1 Nov 2022 Morning Session Analysis

Greenback surged ahead of another big rate hike.

The dollar index, which gauges its value against a basket of six major currencies, managed to extend its gains yesterday as the market sentiment cheered by another supersized rate increase later this week. At this juncture, the market participants are expecting the US Central Bank Federal Reserve to raise its benchmark overnight interest rate by 75 basis point to a range of 3.75% to 4.00%, as a result of fourth supersize increase in a row. However, the gains of the dollar index were limited as the investors are still waiting for the Fed signals on Thursday early morning, whether if the rate hike’s path after the November meeting will be pivoted to a slower pace. According to the FedWatch tools, the possibility of 50 basis point of rate hike in the last meeting of 2022 is as high as 47.8%, whereas the possibility of another supersize rate hike is 47.1% and there is only 5.1% of possibility that the Federal Reserve will have a 25-basis point of rate hike. As of writing, the dollar index rose 0.75% to 111.60.

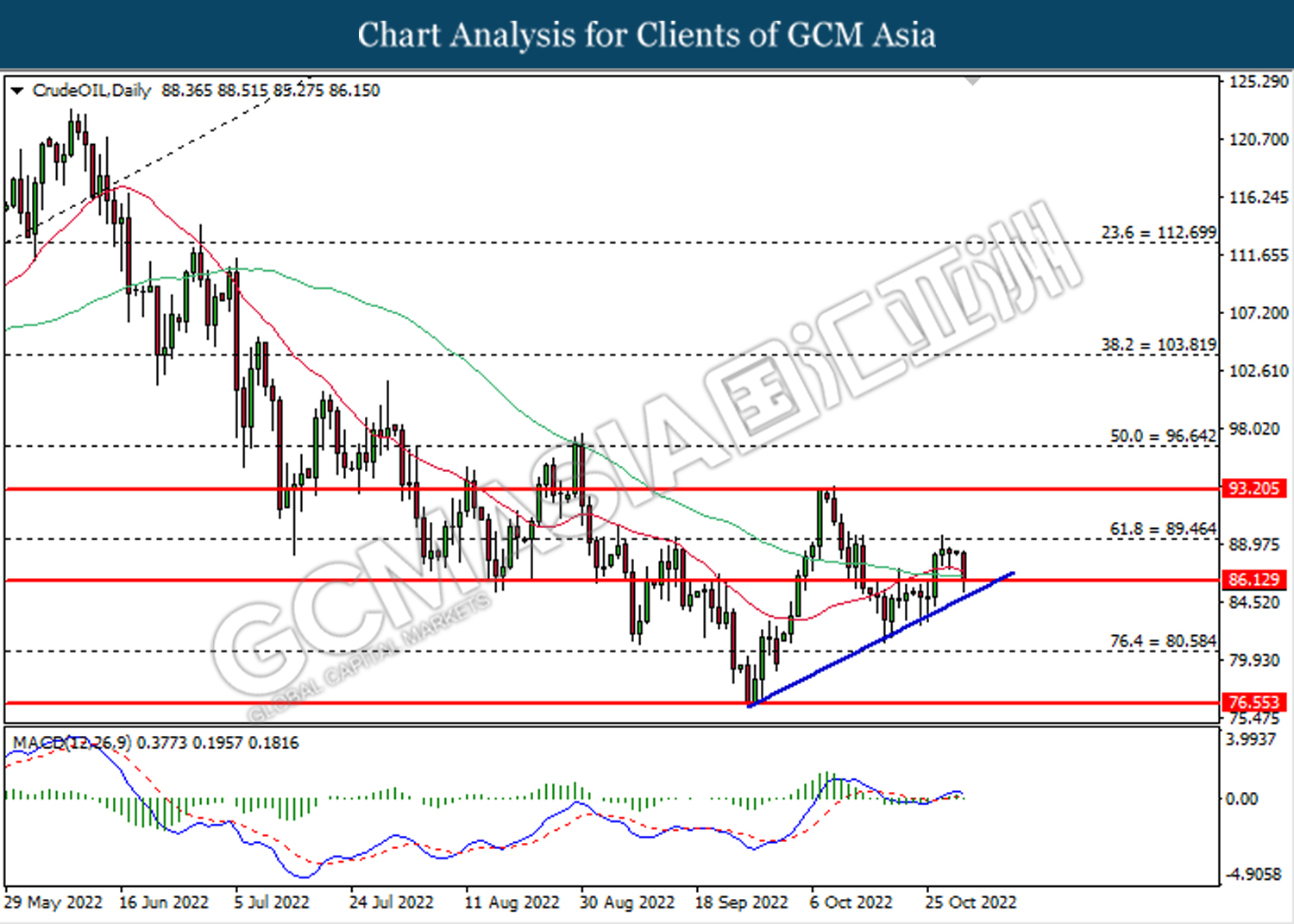

In the commodities market, the crude oil price edged down by -0.21% to $86.75 per barrel following the dollar index strengthened, whereby it increased the cost of oil product toward the non-US buyer. Besides, the gold prices dropped -0.03% to $1633.15 per troy ounce as the dollar strengthened.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:30 AUD RBA Rate Statement

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:30 | AUD – RBA Interest Rate Decision (Nov) | 2.60% | 2.85% | – |

| 17:30 | GBP – Manufacturing PMI (Oct) | 45.8 | 45.8 | – |

| 22:00 | USD – ISM Manufacturing PMI (Oct) | 50.9 | 50.0 | – |

| 22:00 | USD – JOLTs Job Openings (Sep) | 10.053M | 10.000M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 111.25. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 111.25, 113.30

