2 May 2023 Morning Session Analysis

Greenback revived amid upbeat manufacturing data.

The dollar index, which was traded against a basket of six major currencies, regained its luster after hitting the lowest level in three years as the manufacturing activity in the US slightly improved, but still in the contraction territory with a slower pace. According to the Institute Supply Management (ISM), the US Manufacturing PMI was printed at 47.1 in April, stronger than the consensus forecast and prior month’s reading at 46.8 and 46.3 respectively. In details, there are only 2 of the 6 biggest manufacturing industries experienced a growth in April, which are the petroleum and coal products and transportation equipment. The sluggish activity was caused by the higher borrowing costs and tighter credit, which have raised the market worries over the risk of recession and restricted the customers from placing orders. Besides, the acquisition of First Republic Bank has largely reduced the market fears about further banking crisis to happen in the nation, lifting the appeal of the US dollar. Yesterday, JP Morgan won the auction to buy seized First Republic Bank for$12 billion. JP Morgan will be on the hook for all of the First Republic Bank’s $92 billion in deposits, including the $30 billion that JP Morgan and other big banks injected into the bank in March to keep it from going bankrupt. JP Morgan will also acquire most of the assets, including about $173 billion in loans and $30 billion in securities. As of writing, the dollar index rose 0.47% to 102.15.

