2 October 2017 Weekly Analysis

GCMAsia Weekly Report: October 2 – 6

Market Review (Forex): September 25 – 29

U.S. Dollar

Greenback was a little changed against other major peers last Friday following the release of mixed US economic data. However, it has ended September with first monthly gain for the first time in seven months. The dollar index was thinly traded at around 92.91 during late Friday trade while ended the week with 0.99% of gains.

US dollar slipped last Friday after data showed that Federal Reserve’s inflation preferred measure – the Core Personal Consumption Expenditure (PCE) Price Index missed economist expectations with only 0.1% for the month of August. However, the data failed to temper market sentiment towards US interest rate hike as Fed Chair Janet Yellen signaled that the central bank is still on track for a third rate hike this year and three in the year 2018.

Likewise, US dollar was further supported after US President Donald Trump’s tax reform which suggested to cut corporate tax rate from 39% to around 20%. The Republicans aimed to have the tax reform signed into law before January and it may be enacted sometime within the first half of 2018.

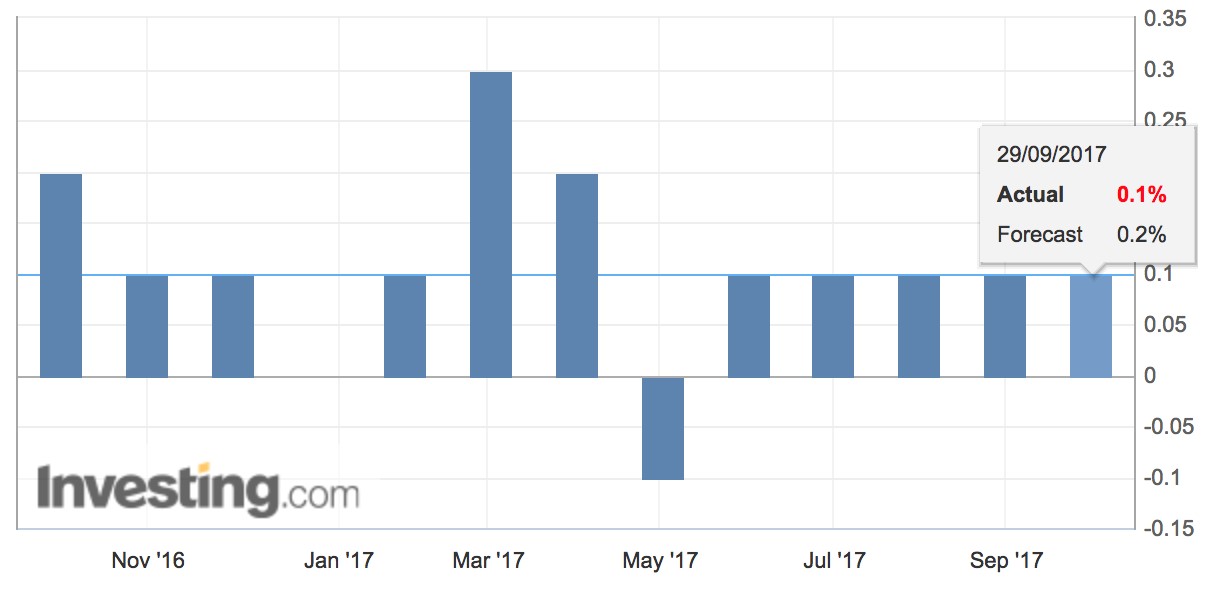

US Core PCE Price Index

US Core Personal Consumption Expenditure came in at only 0.1% versus forecast of 0.2%.

USD/JPY

Pair of USD/JPY rose 0.18% and ended the week around 112.49. It has recorded a monthly gain of up to 2.02%.

EUR/USD

Euro extended its gains by 0.26% to $1.1818 against the US dollar. It has recovered from Thursday’s five-weeks low of $1.1716 amid political uncertainty in Germany which could falter Eurozone economy and make close integration more difficult.

GBP/USD

GBP/USD extended its losses by 0.33% to $1.3397 after second quarter GDP missed economist forecast with only 1.5% versus 1.7%.

Market Review (Commodities): September 25 – 29

GOLD

Gold prices extended its losses on Friday although US economic data pose a threat to the upcoming interest rate hike by US Federal Reserve. Price of the yellow metal settled down by 0.41% and ended the week around $1,283.47 a troy ounce. It has posted the largest monthly loss for the year with 2.83% as the US dollar stages its bottom recovery.

