1 June 2022 Morning Session Analysis

US Dollar rallied following the hawkish speech from Joe Biden.

The Dollar Index which traded against a basket of six major currencies surged on Tuesday amid the rising Treasury yield as well as the worries over a further acceleration in global inflation continued to weigh down investors’ risk appetite in the global financial market. The US Treasury Yield received bullish momentum following the US President Joe Biden unleashed hawkish tone toward the monetary policy decision. According to Reuters, President Joe Biden told Fed Chair Jerome Powell on Tuesday that he will give sufficient space and independence for the Federal Reserve to stabilize the inflation rate by aggressive contractionary monetary policy. Besides, the US Dollar extend its gains over the backdrop of upbeat economic data. According to Conference Board, US Conference Board (CB) Consumer Confidence came in at 106.4, exceeding the market forecast at 103.9. The CB Consumer Confidence was used to indicate the confidence level of consumers in economy activities. The higher-than-expected reading indicated that the consumers in US are more willing to spend, dialed up the market optimism toward the economic progression in US. As of writing, the Dollar Index appreciated by 0.49% to 101.80.

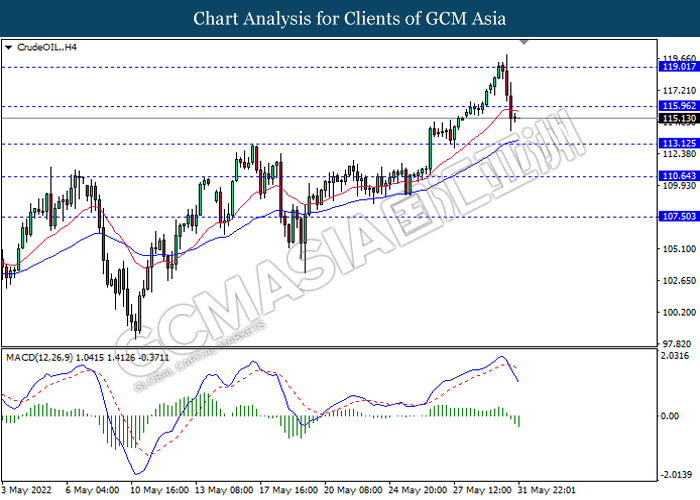

In the commodities market, crude oil price rose by 0.46% to $115.22 per barrel as of writing ahead of EU agreed to ban Russian crude oil imports. On the other hand, gold price edged down by 0.48% to $1839.60 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (May) | 54.7 | 54.7 | – |

| 16:30 | GBP – Manufacturing PMI (May) | 54.6 | 54.6 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (May) | 247K | 300K | – |