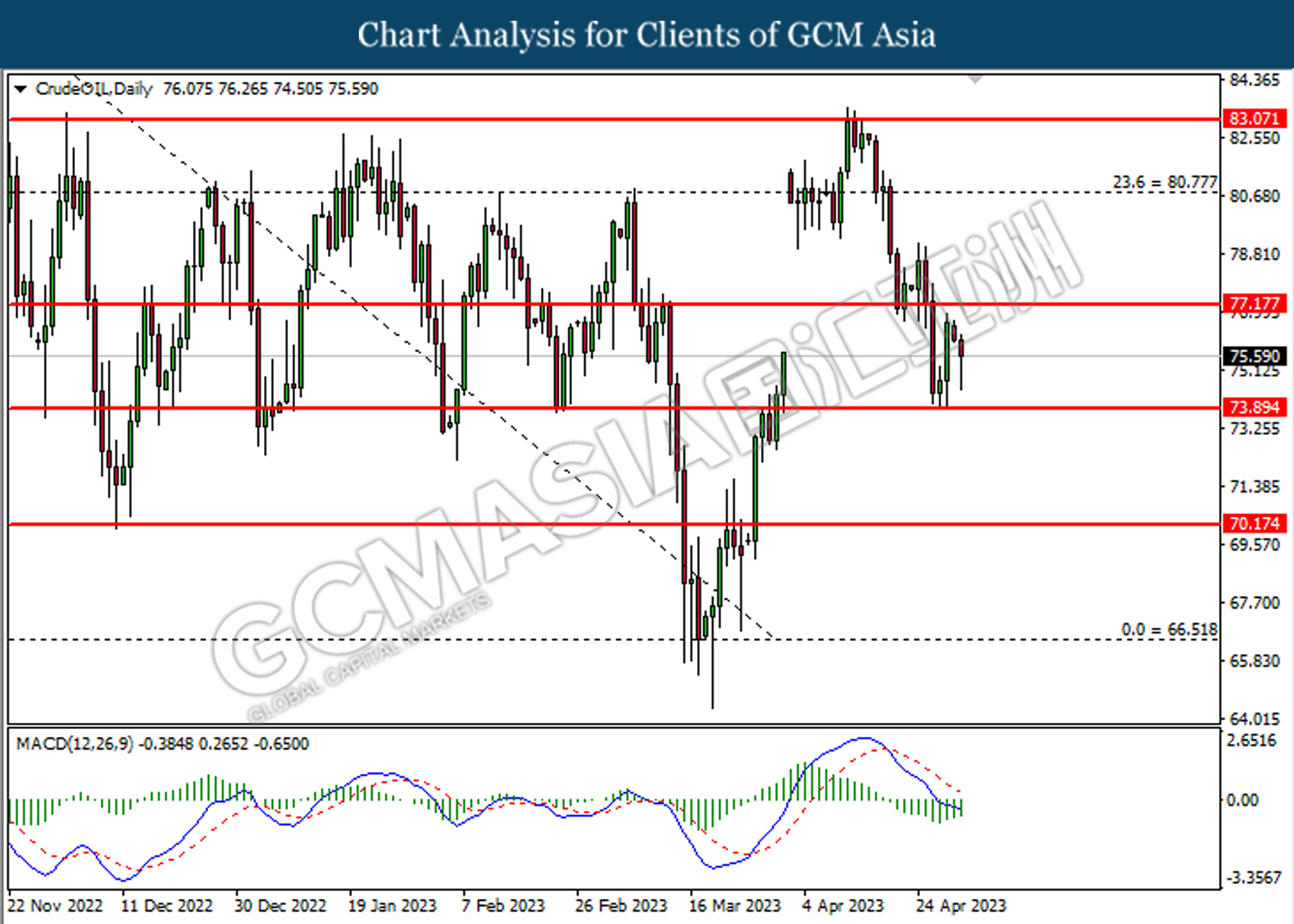

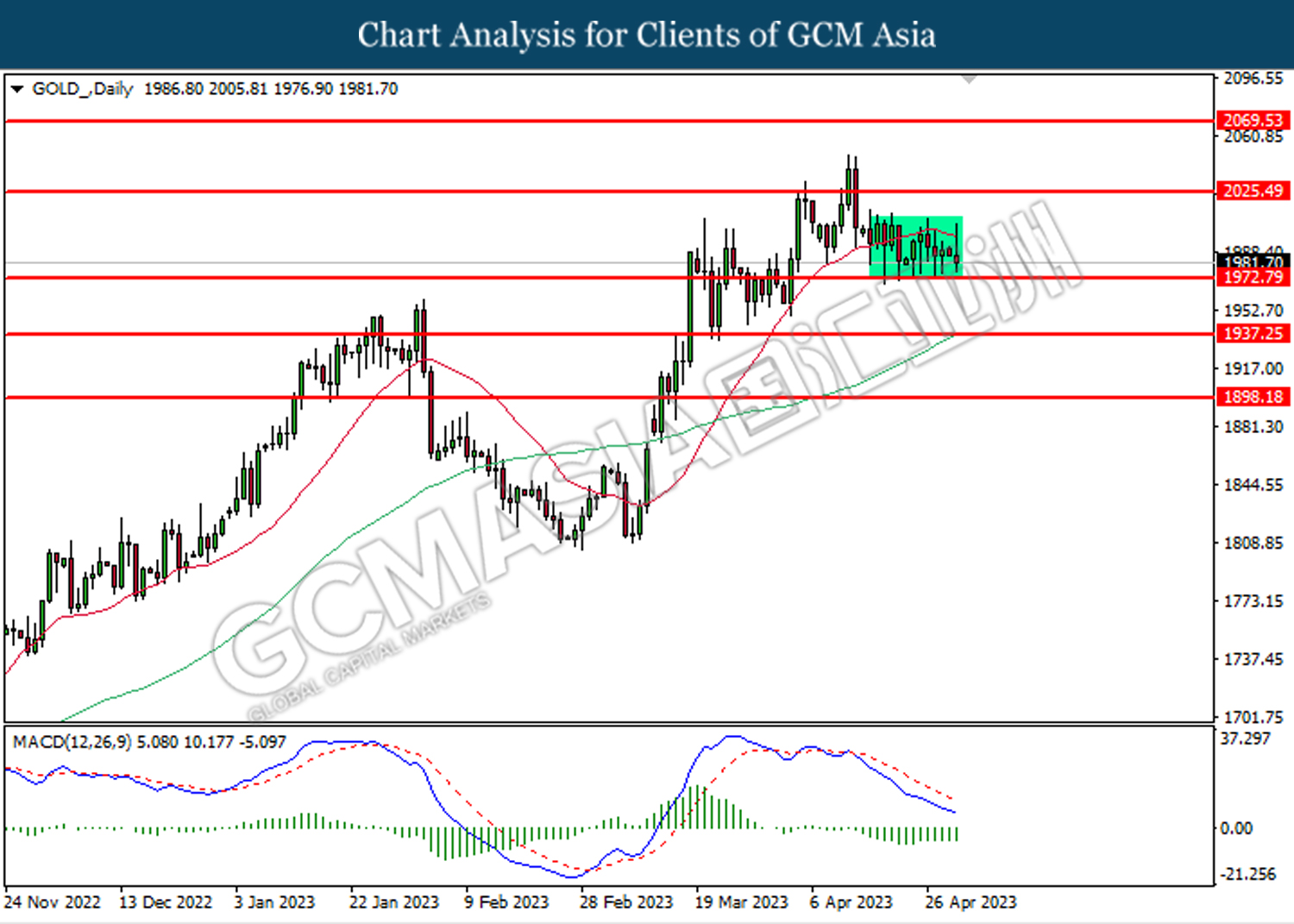

In the commodities market, crude oil prices were down by -0.10% to $75.80 per barrel as the disappointing China Manufacturing PMI weighed on the prospect of oil demand. Besides, gold prices ticked down by -0.04% to $1982.80 per troy ounce as contagion fears disappeared following the acquisition of First Republic Bank.

Today’s Holiday Market Close

Time Market Event

All Day CNY Labor Day

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 12:30 | AUD – RBA Interest Rate Decision (May) | 3.60% | 3.60% | – |

