02 March 2022 Afternoon Session Analysis

Euro slumped amid rising tensions Russia-Ukraine.

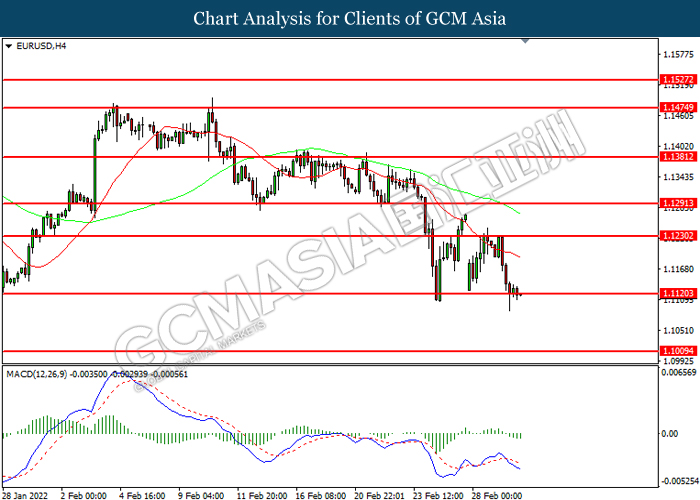

The Euro extend its losses following the rising tensions between Russia-Ukraine had continue to jeopardize the overall economic momentum in the European region. According to Reuters, the Council of the European Union voted on Tuesday on sanctions to exclude Russian banks from SWIFT system to harm their ability to operate globally. Earlier, Russia warned Kyiv residents to flee their homes while Russian commanders have intensified the bombardment of Ukrainian cities. The Europe imports mostly 40% of its natural gas consumption and more than quarter demand for oil from Russia. The rising tensions between Russia-Ukraine as well as the implementation on sanction toward Russia would likely to increase the of raw materials for European countries, which leading to higher inflation risk in future while dragging down the appeal for Euro. As of writing, EUR/USD depreciated by 0.04% to 1.1121.

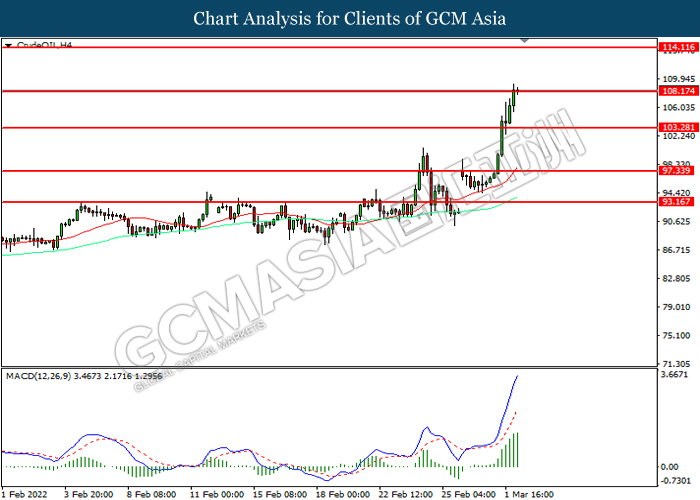

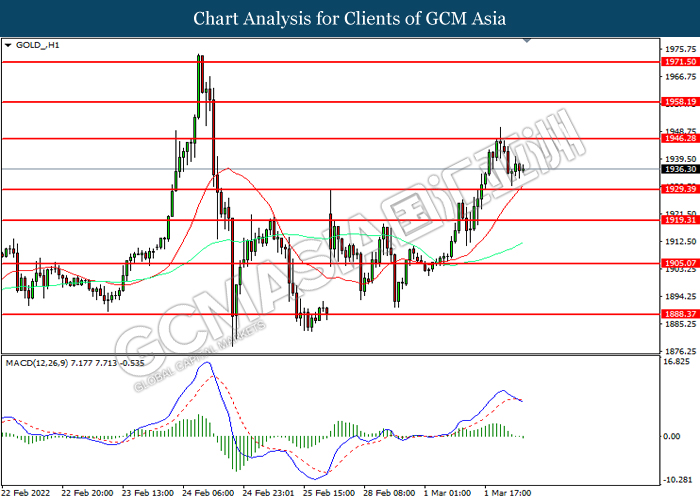

In the commodities market, the crude oil price surged 2.02% to 110.10 per barrel as of writing. The oil market edged higher over the backdrop of magnified tensions between Russian-Ukraine had continue to insinuate the oil supply concerns in future. On the other hand, the gold price appreciated by 0.05% to $1937.90 per troy ounces as of writing amid diminishing risk appetite in the global financial market had stoked a shift in sentiment toward safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

