2 May 2023 Afternoon Session Analysis

The Aussie soars up after the RBA hikes cash rates.

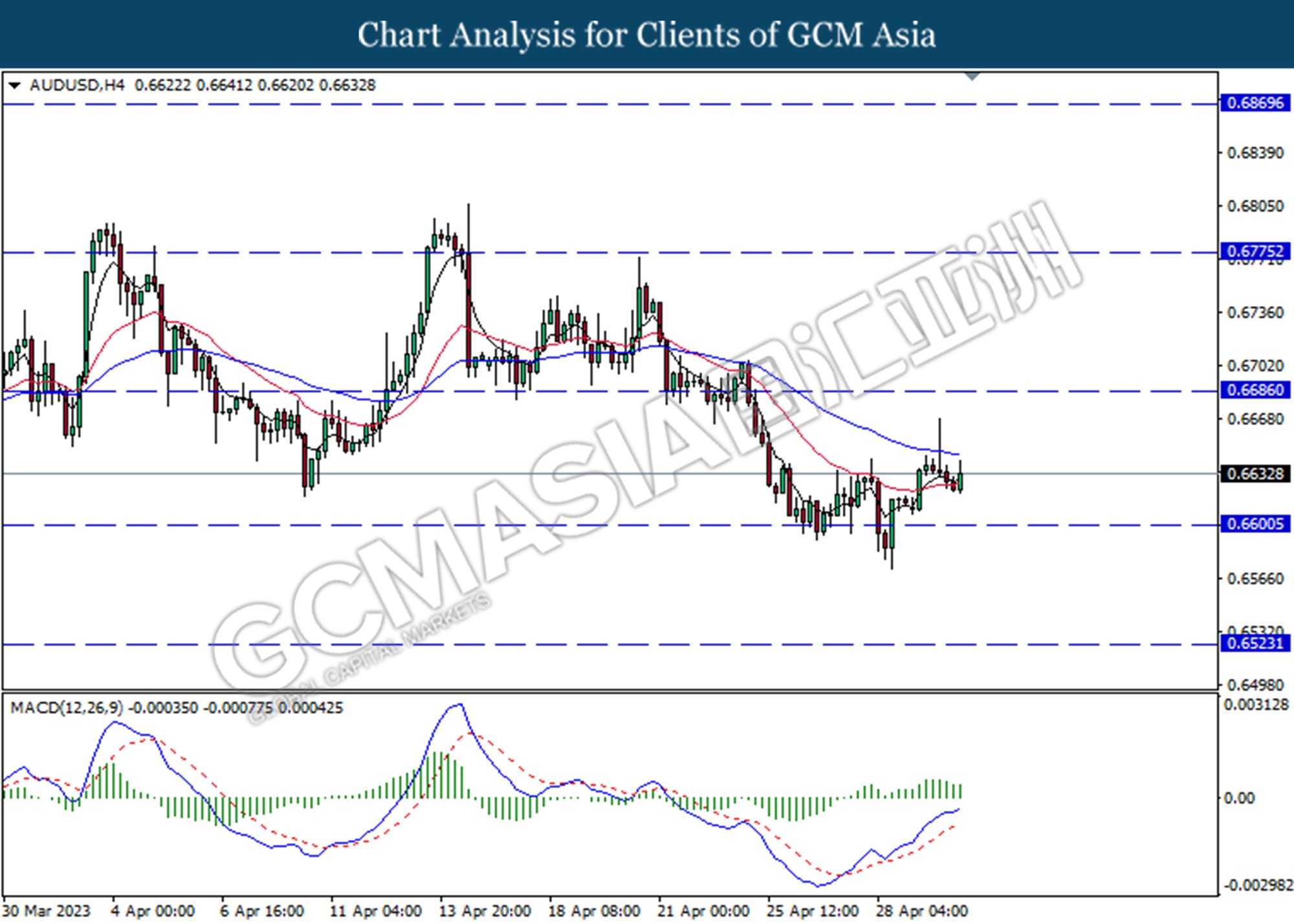

The Reserve Bank of Australia (RBA) hikes cash rate by 25 basis points to 3.85% from 3.60%, the Aussie soars up afterward. Since the RBA Governor Philip Lowe had maintained the interest rate at 3.60% in April, the markets anticipate that the RBA will likely remain on hold on its following tightening monetary policy. However, the RBA moves to surprise the market. Lowe said that the inflation in Australia has passed its peak, but the inflation remains sticky at 7% and far from the RBA 2% target range. The statement mentioned that inflation needs to take a couple of years to decline and expects to achieve 4.5% and the end of 2023 and 3% in 2025, according to the central bank. This also contributed to the RBA’s decision to maintain its tightening monetary policy. Besides, Australia’s recent labor data confirmed that the labor market remains in tight conditions with the unemployment rate at a bear 50-year low. As wage growth has increased in response to the tight labor market and high inflation. It provides additional space for the RBA to tighten in May. As of writing, the AUD/USD soars up by 1.16% to $0.6706.