| 15:55 | EUR – German Manufacturing PMI (Apr) | 44.0 | 44.0 | – |

| 16:30 | GBP – Manufacturing PMI (Apr) | 47.9 | 46.6 | – |

| 17:00 | EUR – CPI (YoY) (Apr) | 6.9% | 7.0% | – |

| 22:00 | USD – JOLTs Job Openings (Mar) | 9.931M | 9.775M | – |

Technical Analysis

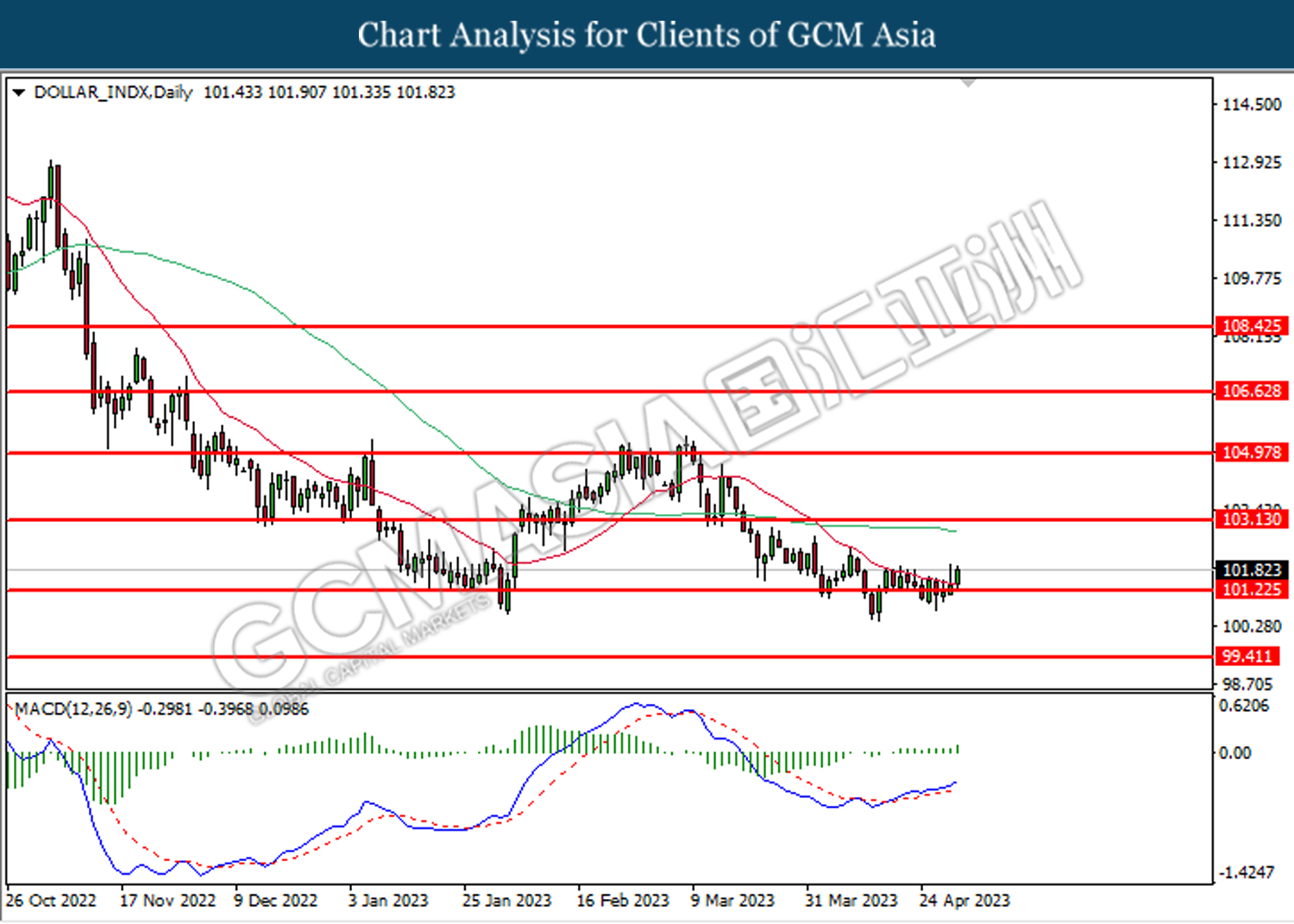

DOLLAR_INDX, Daily: Dollar index was traded higher following the prior rebound from the support level at 101.25. MACD which illustrated bullish bias momentum suggests the index to extend its gains toward the resistance level at 103.15.

