1 September 2022 Morning Session Analysis

Dollar edged down amid downbeat employment data.

The dollar index, which gauges its value against a basket of six major currencies, failed to extend its upward momentum yesterday following the release of a weaker-than-expected data. According to the ADP, US Nonfarm Employment Change came in at 132K, far lower than the consensus forecast at 300K, while dropping significantly compared to the prior month reading’s 268K. It showed that the companies in the US have slowed down their hiring pace in August, highly due to the heightening fears of an economic recession. Prior to now, the ADP report was suspended for the past two months as the company revamped the methodology for the data after showing a great deviation between their prediction and the actual reading over the private payrolls’ figures in the Labor Department’s Bureau of Labor Statistics employment report. Nonetheless, with such a disappointing data, investors started to sell their holdings in the US dollar market and flee away to other market, such as Euro. Going forward, the attention of the investors were still the Nonfarm Payroll data on Friday, as the investor would rely on the data to scrutinize the further direction of the dollar index. As of writing, the dollar index dropped -0.08% to 108.70.

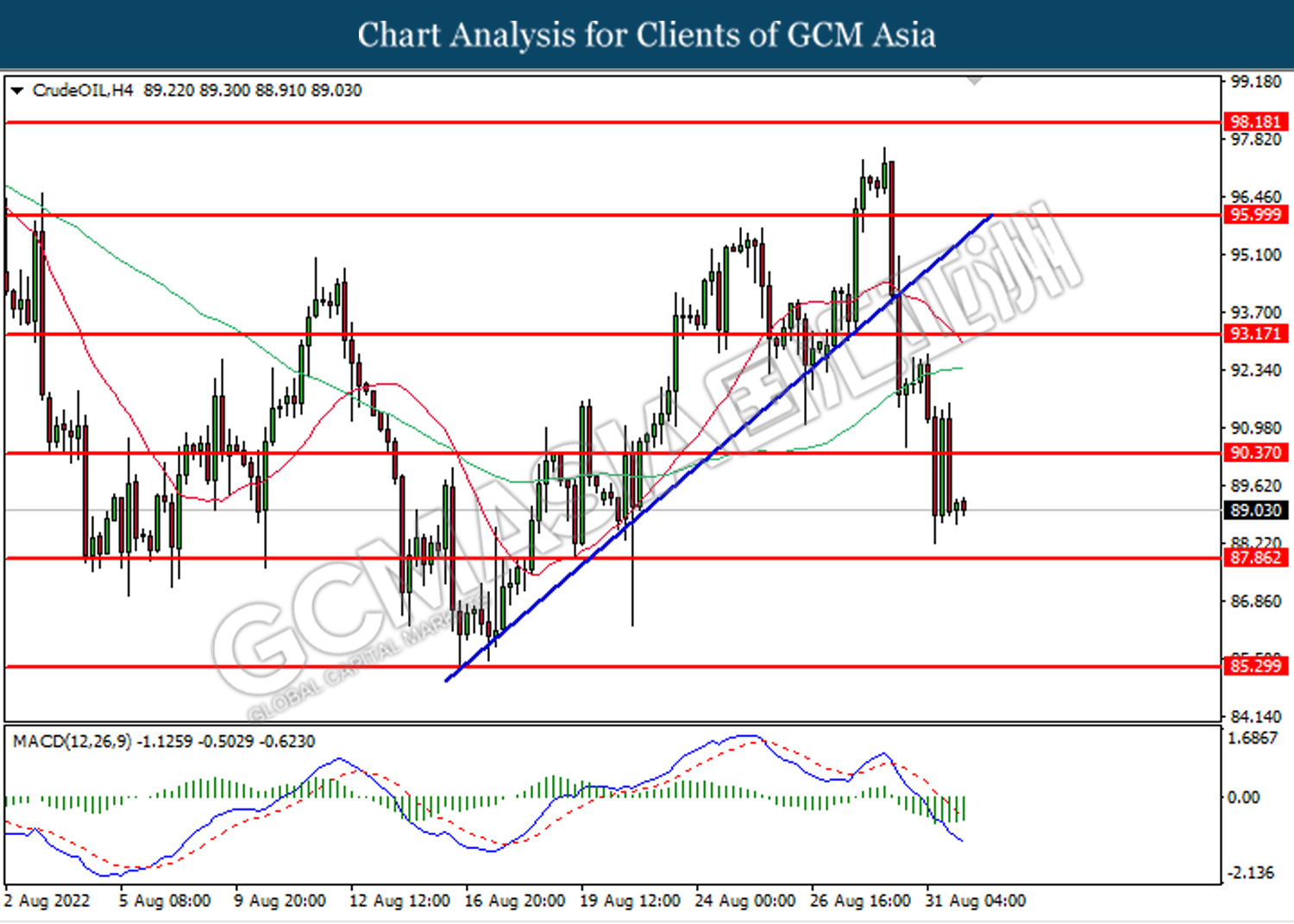

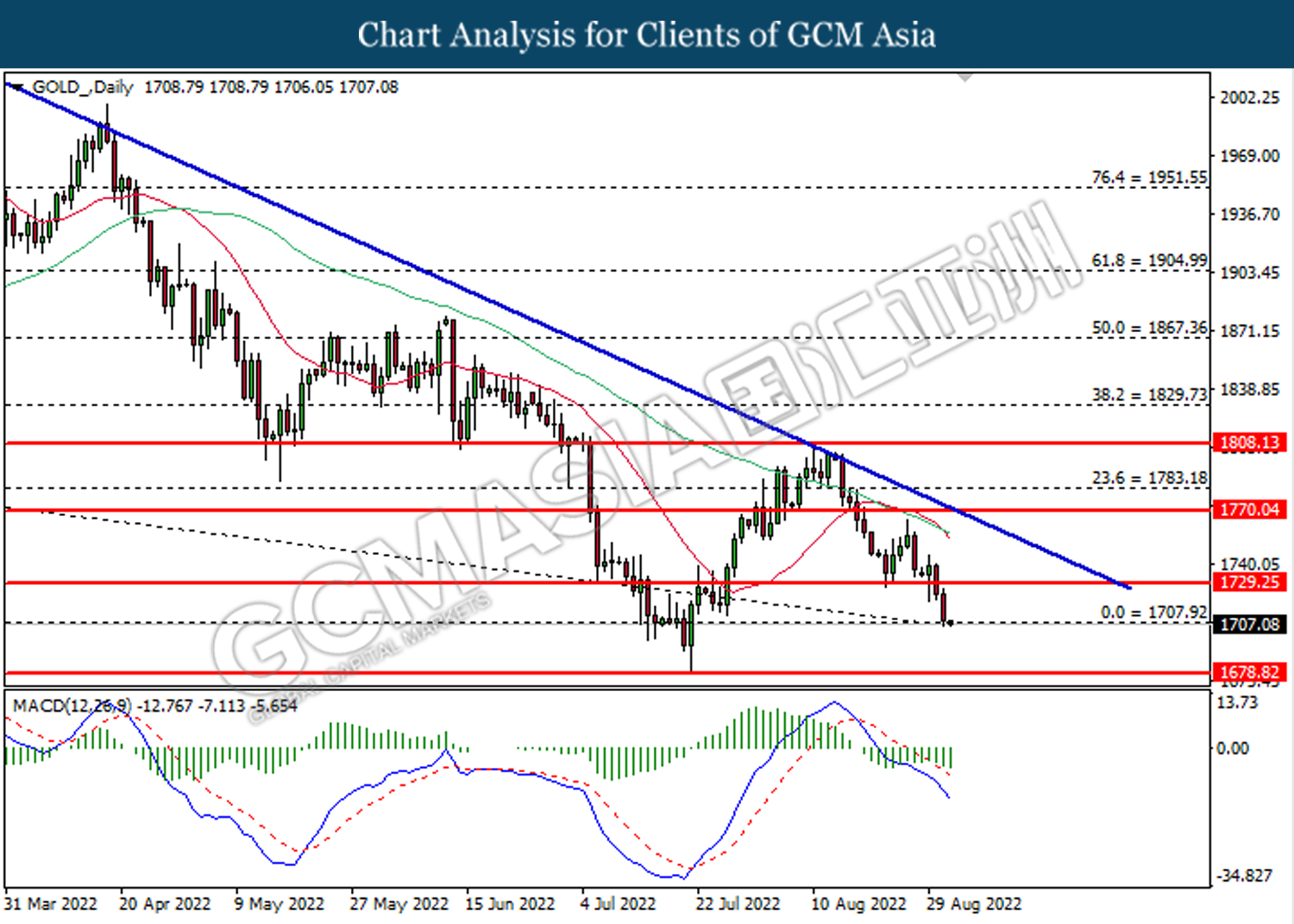

In the commodities market, the crude oil price was down by -0.02% to $89.10 a barrel as increased restriction to curb Covid-19 in China dampened the outlook of this black commodity. Besides, the gold prices edged down by -0.13% to $1708.90 per troy ounce amid the rebound in dollar index market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Aug) | 49.3 | 49.8 | – |

