1 August 2022 Morning Session Analysis

Dollar seesawed despite an upbeat inflation figure.

The dollar index, which traded against a basket of six major currencies dived after a sudden jump during the late Friday night session amid inflation figure hits the highest level in 40 years. The PCE Price Index, an inflation barometer which the US central bank – Federal Reserve follows closely skyrocketed to its highest level since January 1982 in June. According to the Bureau of Economic Analysis, the US PCE Price Index for the month of June came in at 6.8% as widely expected, while higher than the prior month’s reading of 6.3%. Besides, another inflation gauge which excluding food and energy, the Core PCE data also increased by 0.6%, recording its biggest gain since a year ago. The dollar index initially reacted positively to the positive figure from the inflation data, but loss the footing on gain before the Friday trading session ended. At this juncture, the attention of the market participants would be given to the upcoming crucial employment data, which is the Non-Farm Payrolls and Unemployment rate, in order to scrutinize the further direction of the dollar index. As of writing, the dollar index rose 0.05% to 105.95.

In the commodities market, the crude oil price was down 0.38% to $98.00 a barrel as the market fears over the recession risk outweigh the global supply concern. Besides, the gold prices depreciated by 0.16% to $1763.40 per troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Jul) | 49.2 | 49.2 | – |

| 16:30 | GBP – Manufacturing PMI (Jul) | 52.2 | 52.2 | – |

| 22:00 | USD – ISM Manufacturing PMI (Jul) | 53.0 | 52.0 | – |

Technical Analysis

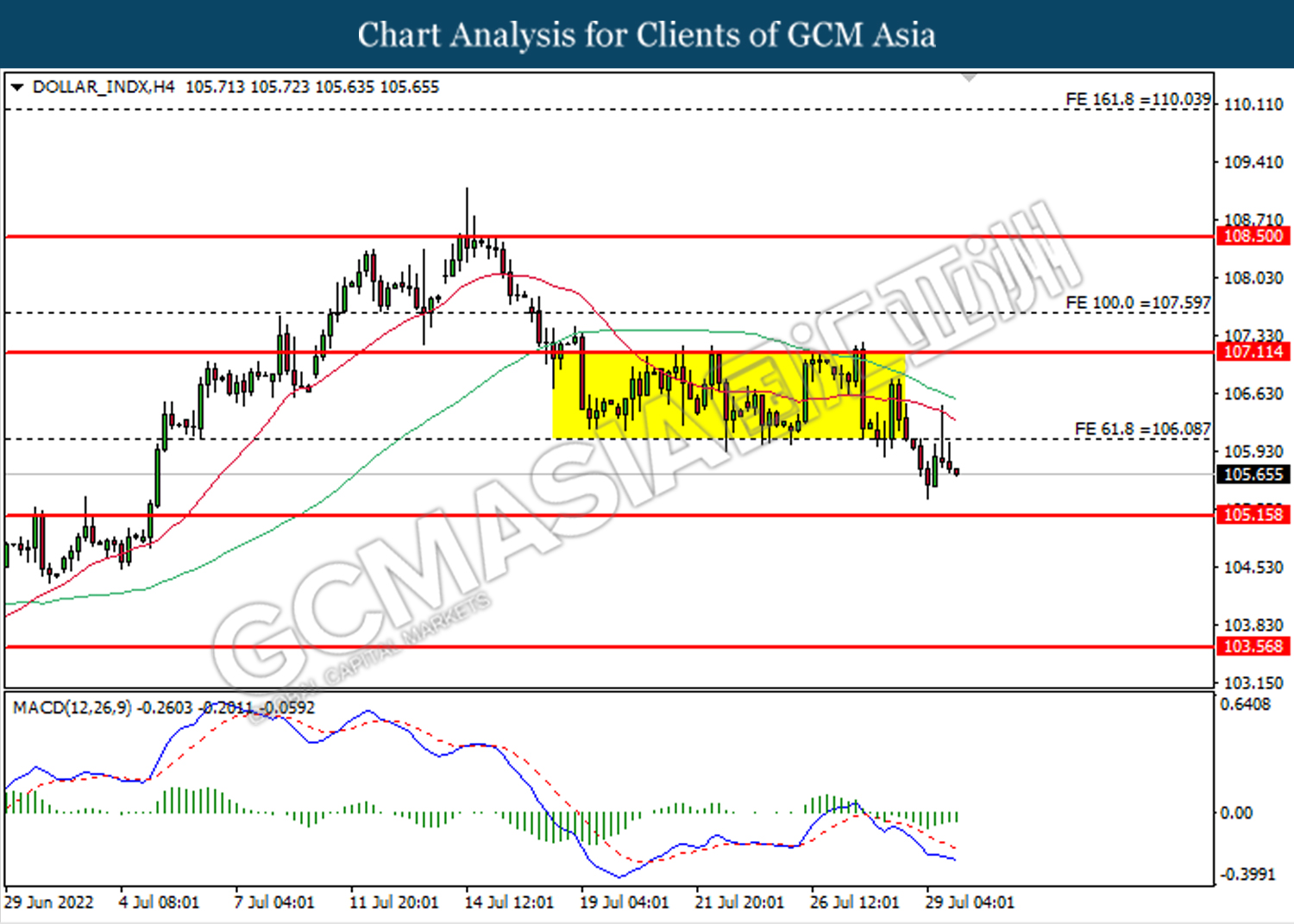

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level at 106.10. MACD which illustrated bearish bias momentum suggests the index to extend its losses toward the support level at 105.15.