Resistance level: 103.15, 104.95

Support level: 101.25, 99.40

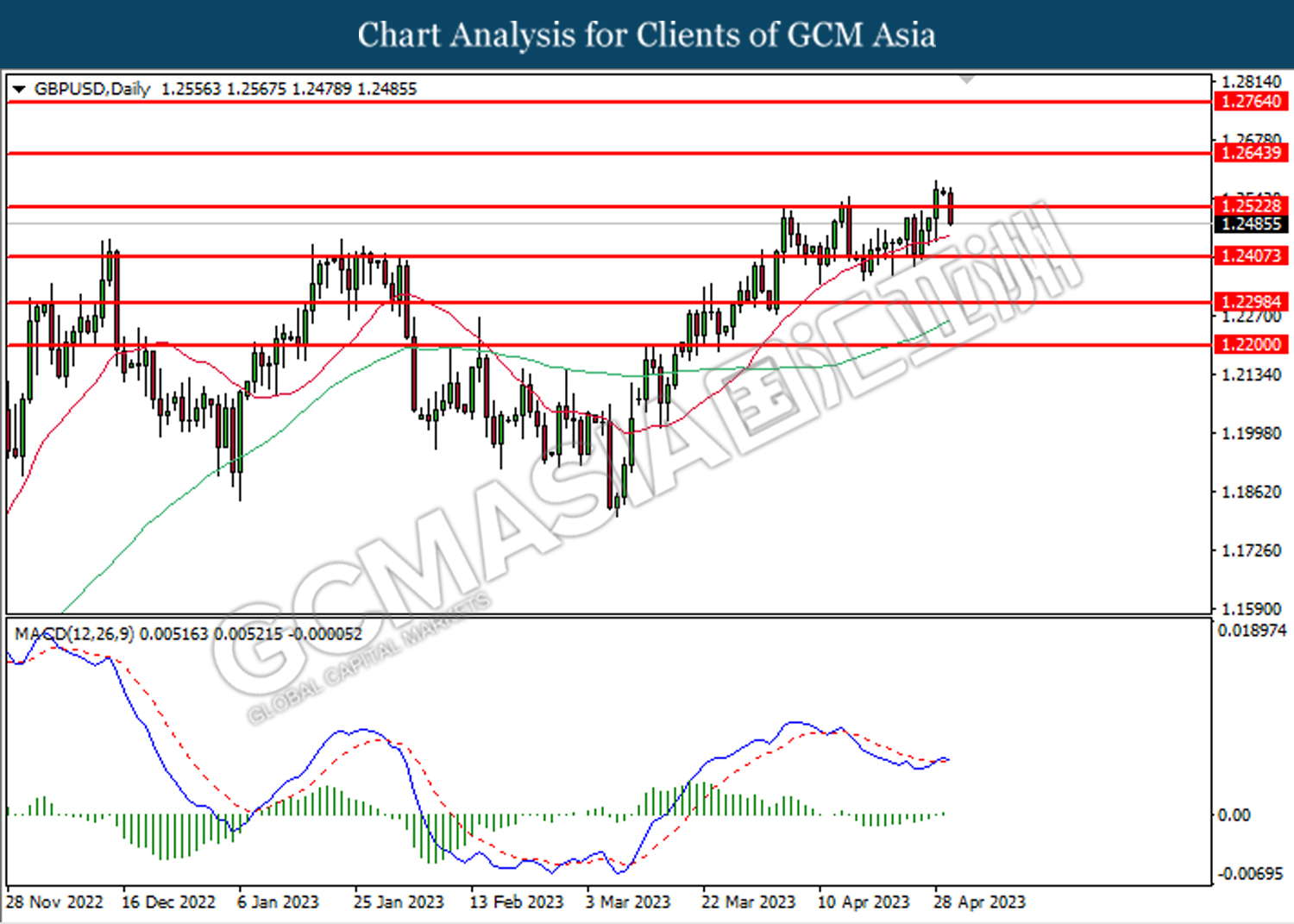

GBPUSD, Daily: GBPUSD was traded lower while currently testing the support level at 1.2525. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2645, 2.2765

Support level: 1.2525, 1.2405

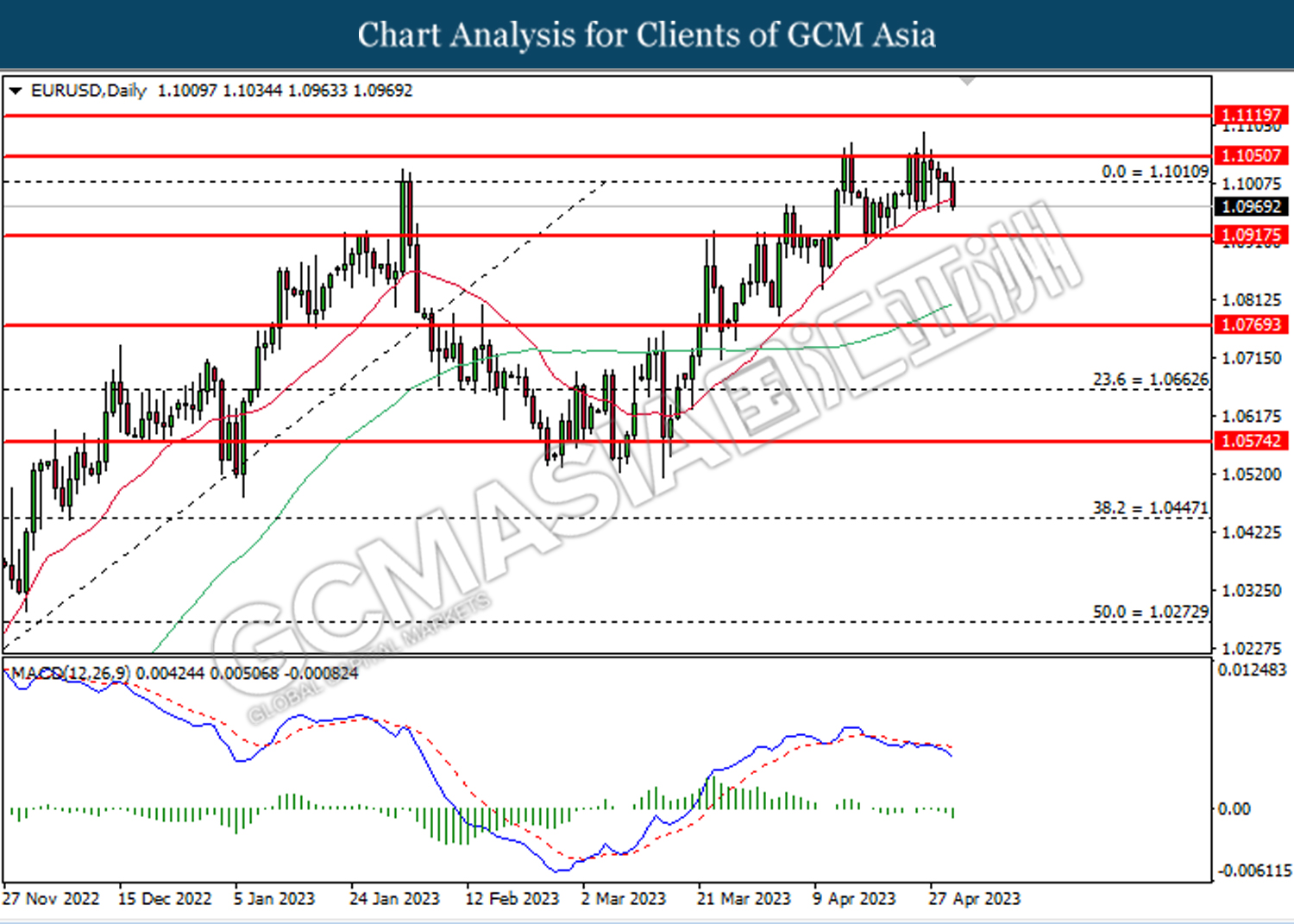

EURUSD, Daily: EURUSD was traded lower following the prior breakout below the previous support level at 1.1010. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0915.

