1 September 2022 Afternoon Session Analysis

Euro rose as inflation in European heightened.

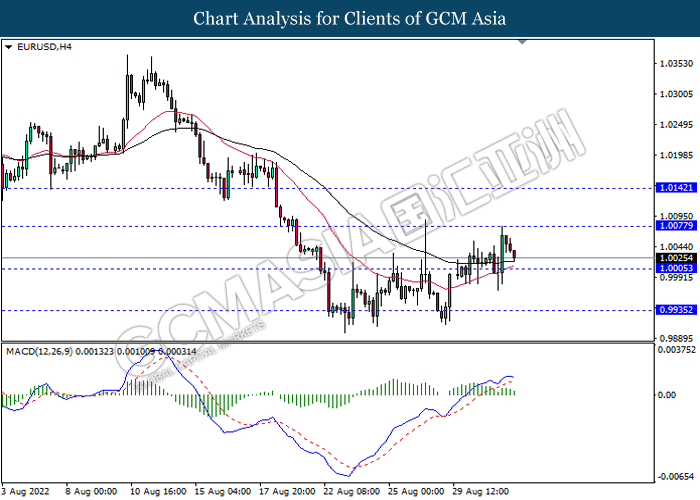

The EUR/USD, which traded by majority of investors surged significantly on yesterday over the higher-than-expected CPI data. According to Eurostat, the Eurozone Consumer Price Index (CPI) YoY for August notched up from the previous reading of 8.9% to 9.1%, exceeding the market expectation of 9.0%. The CPI figure which higher than prior had shown that the inflationary issue in Eurozone still having the sign to rise, which adding the odds of rate hikes from ECB in order to tamp down the soaring prices. Earlier of the week, the ECB members have emphasized that the central bank should raise its interest rate, even though it would likely to disrupt economic growth. Besides, they reiterated that higher rate increase would be considered if the inflation risk keep hovering in the Eurozone. As of now, market participant would eye on ECB interest rate decision which scheduled on 8 September. Nonetheless, the gains of EUR/USD was limited over the hawkish speech from Federal Reserve member. As of writing, EUR/USD depreciated by 0.34% to 1.0023.

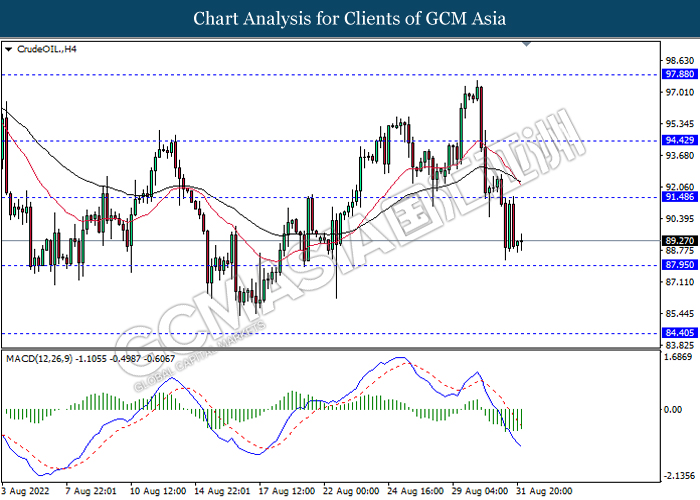

In the commodities market, the crude oil price dropped by 0.23% to $89.34 per barrel as of writing amid the return of the Iran nuclear deal could be imminent and it might be reached in upcoming weeks. On the other side, the gold price eased by 0.62% to $1705.02 per troy ounce as of writing following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Aug) | 49.3 | 49.8 | – |

| 16:30 | GBP – Manufacturing PMI (Aug) | 46.0 | 46.0 | – |

| 20:30 | USD – Initial Jobless Claims | 243K | 248K | – |

| 22:00 | USD – ISM Manufacturing PMI (Aug) | 52.8 | 52.0 | – |

Technical Analysis

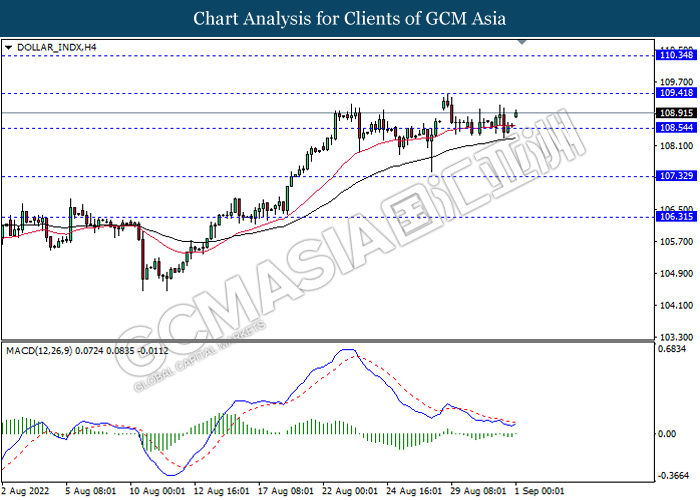

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains.

