounces as of writing amid the strengthen of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Mar) | 58.4 | 57.6 | – |

| 16:30 | GBP – Manufacturing PMI (Mar) | 55.5 | 55.5 | – |

| 17:00 | EUR – CPI (YoY) (Mar) | 5.90% | 6.50% | – |

| 20:30 | USD – Nonfarm Payrolls (Mar) | 678K | 475K | – |

| 20:30 | USD – Unemployment Rate (Mar) | 3.80% | 3.70% | – |

Technical Analysis

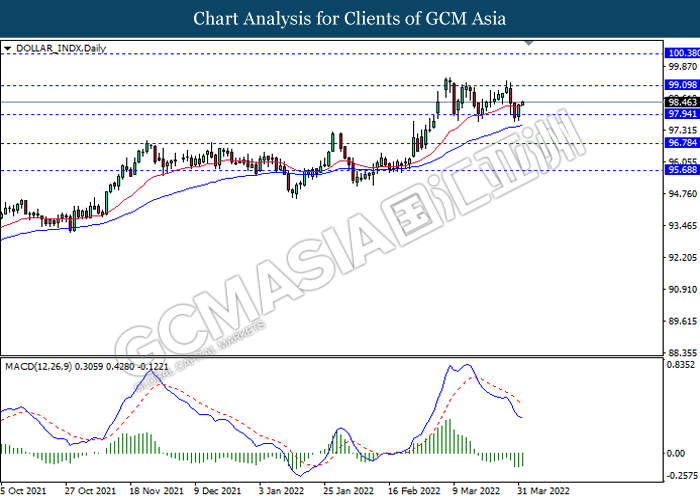

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 99.10, 100.40

Support level: 97.95, 96.80

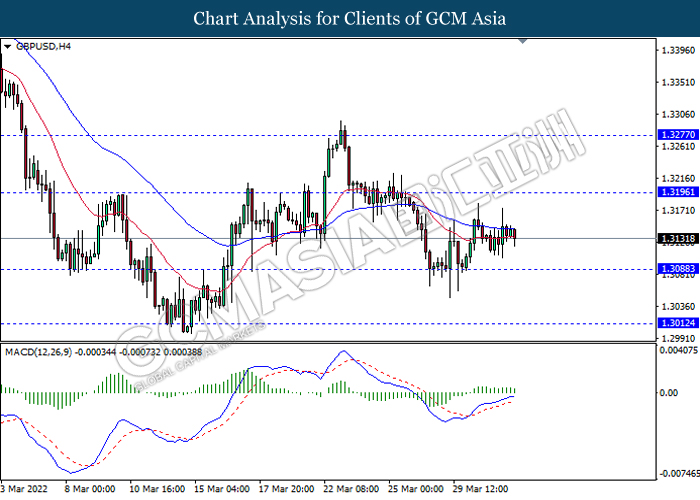

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3195, 1.3275

Support level: 1.3090, 1.3010

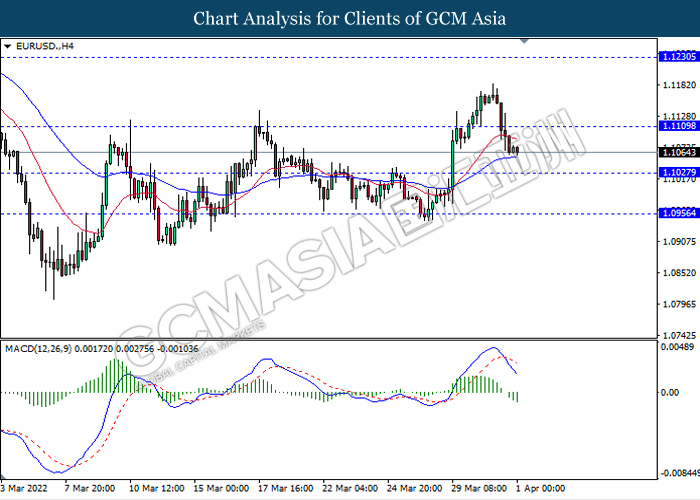

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1110, 1.1230

Support level: 1.1025, 1.0955

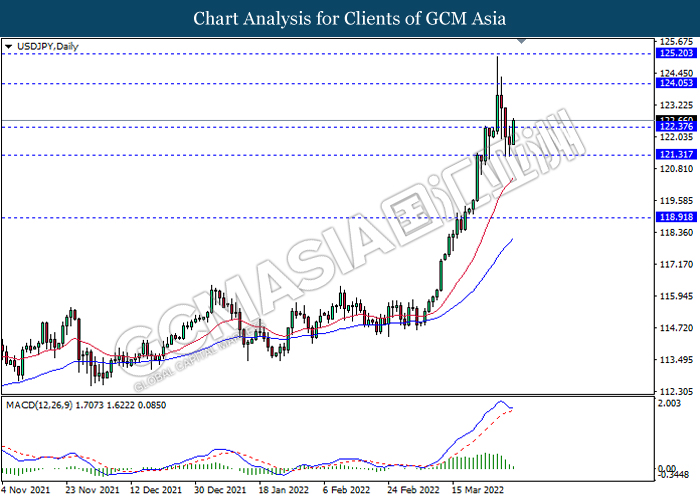

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 124.05, 125.20