Tentative GBP Annual Budget Release

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Unemployment Change (Feb) | -48K | -23K | – |

| 18:00 | EUR – CPI (YoY) (Feb) | 5.10% | 5.30% | – |

| 21:15 | USD – ADP Nonfarm Employment Change (Feb) | -301K | 350K | – |

| 23:00 | CAD – BoC Interest Rate Decision | 0.25% | 0.50% | – |

| 23:30 | CrudeOIL – Crude Oil Inventories | 4.515M | – | – |

Technical Analysis

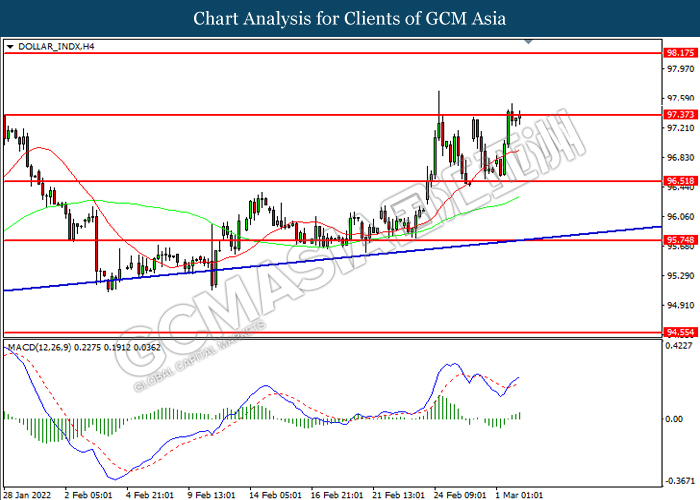

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 97.35. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 97.35, 98.20

Support level: 96.50, 95.75

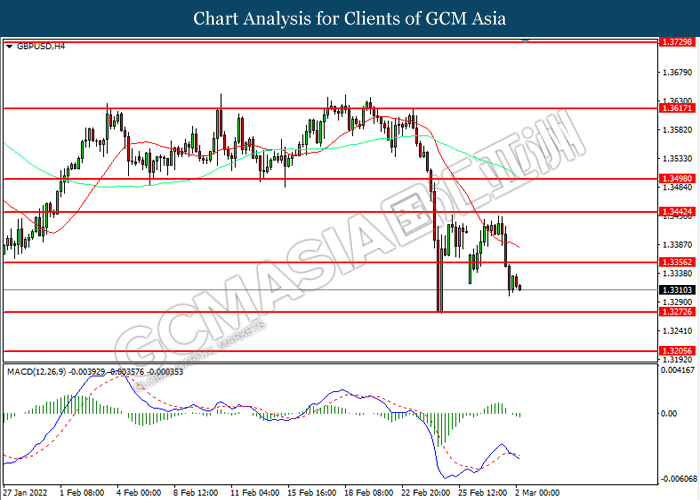

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level at 1.3355. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level at 1.3275.

Resistance level: 1.3355, 1.3440

Support level: 1.3275, 1.3205

EURUSD, H4: EURUSD was traded lower while currently testing the support level at 1.1120. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.1230, 1.1290

Support level: 1.1120, 1.1010

USDJPY, H4: USDJPY was traded higher following prior rebound from the support level at 114.60. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level at 115.65.