Resistance level: 106.10, 107.10

Support level: 105.15, 103.55

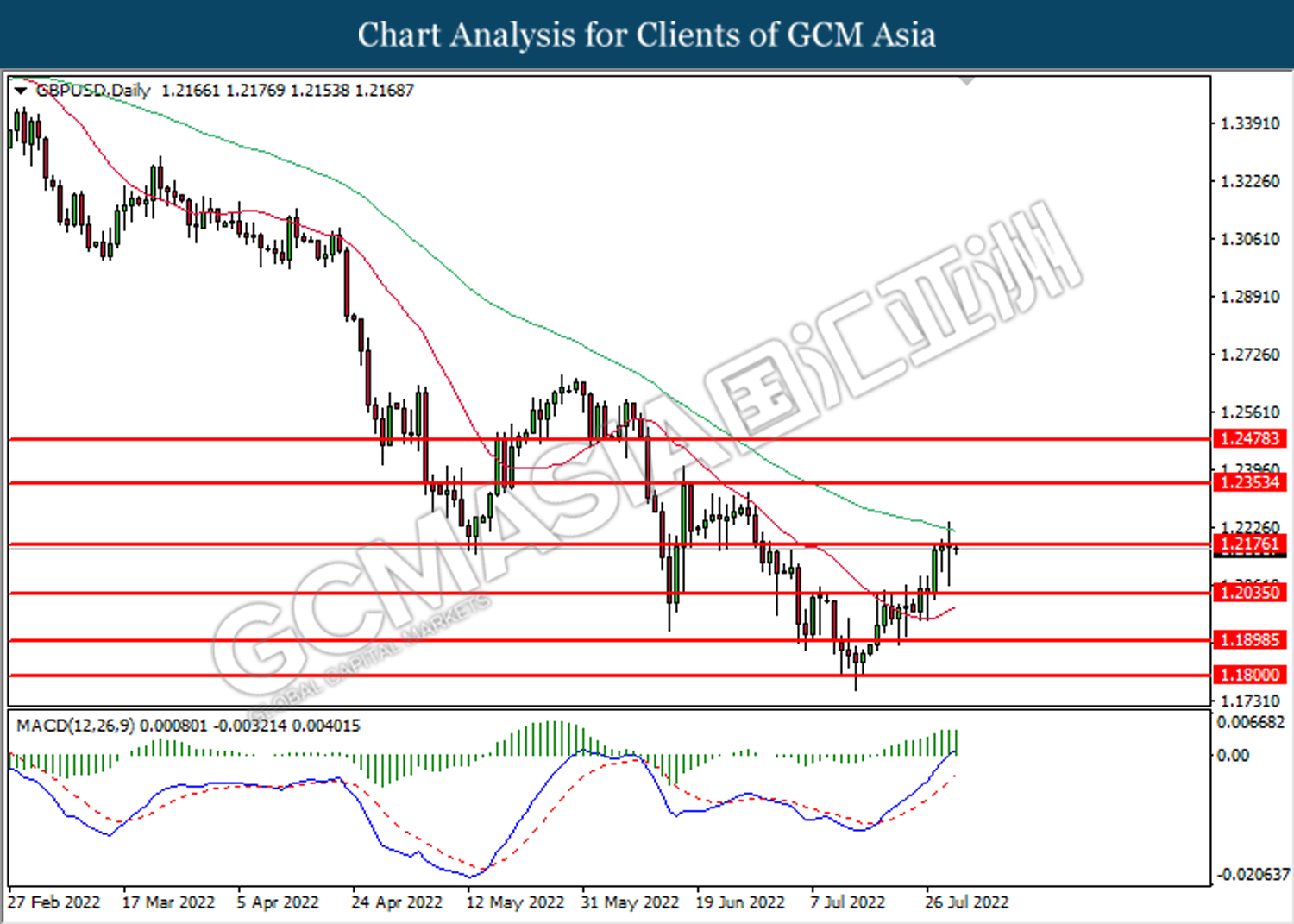

GBPUSD, Daily: GBPUSD was traded higher while currently testing the resistance level at 1.2175. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.2175, 1.2355