| 22:00 | USD – ISM Manufacturing PMI (May) | 55.4 | 54.5 | – |

| 22:00 | USD – JOLTs Job Openings (Apr) | 11.549M | 11.400M | – |

| 22:00 | CAD – BoC Interest Rate Decision | 1.00% | 1.50% | – |

Technical Analysis

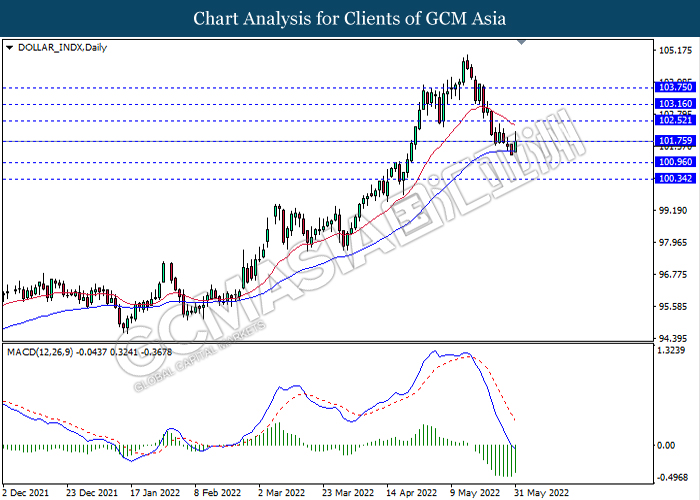

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 101.75, 102.50

Support level: 100.95, 100.35

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

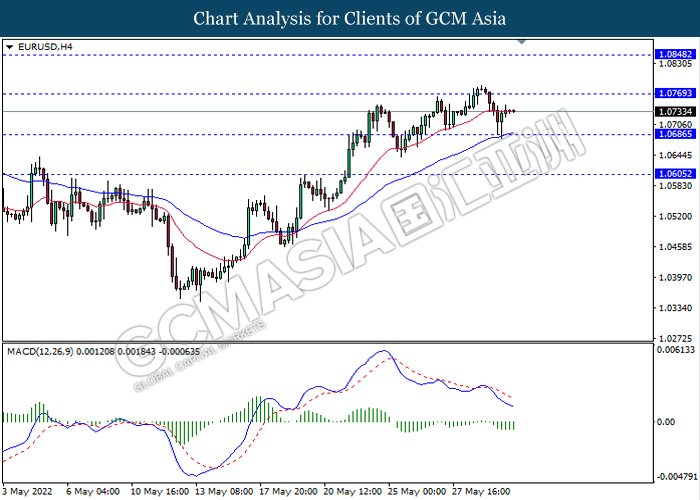

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

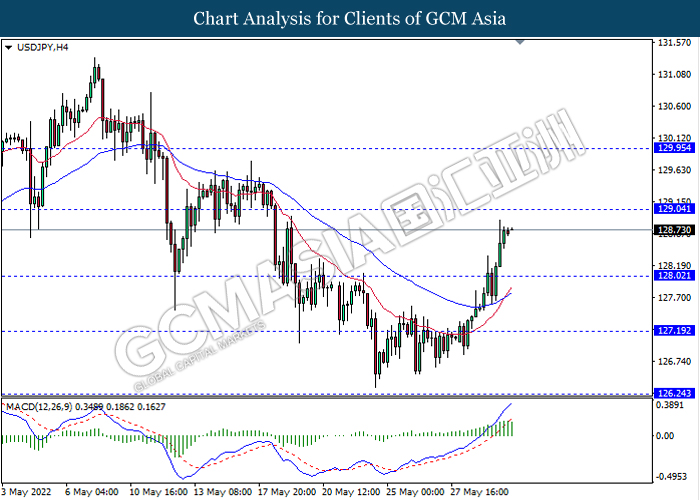

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 129.05, 129.95

Support level: 128.00, 127.20