Support level: 109.00, 107.35

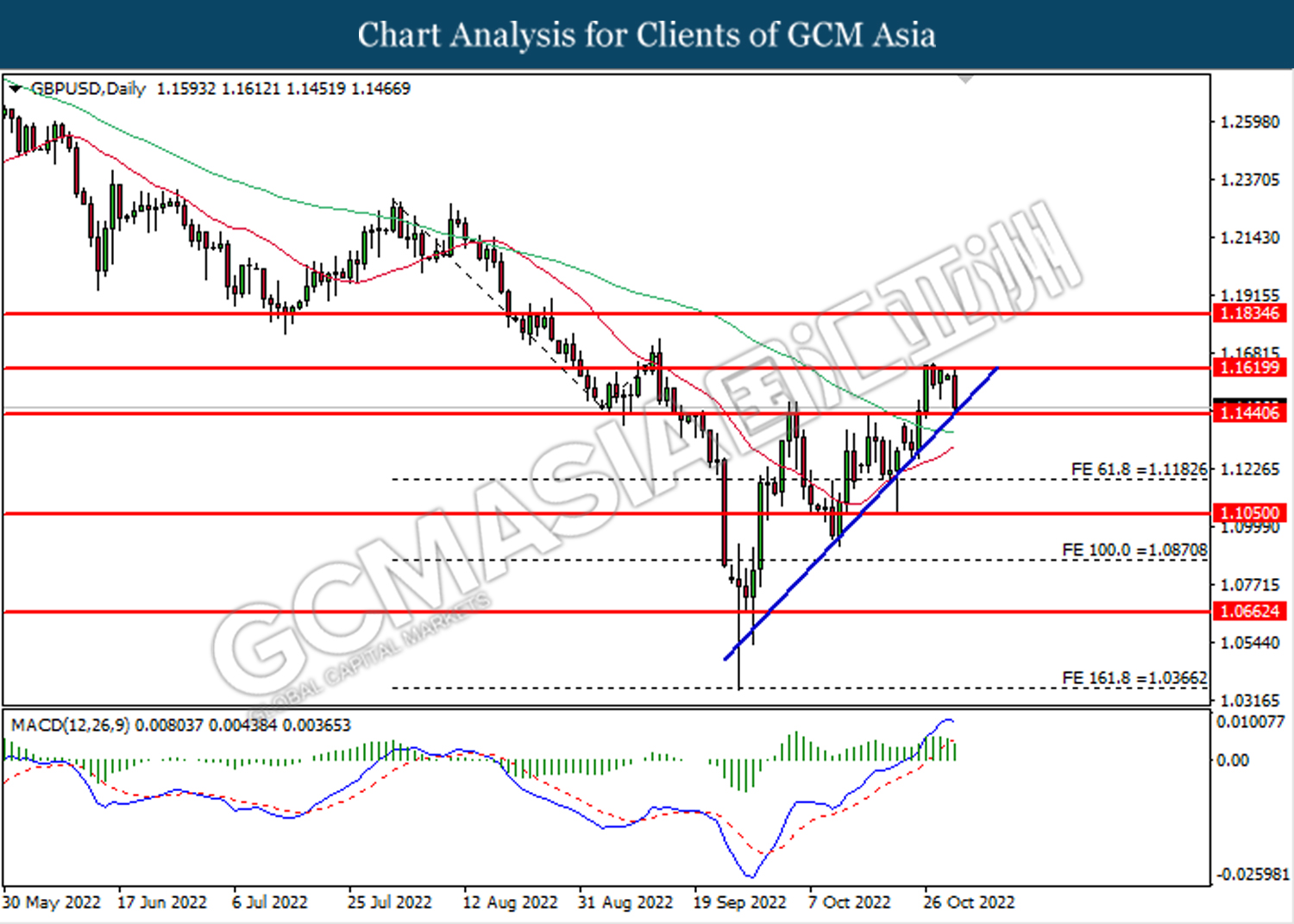

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1620. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1440.

