1 November 2022 Afternoon Session Analysis

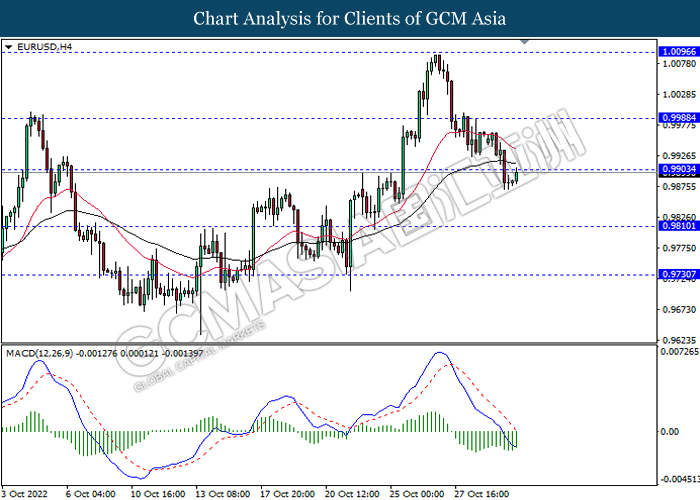

Euro dived upon bearish economic outlook in Eurozone.

The EUR/USD, which widely traded by majority of investors slumped on yesterday despite rising inflationary risk. According to Eurostat, the Eurozone Consumer Price Index (CPI) YoY in October notched up from the previous reading of 9.9% to 10.7%, exceeding the market expectation of 10.2%. With that, European Central Bank (ECB) would likely to raise its rate forcefully to bring down the sky-high prices. Though, the possibility of aggressive rate hike from ECB in the next meeting was diminished over the pessimistic economic outlook in Eurozone. The Eurozone Gross Domestic Product (GDP) QoQ in third quarter has shown a sign of slowdown, which notched down from the previous figures of 0.8% to 0.2%. In order to avoid a more serious issue such as stagflation risk, ECB might reduce the size of rate increase, says 50 basis point or lower. On the other hand, the China-proxy currency, AUD/USD rose on early Tuesday amid the upbeat economic data from China. The China Caixin Manufacturing Purchasing Managers Index (PMI) posted at the reading of 49.2, higher tan the consensus forecast of 49.0. As of writing, EUR/USD appreciated by 0.19% to 0.9901 while AUD/USD rose by 0.67% to 0.6440.

In the commodities market, the crude oil price raised by 0.58% to $87.03 per barrel as of writing following the bullish China economic data. In addition, the gold price edged down by 0.02% to $1637.45 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:30 | GBP – Manufacturing PMI (Oct) | 45.8 | 45.8 | – |