| 16:30 | GBP – Manufacturing PMI (Aug) | 46.0 | 46.0 | – |

| 20:30 | USD – Initial Jobless Claims | 243K | 248K | – |

| 22:00 | USD – ISM Manufacturing PMI (Aug) | 52.8 | 52.0 | – |

Technical Analysis

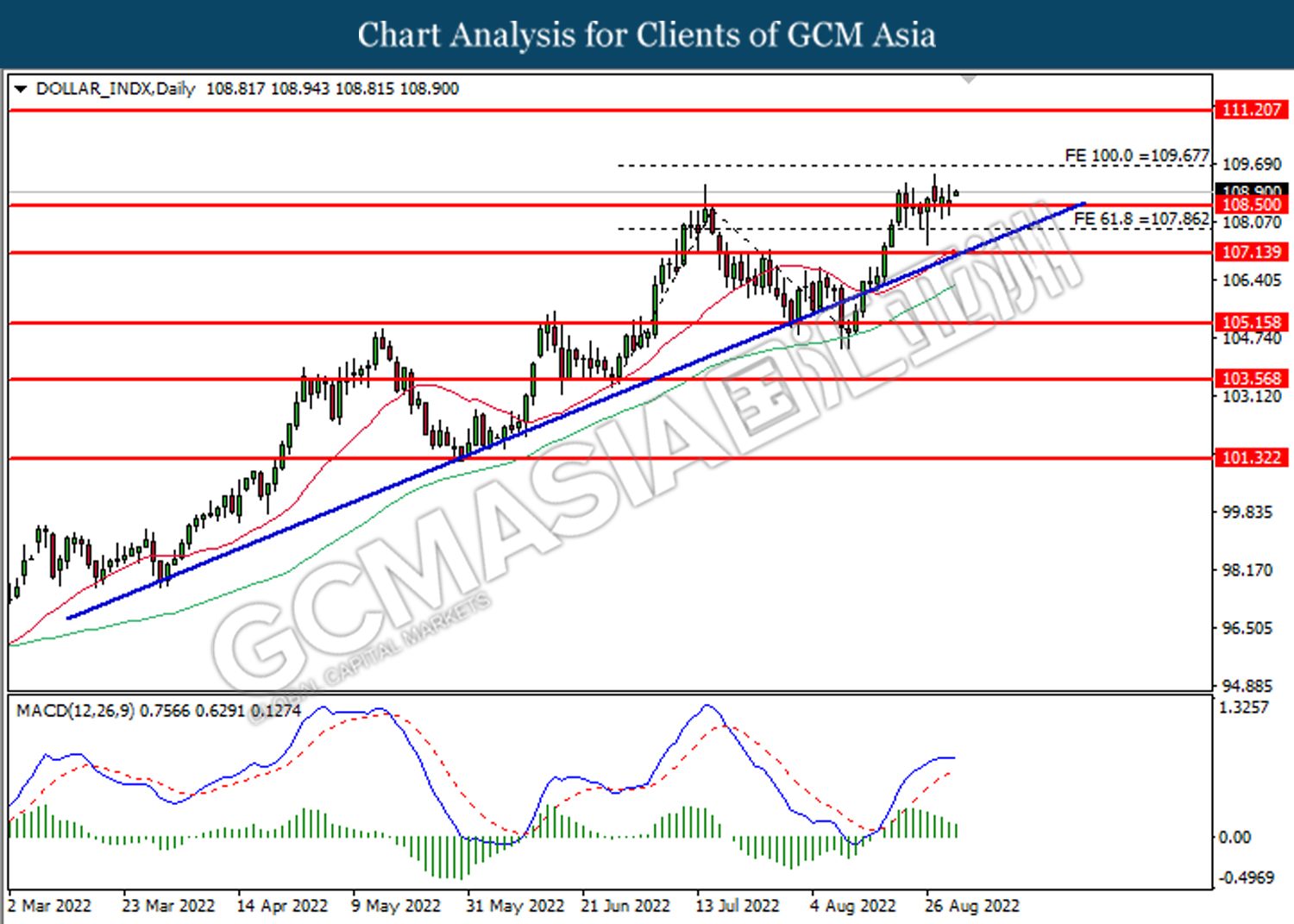

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound from the support level at 108.50. However, MACD