02 March 2023 Morning Session Analysis

Dollar slumped amid optimism over China’s economic recovery.

The dollar index, which is traded against a basket of six major currencies, lost its luster recently as the upbeat economic data in China had boosted the market optimism over the on track recovery in the second largest economy in the world. Yesterday, China posted its Manufacturing PMI data and Non-Manufacturing PMI at 52.6 and 56.3, stronger than the consensus forecast at 50.5 and 55.0 respectively. These data mirrored that the China’s factory and services activity experienced a decent rebound in the month of February after the reopening of economy not too long ago. With that, it wiped off the cloudy outlook of the China economy while sparked large buying momentum in the related currency market, such as the major trading partners of China including Aussie and New Zealand dollar. Besides, the US manufacturing activity contracted for the fourth consecutive straight month in February, yet showing some sign of activity stabilization compared to the previous month. According to the ISM, the US Manufacturing PMI rose from the prior month’s reading of 47.4 to 47.7 in February, slightly below the consensus forecast at 48.0. As of writing, the dollar index dropped 0.44% to 104.40.

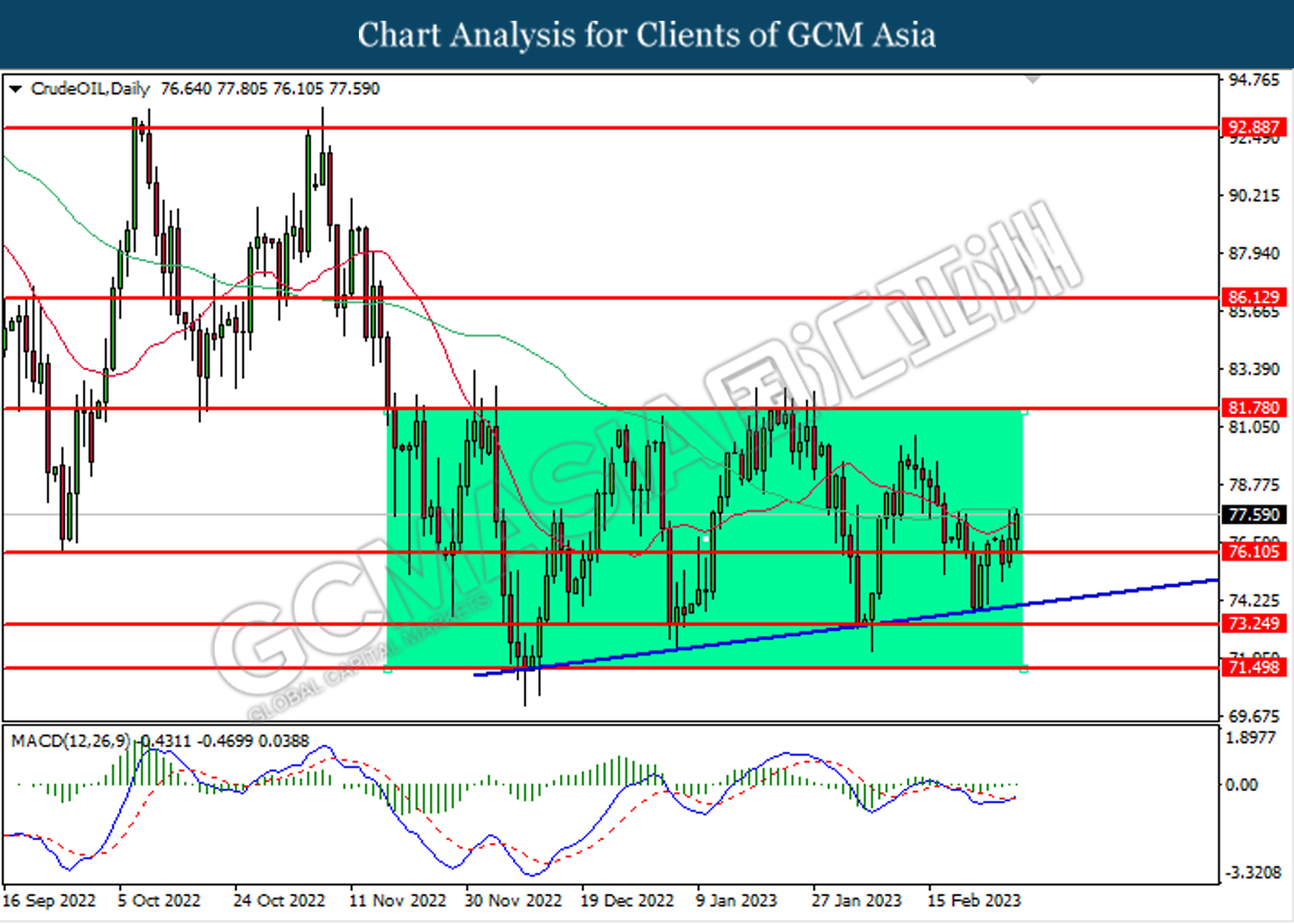

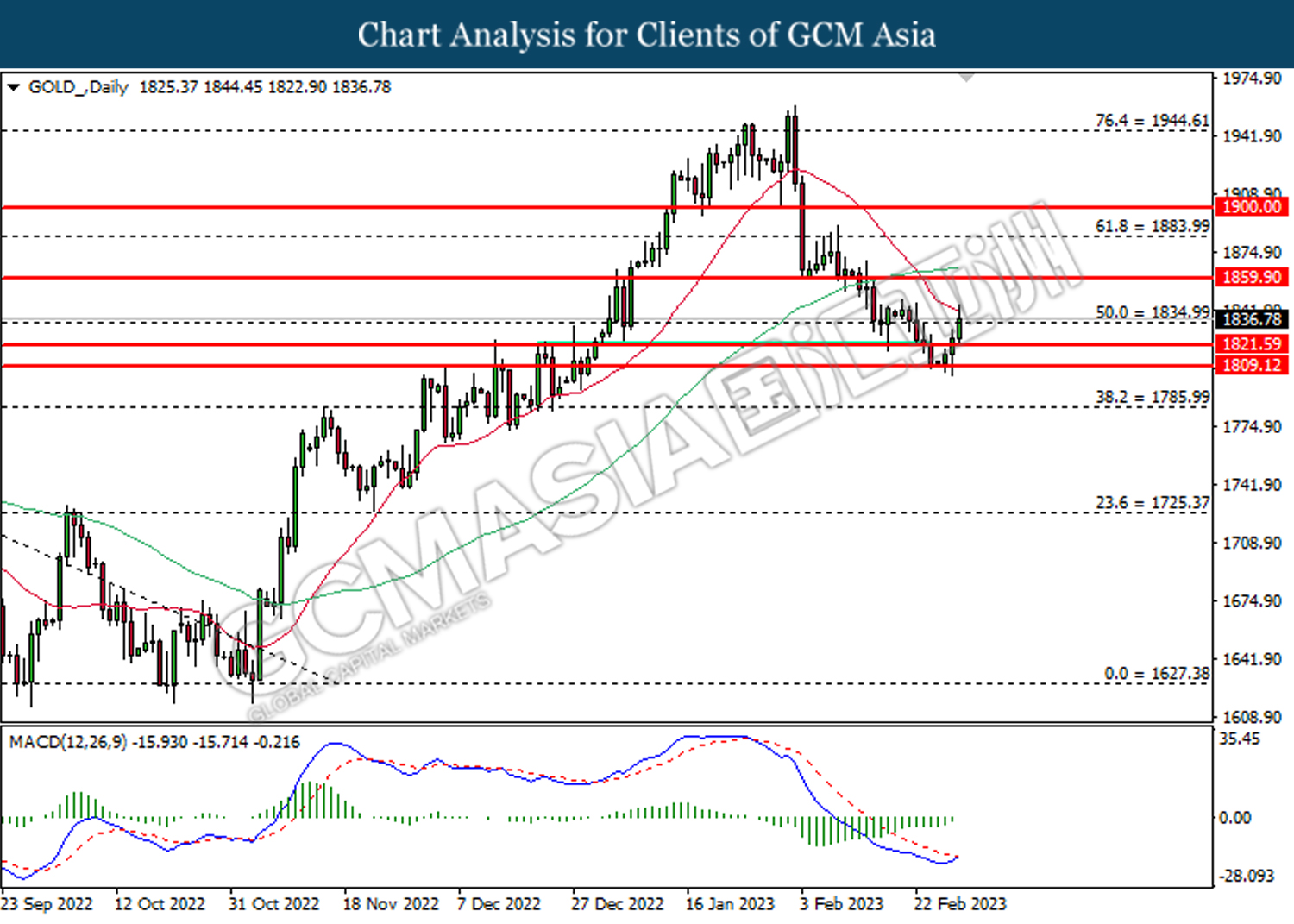

In the commodities market, crude oil prices were up by 1.17% to $77.60 per barrel as China recovery hopes outweighed the rising oil inventories level in the US. Besides, gold prices edged up by 0.58% to $1837.15 per troy ounce as the Greenback failed to revive amid disappointed manufacturing activity growth in the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 18:00 | EUR – CPI (YoY) (Feb) | 8.6% | 8.2% | – |

