2 January 2019 Afternoon Session Analysis

Dollar recovers amid trade dispute optimism.

Dollar index slowly regains its losses against its basket of six major rival pairs as market engendered by trade optimism. Despite recent risk-off rattled sentiment such as U.S government shutdown and a slower pace of Fed rate hike, market sentiments were starting to be lifted by renewed hopes where President Donald Trump have indicated that progress had been made toward a potential settlement of trade tensions between US and China. Besides that, Chinese state media were also stated that Chinese Premier Xi Jinping hoped the negotiating teams could meet each other halfway and reach an agreement that was mutually beneficial. Dollar index inched higher 0.03% to 95.70 as of writing. Meanwhile, AUD/USD plummets 0.50% to 0.7015 as of writing following the release of China’s Caixin PMI data. According to data, China’s Caixin Manufacturing PMI came in at 49.7 which is lower than forecasted reading of 50.3. The data which have illustrate gloomy economy outlook in China, providing bearish traders more reason to sell-off Australian Dollar where Australia is the largest trading partner with China and also highly sensitive to its economic conditions,

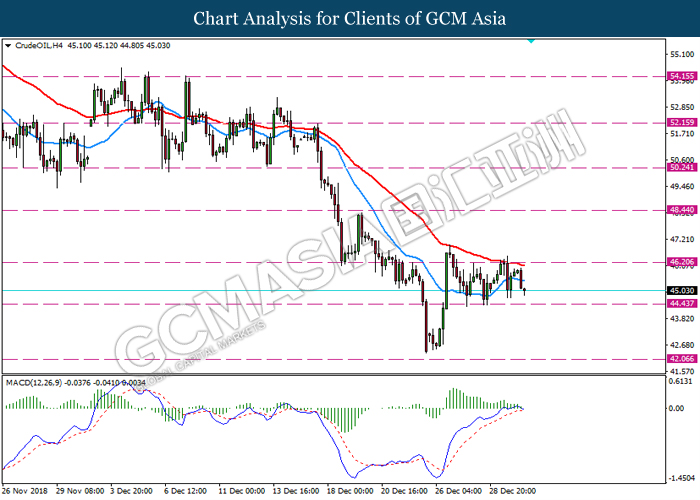

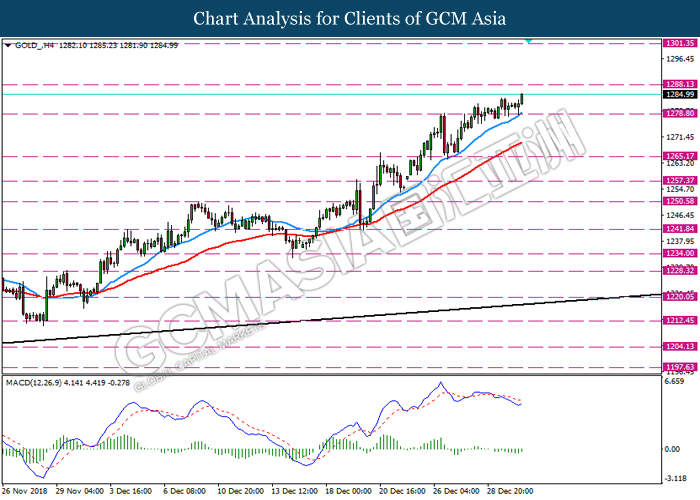

As for commodities market, crude oil price continues to struggle and slumped 0.38% to $44.94 following a surge in U.S crude oil production and also concerns of economic slowdown. Oversupply remains a major pressure in the market as crude oil inventories unable to provide optimism outlook with the reading of only -0.046M against forecasted of -2.869M. Besides that, a private survey also showed that China’s factory activity has started to showed signs of contractions for the first time in 19 months which could lead to less demand for the commodity. On the other hand, gold price soars 0.30% to 1283.82 at the time of writing following geopolitical risk continues to support the safe-haven asset.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Market & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Dec) | 51.5 | 51.5 | – |

