1 April 2022 Morning Session Analysis

Safe-haven Dollar surged following the re-escalating tensions on Russia-Ukraine.

The Dollar Index which traded against a basket of six major currencies extend its rebounded following the re-escalating tensions between the Russia-Ukraine issues toward the global economic, which stoked a shift in sentiment toward safe-haven asset such as US Dollar. According to Reuters, Russian President Vladimir Putin yesterday forced to foreign buyers to pay in roubles for Russian gas beginning on Friday as he tries to tit-for-tat against the Western sanctions earlier. Since the European Union gets more than 30% of its oil usage from Moscow and 40% for national gas from Russia, the reiteration move from Russia would likely to trigger further tensions for the countries while leading to spill over effect toward the global economy. Nonetheless, a senior Ukrainian official claimed that the peace negotiations between Moscow and Kyiv will resume on Friday. Investors would remain their focus toward the talks to receive further trading signal. As of writing, the Dollar Index appreciated by 0.57% to 98.35.

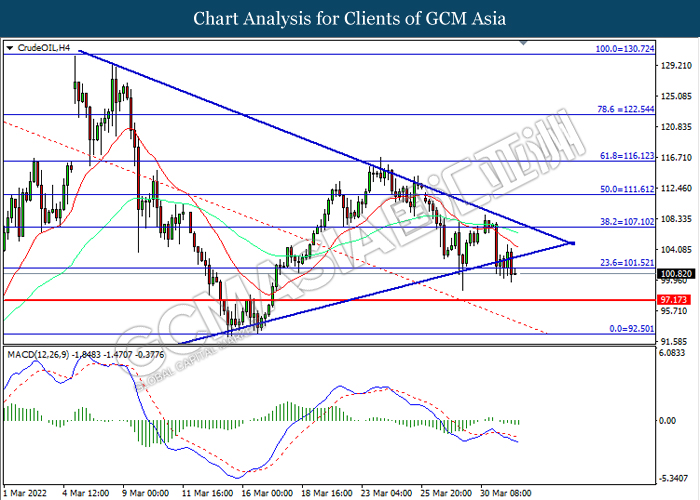

In the commodities market, the oil price slumped significantly following US President Joe Biden announced the largest ever release from the US Strategic Petroleum Reserve to boost up the oil supply while stabilize the inflation risk in future. On the other hand, the gold market depreciated by 0.07% to $1936.10 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Mar) | 58.4 | 57.6 | – |