Support level: 1.2035, 1.1900

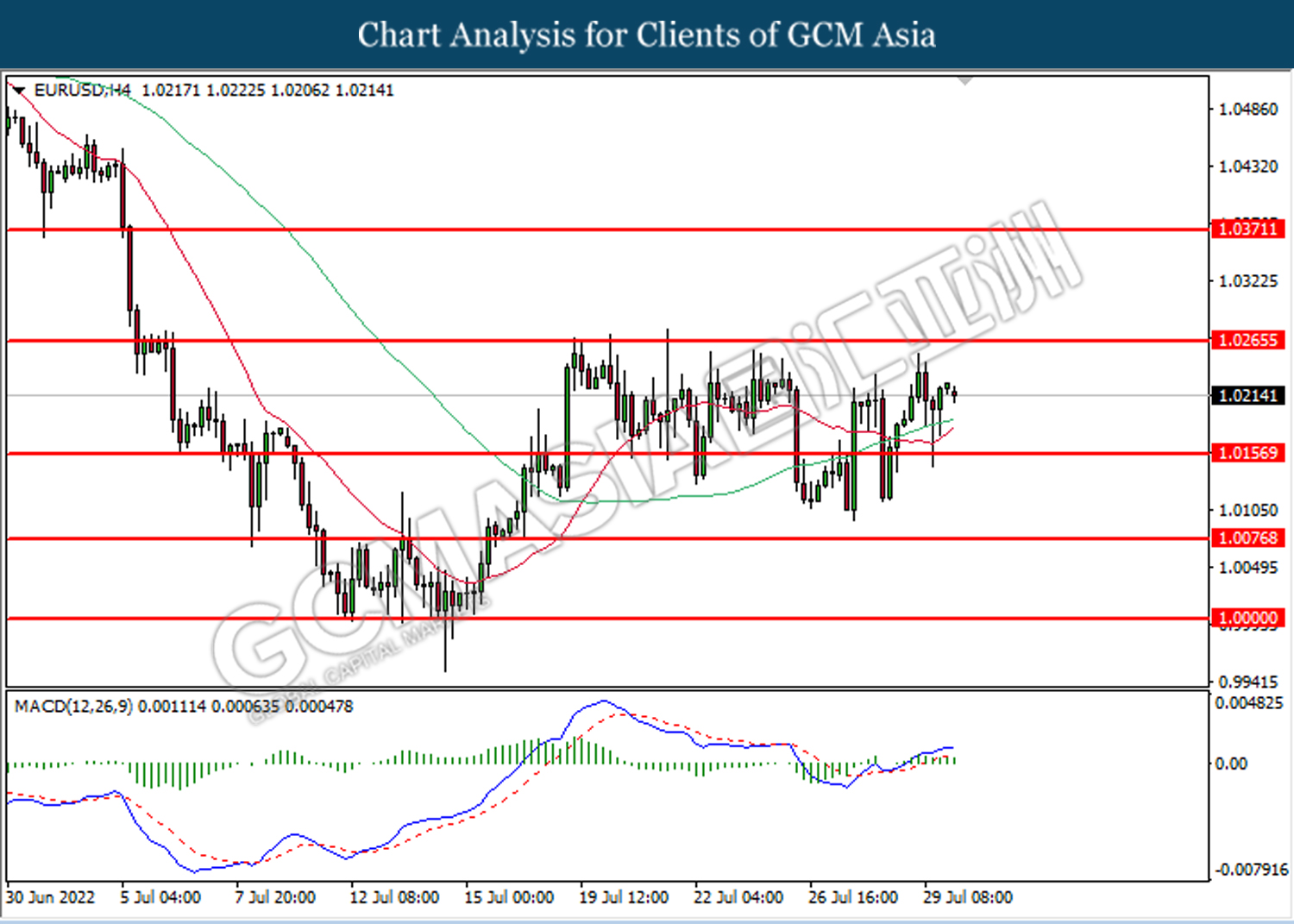

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

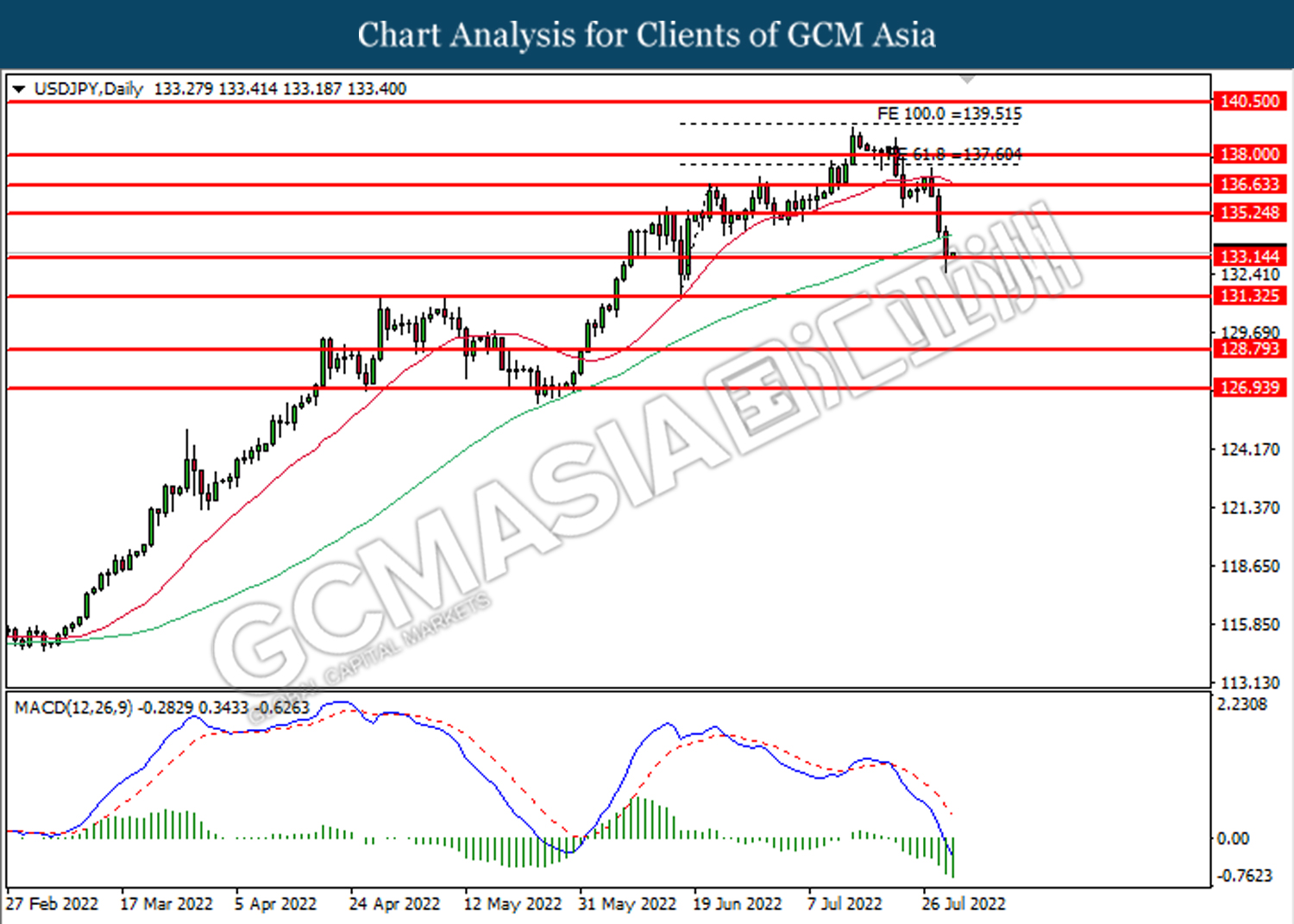

USDJPY, Daily: USDJPY was traded lower while currently testing the support level at 133.15. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout the support level.