Resistance level: 1.1010, 1.1050

Support level: 1.0915, 1.0770

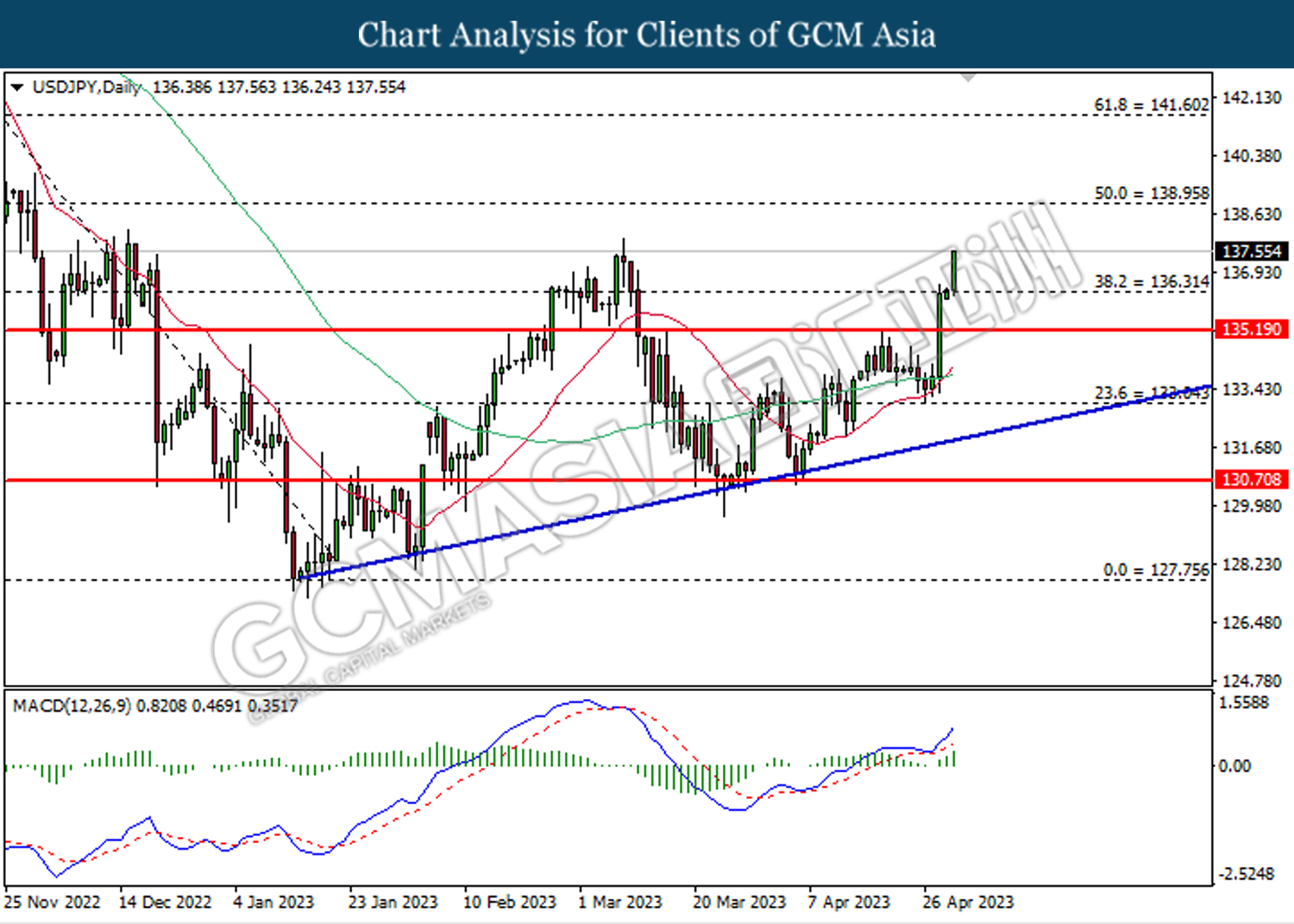

USDJPY, Daily: USDJPY was traded higher following the prior breakout above the previous resistance level at 136.30. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 138.95.

