2 November 2022 Morning Session Analysis

US Dollar edged higher following a series of upbeat data.

The dollar index, which gauges its value against a basket of six major currencies, managed to extend its rally for the third consecutive trading session as yesterday’s economic data showed that the economic health in the US remains resilient. According to the Institute for Supply Management (ISM), the US Manufacturing PMI data dropped from the previous month’s reading of 50.9 to 50.2 in October, refreshing the record of the slowest growth pace in nearly two and a half years. The decline could be attributed to the effectiveness of the Fed’s aggressive rate hike plan, which seems as a result of successfully squeezing the demand for goods while cooling down inflation. However, it is noteworthy to mention that a reading above 50 still signals expansion in manufacturing. On the other hand, another last batch of economic data before the Federal Reserve meeting on 3 Nov showed that the labour market in the US remains robust. According to the Bureau of Labor Statistics, the US JOLTs Job Openings data came in at 10.717M, stronger than both the previous month’s reading as well as the consensus forecast at 10.280M and 10.000M respectively. As of writing, the dollar index rose 0.02% to 111.55.

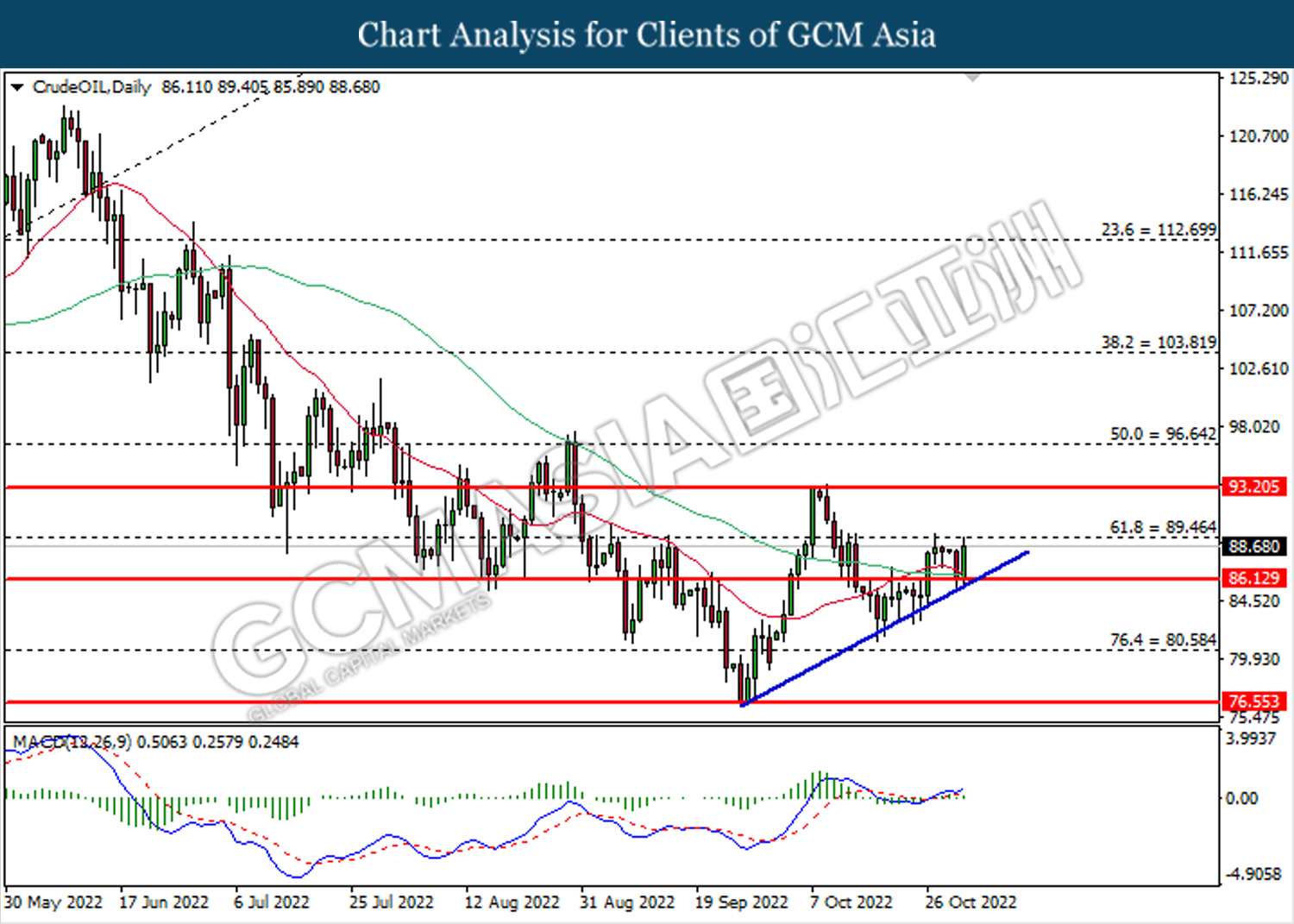

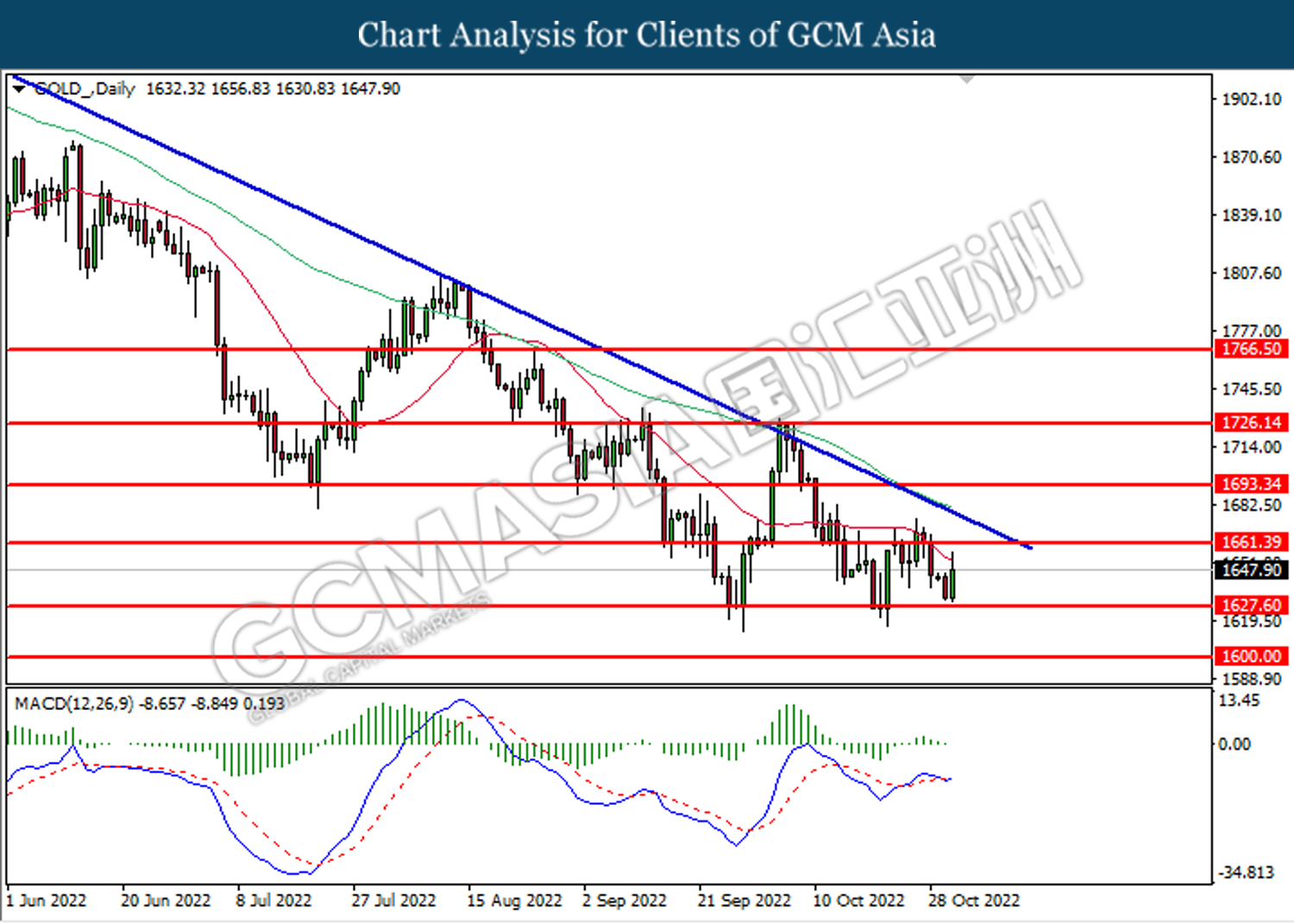

In the commodities market, the crude oil price edged up by 0.16% to $88.65 per barrel as the US API Weekly Crude Oil Stock showed a huge draw over the week. According to the API, the US crude oil inventories declined by -6.530M, missing the consensus forecast at 0.267M. Besides, the gold price fell by -0.05% to $1647.00 per troy ounce following the rebound in the US dollar market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:55 | EUR – German Manufacturing PMI (Oct) | 45.7 | 45.7 | – |

