2 November 2022 Afternoon Session Analysis

Euro slipped as greenback turned stronger.

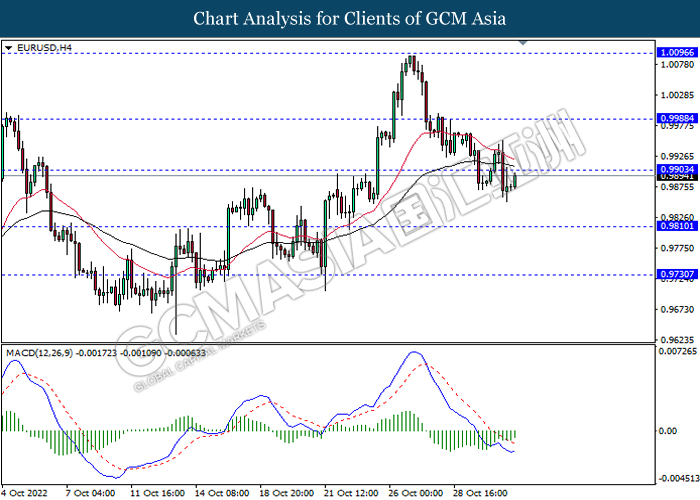

The EUR/USD, which widely traded by majority of investors dropped significantly on yesterday amid the upbeat economic data from the US, which prompting investors to shift their capitals toward US currency market. Though, the losses experienced by Euro was limited upon the hawkish speech European Central Bank (ECB). According to Reuters, ECB President Christine Lagarde reiterated on Tuesday that ECB should keep rising interest rate in order to restore price stability, even the aggressive move might lead Eurozone economy to enter recession. Besides, Christine Lagarde also vowed that the central bank would do whatever is necessary to dampen the inflation rate back to 2% target. The Eurozone inflation which rose to 10.7% has added the odds of aggressive contractionary monetary policy from ECB, which spurred bullish momentum on the Euro. On the other hand, the AUD/USD has slumped on yesterday after Reserve Bank of Australia hiked its rate by 25 basis point to 2.85%, which met the market expectation. As of writing, EUR/USD appreciated by 0.23% to 0.9897 while AUD/USD rose by 0.42% to 0.6422.

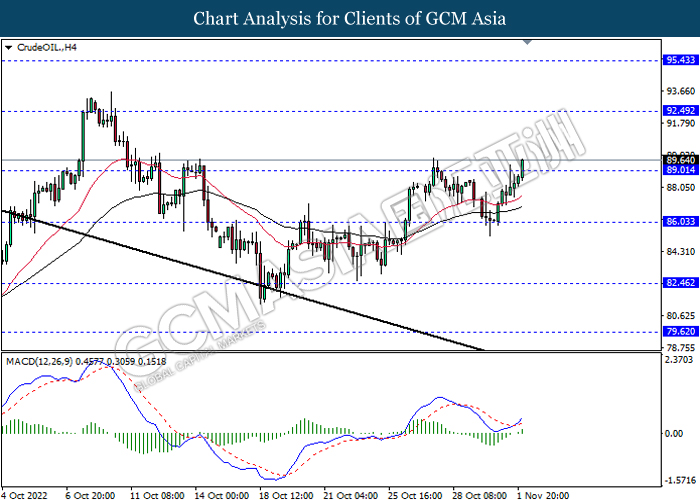

In the commodities market, the crude oil price appreciated by 1.46% to $89.66 per barrel as of writing following the upbeat manufacturing data in China has outweighed strict Covid curb. In addition, the gold price raised by 0.34% to $1652.31 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Oct) | 45.7 | 45.7 | – |