| 21:30 | USD – Initial Jobless Claims | 192K | 197K | – |

Technical Analysis

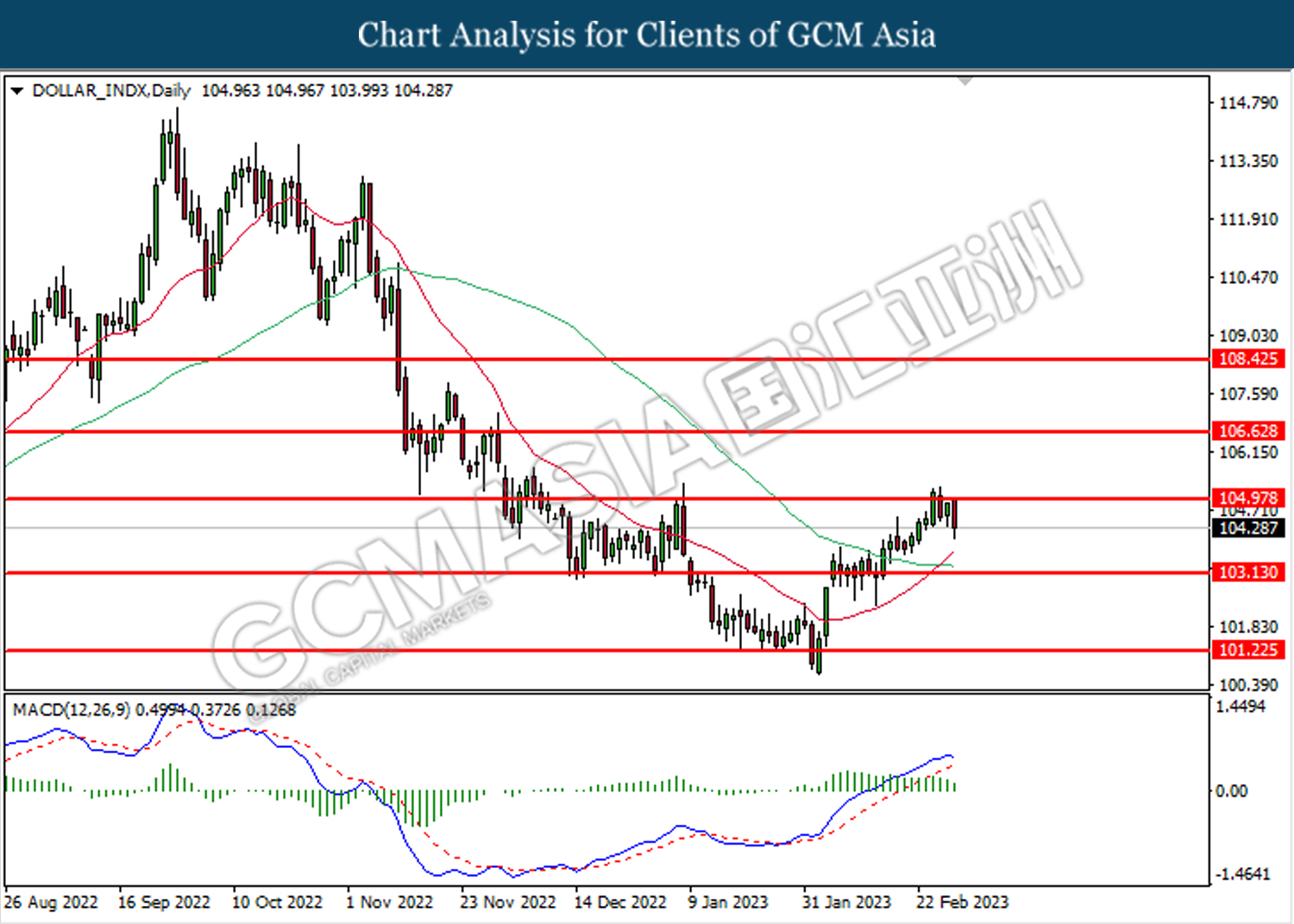

DOLLAR_INDX, Daily: Dollar index was traded lower following the prior retracement from the resistance level at 105.00. MACD which illustrated diminishing bullish momentum suggests the index to extend its losses toward the support level at 103.15.