Resistance level: 1.1620, 1.1835

Support level: 1.1440, 1.1185

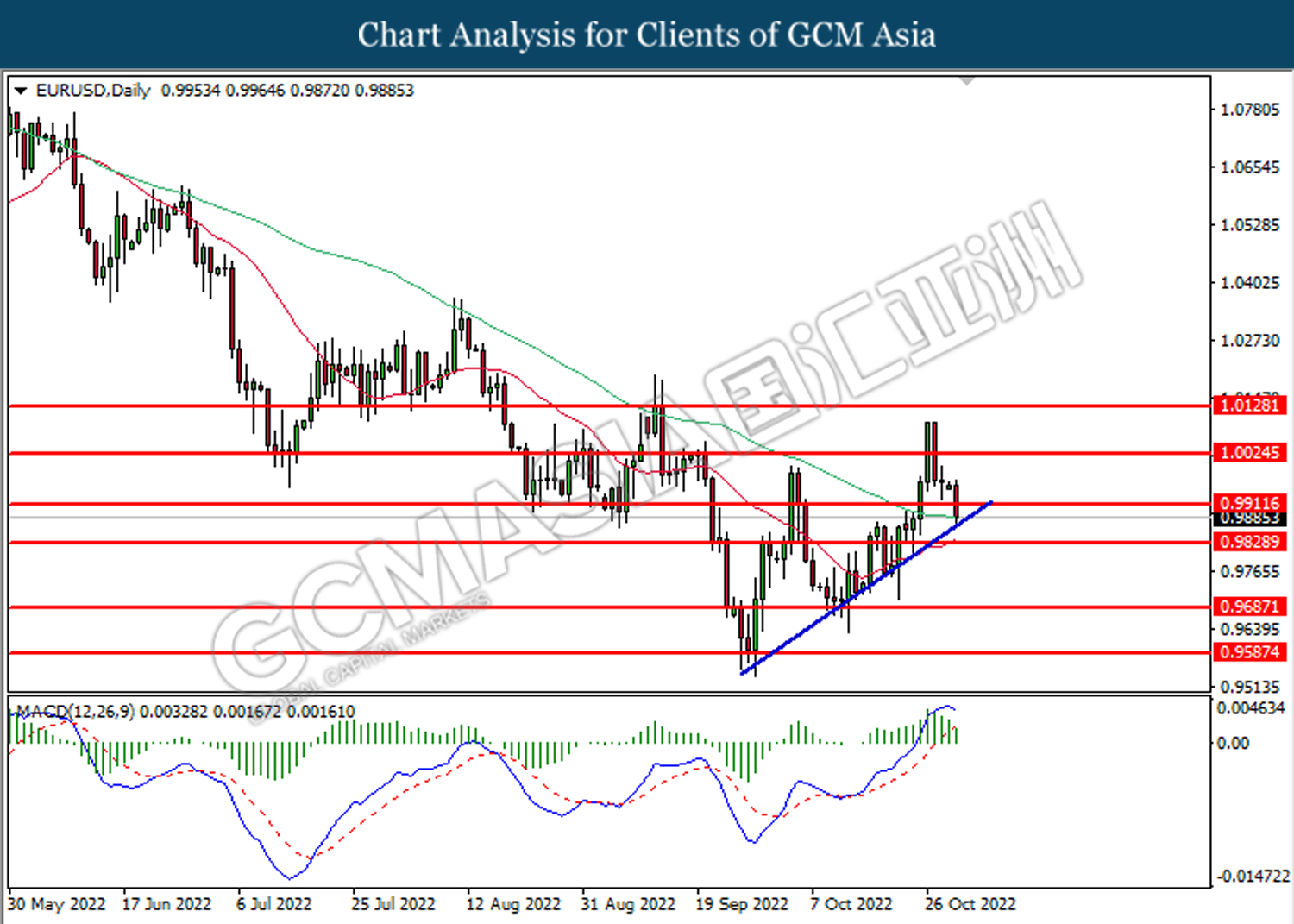

EURUSD, Daily: EURUSD was traded lower while currently testing the upward trendline. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the trendline.