Support level: 122.35, 121.30

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7485, 0.7545

Support level: 0.7420, 0.7365

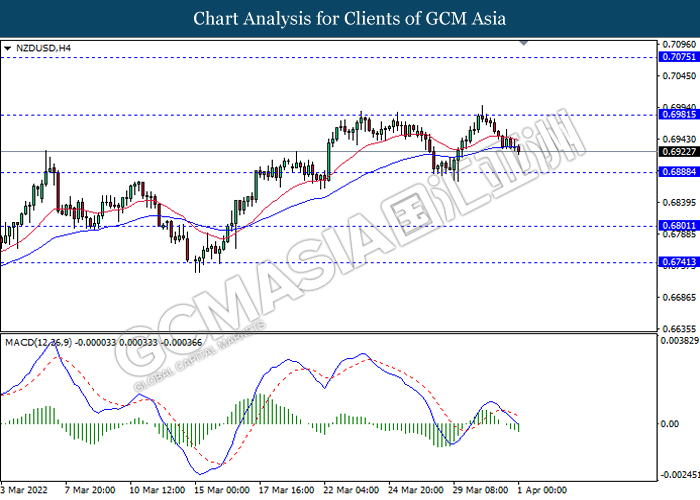

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6980, 0.7075

Support level: 0.6890, 0.6800

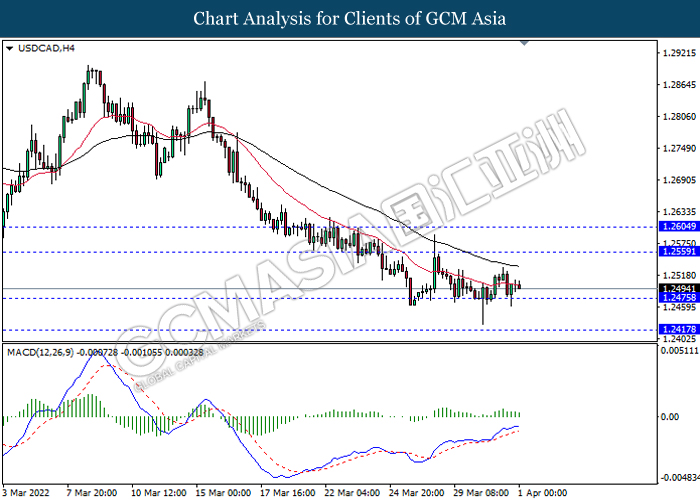

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2560, 1.2605

Support level: 1.2475, 1.2415

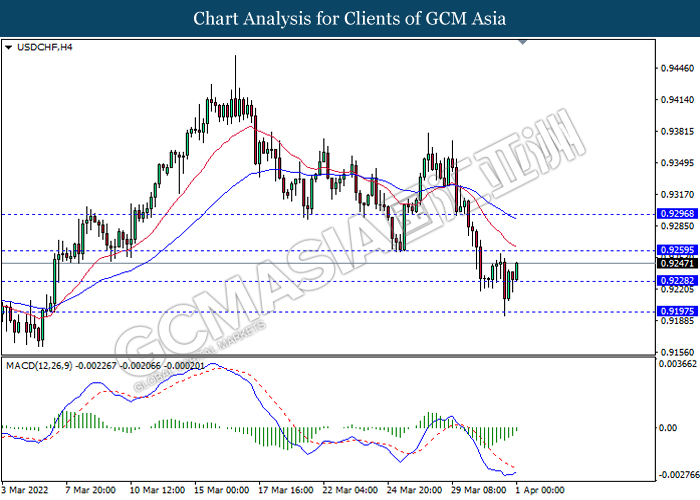

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9260, 0.9295

Support level: 0.9230, 0.9195

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 104.45, 108.40

Support level: 99.60, 95.35

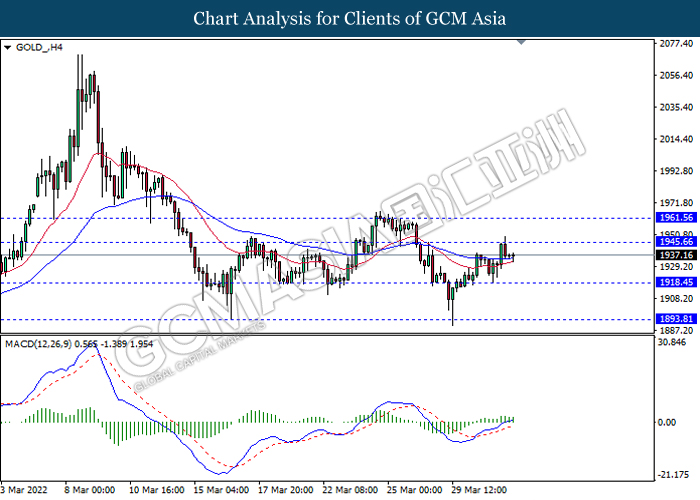

GOLD_, H4: Gold price was traded lower following prior retracement from resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1945.65, 1961.55

Support level: 1918.45, 1893.81