Resistance level: 135.25, 136.65

Support level: 133.15, 131.35

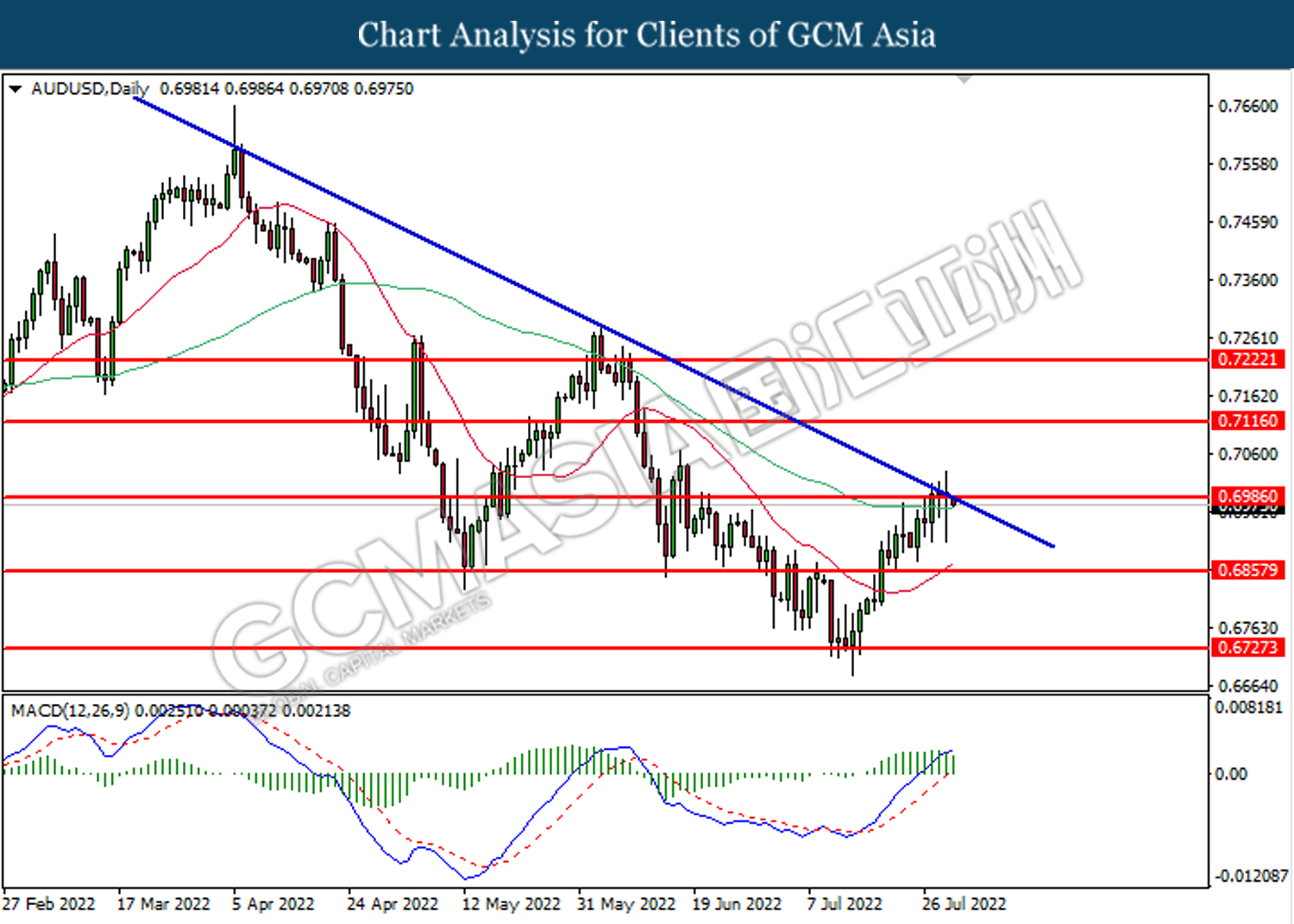

AUDUSD, Daily: AUDUSD was traded higher while currently testing the downward trendline. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the trendline.