Resistance level: 0.9910, 1.0025

Support level: 0.9830, 0.9685

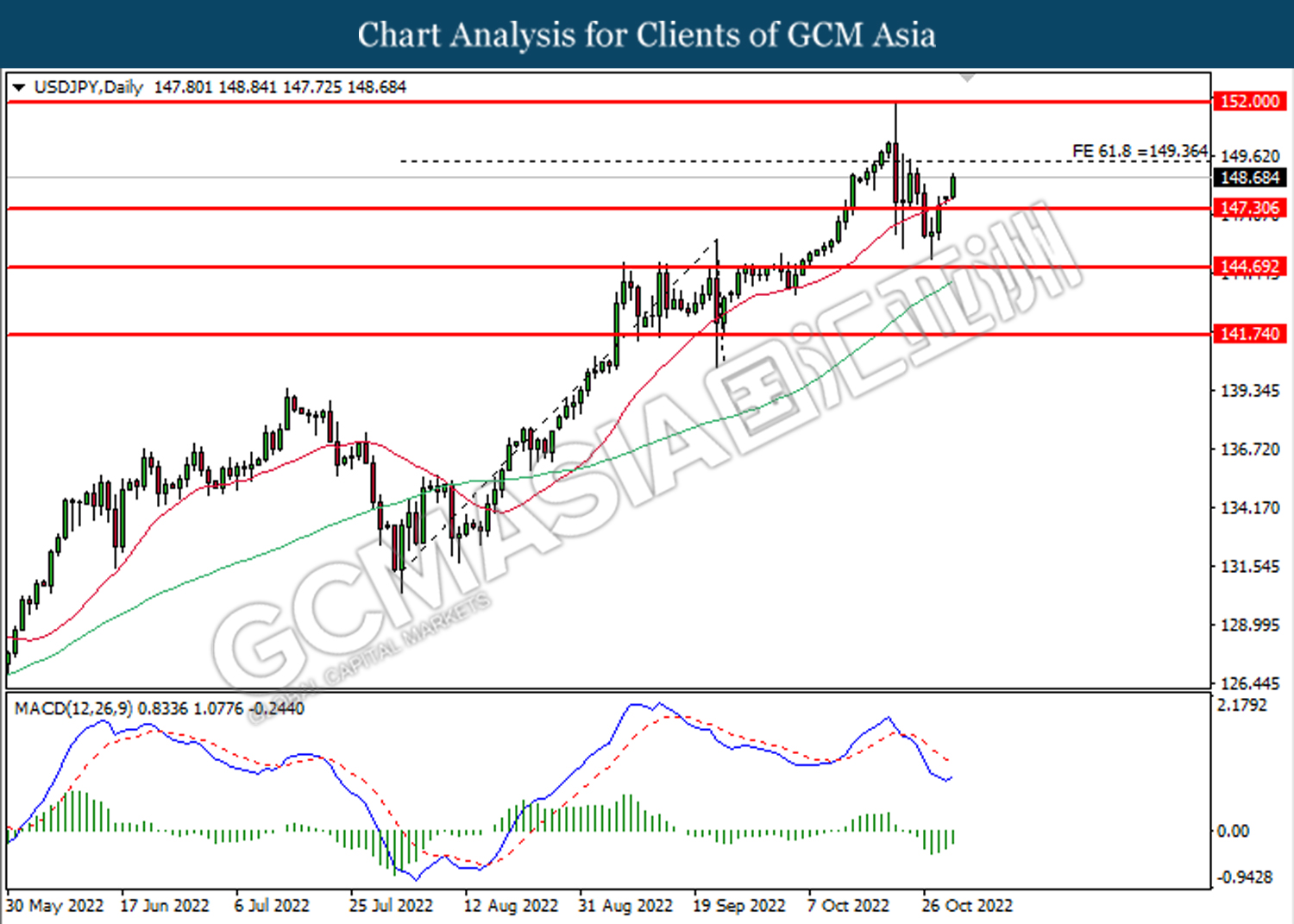

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 147.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 149.35.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