| 16:55 | EUR – German Unemployment Change (Oct) | 14K | 15K | – |

| 20:15 | USD – ADP Nonfarm Employment Change (Oct) | 208K | 195K | – |

| 22:30 | USD – Crude Oil Inventories | 2.588M | 0.367M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level at 111.25. MACD which illustrated diminishing bearish momentum suggests the index to extend its gains toward the resistance level at 113.30.

Resistance level: 113.30, 115.00

Support level: 111.25, 109.00

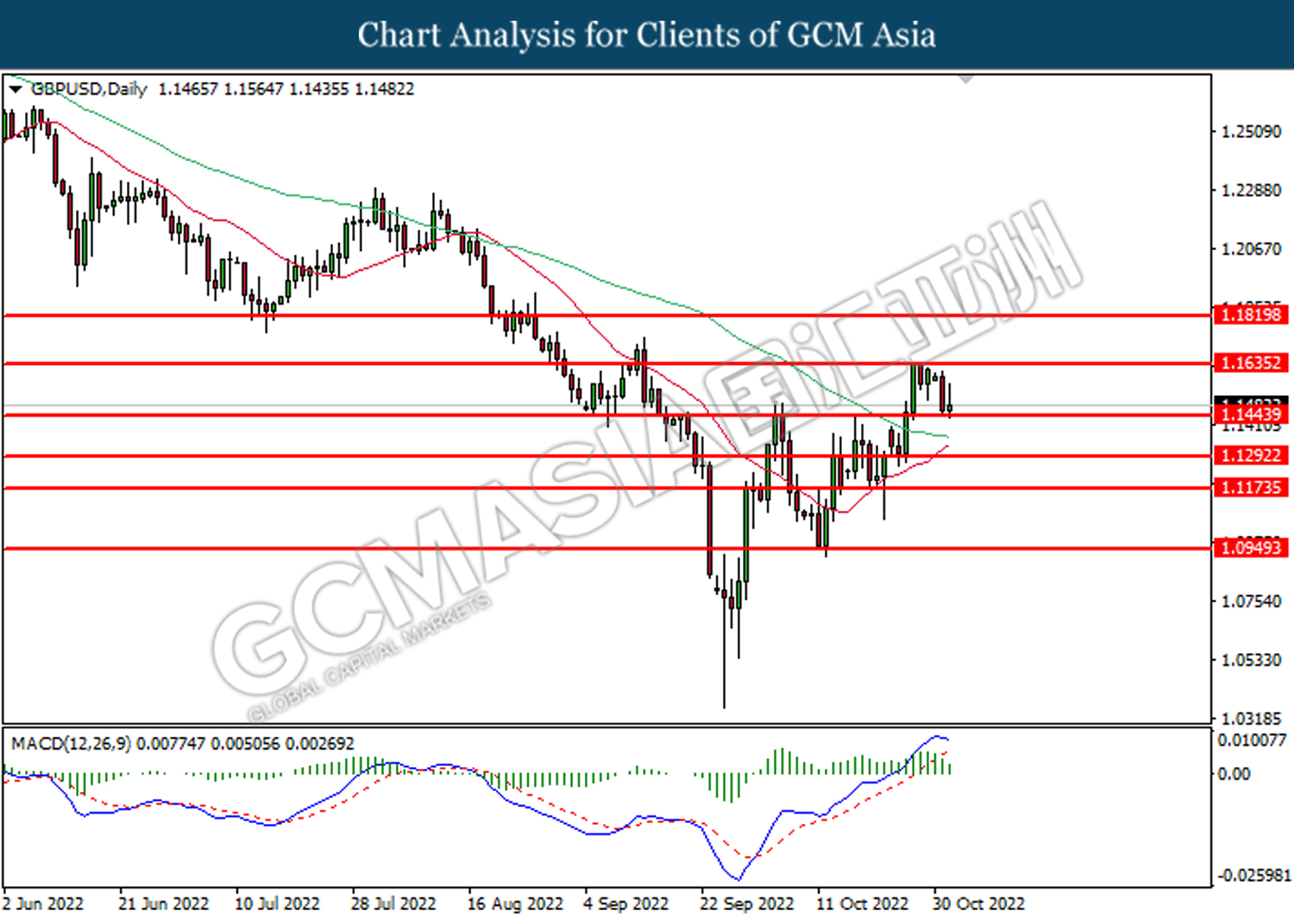

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.1620. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1440.

