2 September 2022 Morning Session Analysis

Upbeat data provides room for aggressive rate hike.

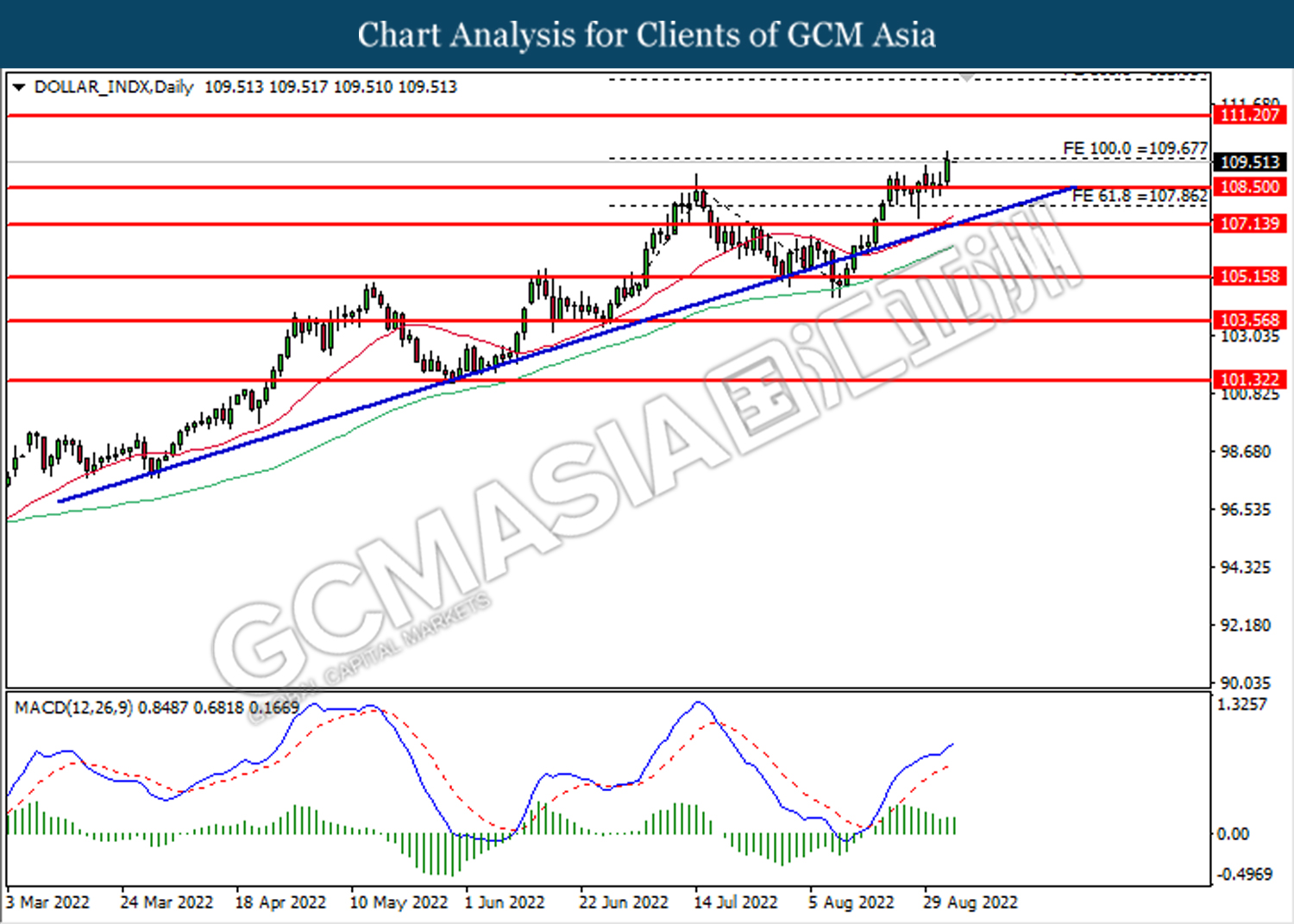

The dollar index, which gauges its value against a basket of six major currencies, jumped significantly yesterday as a series of upbeat data allowed the Federal Reserve for further rate hikes in the coming meeting. According to the Institute for Supply Management (ISM), US Manufacturing sector grew steadily as new orders increased while the hiring activities surged in August. The data came in at 52.8, similar to the prior month reading but slightly higher than the consensus forecast at 52.0. A reading of above 50 indicates an expansion in the US manufacturing sector. On the other sides, the US weekly Initial Jobless Claims has shown a consecutive drop for third straight week amid continued labor market tightness. According to the Bureau of Labor Statistics, the number of Americans who filed for unemployment benefits dropped from 237K to 232K, while recording a lower figure compared to the consensus forecast at 248K. Despite, the eyes of the investor are all now on the Nonfarm Payrolls data, which will be released tonight 20:30PM (GMT+8) sharp, as the data would provide a clearer picture about the ongoing labor market condition in the US. As of writing, the dollar index up by 0.86% to 109.65.