Resistance level: 138.95, 141.60

Support level: 136.30, 135.20

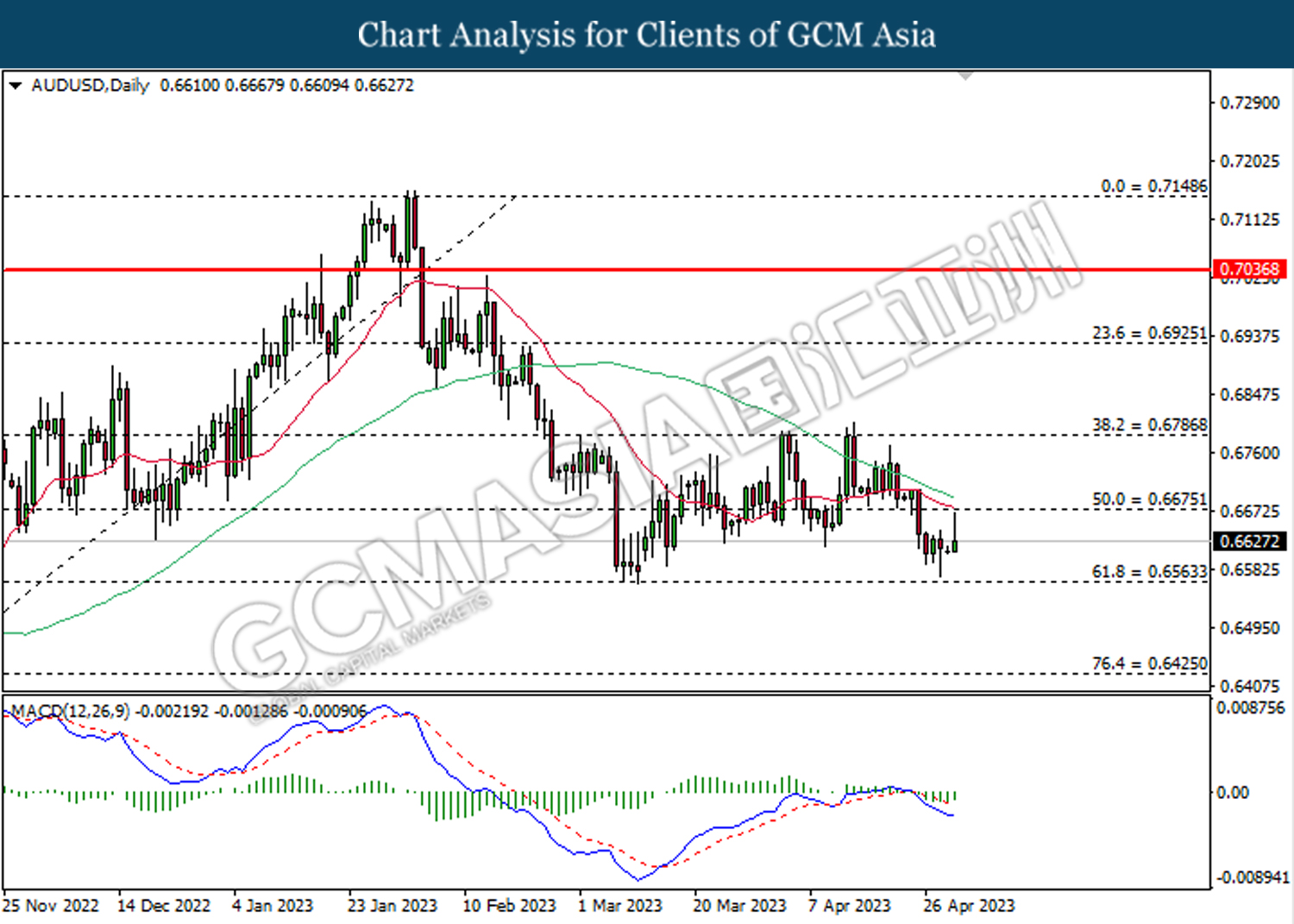

AUDUSD, Daily: AUDUSD was traded higher while currently testing the resistance level at 0.6675. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.6675, 0.6785