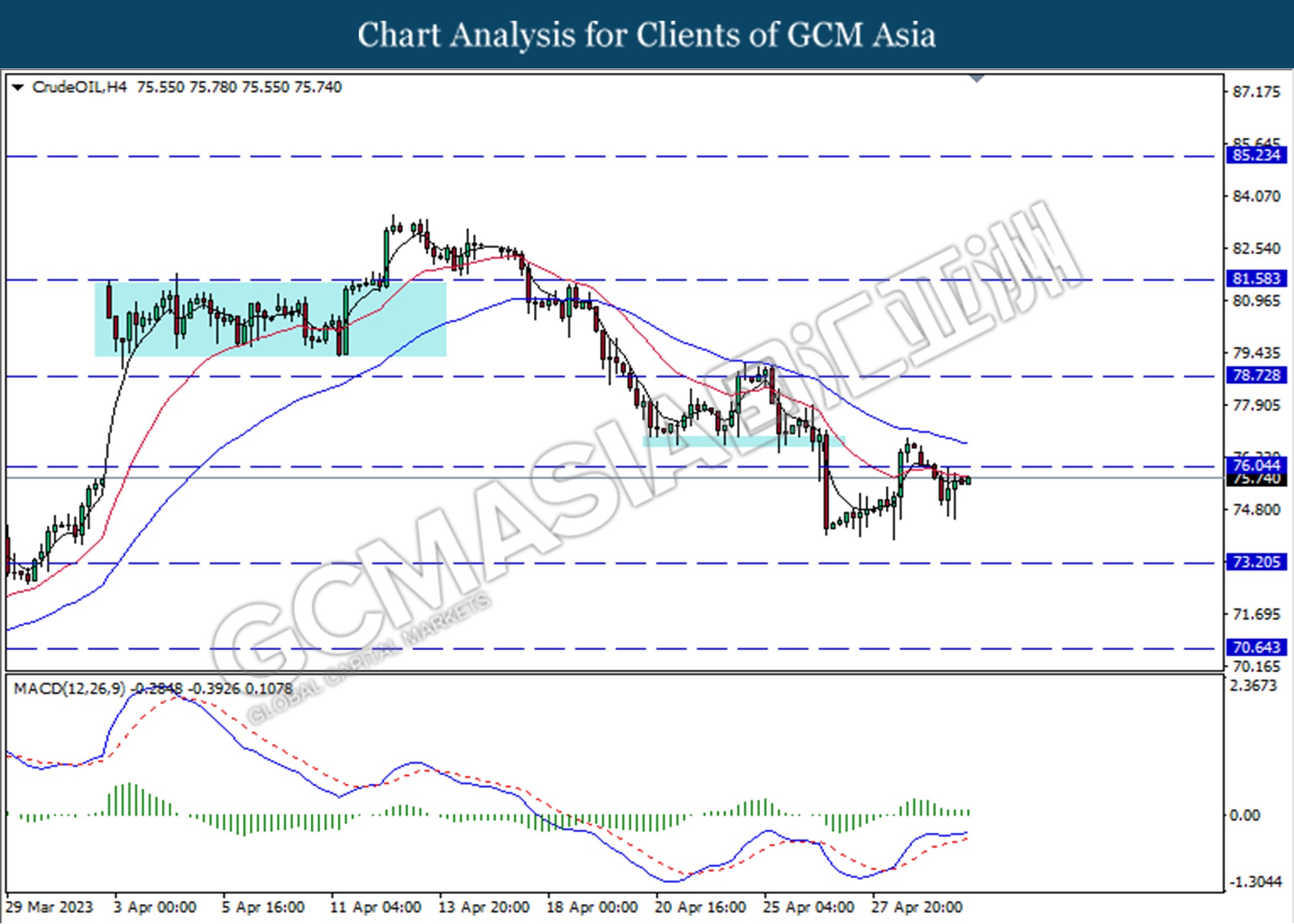

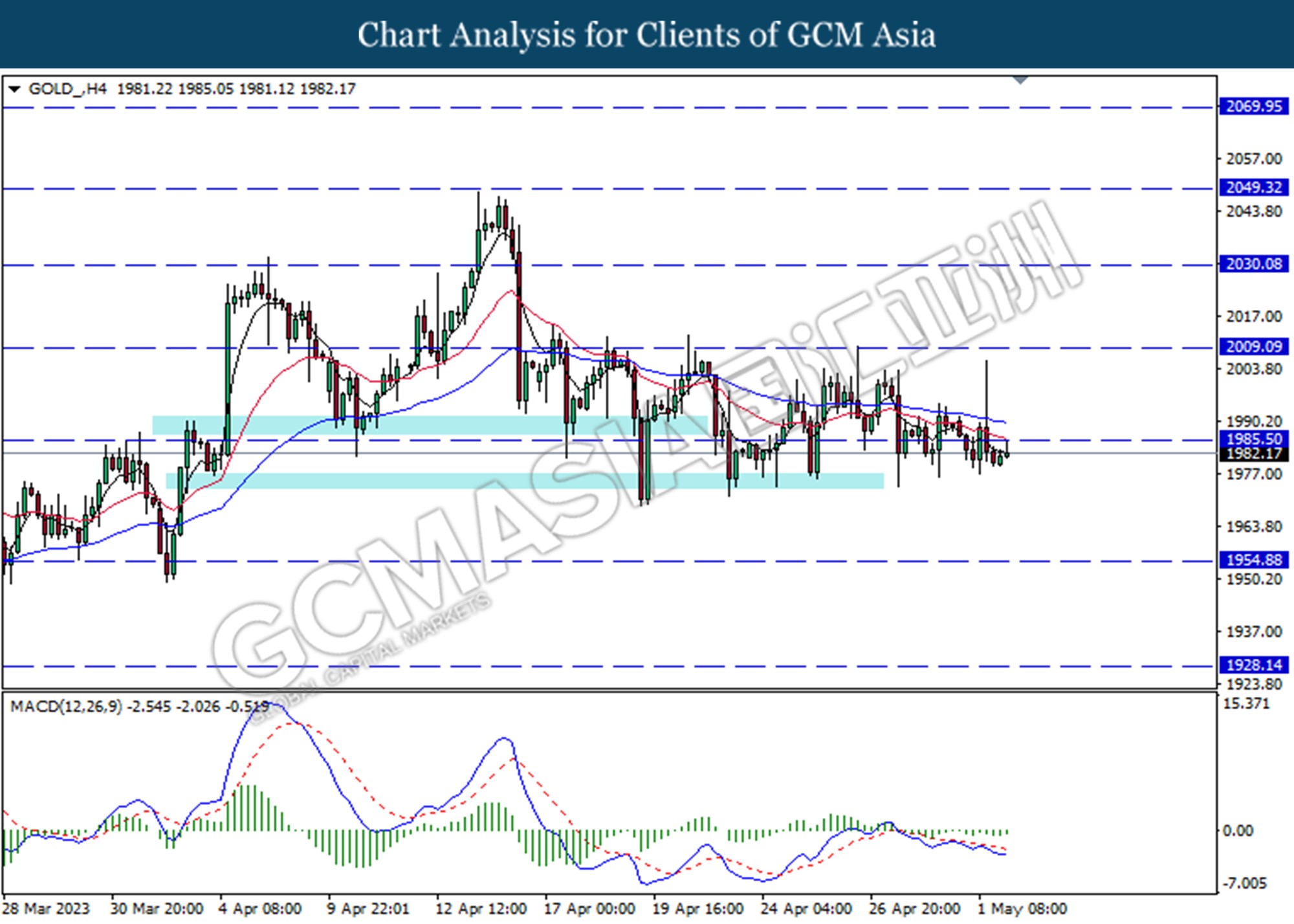

In the commodities market, crude oil prices were up by 0.09% to $75.73 per barrel as mixed economic data from China and investors forecasts on declining crude stockpiles. Besides, gold prices edged up by 0.04% to $1983.38 per troy ounce as investors awaited the Fed interest rate hike.