Resistance level: 105.00, 106.65

Support level: 103.15, 101.25

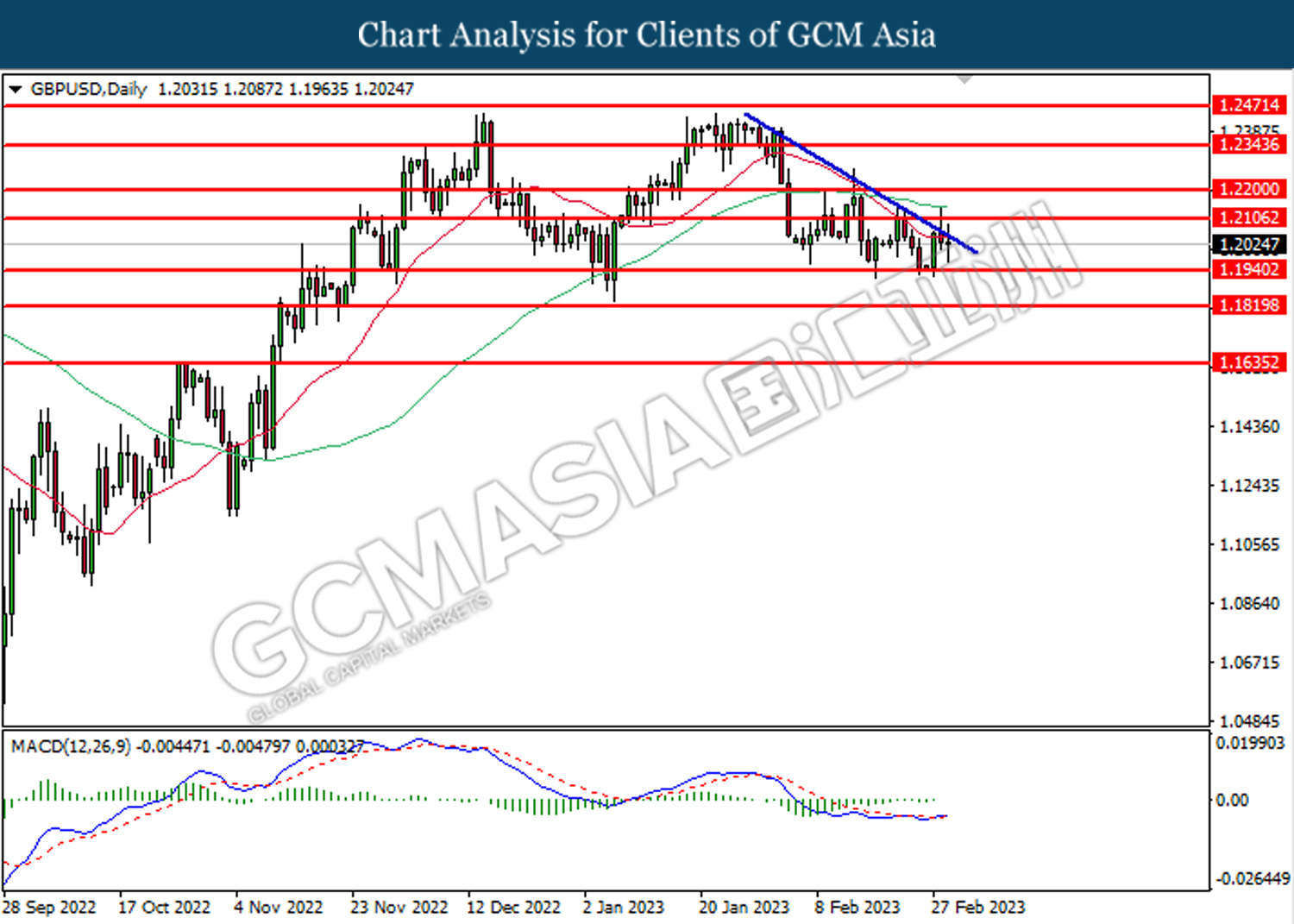

GBPUSD, Daily: GBPUSD was traded lower following the prior retracement from the downward trend line. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2105, 1.2200

Support level: 1.1940, 1.1820

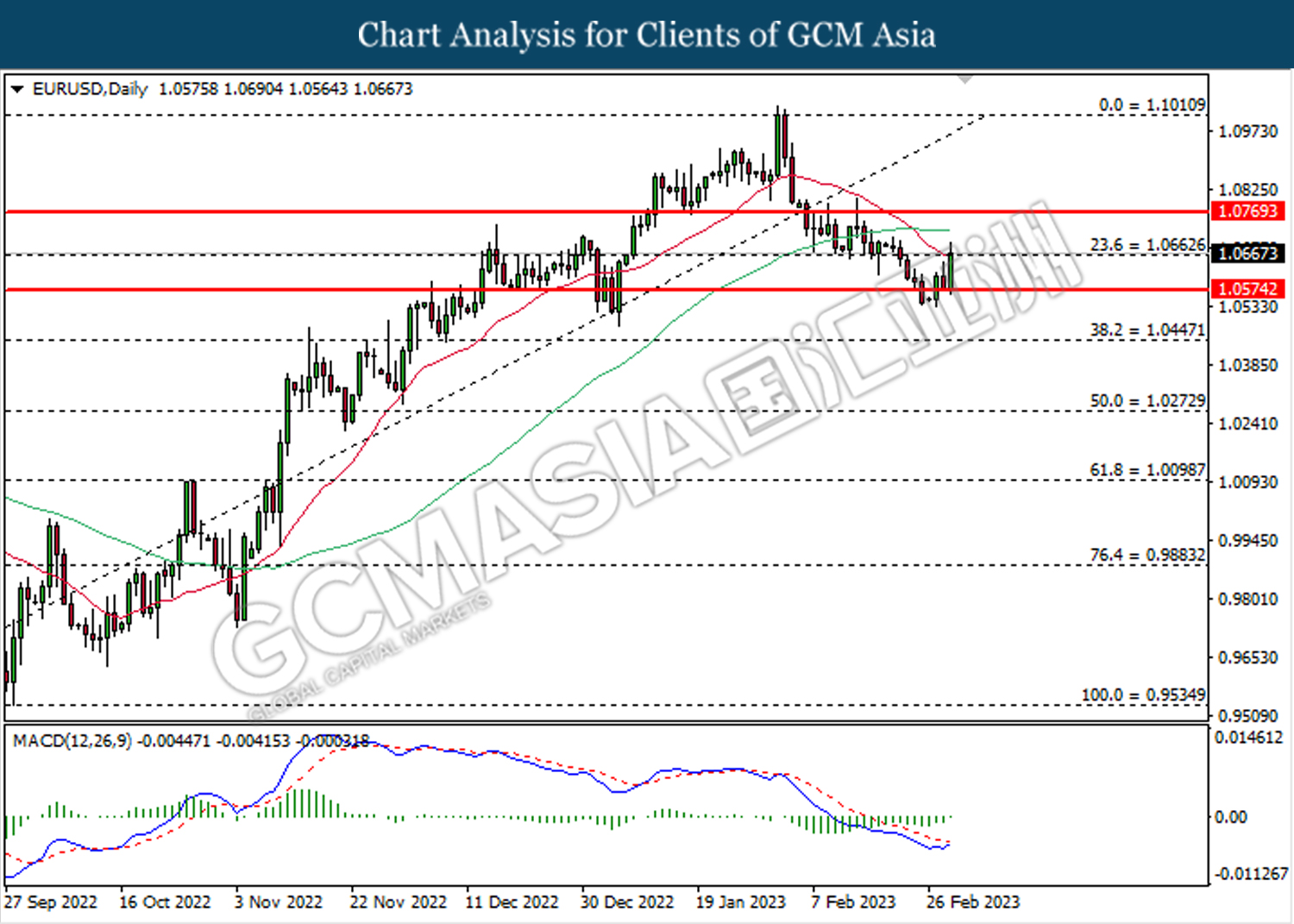

EURUSD, Daily: EURUSD was traded higher while currently testing the resistance level at 1.0665. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.0665, 1.0770