| 16:55 | EUR – German Unemployment Change (Oct) | 14K | 15K | – |

| 20:15 | USD – ADP Nonfarm Employment Change (Oct) | 208K | 195K | – |

| 22:30 | USD – Crude Oil Inventories | 2.588M | 0.367M | – |

Technical Analysis

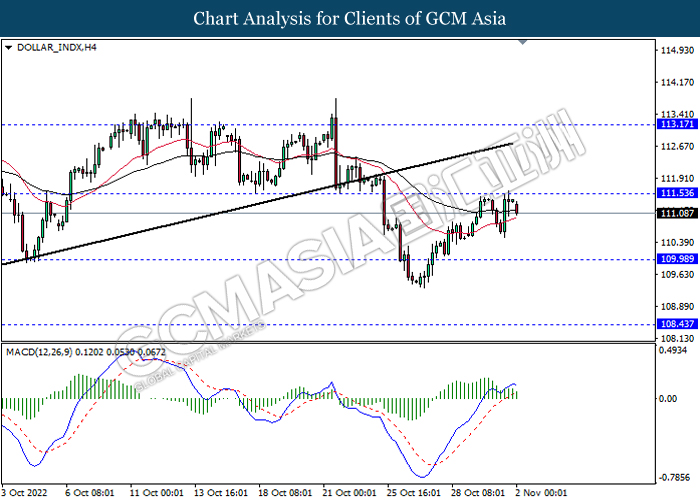

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 111.55, 113.15

Support level: 109.95, 108.45

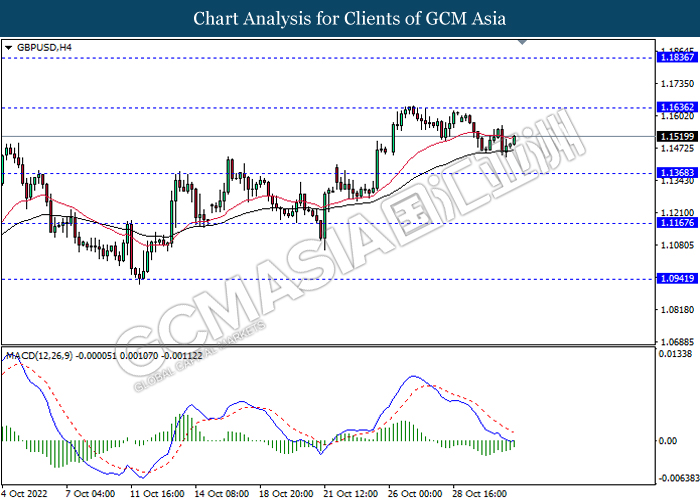

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.1635, 1.1835

Support level: 1.1370, 1.1165

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9905, 0.9990

Support level: 0.9810, 0.9730

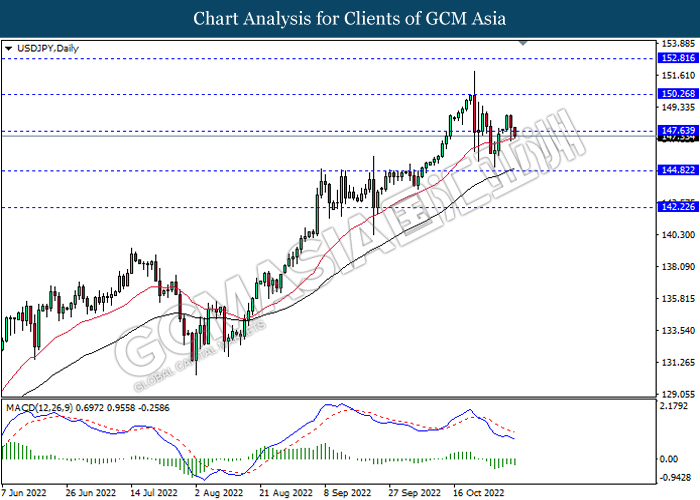

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 147.65, 150.25

Support level: 144.80, 142.20

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6470, 0.6590

Support level: 0.6370, 0.6265

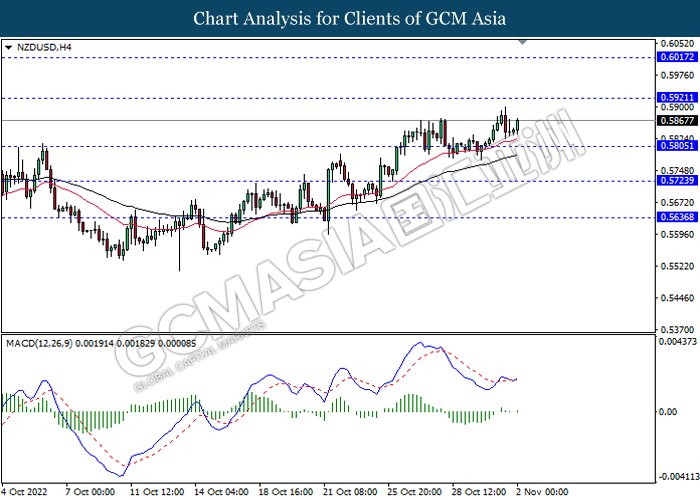

NZDUSD, H4: NZDUSD was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.5920, 0.6015