which illustrated diminishing bullish momentum suggests the index to undergo technical correction in short term.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

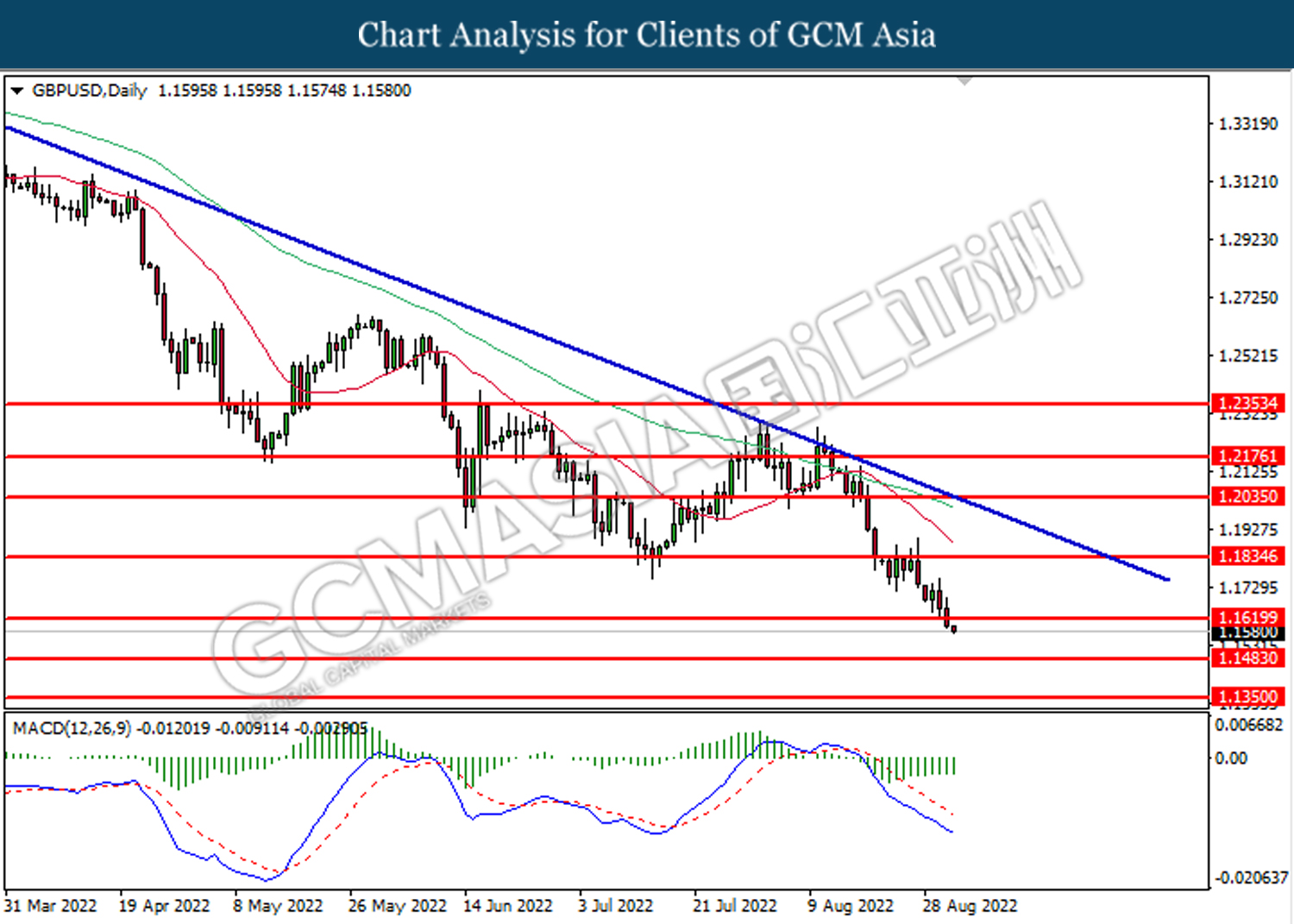

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1620. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the next support level.