| 17:30 | GBP – Manufacturing PMI (Dec) | 53.1 | 52.6 | – |

| 22:45 | USD – Manufacturing PMI (Dec) | 53.9 | 53.9 | – |

Technical Analysis

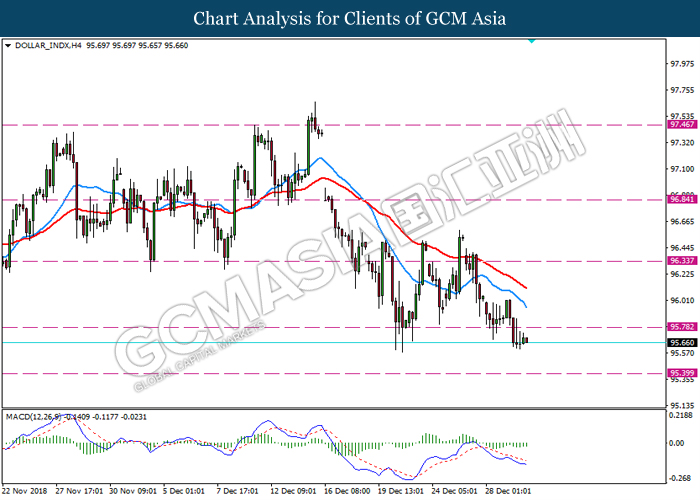

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level 95.80. MACD which illustrate bearish momentum suggest the pair to extend its losses towards the support level 95.40.

Resistance level: 95.80, 96.35

Support level: 95.40, 94.60

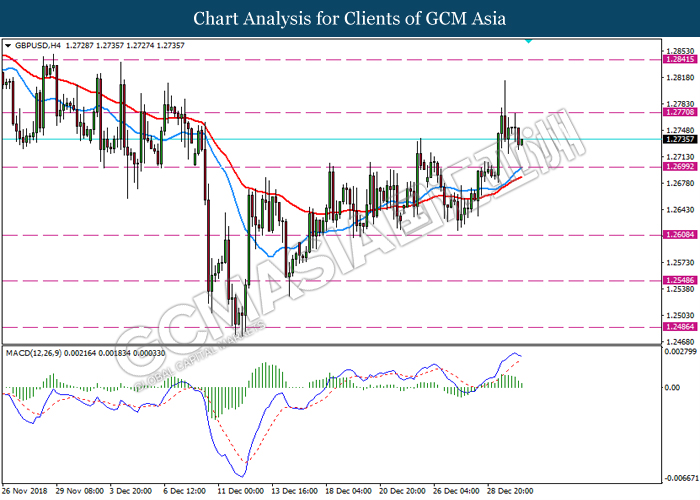

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level 1.2770. MACD which illustrate diminishing bullish momentum suggest the pair to be traded lower towards the support level 1.2700.

Resistance level: 1.2770, 1.2840

Support level: 1.2700, 1.2610

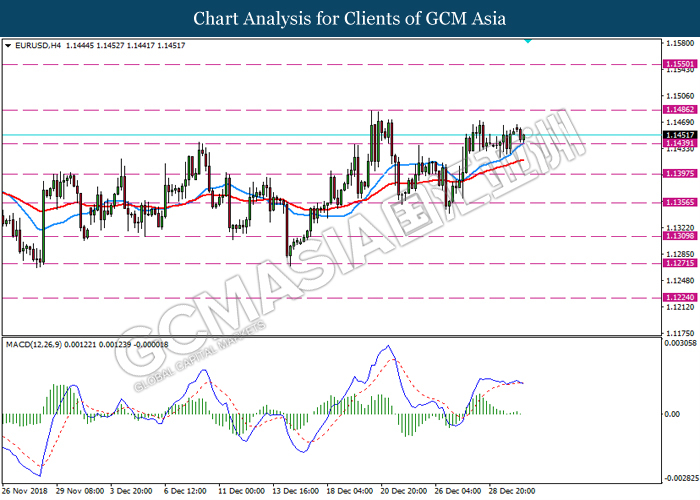

EURUSD, H4: EURUSD was traded higher following recent rebound from the support level 1.1440. MACD which illustrate bullish momentum suggest the pair to extend its rebound towards the resistance level 1.1485.