In the commodities market, the crude oil price was down by -0.03% to $86.40 a barrel as the new round of lockdown across the major cities in China stoked the demand fears. Besides, the gold prices edged down by -0.12% to $1695.65 per troy ounce following the release of the upbeat data in the US.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Aug) | 528K | 300K | – |

| 20:30 | USD – Unemployment Rate (Aug) | 3.5% | 3.5% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 109.65. MACD which illustrated bullish bias momentum suggests the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 109.65, 111.20

Support level: 108.50, 107.85

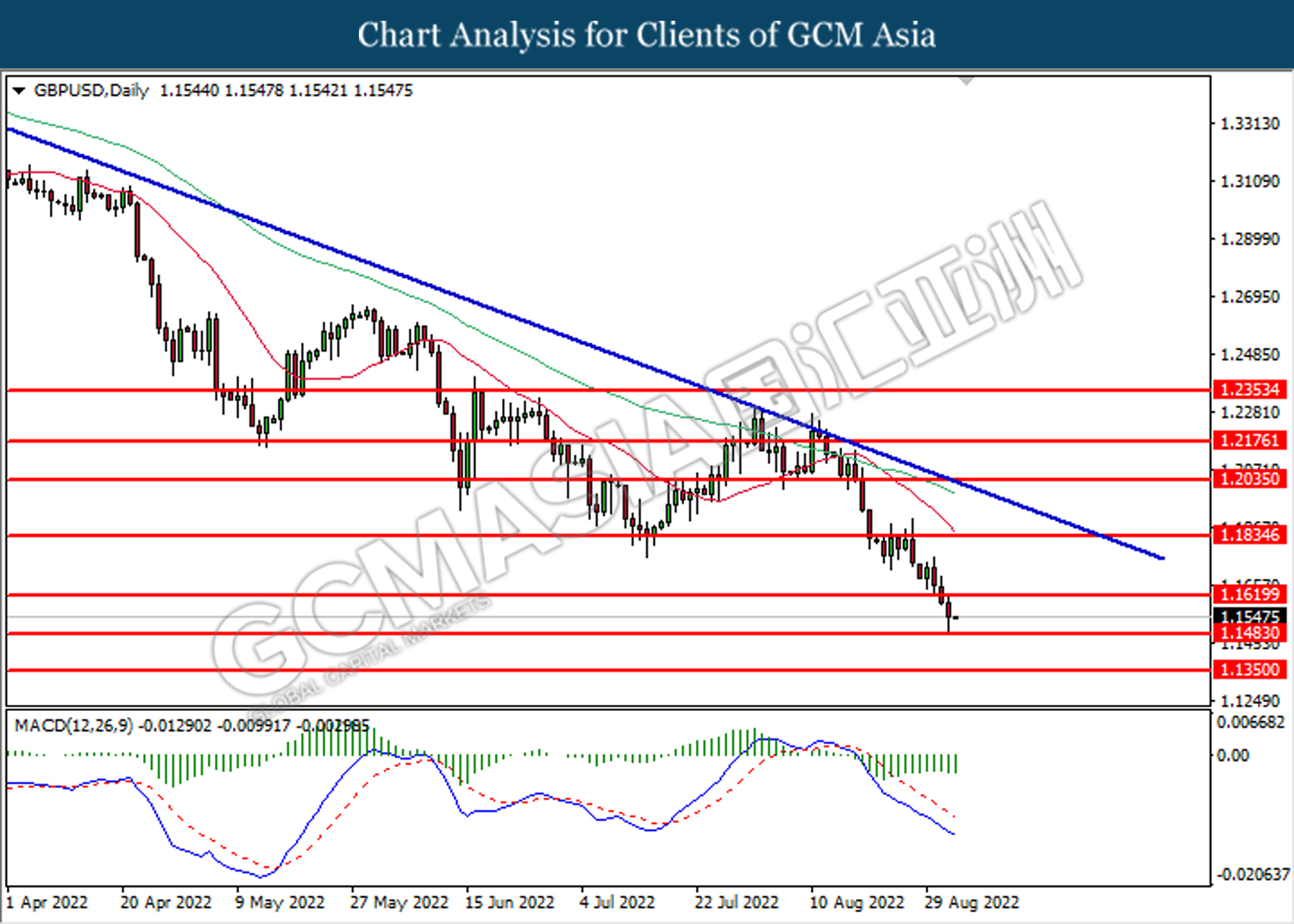

GBPUSD, Daily: GBPUSD was traded lower following prior breakout below the previous support level at 1.1620. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the next support level.