Today’s Holiday Market Close

Time Market Event

All Day CNY Labor Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (Apr) | 44.0 | 44.0 | – |

| 16:30 | GBP – Manufacturing PMI (Apr) | 47.9 | 46.6 | – |

| 17:00 | EUR – CPI (YoY) (Apr) | 6.9% | 7.0% | – |

| 22:00 | USD – JOLTs Job Openings (Mar) | 9.931M | 9.775M | – |

Technical Analysis

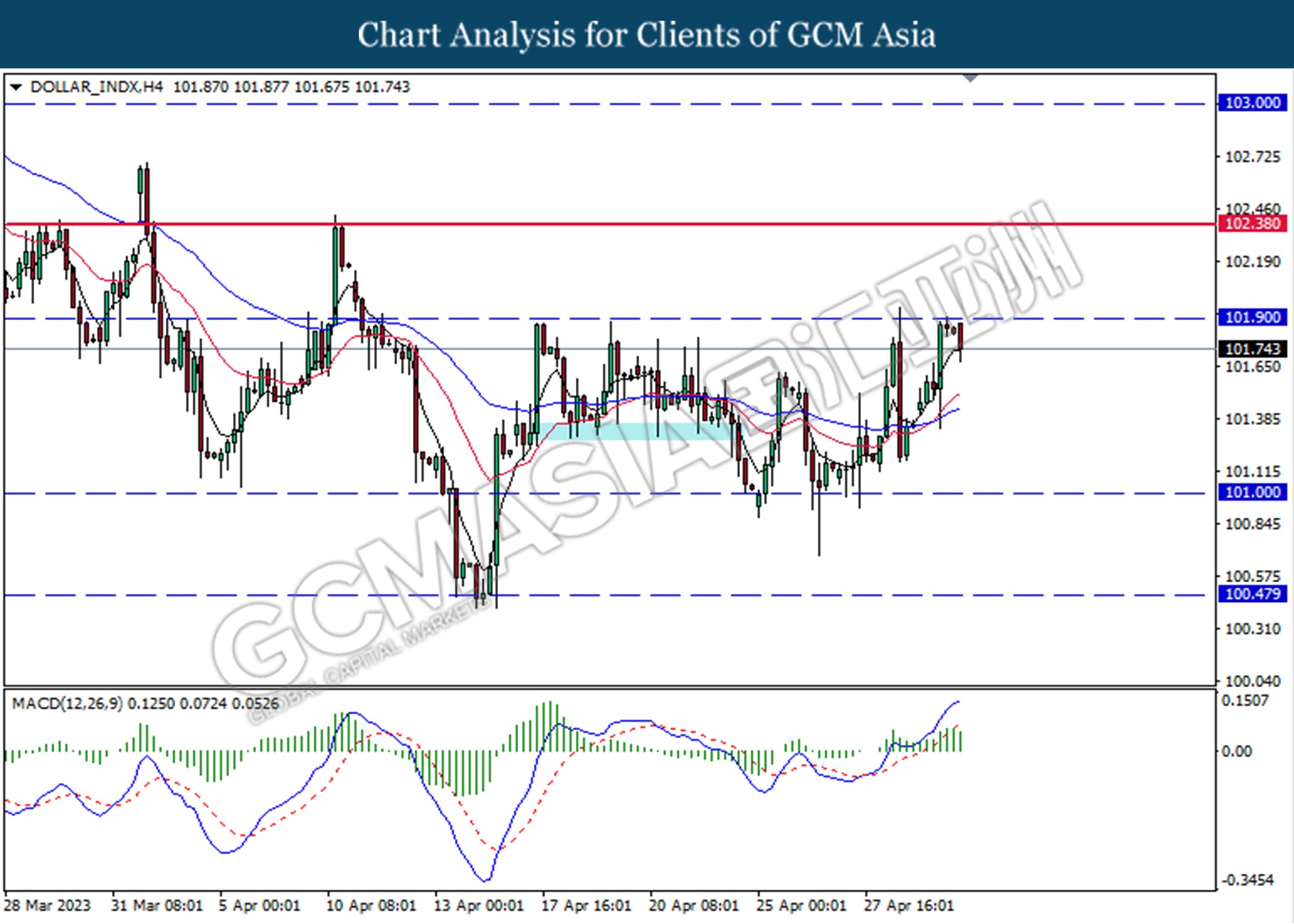

DOLLAR_INDX, H4: Dollar index was traded lower following the prior retracement from the resistance level at 101.90. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level at 101.00.

Resistance level: 101.90, 102.40

Support level: 101.00, 100.50

GBPUSD, H4: GBPUSD was traded higher following rebounded from the lower level at. However, MACD which illustrated bearish momentum suggests the pair to traded lower as a technical correction.