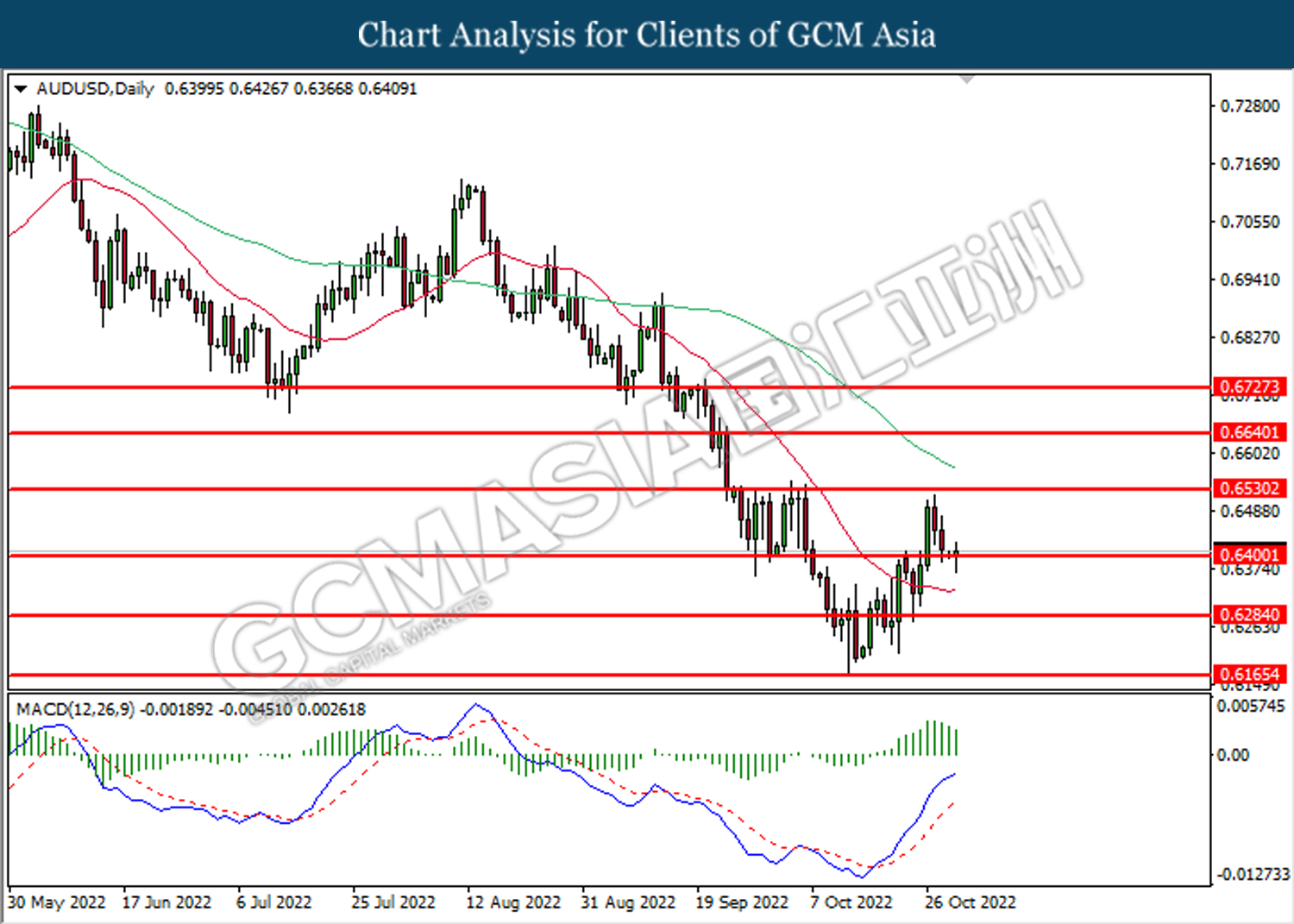

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.6400. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6530, 0.6640