Support level: 1.0445, 1.0275

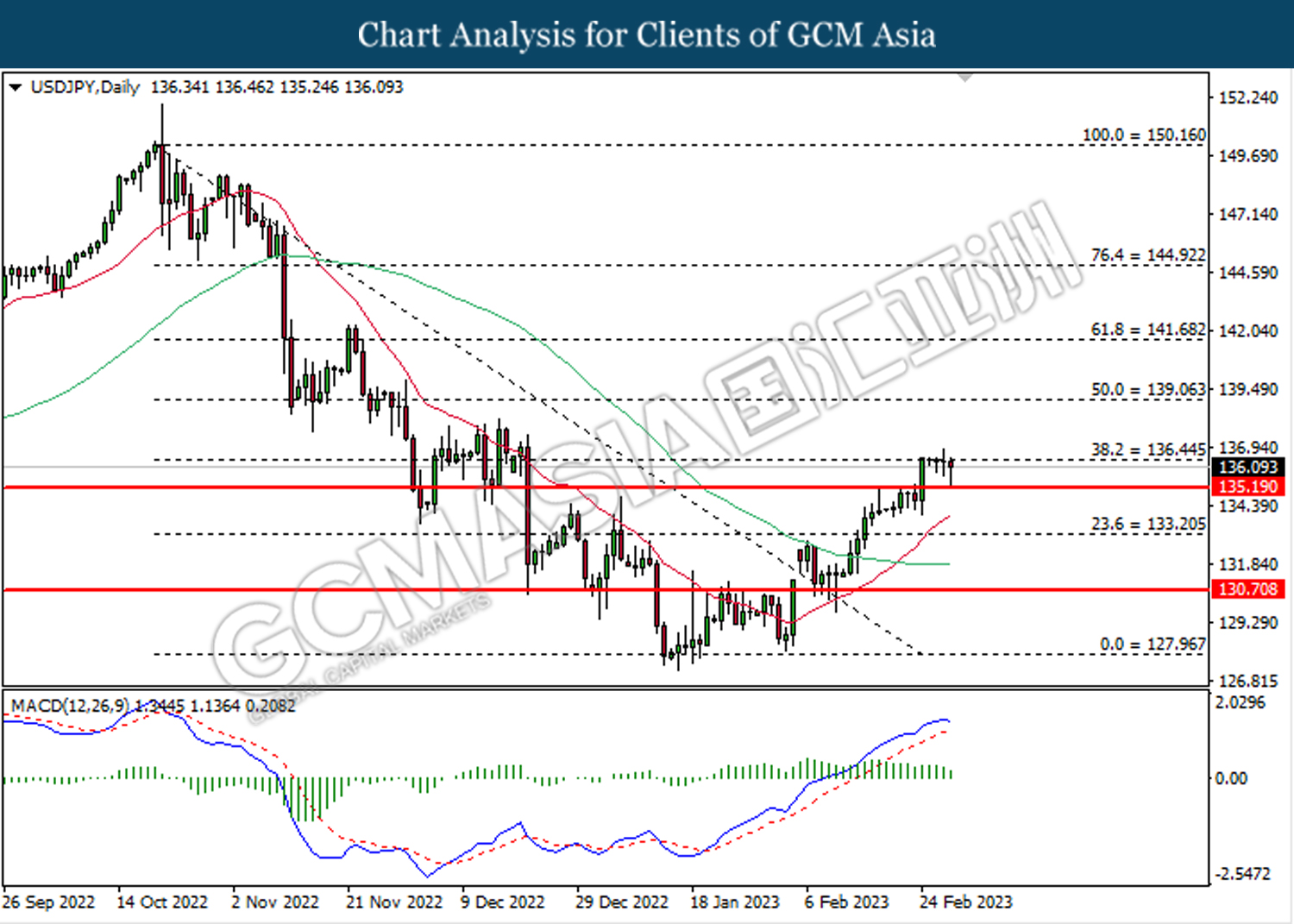

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 136.45. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.45, 139.05