Support level: 0.6565, 0.6425

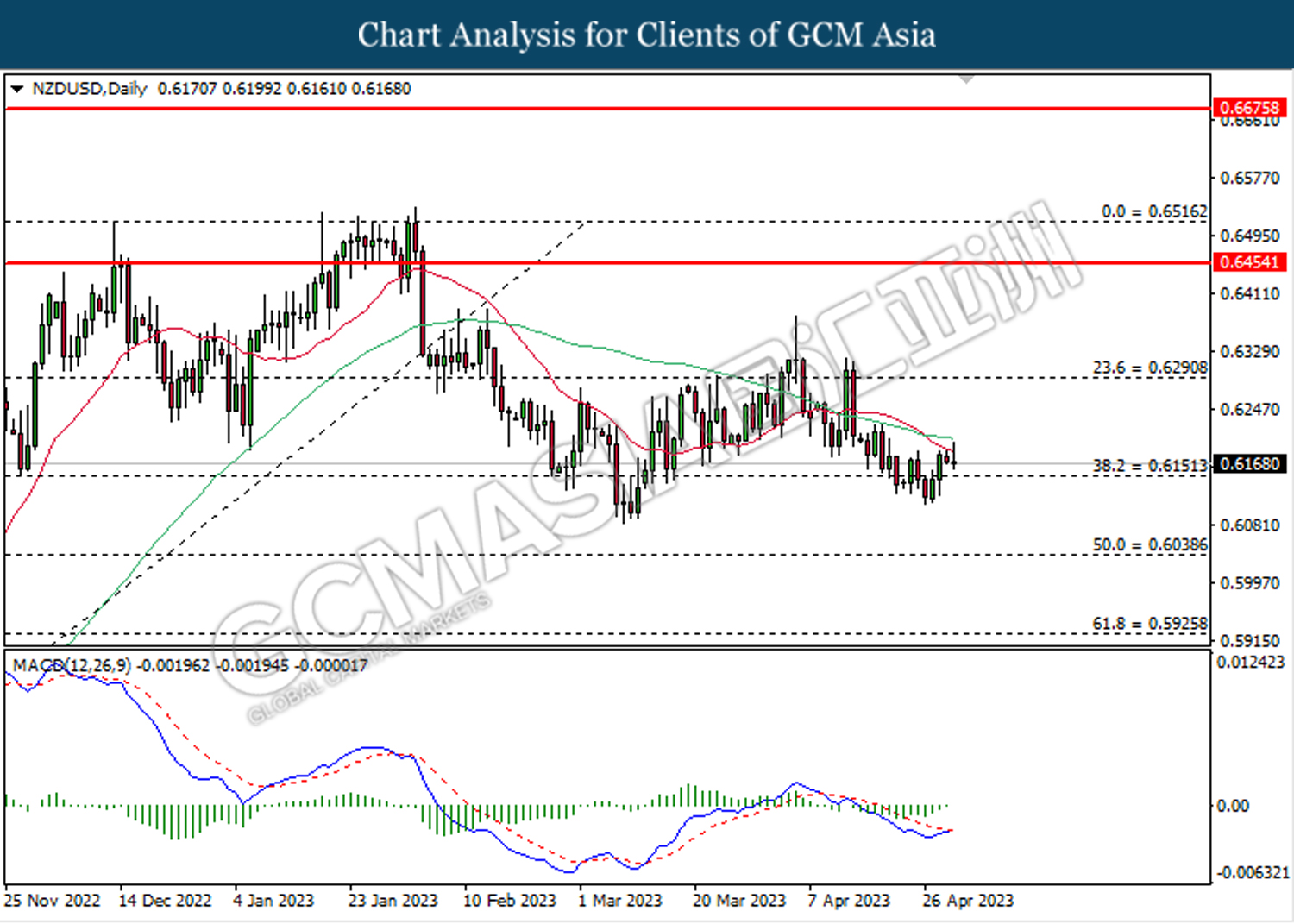

NZDUSD, Daily: NZDUSD was traded higher following the prior breakout above the previous resistance level at 0.6150. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6290.