Support level: 0.6400, 0.6285

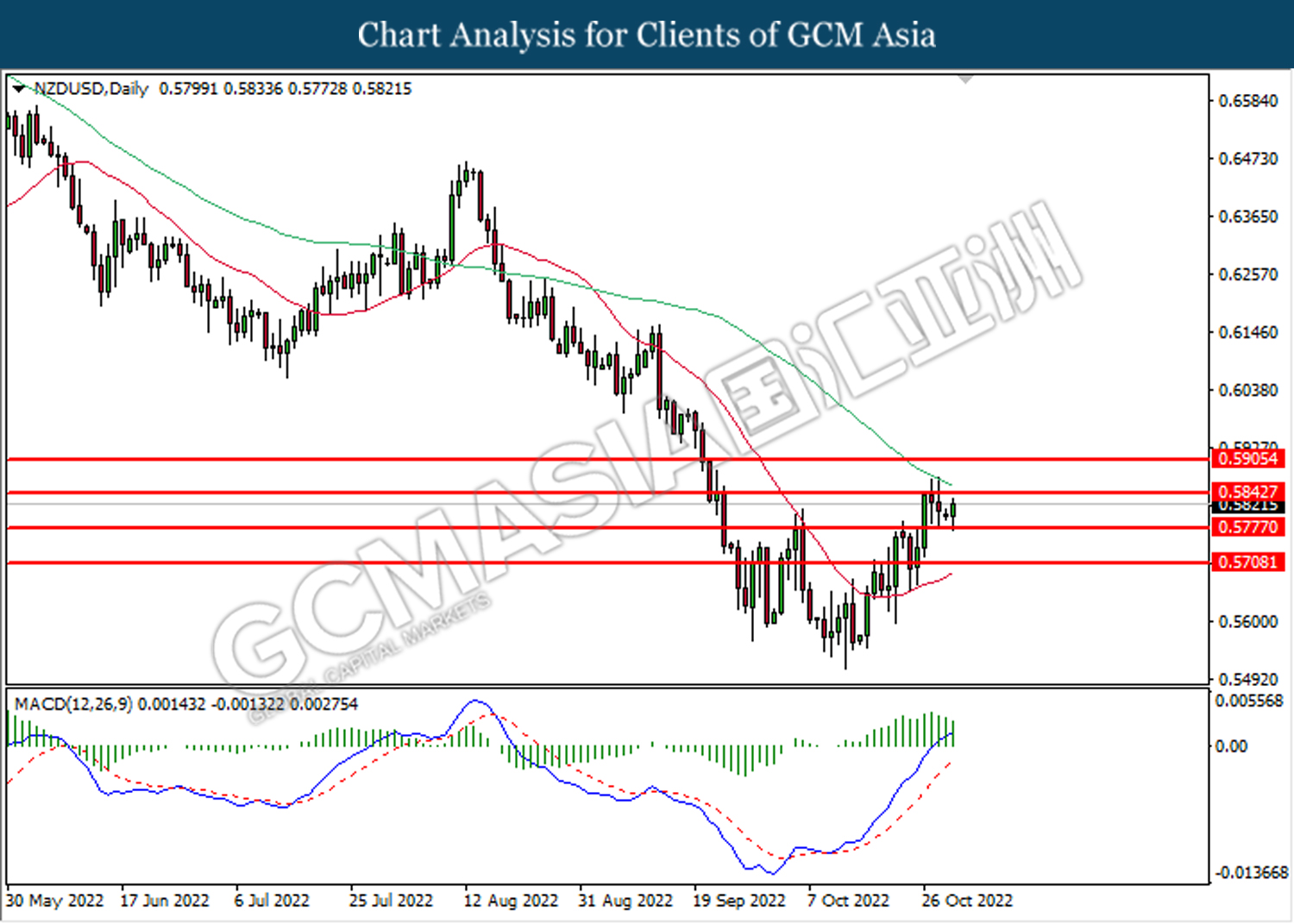

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.5770. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.5845, 0.5905