Support level: 135.20, 133.20

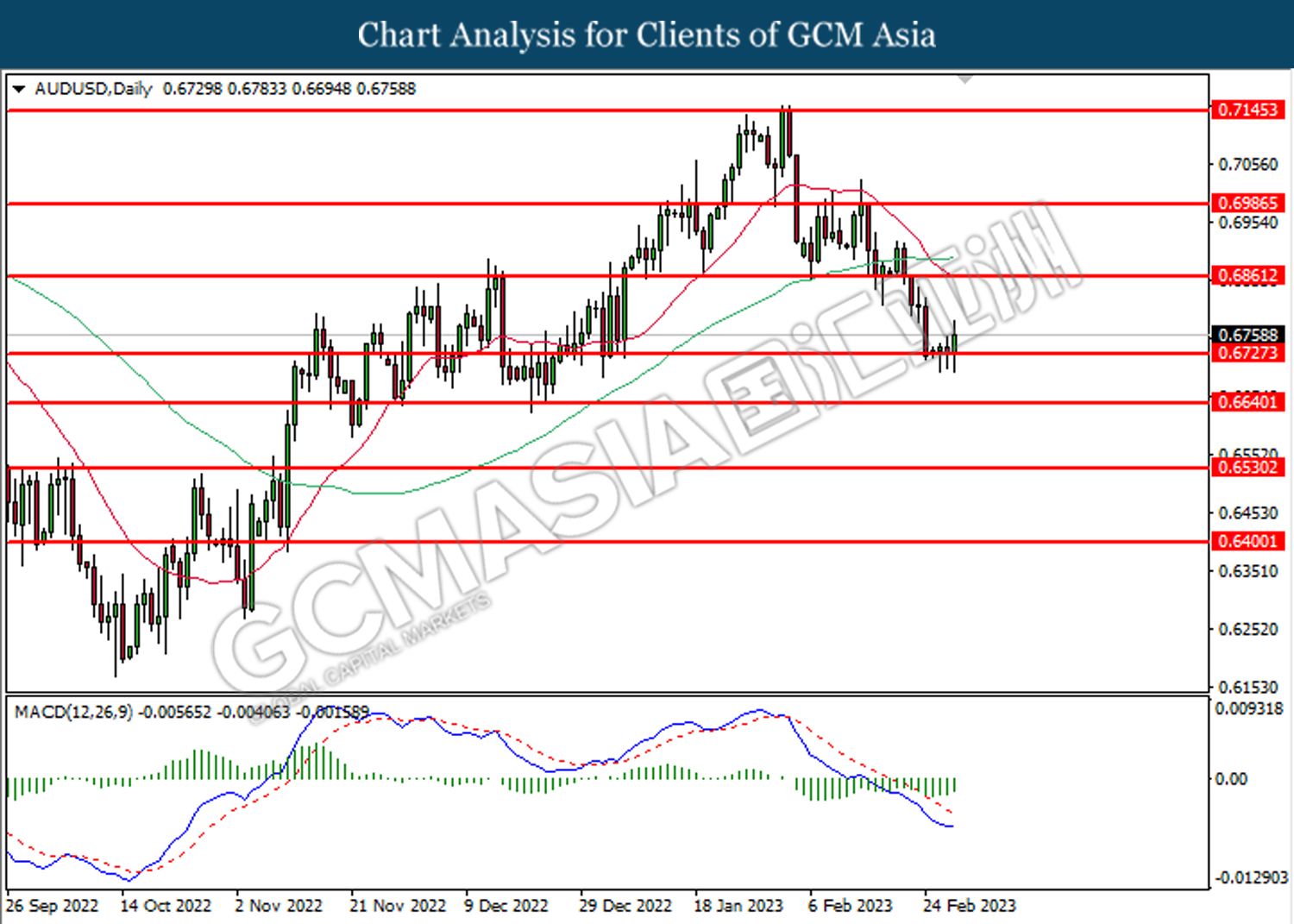

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6725. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