Resistance level: 0.6290, 0.6455

Support level: 0.6150, 0.6040

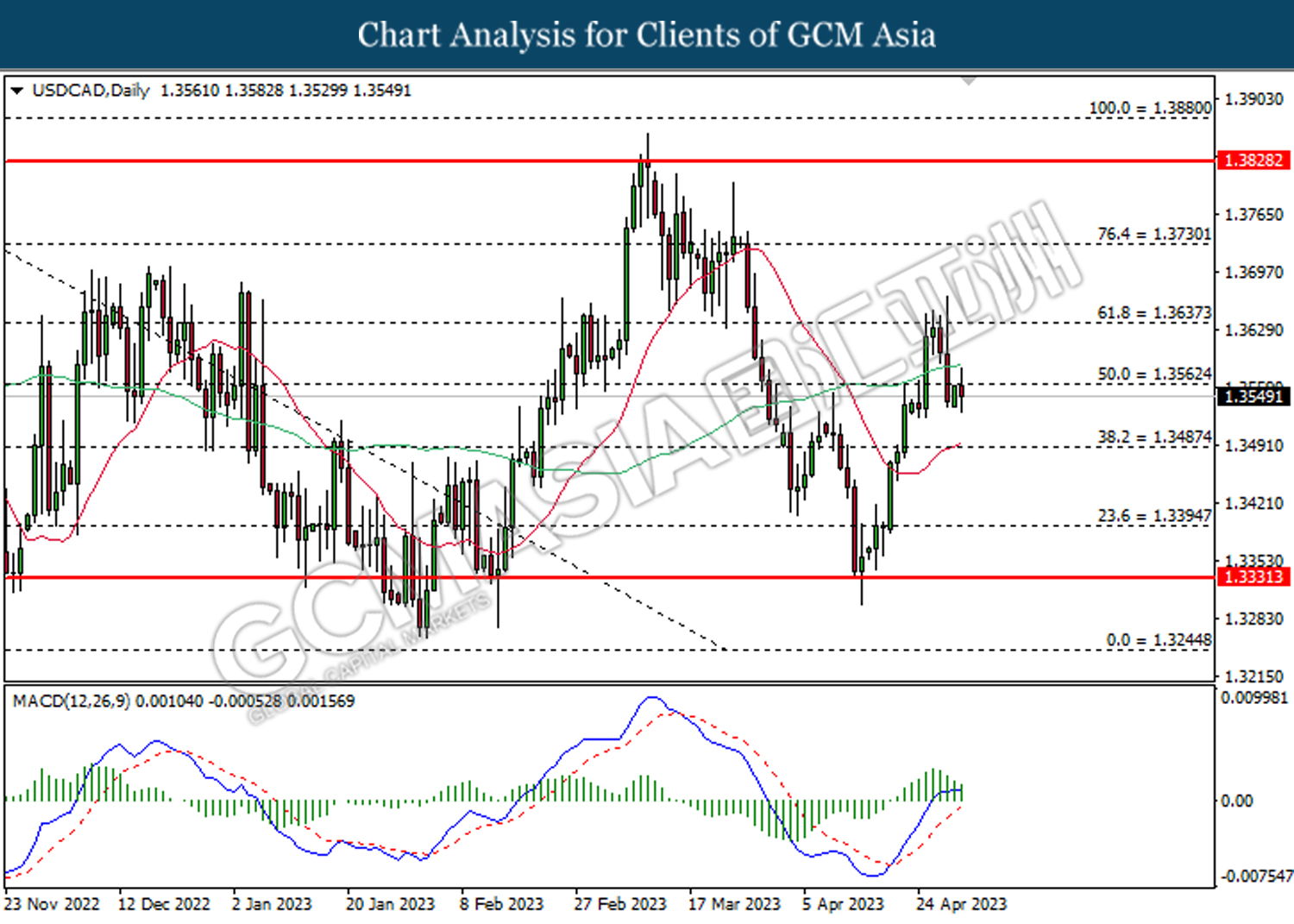

USDCAD, Daily: USDCAD was traded lower following the prior retracement from the resistance level at 1.3565. MACD which illustrated diminishing bullish momentum suggests the pair to extend its losses toward the support level at 1.3485.

Resistance level: 1.3565, 1.3635

Support level: 1.3485, 1.3395

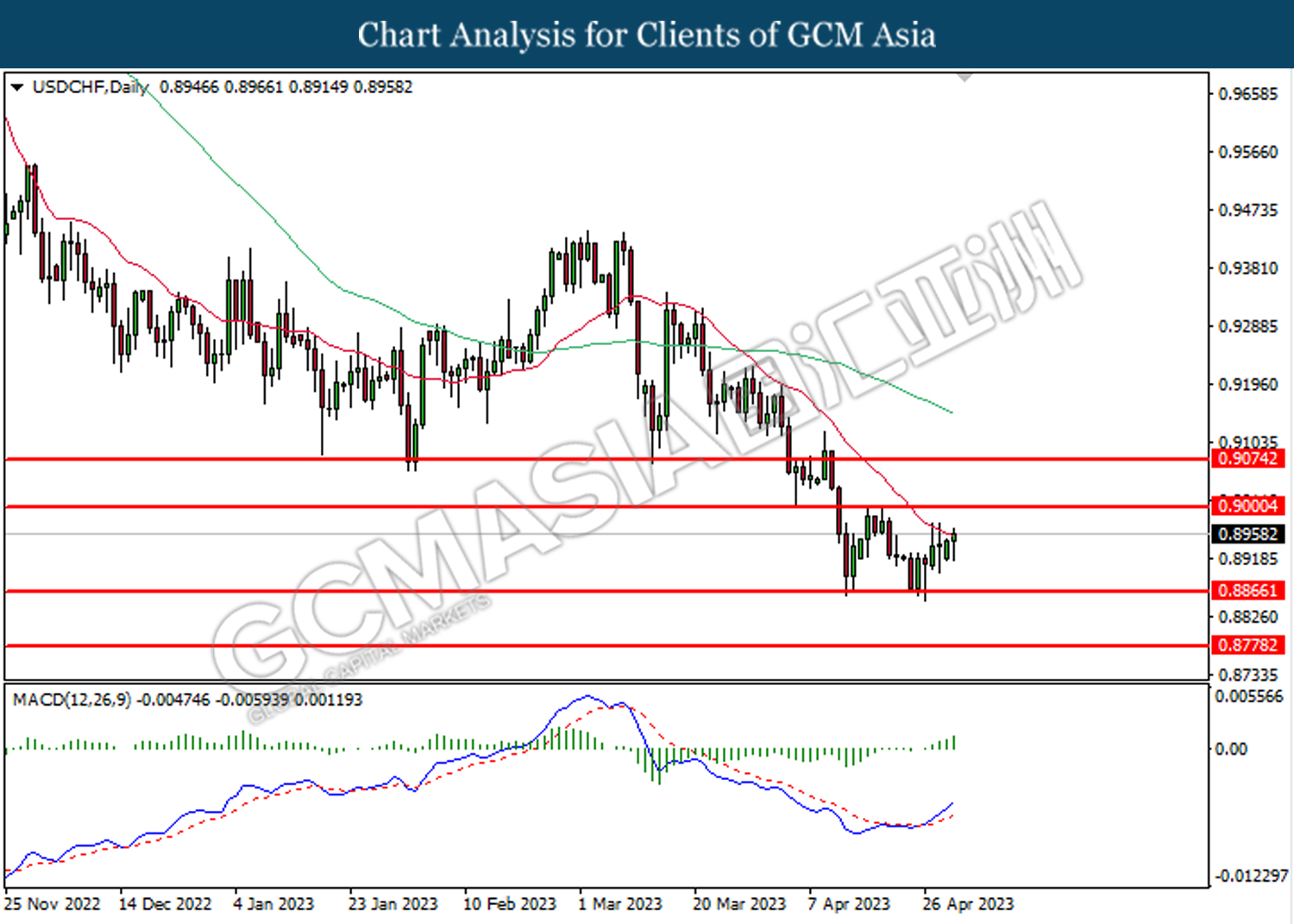

USDCHF, Daily: USDCHF was traded higher following the prior rebound from the support level at 0.8865. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9000.

Resistance level: 0.9000, 0.9075

Support level: 0.8865, 0.8780

CrudeOIL, Daily: Crude oil price was traded lower following the prior retracement from the resistance level at 77.15. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 73.90.

Resistance level: 77.15, 80.75

Support level: 73.90, 70.15

GOLD_, Daily: Gold price was traded lower while currently testing the support level at 1972.80. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 2025.50, 2069.55

Support level: 1972.80, 1937.25