Resistance level: 1.1620, 1.1835

Support level: 1.1485, 1.1350

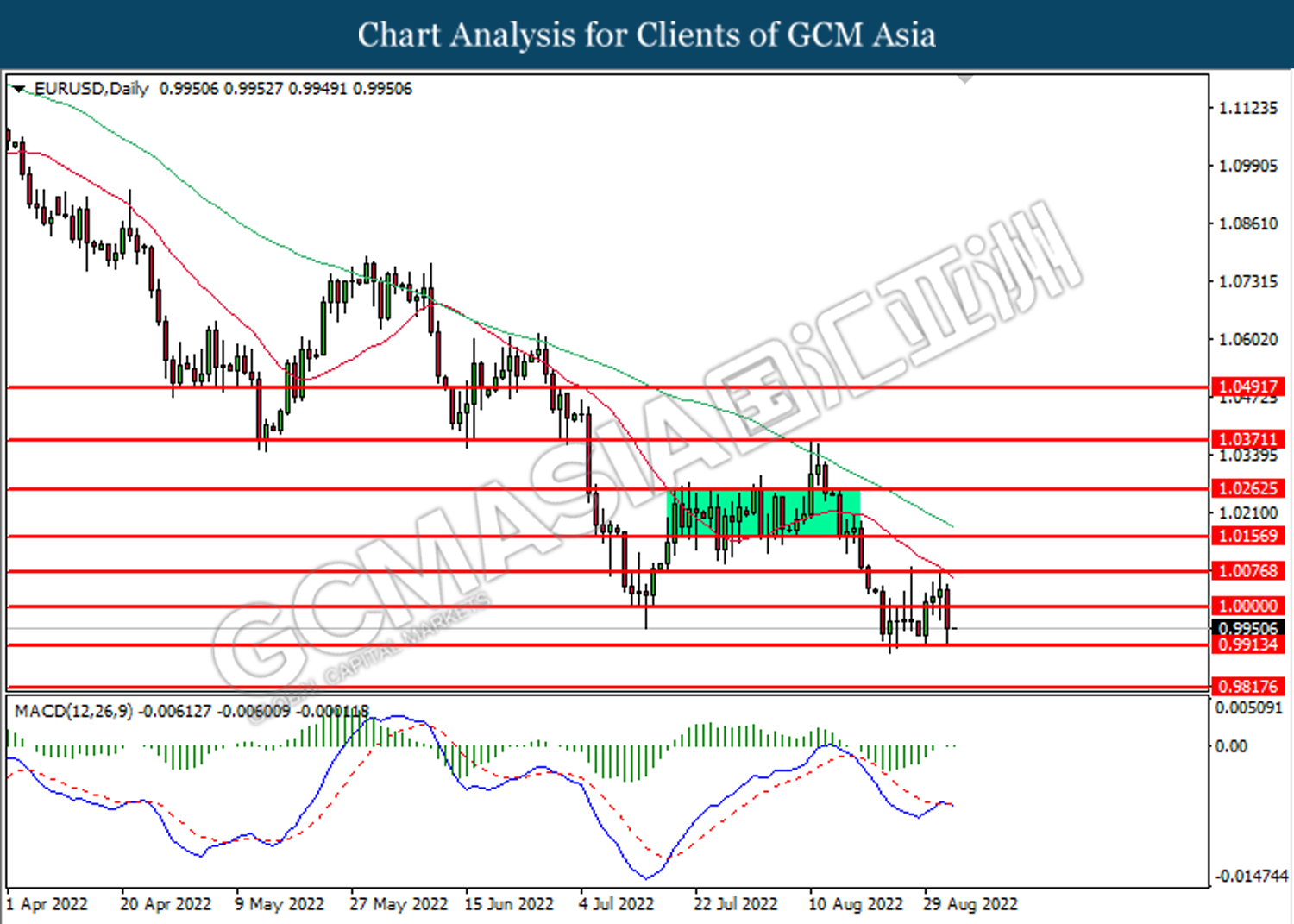

EURUSD, Daily: EURUSD was traded lower following prior breakout below the previous support level at 1.0000. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9915.