Resistance level: 1.1620, 1.1835

Support level: 1.1485, 1.1350

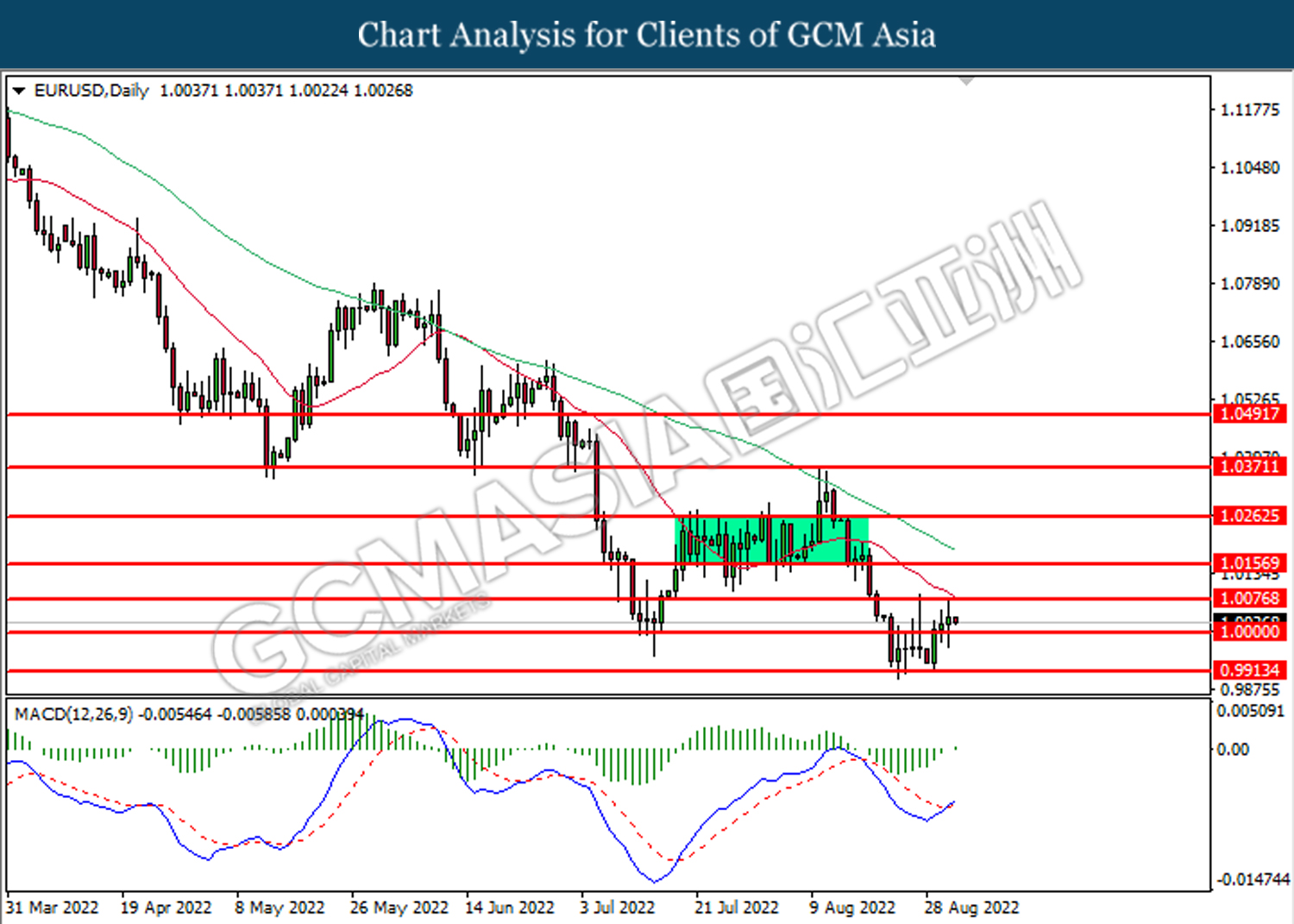

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0075. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0075, 1.0155