Resistance level: 1.1620, 1.1835

Support level: 1.1440, 1.1185

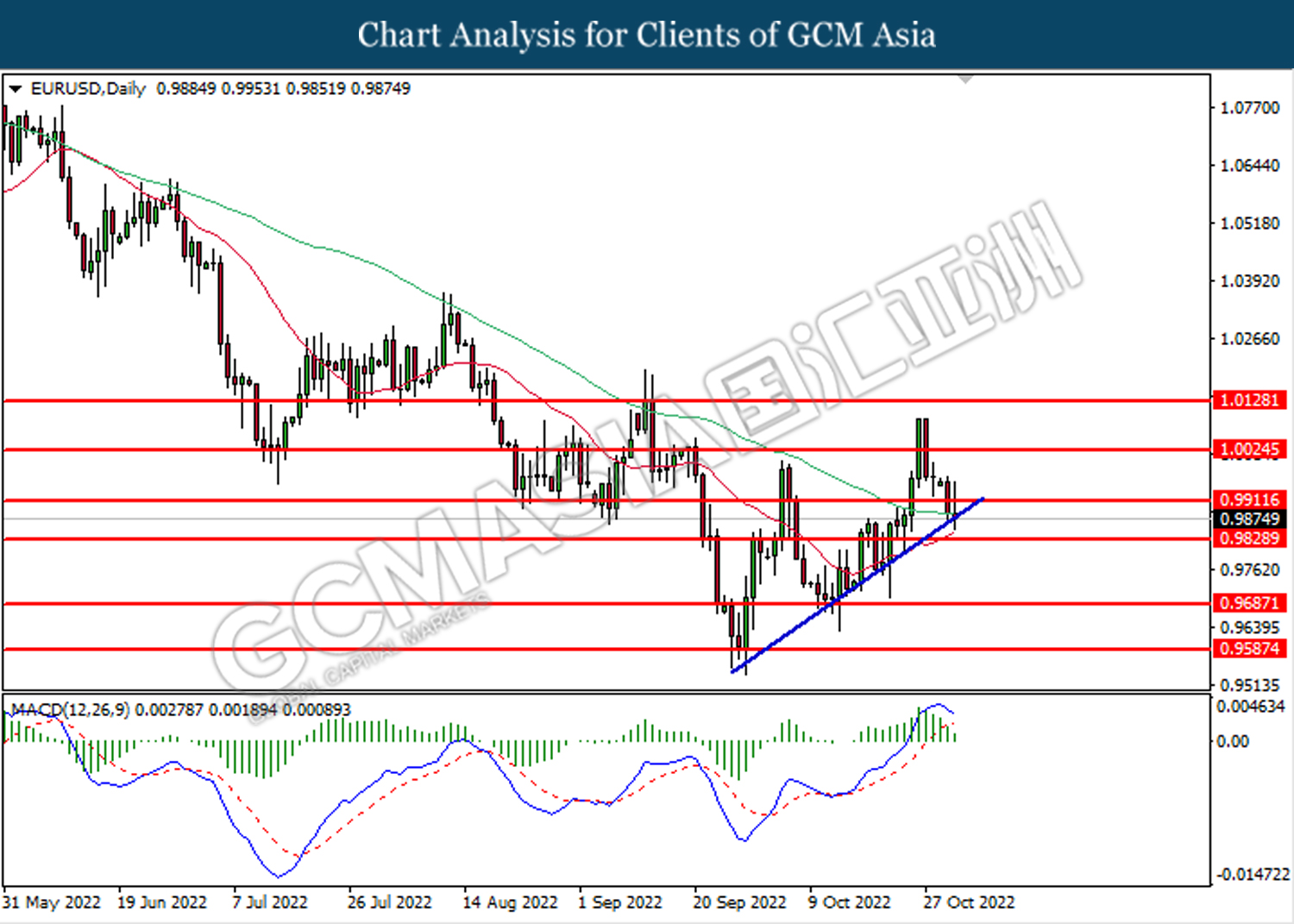

EURUSD, Daily: EURUSD was traded lower while currently testing the upward trendline. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the trendline.