Resistance level: 1.1485, 1.1550

Support level: 1.1440, 1.1395

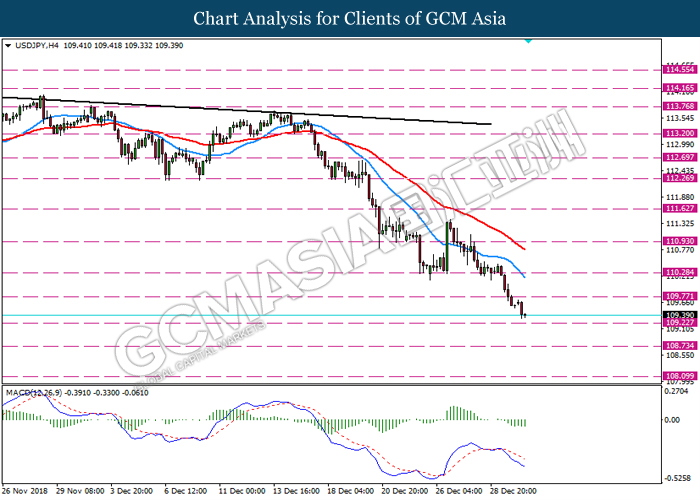

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level 109.75. MACD which illustrate persistent bearish momentum with the formation of death cross suggest the pair to extend its losses towards the support level 109.20

Resistance level: 109.75, 110.30

Support level: 109.20, 108.75

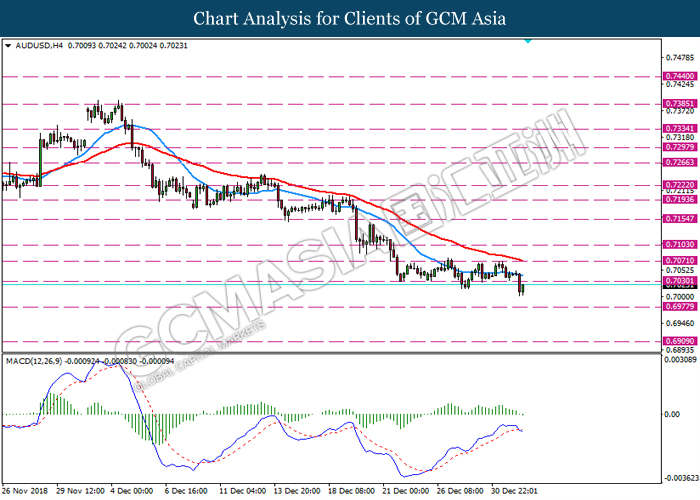

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previos support level 0.7030. MACD which illustrate bearish bias signal with the formation of death cross suggest the pair to extend its losses towards the support level 0.6975.

Resistance level: 0.7030, 0.7070

Support level: 0.6975, 0.6910

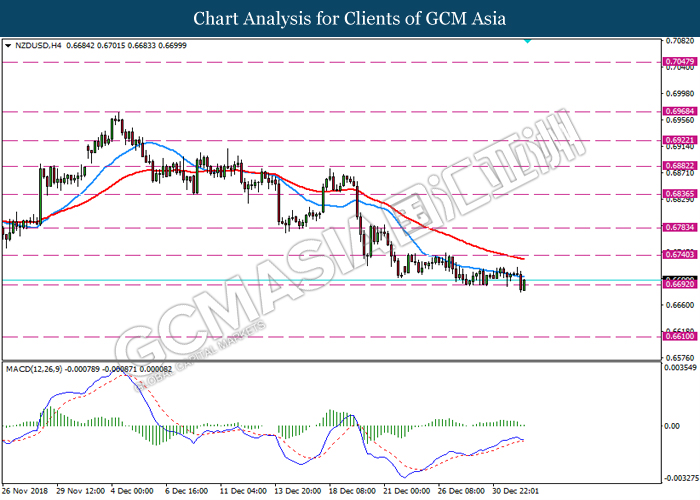

NZDUSD, H4: NZDUSD was traded higher following recent rebound from the support level 0.6690. MACD which illustrate starting bullish momentum suggest the pair to extend its rebound towards the resistance level 0.6740.