| 16:30 | GBP – Manufacturing PMI (Mar) | 55.5 | 55.5 | – |

| 17:00 | EUR – CPI (YoY) (Mar) | 5.90% | 6.50% | – |

| 20:30 | USD – Nonfarm Payrolls (Mar) | 678K | 475K | – |

| 20:30 | USD – Unemployment Rate (Mar) | 3.80% | 3.70% | – |

Technical Analysis

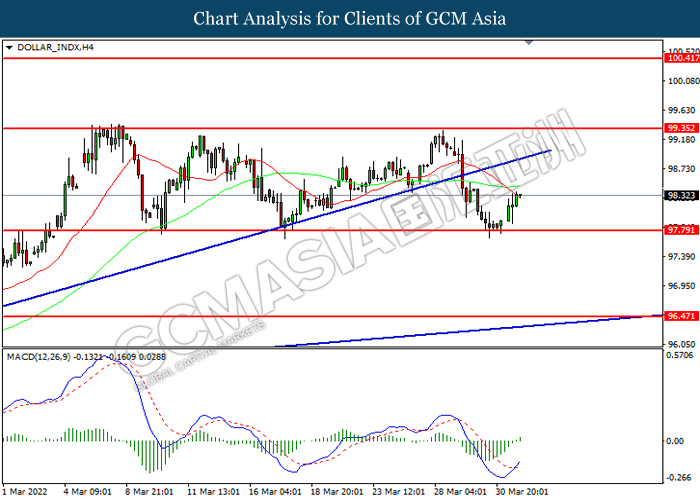

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 99.35, 100.40

Support level: 97.80, 96.45

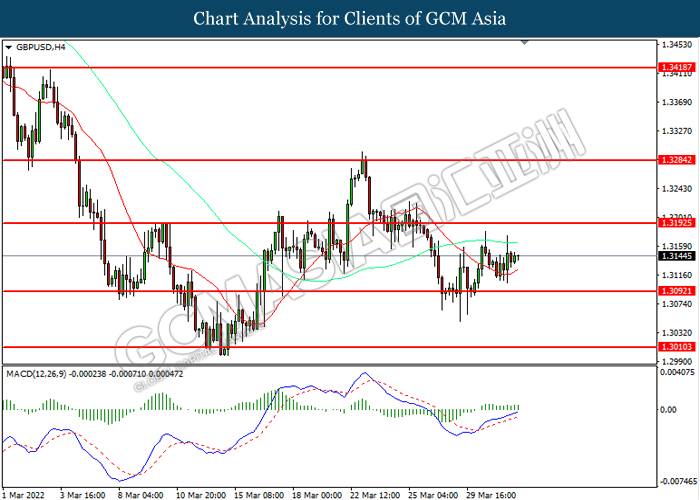

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3010

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.1135, 1.1245

Support level: 1.0980, 1.0895

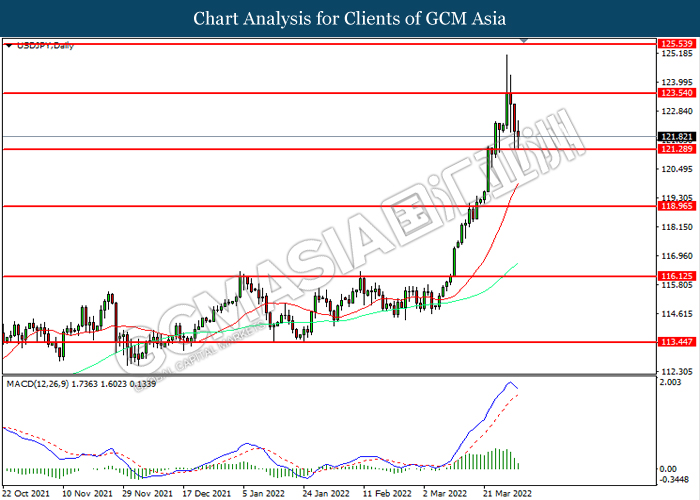

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 123.55, 125.55

Support level: 121.30, 118.95

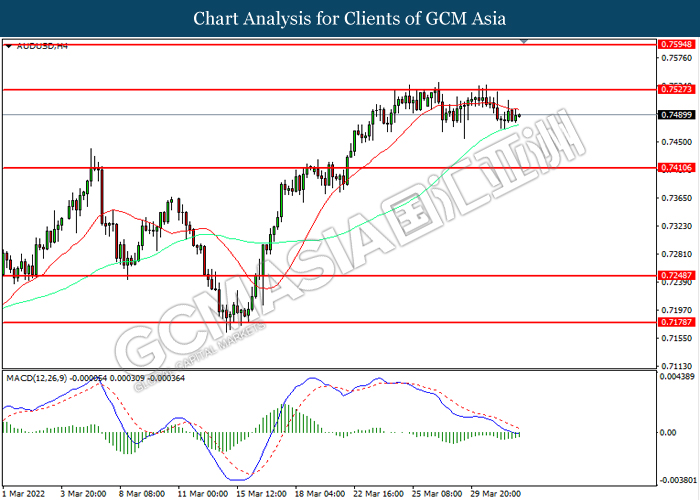

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.7525, 0.7595

Support level: 0.7410, 0.7250

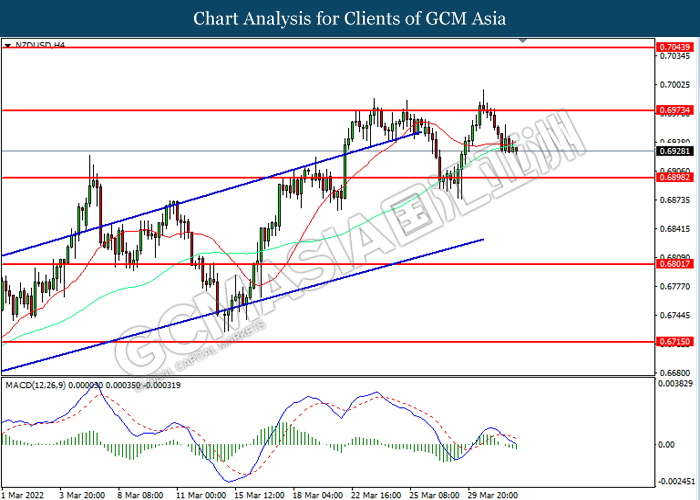

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6975, 0.7045

Support level: 0.6890, 0.6800

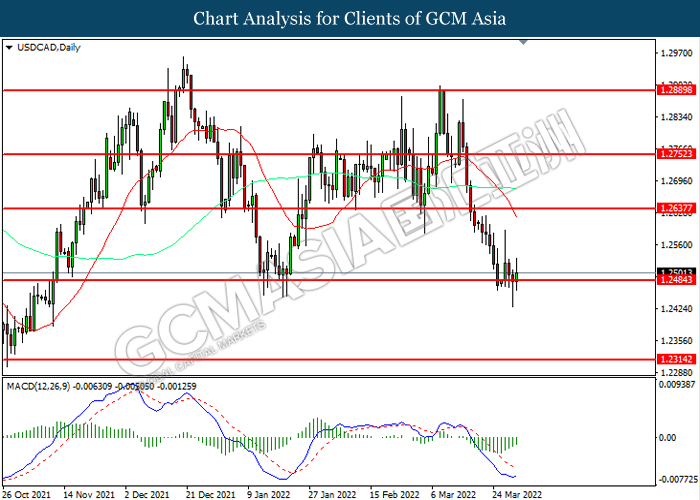

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

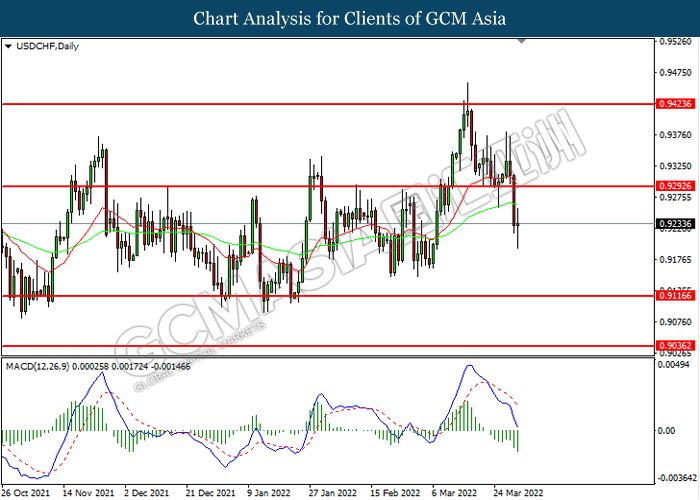

USDCHF, Daily: USDCHF was traded lower following prior breakout below the previous support level at 0.9295. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.9295, 0.9425

Support level: 0.9115, 0.9035

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 101.50, 107.10

Support level: 97.15, 92.50

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35