Support level: 1.0000, 0.9915

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 139.35. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 139.35, 140.50

Support level: 138.00, 136.65

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its to extend its losses toward the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

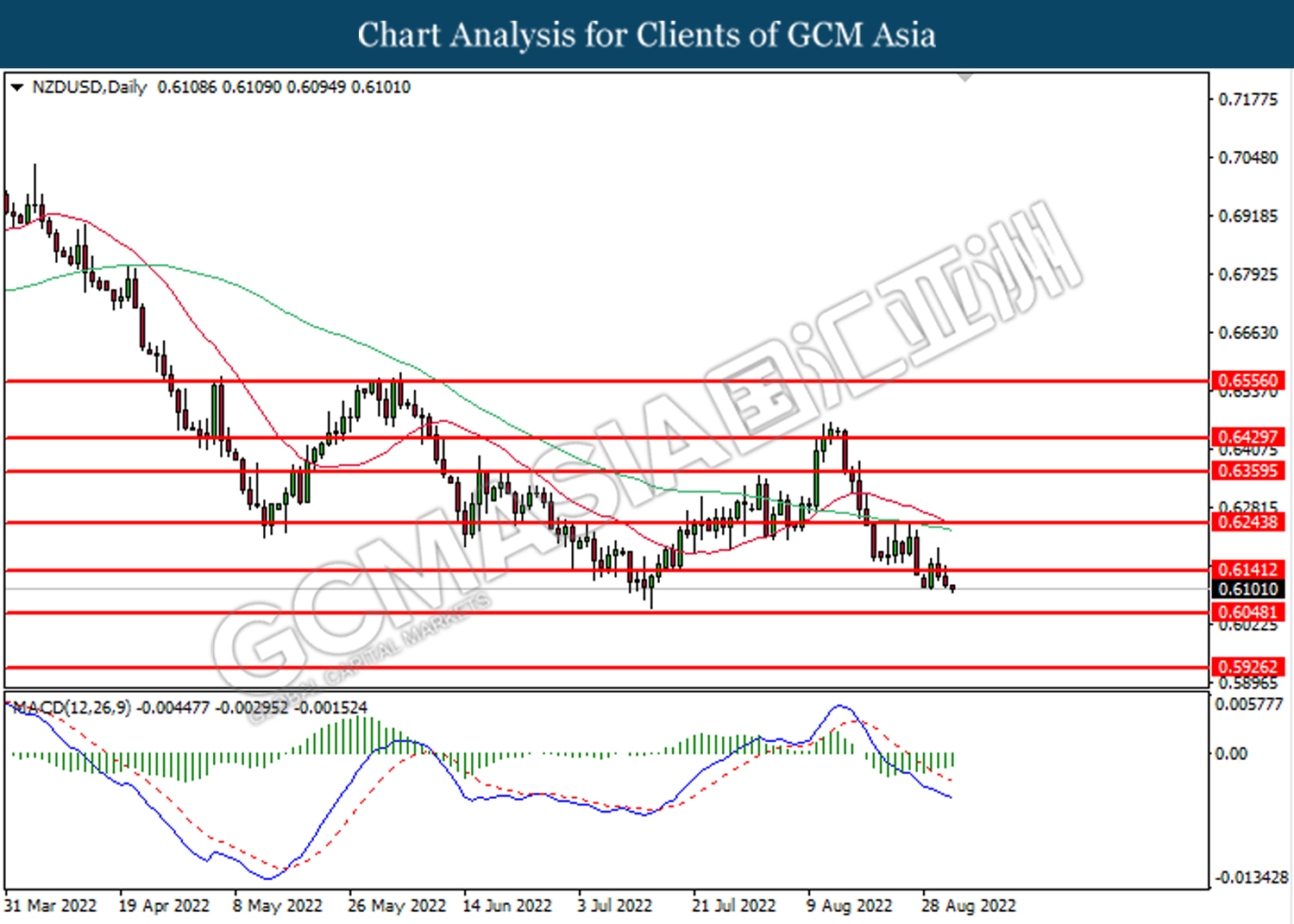

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6140. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical rebound in short term.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