Resistance level: 1.0000, 1.0075

Support level: 0.9915, 0.9820

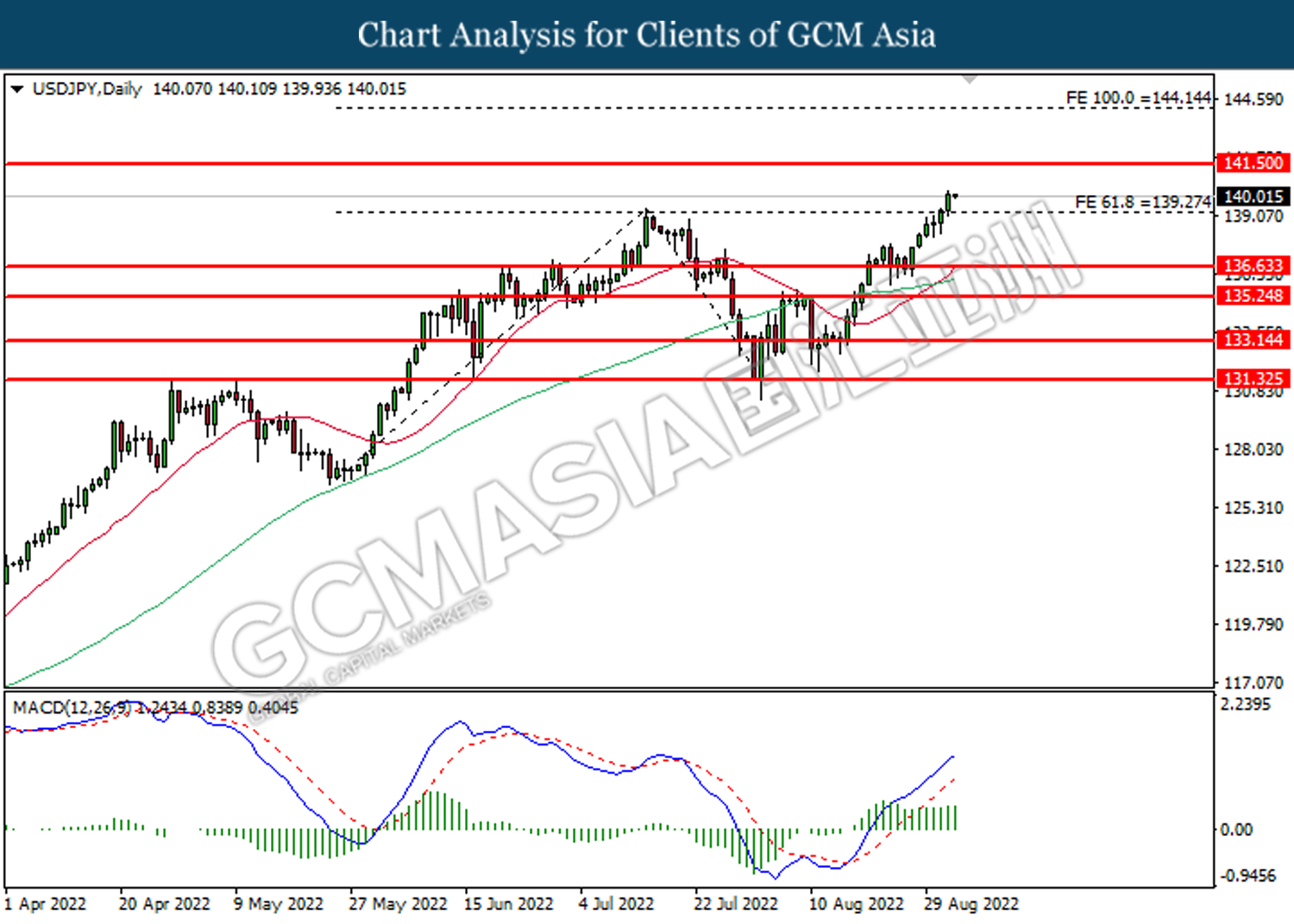

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 139.25. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 141.50.

Resistance level: 141.50, 144.15

Support level: 139.25, 136.65

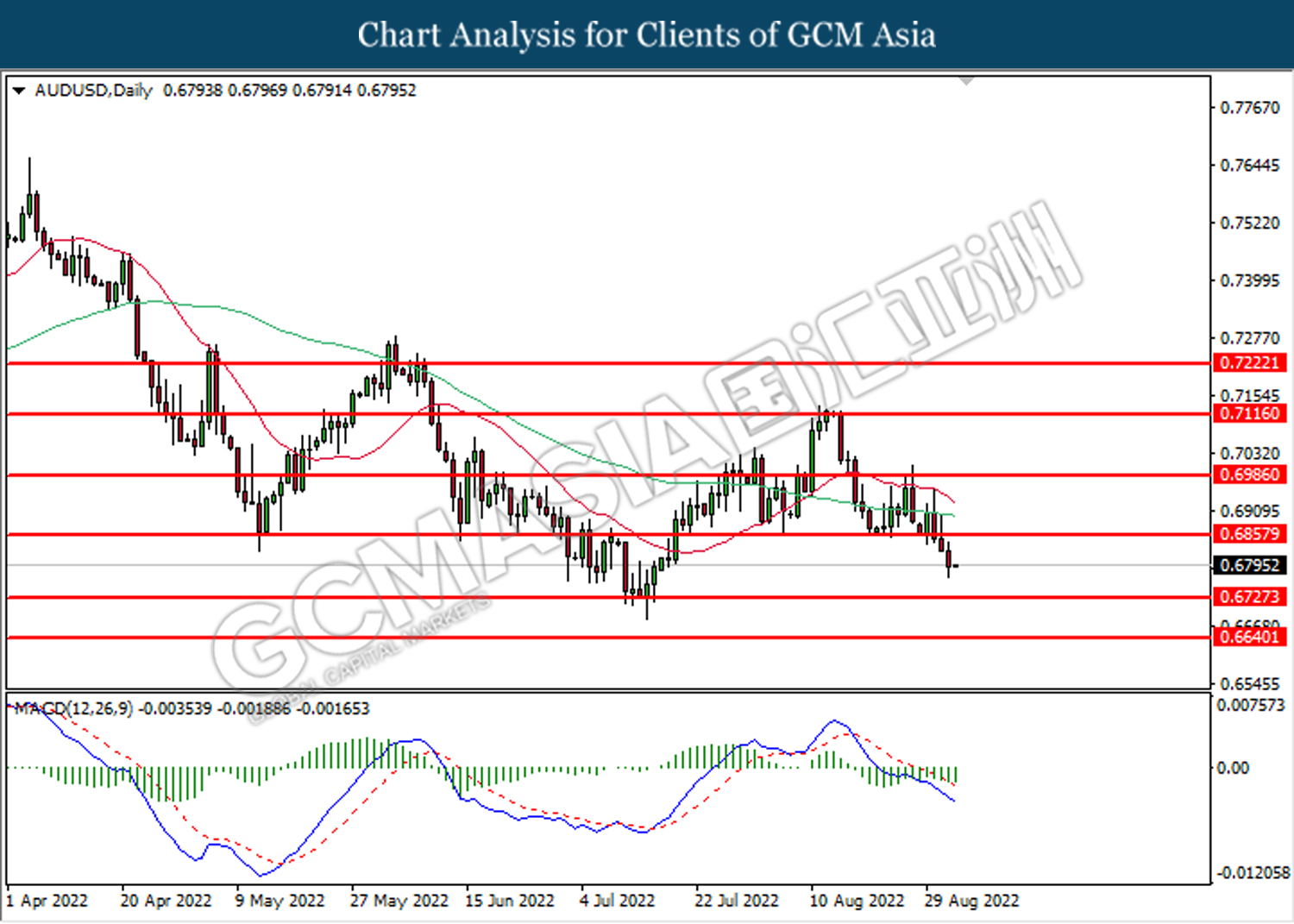

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6860. MACD which illustrated bearish bias momentum suggest the pair to extend its to extend its losses toward the support level at 0.6725.