Resistance level: 0.6985, 0.7115

Support level: 0.6655, 0.6725

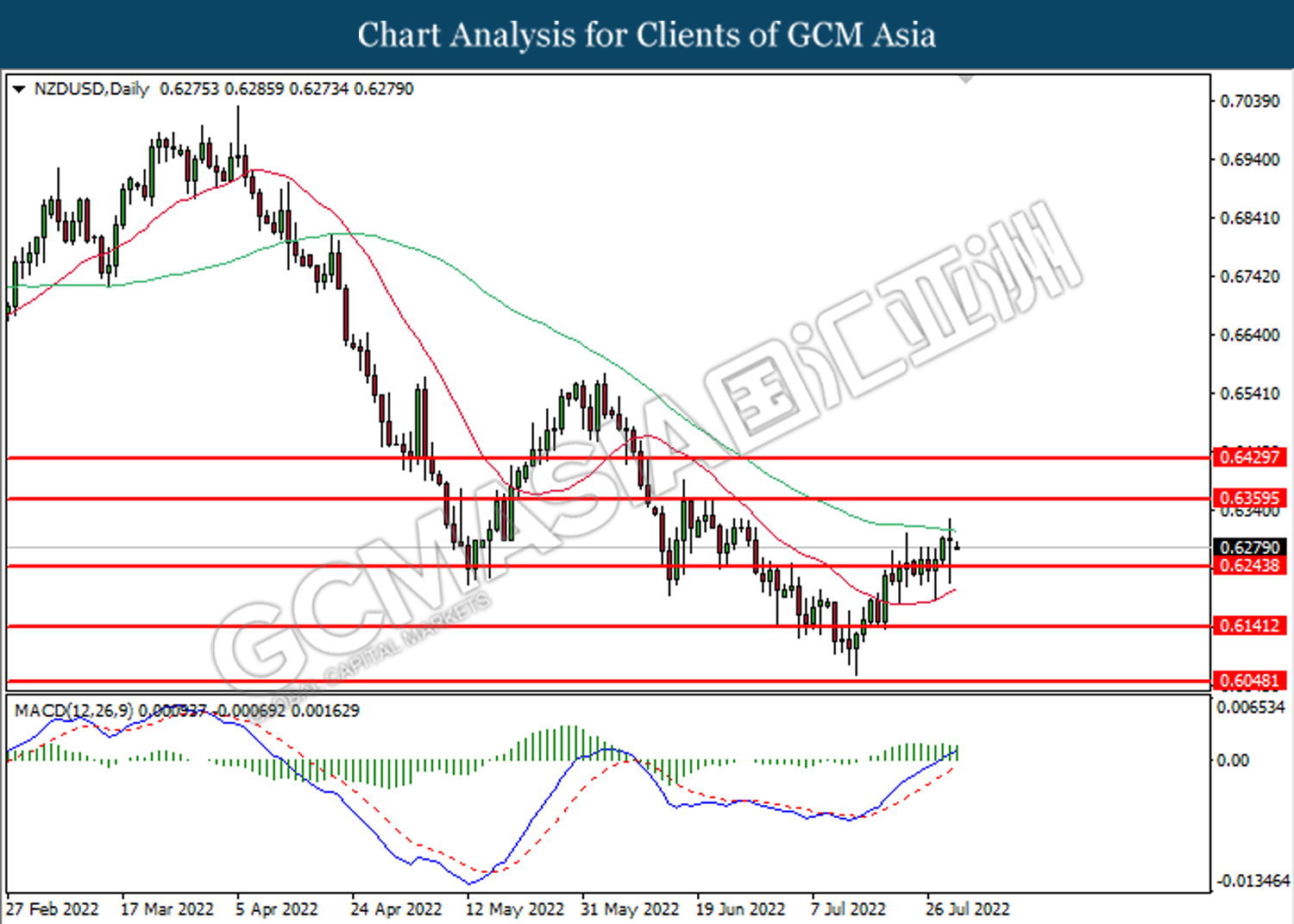

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6245. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.6360.