Resistance level: 0.9910, 1.0025

Support level: 0.9830, 0.9685

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 147.30. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 149.35.

Resistance level: 149.35, 152.00

Support level: 147.30, 144.70

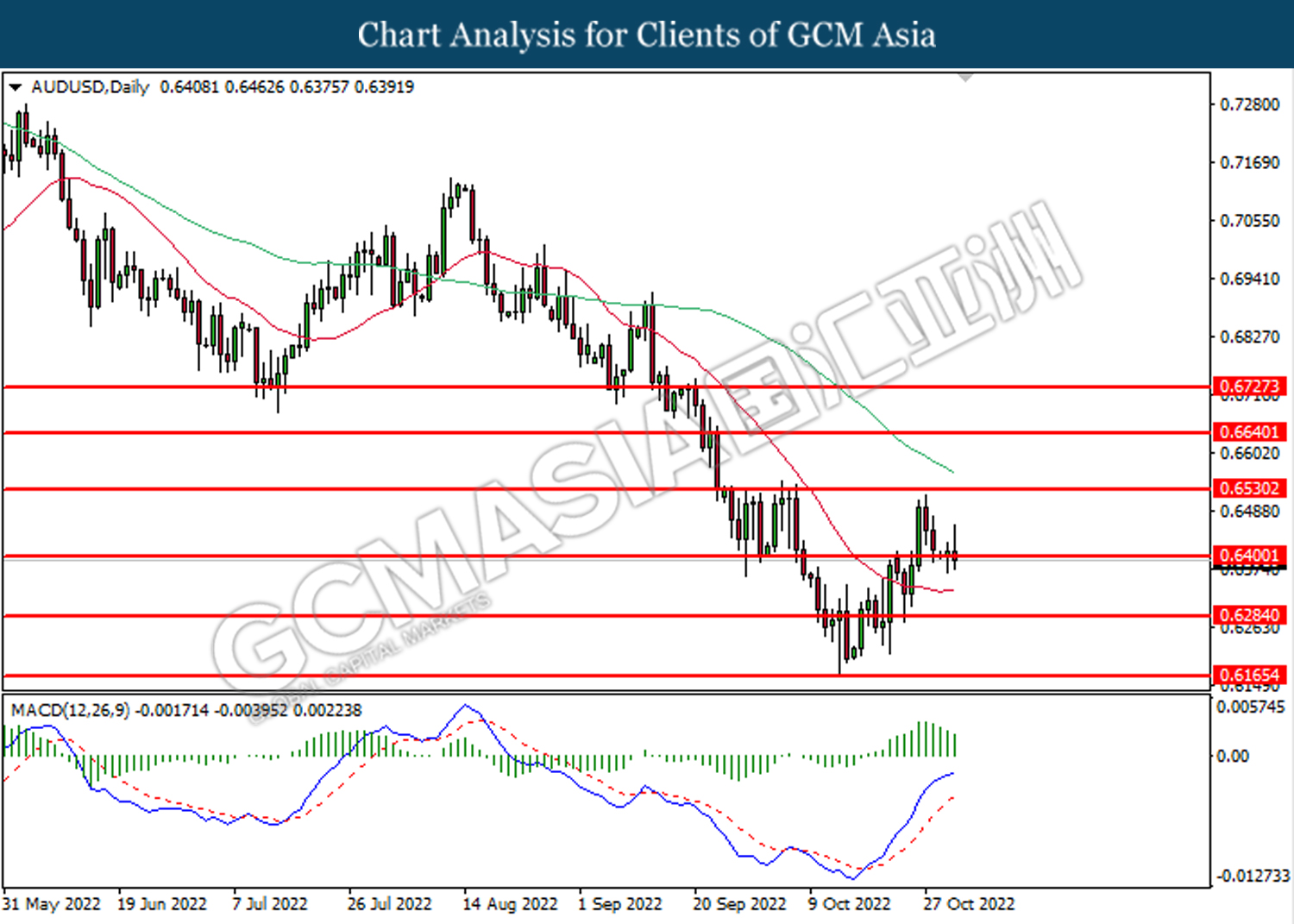

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.6400. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 0.6530, 0.6640