Resistance level: 0.6860, 0.6985

Support level: 0.6725, 0.6640

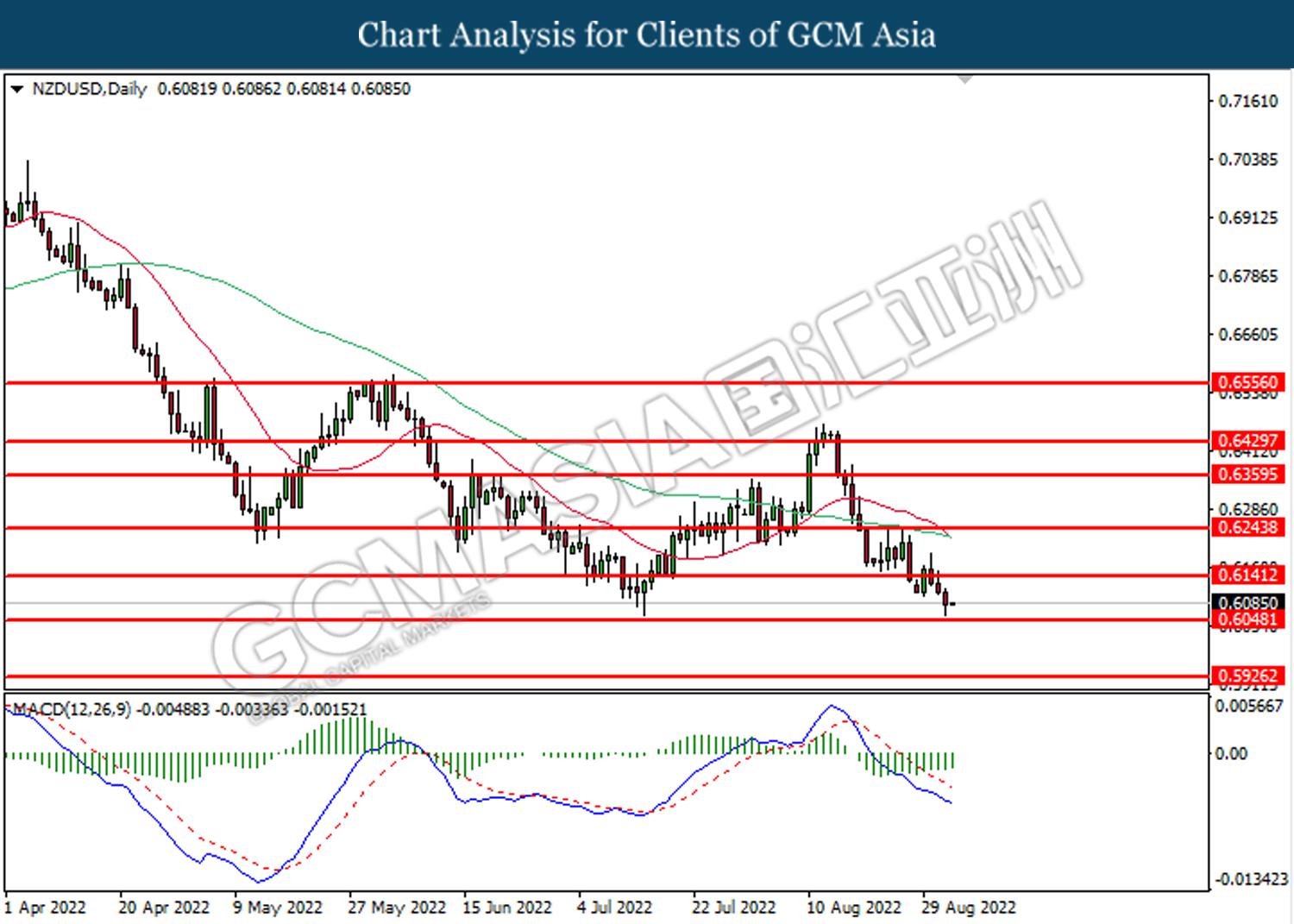

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level at 0.6140. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6050.