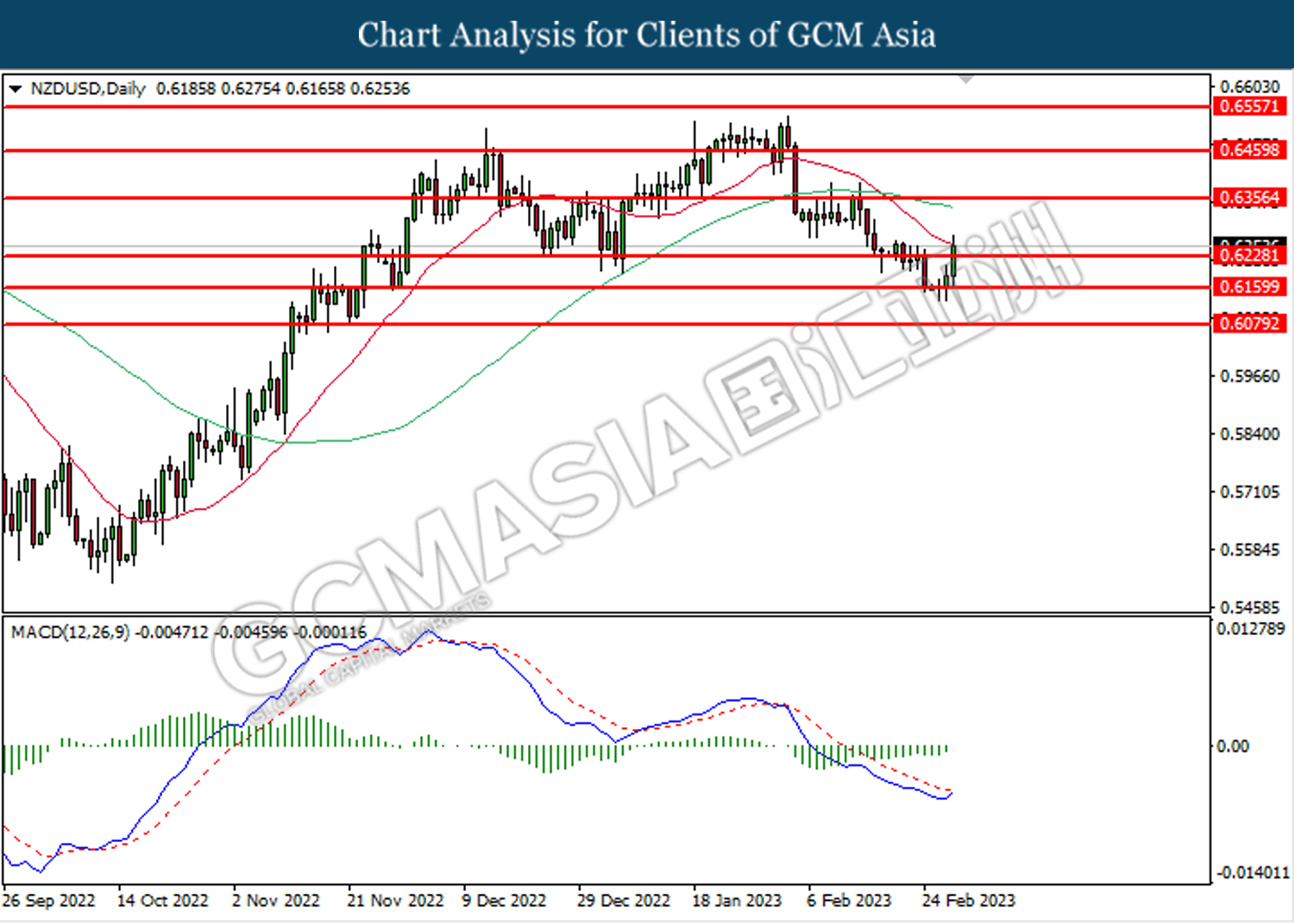

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.6230. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6230.