Greenback has risen in the recent weeks as investors grow more optimistic about the prospect for US interest rate hikes while tax cuts proposed by Trump may help to boost the US economy in the future. Gold prices are highly sensitive to rising rates as it could lift the opportunity cost for holding non-yielding assets while boosting the dollar which it is priced in.

Crude Oil

Oil prices extended its gains on Friday while recording its largest gains for the week, month and quarter amid higher optimism towards the market as the market points towards rebalancing of supply and demand. Crude oil price was up by 11 cents or around 0.2% and ended the week at $51.67 per barrel. For the week, it has notched in 2% of gains while roughly 9.5% for the month and 12% for the quarter. Its prices have gained more than 20% since June lows following bullish market data which showed strong compliance among other major producers within the OPEC plan to freeze their daily production level.

On the other hand, mounting fears over the potential fallout from the independence referendum in the oil-rich Kurdish region of Iraq has provided further support for its prices. Previously, Kurdish voters overwhelmingly cast their ballot in favor of independence from Iraq has sparked strong opposition from around the world while neighboring country such as Turkey and Iran threatened to disrupt the flow of crude oil from the country as much as 500,000 barrels per day. A significant reduction of supply in the market may help to reduce the global oil supply glut which has linger for three years.

Weekly Outlook: October 2 – 6

For the week ahead, comments from the US Fed Chair Janet Yellen will be closely monitored for further clues regarding the timing of next rate hike. In addition, the highly anticipated US jobs report will also be in focus.

In the European region, investors will be focusing on remarks by ECB President Mario Draghi on Wednesday and UK PMI data for further clues regarding their economic performance ahead of Brexit cut-off.

As for oil traders, they will be eyeing on US inventories level reported by API and EIA to gauge the strength of crude demand for world’s largest oil consumer.

Highlighted economy data and events for the week: October 2 – 6

| Monday, October 2 |

Data JPY – Tankan Large Manufacturers Index (Q3) JPY – Tankan Large Non-Manufacturers Index (Q3) GBP – Manufacturing PMI (Sep) USD – ISM Manufacturing PMI (Sep)

Events USD – FOMC Member Kaplan Speaks

|

| Tuesday, October 3 |

Data AUD – RBA Interest Rate Decision (Oct) GBP – Construction PMI (Sep)

Events AUD – RBA Rate Statement USD – FOMC Member Powell Speaks

|

| Wednesday, October 4 |

Data CrudeOIL – API Weekly Crude Oil Stock GBP – Services PMI (Sep) EUR – Retail Sales (MoM) (Aug) USD – ADP Nonfarm Employment Change (Sep) USD – ISM Non-Manufacturing PMI (Sep) CrudeOIL – Crude Oil Inventories

Events EUR – ECB President Draghi Speaks USD – FOMC Member Bullard Speaks USD – Fed Chair Yellen Speaks

|

| Thursday, October 5 |

Data AUD – Retail Sales (MoM) (Aug) USD – Initial Jobless Claims USD – Trade Balance (Aug) CAD – Trade Balance (Aug) USD – Factory Orders (MoM) (Aug)

Events EUR – ECB Publishes Account of Monetary Policy Meeting USD – FOMC Member Powell Speaks USD – FOMC Member Williams Speaks USD – FOMC Member Harker Speaks

|

|

Friday, October 6

|

Data EUR – German Factory Orders (MoM) (Aug) GBP – Halifax House Price Index (MoM) (Sep) USD – Average Hourly Earnings (MoM) (Sep) USD – Nonfarm Payrolls (Sep) USD – Unemployment Rate (Sep) CAD – Building Permits (MoM) (Aug) CAD – Employment Change (Sep) CAD – Ivey PMI (Sep) CrudeOIL – US Baker Hughes Oil Rig Count