Resistance level: 115.65, 116.25

Support level: 114.60, 113.65

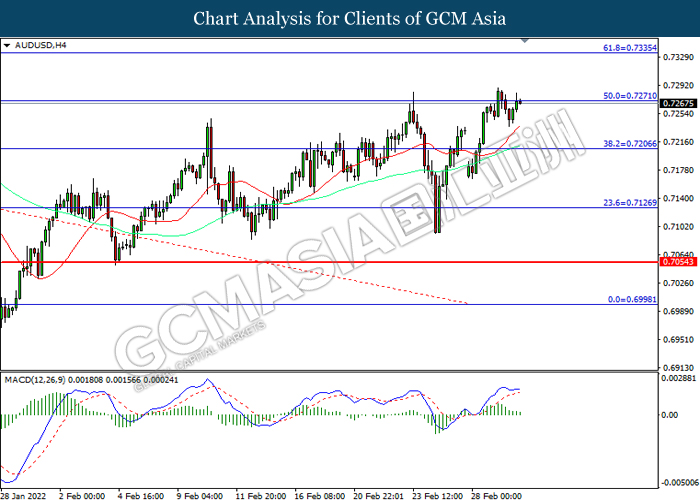

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level at 0.7270. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.7270, 0.7335

Support level: 0.7205, 0.7125

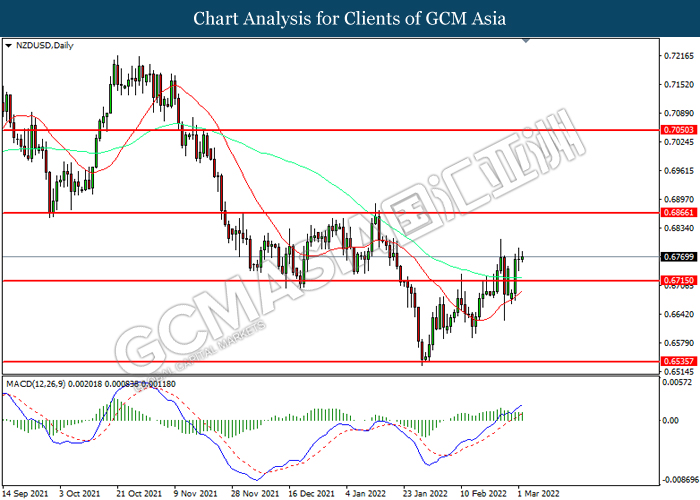

NZDUSD, Daily: NZDUSD was traded higher following prior breakout above the previous resistance level at 0.6715. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level at 0.6865.

Resistance level: 0.6865, 0.7050

Support level: 0.6715, 0.6535

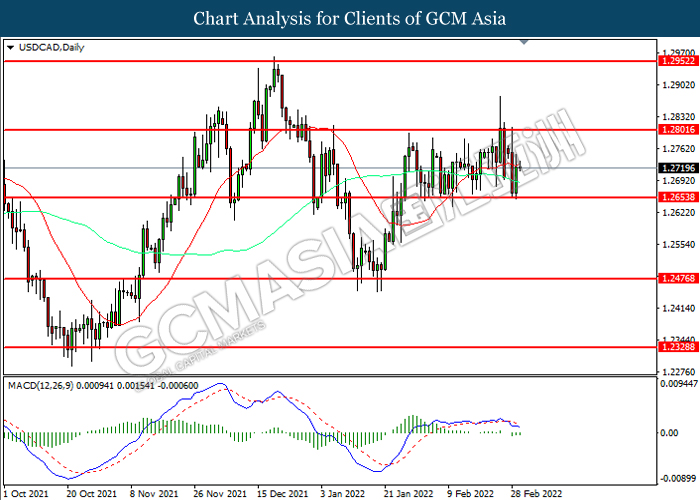

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.2655. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2800, 1.2950

Support level: 1.2655, 1.2475

USDCHF, Daily: USDCHF was traded lower while currently testing the support level at 0.9175. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.9270, 0.9345

Support level: 0.9175, 0.9095

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 108.15. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 108.15, 114.10

Support level: 103.30, 97.35

GOLD_, H1: Gold price was traded lower while currently near the support level at 1929.40. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1946.30, 1958.20

Support level: 1929.40, 1919.30