Resistance level: 0.6230, 0.6355

Support level: 0.6160, 0.6080

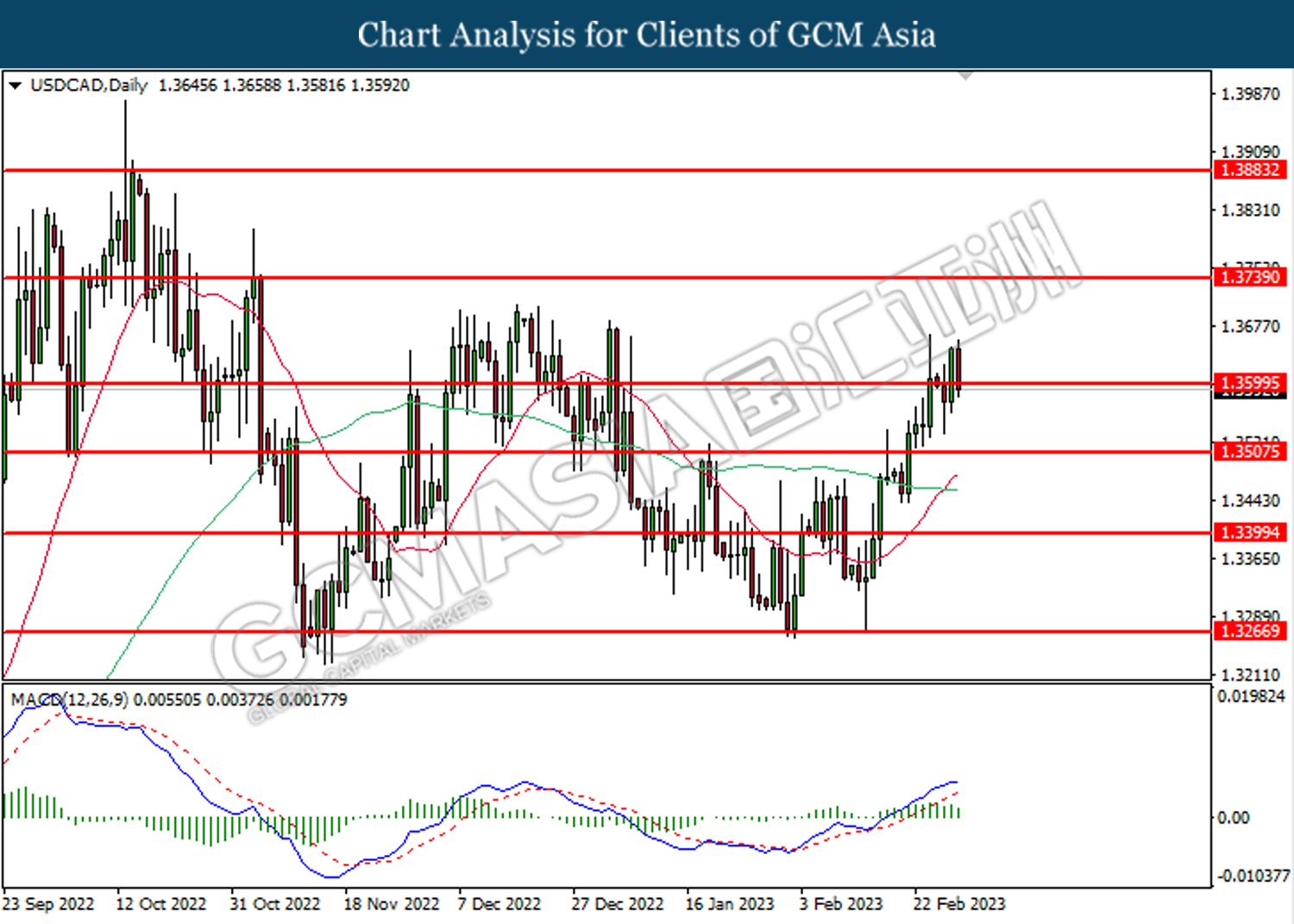

USDCAD, Daily: USDCAD was traded lower while currently testing the support level at 1.3600. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.3740, 1.3885

Support level: 1.3600, 1.3505

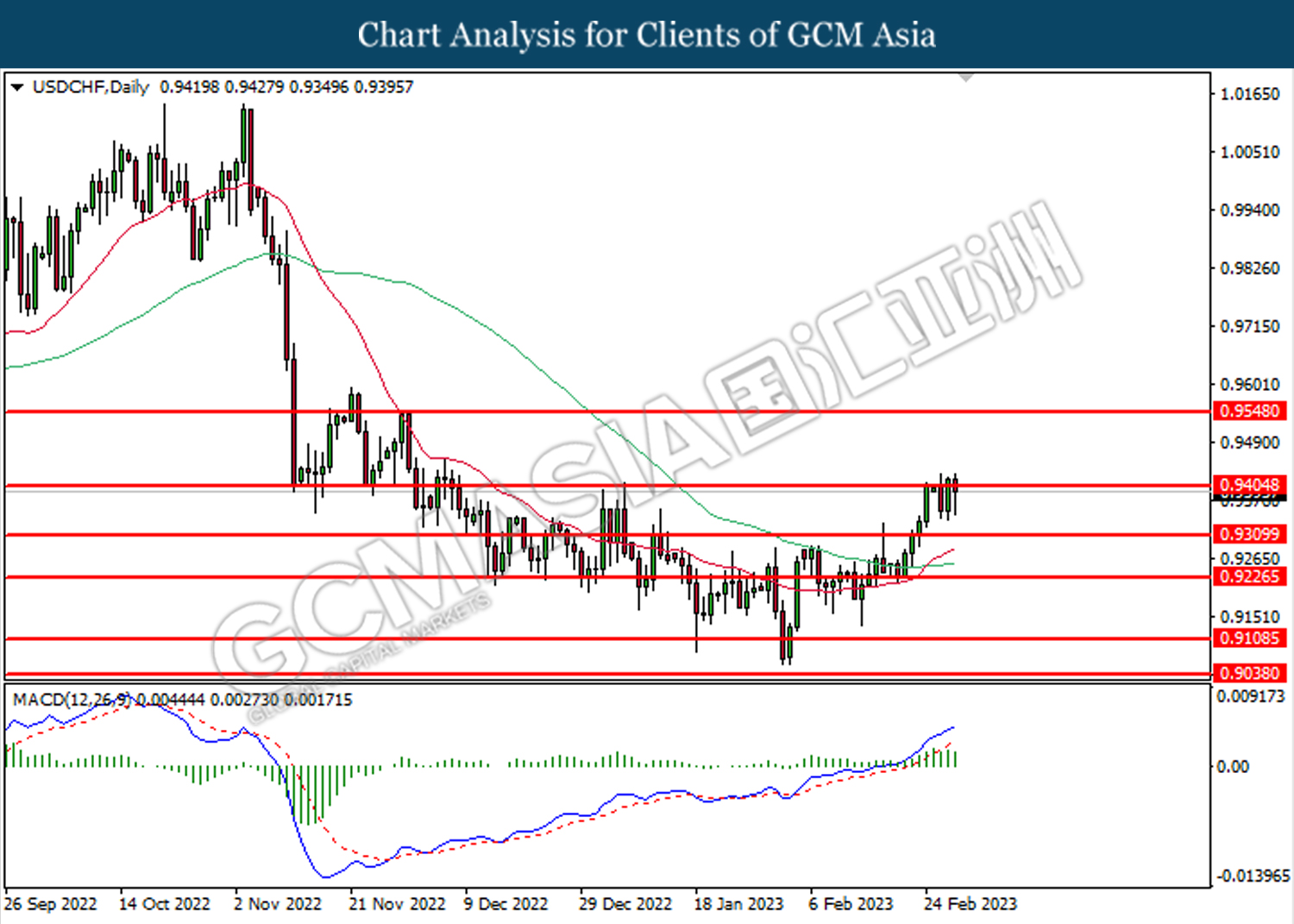

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9405. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9405, 0.9550

Support level: 0.9310, 0.9225

CrudeOIL, Daily: Crude oil price was traded higher following the prior breakout above the previous resistance level at 76.10. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward the resistance level at 81.80.

Resistance level: 81.80, 86.15

Support level: 76.10, 73.25

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1835.00 MACD which illustrated diminishing bearish momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level at 1835.00.

Resistance level: 1835.00, 1859.90

Support level: 1821.60, 1809.15