| 22:00 | USD – ISM Manufacturing PMI (Oct) | 50.9 | 50.0 | – |

| 22:00 | USD – JOLTs Job Openings (Sep) | 10.053M | 10.000M | – |

Technical Analysis

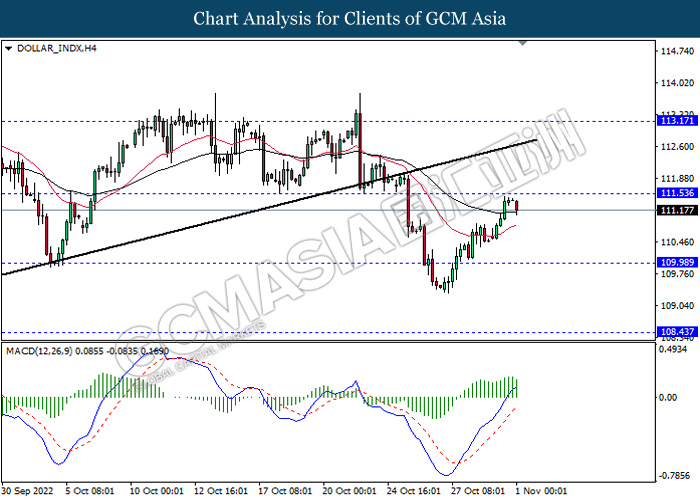

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

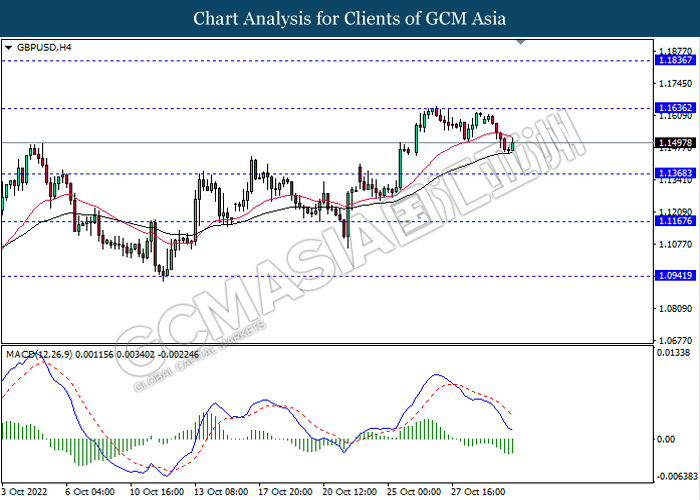

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9905, 0.9990

Support level: 0.9810, 0.9730

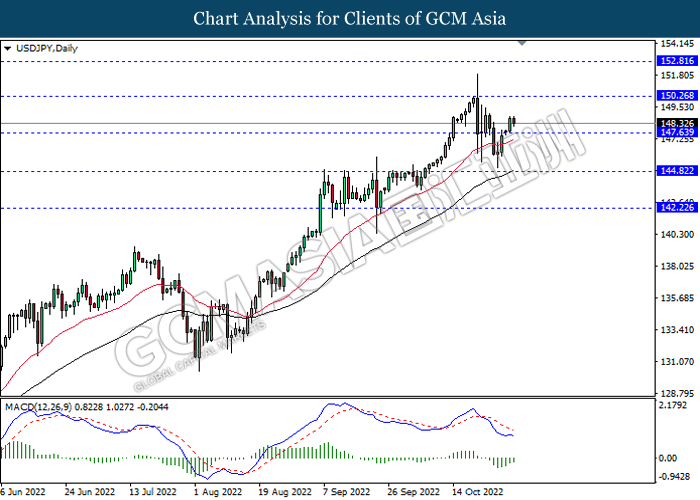

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 150.25, 152.80

Support level: 147.65, 144.80

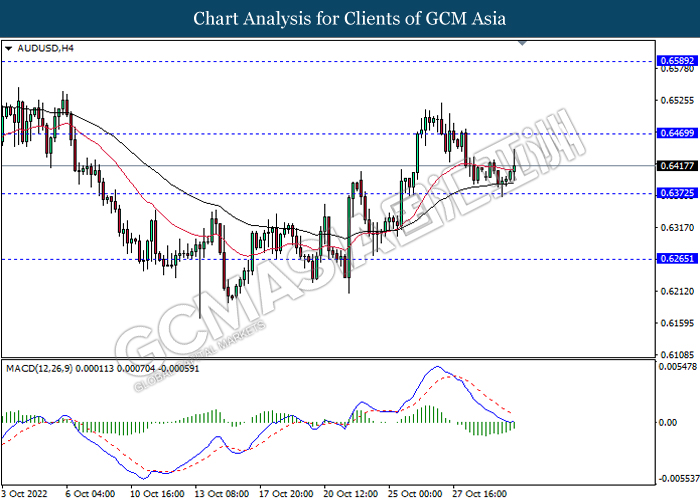

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6470, 0.6590

Support level: 0.6370, 0.6265

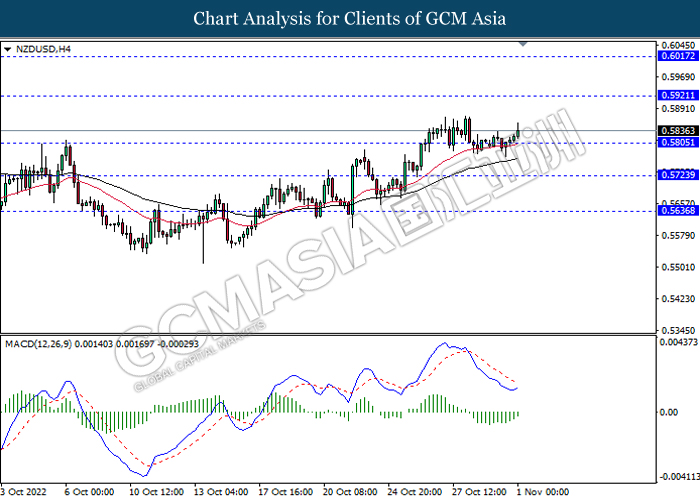

NZDUSD, H4: NZDUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.5920, 0.6015