Resistance level: 1.2590, 1.2735

Support level: 1.2445, 1.2300

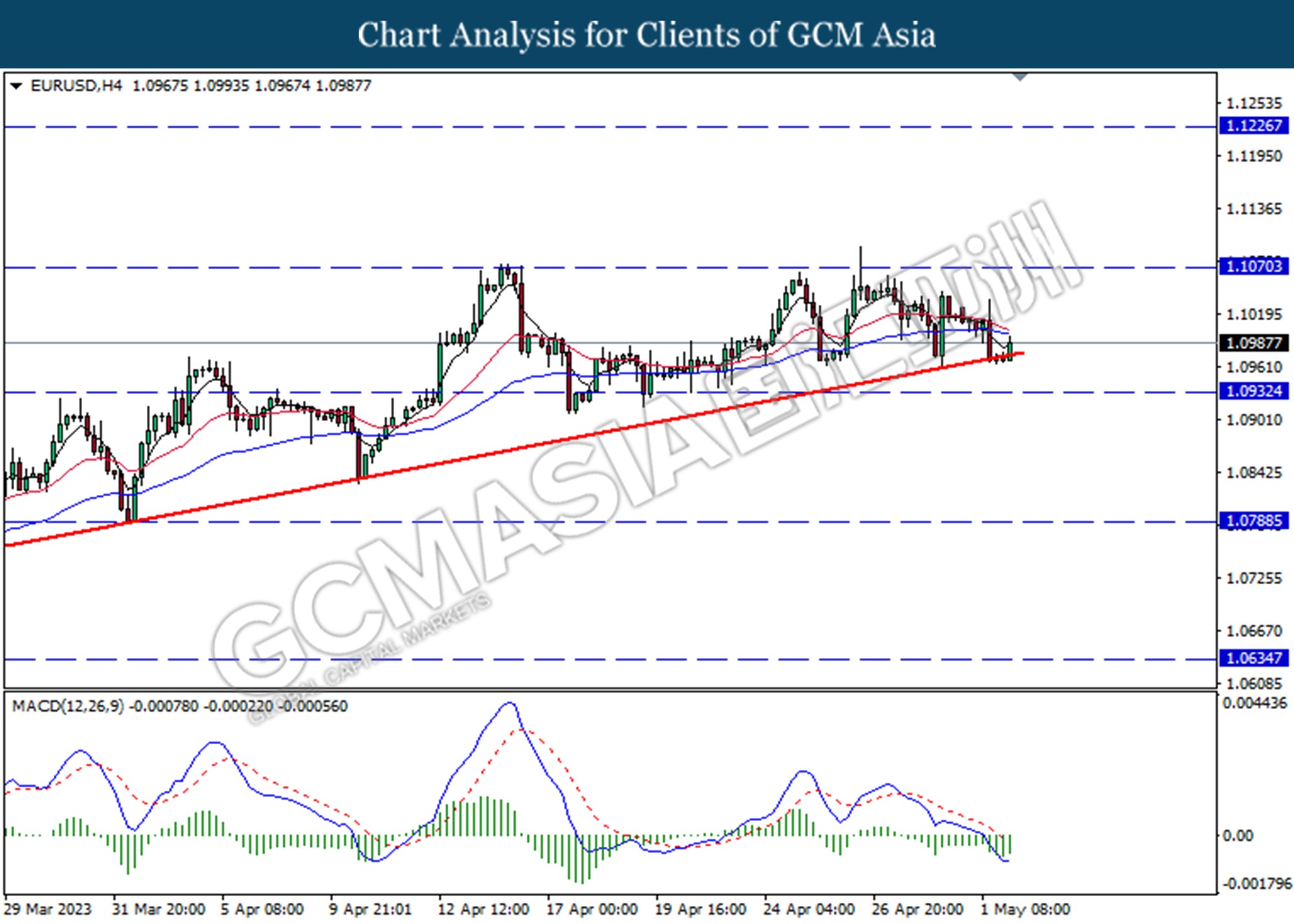

EURUSD, H4: EURUSD was traded higher following the prior rebound from the upward trend line. MACD which illustrated diminishing bullish momentum suggests the pair extended its gains toward the resistance level at 1.1070.