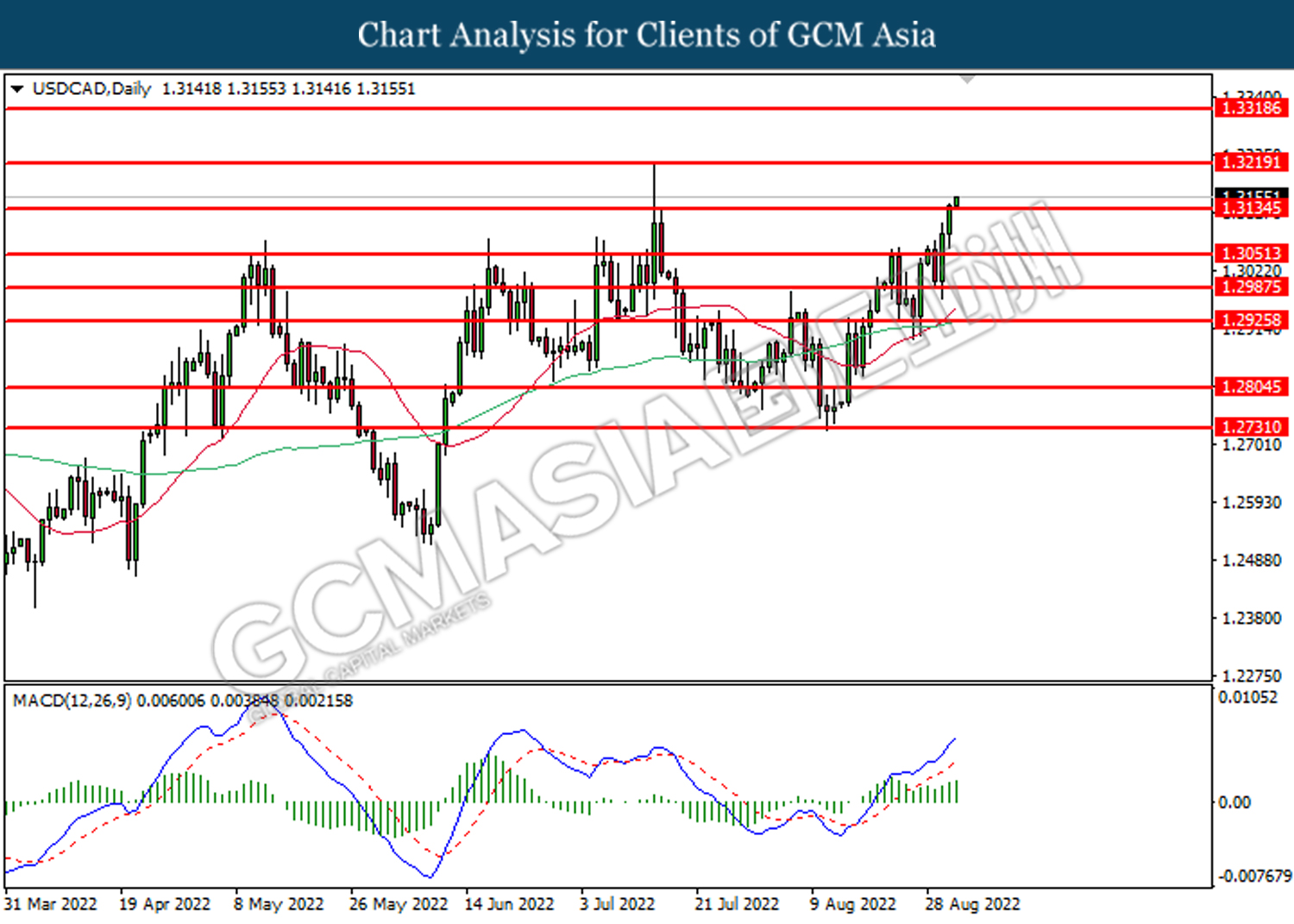

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3135. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3135, 1.3220