Resistance level: 0.6140, 0.6245

Support level: 0.6050, 0.5925

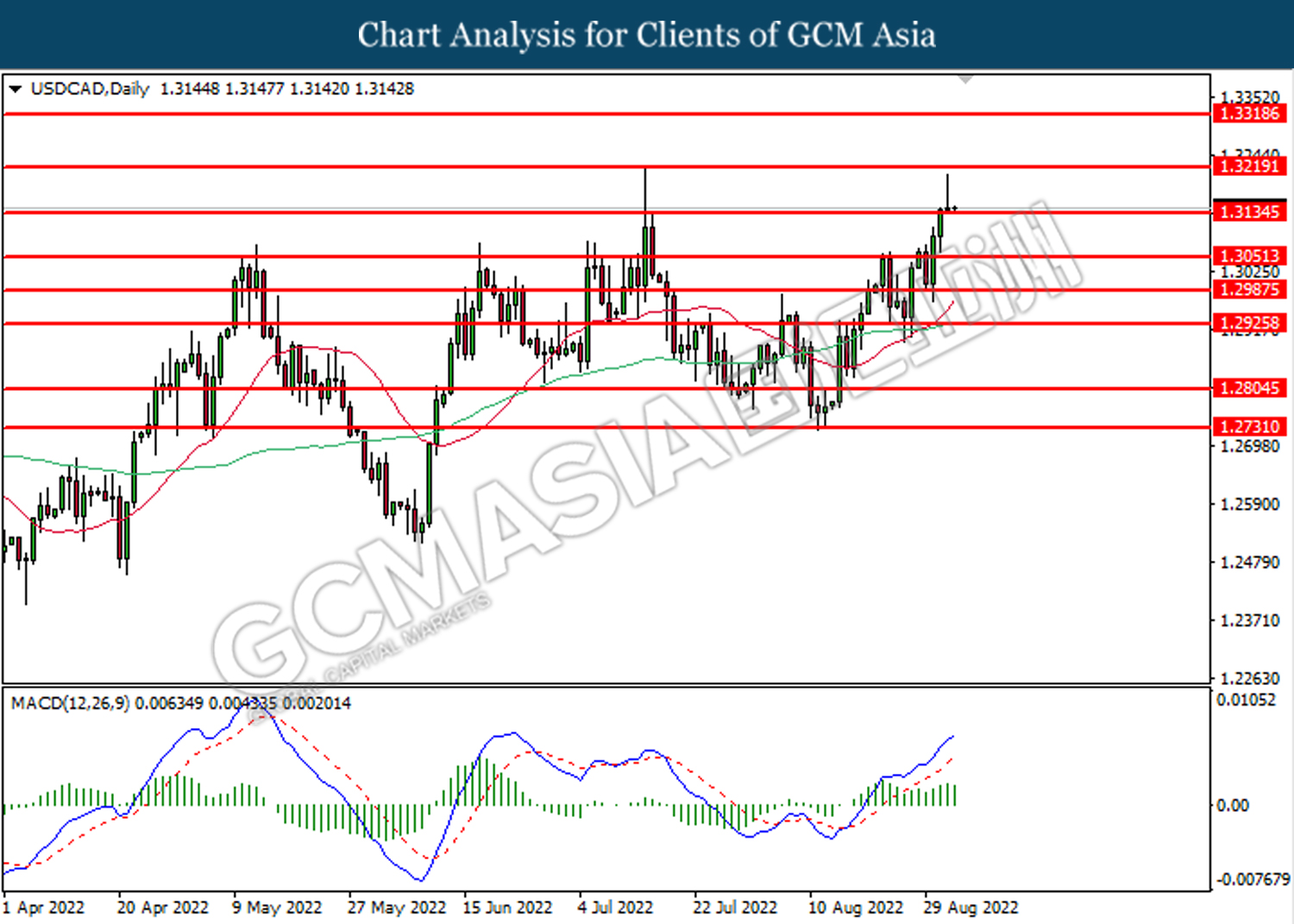

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.3135. MACD which illustrated bullish bias momentum suggests the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1.3135, 1.3220