Support level: 0.6400, 0.6285

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level at 0.5845. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.5845, 0.5905

Support level: 0.5775, 0.5710

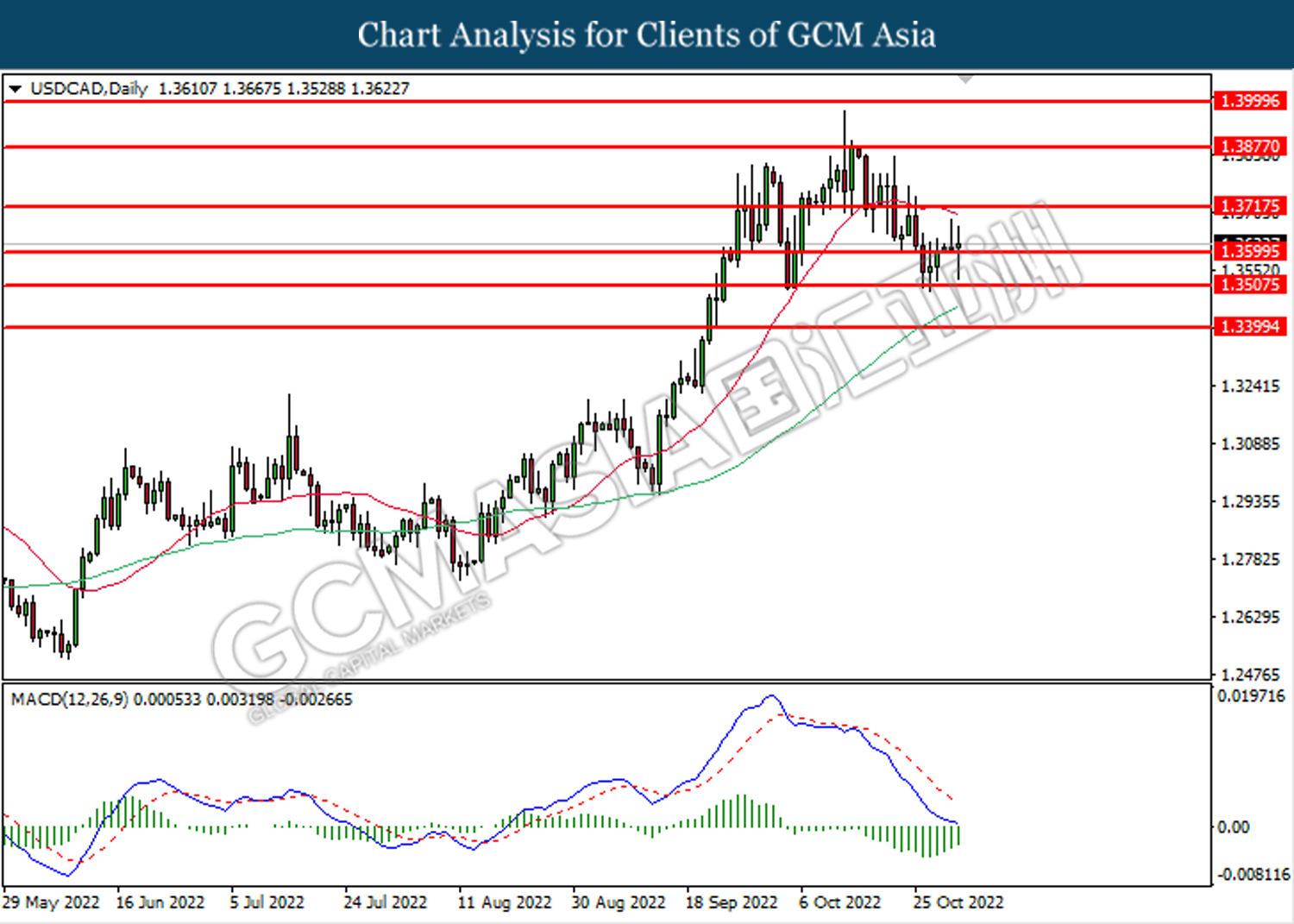

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level at 1.3600. MACD which illustrated diminishing bearish momentum suggests the pair to extend its gains toward the resistance level at 1.3715.