Support level: 0.5805, 0.5725

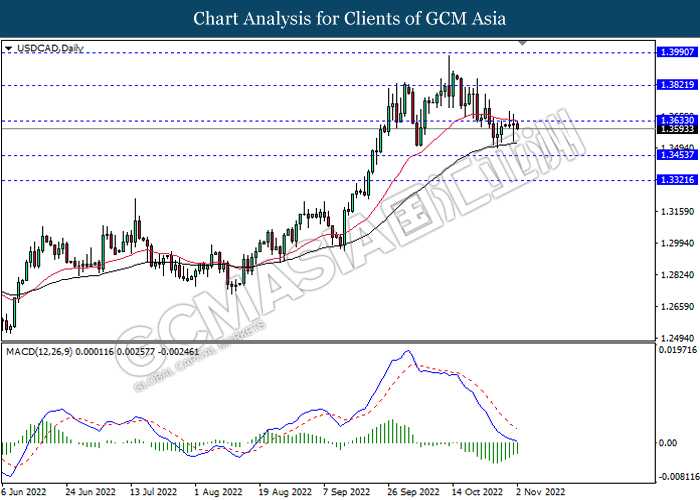

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3635, 1.3820

Support level: 1.3455, 1.3320

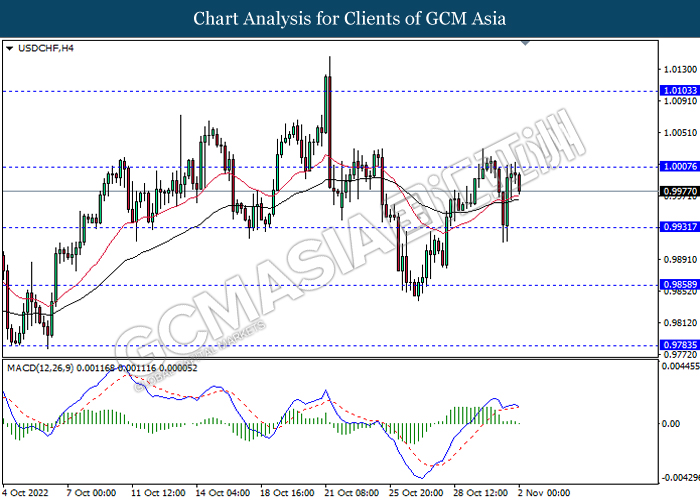

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0005, 1.0105

Support level: 0.9930, 0.9860

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 92.50, 95.45

Support level: 89.00, 86.05

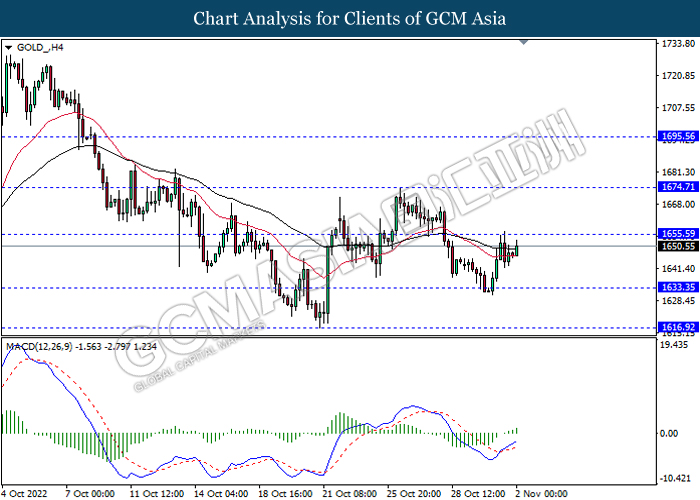

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1655.60, 1674.70

Support level: 1633.35, 1616.90