Resistance level: 1.1070, 1.1225

Support level: 1.0930, 1.0790

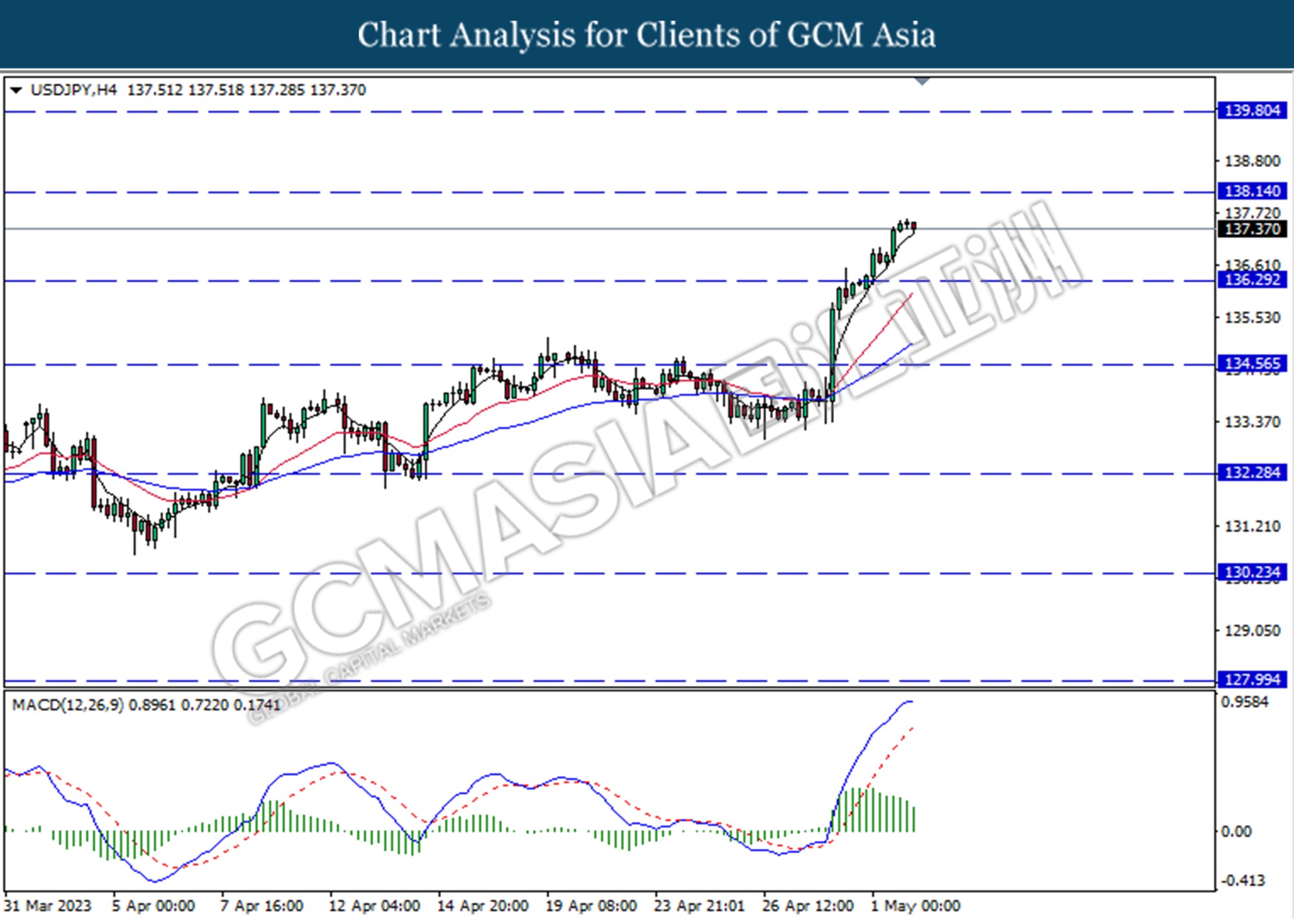

USDJPY, H4: USDJPY was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the index extended its losses toward the support level at 136.30.

Resistance level: 138.15, 139.80

Support level: 136.30, 134.55

AUDUSD, H4: AUDUSD was traded higher following rebounded from the lower level. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.6685.

Resistance level: 0.6685, 0.6775

Support level: 0.6600, 0.6525

NZDUSD, H4: NZDUSD was traded higher following rebounded from the lower level. MACD which illustrated bullish momentum suggests the pair extended its gains toward the resistance level at 0.6195.