Resistance level: 1.3715, 1.3875

Support level: 1.3600, 1.3505

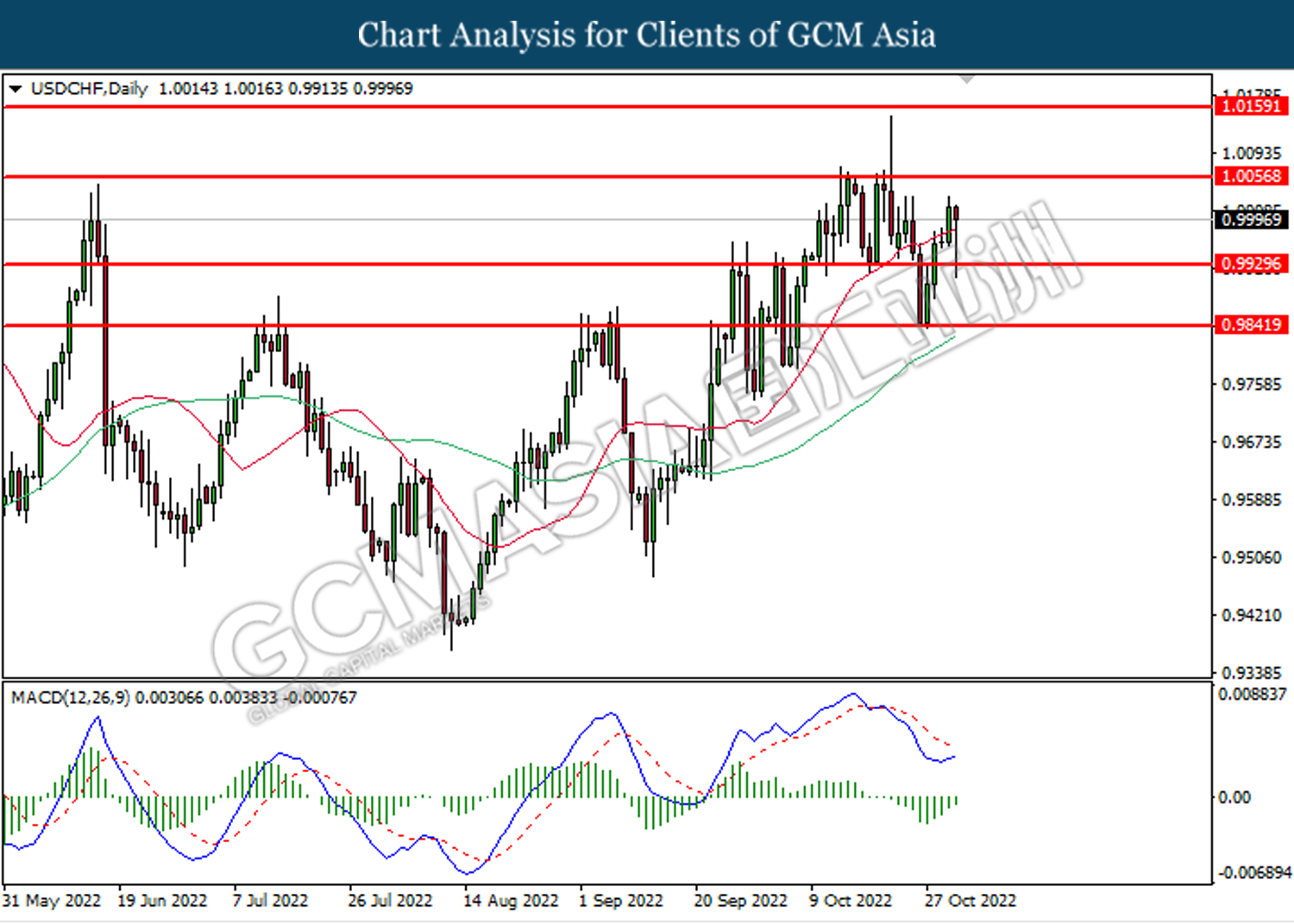

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level at 0.9930. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 1.0055.

Resistance level: 1.0055, 1.0160

Support level: 0.9930, 0.9840

CrudeOIL, Daily: Crude oil price was traded higher while currently testing the resistance level at 89.45. MACD which illustrated bullish bias momentum suggests the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 89.45, 93.20

Support level: 86.15, 80.60

GOLD_, Daily: Gold price was traded higher following prior rebound from the support level at 1627.60. However, MACD which illustrated diminishing bullish momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 1661.40, 1693.35

Support level: 1627.60, 1600.00