Resistance level: 0.6360, 0.6430

Support level: 0.6245, 0.6140

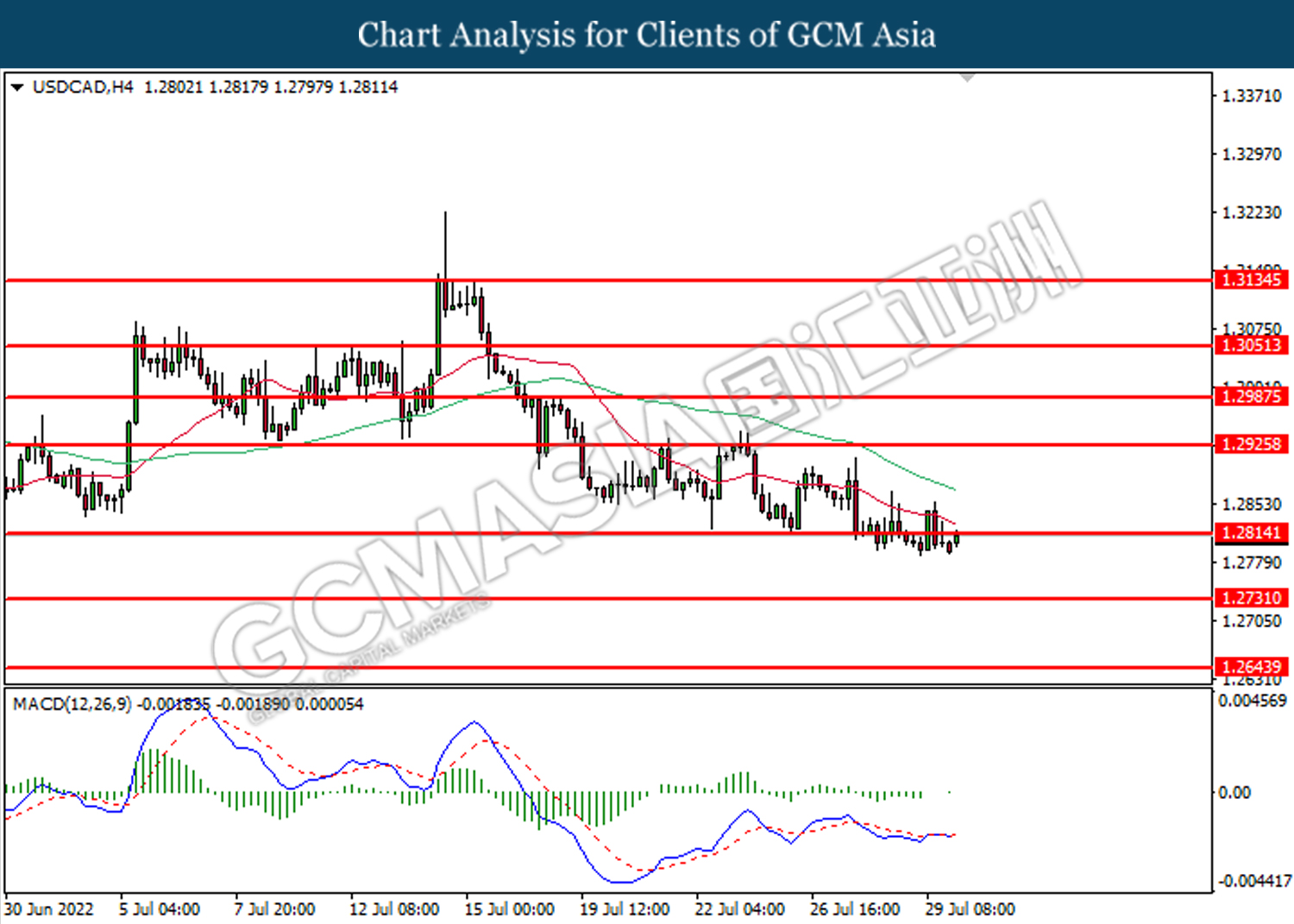

USDCAD, H4: USDCAD was traded higher while currently retesting the resistance level at 1.2815. Due to lack of signal from MACD, it is suggested to wait for further confirmation before entering into the market.