Resistance level: 0.6195, 0.6265

Support level: 0.6120, 0.6050

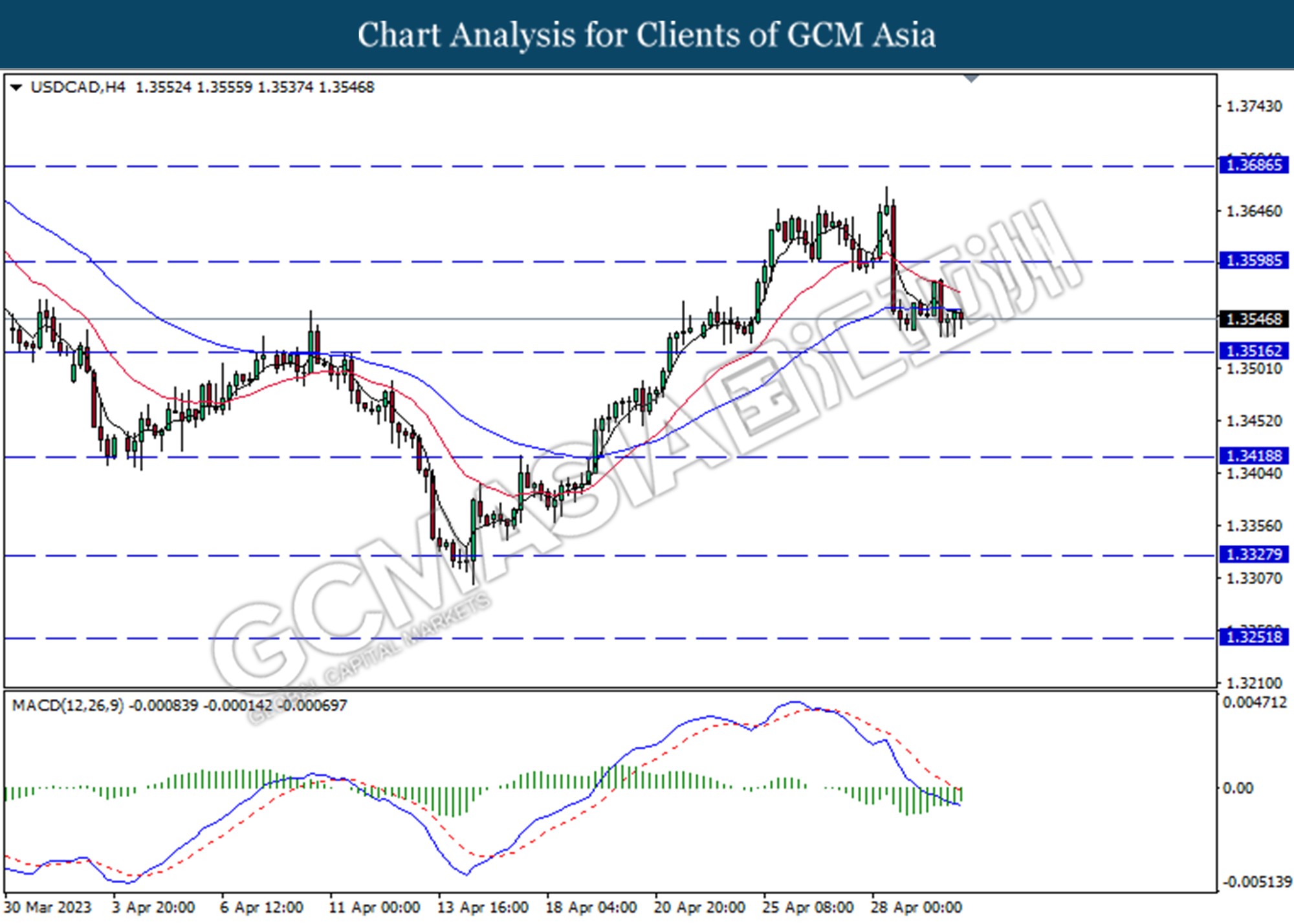

USDCAD, H4: USDCAD was traded lower following the prior retracement from the higher level. However, MACD which illustrated diminishing bearish momentum suggests the pair undergo technical correction in the short term.