Support level: 0.5775, 0.5710

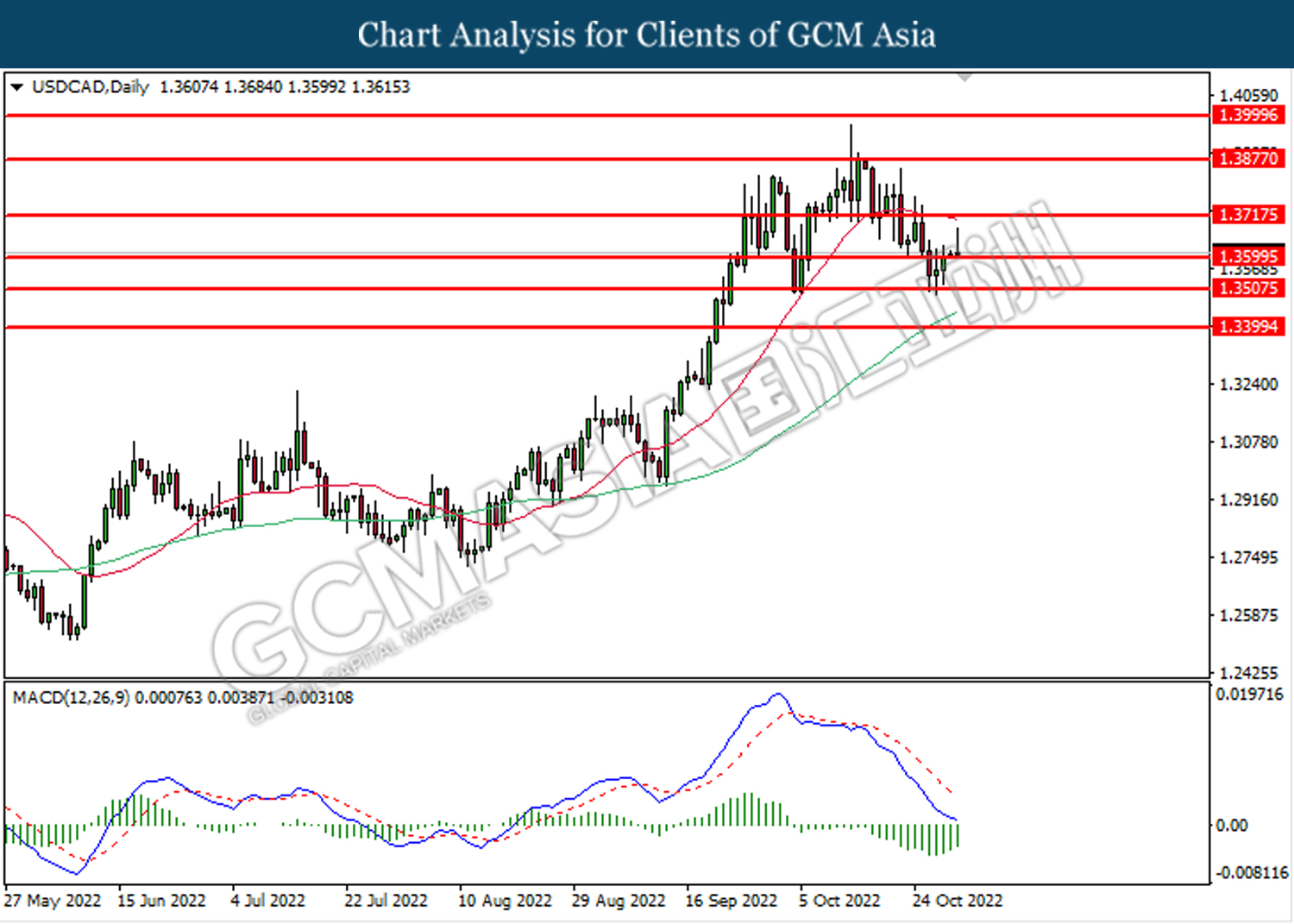

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3600. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3715.