Events USD – FOMC Member Dudley Speaks USD – FOMC Member Kaplan Speaks USD – FOMC Member Bullard Speaks

|

Technical weekly outlook: October 2 – 6

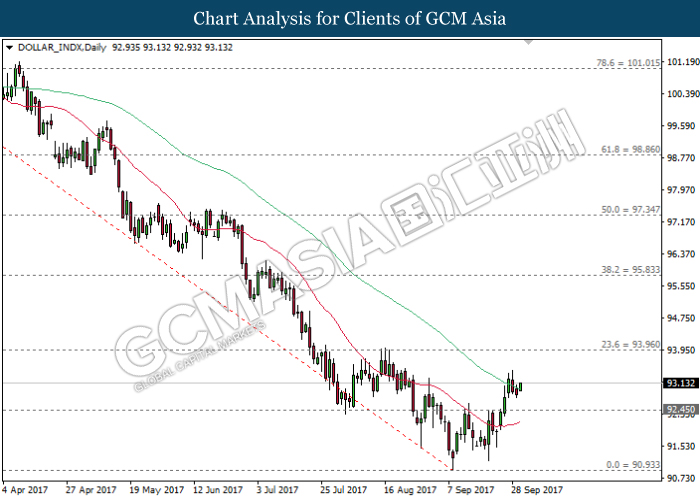

Dollar Index

DOLLAR_INDX, Daily: Dollar index extended its gains following prior rebound from the bottom of 90.95. Both MA lines which begins to narrow upwards suggest further upside bias, first target will be focused at 93.95.

Resistance level: 93.95, 95.85

Support level: 92.45, 90.95

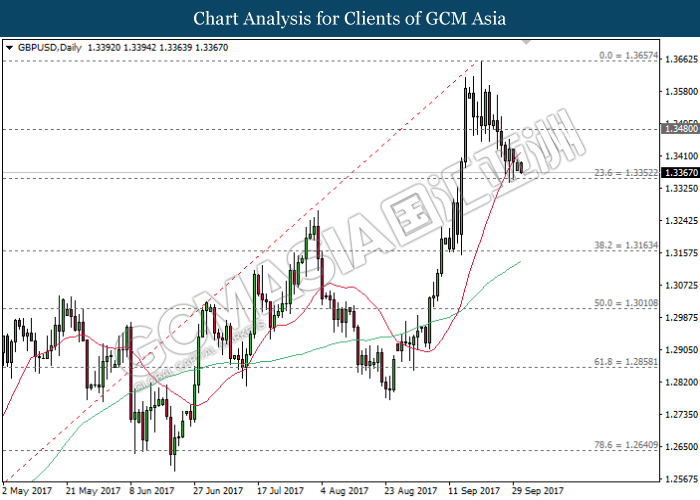

GBPUSD

GBPUSD, Daily: GBPUSD was traded lower following prior retracement while closing below the 20-MA line (red). A successful closure below the support level of 1.3350 would suggest the pair to extend its losses towards the next target at 1.3165.

Resistance level: 1.3480, 1.3660

Support level: 1.3350, 1.3165

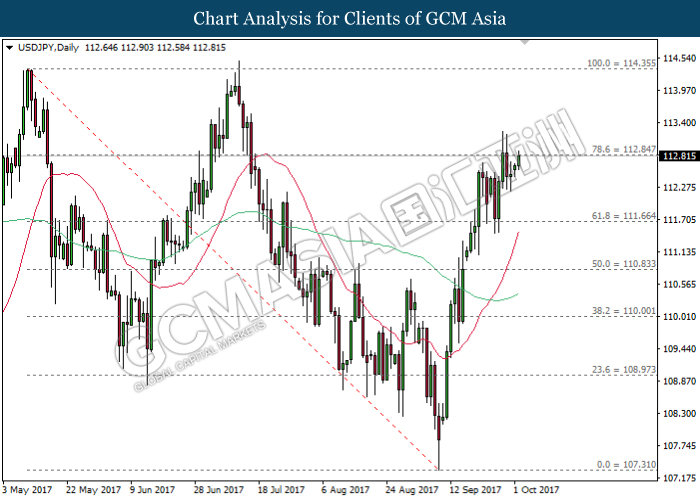

USDJPY

USDJPY, Daily: USDJPY advance further upwards following previous rebound from the strong support level near 111.65. Both MA lines which continues to expand upwards suggests the pair to extend its upward momentum after closing above the resistance level of 112.85.