Resistance level: 109.40, 110.35

Support level: 108.55, 107.30

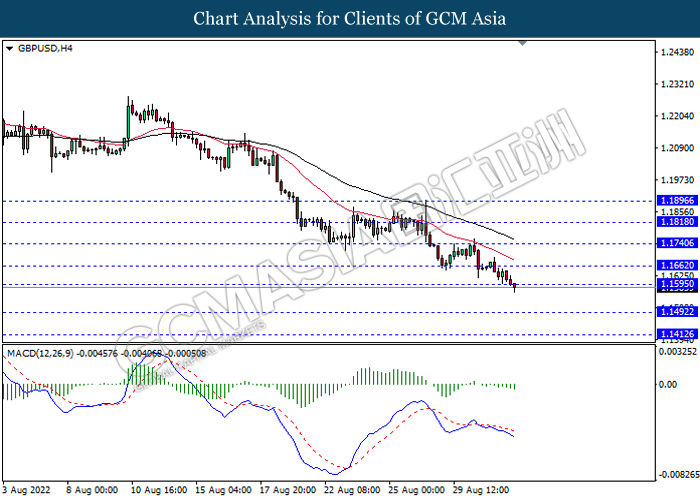

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.1595, 1.1660

Support level: 1.1490, 1.1410

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0075, 1.0140

Support level: 1.0005, 0.9935

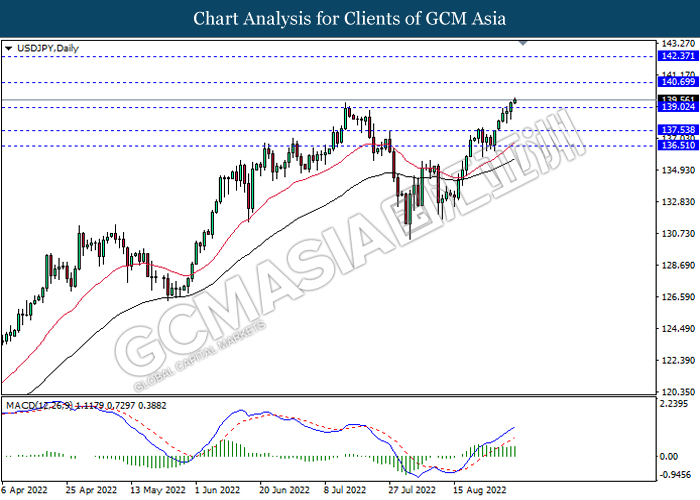

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 140.70, 142.35

Support level: 139.00, 137.55

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6865, 0.6930

Support level: 0.6780, 0.6720

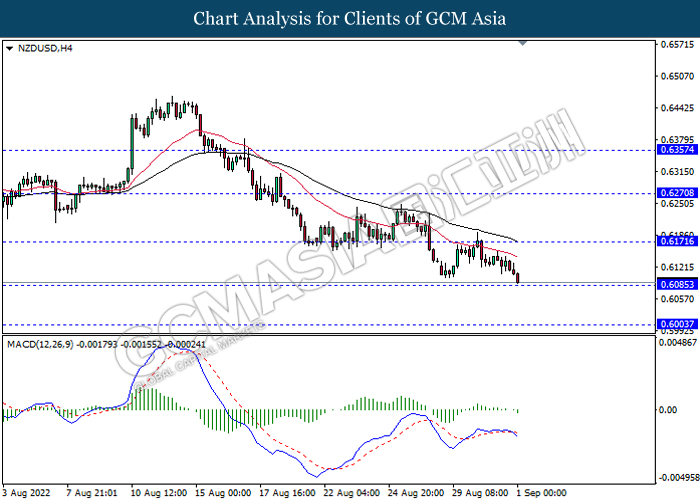

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6170, 0.6270

Support level: 0.6085, 0.6005

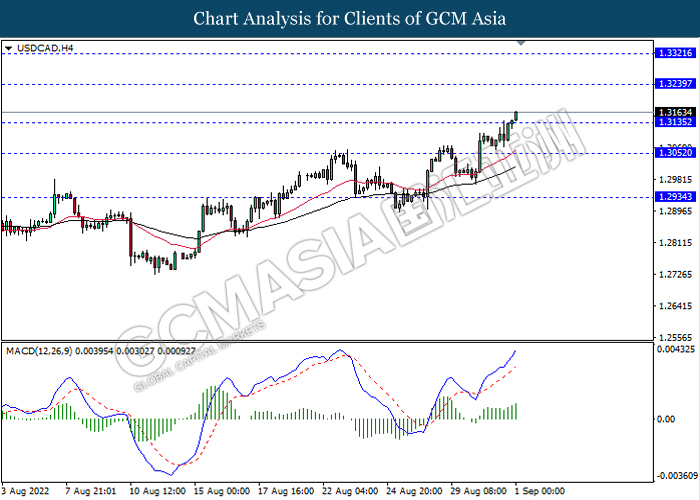

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3240, 1.3320

Support level: 1.3135, 1.3050

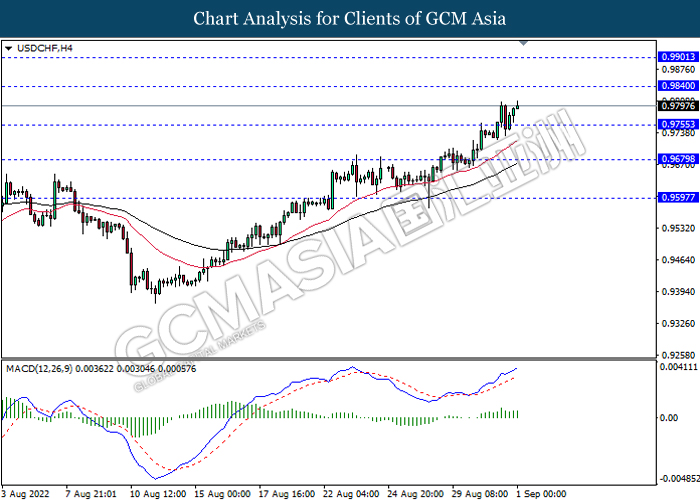

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9840, 0.9900

Support level: 0.9755, 0.9680

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 91.50, 94.40

Support level: 87.95, 84.40

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1712.80, 1731.55

Support level: 1693.65, 1674.85