Resistance level: 1.3600, 1.3685

Support level: 1.3515, 1.3420

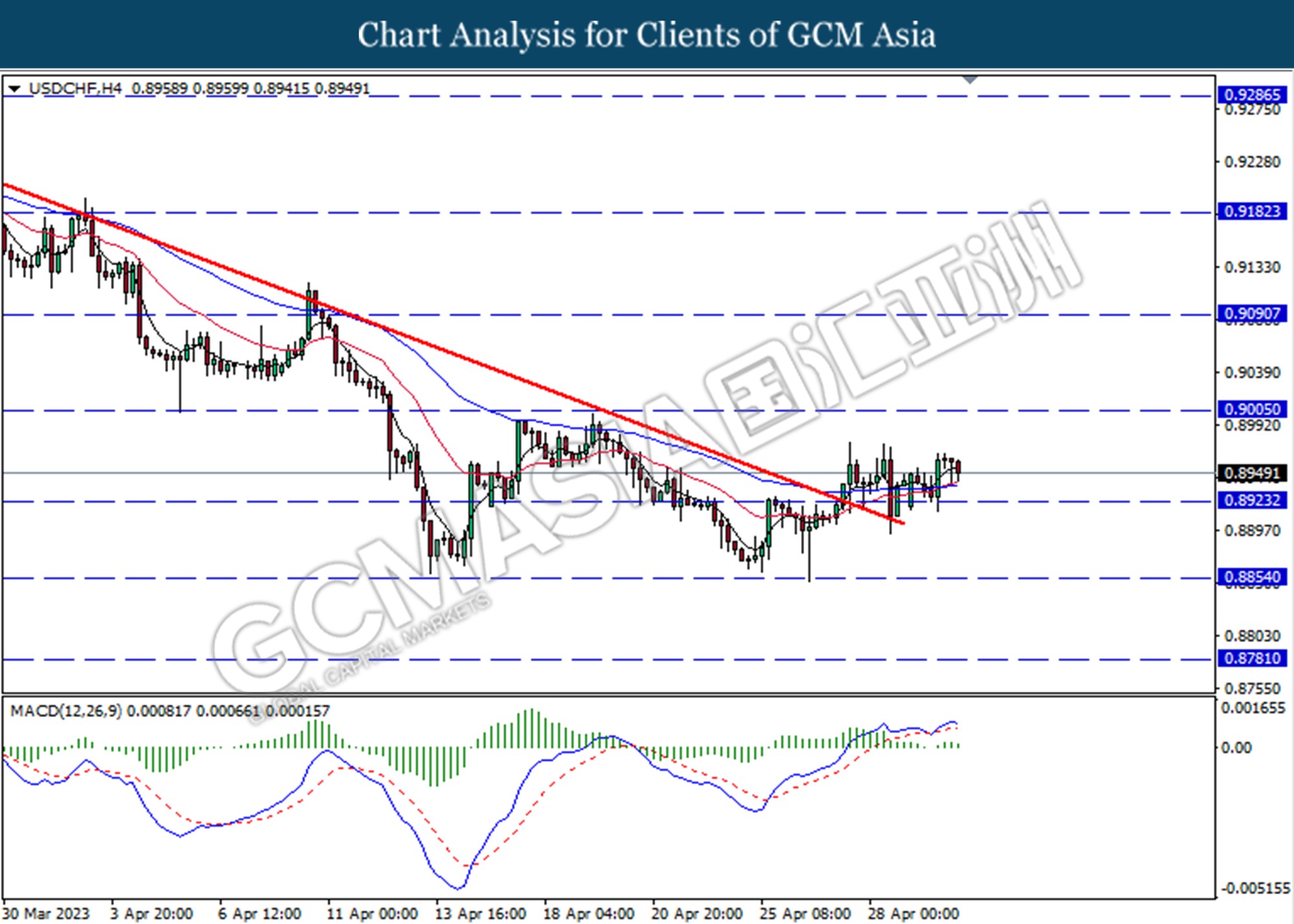

USDCHF, H4: USDCHF was traded lower following the prior retracement from the higher level. MACD which illustrated diminishing bullish momentum suggests the pair extended its losses toward the support level at 0.8925.

Resistance level: 0.9005, 0.9090

Support level: 0.8925, 0.8855

CrudeOIL, H4: Crude oil price was traded higher following rebound from the lower level. MACD which illustrated bullish momentum suggests the commodity extended its gains toward the resistance level at 76.05.

Resistance level: 76.05, 78.70

Support level: 73.20, 70.65

GOLD_, H4: Gold price was traded higher while currently testing the resistance level at 1985.50. MACD which illustrated diminishing bearish momentum suggests the commodity extended its gains after it successfully breakout above the resistance level.

Resistance level: 1985.50, 2009.10

Support level: 1954.90, 1928.15