Support level: 1.3050, 1.2985

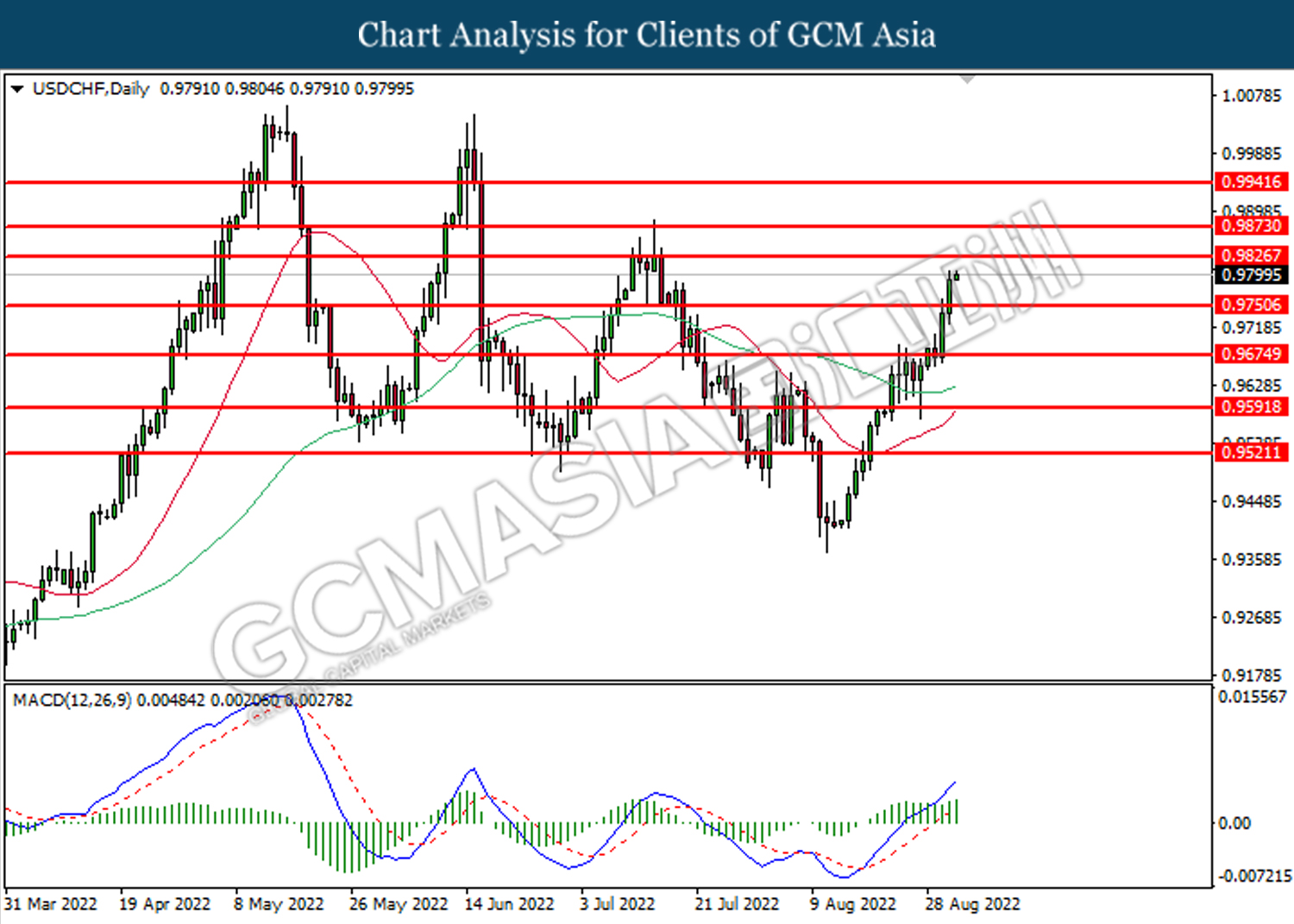

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9750. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9825.

Resistance level: 0.9825, 0.9875

Support level: 0.9750, 0.9675

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level at 90.35. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 87.85.

Resistance level: 90.35, 93.15

Support level: 87.85, 85.30

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1707.90. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1729.25, 1770.05

Support level: 1707.90, 1678.80