Support level: 1.3050, 1.2985

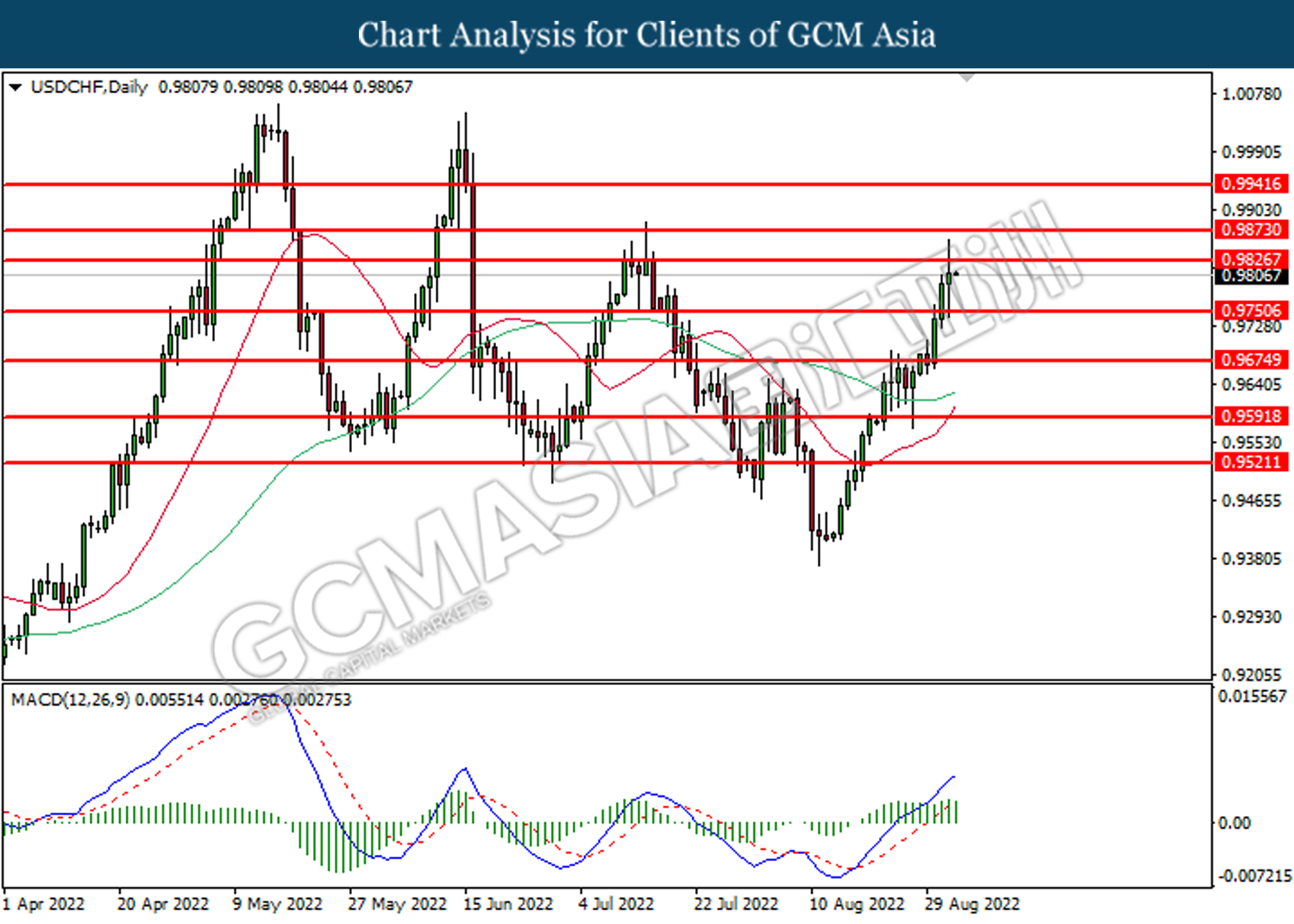

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9750. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.9825.