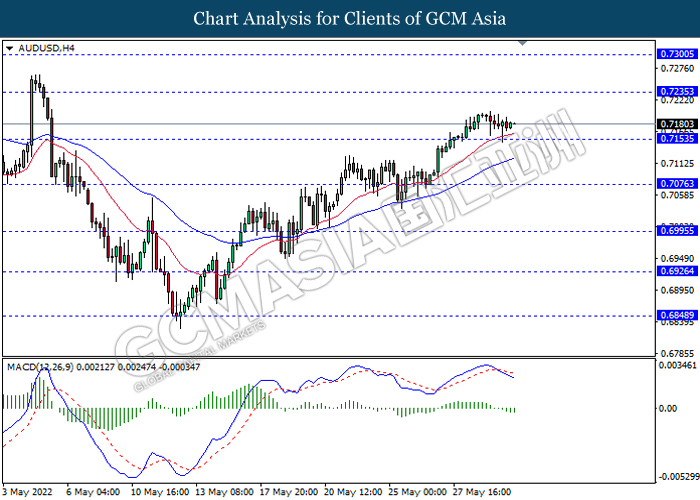

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7235, 0.7300

Support level: 0.7155, 0.7075

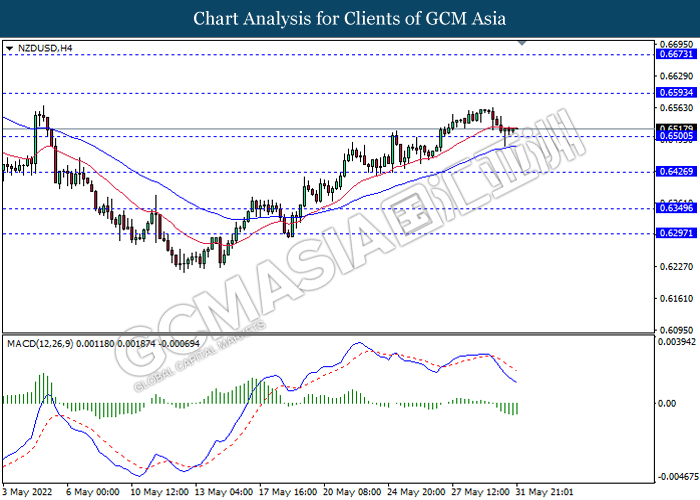

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6595, 0.6675

Support level: 0.6500, 0.6425

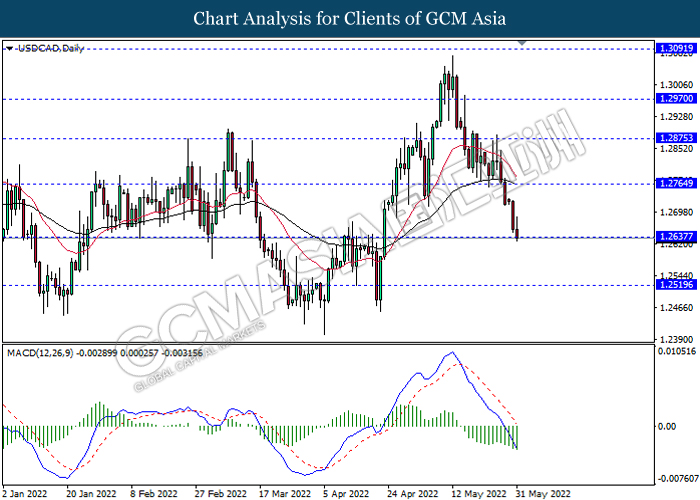

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2520

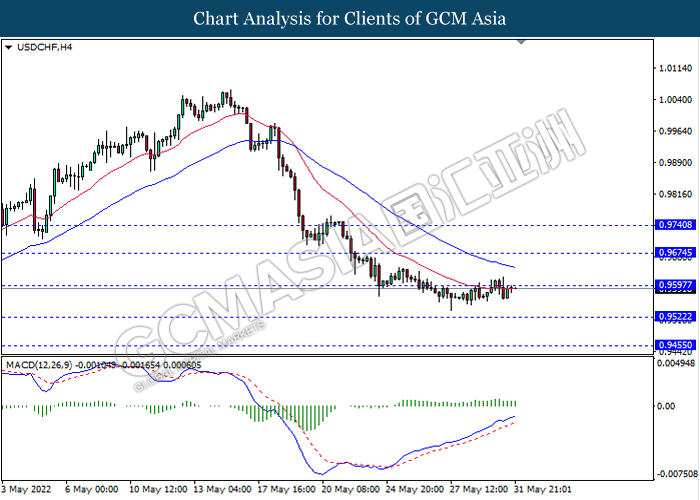

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 115.95, 119.00

Support level: 113.10, 110.65

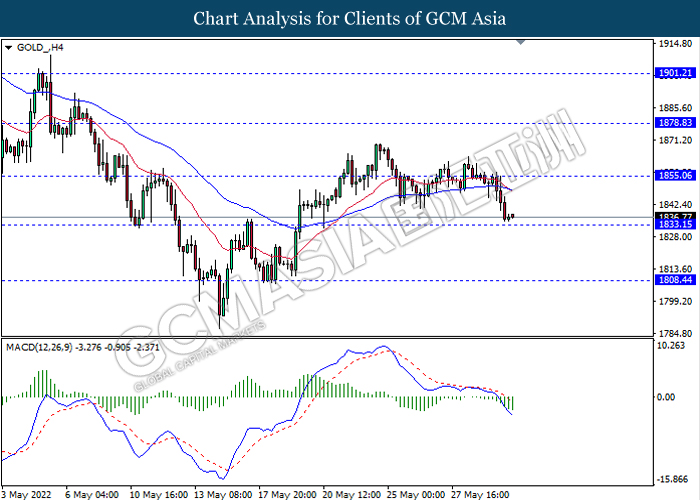

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1855.05, 1878.85

Support level: 1833.15, 1808.45