Support level: 0.5805, 0.5725

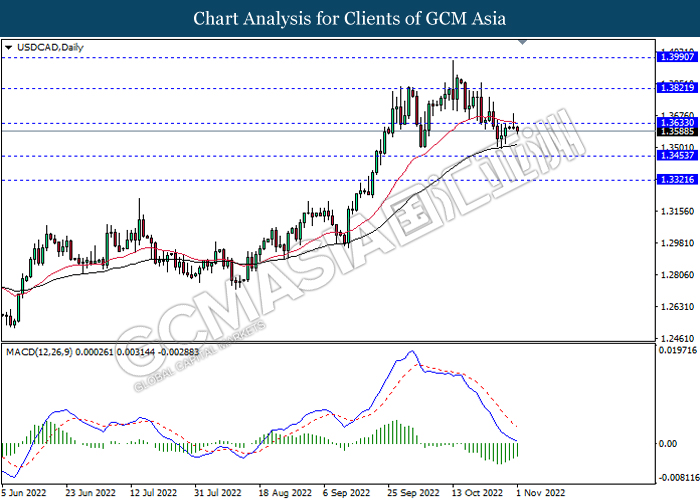

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0005, 1.0105

Support level: 0.9930, 0.9860

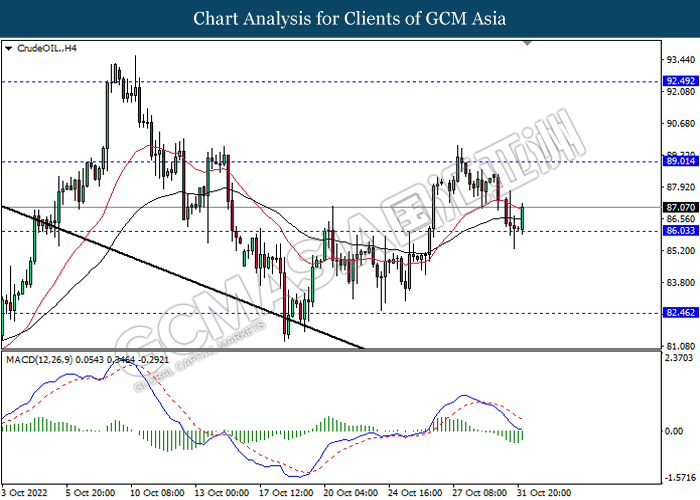

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 89.00, 92.50

Support level: 86.05, 82.45

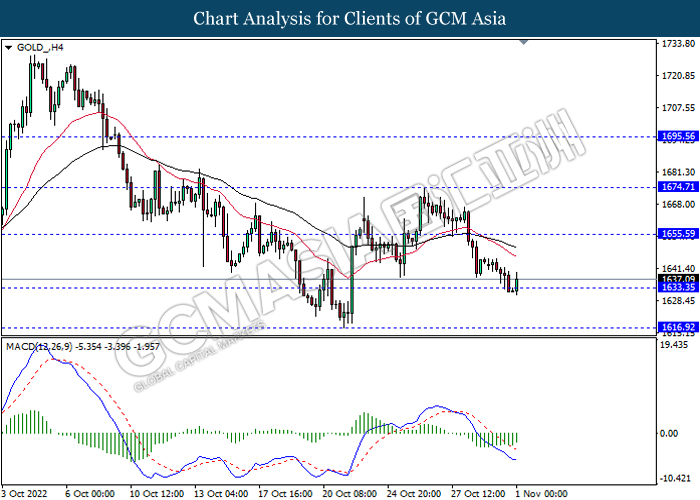

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1655.60, 1674.70

Support level: 1633.35, 1616.90