Resistance level: 1.3715, 1.3875

Support level: 1.3600, 1.3505

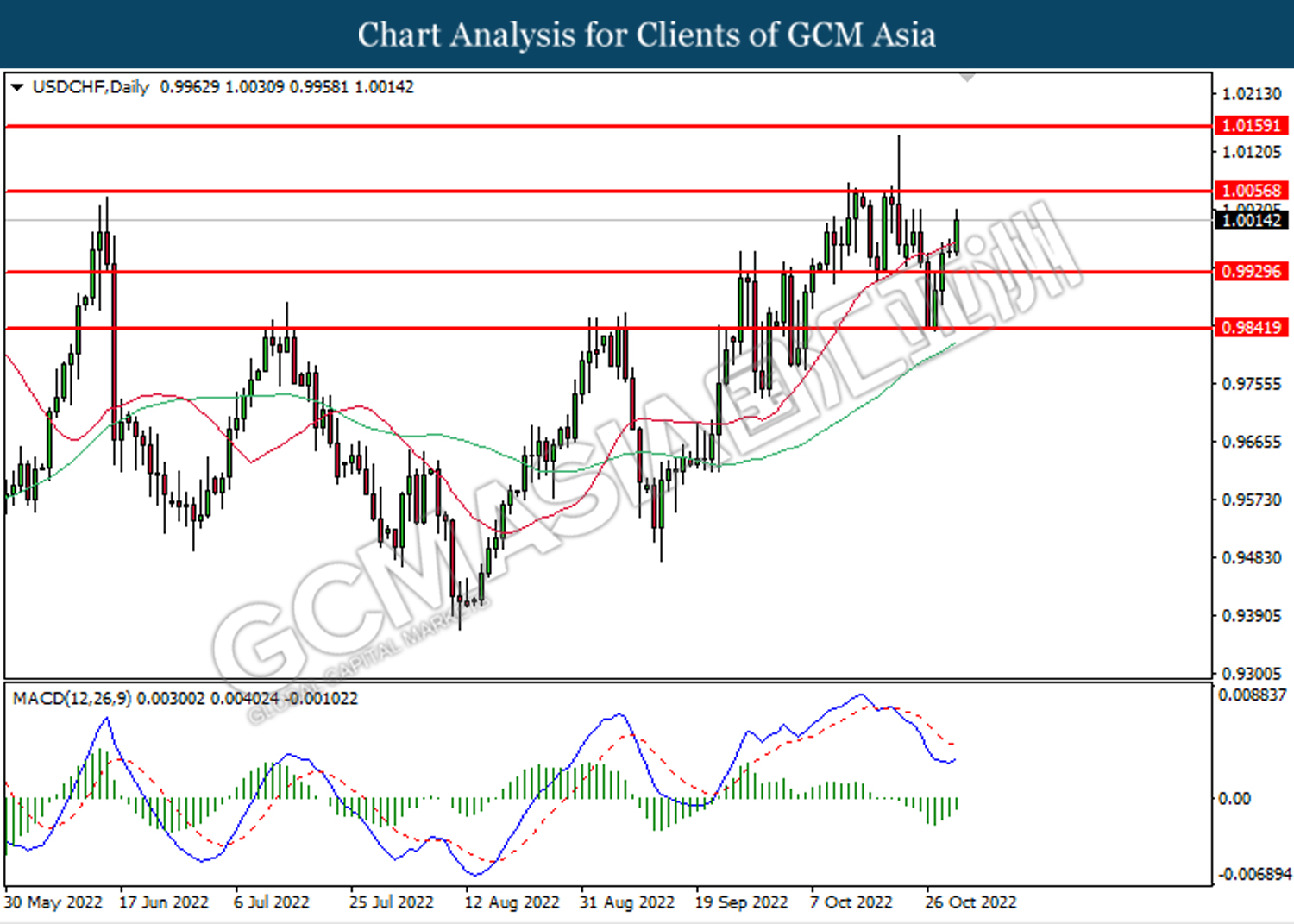

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9930. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0055.

Resistance level: 1.0055, 1.0160

Support level: 0.9930, 0.9840

CrudeOIL, Daily: Crude oil price was traded lower while currently testing the support level at 86.15. MACD which illustrated diminishing bullish momentum suggests the commodity to extend its losses after it successfully breakout below the support level at 86.15.

Resistance level: 89.45, 93.20

Support level: 86.15, 80.60

GOLD_, Daily: Gold price was traded lower following prior retracement from the resistance level at 1661.40. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1627.60.

Resistance level: 1661.40, 1693.35

Support level: 1627.60, 1600.00