Resistance level: 0.9825, 0.9875

Support level: 0.9750, 0.9675

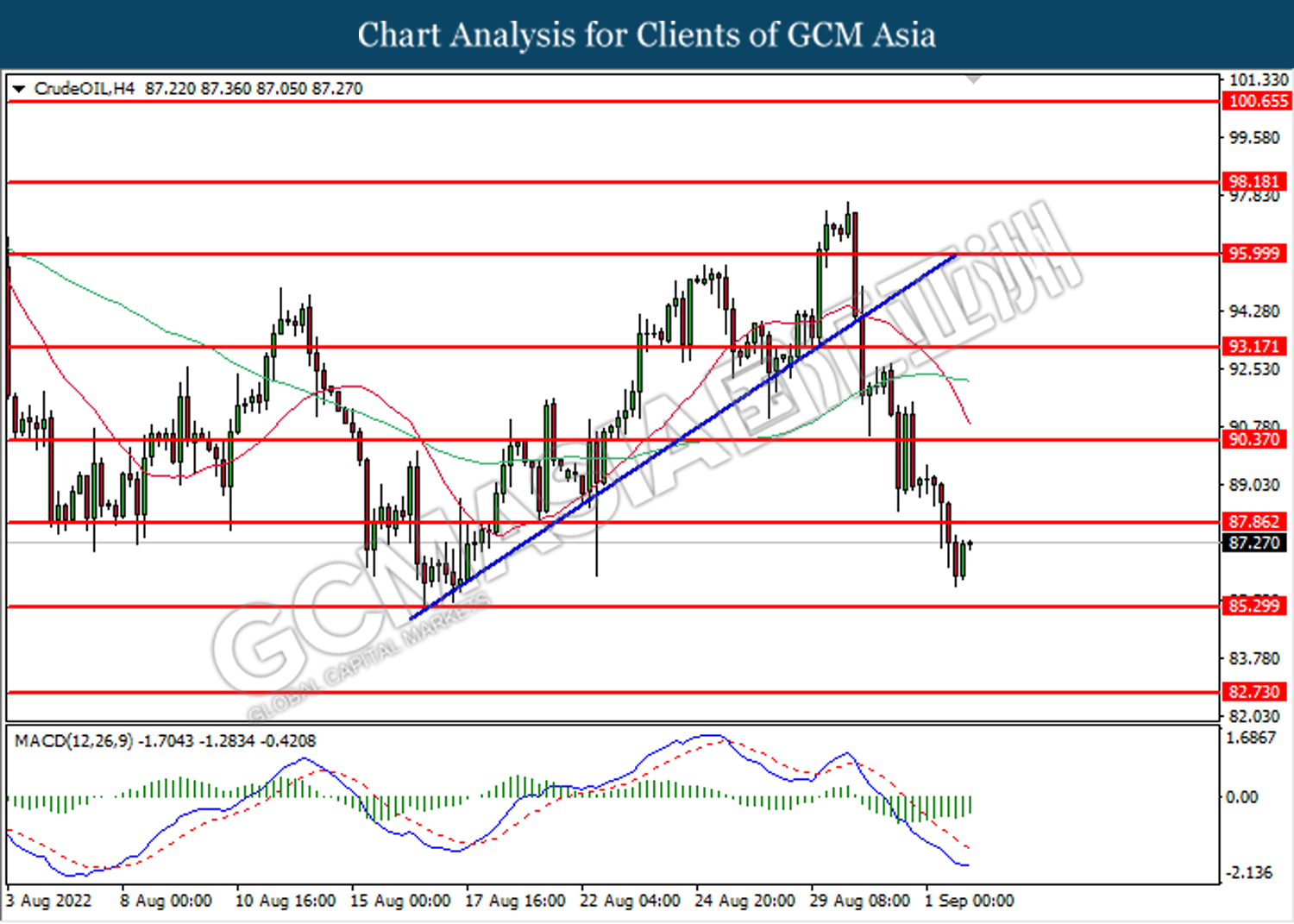

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the lower level. MACD which illustrated diminishing bearish momentum suggests the commodity to extend its rebound toward the resistance level at 87.85.

Resistance level: 87.85, 90.35

Support level: 85.30, 82.75

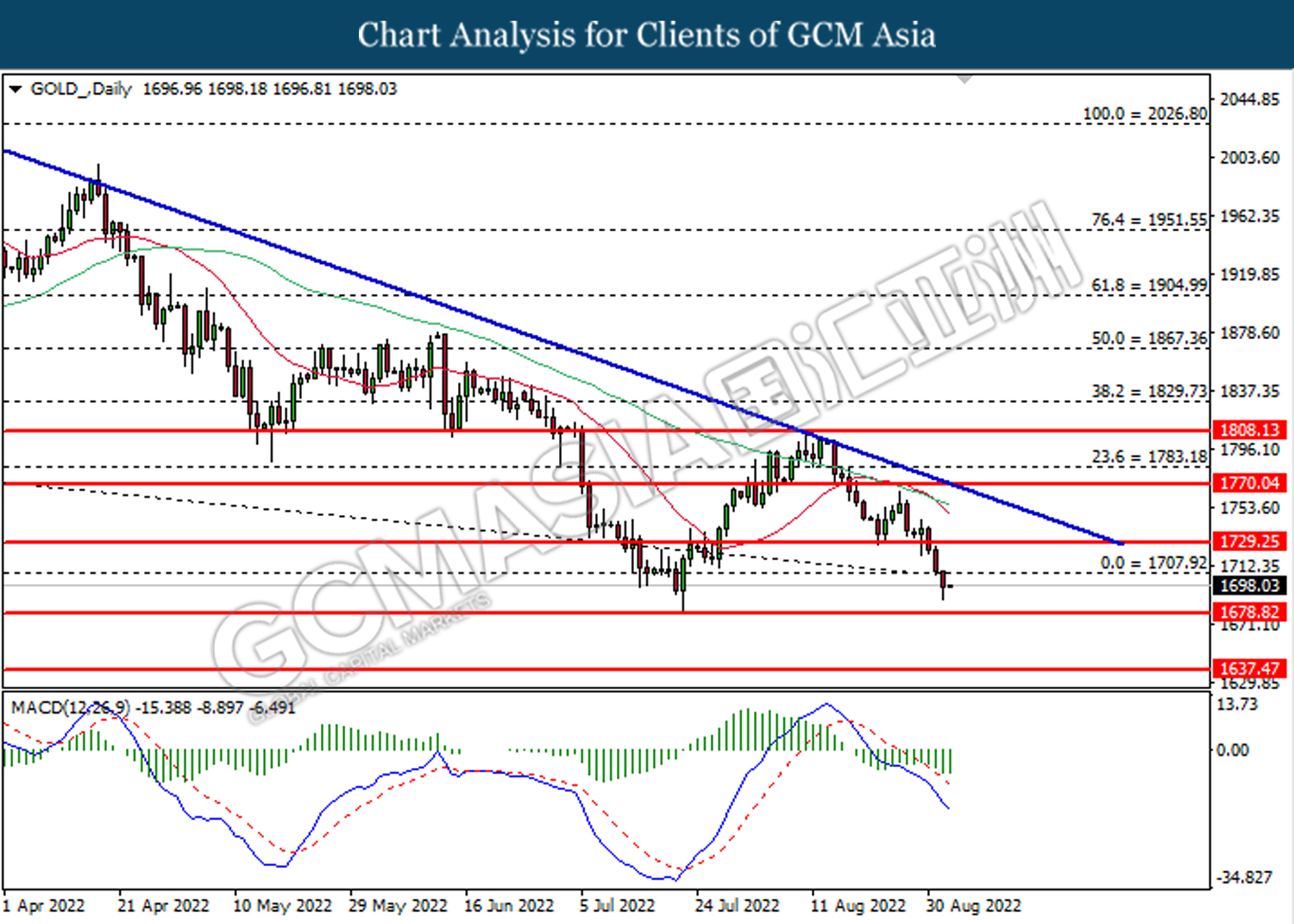

GOLD_, Daily: Gold price was traded lower following prior breakout below the previous support level at 1707.90. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 1678.80.

Resistance level: 1707.90, 1729.25

Support level: 1678.80, 1637.45