Resistance level: 1.2815, 1.2925

Support level: 1.2730, 1.2645

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9520. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9590, 0.9675

Support level: 0.9520, 0.9450

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 98.20. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 98.20, 100.10

Support level: 91.80, 89.55

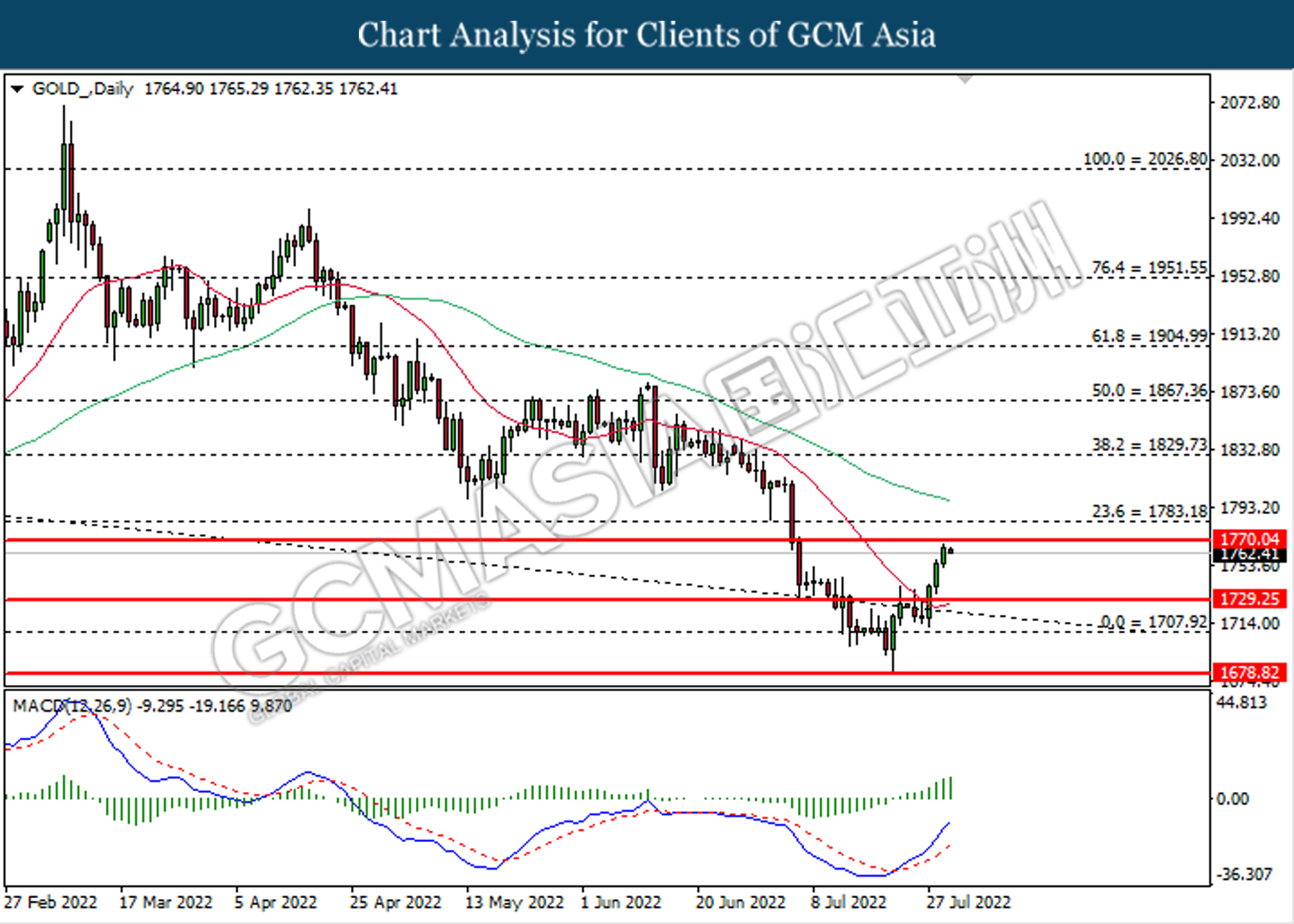

GOLD_, Daily: Gold price was traded higher following prior breakout above the previous resistance level at 1729.25. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains toward the resistance level at 1770.05.

Resistance level: 1770.05, 1783.20

Support level: 1729.25, 1707.90