Resistance level: 112.85, 114.35

Support level: 111.65, 110.85

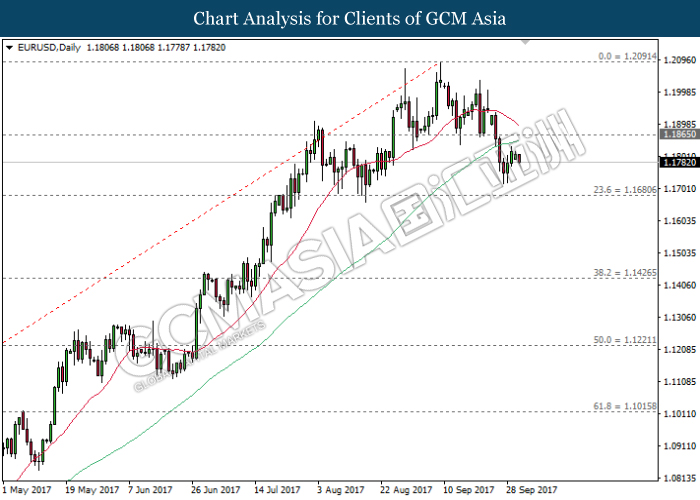

EURUSD

EURUSD, Daily: EURUSD was traded higher following prior rebound while remained pressured below both MA lines. Both lines which continues to narrow downwards suggests further downside bias for the pair to extend its losses towards the support level of 1.1680.

Resistance level: 1.1865, 1.2090

Support level: 1.1680, 1.1425

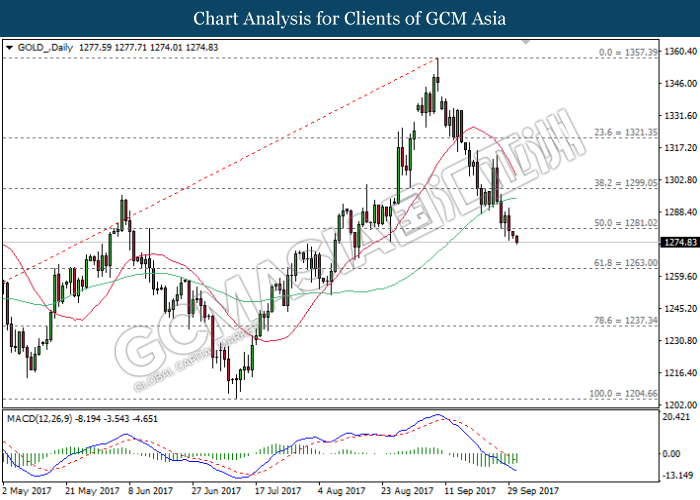

GOLD

GOLD_, Daily: Gold price extended its losses following previous closure below the strong support level near 1281.00. Such price action while coupled with ongoing downward signal from MACD histogram suggests gold price to advance further down, towards the first target at 1263.00.

Resistance level: 1281.00, 1299.05

Support level: 1263.00, 1237.35

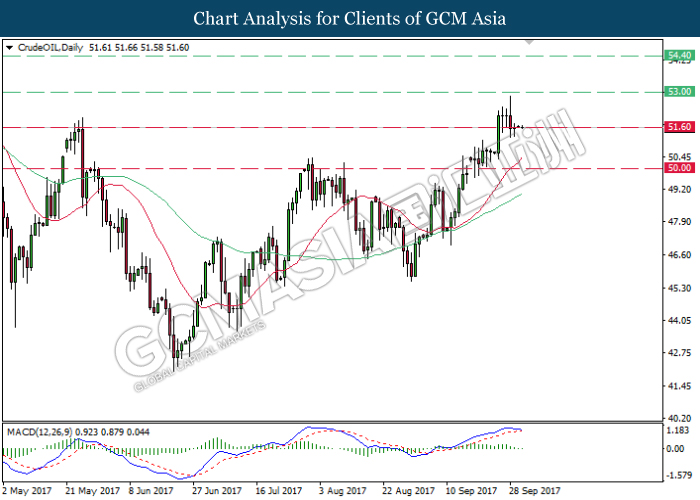

Crude Oil

CrudeOIL, Daily: Crude oil price was traded lower following prior retrace while currently testing at the support level of 51.60. Upward signal from MACD histogram which continues to diminish suggests further downside bias and its price is expected to advance further downwards after closing below the level of 51.60.

Resistance level: 53.00, 54.40

Support level: 51.60, 50.00