Resistance level: 0.6740, 0.6785

Support level: 0.6690, 0.6610

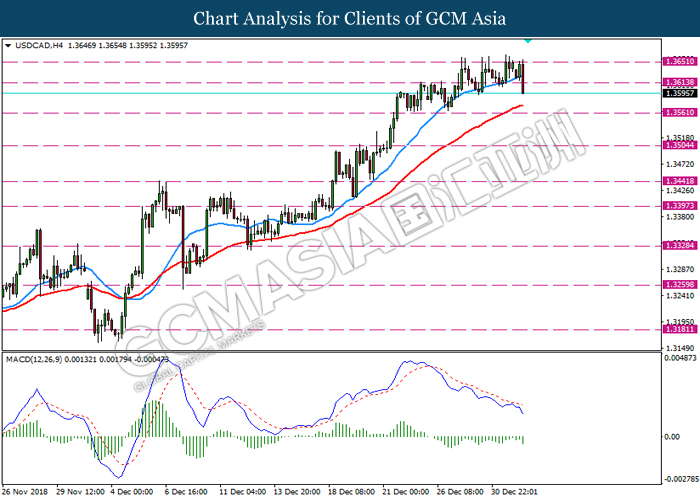

USDCAD, H4: USDCAD was traded lower following recent breakout below the previous support level 1.3615. MACD which display persistent bearish bias signal suggest the pair to extend its losses towards the support level 1.3560.

Resistance level: 1.3615, 1.3650

Support level: 1.3560, 1.3505

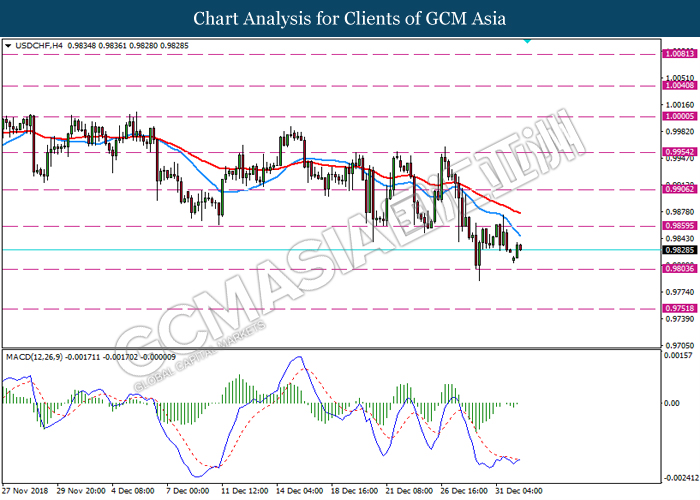

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level 0.9860. However, MACD which illustrate diminishing bearish momentum suggest the pair to undergo short term technical correction towards the resistance level 0.9860.

Resistance level: 0.9860, 0.9905

Support level: 0.9805, 0.9750

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level 46.20. MACD which illustrate bearish momentum with the formation of death cross suggest the pair to extend its retracement towards the support level 44.45.

Resistance level: 46.20, 48.44

Support level: 44.45, 42.05

GOLD_, H4: Gold was traded higher following recent rebound from the support level 128.80. MACD which illustrate persistent bullish signal suggest the pair to extend its gains towards the resistance level 1288.15.

Resistance level: 1288.15, 1301.35

Support level: 1278.80, 1265.15